Key Insights

The European Minimally Invasive Surgery (MIS) Devices Market is poised for substantial growth, projected to reach approximately USD 9.3 billion in 2025. Driven by an impressive CAGR of 13.31%, this dynamic sector is anticipated to witness robust expansion throughout the forecast period ending in 2033. Several key factors are fueling this upward trajectory. The increasing prevalence of chronic diseases and the growing demand for less invasive treatment options are major catalysts. Furthermore, advancements in medical technology, including the development of sophisticated robotic-assisted surgical systems, laser-based devices, and high-definition visualization tools, are significantly enhancing surgical precision, reducing patient recovery times, and minimizing complications. This technological innovation directly translates into improved patient outcomes and greater adoption of MIS procedures across various medical specialties.

Europe Minimally Invasive Surgery Devices Market Market Size (In Billion)

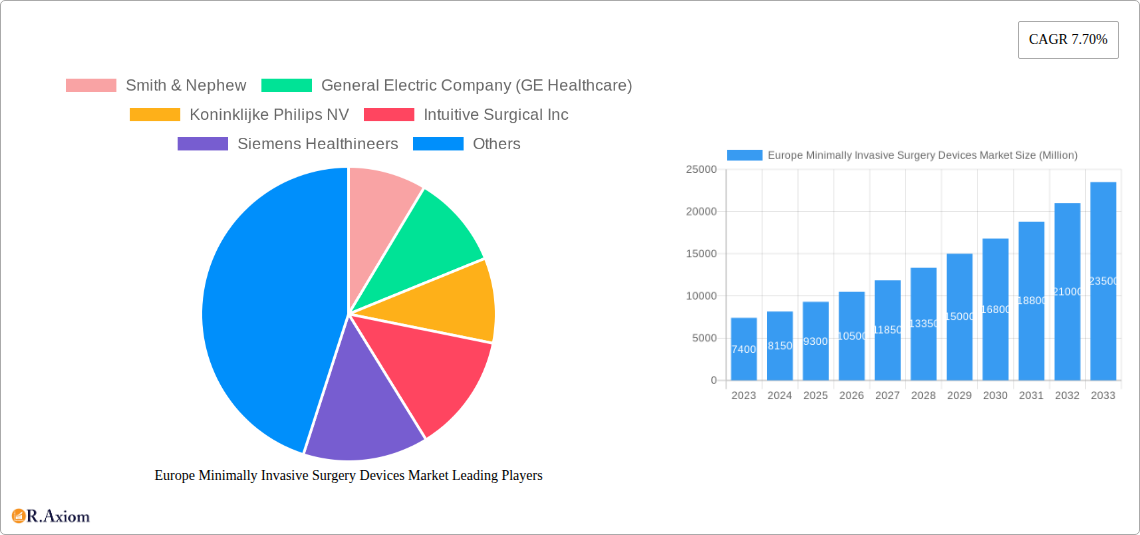

The market is segmented across a wide array of product categories, including handheld instruments, guiding devices, electrosurgical devices, endoscopic devices, laparoscopic devices, monitoring and visualization devices, robotic-assisted surgical systems, ablation devices, and laser-based devices. Applications span critical areas such as cardiovascular, gastrointestinal, gynecological, orthopedic, and urological procedures, among others. Geographically, the market is characterized by significant contributions from key European economies, including Germany, the United Kingdom, France, Italy, and Spain, with the "Rest of Europe" also playing a vital role. Leading companies such as Smith & Nephew, General Electric Company (GE Healthcare), Koninklijke Philips NV, Intuitive Surgical Inc., Siemens Healthineers, Medtronic, Stryker Corporation, Zimmer Biomet, Abbott Laboratories, and Olympus Corporation are at the forefront of innovation and market development, continually introducing cutting-edge solutions to meet the evolving needs of healthcare providers and patients.

Europe Minimally Invasive Surgery Devices Market Company Market Share

Europe Minimally Invasive Surgery Devices Market Market Concentration & Innovation

The Europe Minimally Invasive Surgery (MIS) Devices Market is characterized by a moderate to high degree of market concentration, with a few key players dominating significant market share. Innovation remains a critical driver, fueled by continuous advancements in robotics, imaging, and instrumentation. Regulatory frameworks, primarily dictated by the European Medical Device Regulation (MDR), shape product development and market entry, emphasizing stringent safety and performance standards. While direct product substitutes are limited, the adoption of traditional open surgery techniques presents an indirect competitive force. End-user trends reveal a growing preference for less invasive procedures due to faster recovery times, reduced pain, and shorter hospital stays. Mergers and acquisitions (M&A) activity is a significant factor in market consolidation and the expansion of product portfolios. Key M&A deals in the historical period (2019-2024) have involved valuations ranging from hundreds of millions to several billion euros, strategically acquiring innovative technologies or expanding geographic reach.

- Market Share: Major players like Medtronic, Intuitive Surgical Inc., and Siemens Healthineers hold substantial market share, estimated to be between 15-25% for the top three entities in the base year 2025.

- Innovation Drivers: Advancements in AI-powered diagnostics, miniaturization of surgical tools, and enhanced robotic control systems are key innovation catalysts.

- M&A Activity: Strategic acquisitions of smaller, specialized MIS device companies are prevalent, aimed at bolstering product offerings in high-growth application areas.

Europe Minimally Invasive Surgery Devices Market Industry Trends & Insights

The Europe Minimally Invasive Surgery Devices Market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% to 9.5% from 2025 to 2033. This sustained expansion is propelled by a confluence of factors, including an aging population, increasing prevalence of chronic diseases requiring surgical intervention, and a growing awareness among patients and healthcare professionals regarding the benefits of MIS procedures. The technological evolution within the MIS device landscape is a pivotal trend, with a significant surge in the development and adoption of robotic-assisted surgical systems. These advanced systems offer enhanced precision, dexterity, and visualization for surgeons, leading to improved patient outcomes and enabling more complex procedures to be performed minimally invasively. The integration of artificial intelligence (AI) and machine learning (ML) into surgical planning and execution is another transformative trend, promising to further refine surgical techniques and personalize treatment approaches.

Furthermore, the shift in consumer preferences towards less invasive treatment options, driven by the desire for reduced post-operative pain, shorter recovery times, and minimized scarring, is a significant market penetrator. This patient-centric demand incentivizes healthcare providers to invest in and adopt MIS technologies. The competitive dynamics within the market are characterized by intense R&D efforts, strategic partnerships between device manufacturers and healthcare institutions, and a focus on expanding product portfolios to address a wider range of surgical specialties. The market penetration of robotic-assisted surgery, though still evolving, is expected to accelerate, driven by increasing affordability and the growing body of clinical evidence supporting its efficacy.

- Market Size Projections: The market size is estimated to reach over $25 billion in 2025, with significant growth anticipated throughout the forecast period.

- CAGR: An estimated CAGR of 8.5% to 9.5% underscores the strong growth trajectory of the MIS devices market in Europe.

- Technological Advancements: Key technological disruptions include advancements in robotic surgery, AI integration, and miniaturized instrumentation.

- Consumer Preferences: The demand for faster recovery, reduced pain, and cosmetic benefits directly fuels the adoption of MIS.

- Market Penetration: The penetration of robotic-assisted surgery is increasing, driven by technological improvements and growing surgeon familiarity.

Dominant Markets & Segments in Europe Minimally Invasive Surgery Devices Market

The European Minimally Invasive Surgery Devices Market exhibits a varied landscape of dominance across its geographical regions and product/application segments. Geographically, Germany currently stands as a leading market due to its robust healthcare infrastructure, high per capita healthcare spending, and early adoption of advanced medical technologies. The United Kingdom also represents a significant market, driven by a strong emphasis on public health initiatives and a growing number of hospitals investing in MIS technologies. France and Italy, with their established healthcare systems and increasing investments in medical innovation, are also key contributors to market growth.

From a product perspective, Handheld Instruments and Endoscopic Devices currently command a substantial market share, reflecting their widespread use across various surgical disciplines. However, the Robotic Assisted Surgical Systems segment is experiencing the most rapid growth, indicating a significant shift in surgical practice and investment. The increasing adoption of these systems is a direct response to the demand for enhanced surgical precision and minimally invasive approaches in complex procedures.

In terms of applications, Cardiovascular and Gastrointestinal surgeries represent dominant segments, owing to the high incidence of related diseases and the established efficacy of MIS in treating these conditions. The Orthopedic and Urological segments are also witnessing substantial growth, driven by advancements in specialized MIS devices and increasing patient demand for less invasive treatment options.

- Dominant Geography: Germany is a leading market, characterized by:

- High healthcare expenditure.

- Early adoption of advanced surgical technologies.

- Strong reimbursement policies supporting MIS.

- Dominant Products:

- Handheld Instruments: Ubiquitous in MIS, representing a foundational segment.

- Endoscopic Devices: Crucial for visualization and intervention in various procedures.

- Robotic Assisted Surgical Systems: Fastest-growing segment, driven by technological advancements and demand for precision.

- Dominant Applications:

- Cardiovascular: High prevalence of cardiac diseases and established MIS procedures.

- Gastrointestinal: Significant volume of procedures for various gastrointestinal conditions.

- Orthopedic: Growing demand for minimally invasive joint replacements and spinal surgeries.

- Urological: Increasing adoption of MIS for prostatectomies, nephrectomies, and other urological interventions.

Europe Minimally Invasive Surgery Devices Market Product Developments

The Europe Minimally Invasive Surgery Devices Market is continuously shaped by groundbreaking product developments. Innovations are focused on enhancing precision, reducing invasiveness, and improving surgeon ergonomics. Key trends include the development of smaller, more agile robotic surgical arms for intricate procedures, advanced imaging technologies integrated directly into surgical instruments for real-time feedback, and the creation of novel biomaterials for implantable MIS devices. These advancements offer significant competitive advantages by enabling surgeons to perform more complex procedures with greater safety and efficacy, leading to faster patient recovery and reduced complications.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Europe Minimally Invasive Surgery Devices Market, encompassing segmentation across Products, Applications, and Geography.

- Products: The market is segmented into Handheld Instruments, Guiding Devices, Electrosurgical Devices, Endoscopic Devices, Laproscopic Devices, Monitoring and Visualization Devices, Robotic Assisted Surgical Systems, Ablation Devices, Laser Based Devices, and Other MIS Devices. The Robotic Assisted Surgical Systems segment is projected to witness the highest CAGR of over 10% during the forecast period due to increasing technological sophistication and adoption.

- Applications: Key application segments include Cardiovascular, Gastrointestinal, Gynecological, Orthopedic, Urological, and Other Applications. Cardiovascular and Gastrointestinal segments are expected to maintain their dominance in terms of market size, while Orthopedic and Urological segments are anticipated to show strong growth.

- Geography: The analysis covers Germany, the United Kingdom, France, Italy, Spain, and the Rest of Europe. Germany is projected to remain the largest market, followed by the United Kingdom.

Key Drivers of Europe Minimally Invasive Surgery Devices Market Growth

The growth of the Europe Minimally Invasive Surgery Devices Market is propelled by several key drivers. Technological advancements in robotics, artificial intelligence, and imaging systems are enabling more sophisticated and precise surgical interventions. The increasing prevalence of chronic diseases, coupled with an aging population, is creating a higher demand for surgical treatments. Furthermore, the clear benefits of MIS, including reduced patient trauma, shorter hospital stays, and faster recovery times, are driving patient preference and clinician adoption. Favorable reimbursement policies in many European countries also support the adoption of these advanced technologies.

Challenges in the Europe Minimally Invasive Surgery Devices Market Sector

Despite the positive growth trajectory, the Europe Minimally Invasive Surgery Devices Market faces several challenges. High initial costs associated with advanced MIS equipment, particularly robotic systems, can be a significant barrier to adoption for smaller healthcare facilities. Stringent regulatory approval processes, such as those under the MDR, can lead to extended time-to-market for new devices. Furthermore, the need for specialized training for surgeons and support staff to effectively utilize complex MIS technologies presents an ongoing challenge. Limited reimbursement for certain novel MIS procedures in some regions can also hinder market expansion.

Emerging Opportunities in Europe Minimally Invasive Surgery Devices Market

Emerging opportunities in the Europe Minimally Invasive Surgery Devices Market are abundant and diverse. The increasing focus on telehealth and remote surgical assistance presents a significant opportunity for the integration of advanced communication and visualization technologies into MIS. The development of single-use MIS devices offers potential solutions for infection control and cost reduction. Furthermore, the expanding application of MIS in traditionally open surgical fields, such as certain oncological and neurosurgical procedures, opens up new market avenues. The growing demand for personalized medicine and AI-driven surgical planning also represents a promising area for innovation and market growth.

Leading Players in the Europe Minimally Invasive Surgery Devices Market Market

- Smith & Nephew

- General Electric Company (GE Healthcare)

- Koninklijke Philips NV

- Intuitive Surgical Inc

- Siemens Healthineers

- Medtronic

- Stryker Corporation

- Zimmer Biomet

- Abbott Laboratories

- Olympus Corporation

Key Developments in Europe Minimally Invasive Surgery Devices Market Industry

- February 2022: Medtronic plc and OLV Hospital Aalst announced that the first clinical procedure in Europe had been performed with the Hugo robotic-assisted surgery (RAS) system.

- March 2022: Quantum Surgical announced FDA 510(k) clearance for Epione, which the company describes as a new category of interventional oncology robotics dedicated to minimally invasive liver cancer treatment.

Strategic Outlook for Europe Minimally Invasive Surgery Devices Market Market

The strategic outlook for the Europe Minimally Invasive Surgery Devices Market remains highly positive, driven by ongoing technological innovation and a persistent demand for less invasive healthcare solutions. The market is poised for continued expansion as companies focus on developing more integrated, AI-enabled, and cost-effective MIS devices. Strategic partnerships between manufacturers and healthcare providers will be crucial for driving adoption and addressing training needs. The growing emphasis on value-based healthcare will further incentivize the adoption of MIS technologies that demonstrate superior patient outcomes and economic efficiency, solidifying its position as a cornerstone of modern surgery.

Europe Minimally Invasive Surgery Devices Market Segmentation

-

1. Products

- 1.1. Handheld Instruments

- 1.2. Guiding Devices

- 1.3. Electrosurgical Devices

- 1.4. Endoscopic Devices

- 1.5. Laproscopic Devices

- 1.6. Monitoring and Visualization Devices

- 1.7. Robotic Assisted Surgical Systems

- 1.8. Ablation Devices

- 1.9. Laser Based Devices

- 1.10. Other MIS Devices

-

2. Application

- 2.1. Cardiovascular

- 2.2. Gastrointestinal

- 2.3. Gynecological

- 2.4. Orthopedic

- 2.5. Urological

- 2.6. Other Applications

- 3. Geography

- 4. Germany

- 5. United Kingdom

- 6. France

- 7. Italy

- 8. Spain

- 9. Rest of Europe

Europe Minimally Invasive Surgery Devices Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

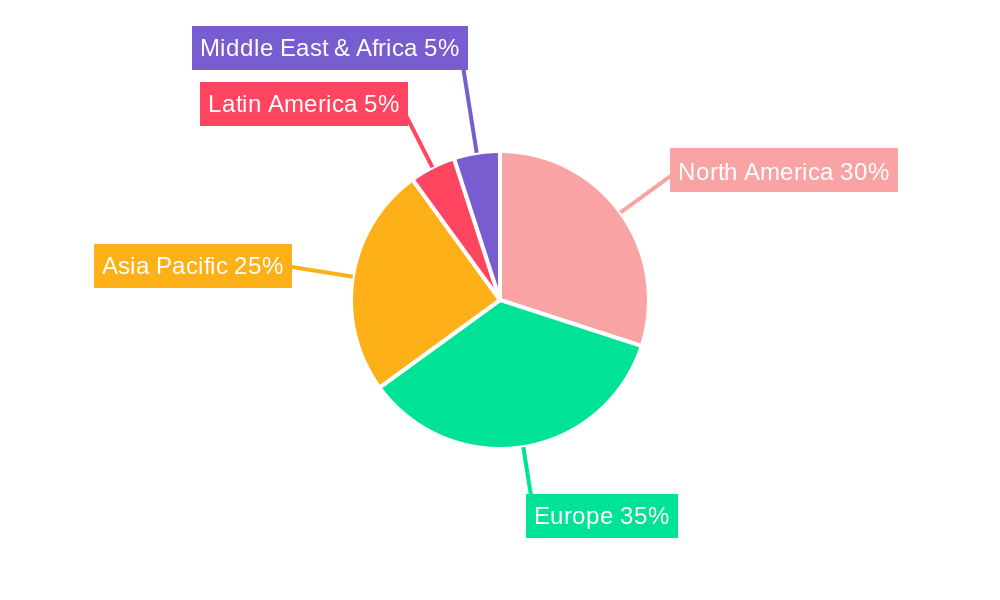

Europe Minimally Invasive Surgery Devices Market Regional Market Share

Geographic Coverage of Europe Minimally Invasive Surgery Devices Market

Europe Minimally Invasive Surgery Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Lifestyle-related and Chronic Disorders; Higher Acceptance Rate of Minimally Invasive Surgeries Over Traditional Surgeries; Technological Advancements in Minimally Invasive Devices

- 3.3. Market Restrains

- 3.3.1. Shortage of Experienced Professionals

- 3.4. Market Trends

- 3.4.1. Gastrointestinal Segment is Expected to be the Fastest Growing Segment Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Minimally Invasive Surgery Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. Handheld Instruments

- 5.1.2. Guiding Devices

- 5.1.3. Electrosurgical Devices

- 5.1.4. Endoscopic Devices

- 5.1.5. Laproscopic Devices

- 5.1.6. Monitoring and Visualization Devices

- 5.1.7. Robotic Assisted Surgical Systems

- 5.1.8. Ablation Devices

- 5.1.9. Laser Based Devices

- 5.1.10. Other MIS Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiovascular

- 5.2.2. Gastrointestinal

- 5.2.3. Gynecological

- 5.2.4. Orthopedic

- 5.2.5. Urological

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.4. Market Analysis, Insights and Forecast - by Germany

- 5.5. Market Analysis, Insights and Forecast - by United Kingdom

- 5.6. Market Analysis, Insights and Forecast - by France

- 5.7. Market Analysis, Insights and Forecast - by Italy

- 5.8. Market Analysis, Insights and Forecast - by Spain

- 5.9. Market Analysis, Insights and Forecast - by Rest of Europe

- 5.10. Market Analysis, Insights and Forecast - by Region

- 5.10.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Smith & Nephew

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 General Electric Company (GE Healthcare)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Koninklijke Philips NV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Intuitive Surgical Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens Healthineers

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Medtronic

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Stryker Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zimmer Biomet

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Abbott Laboratories

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Olympus Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Smith & Nephew

List of Figures

- Figure 1: Europe Minimally Invasive Surgery Devices Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Minimally Invasive Surgery Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Products 2020 & 2033

- Table 2: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by Products 2020 & 2033

- Table 3: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Germany 2020 & 2033

- Table 8: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by Germany 2020 & 2033

- Table 9: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by United Kingdom 2020 & 2033

- Table 10: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by United Kingdom 2020 & 2033

- Table 11: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by France 2020 & 2033

- Table 12: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by France 2020 & 2033

- Table 13: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Italy 2020 & 2033

- Table 14: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by Italy 2020 & 2033

- Table 15: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Spain 2020 & 2033

- Table 16: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by Spain 2020 & 2033

- Table 17: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Rest of Europe 2020 & 2033

- Table 18: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by Rest of Europe 2020 & 2033

- Table 19: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 20: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 21: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Products 2020 & 2033

- Table 22: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by Products 2020 & 2033

- Table 23: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 25: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 26: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 27: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Germany 2020 & 2033

- Table 28: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by Germany 2020 & 2033

- Table 29: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by United Kingdom 2020 & 2033

- Table 30: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by United Kingdom 2020 & 2033

- Table 31: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by France 2020 & 2033

- Table 32: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by France 2020 & 2033

- Table 33: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Italy 2020 & 2033

- Table 34: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by Italy 2020 & 2033

- Table 35: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Spain 2020 & 2033

- Table 36: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by Spain 2020 & 2033

- Table 37: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Rest of Europe 2020 & 2033

- Table 38: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by Rest of Europe 2020 & 2033

- Table 39: Europe Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Europe Minimally Invasive Surgery Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: United Kingdom Europe Minimally Invasive Surgery Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: United Kingdom Europe Minimally Invasive Surgery Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Germany Europe Minimally Invasive Surgery Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Germany Europe Minimally Invasive Surgery Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: France Europe Minimally Invasive Surgery Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: France Europe Minimally Invasive Surgery Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Italy Europe Minimally Invasive Surgery Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Italy Europe Minimally Invasive Surgery Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Spain Europe Minimally Invasive Surgery Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Spain Europe Minimally Invasive Surgery Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Netherlands Europe Minimally Invasive Surgery Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Netherlands Europe Minimally Invasive Surgery Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Belgium Europe Minimally Invasive Surgery Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Belgium Europe Minimally Invasive Surgery Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Sweden Europe Minimally Invasive Surgery Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: Sweden Europe Minimally Invasive Surgery Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Norway Europe Minimally Invasive Surgery Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Norway Europe Minimally Invasive Surgery Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: Poland Europe Minimally Invasive Surgery Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Poland Europe Minimally Invasive Surgery Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Denmark Europe Minimally Invasive Surgery Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Denmark Europe Minimally Invasive Surgery Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Minimally Invasive Surgery Devices Market?

The projected CAGR is approximately 13.31%.

2. Which companies are prominent players in the Europe Minimally Invasive Surgery Devices Market?

Key companies in the market include Smith & Nephew, General Electric Company (GE Healthcare), Koninklijke Philips NV, Intuitive Surgical Inc, Siemens Healthineers, Medtronic, Stryker Corporation, Zimmer Biomet, Abbott Laboratories, Olympus Corporation.

3. What are the main segments of the Europe Minimally Invasive Surgery Devices Market?

The market segments include Products, Application, Geography, Germany, United Kingdom, France, Italy, Spain, Rest of Europe.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Lifestyle-related and Chronic Disorders; Higher Acceptance Rate of Minimally Invasive Surgeries Over Traditional Surgeries; Technological Advancements in Minimally Invasive Devices.

6. What are the notable trends driving market growth?

Gastrointestinal Segment is Expected to be the Fastest Growing Segment Over the Forecast Period.

7. Are there any restraints impacting market growth?

Shortage of Experienced Professionals.

8. Can you provide examples of recent developments in the market?

February 2022: Medtronic plc and OLV Hospital Aalst announced that the first clinical procedure in Europe had been performed with the Hugo robotic-assisted surgery (RAS) system.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Minimally Invasive Surgery Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Minimally Invasive Surgery Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Minimally Invasive Surgery Devices Market?

To stay informed about further developments, trends, and reports in the Europe Minimally Invasive Surgery Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence