Key Insights

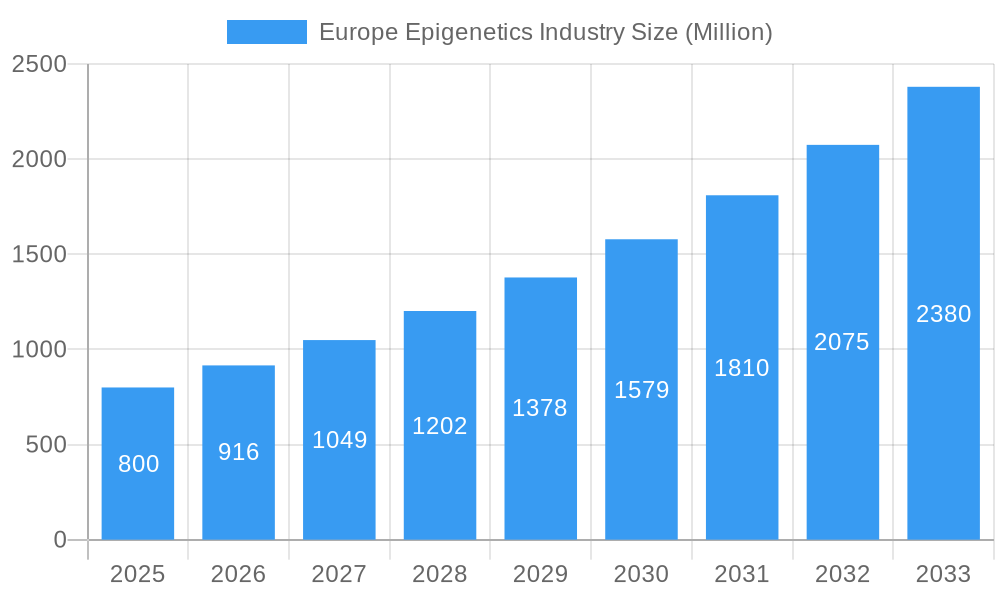

The European epigenetics market, valued at €0.63 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 14.1% from 2025 to 2033. This expansion is driven by the rising prevalence of chronic diseases, particularly cancer, which necessitates advanced diagnostic and therapeutic tools, thus fueling demand for epigenetic research and technologies. Significant advancements in epigenetic research and the development of sophisticated technologies, including next-generation sequencing and high-throughput screening, enable more precise and efficient analysis of epigenetic modifications, translating into effective drug discovery and personalized medicine approaches.

Europe Epigenetics Industry Market Size (In Million)

Increased research funding from public and private sectors, coupled with growing academic-industry collaborations, are propelling innovation and accelerating the commercialization of epigenetic products and services. Germany, France, and the UK are anticipated to lead the European market due to their established research infrastructure, robust healthcare systems, and significant life sciences sector presence. Despite challenges such as high testing and therapy costs, the complexity of epigenetic mechanisms, and the need for sophisticated analytical techniques, the long-term outlook remains positive. Continuous technological advancements, a growing understanding of epigenetic mechanisms, and increasing awareness of epigenetics' potential in disease diagnosis and treatment will drive future growth. The market segmentation highlights strong growth in oncology applications, with DNA methylation and histone modification analysis techniques leading the way. The increasing adoption of kits and reagents further signifies market maturity and readiness for continued expansion.

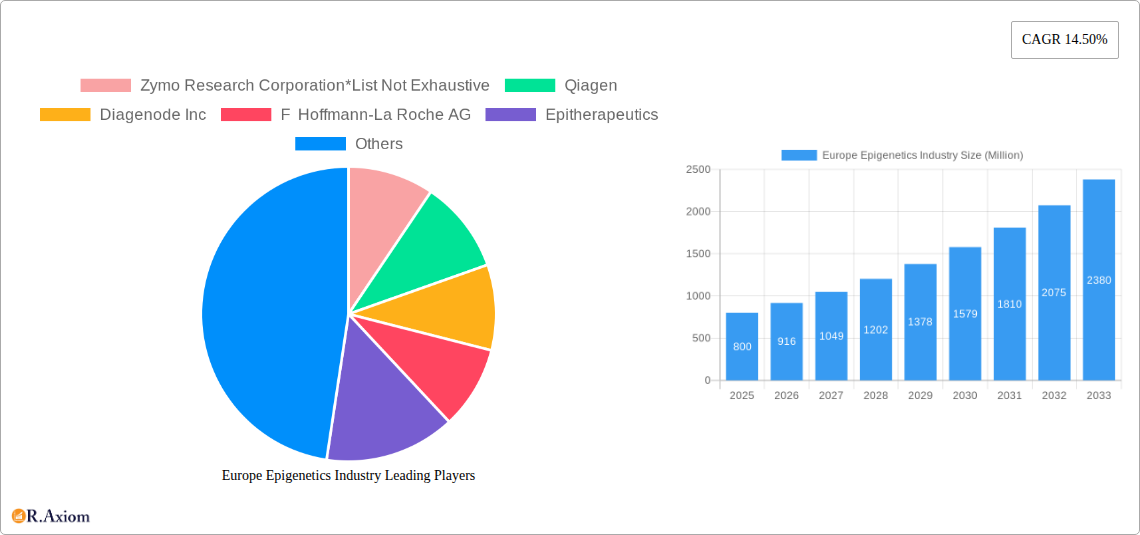

Europe Epigenetics Industry Company Market Share

Europe Epigenetics Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Epigenetics industry, covering market size, growth drivers, challenges, and opportunities from 2019 to 2033. The report leverages extensive primary and secondary research to deliver actionable insights for industry stakeholders, including manufacturers, researchers, investors, and regulatory bodies. The base year for this report is 2025, with estimations for 2025 and forecasts extending to 2033. The historical period analyzed is 2019-2024. The market is segmented by technology, product, and application, providing a granular view of the industry landscape.

Europe Epigenetics Industry Market Concentration & Innovation

The European epigenetics market exhibits a moderately concentrated structure, with a few major players holding significant market share. While precise market share data for individual companies remains proprietary, companies like Qiagen, F. Hoffmann-La Roche AG, Illumina Inc, Thermo Fisher Scientific, and Zymo Research Corporation are estimated to collectively command over xx% of the market in 2025. This concentration is partly driven by significant investments in R&D and a strong focus on technological innovation. The market witnessed xx Million in M&A activity during the historical period (2019-2024), reflecting the strategic importance of epigenetics in drug discovery and diagnostics.

- Innovation Drivers: Advances in next-generation sequencing (NGS), CRISPR-Cas9 gene editing technology, and bioinformatics are driving innovation within the epigenetics market.

- Regulatory Frameworks: Stringent regulatory approvals for epigenetic-based therapies and diagnostic tools influence market growth.

- Product Substitutes: The emergence of alternative technologies and approaches in genomics research presents potential substitutes.

- End-User Trends: Increasing demand for personalized medicine and precision oncology is fostering the growth of the epigenetics market.

- M&A Activity: Strategic acquisitions and mergers are reshaping the competitive landscape, leading to the consolidation of market share among leading players.

Europe Epigenetics Industry Industry Trends & Insights

The European epigenetics market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This expansion is fueled by multiple factors including: the increasing prevalence of chronic diseases (cancer, cardiovascular diseases, neurodegenerative disorders), rising investments in genomic research and personalized medicine, and growing adoption of epigenetic-based diagnostic tools. Technological advancements, especially in high-throughput screening and data analysis, are further accelerating market growth. The market penetration of epigenetic technologies in oncology is significantly high, with a projected xx% market share in 2025. The competitive landscape remains highly dynamic, with both established players and emerging companies vying for market dominance through strategic partnerships, product development, and aggressive marketing strategies. Consumer preferences are shifting towards more accurate, faster, and cost-effective epigenetic testing solutions.

Dominant Markets & Segments in Europe Epigenetics Industry

Germany, the UK, and France are expected to be the dominant markets within Europe, accounting for a significant portion of the total market revenue in 2025. This dominance is driven by factors such as:

- Strong research infrastructure: These countries possess robust research institutions and universities actively involved in epigenetics research.

- Government funding: Significant government investment in healthcare and biomedical research fuels market growth.

- Pharmaceutical industry presence: A strong pharmaceutical industry presence facilitates market expansion.

Within the segmentations:

- By Technology: DNA Methylation is currently the leading technology segment, followed by Histone Methylation. The growth of these segments is driven by the accessibility of respective technologies and their application in various disease areas.

- By Product: Kits represent the largest product segment, due to their ease of use and standardization. The reagents market is also experiencing robust growth, driven by the need for high-quality materials for epigenetic research.

- By Application: Oncology remains the dominant application segment, driven by the significant role of epigenetics in cancer development, diagnosis, and treatment. Non-oncology applications, such as developmental biology, are also growing rapidly, though at a slower pace.

Europe Epigenetics Industry Product Developments

Recent product developments have focused on improving the sensitivity, specificity, and throughput of epigenetic assays. The integration of advanced technologies such as NGS and microarrays into epigenetic platforms is a key trend. New kits and reagents designed for specific epigenetic modifications are constantly being introduced, improving researchers' access to advanced techniques. Companies are striving to develop user-friendly, cost-effective solutions tailored for various research applications and clinical settings, leading to increased market penetration and improved market fit.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the European Epigenetics industry, segmented by:

By Technology: DNA Methylation, Histone Methylation, Histone Acetylation, Large non-coding RNA, MicroRNA modification, Chromatin Structures. Each segment's market size, growth projections, and competitive dynamics are analyzed in detail.

By Product: Kits (including specific kits for various applications), Reagents (including enzymes and other reagents for epigenetic analysis), and Instruments (e.g., sequencers, microarrays). Each segment's market share and future growth are evaluated.

By Application: Oncology (cancer research and diagnostics), Non-Oncology (including developmental biology, cardiovascular disease research, and other areas), providing market size projections and growth analysis.

Key Drivers of Europe Epigenetics Industry Growth

The growth of the European epigenetics industry is driven by several factors:

- Technological advancements: Improvements in sequencing technologies, assay development, and bioinformatics tools enable high-throughput epigenetic analysis.

- Increased investment in research: Significant funding for epigenetic research from both public and private sectors fuels market growth.

- Growing understanding of epigenetics: A deeper understanding of epigenetic mechanisms and their role in various diseases enhances the value of epigenetic technologies.

- Personalized medicine: The increasing demand for personalized medicine and precision oncology has led to higher demand for epigenetic tests and therapies.

Challenges in the Europe Epigenetics Industry Sector

The European epigenetics market faces certain challenges:

- High cost of technologies: The cost of epigenetic testing and sequencing can be prohibitive for some research facilities and healthcare providers.

- Data interpretation and analysis: Analyzing complex epigenetic data requires specialized expertise and bioinformatics tools.

- Regulatory hurdles: Obtaining regulatory approvals for new epigenetic-based therapies and diagnostics can be complex and time-consuming.

Emerging Opportunities in Europe Epigenetics Industry

Several emerging opportunities exist within the European epigenetics market:

- Liquid biopsies: Liquid biopsies are emerging as a minimally invasive method for detecting epigenetic biomarkers in cancer and other diseases.

- Epigenetic drug development: The development of epigenetic drugs targeting specific epigenetic modifications holds significant potential for treating various diseases.

- Diagnostics: The expanding application of epigenetic biomarkers in diagnostic testing across a broad range of diseases creates substantial opportunities.

Leading Players in the Europe Epigenetics Industry Market

- Zymo Research Corporation

- Qiagen

- Diagenode Inc

- F Hoffmann-La Roche AG

- Epitherapeutics

- Illumina Inc

- Merck & Co

- Thermo Fisher Scientific

Key Developments in Europe Epigenetics Industry Industry

- 2023-Oct: Illumina launched a new NGS platform for high-throughput epigenetic analysis.

- 2022-June: Qiagen acquired a smaller company specializing in epigenetic biomarker development.

- (Further significant developments to be added here based on actual data.)

Strategic Outlook for Europe Epigenetics Industry Market

The European epigenetics market holds immense potential for future growth. Continued advancements in technology, increased research funding, and a growing understanding of epigenetic mechanisms are expected to drive market expansion. The development of new epigenetic therapies and diagnostic tools will play a crucial role in shaping the market's future. The market will see continued consolidation through M&A activity as larger players seek to expand their product portfolios and market share. The focus will increasingly shift towards developing more personalized and targeted epigenetic-based solutions.

Europe Epigenetics Industry Segmentation

-

1. Product

-

1.1. By Kits

- 1.1.1. Bisulfite Conversion Kits

- 1.1.2. Chip-seq Kits

- 1.1.3. RNA Sequencing Market

- 1.1.4. Whole Genome Amplification Market

- 1.1.5. 5-HMC and 5-MC Analysis Kits

- 1.1.6. Other Kits

-

1.2. By Reagents

- 1.2.1. Antibodies

- 1.2.2. Buffers

- 1.2.3. Histones

- 1.2.4. Magnetic Beads

- 1.2.5. Primers

- 1.2.6. Other Reagents

-

1.3. By Enzymes

- 1.3.1. DNA - Modifying Enzymes

- 1.3.2. Protein Modifying Enzymes

- 1.3.3. RNA Modifying Enzymes

-

1.4. By Instruments

- 1.4.1. Mass Spectrometer

- 1.4.2. Sonicators

- 1.4.3. Next Generation Sequencers

- 1.4.4. Other Instruments

-

1.1. By Kits

-

2. Application

- 2.1. Oncology

-

2.2. Non-Oncology

- 2.2.1. Inflammatory Diseases

- 2.2.2. Metabolic Diseases

- 2.2.3. Infectious Diseases

- 2.2.4. Cardiovascular Diseases

- 2.2.5. Other Non-Oncology Applications

- 2.3. Developmental Biology

- 2.4. Other Research Areas

-

3. Technology

- 3.1. DNA Methylation

- 3.2. Histone Methylation

- 3.3. Histone Acetylation

- 3.4. Large noncoding RNA

- 3.5. MicroRNA modification

- 3.6. Chromatin Structures

Europe Epigenetics Industry Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. UK

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Rest of Europe

Europe Epigenetics Industry Regional Market Share

Geographic Coverage of Europe Epigenetics Industry

Europe Epigenetics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Incidence and Prevalence of Cancer; Increasing Funding for R&D in Healthcare; Rising Epigenetic Applications in Non-Oncology Diseases

- 3.3. Market Restrains

- 3.3.1. ; Rising Cost of Instruments; Dearth of Skilled Researchers

- 3.4. Market Trends

- 3.4.1. Oncology is Expected to Grow Faster in the Application Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Epigenetics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Kits

- 5.1.1.1. Bisulfite Conversion Kits

- 5.1.1.2. Chip-seq Kits

- 5.1.1.3. RNA Sequencing Market

- 5.1.1.4. Whole Genome Amplification Market

- 5.1.1.5. 5-HMC and 5-MC Analysis Kits

- 5.1.1.6. Other Kits

- 5.1.2. By Reagents

- 5.1.2.1. Antibodies

- 5.1.2.2. Buffers

- 5.1.2.3. Histones

- 5.1.2.4. Magnetic Beads

- 5.1.2.5. Primers

- 5.1.2.6. Other Reagents

- 5.1.3. By Enzymes

- 5.1.3.1. DNA - Modifying Enzymes

- 5.1.3.2. Protein Modifying Enzymes

- 5.1.3.3. RNA Modifying Enzymes

- 5.1.4. By Instruments

- 5.1.4.1. Mass Spectrometer

- 5.1.4.2. Sonicators

- 5.1.4.3. Next Generation Sequencers

- 5.1.4.4. Other Instruments

- 5.1.1. By Kits

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Oncology

- 5.2.2. Non-Oncology

- 5.2.2.1. Inflammatory Diseases

- 5.2.2.2. Metabolic Diseases

- 5.2.2.3. Infectious Diseases

- 5.2.2.4. Cardiovascular Diseases

- 5.2.2.5. Other Non-Oncology Applications

- 5.2.3. Developmental Biology

- 5.2.4. Other Research Areas

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. DNA Methylation

- 5.3.2. Histone Methylation

- 5.3.3. Histone Acetylation

- 5.3.4. Large noncoding RNA

- 5.3.5. MicroRNA modification

- 5.3.6. Chromatin Structures

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zymo Research Corporation*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Qiagen

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Diagenode Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 F Hoffmann-La Roche AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Epitherapeutics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Illumina Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Merck & Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thermo Fisher Scientific

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Zymo Research Corporation*List Not Exhaustive

List of Figures

- Figure 1: Europe Epigenetics Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Epigenetics Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Epigenetics Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Europe Epigenetics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Europe Epigenetics Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Europe Epigenetics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Epigenetics Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 6: Europe Epigenetics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Europe Epigenetics Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: Europe Epigenetics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Germany Europe Epigenetics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: UK Europe Epigenetics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Epigenetics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Epigenetics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Epigenetics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe Europe Epigenetics Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Epigenetics Industry?

The projected CAGR is approximately 14.1%.

2. Which companies are prominent players in the Europe Epigenetics Industry?

Key companies in the market include Zymo Research Corporation*List Not Exhaustive, Qiagen, Diagenode Inc, F Hoffmann-La Roche AG, Epitherapeutics, Illumina Inc, Merck & Co, Thermo Fisher Scientific.

3. What are the main segments of the Europe Epigenetics Industry?

The market segments include Product, Application, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.63 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Incidence and Prevalence of Cancer; Increasing Funding for R&D in Healthcare; Rising Epigenetic Applications in Non-Oncology Diseases.

6. What are the notable trends driving market growth?

Oncology is Expected to Grow Faster in the Application Segment.

7. Are there any restraints impacting market growth?

; Rising Cost of Instruments; Dearth of Skilled Researchers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Epigenetics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Epigenetics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Epigenetics Industry?

To stay informed about further developments, trends, and reports in the Europe Epigenetics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence