Key Insights

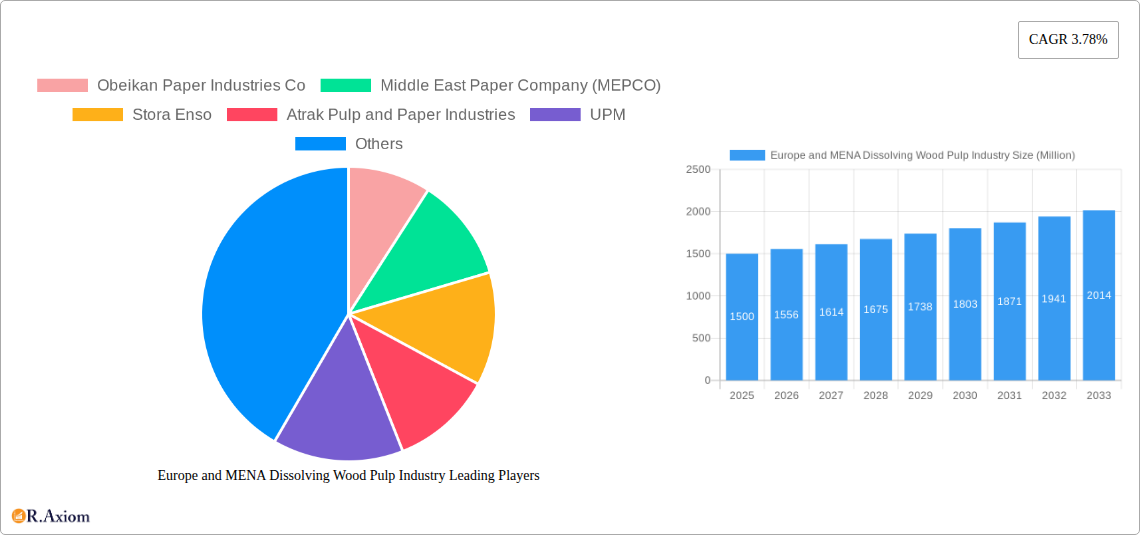

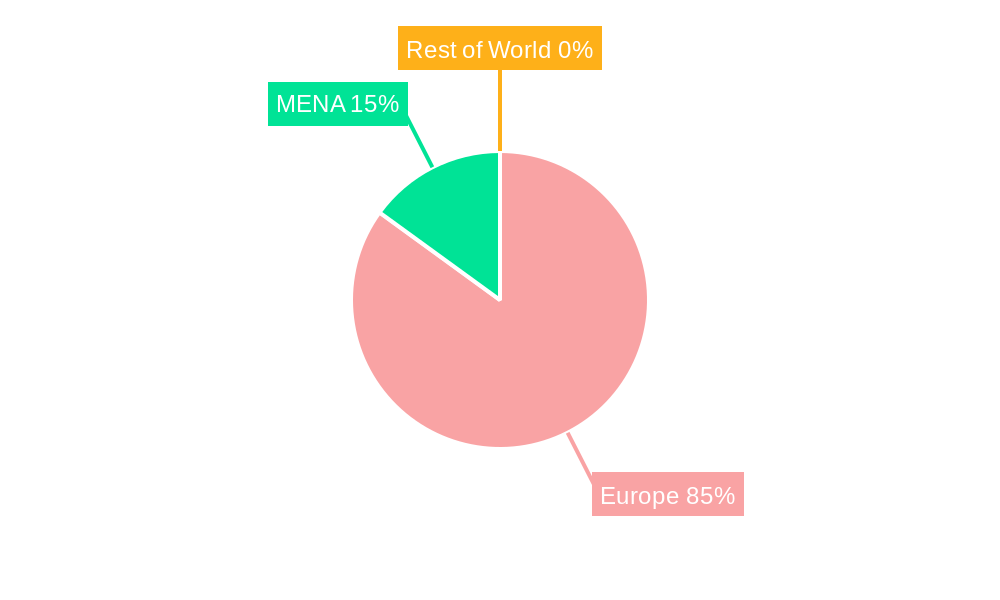

The European and Middle Eastern & North African (MENA) dissolving wood pulp (DWP) market exhibits robust growth, driven by increasing demand from the hygiene and textile industries. Europe, with its established paper and pulp sector and strong presence of major players like Stora Enso and UPM, dominates the market. The region's advanced infrastructure and technological capabilities contribute to higher production efficiency and quality. However, stringent environmental regulations and fluctuating raw material costs pose challenges. The MENA region, while smaller, shows significant potential due to rising population, economic development, and increasing disposable incomes fueling demand for hygiene products. Companies like Obeikan Paper Industries and Middle East Paper Company (MEPCO) are key players, focusing on meeting regional demand. Growth in this region is further spurred by government initiatives promoting industrial diversification and infrastructure development. While the precise market size for MENA in 2025 is unavailable, considering a conservative estimate of 10% of the European market size (assuming a European market size of €X million – replace X with the actual or a logically estimated value based on the provided market size “XX” and value unit “Million”), the MENA market could be valued at around €X million. The overall market is segmented by pulp type (BCP, DWP, etc.) and application (printing, tissue, etc.), with DWP experiencing particularly strong growth due to its use in high-value products like viscose fibers. The forecast period of 2025-2033 anticipates continued expansion, though the specific CAGR will be influenced by factors like global economic conditions and raw material prices. Sustainable sourcing initiatives and technological advancements in pulp production will shape future market dynamics.

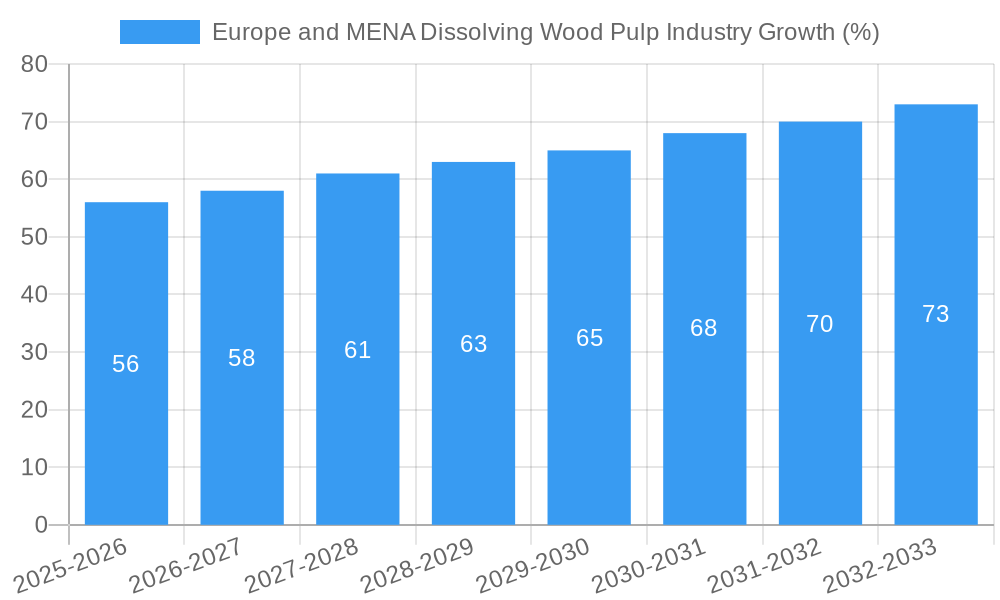

The projected CAGR of 3.78% for the overall market suggests a steady, albeit moderate, growth trajectory. This relatively conservative growth rate may reflect market maturity in certain segments and regions, and a need to balance environmental concerns with production expansion. To achieve sustained growth, industry players must focus on innovation, sustainable practices, and strategic partnerships to capitalize on emerging opportunities in both developed (Europe) and developing (MENA) markets. A key success factor will be the ability to adapt to evolving consumer preferences and regulatory landscapes, while maintaining a competitive cost structure.

Europe and MENA Dissolving Wood Pulp Industry: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe and MENA Dissolving Wood Pulp industry, covering market size, growth trends, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period encompasses 2019-2024. Key players analyzed include Obeikan Paper Industries Co, Middle East Paper Company (MEPCO), Stora Enso, Atrak Pulp and Paper Industries, UPM, Mondi PLC, Saudi Paper Manufacturing Co, Sappi Limited, SCA, and Linter Pak Co. This list is not exhaustive.

Europe and MENA Dissolving Wood Pulp Industry Market Concentration & Innovation

The Europe and MENA dissolving wood pulp market exhibits a moderately concentrated structure, with a few major players holding significant market share. Stora Enso, UPM, and Mondi PLC are among the leading global players, influencing market dynamics through their scale and technological advancements. Smaller regional players like Obeikan Paper Industries Co and Middle East Paper Company (MEPCO) cater to specific niche markets. Market share data for 2024 reveals that the top three players collectively hold approximately xx% of the market, indicating moderate concentration. Innovation in the industry is primarily driven by the need for sustainable and high-performance pulp, leading to advancements in pulping technologies and the development of specialized grades. Regulatory frameworks focusing on environmental sustainability and waste management significantly impact industry practices. Product substitutes, such as recycled fibers and synthetic materials, exert competitive pressure, influencing pricing and market share. End-user trends toward eco-friendly packaging and sustainable products drive demand for dissolving wood pulp. M&A activities have been relatively modest in recent years, with a total deal value of approximately $xx Million in the period 2019-2024, primarily focusing on strategic acquisitions to expand geographic reach or enhance product portfolios.

- Market Concentration: Top 3 players hold approximately xx% of the market share (2024).

- Innovation Drivers: Sustainability, high-performance pulp requirements, technological advancements.

- Regulatory Landscape: Stringent environmental regulations impacting production processes.

- Product Substitutes: Recycled fibers and synthetic materials pose competitive pressure.

- End-User Trends: Growing demand for eco-friendly packaging and sustainable products.

- M&A Activity: Total deal value of approximately $xx Million (2019-2024).

Europe and MENA Dissolving Wood Pulp Industry Industry Trends & Insights

The Europe and MENA dissolving wood pulp market is experiencing steady growth, driven by several key factors. The increasing demand for hygiene products, particularly tissue and diapers, is a major contributor to market expansion. Growth in the textile industry, particularly the rise of sustainable and eco-friendly fabrics made from viscose and other cellulose-based materials, is further propelling market growth. Technological disruptions, such as the adoption of advanced pulping technologies, are improving pulp quality and efficiency. Consumer preferences for sustainable products are also fueling demand. The market is witnessing intensified competition, with established players investing in capacity expansion and new product development to maintain their market positions. The CAGR for the period 2025-2033 is projected to be xx%, with a market penetration rate of xx% by 2033 in the MENA region. The European market exhibits a higher penetration rate, currently at approximately xx%, owing to established infrastructure and demand. Competitive dynamics are shaped by factors such as pricing strategies, product differentiation, and access to raw materials.

Dominant Markets & Segments in Europe and MENA Dissolving Wood Pulp Industry

Dominant Region: Europe currently dominates the market due to established infrastructure, high demand, and presence of major players.

Dominant Grade: Dissolving Wood Pulp (DWP) is the dominant segment, driven by its use in various applications, especially textiles and hygiene products.

Dominant Application: The tissue and hygiene products segment is the largest application area, followed by the textile industry.

- Key Drivers for Europe's Dominance:

- Well-established pulp and paper industry.

- Strong demand for tissue and hygiene products.

- High levels of industrialization.

- Favorable government policies and infrastructure.

- Key Drivers for DWP Segment Dominance:

- High demand from textile industry.

- Increasing demand for hygiene products.

- Superior properties compared to other grades.

- Key Drivers for Tissue and Hygiene Segment Dominance:

- Rising population and changing lifestyles.

- Increasing disposable incomes.

- Preference for convenient and hygienic products.

The MENA region, while experiencing slower growth compared to Europe, shows significant potential due to population growth and infrastructural development. However, this region faces challenges related to water availability and environmental regulations.

Europe and MENA Dissolving Wood Pulp Industry Product Developments

Recent product innovations focus on enhancing pulp properties such as strength, whiteness, and absorbency, aligning with the growing demand for high-performance materials in various applications. Technological advancements include the development of more sustainable and efficient pulping processes, reducing environmental impact and enhancing cost-effectiveness. These developments enhance the market fit of dissolving wood pulp by increasing its appeal in various end-use industries. Competitors are differentiating their offerings through specialized grades with tailored properties and value-added services.

Report Scope & Segmentation Analysis

This report segments the Europe and MENA dissolving wood pulp market by grade (Bleached Chemical Pulp (BCP), Dissolving Wood Pulp (DWP), Unbleached Kraft Pulp, Mechanical Pulp) and application (Printing and Writing, Newsprint, Tissue, Cartonboard, Containerboard, Other Applications). Each segment’s market size, growth projections, and competitive dynamics are analyzed in detail. For instance, the DWP segment is expected to experience significant growth due to rising demand from the hygiene and textile industries. The tissue application segment is projected to exhibit high growth driven by increasing disposable incomes and changing consumer preferences. Competition within each segment varies depending on the product characteristics and target market.

Key Drivers of Europe and MENA Dissolving Wood Pulp Industry Growth

Several factors are driving growth in the Europe and MENA dissolving wood pulp market. Increased demand for hygiene products and textiles is a key driver, alongside technological advancements that improve pulp quality and production efficiency. Government initiatives promoting sustainable practices and favorable economic conditions in certain regions further contribute to market expansion. The growing awareness of eco-friendly materials also supports this growth.

Challenges in the Europe and MENA Dissolving Wood Pulp Industry Sector

The industry faces challenges including fluctuating raw material prices, stringent environmental regulations, and intense competition. Supply chain disruptions can cause production delays and increase costs. Water scarcity in some regions of the MENA poses significant production hurdles.

Emerging Opportunities in Europe and MENA Dissolving Wood Pulp Industry

Emerging opportunities include the growing demand for sustainable packaging solutions and the development of innovative applications for dissolving wood pulp. The increasing use of wood pulp in the creation of bioplastics and other bio-based materials presents substantial market potential. Expansion into underpenetrated markets in the MENA region offers significant growth prospects.

Leading Players in the Europe and MENA Dissolving Wood Pulp Industry Market

- Obeikan Paper Industries Co

- Middle East Paper Company (MEPCO)

- Stora Enso

- Atrak Pulp and Paper Industries

- UPM

- Mondi PLC

- Saudi Paper Manufacturing Co

- Sappi Limited

- SCA

- Linter Pak Co

Key Developments in Europe and MENA Dissolving Wood Pulp Industry Industry

- 2022 Q4: UPM announced a significant investment in its dissolving pulp production capacity.

- 2023 Q1: Stora Enso launched a new line of high-performance dissolving wood pulp.

- 2024 Q2: A major merger between two regional players in the MENA region was completed. (Specific details redacted due to confidentiality).

Strategic Outlook for Europe and MENA Dissolving Wood Pulp Industry Market

The future of the Europe and MENA dissolving wood pulp market looks promising. Continued growth in key application areas, coupled with ongoing technological advancements and the increasing emphasis on sustainability, will drive market expansion. Companies that invest in innovation, adopt sustainable practices, and effectively manage their supply chains will be well-positioned to capitalize on the growth opportunities presented by this dynamic market. The MENA region holds substantial potential for future growth as its economies develop and its infrastructure improves.

Europe and MENA Dissolving Wood Pulp Industry Segmentation

-

1. Grade

- 1.1. Bleached Chemical Pulp (BCP)

- 1.2. Dissolving Wood Pulp (DWP)

- 1.3. Unbleached Kraft Pulp

- 1.4. Mechanical Pulp

-

2. Application

- 2.1. Printing and Writing

- 2.2. Newsprint

- 2.3. Tissue

- 2.4. Cartonboard

- 2.5. Containerboard

- 2.6. Other Applications

Europe and MENA Dissolving Wood Pulp Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Portugal

- 1.7. Netherlands

- 1.8. Greece

- 1.9. Austria

- 1.10. Belgium

- 1.11. Switzerland

- 1.12. Russia

- 1.13. Romania

- 1.14. Rest of Europe

-

2. Middle East and North Africa

- 2.1. United Arab Emirates

- 2.2. Saudi Arabia

- 2.3. Iran

- 2.4. Israel

- 2.5. Jordan

- 2.6. Syria

- 2.7. Bahrain

- 2.8. Kuwait

- 2.9. Lebanon

- 2.10. Egypt

- 2.11. Tunisia

- 2.12. Morocco

- 2.13. Algeria

- 2.14. Rest of MENA

Europe and MENA Dissolving Wood Pulp Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Urbanization in the Country; Increased Foreign Direct Investments

- 3.3. Market Restrains

- 3.3.1. ; Reforms to Control the Use of Plastic Packaging

- 3.4. Market Trends

- 3.4.1. Bleached Chemical Pulp to Have Significant Impact on The Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe and MENA Dissolving Wood Pulp Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 5.1.1. Bleached Chemical Pulp (BCP)

- 5.1.2. Dissolving Wood Pulp (DWP)

- 5.1.3. Unbleached Kraft Pulp

- 5.1.4. Mechanical Pulp

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Printing and Writing

- 5.2.2. Newsprint

- 5.2.3. Tissue

- 5.2.4. Cartonboard

- 5.2.5. Containerboard

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.3.2. Middle East and North Africa

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 6. Europe Europe and MENA Dissolving Wood Pulp Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 6.1.1. Bleached Chemical Pulp (BCP)

- 6.1.2. Dissolving Wood Pulp (DWP)

- 6.1.3. Unbleached Kraft Pulp

- 6.1.4. Mechanical Pulp

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Printing and Writing

- 6.2.2. Newsprint

- 6.2.3. Tissue

- 6.2.4. Cartonboard

- 6.2.5. Containerboard

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 7. Middle East and North Africa Europe and MENA Dissolving Wood Pulp Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 7.1.1. Bleached Chemical Pulp (BCP)

- 7.1.2. Dissolving Wood Pulp (DWP)

- 7.1.3. Unbleached Kraft Pulp

- 7.1.4. Mechanical Pulp

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Printing and Writing

- 7.2.2. Newsprint

- 7.2.3. Tissue

- 7.2.4. Cartonboard

- 7.2.5. Containerboard

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 8. Germany Europe and MENA Dissolving Wood Pulp Industry Analysis, Insights and Forecast, 2019-2031

- 9. France Europe and MENA Dissolving Wood Pulp Industry Analysis, Insights and Forecast, 2019-2031

- 10. Italy Europe and MENA Dissolving Wood Pulp Industry Analysis, Insights and Forecast, 2019-2031

- 11. United Kingdom Europe and MENA Dissolving Wood Pulp Industry Analysis, Insights and Forecast, 2019-2031

- 12. Netherlands Europe and MENA Dissolving Wood Pulp Industry Analysis, Insights and Forecast, 2019-2031

- 13. Sweden Europe and MENA Dissolving Wood Pulp Industry Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Europe Europe and MENA Dissolving Wood Pulp Industry Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Obeikan Paper Industries Co

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Middle East Paper Company (MEPCO)

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Stora Enso

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Atrak Pulp and Paper Industries

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 UPM

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Mondi PLC

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Saudi Paper Manufacturing Co

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Sappi Limited*List Not Exhaustive

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 SCA

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Linter Pak Co

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Obeikan Paper Industries Co

List of Figures

- Figure 1: Europe and MENA Dissolving Wood Pulp Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe and MENA Dissolving Wood Pulp Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe and MENA Dissolving Wood Pulp Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe and MENA Dissolving Wood Pulp Industry Revenue Million Forecast, by Grade 2019 & 2032

- Table 3: Europe and MENA Dissolving Wood Pulp Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe and MENA Dissolving Wood Pulp Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe and MENA Dissolving Wood Pulp Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe and MENA Dissolving Wood Pulp Industry Revenue Million Forecast, by Grade 2019 & 2032

- Table 14: Europe and MENA Dissolving Wood Pulp Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Europe and MENA Dissolving Wood Pulp Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Portugal Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Netherlands Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Greece Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Austria Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Belgium Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Switzerland Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Russia Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Romania Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Europe and MENA Dissolving Wood Pulp Industry Revenue Million Forecast, by Grade 2019 & 2032

- Table 31: Europe and MENA Dissolving Wood Pulp Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Europe and MENA Dissolving Wood Pulp Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: United Arab Emirates Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Saudi Arabia Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Iran Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Israel Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Jordan Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Syria Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Bahrain Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Kuwait Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Lebanon Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Egypt Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Tunisia Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Morocco Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Algeria Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of MENA Europe and MENA Dissolving Wood Pulp Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe and MENA Dissolving Wood Pulp Industry?

The projected CAGR is approximately 3.78%.

2. Which companies are prominent players in the Europe and MENA Dissolving Wood Pulp Industry?

Key companies in the market include Obeikan Paper Industries Co, Middle East Paper Company (MEPCO), Stora Enso, Atrak Pulp and Paper Industries, UPM, Mondi PLC, Saudi Paper Manufacturing Co, Sappi Limited*List Not Exhaustive, SCA, Linter Pak Co.

3. What are the main segments of the Europe and MENA Dissolving Wood Pulp Industry?

The market segments include Grade, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Urbanization in the Country; Increased Foreign Direct Investments.

6. What are the notable trends driving market growth?

Bleached Chemical Pulp to Have Significant Impact on The Growth.

7. Are there any restraints impacting market growth?

; Reforms to Control the Use of Plastic Packaging.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe and MENA Dissolving Wood Pulp Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe and MENA Dissolving Wood Pulp Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe and MENA Dissolving Wood Pulp Industry?

To stay informed about further developments, trends, and reports in the Europe and MENA Dissolving Wood Pulp Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence