Key Insights

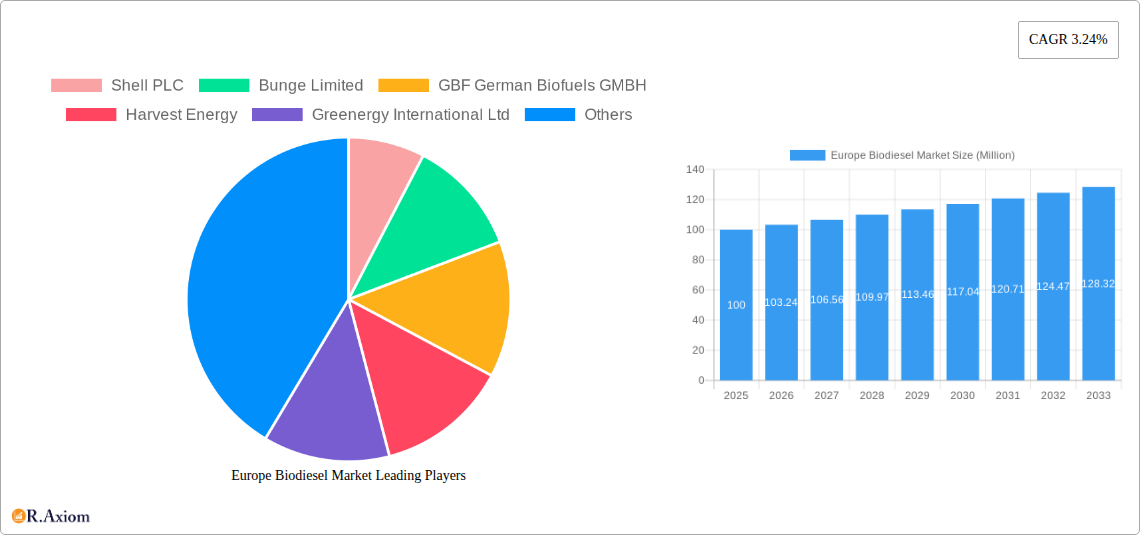

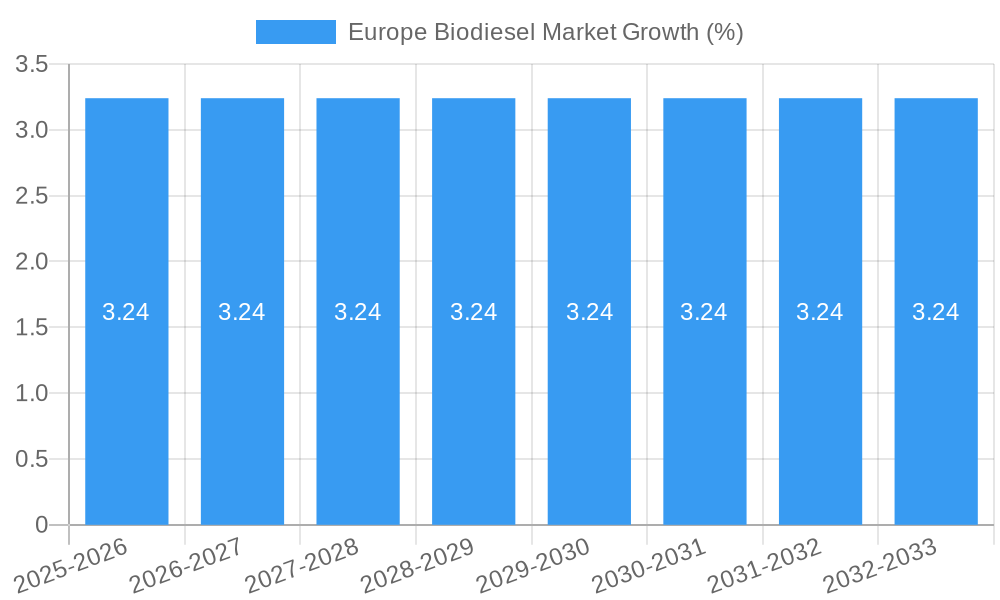

The European biodiesel market, valued at approximately €[Estimate based on market size XX and value unit million. For example, if XX was 100, the value would be €100 million in 2025], is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 3.24% from 2025 to 2033. This growth is driven by several key factors. Stringent environmental regulations across Europe, particularly aimed at reducing greenhouse gas emissions from the transportation sector, are mandating the increased blending of biodiesel into conventional diesel fuel. This regulatory push is complemented by growing consumer awareness of sustainable transportation alternatives and a rising preference for biofuels as a greener fuel option. Furthermore, advancements in feedstock technology and processing are enhancing the efficiency and cost-effectiveness of biodiesel production, making it a more competitive alternative to traditional fossil fuels.

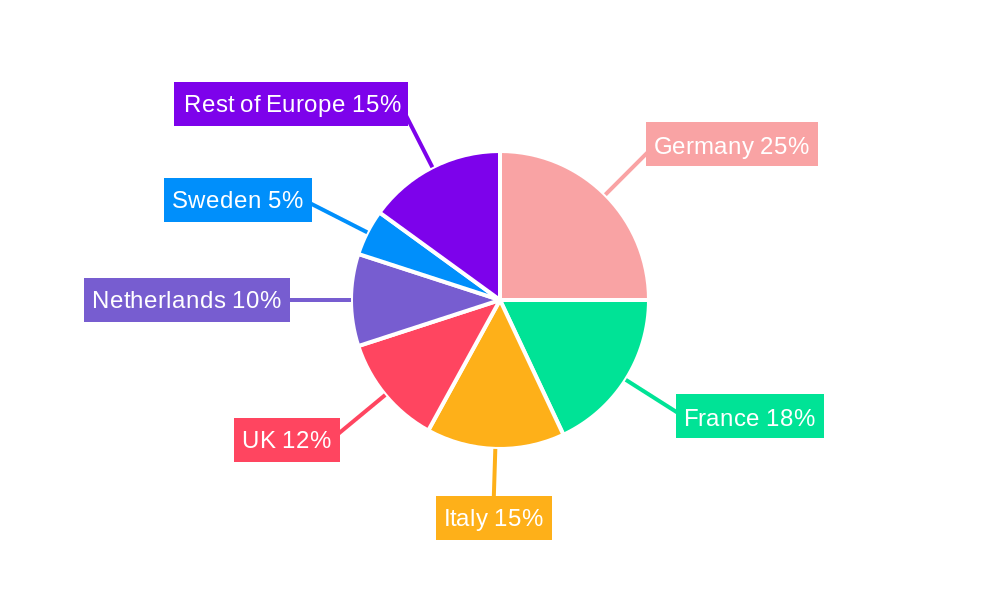

However, the market faces certain challenges. Fluctuations in the price of feedstocks, such as rapeseed oil and palm oil, can impact biodiesel production costs and profitability. Concerns surrounding land use change associated with certain feedstock crops, as well as the potential for indirect land use change, remain a significant restraint. Competition from other renewable energy sources, such as electricity and hydrogen-based fuels, may also influence the market's trajectory. The market segmentation, encompassing various biodiesel blends (B7, B10, B20, B30) and feedstocks (rapeseed oil, palm oil, used cooking oil, and others), presents both opportunities and complexities. The dominance of certain feedstocks will depend on factors like regional availability, price volatility, and sustainability concerns. Key players like Shell PLC, Bunge Limited, and others are actively shaping market dynamics through investments in production capacity, research and development, and strategic partnerships. The regional breakdown, with Germany, France, Italy, the United Kingdom, and the Netherlands representing significant markets, highlights opportunities for targeted market penetration.

Europe Biodiesel Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Europe Biodiesel Market, covering market size, segmentation, growth drivers, challenges, and future opportunities. The report encompasses historical data (2019-2024), the base year (2025), and a forecast period (2025-2033). This in-depth study is essential for industry stakeholders, investors, and anyone seeking to understand the complexities and future trajectory of this dynamic market.

Europe Biodiesel Market Concentration & Innovation

This section analyzes the competitive landscape of the European biodiesel market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market is moderately concentrated, with several key players holding significant market share, but also featuring a number of smaller, regional producers.

Market Share: Shell PLC and Bunge Limited collectively hold an estimated xx% market share, indicating their dominance. Other key players like GBF German Biofuels GMBH and Greenergy International Ltd contribute to a more fragmented market structure. Precise figures require in-depth analysis and are detailed within the report.

Innovation Drivers: Technological advancements in feedstock utilization, particularly the increased adoption of used cooking oil (UCO), are driving innovation. Improvements in biodiesel production processes, including the use of advanced catalysts and more efficient reactors, are boosting overall market efficiency.

Regulatory Frameworks: The European Union's Renewable Energy Directive (RED) and national policies significantly influence the market. Changes in these policies, such as Germany's announced shift away from crop-based biofuels (detailed in the Key Developments section), create both opportunities and challenges.

Product Substitutes: Competition from other biofuels, such as hydrotreated vegetable oil (HVO), and traditional fossil fuels presents a significant challenge. The competitiveness of biodiesel relies on factors including pricing, sustainability certifications, and regulatory support.

End-User Trends: The growing demand for sustainable and renewable energy sources from transportation and heating sectors drives the market’s growth. Stringent emission norms and government incentives further increase demand.

M&A Activities: The European biodiesel market has witnessed xx M&A deals in the last five years, with an estimated total value of xx Million. These activities reflect industry consolidation and the pursuit of economies of scale and technological advancements. The report provides a detailed list of these transactions and their impacts.

Europe Biodiesel Market Industry Trends & Insights

The European biodiesel market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including: increasing demand for renewable fuels driven by stringent emission regulations, growing environmental concerns, and supportive government policies across several European countries. The market penetration of biodiesel blends, particularly B7 and B10, is expected to steadily increase across several European nations. However, the industry also faces significant challenges such as feedstock price volatility, technological disruptions, and changing consumer preferences.

The transition towards advanced biofuels, including those made from waste and residue feedstocks, is a prominent technological disruption impacting the landscape. This transition is mainly driven by sustainability concerns, and it may influence the market share of traditional feedstocks. The report analyzes these trends and provides a deeper insight into their impact on overall growth and market share of different feedstock sources. Furthermore, the analysis explores the shifting consumer preferences towards sustainable and ethically sourced biofuels, alongside competitive dynamics influencing pricing and market access for different players.

Dominant Markets & Segments in Europe Biodiesel Market

The report identifies Germany as the leading market within Europe. This dominance is attributable to several factors:

Germany: Despite the announced policy shift away from crop-based biofuels, Germany remains a significant player due to its established infrastructure, substantial renewable energy targets, and existing biodiesel production capacity. The shift will undoubtedly lead to changes in feedstock composition.

Leading Biodiesel Blends: B7 and B10 blends currently hold the largest market share due to widespread adoption and compatibility with existing infrastructure. B20 and B30 blends are projected to see increased growth during the forecast period, driven by governmental mandates and the ongoing push for higher blending rates.

Dominant Feedstock: Rapeseed oil remains the leading feedstock, however, the utilization of Used Cooking Oil (UCO) is rapidly expanding, driven by sustainability concerns and cost advantages. Palm oil faces increasing scrutiny due to environmental considerations. The report analyzes the dynamics of each feedstock in detail, projecting their future market share and analyzing the factors driving their growth or decline.

Europe Biodiesel Market Product Developments

Recent product innovations center on improving biodiesel quality, enhancing feedstock utilization, and optimizing production processes. The integration of advanced technologies, such as advanced catalysts and process optimization techniques, is leading to higher yields and reduced production costs. New production facilities, like the one recently opened in Hungary, demonstrate a focus on multi-feedstock capabilities, enabling producers to respond to fluctuating feedstock availability and costs. These advancements aim to make biodiesel a more competitive alternative to traditional fuels, while also enhancing its environmental profile.

Report Scope & Segmentation Analysis

This report segments the Europe Biodiesel Market based on:

Biodiesel Blends:

- B7: This segment currently holds the largest market share, offering a balance between ease of implementation and sustainability benefits. Projected growth will be slower than higher blends.

- B10: Growth in this segment is expected to be strong due to increased policy support and its relative ease of adoption compared to higher blends.

- B20: This segment is witnessing increased adoption, but faces challenges related to infrastructure and engine compatibility. The market size is projected to be xx Million by 2033.

- B30: The growth of B30 is linked to further policy support and technological advancements in engine compatibility. The market size is predicted to be xx Million by 2033.

Feedstock:

- Rapeseed Oil: Remains the dominant feedstock due to its widespread availability and established supply chains. Growth will be influenced by crop yields and competition from other feedstocks.

- Palm Oil: While currently utilized, this segment faces ongoing challenges related to sustainability concerns and increasing regulatory pressures. Market growth is predicted to slow.

- Used Cooking Oil (UCO): Rapid growth is projected due to its environmental benefits and cost-effectiveness. However, supply chain development and quality control remain important factors.

- Other Feedstocks: This segment includes various alternative feedstocks, and their growth will depend on technological advancements and economic viability.

Key Drivers of Europe Biodiesel Market Growth

The growth of the European biodiesel market is primarily driven by stringent government regulations aimed at reducing greenhouse gas emissions. The EU's Renewable Energy Directive and national-level policies provide incentives and mandates for biodiesel blending. The increasing awareness of environmental concerns amongst consumers and the push for sustainable transportation fuels also contribute significantly. Furthermore, technological advancements, such as improved production processes and utilization of diverse feedstocks, are continually enhancing the competitiveness and efficiency of biodiesel production.

Challenges in the Europe Biodiesel Market Sector

The Europe Biodiesel market faces several key challenges, including feedstock price volatility, which significantly impacts production costs and profitability. Competition from other renewable fuels and fossil fuels also poses a challenge. Regulatory uncertainty and changes in government policies can create instability and impact investment decisions. Supply chain disruptions and logistical challenges can impede the smooth functioning of the market and increase production costs. The fluctuating costs associated with feedstock sourcing and processing frequently lead to inconsistent pricing, affecting the overall market profitability.

Emerging Opportunities in Europe Biodiesel Market

Significant opportunities lie in the increased adoption of advanced biofuels produced from waste and residue feedstocks, offering enhanced sustainability and reduced reliance on food crops. Technological innovations in production processes will enable greater efficiency and lower costs, while expanding the range of utilizable feedstocks. Further development of sustainable feedstock sourcing practices will reduce reliance on crops and enhance the environmental footprint of biodiesel production.

Leading Players in the Europe Biodiesel Market Market

- Shell PLC

- Bunge Limited

- GBF German Biofuels GMBH

- Harvest Energy

- Greenergy International Ltd

- Air Liquide SA

- Abengoa Bioenergia SA

- Envien Group

- BP PLC

Key Developments in Europe Biodiesel Market Industry

- March 2022: Rossi Biofuel Zrt, a subsidiary of the ENVIEN Group, inaugurated a new biodiesel plant in Hungary, increasing its annual production capacity by 60,000 tons.

- January 2023: Germany's Ministry of Environment proposed a cabinet plan to withdraw from crop-based biofuels to reduce greenhouse gas emissions, significantly impacting the market dynamics within the German biodiesel sector.

Strategic Outlook for Europe Biodiesel Market Market

The European biodiesel market holds significant long-term growth potential, driven by the increasing demand for renewable transportation fuels and stringent environmental regulations. The ongoing focus on technological innovation, particularly in feedstock utilization and production processes, will further enhance market competitiveness. The successful integration of sustainable feedstock sourcing and supply chain optimization will improve the environmental impact and economic viability of biodiesel. The transition towards advanced biofuels will lead to new opportunities and market dynamics.

Europe Biodiesel Market Segmentation

-

1. Feedstock

- 1.1. Rapeseed Oil

- 1.2. Palm Oil

- 1.3. Used Cooking Oil

- 1.4. Other Feedstocks

-

2. Biodiesel Blends

- 2.1. B5

- 2.2. B20

- 2.3. B100

Europe Biodiesel Market Segmentation By Geography

- 1. Germany

- 2. Spain

- 3. United Kingdom

- 4. France

- 5. Rest of Europe

Europe Biodiesel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.24% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Supportive Policies and Regulations4.; Energy Security

- 3.3. Market Restrains

- 3.3.1. 4.; Feedstock Availability and Price Volatility

- 3.4. Market Trends

- 3.4.1. Palm Oil Is Likely To Dominate The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Biodiesel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Feedstock

- 5.1.1. Rapeseed Oil

- 5.1.2. Palm Oil

- 5.1.3. Used Cooking Oil

- 5.1.4. Other Feedstocks

- 5.2. Market Analysis, Insights and Forecast - by Biodiesel Blends

- 5.2.1. B5

- 5.2.2. B20

- 5.2.3. B100

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. Spain

- 5.3.3. United Kingdom

- 5.3.4. France

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Feedstock

- 6. Germany Europe Biodiesel Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Feedstock

- 6.1.1. Rapeseed Oil

- 6.1.2. Palm Oil

- 6.1.3. Used Cooking Oil

- 6.1.4. Other Feedstocks

- 6.2. Market Analysis, Insights and Forecast - by Biodiesel Blends

- 6.2.1. B5

- 6.2.2. B20

- 6.2.3. B100

- 6.1. Market Analysis, Insights and Forecast - by Feedstock

- 7. Spain Europe Biodiesel Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Feedstock

- 7.1.1. Rapeseed Oil

- 7.1.2. Palm Oil

- 7.1.3. Used Cooking Oil

- 7.1.4. Other Feedstocks

- 7.2. Market Analysis, Insights and Forecast - by Biodiesel Blends

- 7.2.1. B5

- 7.2.2. B20

- 7.2.3. B100

- 7.1. Market Analysis, Insights and Forecast - by Feedstock

- 8. United Kingdom Europe Biodiesel Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Feedstock

- 8.1.1. Rapeseed Oil

- 8.1.2. Palm Oil

- 8.1.3. Used Cooking Oil

- 8.1.4. Other Feedstocks

- 8.2. Market Analysis, Insights and Forecast - by Biodiesel Blends

- 8.2.1. B5

- 8.2.2. B20

- 8.2.3. B100

- 8.1. Market Analysis, Insights and Forecast - by Feedstock

- 9. France Europe Biodiesel Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Feedstock

- 9.1.1. Rapeseed Oil

- 9.1.2. Palm Oil

- 9.1.3. Used Cooking Oil

- 9.1.4. Other Feedstocks

- 9.2. Market Analysis, Insights and Forecast - by Biodiesel Blends

- 9.2.1. B5

- 9.2.2. B20

- 9.2.3. B100

- 9.1. Market Analysis, Insights and Forecast - by Feedstock

- 10. Rest of Europe Europe Biodiesel Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Feedstock

- 10.1.1. Rapeseed Oil

- 10.1.2. Palm Oil

- 10.1.3. Used Cooking Oil

- 10.1.4. Other Feedstocks

- 10.2. Market Analysis, Insights and Forecast - by Biodiesel Blends

- 10.2.1. B5

- 10.2.2. B20

- 10.2.3. B100

- 10.1. Market Analysis, Insights and Forecast - by Feedstock

- 11. Germany Europe Biodiesel Market Analysis, Insights and Forecast, 2019-2031

- 12. France Europe Biodiesel Market Analysis, Insights and Forecast, 2019-2031

- 13. Italy Europe Biodiesel Market Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Europe Biodiesel Market Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Europe Biodiesel Market Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Europe Biodiesel Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Biodiesel Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Shell PLC

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Bunge Limited

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 GBF German Biofuels GMBH

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Harvest Energy

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Greenergy International Ltd

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Air Liquide SA

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Abengoa Bioenergia SA

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Envien Group

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 BP PLC

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.1 Shell PLC

List of Figures

- Figure 1: Europe Biodiesel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Biodiesel Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Biodiesel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Biodiesel Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Europe Biodiesel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 4: Europe Biodiesel Market Volume Billion Forecast, by Feedstock 2019 & 2032

- Table 5: Europe Biodiesel Market Revenue Million Forecast, by Biodiesel Blends 2019 & 2032

- Table 6: Europe Biodiesel Market Volume Billion Forecast, by Biodiesel Blends 2019 & 2032

- Table 7: Europe Biodiesel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Biodiesel Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Europe Biodiesel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Biodiesel Market Volume Billion Forecast, by Country 2019 & 2032

- Table 11: Germany Europe Biodiesel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe Biodiesel Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 13: France Europe Biodiesel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Europe Biodiesel Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe Biodiesel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe Biodiesel Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Biodiesel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe Biodiesel Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Biodiesel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe Biodiesel Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Biodiesel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Sweden Europe Biodiesel Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Biodiesel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Europe Biodiesel Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Europe Biodiesel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 26: Europe Biodiesel Market Volume Billion Forecast, by Feedstock 2019 & 2032

- Table 27: Europe Biodiesel Market Revenue Million Forecast, by Biodiesel Blends 2019 & 2032

- Table 28: Europe Biodiesel Market Volume Billion Forecast, by Biodiesel Blends 2019 & 2032

- Table 29: Europe Biodiesel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Biodiesel Market Volume Billion Forecast, by Country 2019 & 2032

- Table 31: Europe Biodiesel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 32: Europe Biodiesel Market Volume Billion Forecast, by Feedstock 2019 & 2032

- Table 33: Europe Biodiesel Market Revenue Million Forecast, by Biodiesel Blends 2019 & 2032

- Table 34: Europe Biodiesel Market Volume Billion Forecast, by Biodiesel Blends 2019 & 2032

- Table 35: Europe Biodiesel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Europe Biodiesel Market Volume Billion Forecast, by Country 2019 & 2032

- Table 37: Europe Biodiesel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 38: Europe Biodiesel Market Volume Billion Forecast, by Feedstock 2019 & 2032

- Table 39: Europe Biodiesel Market Revenue Million Forecast, by Biodiesel Blends 2019 & 2032

- Table 40: Europe Biodiesel Market Volume Billion Forecast, by Biodiesel Blends 2019 & 2032

- Table 41: Europe Biodiesel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Europe Biodiesel Market Volume Billion Forecast, by Country 2019 & 2032

- Table 43: Europe Biodiesel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 44: Europe Biodiesel Market Volume Billion Forecast, by Feedstock 2019 & 2032

- Table 45: Europe Biodiesel Market Revenue Million Forecast, by Biodiesel Blends 2019 & 2032

- Table 46: Europe Biodiesel Market Volume Billion Forecast, by Biodiesel Blends 2019 & 2032

- Table 47: Europe Biodiesel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Europe Biodiesel Market Volume Billion Forecast, by Country 2019 & 2032

- Table 49: Europe Biodiesel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 50: Europe Biodiesel Market Volume Billion Forecast, by Feedstock 2019 & 2032

- Table 51: Europe Biodiesel Market Revenue Million Forecast, by Biodiesel Blends 2019 & 2032

- Table 52: Europe Biodiesel Market Volume Billion Forecast, by Biodiesel Blends 2019 & 2032

- Table 53: Europe Biodiesel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Europe Biodiesel Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Biodiesel Market?

The projected CAGR is approximately 3.24%.

2. Which companies are prominent players in the Europe Biodiesel Market?

Key companies in the market include Shell PLC, Bunge Limited, GBF German Biofuels GMBH, Harvest Energy, Greenergy International Ltd, Air Liquide SA, Abengoa Bioenergia SA, Envien Group, BP PLC.

3. What are the main segments of the Europe Biodiesel Market?

The market segments include Feedstock, Biodiesel Blends.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Supportive Policies and Regulations4.; Energy Security.

6. What are the notable trends driving market growth?

Palm Oil Is Likely To Dominate The Market.

7. Are there any restraints impacting market growth?

4.; Feedstock Availability and Price Volatility.

8. Can you provide examples of recent developments in the market?

January 2023, Germany's Ministry of Environment announced plans to send proposals to the cabinet soon for the country to withdraw from the usage of crop-based biofuels to accomplish decreases in greenhouse gases.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Biodiesel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Biodiesel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Biodiesel Market?

To stay informed about further developments, trends, and reports in the Europe Biodiesel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence