Key Insights

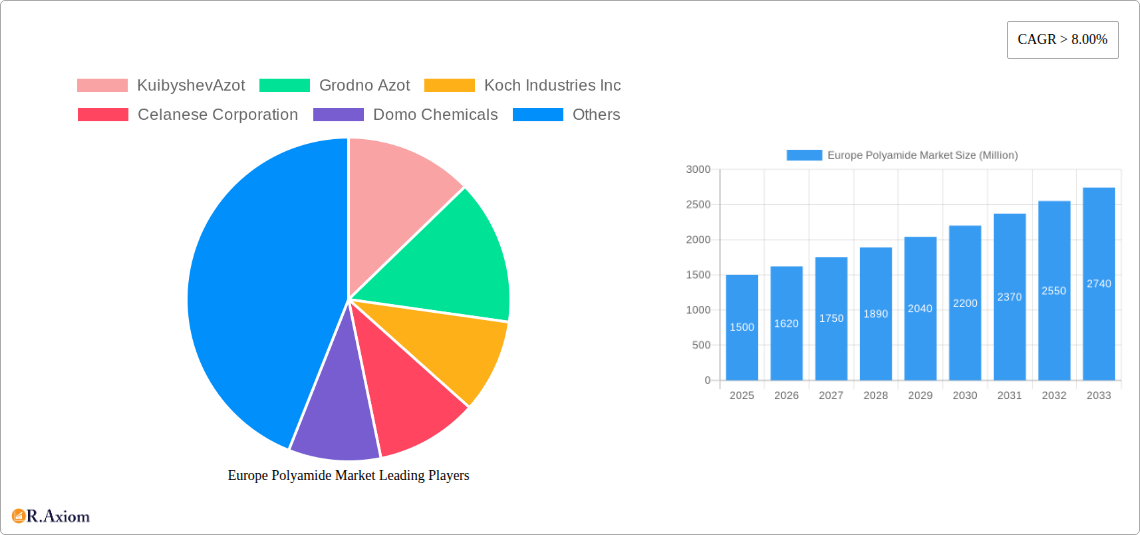

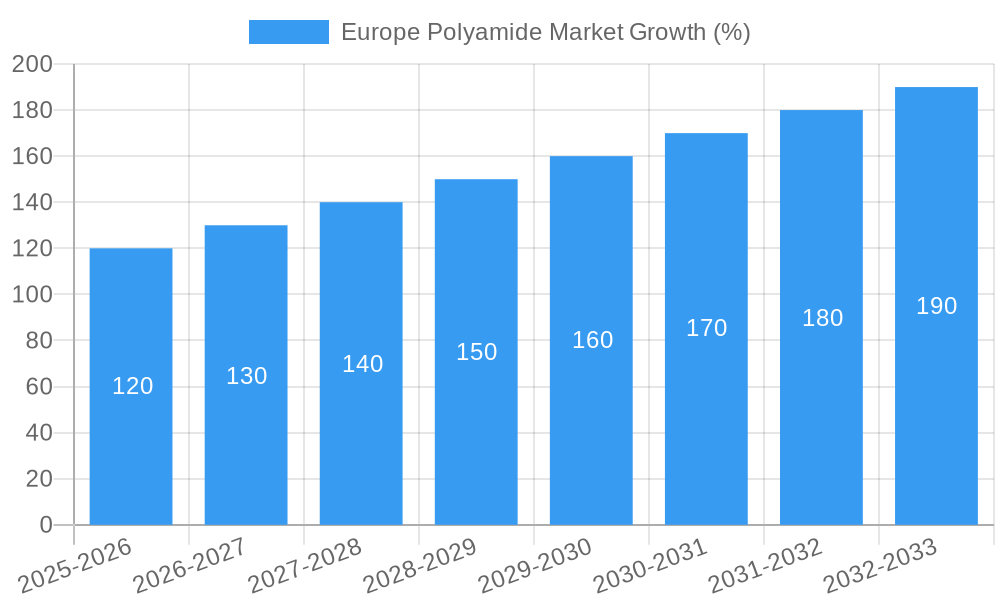

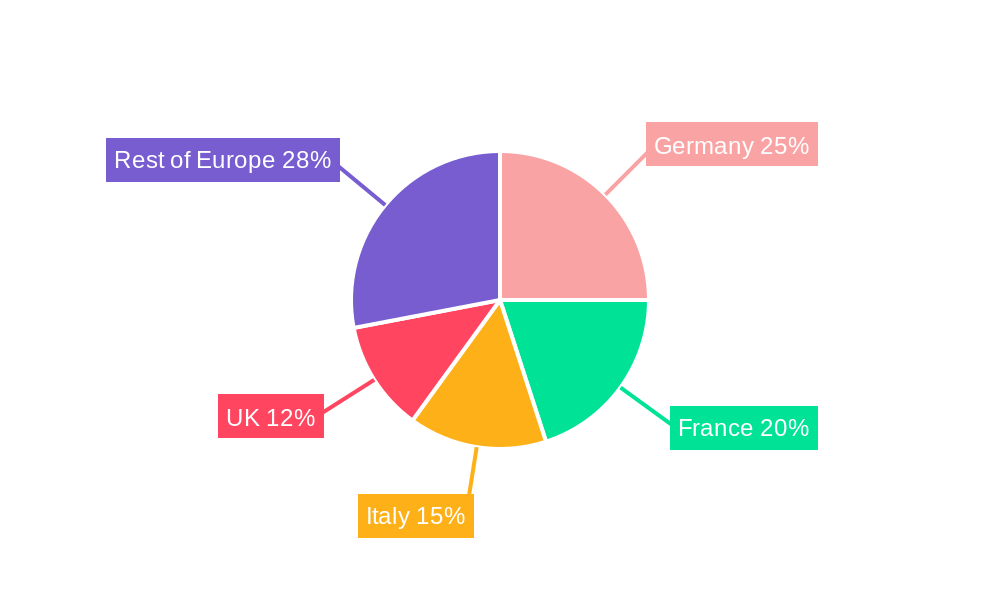

The European polyamide market is experiencing robust growth, driven by increasing demand from diverse end-use industries. With a market size exceeding €X million in 2025 (estimated based on provided CAGR and market trends) and a Compound Annual Growth Rate (CAGR) exceeding 8%, the market is poised for significant expansion through 2033. Key drivers include the burgeoning automotive sector, particularly electric vehicle (EV) production which necessitates lightweight and high-performance materials. The aerospace industry also contributes significantly, fueled by advancements in aircraft manufacturing requiring durable and reliable components. Furthermore, the construction and packaging industries present substantial growth opportunities as polyamide finds application in pipes, films, and various protective materials. Technological advancements leading to improved polyamide formulations with enhanced properties like strength, heat resistance, and flexibility are fueling innovation and driving market expansion. Germany, France, and Italy remain dominant markets within Europe, accounting for a significant share of overall consumption. However, other countries such as the United Kingdom and emerging markets within the "Rest of Europe" segment show promising growth potential.

While the market enjoys considerable momentum, certain restraints remain. Fluctuations in raw material prices, particularly for petroleum-based feedstocks, can impact profitability and market dynamics. Additionally, environmental concerns related to the production and disposal of plastics may pose challenges, necessitating the development and adoption of more sustainable polyamide alternatives and recycling strategies. Competition among established players like BASF SE, DSM, and LANXESS, alongside emerging regional players, adds complexity to the competitive landscape. However, the overall outlook for the European polyamide market remains positive, with significant opportunities for growth and innovation in the coming years. Market segmentation by resin type (Aramid, Polyamide 6, Polyamide 66, Polyphthalamide) further allows for granular analysis and targeted market penetration strategies.

Europe Polyamide Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Polyamide Market, covering the period 2019-2033, with a focus on market dynamics, key players, and future growth potential. It leverages detailed market segmentation, incorporating historical data (2019-2024), estimated figures for 2025, and forecasts for 2025-2033, providing actionable insights for stakeholders across the value chain. High-traffic keywords like "Europe Polyamide Market," "Polyamide Resin," "PA66 Market," "Engineering Plastics," and specific country markets (e.g., "Germany Polyamide Market") are strategically integrated for enhanced search engine optimization.

Europe Polyamide Market Concentration & Innovation

This section analyzes the competitive landscape of the European polyamide market, examining market concentration, innovation drivers, regulatory frameworks, and key industry trends. The market is characterized by a moderately concentrated structure, with a few major players controlling a significant share. Precise market share figures require extensive primary research. However, based on industry reports, it's estimated that the top 5 players likely hold over xx% of the market share in 2025.

Key Aspects:

- Market Concentration: The market is characterized by a combination of large multinational corporations and specialized regional players. Competition is intense, driven by factors such as pricing, product innovation, and sustainability initiatives.

- Innovation Drivers: Continuous research and development efforts are focused on developing high-performance polyamide grades with enhanced properties like heat resistance, improved strength, and better chemical resistance. Sustainability initiatives like the use of recycled materials are also driving innovation.

- Regulatory Frameworks: European Union regulations on chemical safety and environmental protection significantly influence the market. Compliance with REACH regulations and other environmental standards is crucial for players in this market.

- Product Substitutes: Polyamide faces competition from other engineering plastics, such as polypropylene and polyethylene. However, polyamide's unique properties make it irreplaceable in many high-performance applications.

- End-User Trends: The increasing demand for lightweight and high-strength materials in various end-use industries like automotive and aerospace is driving the growth of the European polyamide market.

- M&A Activities: The European polyamide market has witnessed several mergers and acquisitions in recent years. The acquisition of DuPont's Mobility & Materials business by Celanese Corporation in 2022 exemplifies this trend. While precise deal values are confidential, these activities are indicative of efforts to consolidate market share and expand product portfolios.

Europe Polyamide Market Industry Trends & Insights

The European polyamide market is expected to experience significant growth during the forecast period (2025-2033), driven by several key factors. The Compound Annual Growth Rate (CAGR) is projected to be xx% during this period. This robust growth is fueled by rising demand across diverse sectors, including automotive, packaging, and electronics. Technological advancements, specifically in sustainable polyamide production methods, are also contributing to this positive trend.

Market penetration of polyamide in various applications continues to increase, particularly in sectors demanding high-performance materials. The market dynamics are shaped by increasing consumer preferences for sustainable and eco-friendly materials, as evidenced by the introduction of recycled-content polyamides. Competitive intensity remains high, with major players constantly innovating to maintain market share and attract new customers.

Dominant Markets & Segments in Europe Polyamide Market

The German and French markets represent substantial shares of the European polyamide market. Germany's established automotive industry and strong chemical sector contribute significantly to its dominance. France, meanwhile, benefits from a robust manufacturing sector and the growing need for high-performance materials in various applications.

Key Drivers:

- Germany: Strong automotive industry, robust chemical sector, well-developed infrastructure.

- France: Established manufacturing base, growing demand from various end-use sectors, government support for industrial growth.

- Italy: Presence of specialized players in the chemical industry, demand for high-performance materials.

- United Kingdom: Robust aerospace sector, demand for advanced materials in various sectors.

- Russia: Emerging market with potential for growth, supported by infrastructure developments, though geopolitical uncertainties may impact this.

Dominant Segments:

- End-User Industry: The automotive and electrical and electronics segments are expected to witness the highest growth during the forecast period, due to increasing demand for lightweight and high-performance materials.

- Sub Resin Type: Polyamide (PA) dominates the market due to its versatility and wide range of applications.

Europe Polyamide Market Product Developments

Recent product developments emphasize sustainability and enhanced performance. LANXESS's Durethan ECO showcases the integration of recycled materials, reducing environmental impact. DSM's introduction of Akulon FLX-LP and Akulon FLX40-HP targets the hydrogen storage sector, highlighting the market's adaptation to emerging technologies. These advancements underscore the competitive landscape's focus on delivering improved material properties and environmentally responsible production processes.

Report Scope & Segmentation Analysis

This report offers a granular segmentation of the European polyamide market across various dimensions. By end-user industry, it covers Aerospace, Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, Packaging, and Other End-user Industries. Sub-resin type segmentation includes Aramid, Polyamide (PA), and Polyphthalamide. Geographical segmentation includes France, Germany, Italy, Russia, the United Kingdom, and the Rest of Europe. Each segment's growth projection, market size, and competitive dynamics are meticulously analyzed.

Key Drivers of Europe Polyamide Market Growth

The market's growth is propelled by several crucial factors: Firstly, the robust growth of the automotive and electronics industries significantly increases demand for high-performance engineering plastics. Secondly, advancements in material science lead to the development of polyamide grades with enhanced properties, such as increased strength and heat resistance. Finally, the rising adoption of sustainable materials and environmentally friendly manufacturing practices enhances market appeal.

Challenges in the Europe Polyamide Market Sector

Challenges include fluctuations in raw material prices and supply chain disruptions impacting production costs and profitability. Stringent environmental regulations necessitate ongoing investments in sustainable production methods. Intense competition among established and emerging players necessitates strategic differentiation and innovation for market share retention. Geopolitical instability, especially in Eastern Europe, adds to the complexities of raw material sourcing and market stability.

Emerging Opportunities in Europe Polyamide Market

Several key opportunities exist: Firstly, the burgeoning renewable energy sector offers promising avenues for high-performance polyamides in applications such as wind turbine components. Secondly, the growing adoption of electric vehicles creates demand for lighter-weight materials. Finally, the increasing awareness of sustainability pushes the adoption of bio-based and recycled polyamides.

Leading Players in the Europe Polyamide Market Market

- KuibyshevAzot

- Grodno Azot

- Koch Industries Inc

- Celanese Corporation

- Domo Chemicals

- Grupa Azoty S A

- LANXESS

- Radici Partecipazioni SpA

- BASF SE

- DSM

Key Developments in Europe Polyamide Market Industry

- September 2022: LANXESS introduced Durethan ECO, a sustainable polyamide resin utilizing recycled glass fibers.

- November 2022: Celanese Corporation acquired DuPont's Mobility & Materials business, expanding its engineered thermoplastics portfolio.

- January 2023: DSM launched Akulon FLX-LP and Akulon FLX40-HP polyamide grades for hydrogen storage applications.

Strategic Outlook for Europe Polyamide Market Market

The European polyamide market exhibits strong growth potential. Continued innovation in sustainable materials and high-performance grades will drive future expansion. The increasing demand across diverse end-use sectors, coupled with strategic partnerships and mergers and acquisitions, solidifies the market's promising trajectory. Focus on meeting stringent environmental regulations and navigating supply chain challenges will determine long-term success.

Europe Polyamide Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Sub Resin Type

- 2.1. Aramid

- 2.2. Polyamide (PA) 6

- 2.3. Polyamide (PA) 66

- 2.4. Polyphthalamide

Europe Polyamide Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Polyamide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand from Automotive and Aerospace Industries

- 3.3. Market Restrains

- 3.3.1. Volatility in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Growing emphasis on developing bio-based and recyclable polyamides to reduce environmental impact

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Polyamide Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Sub Resin Type

- 5.2.1. Aramid

- 5.2.2. Polyamide (PA) 6

- 5.2.3. Polyamide (PA) 66

- 5.2.4. Polyphthalamide

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Germany Europe Polyamide Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Polyamide Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Polyamide Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Polyamide Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Polyamide Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Polyamide Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Polyamide Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 KuibyshevAzot

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Grodno Azot

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Koch Industries Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Celanese Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Domo Chemicals

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Grupa Azoty S A

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 LANXESS

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Radici Partecipazioni Sp

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 BASF SE

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 DSM

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 KuibyshevAzot

List of Figures

- Figure 1: Europe Polyamide Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Polyamide Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Polyamide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Polyamide Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Europe Polyamide Market Revenue Million Forecast, by Sub Resin Type 2019 & 2032

- Table 4: Europe Polyamide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Polyamide Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Polyamide Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 14: Europe Polyamide Market Revenue Million Forecast, by Sub Resin Type 2019 & 2032

- Table 15: Europe Polyamide Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Polyamide Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Europe Polyamide Market?

Key companies in the market include KuibyshevAzot, Grodno Azot, Koch Industries Inc, Celanese Corporation, Domo Chemicals, Grupa Azoty S A, LANXESS, Radici Partecipazioni Sp, BASF SE, DSM.

3. What are the main segments of the Europe Polyamide Market?

The market segments include End User Industry, Sub Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand from Automotive and Aerospace Industries.

6. What are the notable trends driving market growth?

Growing emphasis on developing bio-based and recyclable polyamides to reduce environmental impact.

7. Are there any restraints impacting market growth?

Volatility in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

January 2023: DSM introduced two new polyamide grades, Akulon FLX-LP and Akulon FLX40-HP, which will be used as liner materials and will provide robust performance in Type IV pressure vessels used for hydrogen storage.November 2022: Celanese Corporation completed the acquisition of the Mobility & Materials (“M&M”) business of DuPont. This acquisition enhanced the company's product portfolio of engineered thermoplastics through the addition of well-recognized brands and intellectual properties of DuPont.September 2022: LANXESS introduced a sustainable polyamide resin, Durethan ECO, which consists of recycled fibers made from waste glass to reduce its carbon footprint.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Polyamide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Polyamide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Polyamide Market?

To stay informed about further developments, trends, and reports in the Europe Polyamide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence