Key Insights

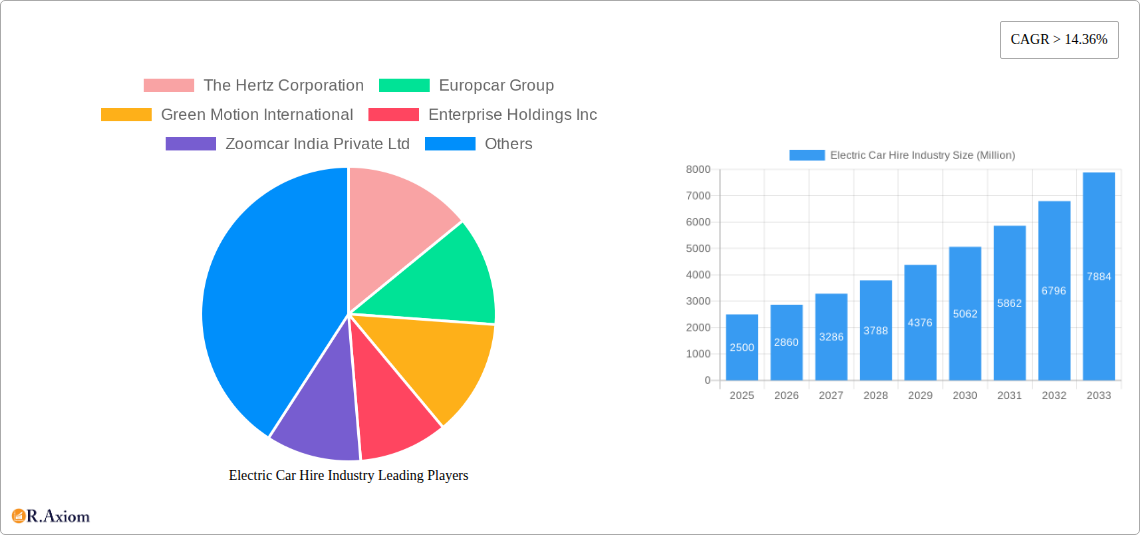

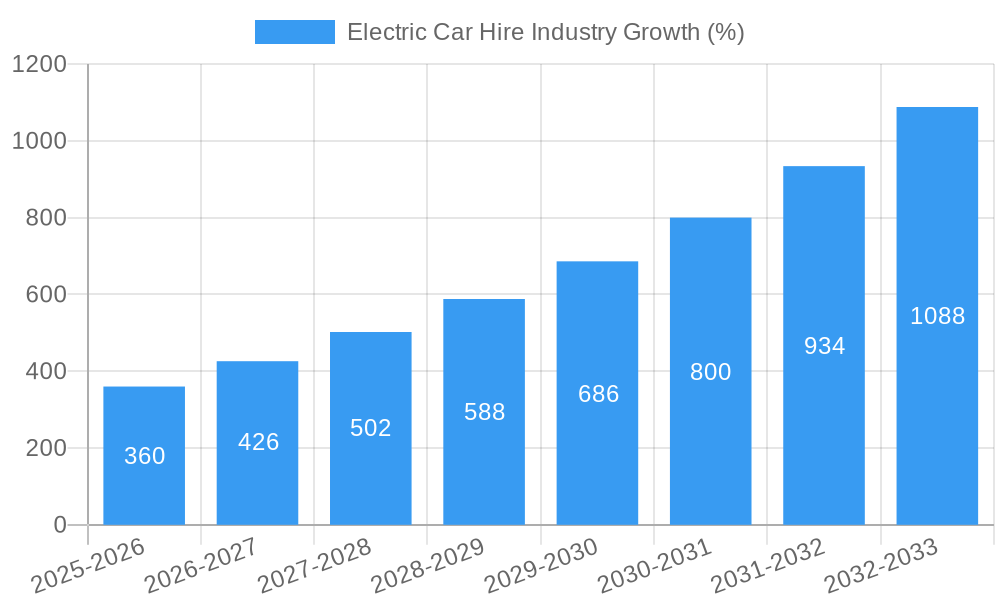

The electric car hire market is experiencing robust growth, driven by increasing environmental concerns, government incentives promoting electric vehicle adoption, and a rising demand for sustainable transportation solutions. The market's Compound Annual Growth Rate (CAGR) exceeding 14.36% from 2019 to 2024 suggests a significant upward trajectory. This growth is fueled by several key factors. Firstly, the expanding charging infrastructure is making electric vehicle rentals more convenient and accessible. Secondly, the introduction of innovative battery technologies resulting in increased vehicle range and reduced charging times is bolstering consumer confidence. Thirdly, a growing number of rental companies are incorporating electric vehicles into their fleets, expanding the availability and choice for consumers. Different vehicle types, body styles (from hatchbacks to SUVs), and price points (budget to luxury) cater to diverse customer needs, further stimulating market expansion. Online booking platforms also contribute to the market’s accessibility, leading to increased adoption. The market segmentation by end-use – local usage, airport transport, and outstation travel – highlights the versatility and expanding applications of electric car hire services.

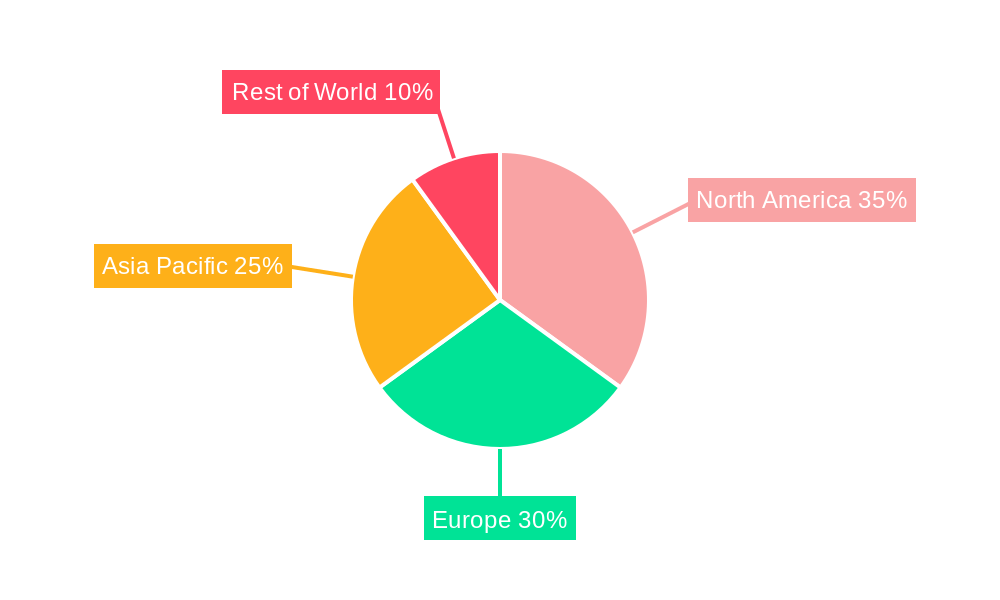

Geographically, North America and Europe currently hold significant market share, but the Asia-Pacific region, particularly India and China, is poised for substantial growth due to rapid urbanization, rising disposable incomes, and supportive government policies. The competitive landscape includes both established players like Hertz, Europcar, and Enterprise, and emerging players focused on electric vehicle rentals specifically. The market's future growth will likely be shaped by technological advancements in battery technology, the expansion of charging infrastructure, and government regulations influencing EV adoption. Continued focus on affordability and wider availability of electric vehicles within rental fleets will be crucial for sustaining the impressive growth trajectory observed in recent years. While challenges remain, including charging infrastructure limitations in certain regions and the initial higher cost of electric vehicles compared to gasoline-powered vehicles, the long-term outlook for the electric car hire market remains exceptionally promising.

Electric Car Hire Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the electric car hire industry, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report incorporates extensive data analysis and insights to help stakeholders make informed decisions. The global market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Electric Car Hire Industry Market Concentration & Innovation

The electric car hire market exhibits a moderately concentrated structure, with key players like The Hertz Corporation, Europcar Group, Enterprise Holdings Inc, and Avis Rent a Car Ltd holding significant market share. However, the emergence of smaller, agile companies like UFODrive demonstrates the potential for disruption. Market share data for 2025 estimates Hertz at xx%, Europcar at xx%, Enterprise at xx%, and Avis at xx%, with the remaining share distributed amongst numerous smaller players and regional companies. Innovation is driven by factors including:

- Technological advancements: Battery technology improvements, charging infrastructure development, and connected car features are key drivers.

- Government regulations: Incentives for electric vehicle adoption and stricter emission standards are shaping market dynamics.

- Consumer preferences: Growing environmental awareness and the desire for sustainable transportation fuel demand.

- Mergers and acquisitions (M&A): Consolidation activities, although not at a high frequency, shape the market landscape. Recent M&A activity includes (Data on M&A deal values is unavailable; further research is required).

The presence of substitute options like traditional car rentals and ride-hailing services poses a competitive challenge. The market is witnessing a gradual shift towards online booking platforms, indicating a growing preference for convenience and digital engagement.

Electric Car Hire Industry Industry Trends & Insights

The electric car hire industry is experiencing substantial growth, fueled by several factors. The global shift towards electric mobility, driven by environmental concerns and government policies, is a primary growth driver. Technological advancements, such as improved battery technology and faster charging infrastructure, are further accelerating market expansion. Consumer preferences are increasingly shifting towards electric vehicles due to their lower running costs and eco-friendly nature.

Technological disruptions are impacting the industry through the introduction of autonomous driving technologies and smart charging solutions. These innovations enhance efficiency and offer improved user experience. Competitive dynamics are characterized by intense competition among established players and the emergence of new entrants, leading to strategic partnerships and technological advancements. Market penetration for electric car rentals is expected to reach xx% by 2033, up from xx% in 2025.

Dominant Markets & Segments in Electric Car Hire Industry

The dominant markets and segments vary considerably. While data on specific market shares is limited, trends point towards specific areas of significant growth and dominance:

- By Vehicle Type: Battery Electric Vehicles (BEVs) are expected to dominate the market, given their zero-emission nature and technological advancements.

- By Body Style: SUVs and Sedans are anticipated to hold the largest market share due to their versatility and popularity.

- By Type: The Budget/Economy segment is expected to witness significant growth owing to increasing affordability and rising demand for eco-friendly transportation.

- By Booking Type: Online bookings are steadily gaining popularity due to convenience and accessibility, outpacing offline booking methods.

- By End-Use: Local usage and airport transport currently constitute the dominant end-use segments.

Key Drivers of Dominance:

- Economic policies: Government subsidies and tax incentives for electric vehicles and charging infrastructure development.

- Infrastructure: Expansion of public charging networks and advancements in fast-charging technologies.

- Consumer awareness: Rising awareness about environmental issues and the benefits of electric vehicles.

Electric Car Hire Industry Product Developments

Recent product innovations focus on enhanced battery range, faster charging capabilities, and the integration of advanced driver-assistance systems (ADAS). The market is witnessing the introduction of various vehicle types to cater to diverse customer preferences. This includes offering a wide range of BEVs, PHEVs, and Hybrid vehicles, as well as different body styles like sedans, SUVs, and hatchbacks. The competitive advantage lies in offering a broader selection, better charging infrastructure access, and advanced features that enhance the overall customer experience.

Report Scope & Segmentation Analysis

This report segments the electric car hire market comprehensively:

By Vehicle Type: Battery Electric, Hybrid Electric, Plug-in Hybrid Electric – each segment’s growth is analyzed based on technology adoption rates and government regulations.

By Body Style: Hatchback, Sedan, SUVs, MUV – segmentation based on vehicle size, space, and features caters to varying consumer needs.

By Type: Luxury, Budget/Economy – differentiated by pricing, vehicle features, and target customer segments.

By Booking Type: Online, Offline – analyzes the impact of digitalization on market dynamics.

By End-Use: Local Usage, Airport Transport, Outstation – highlights the specific demands of each segment.

Key Drivers of Electric Car Hire Industry Growth

Several factors contribute to the industry’s growth:

- Government incentives: Subsidies and tax breaks for EV purchases and charging infrastructure development.

- Technological advancements: Improved battery technology and faster charging times.

- Environmental concerns: Growing awareness of climate change and the need for sustainable transportation.

- Decreasing battery costs: Making EVs more affordable and accessible.

Challenges in the Electric Car Hire Industry Sector

The industry faces challenges such as:

- High initial investment costs: Purchasing EVs and establishing charging infrastructure require significant capital.

- Range anxiety: Concerns about the limited driving range of EVs remain a barrier to adoption.

- Charging infrastructure limitations: The lack of widespread charging networks hinders accessibility.

- Competition from traditional rental companies: Established players pose a significant competitive threat.

Emerging Opportunities in Electric Car Hire Industry

Opportunities exist in:

- Expansion into new markets: Untapped potential in developing countries with growing economies.

- Subscription models: Offering flexible rental options for various needs.

- Integration with smart city initiatives: Collaborating on smart charging solutions and efficient traffic management.

- Autonomous driving integration: Leveraging autonomous technology to improve efficiency and safety.

Leading Players in the Electric Car Hire Industry Market

- The Hertz Corporation

- Europcar Group

- Green Motion International

- Enterprise Holdings Inc

- Zoomcar India Private Ltd

- Zipcar Inc

- Avis Rent a Car Ltd

- DriveElectric

- BlueIndy

- Sixt SE

Key Developments in Electric Car Hire Industry Industry

- August 2022: UFODrive expands into the US market, launching in San Francisco.

- October 2022 (Planned): UFODrive plans to launch in New York and Austin.

Strategic Outlook for Electric Car Hire Industry Market

The electric car hire market holds immense potential for growth, driven by increasing EV adoption, supportive government policies, and technological advancements. Companies that successfully adapt to changing consumer preferences, invest in charging infrastructure, and embrace technological innovations are poised to capture significant market share. The focus on sustainability, coupled with the convenience of electric vehicle rentals, will continue to fuel market expansion in the coming years.

Electric Car Hire Industry Segmentation

-

1. Vehicle Type

- 1.1. Battery Electric

- 1.2. Hybrid Electric

- 1.3. Plug-in Hybrid Electric

-

2. Body Style

- 2.1. Hatchback

- 2.2. Sedan

- 2.3. Sports Utility Vehicles (SUVs)

- 2.4. Multi-utility Vehicle (MUV)

-

3. Type

- 3.1. Luxury

- 3.2. Budget/Economy

-

4. Booking Type

- 4.1. Online

- 4.2. Offline

-

5. End-Use

- 5.1. Local Usage

- 5.2. Airport Transport

- 5.3. Outstation

Electric Car Hire Industry Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of World

- 4.1. South America

- 4.2. Middle East and Africa

Electric Car Hire Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 14.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives to Promote Sales of Electric Vehicle

- 3.3. Market Restrains

- 3.3.1. High Initial Investment for Installing Electric Vehicle Charging Infrastructure

- 3.4. Market Trends

- 3.4.1. Online Booking Type Is Expected To Have High Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Car Hire Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Battery Electric

- 5.1.2. Hybrid Electric

- 5.1.3. Plug-in Hybrid Electric

- 5.2. Market Analysis, Insights and Forecast - by Body Style

- 5.2.1. Hatchback

- 5.2.2. Sedan

- 5.2.3. Sports Utility Vehicles (SUVs)

- 5.2.4. Multi-utility Vehicle (MUV)

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Luxury

- 5.3.2. Budget/Economy

- 5.4. Market Analysis, Insights and Forecast - by Booking Type

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by End-Use

- 5.5.1. Local Usage

- 5.5.2. Airport Transport

- 5.5.3. Outstation

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Electric Car Hire Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Battery Electric

- 6.1.2. Hybrid Electric

- 6.1.3. Plug-in Hybrid Electric

- 6.2. Market Analysis, Insights and Forecast - by Body Style

- 6.2.1. Hatchback

- 6.2.2. Sedan

- 6.2.3. Sports Utility Vehicles (SUVs)

- 6.2.4. Multi-utility Vehicle (MUV)

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Luxury

- 6.3.2. Budget/Economy

- 6.4. Market Analysis, Insights and Forecast - by Booking Type

- 6.4.1. Online

- 6.4.2. Offline

- 6.5. Market Analysis, Insights and Forecast - by End-Use

- 6.5.1. Local Usage

- 6.5.2. Airport Transport

- 6.5.3. Outstation

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Electric Car Hire Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Battery Electric

- 7.1.2. Hybrid Electric

- 7.1.3. Plug-in Hybrid Electric

- 7.2. Market Analysis, Insights and Forecast - by Body Style

- 7.2.1. Hatchback

- 7.2.2. Sedan

- 7.2.3. Sports Utility Vehicles (SUVs)

- 7.2.4. Multi-utility Vehicle (MUV)

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Luxury

- 7.3.2. Budget/Economy

- 7.4. Market Analysis, Insights and Forecast - by Booking Type

- 7.4.1. Online

- 7.4.2. Offline

- 7.5. Market Analysis, Insights and Forecast - by End-Use

- 7.5.1. Local Usage

- 7.5.2. Airport Transport

- 7.5.3. Outstation

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Electric Car Hire Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Battery Electric

- 8.1.2. Hybrid Electric

- 8.1.3. Plug-in Hybrid Electric

- 8.2. Market Analysis, Insights and Forecast - by Body Style

- 8.2.1. Hatchback

- 8.2.2. Sedan

- 8.2.3. Sports Utility Vehicles (SUVs)

- 8.2.4. Multi-utility Vehicle (MUV)

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Luxury

- 8.3.2. Budget/Economy

- 8.4. Market Analysis, Insights and Forecast - by Booking Type

- 8.4.1. Online

- 8.4.2. Offline

- 8.5. Market Analysis, Insights and Forecast - by End-Use

- 8.5.1. Local Usage

- 8.5.2. Airport Transport

- 8.5.3. Outstation

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of World Electric Car Hire Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Battery Electric

- 9.1.2. Hybrid Electric

- 9.1.3. Plug-in Hybrid Electric

- 9.2. Market Analysis, Insights and Forecast - by Body Style

- 9.2.1. Hatchback

- 9.2.2. Sedan

- 9.2.3. Sports Utility Vehicles (SUVs)

- 9.2.4. Multi-utility Vehicle (MUV)

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Luxury

- 9.3.2. Budget/Economy

- 9.4. Market Analysis, Insights and Forecast - by Booking Type

- 9.4.1. Online

- 9.4.2. Offline

- 9.5. Market Analysis, Insights and Forecast - by End-Use

- 9.5.1. Local Usage

- 9.5.2. Airport Transport

- 9.5.3. Outstation

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. North America Electric Car Hire Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 US

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Electric Car Hire Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 UK

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Spain

- 11.1.6 Rest of Europe

- 12. Asia Pacific Electric Car Hire Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of World Electric Car Hire Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 The Hertz Corporation

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Europcar Group

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Green Motion International

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Enterprise Holdings Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Zoomcar India Private Ltd

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Zipcar Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Avis Rent a Car Ltd

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 DriveElectric

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 BlueIndy*List Not Exhaustive

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Sixt SE

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 The Hertz Corporation

List of Figures

- Figure 1: Global Electric Car Hire Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Electric Car Hire Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Electric Car Hire Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Electric Car Hire Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Electric Car Hire Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Electric Car Hire Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Electric Car Hire Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of World Electric Car Hire Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of World Electric Car Hire Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Electric Car Hire Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 11: North America Electric Car Hire Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 12: North America Electric Car Hire Industry Revenue (Million), by Body Style 2024 & 2032

- Figure 13: North America Electric Car Hire Industry Revenue Share (%), by Body Style 2024 & 2032

- Figure 14: North America Electric Car Hire Industry Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Electric Car Hire Industry Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Electric Car Hire Industry Revenue (Million), by Booking Type 2024 & 2032

- Figure 17: North America Electric Car Hire Industry Revenue Share (%), by Booking Type 2024 & 2032

- Figure 18: North America Electric Car Hire Industry Revenue (Million), by End-Use 2024 & 2032

- Figure 19: North America Electric Car Hire Industry Revenue Share (%), by End-Use 2024 & 2032

- Figure 20: North America Electric Car Hire Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Electric Car Hire Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Electric Car Hire Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 23: Europe Electric Car Hire Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 24: Europe Electric Car Hire Industry Revenue (Million), by Body Style 2024 & 2032

- Figure 25: Europe Electric Car Hire Industry Revenue Share (%), by Body Style 2024 & 2032

- Figure 26: Europe Electric Car Hire Industry Revenue (Million), by Type 2024 & 2032

- Figure 27: Europe Electric Car Hire Industry Revenue Share (%), by Type 2024 & 2032

- Figure 28: Europe Electric Car Hire Industry Revenue (Million), by Booking Type 2024 & 2032

- Figure 29: Europe Electric Car Hire Industry Revenue Share (%), by Booking Type 2024 & 2032

- Figure 30: Europe Electric Car Hire Industry Revenue (Million), by End-Use 2024 & 2032

- Figure 31: Europe Electric Car Hire Industry Revenue Share (%), by End-Use 2024 & 2032

- Figure 32: Europe Electric Car Hire Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe Electric Car Hire Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Asia Pacific Electric Car Hire Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 35: Asia Pacific Electric Car Hire Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 36: Asia Pacific Electric Car Hire Industry Revenue (Million), by Body Style 2024 & 2032

- Figure 37: Asia Pacific Electric Car Hire Industry Revenue Share (%), by Body Style 2024 & 2032

- Figure 38: Asia Pacific Electric Car Hire Industry Revenue (Million), by Type 2024 & 2032

- Figure 39: Asia Pacific Electric Car Hire Industry Revenue Share (%), by Type 2024 & 2032

- Figure 40: Asia Pacific Electric Car Hire Industry Revenue (Million), by Booking Type 2024 & 2032

- Figure 41: Asia Pacific Electric Car Hire Industry Revenue Share (%), by Booking Type 2024 & 2032

- Figure 42: Asia Pacific Electric Car Hire Industry Revenue (Million), by End-Use 2024 & 2032

- Figure 43: Asia Pacific Electric Car Hire Industry Revenue Share (%), by End-Use 2024 & 2032

- Figure 44: Asia Pacific Electric Car Hire Industry Revenue (Million), by Country 2024 & 2032

- Figure 45: Asia Pacific Electric Car Hire Industry Revenue Share (%), by Country 2024 & 2032

- Figure 46: Rest of World Electric Car Hire Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 47: Rest of World Electric Car Hire Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 48: Rest of World Electric Car Hire Industry Revenue (Million), by Body Style 2024 & 2032

- Figure 49: Rest of World Electric Car Hire Industry Revenue Share (%), by Body Style 2024 & 2032

- Figure 50: Rest of World Electric Car Hire Industry Revenue (Million), by Type 2024 & 2032

- Figure 51: Rest of World Electric Car Hire Industry Revenue Share (%), by Type 2024 & 2032

- Figure 52: Rest of World Electric Car Hire Industry Revenue (Million), by Booking Type 2024 & 2032

- Figure 53: Rest of World Electric Car Hire Industry Revenue Share (%), by Booking Type 2024 & 2032

- Figure 54: Rest of World Electric Car Hire Industry Revenue (Million), by End-Use 2024 & 2032

- Figure 55: Rest of World Electric Car Hire Industry Revenue Share (%), by End-Use 2024 & 2032

- Figure 56: Rest of World Electric Car Hire Industry Revenue (Million), by Country 2024 & 2032

- Figure 57: Rest of World Electric Car Hire Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Electric Car Hire Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Electric Car Hire Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Global Electric Car Hire Industry Revenue Million Forecast, by Body Style 2019 & 2032

- Table 4: Global Electric Car Hire Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 5: Global Electric Car Hire Industry Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 6: Global Electric Car Hire Industry Revenue Million Forecast, by End-Use 2019 & 2032

- Table 7: Global Electric Car Hire Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Electric Car Hire Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: US Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Electric Car Hire Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Germany Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: UK Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: France Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Spain Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Electric Car Hire Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: India Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: China Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Korea Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia Pacific Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Electric Car Hire Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: South America Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Middle East and Africa Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Electric Car Hire Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 29: Global Electric Car Hire Industry Revenue Million Forecast, by Body Style 2019 & 2032

- Table 30: Global Electric Car Hire Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global Electric Car Hire Industry Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 32: Global Electric Car Hire Industry Revenue Million Forecast, by End-Use 2019 & 2032

- Table 33: Global Electric Car Hire Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: US Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of North America Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Electric Car Hire Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 38: Global Electric Car Hire Industry Revenue Million Forecast, by Body Style 2019 & 2032

- Table 39: Global Electric Car Hire Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Electric Car Hire Industry Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 41: Global Electric Car Hire Industry Revenue Million Forecast, by End-Use 2019 & 2032

- Table 42: Global Electric Car Hire Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Germany Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: UK Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Electric Car Hire Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 50: Global Electric Car Hire Industry Revenue Million Forecast, by Body Style 2019 & 2032

- Table 51: Global Electric Car Hire Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Global Electric Car Hire Industry Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 53: Global Electric Car Hire Industry Revenue Million Forecast, by End-Use 2019 & 2032

- Table 54: Global Electric Car Hire Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 55: India Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: China Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Japan Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: South Korea Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Global Electric Car Hire Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 61: Global Electric Car Hire Industry Revenue Million Forecast, by Body Style 2019 & 2032

- Table 62: Global Electric Car Hire Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 63: Global Electric Car Hire Industry Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 64: Global Electric Car Hire Industry Revenue Million Forecast, by End-Use 2019 & 2032

- Table 65: Global Electric Car Hire Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 66: South America Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Middle East and Africa Electric Car Hire Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Car Hire Industry?

The projected CAGR is approximately > 14.36%.

2. Which companies are prominent players in the Electric Car Hire Industry?

Key companies in the market include The Hertz Corporation, Europcar Group, Green Motion International, Enterprise Holdings Inc, Zoomcar India Private Ltd, Zipcar Inc, Avis Rent a Car Ltd, DriveElectric, BlueIndy*List Not Exhaustive, Sixt SE.

3. What are the main segments of the Electric Car Hire Industry?

The market segments include Vehicle Type, Body Style, Type, Booking Type, End-Use.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives to Promote Sales of Electric Vehicle.

6. What are the notable trends driving market growth?

Online Booking Type Is Expected To Have High Market Share.

7. Are there any restraints impacting market growth?

High Initial Investment for Installing Electric Vehicle Charging Infrastructure.

8. Can you provide examples of recent developments in the market?

In August 2022, UFODrive, an electric vehicle rental firm based in Europe, arrived in San Francisco on Thursday, marking the startup's first foray into the United States. Since its inception in 2018, UFODrive has expanded rapidly in 16 cities across Europe, including London, Paris, Berlin, Amsterdam, and Dublin. In addition, the business plans separate launches in New York and Austin in October.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Car Hire Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Car Hire Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Car Hire Industry?

To stay informed about further developments, trends, and reports in the Electric Car Hire Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence