Key Insights

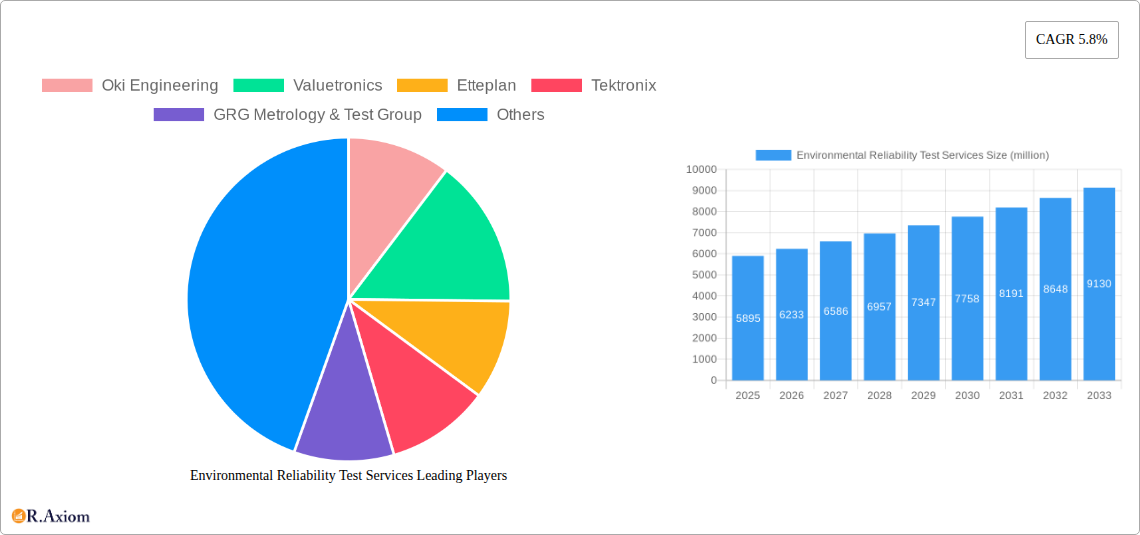

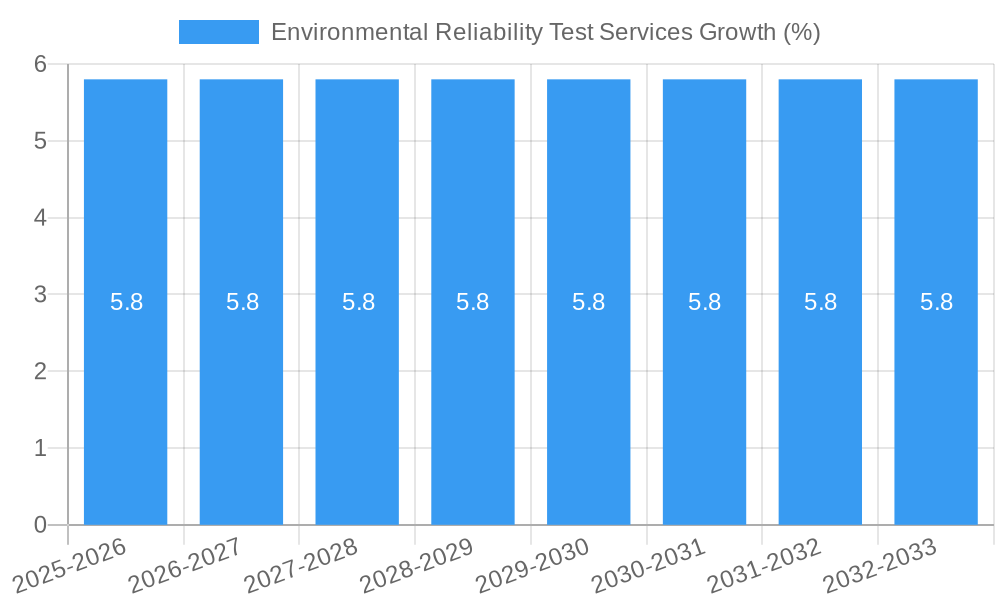

The global Environmental Reliability Test Services market is poised for significant expansion, projected to reach an estimated market size of approximately $5,895 million. This growth is fueled by an anticipated Compound Annual Growth Rate (CAGR) of 5.8% from 2019 to 2033. A critical driver for this upward trajectory is the increasing demand for robust product performance and longevity across diverse industries. As electronic devices become more complex and integrated into daily life, consumers and manufacturers alike prioritize rigorous testing to ensure reliability in various environmental conditions, from extreme temperatures to humidity and vibration. The proliferation of the Internet of Things (IoT) devices, advancements in the automotive sector with the rise of electric vehicles requiring specialized environmental testing, and the continuous innovation in consumer electronics all contribute to this demand. Furthermore, regulatory compliance and quality assurance standards are becoming more stringent, compelling businesses to invest heavily in environmental reliability testing services to meet these evolving requirements. The photovoltaic sector, with its reliance on long-term performance in exposed conditions, also presents a substantial growth avenue, underscoring the universal need for dependable product operation.

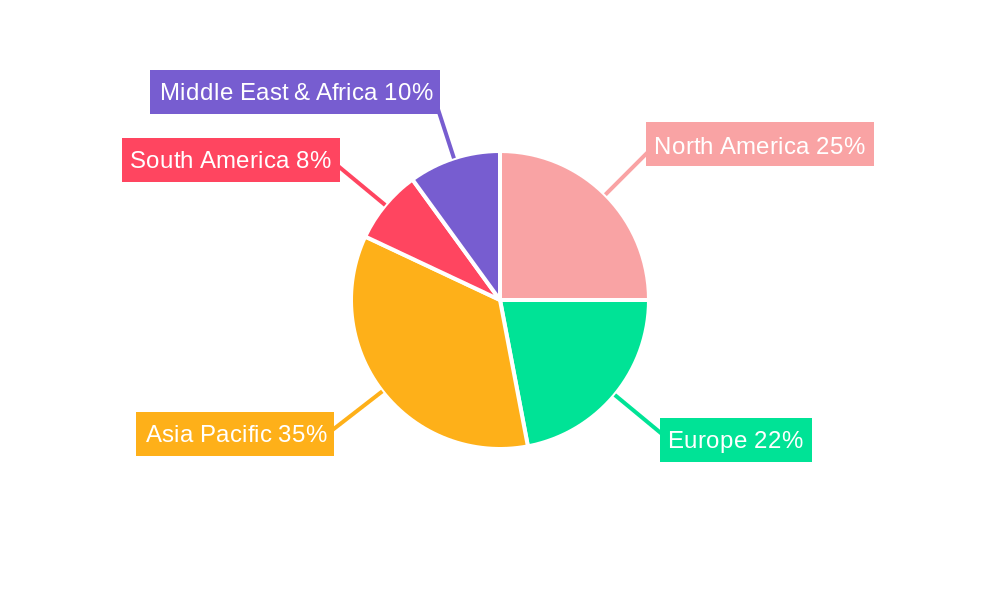

The market is segmented into distinct application areas, with Power and Electronic applications expected to dominate due to the high density of sensitive components and critical operational demands in these sectors. The Photovoltaic segment is also a key growth area, driven by global efforts towards renewable energy adoption. In terms of testing types, Comprehensive Environmental Test services are likely to gain prominence as they offer a holistic approach to assessing product resilience under a multitude of stressors, reflecting a move towards more integrated and advanced testing methodologies. Key players such as Oki Engineering, Valuetronics, Tektronix, and TÜV SÜD are actively shaping the market landscape through innovation, strategic partnerships, and service expansions. Geographically, the Asia Pacific region, led by China and India, is anticipated to exhibit the fastest growth due to its burgeoning manufacturing base and increasing domestic demand for high-quality, reliable products. North America and Europe, with their established industrial ecosystems and advanced technological adoption, will continue to be significant markets. Emerging economies in South America and the Middle East & Africa also present considerable untapped potential for environmental reliability test services.

Absolutely! Here is the detailed report description for Environmental Reliability Test Services, fully optimized for SEO and ready for immediate use.

Environmental Reliability Test Services Market Concentration & Innovation

The Environmental Reliability Test Services market exhibits a XX level of concentration, with key players like Oki Engineering, Valuetronics, Etteplan, Tektronix, GRG Metrology & Test Group, TÜV SÜD, ETC, STC, Ti Testing and Certification Group, Guangdong Future Test Service, Guangdong Eurber Testing, and BE Analytic holding significant market share. Innovation in this sector is primarily driven by the increasing complexity of electronic devices, the growing demand for high-performance power systems, and the rapid expansion of the photovoltaic industry. Regulatory frameworks, such as those mandating stringent performance and safety standards for electronic components and renewable energy infrastructure, also act as significant innovation catalysts. Product substitutes are limited, as specialized environmental testing is critical for product validation and quality assurance. End-user trends indicate a strong preference for comprehensive testing solutions that cover a wide range of environmental stressors, from extreme temperatures and humidity to vibration and ingress protection. Mergers and acquisitions (M&A) activities, with deal values estimated to be in the hundreds of millions, are observed as companies seek to expand their service portfolios and geographical reach. For instance, recent M&A activities have consolidated the market, with a projected M&A deal value of over $500 million in the historical period.

Environmental Reliability Test Services Industry Trends & Insights

The Environmental Reliability Test Services industry is poised for significant growth, driven by an insatiable demand for robust and dependable products across various sectors. The market is expected to witness a compound annual growth rate (CAGR) of approximately 7.5% over the forecast period of 2025–2033, escalating from an estimated market size of $12,000 million in the base year 2025. This robust growth trajectory is fueled by several key factors. Firstly, the increasing sophistication and miniaturization of electronic devices necessitate rigorous testing to ensure their resilience against diverse environmental conditions. From consumer electronics to advanced automotive systems and critical aerospace components, the need for validated reliability is paramount. Secondly, the global push towards sustainable energy sources, particularly in the photovoltaic sector, is a major growth driver. Solar panels and associated equipment are exposed to harsh outdoor environments, requiring extensive testing to guarantee their longevity and optimal performance. The market penetration of advanced testing methodologies is projected to reach 85% by 2033.

Technological disruptions are playing a pivotal role in reshaping the industry. The advent of advanced simulation software, AI-powered predictive analytics for failure prediction, and the integration of IoT devices for real-time environmental monitoring are enhancing the efficiency and accuracy of reliability testing. These innovations allow for faster test cycles, reduced costs, and more insightful data analysis, providing manufacturers with a competitive edge. Consumer preferences are increasingly leaning towards products with proven durability and extended lifespans, pushing manufacturers to invest more heavily in comprehensive environmental reliability testing. This consumer demand translates into higher market penetration for testing services that can guarantee product resilience.

Competitive dynamics are characterized by a blend of established global players and emerging regional specialists. Companies are differentiating themselves through specialized expertise, accreditations, and the development of unique testing methodologies. Strategic partnerships and collaborations are also becoming more prevalent as firms aim to broaden their service offerings and cater to a wider range of industry needs. The market is also seeing a trend towards integrated testing solutions, where multiple environmental stressors are simulated simultaneously, providing a more holistic assessment of product reliability. This integrated approach not only saves time but also offers a more realistic representation of real-world operational conditions, a crucial factor in today's demanding product development cycles.

Dominant Markets & Segments in Environmental Reliability Test Services

The Environmental Reliability Test Services market is dominated by the Electronic segment, accounting for an estimated 45% of the total market share, valued at over $5,400 million in 2025. This dominance stems from the ubiquitous nature of electronic devices in modern life, ranging from consumer electronics and telecommunications equipment to automotive control units and industrial automation systems. The inherent complexity and sensitivity of electronic components to environmental factors like temperature fluctuations, humidity, vibration, and electromagnetic interference necessitate rigorous reliability testing to ensure operational integrity and prevent costly failures. Key drivers within this segment include the rapid pace of technological innovation, shorter product life cycles, and stringent quality standards imposed by regulatory bodies and industry consortia. The demand for testing in this segment is further amplified by the increasing adoption of advanced technologies such as artificial intelligence, the Internet of Things (IoT), and 5G infrastructure, all of which rely heavily on robust and reliable electronic components.

Within the Type segmentation, Climate Environment Test services represent the largest market share, estimated at 35% of the total market, with a projected market value of $4,200 million in 2025. This is due to the universal impact of climatic conditions on a vast array of products. From extreme temperatures and humidity that can affect material integrity and electronic performance to corrosive atmospheres that can lead to premature degradation, climate testing is a fundamental requirement for product validation across nearly all industries. The increasing global emphasis on climate resilience and the extended operational life of products in diverse geographical locations further bolster the demand for comprehensive climate testing.

The Power segment, with an estimated market share of 30% and a value of $3,600 million in 2025, is another significant contributor. The reliability of power generation, transmission, and distribution equipment is critical for societal infrastructure and economic stability. Testing services ensure that power systems, including generators, transformers, switchgear, and renewable energy components like solar inverters and wind turbine controllers, can withstand the stresses of operation and varying environmental conditions. Economic policies promoting energy security and the transition to renewable energy sources are key drivers here.

The Photovoltaic segment, though smaller, is experiencing rapid growth, driven by global efforts to expand renewable energy capacity. Environmental testing for photovoltaic modules and related components is crucial to ensure their long-term performance and durability in outdoor environments subjected to extreme weather, UV radiation, and temperature cycles. The projected market for photovoltaic reliability testing is expected to grow at a CAGR of over 8% from 2025 to 2033.

The Others segment encompasses diverse applications such as aerospace, defense, medical devices, and industrial machinery, each with its own unique and often stringent reliability testing requirements. While individually smaller, collectively they contribute a substantial portion to the overall market, estimated at 15% of the total market, with a value of $1,800 million in 2025. The growth in this segment is propelled by advancements in specialized technologies and the increasing demand for high-reliability components in critical applications.

Environmental Reliability Test Services Product Developments

Product developments in Environmental Reliability Test Services are focusing on enhancing testing precision, efficiency, and comprehensive data analytics. Innovations include advanced climatic chambers capable of simulating extreme temperature and humidity cycles with unparalleled accuracy, and sophisticated vibration tables that replicate complex multi-axis motion. The integration of AI and machine learning algorithms is enabling predictive failure analysis, allowing manufacturers to identify potential weaknesses early in the development cycle. Furthermore, there is a growing trend towards modular and scalable testing solutions that can be adapted to a wide range of product types and testing protocols, providing competitive advantages through faster validation and reduced development costs.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Environmental Reliability Test Services market, segmented by Application, Type, and Region. The Application segmentation includes Power, Electronic, Photovoltaic, and Others. The Electronic segment, projected to grow at a CAGR of 7.2% and reach $8,900 million by 2033, is driven by the ever-expanding consumer electronics and IoT markets. The Power segment, with a projected CAGR of 6.8% and a market value of $7,800 million by 2033, is influenced by grid modernization and renewable energy integration. The Photovoltaic segment, experiencing a robust CAGR of 8.5% and expected to reach $5,200 million by 2033, is a direct beneficiary of global clean energy initiatives. The Others segment, encompassing aerospace, automotive, and medical devices, is projected to grow at a CAGR of 7.0% to $4,500 million by 2033, driven by specialized industry demands.

The Type segmentation includes Mechanical Environment Test, Climate Environment Test, and Comprehensive Environmental Test. Climate Environment Test, expected to grow at a CAGR of 7.3% and reach $9,500 million by 2033, remains dominant due to the universal impact of environmental factors. Mechanical Environment Test, with a CAGR of 6.9% and a projected market of $7,000 million by 2033, is essential for products subjected to physical stress. Comprehensive Environmental Test, offering integrated solutions, is anticipated to grow at a CAGR of 7.8% to $6,200 million by 2033, reflecting a demand for holistic product validation.

Key Drivers of Environmental Reliability Test Services Growth

The Environmental Reliability Test Services market is propelled by a confluence of critical drivers. The relentless pace of technological innovation, particularly in the electronics and renewable energy sectors, necessitates increasingly sophisticated and rigorous testing to ensure product longevity and performance in diverse operating conditions. Stringent regulatory frameworks and industry standards, such as those mandated for automotive safety, aerospace components, and photovoltaic systems, compel manufacturers to invest heavily in reliability testing to achieve market compliance and avoid costly recalls. The growing consumer demand for durable, long-lasting products, coupled with an increasing awareness of the economic and environmental implications of product failures, further fuels market growth. Furthermore, the expansion of emerging markets and the rise of new industrial applications contribute to the sustained expansion of the testing services sector, with global investments in R&D for next-generation technologies exceeding $1.2 million annually.

Challenges in the Environmental Reliability Test Services Sector

The Environmental Reliability Test Services sector faces several significant challenges that can impede growth. Escalating operational costs, including the procurement and maintenance of advanced testing equipment and specialized laboratory infrastructure, pose a considerable barrier. The need for highly skilled personnel with expertise in diverse testing methodologies and regulatory compliance further adds to operational expenditures. Intense competition among service providers, leading to price pressures, can impact profit margins. Evolving regulatory landscapes, which often require continuous adaptation and investment in new testing capabilities, present ongoing challenges. Additionally, the supply chain disruptions experienced globally can affect the availability of testing equipment and critical consumables, impacting service delivery timelines and overall operational efficiency, with an estimated impact of over $500 million in project delays in the historical period.

Emerging Opportunities in Environmental Reliability Test Services

Emerging opportunities within the Environmental Reliability Test Services market are abundant, driven by technological advancements and evolving industry demands. The rapid growth of the electric vehicle (EV) market presents a significant opportunity, requiring extensive testing of batteries, charging systems, and other critical components under various environmental conditions. The burgeoning Internet of Things (IoT) ecosystem demands robust testing for a vast array of connected devices, many of which operate in harsh or remote environments. The continuous expansion of renewable energy sources, particularly solar and wind power, necessitates specialized reliability testing to ensure the long-term performance and durability of infrastructure. Furthermore, the increasing adoption of smart manufacturing and Industry 4.0 technologies creates a demand for integrated testing solutions that can provide real-time data analysis and predictive maintenance insights, opening avenues for advanced service offerings. The global market for sustainable technologies is projected to reach $10 million by 2030, creating significant downstream testing demands.

Leading Players in the Environmental Reliability Test Services Market

- Oki Engineering

- Valuetronics

- Etteplan

- Tektronix

- GRG Metrology & Test Group

- TÜV SÜD

- ETC

- STC

- Ti Testing and Certification Group

- Guangdong Future Test Service

- Guangdong Eurber Testing

- BE Analytic

Key Developments in Environmental Reliability Test Services Industry

- 2023 May: Oki Engineering expands its climatic testing capabilities with the acquisition of a new state-of-the-art environmental chamber, enhancing its capacity to handle high-volume testing for the automotive sector.

- 2023 September: Valuetronics launches an AI-powered predictive reliability analysis service, integrating machine learning algorithms to offer clients faster failure detection and root cause analysis.

- 2024 January: Etteplan announces a strategic partnership with a leading semiconductor manufacturer to provide comprehensive qualification testing for next-generation microprocessors.

- 2024 March: Tektronix introduces a new suite of advanced vibration testing solutions, capable of simulating complex multi-axis shock and vibration profiles for aerospace and defense applications.

- 2024 June: GRG Metrology & Test Group inaugurates a new testing facility dedicated to the photovoltaic industry, equipped with accelerated aging chambers and advanced solar simulation capabilities.

- 2024 August: TÜV SÜD achieves accreditation for new environmental testing standards related to electromobility, strengthening its position in the EV testing market.

- 2024 October: ETC announces a significant investment in upgrading its humidity and temperature-controlled testing environments to meet the evolving demands of the consumer electronics market.

Strategic Outlook for Environmental Reliability Test Services Market

The strategic outlook for the Environmental Reliability Test Services market is overwhelmingly positive, driven by persistent demand for product quality and safety across all industries. Future growth will be catalyzed by the increasing integration of advanced technologies such as AI and IoT into testing methodologies, enabling more predictive and efficient validation processes. The sustained global focus on renewable energy, electric mobility, and resilient infrastructure will continue to fuel the need for specialized and comprehensive environmental testing. Companies that invest in expanding their service portfolios to encompass emerging technologies and cater to the unique requirements of high-growth sectors will be best positioned for success. Strategic acquisitions and partnerships will remain crucial for market players looking to broaden their geographical reach, acquire specialized expertise, and consolidate their market positions, with an estimated market potential of over $20,000 million by 2033.

Environmental Reliability Test Services Segmentation

-

1. Application

- 1.1. Power

- 1.2. Electronic

- 1.3. Photovoltaic

- 1.4. Others

-

2. Type

- 2.1. Mechanical Environment Test

- 2.2. Climate Environment Test

- 2.3. Comprehensive Environmental Test

Environmental Reliability Test Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Environmental Reliability Test Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Environmental Reliability Test Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power

- 5.1.2. Electronic

- 5.1.3. Photovoltaic

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Mechanical Environment Test

- 5.2.2. Climate Environment Test

- 5.2.3. Comprehensive Environmental Test

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Environmental Reliability Test Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Power

- 6.1.2. Electronic

- 6.1.3. Photovoltaic

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Mechanical Environment Test

- 6.2.2. Climate Environment Test

- 6.2.3. Comprehensive Environmental Test

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Environmental Reliability Test Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Power

- 7.1.2. Electronic

- 7.1.3. Photovoltaic

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Mechanical Environment Test

- 7.2.2. Climate Environment Test

- 7.2.3. Comprehensive Environmental Test

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Environmental Reliability Test Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Power

- 8.1.2. Electronic

- 8.1.3. Photovoltaic

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Mechanical Environment Test

- 8.2.2. Climate Environment Test

- 8.2.3. Comprehensive Environmental Test

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Environmental Reliability Test Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Power

- 9.1.2. Electronic

- 9.1.3. Photovoltaic

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Mechanical Environment Test

- 9.2.2. Climate Environment Test

- 9.2.3. Comprehensive Environmental Test

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Environmental Reliability Test Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Power

- 10.1.2. Electronic

- 10.1.3. Photovoltaic

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Mechanical Environment Test

- 10.2.2. Climate Environment Test

- 10.2.3. Comprehensive Environmental Test

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Oki Engineering

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Valuetronics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Etteplan

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tektronix

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GRG Metrology & Test Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TÜV SÜD

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ETC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 STC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ti Testing and Certification Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Guangdong Future Test Service

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Guangdong Eurber Testing

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BE Analytic

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Oki Engineering

List of Figures

- Figure 1: Global Environmental Reliability Test Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Environmental Reliability Test Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America Environmental Reliability Test Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Environmental Reliability Test Services Revenue (million), by Type 2024 & 2032

- Figure 5: North America Environmental Reliability Test Services Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Environmental Reliability Test Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America Environmental Reliability Test Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Environmental Reliability Test Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America Environmental Reliability Test Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Environmental Reliability Test Services Revenue (million), by Type 2024 & 2032

- Figure 11: South America Environmental Reliability Test Services Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Environmental Reliability Test Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America Environmental Reliability Test Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Environmental Reliability Test Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Environmental Reliability Test Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Environmental Reliability Test Services Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Environmental Reliability Test Services Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Environmental Reliability Test Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Environmental Reliability Test Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Environmental Reliability Test Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Environmental Reliability Test Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Environmental Reliability Test Services Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Environmental Reliability Test Services Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Environmental Reliability Test Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Environmental Reliability Test Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Environmental Reliability Test Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Environmental Reliability Test Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Environmental Reliability Test Services Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Environmental Reliability Test Services Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Environmental Reliability Test Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Environmental Reliability Test Services Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Environmental Reliability Test Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Environmental Reliability Test Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Environmental Reliability Test Services Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Environmental Reliability Test Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Environmental Reliability Test Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Environmental Reliability Test Services Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Environmental Reliability Test Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Environmental Reliability Test Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Environmental Reliability Test Services Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Environmental Reliability Test Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Environmental Reliability Test Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Environmental Reliability Test Services Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Environmental Reliability Test Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Environmental Reliability Test Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Environmental Reliability Test Services Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Environmental Reliability Test Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Environmental Reliability Test Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Environmental Reliability Test Services Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Environmental Reliability Test Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Environmental Reliability Test Services Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Environmental Reliability Test Services?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Environmental Reliability Test Services?

Key companies in the market include Oki Engineering, Valuetronics, Etteplan, Tektronix, GRG Metrology & Test Group, TÜV SÜD, ETC, STC, Ti Testing and Certification Group, Guangdong Future Test Service, Guangdong Eurber Testing, BE Analytic.

3. What are the main segments of the Environmental Reliability Test Services?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5895 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Environmental Reliability Test Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Environmental Reliability Test Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Environmental Reliability Test Services?

To stay informed about further developments, trends, and reports in the Environmental Reliability Test Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence