Key Insights

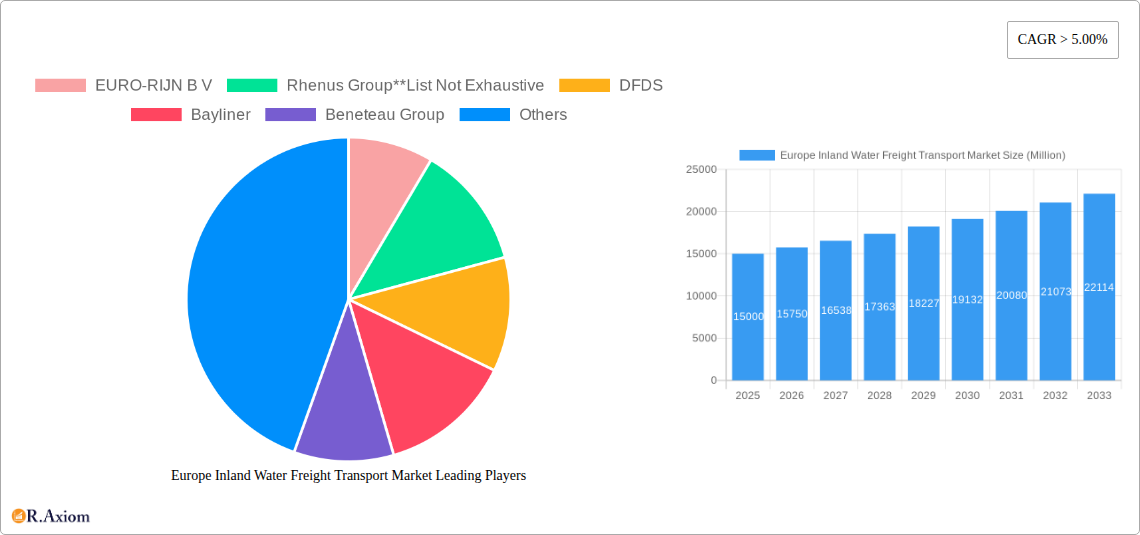

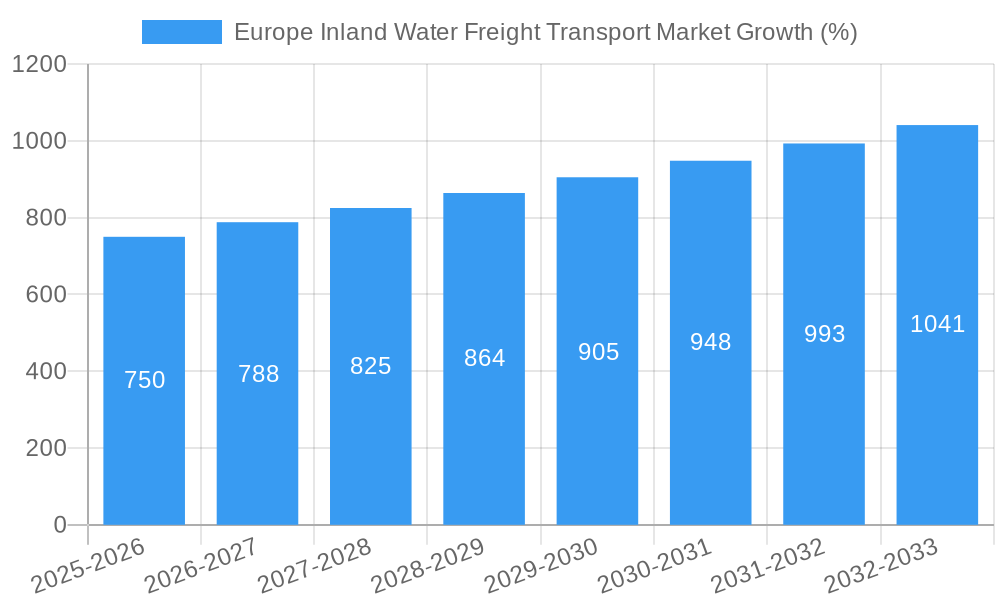

The European inland water freight transport market, valued at approximately €[Estimate based on market size XX and value unit Million; e.g., €15 Billion] in 2025, is projected to experience robust growth, exceeding a 5% Compound Annual Growth Rate (CAGR) through 2033. This growth is fueled by several key drivers. Increased demand for efficient and environmentally friendly logistics solutions is pushing businesses to adopt inland waterways, especially given rising fuel costs and stricter emission regulations impacting road and rail transport. Furthermore, ongoing infrastructure investments across major European waterways, such as river dredging and port modernization in Germany, France, and the Netherlands, are significantly improving capacity and accessibility. The growing e-commerce sector and its reliance on timely and cost-effective delivery also contributes to the market's expansion. The market is segmented by transportation type (liquid and dry bulk) and vessel type (cargo ships, container ships, tankers, and others), with container ships and tankers experiencing particularly strong growth due to increasing global trade and the transport of liquid goods. However, challenges remain, including seasonal fluctuations in water levels, potential bottlenecks at certain crucial waterways, and the need for continued investment in training skilled professionals for the sector. Despite these restraints, the overall outlook for the European inland water freight transport market remains positive, promising substantial growth and a significant contribution to the region's logistics network.

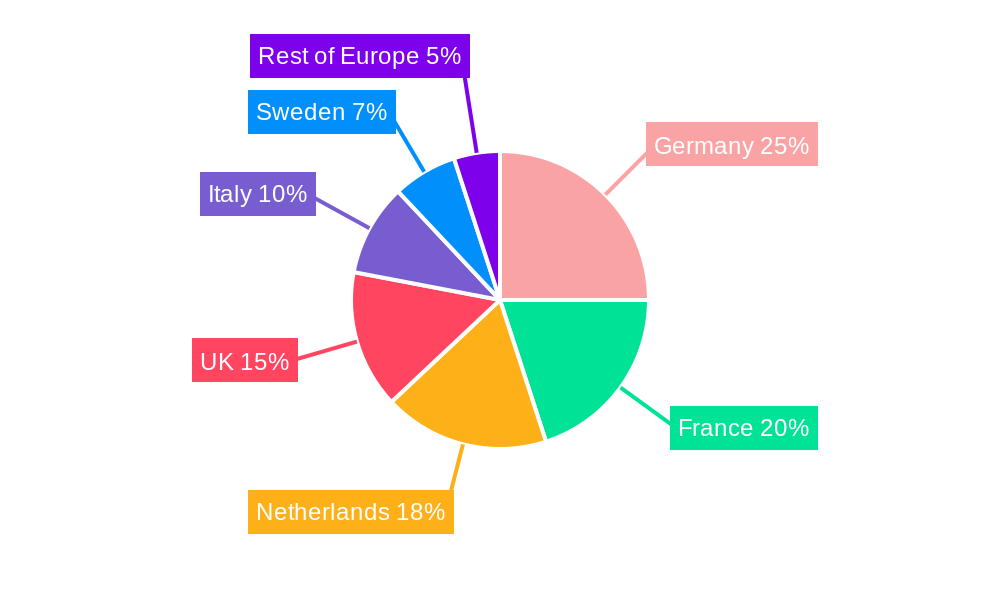

The market's geographical distribution shows significant concentration within key European nations. Germany, France, the Netherlands, and the UK constitute the largest markets, driven by their extensive inland waterway networks and established logistics hubs. Italy and Sweden also contribute significantly to the overall market size, although to a lesser extent. The "Rest of Europe" segment shows promising potential for future growth, driven by ongoing infrastructure developments and increasing adoption of inland water transport in previously less-utilized regions. Competition within the market is fierce, with established players like EURO-RIJN B.V., Rhenus Group, DFDS, and CMA CGM Group vying for market share alongside smaller, regional operators. The competitive landscape is characterized by both consolidation amongst larger players and the emergence of specialized niche service providers catering to specific cargo types or geographical areas. The market's future trajectory will be significantly influenced by government policies supporting sustainable transportation, ongoing infrastructure improvements, and the effectiveness of addressing operational challenges.

Europe Inland Water Freight Transport Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Europe Inland Water Freight Transport Market, covering historical data (2019-2024), the base year (2025), and forecasting the market's trajectory until 2033. The report offers invaluable insights for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic sector. It delves into market segmentation, competitive landscapes, emerging trends, and key challenges, providing a clear strategic roadmap for future growth.

Europe Inland Water Freight Transport Market Concentration & Innovation

The Europe Inland Water Freight Transport Market exhibits a moderately concentrated landscape, with a few major players holding significant market share. While precise market share figures for individual companies are not publicly available and vary significantly by segment, companies like Rhenus Group, DFDS, and CMA CGM Group are recognized as key players, dominating specific segments or regions based on their fleet size and operational reach. EURO-RIJN B V also maintains a notable presence. Smaller players, including Bayliner, Beneteau Group (primarily focused on leisure craft, though some models could be adapted for freight), EUROPEAN CRUISE SERVICE (niche segment), MSC Mediterranean Shipping Company S A (with limited inland waterway presence), Construction Navale Bordeaux, and MEYER WERFT GmbH & Co KG (specialised shipbuilding) contribute to a more fragmented competitive environment.

Innovation is driven by the need for sustainability, efficiency, and technological advancements. This includes the adoption of hybrid and alternative fuel technologies, as demonstrated by Rhenus’ investment in sustainable articulated push barge units. Regulatory frameworks, particularly those promoting greener transport, significantly influence innovation and investment. Product substitutes include road and rail transport, with inland waterways competing on cost-effectiveness and environmental impact for certain freight types. End-user trends favouring sustainable solutions and efficient logistics contribute to the overall growth. M&A activity in this space remains relatively moderate, with deal values varying significantly depending on the size and focus of the acquired company; available data on specific M&A deal values within this sector is limited (xx Million).

Europe Inland Water Freight Transport Market Industry Trends & Insights

The Europe Inland Water Freight Transport Market is experiencing steady growth, driven by increasing demand for efficient and environmentally friendly freight transportation. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, fueled by several key factors. Growing e-commerce and associated logistics requirements are boosting the demand for efficient transportation of goods. Furthermore, stringent environmental regulations and governmental incentives to shift freight from roads to waterways are catalysing the sector's expansion. Technological advancements, including automation and digitalization of logistics operations, are enhancing efficiency and reducing operational costs, improving market penetration rates by improving transportation speeds and reducing error rates. However, challenges remain, including infrastructure limitations in certain regions, competition from established road and rail networks, and the need for further investment in advanced vessel technologies and skilled labor. Consumer preference shifts towards environmentally conscious businesses are also influencing adoption of inland water freight services, resulting in a significant increase in demand. The competitive landscape is characterized by both large established players and smaller, specialized firms which contributes to market fluctuations.

Dominant Markets & Segments in Europe Inland Water Freight Transport Market

Dominant Region: The Rhine-Main-Danube corridor and the Netherlands are currently the dominant regions, benefiting from well-established infrastructure, high cargo volumes, and efficient logistics networks.

Dominant Country: The Netherlands and Germany hold the largest market shares due to their extensive waterway networks and high economic activity.

Dominant Type of Transportation: Dry bulk transportation currently holds a larger market share than liquid bulk transportation. This is due to the high demand for the transportation of agricultural products, construction materials, and other dry goods.

Dominant Vessel Type: Cargo ships and barges constitute the largest segment, reflecting the nature of the majority of transported goods. However, the growing demand for containerized cargo and specific liquid goods is driving growth in container ships and tanker segments.

Key Drivers for Dominant Segments:

Economic Policies: Governmental initiatives promoting inland waterway transport through subsidies, tax incentives, and infrastructure investments are instrumental in driving growth.

Infrastructure: Regions with well-maintained and interconnected waterways enjoy a significant competitive advantage.

Logistics Efficiency: Cost-effective logistics solutions which enable faster, more efficient transit of freight within the inland waterways contribute to the sector’s continued growth.

The dominance of these segments is expected to continue through the forecast period, although the growth of specific segments like container ships and tankers will be influenced by changing market demands and technological innovations.

Europe Inland Water Freight Transport Market Product Developments

Recent product developments focus on enhancing efficiency, sustainability, and capacity. This includes the development of larger, more fuel-efficient vessels, the adoption of hybrid propulsion systems, and improvements in cargo handling technologies. These innovations enhance competitiveness by reducing operational costs and minimizing environmental impact. The integration of advanced technologies, such as automated navigation systems and real-time tracking, improves operational efficiency and enhances safety. Market fit is determined by factors including cost-effectiveness, environmental regulations, and the specific needs of different cargo types.

Report Scope & Segmentation Analysis

This report segments the Europe Inland Water Freight Transport Market by:

Type of Transportation:

Liquid Bulk Transportation: This segment includes the transport of liquids such as oil, chemicals, and other liquids. The market size is projected to grow at xx% CAGR during the forecast period. Competitive dynamics in this segment are influenced by stringent safety and environmental regulations.

Dry Bulk Transportation: This segment involves the carriage of dry goods such as grains, ores, and construction materials. This segment is expected to grow at a CAGR of xx% driven by increased demand for construction materials and agricultural products. Competition in this segment is shaped by factors like infrastructure and efficient logistics management.

Vessel Type:

Cargo Ships: This is a major segment with significant growth projections. The competitiveness of this area is largely based on efficiency and shipping costs.

Container Ships: This segment exhibits growth due to increasing demand for containerized goods. The competition is impacted by port infrastructure and supply chain management.

Tankers: Growth prospects for this segment are dependent on the demand for liquid cargo, subject to stringent safety regulations that impact the competitiveness of the sector.

Other Vessel Types: This segment includes specialized vessels. Growth will depend on niche market needs and associated regulations which can impact competition in the market.

Key Drivers of Europe Inland Water Freight Transport Market Growth

Several factors are driving the growth of the European inland water freight transport market. Firstly, the increasing focus on sustainability and reducing carbon emissions is leading to a shift from road transport to more environmentally friendly options. Governmental incentives, such as the EUR 22.5 million Dutch scheme, are stimulating this transition. Secondly, the rising demand for efficient and cost-effective logistics solutions across Europe is further boosting market growth. Finally, ongoing investments in infrastructure and technological advancements, such as the development of hybrid and alternative fuel vessels, contribute significantly to the sector's expansion.

Challenges in the Europe Inland Water Freight Transport Market Sector

The Europe Inland Water Freight Transport Market faces several challenges. Inadequate infrastructure in certain regions restricts operational efficiency and capacity. Competition from road and rail transport, offering quicker transit times in some cases, also poses a challenge. Moreover, fluctuations in fuel prices and strict environmental regulations impact operational costs and profitability. These factors, coupled with potential labor shortages, can significantly influence the sector’s growth rate. The overall economic climate and its effect on freight demand represent a significant challenge.

Emerging Opportunities in Europe Inland Water Freight Transport Market

The market presents several exciting opportunities. The growing demand for sustainable transportation offers significant potential for companies offering environmentally friendly solutions. Technological advancements such as automation and digitalization can improve operational efficiency and reduce costs. Furthermore, exploring new inland waterway routes and expanding into underserved regions offers potential for market expansion. The development of efficient and well-integrated multi-modal transport systems also offers growth potential.

Leading Players in the Europe Inland Water Freight Transport Market Market

- EURO-RIJN B V

- Rhenus Group

- DFDS

- Bayliner

- Beneteau Group

- EUROPEAN CRUISE SERVICE

- MSC Mediterranean Shipping Company S A

- Construction Navale Bordeaux

- MEYER WERFT GmbH & Co KG

- CMA CGM Group

Key Developments in Europe Inland Water Freight Transport Market Industry

October 2022: The European Commission approves a EUR 22.5 million (USD 23.91 million) Dutch scheme to support shifting freight from road to inland waterways and rail, boosting the market's green credentials and attracting investment.

June 2022: Rhenus PartnerShip invests in sustainable articulated push barge units, highlighting a shift toward environmentally friendly technologies and enhancing the sector's sustainability profile. This investment signals a commitment to long-term growth and innovation in the sector.

Strategic Outlook for Europe Inland Water Freight Transport Market Market

The Europe Inland Water Freight Transport Market is poised for continued growth, driven by increasing demand for sustainable logistics, governmental support, and technological advancements. The focus on environmentally friendly solutions and operational efficiencies will continue to shape market dynamics. Companies that invest in innovation, sustainable practices, and efficient logistics networks are well-positioned to capitalize on the significant growth opportunities this sector presents.

Europe Inland Water Freight Transport Market Segmentation

-

1. Type of Transportation

- 1.1. Liquid Bulk Transportation

- 1.2. Dry Bulk Transportation

-

2. Vessel Type

- 2.1. Cargo Ships

- 2.2. Container Ships

- 2.3. Tankers

- 2.4. Other Vessel Types

Europe Inland Water Freight Transport Market Segmentation By Geography

- 1. Netherland

- 2. Germany

- 3. Begium

- 4. France

- 5. Romania

- 6. Bulgaria

- 7. Rest of Europe

Europe Inland Water Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Fueling the Growth of 3PL Market

- 3.3. Market Restrains

- 3.3.1. Slow Infrastructure Development

- 3.4. Market Trends

- 3.4.1. Digitization of inland-waterway transport

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 5.1.1. Liquid Bulk Transportation

- 5.1.2. Dry Bulk Transportation

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Cargo Ships

- 5.2.2. Container Ships

- 5.2.3. Tankers

- 5.2.4. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Netherland

- 5.3.2. Germany

- 5.3.3. Begium

- 5.3.4. France

- 5.3.5. Romania

- 5.3.6. Bulgaria

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 6. Netherland Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 6.1.1. Liquid Bulk Transportation

- 6.1.2. Dry Bulk Transportation

- 6.2. Market Analysis, Insights and Forecast - by Vessel Type

- 6.2.1. Cargo Ships

- 6.2.2. Container Ships

- 6.2.3. Tankers

- 6.2.4. Other Vessel Types

- 6.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 7. Germany Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 7.1.1. Liquid Bulk Transportation

- 7.1.2. Dry Bulk Transportation

- 7.2. Market Analysis, Insights and Forecast - by Vessel Type

- 7.2.1. Cargo Ships

- 7.2.2. Container Ships

- 7.2.3. Tankers

- 7.2.4. Other Vessel Types

- 7.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 8. Begium Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 8.1.1. Liquid Bulk Transportation

- 8.1.2. Dry Bulk Transportation

- 8.2. Market Analysis, Insights and Forecast - by Vessel Type

- 8.2.1. Cargo Ships

- 8.2.2. Container Ships

- 8.2.3. Tankers

- 8.2.4. Other Vessel Types

- 8.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 9. France Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 9.1.1. Liquid Bulk Transportation

- 9.1.2. Dry Bulk Transportation

- 9.2. Market Analysis, Insights and Forecast - by Vessel Type

- 9.2.1. Cargo Ships

- 9.2.2. Container Ships

- 9.2.3. Tankers

- 9.2.4. Other Vessel Types

- 9.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 10. Romania Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 10.1.1. Liquid Bulk Transportation

- 10.1.2. Dry Bulk Transportation

- 10.2. Market Analysis, Insights and Forecast - by Vessel Type

- 10.2.1. Cargo Ships

- 10.2.2. Container Ships

- 10.2.3. Tankers

- 10.2.4. Other Vessel Types

- 10.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 11. Bulgaria Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 11.1.1. Liquid Bulk Transportation

- 11.1.2. Dry Bulk Transportation

- 11.2. Market Analysis, Insights and Forecast - by Vessel Type

- 11.2.1. Cargo Ships

- 11.2.2. Container Ships

- 11.2.3. Tankers

- 11.2.4. Other Vessel Types

- 11.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 12. Rest of Europe Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 12.1.1. Liquid Bulk Transportation

- 12.1.2. Dry Bulk Transportation

- 12.2. Market Analysis, Insights and Forecast - by Vessel Type

- 12.2.1. Cargo Ships

- 12.2.2. Container Ships

- 12.2.3. Tankers

- 12.2.4. Other Vessel Types

- 12.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 13. Germany Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 EURO-RIJN B V

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Rhenus Group**List Not Exhaustive

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 DFDS

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Bayliner

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Beneteau Group

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 EUROPEAN CRUISE SERVICE

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 MSC Mediterranean Shipping Company S A

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Construction Navale Bordeaux

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 MEYER WERFT GmbH & Co KG

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 CMA CGM Group

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 EURO-RIJN B V

List of Figures

- Figure 1: Europe Inland Water Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Inland Water Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 3: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 4: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 14: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 15: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 17: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 18: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 20: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 21: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 23: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 24: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 26: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 27: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 29: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 30: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 32: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 33: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Inland Water Freight Transport Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Europe Inland Water Freight Transport Market?

Key companies in the market include EURO-RIJN B V, Rhenus Group**List Not Exhaustive, DFDS, Bayliner, Beneteau Group, EUROPEAN CRUISE SERVICE, MSC Mediterranean Shipping Company S A, Construction Navale Bordeaux, MEYER WERFT GmbH & Co KG, CMA CGM Group.

3. What are the main segments of the Europe Inland Water Freight Transport Market?

The market segments include Type of Transportation, Vessel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Fueling the Growth of 3PL Market.

6. What are the notable trends driving market growth?

Digitization of inland-waterway transport.

7. Are there any restraints impacting market growth?

Slow Infrastructure Development.

8. Can you provide examples of recent developments in the market?

October 2022: The European Commission (EC) has approved a EUR 22.5 million (USD 23.91 million) Dutch scheme to support the shifting of freight transport from road to inland waterways and rail. The new scheme is part of an initiative to encourage a greener mode of transport. Designed to run until the end of January 2026, the scheme will enable shippers and logistics operators to secure non-refundable grants for cutting down external costs, including pollution, noise, congestion, and accidents, using inland waterways and rail.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Inland Water Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Inland Water Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Inland Water Freight Transport Market?

To stay informed about further developments, trends, and reports in the Europe Inland Water Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence