Key Insights

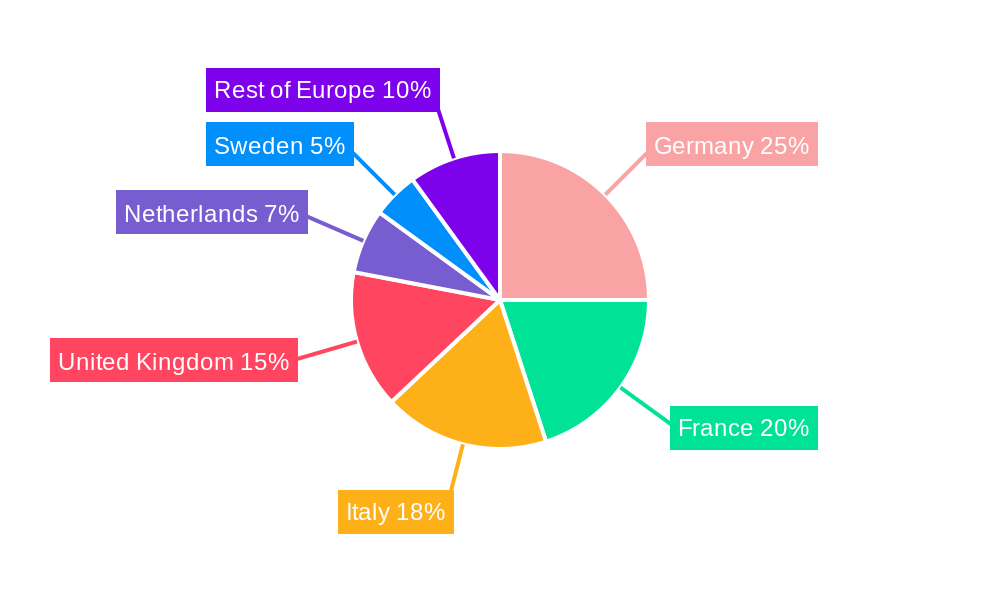

The European cosmetic and perfumery glass bottle packaging market, valued at approximately €[Estimate based on market size XX and value unit Million. Assume a reasonable value, for example, €2 billion] in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 3.20% from 2025 to 2033. This growth is fueled by several key drivers. The increasing demand for premium and sustainable packaging solutions within the cosmetics and perfumery industry is a major factor. Consumers are increasingly seeking aesthetically pleasing, high-quality packaging that aligns with their values, driving demand for sophisticated glass bottles. Furthermore, the growing popularity of luxury and niche cosmetic brands, along with the rise of e-commerce, contributes to the market's expansion. The market is segmented by product type (perfumes, nail care, skincare, and other products), with skincare and perfume packaging likely dominating due to their higher value and premium positioning. Key European markets include Germany, France, Italy, the United Kingdom, and the Netherlands, reflecting established cosmetic and perfumery industries and high consumer spending in these regions. However, the market faces certain restraints, including fluctuating raw material prices (glass and its associated components) and the ongoing need for sustainable and environmentally-friendly production practices.

Despite these restraints, the market's positive trajectory is expected to continue. Innovation in glass packaging design and manufacturing techniques, such as lightweighting and improved decoration options, presents opportunities for growth. The focus on sustainable practices, including using recycled glass and reducing carbon footprint, will likely shape future market trends. Major players, including Apg Group (Verbeeck Packaging Group), Roma International Plc, and others mentioned, are actively participating in this dynamic market, often investing in R&D to enhance their product offerings and manufacturing processes to meet evolving consumer and regulatory demands. The market's future growth will depend on a balance between meeting increasing demand for premium packaging, adhering to sustainability principles, and managing cost pressures associated with raw materials and energy.

Europe Cosmetic and Perfumery Glass Bottle Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe cosmetic and perfumery glass bottle packaging market, offering valuable insights for stakeholders across the industry. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period from 2025 to 2033. Key market segments including Perfumes, Nail Care, Skin Care, and Other Products across major European countries are analyzed, providing a granular view of market dynamics and growth potential.

Europe Cosmetic and Perfumery Glass Bottle Packaging Market Concentration & Innovation

The European cosmetic and perfumery glass bottle packaging market exhibits a moderately concentrated landscape, with several key players holding significant market share. While precise figures are proprietary to the full report, Apg Group (Verbeeck Packaging Group), Stölzle-Oberglas GmbH, Verescence Inc, and Bormioli Luigi are amongst the leading companies, collectively holding an estimated xx% market share in 2025. This concentration is driven by significant economies of scale, established distribution networks, and strong brand recognition.

Innovation is a key driver, focusing on sustainability, lightweighting, and enhanced decoration techniques. The market is witnessing increased adoption of sustainable materials like recycled glass and innovative closures to meet growing consumer demand for eco-friendly packaging. Regulatory pressures surrounding plastics are further accelerating the shift towards glass packaging. Product substitution remains a limited threat, with alternatives like plastic and metal struggling to match the aesthetic appeal, barrier properties, and perceived premium quality of glass. M&A activity has been moderate in recent years, with deal values averaging xx Million annually in the historical period (2019-2024), primarily driven by consolidation among smaller players seeking to increase scale and market reach.

Europe Cosmetic and Perfumery Glass Bottle Packaging Market Industry Trends & Insights

The European cosmetic and perfumery glass bottle packaging market is experiencing robust growth, projected at a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors:

- Rising demand for premium cosmetics: The increasing preference for luxury and high-end cosmetic products is boosting the demand for premium glass packaging.

- Growing e-commerce sales: The expansion of online beauty retail channels is driving demand for aesthetically pleasing and durable packaging suitable for shipping.

- Increased focus on sustainability: Consumers are increasingly conscious of environmental issues, driving demand for eco-friendly packaging solutions.

- Technological advancements: Innovations in glass manufacturing, decoration techniques, and closure systems are enhancing product offerings and boosting market growth.

Market penetration of sustainable glass packaging is expected to increase from xx% in 2025 to xx% by 2033, driven by stringent environmental regulations and consumer preferences. Competitive dynamics are characterized by both price competition and differentiation through innovation, with leading companies investing heavily in R&D to develop novel packaging solutions.

Dominant Markets & Segments in Europe Cosmetic and Perfumery Glass Bottle Packaging Market

The French and German markets represent the largest segments within Europe, accounting for approximately xx% and xx% of the total market respectively in 2025. This dominance stems from established cosmetic industries, high consumer spending on beauty products, and strong regulatory frameworks supporting sustainable packaging.

- Key Drivers for France: Strong domestic cosmetics industry, high consumer spending on luxury goods, sophisticated design preferences.

- Key Drivers for Germany: Large and mature cosmetic market, strong industrial base, robust regulatory environment favoring sustainable materials.

Within product segments, Perfumes are the largest market segment in 2025, accounting for xx% of the market value, owing to their higher price points and demand for premium packaging. Skin care is the second largest segment, experiencing significant growth due to rising awareness of skincare routines and the popularity of premium skincare brands.

Europe Cosmetic and Perfumery Glass Bottle Packaging Market Product Developments

Recent product innovations include the development of lightweight glass bottles reducing transportation costs and carbon footprint, the introduction of sustainable glass materials (recycled and post-consumer recycled content), and the integration of smart packaging features like QR codes for product traceability and authentication. These innovations cater to the growing consumer demand for sustainable and technologically advanced packaging while offering improved product protection and enhancing brand appeal.

Report Scope & Segmentation Analysis

Country: The report covers major European countries including France, Germany, UK, Italy, Spain, and others, analyzing market size, growth rate, and key trends in each region.

Product: The market is segmented by product type: Perfumes, Nail Care, Skin Care, and Other Products (including makeup, hair care). Each segment showcases specific growth projections based on individual market dynamics.

Key Drivers of Europe Cosmetic and Perfumery Glass Bottle Packaging Market Growth

Growth in the European cosmetic and perfumery glass bottle packaging market is primarily driven by the increasing consumer preference for premium and sustainable packaging, the growth of the e-commerce sector, stringent regulations promoting sustainable materials, and ongoing innovation in glass manufacturing and decoration technologies. These factors collectively contribute to an expanding market characterized by evolving consumer demands and a focus on eco-consciousness.

Challenges in the Europe Cosmetic and Perfumery Glass Bottle Packaging Market Sector

The market faces challenges such as fluctuations in raw material prices, increasing transportation costs, stringent environmental regulations requiring compliance, and intensifying competition from alternative packaging materials. These factors exert pressure on profit margins and require manufacturers to optimize their supply chains and innovate to maintain competitiveness.

Emerging Opportunities in Europe Cosmetic and Perfumery Glass Bottle Packaging Market

Opportunities lie in the growing demand for sustainable and lightweight packaging, the integration of smart packaging technologies, and expanding into niche markets like natural and organic cosmetics. The increasing focus on personalization and customization also presents an opportunity for bespoke packaging solutions.

Leading Players in the Europe Cosmetic and Perfumery Glass Bottle Packaging Market

- Apg Group (Verbeeck Packaging Group)

- Roma International Plc

- Pragati Glass Pvt Ltd

- Stölzle-Oberglas GmbH

- Verescence Inc

- Continental Bottle Company Ltd

- Sgb Packaging Inc

- Bormioli Luigi

- Heinz-Glass GmbH & Ko KGAA

- Consol Glass (Pty) Ltd

- Zignago Vetro SpA

- Saver Glass Inc

- Vitro SAB De CV

- Piramal Glass

- Sks Bottle & Packaging Inc

- Gerresheimer AG

- Baralan International SpA

- Lumson Sp

Key Developments in Europe Cosmetic and Perfumery Glass Bottle Packaging Industry

- Jan 2023: Verescence Inc. launched a new range of sustainable glass bottles.

- Apr 2022: Bormioli Luigi invested in a new production line for lightweight glass bottles.

- Oct 2021: Stölzle-Oberglas GmbH acquired a smaller competitor, expanding its market share. (Further details will be included in the full report)

Strategic Outlook for Europe Cosmetic and Perfumery Glass Bottle Packaging Market

The future of the European cosmetic and perfumery glass bottle packaging market is bright, with continued growth driven by strong consumer demand, increased focus on sustainability, and ongoing technological advancements. Companies that can successfully navigate the challenges of raw material costs and environmental regulations while offering innovative and sustainable packaging solutions will be best positioned to capitalize on the market's growth potential.

Europe Cosmetic and Perfumery Glass Bottle Packaging Market Segmentation

-

1. Product

- 1.1. Perfumes

- 1.2. Nail Care

- 1.3. Skin Care

- 1.4. Other Products

Europe Cosmetic and Perfumery Glass Bottle Packaging Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Cosmetic and Perfumery Glass Bottle Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Demand for Dropper Bottles; Increased Emphasis on Packaging for Product Differentiation

- 3.3. Market Restrains

- 3.3.1. ; Growth of Plastic Packaging as a Substitute for Glass Bottles

- 3.4. Market Trends

- 3.4.1. Skin Care is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Cosmetic and Perfumery Glass Bottle Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Perfumes

- 5.1.2. Nail Care

- 5.1.3. Skin Care

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany Europe Cosmetic and Perfumery Glass Bottle Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Cosmetic and Perfumery Glass Bottle Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Cosmetic and Perfumery Glass Bottle Packaging Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Cosmetic and Perfumery Glass Bottle Packaging Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Cosmetic and Perfumery Glass Bottle Packaging Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Cosmetic and Perfumery Glass Bottle Packaging Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Cosmetic and Perfumery Glass Bottle Packaging Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Apg Group (Verbeeck Packaging Group)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Roma International Plc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Pragati Glass Pvt Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Stlozle-Oberglas GmbH

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Verescence Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Continental Bottle Company Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Sgb Packaging Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Bormioli Luigi

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Heinz-Glass GmbH & Ko KGAA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Consol Glass (Pty) Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Zignago Vetro SpA

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Saver Glass Inc

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Vitro SAB De CV

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Piramal Glass

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Sks Bottle & Packaging Inc

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Gerresheimer AG

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Baralan International SpA

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 Lumson Sp

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.1 Apg Group (Verbeeck Packaging Group)

List of Figures

- Figure 1: Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Cosmetic and Perfumery Glass Bottle Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 13: Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Cosmetic and Perfumery Glass Bottle Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Cosmetic and Perfumery Glass Bottle Packaging Market?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Europe Cosmetic and Perfumery Glass Bottle Packaging Market?

Key companies in the market include Apg Group (Verbeeck Packaging Group), Roma International Plc, Pragati Glass Pvt Ltd, Stlozle-Oberglas GmbH, Verescence Inc, Continental Bottle Company Ltd, Sgb Packaging Inc, Bormioli Luigi, Heinz-Glass GmbH & Ko KGAA, Consol Glass (Pty) Ltd, Zignago Vetro SpA, Saver Glass Inc, Vitro SAB De CV, Piramal Glass, Sks Bottle & Packaging Inc, Gerresheimer AG, Baralan International SpA, Lumson Sp.

3. What are the main segments of the Europe Cosmetic and Perfumery Glass Bottle Packaging Market?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Demand for Dropper Bottles; Increased Emphasis on Packaging for Product Differentiation.

6. What are the notable trends driving market growth?

Skin Care is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; Growth of Plastic Packaging as a Substitute for Glass Bottles.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Cosmetic and Perfumery Glass Bottle Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Cosmetic and Perfumery Glass Bottle Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Cosmetic and Perfumery Glass Bottle Packaging Market?

To stay informed about further developments, trends, and reports in the Europe Cosmetic and Perfumery Glass Bottle Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence