Key Insights

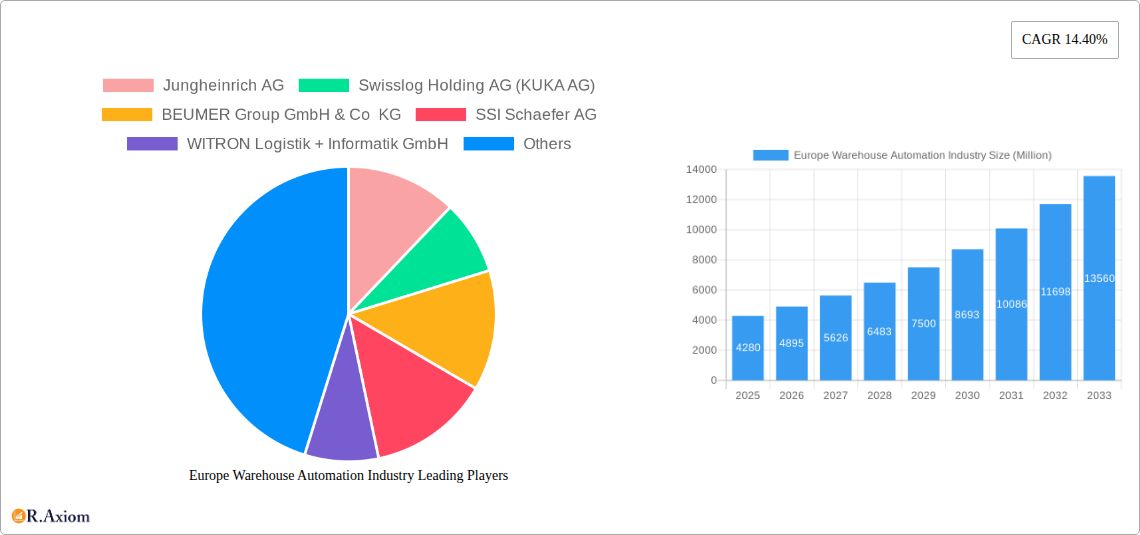

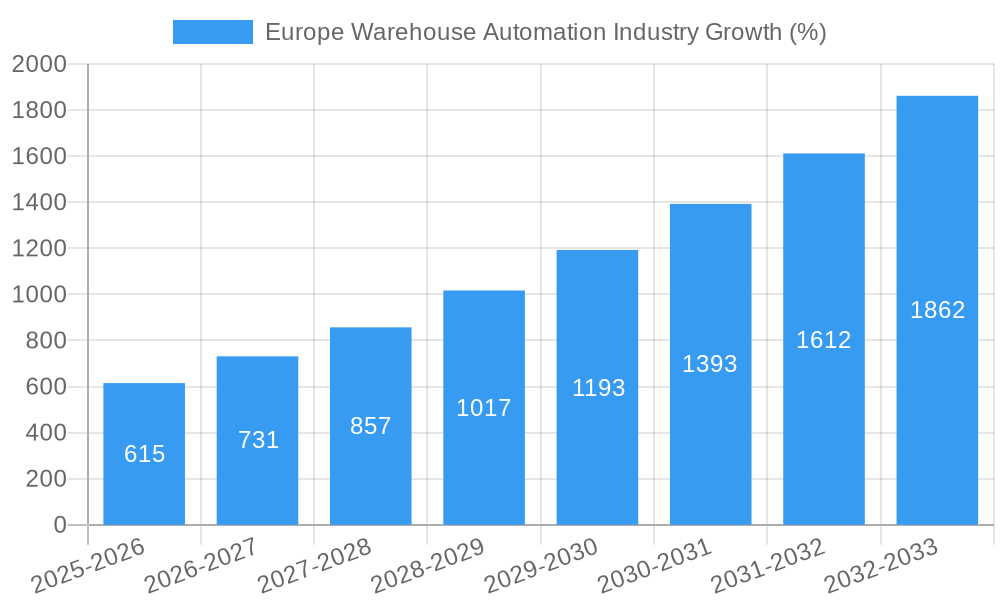

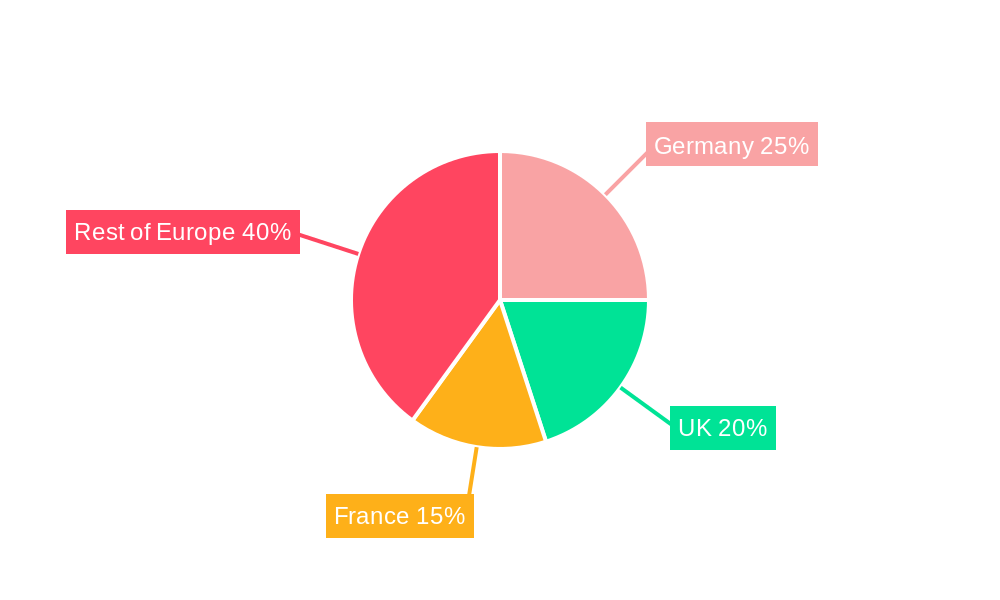

The European warehouse automation market, valued at €4.28 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 14.40% from 2025 to 2033. This surge is fueled by several key factors. E-commerce's continued expansion necessitates efficient order fulfillment, driving demand for automated solutions like piece-picking robots and advanced warehouse management systems (WMS). Labor shortages across Europe are further incentivizing automation, as businesses seek to optimize operational efficiency and reduce reliance on manual labor. Furthermore, advancements in robotics, artificial intelligence (AI), and the Internet of Things (IoT) are continually enhancing the capabilities and affordability of warehouse automation technologies, making them accessible to a broader range of businesses. Germany, the UK, and France represent the largest national markets within Europe, benefitting from established logistics infrastructure and a high concentration of manufacturing and e-commerce operations. The market is segmented by component (hardware, software, services), end-user (food & beverage, post & parcel, groceries, etc.), and country, offering diverse investment and growth opportunities. The competitive landscape is populated by major players like Jungheinrich, Swisslog, Dematic, and Knapp, each vying for market share through innovation and strategic partnerships.

The continued growth trajectory is expected to be influenced by factors such as increasing investment in research and development leading to more sophisticated and integrated automation systems. The adoption of cloud-based WMS and WES solutions will also contribute to market expansion, offering enhanced scalability and data analytics capabilities. However, high initial investment costs and the complexity of integrating new systems into existing infrastructure could present challenges. Regulations surrounding data privacy and security in automated systems will also play a role in shaping market growth. The sustained focus on sustainability and environmental concerns within the supply chain will also drive demand for energy-efficient automation technologies. This market presents a significant opportunity for technology providers and integrators, particularly those that can offer customized solutions tailored to the specific needs of different industry verticals and geographical regions.

This in-depth report provides a comprehensive analysis of the Europe warehouse automation industry, covering market size, growth drivers, key players, and future trends from 2019 to 2033. The report is crucial for businesses, investors, and stakeholders seeking to understand this dynamic and rapidly evolving sector. With a base year of 2025 and a forecast period of 2025-2033, this report offers invaluable insights into the European warehouse automation landscape. The total market size is projected to reach xx Million by 2033, showcasing substantial growth opportunities.

Europe Warehouse Automation Industry Market Concentration & Innovation

The European warehouse automation market exhibits a moderately concentrated landscape, with several major players holding significant market share. Key companies include Jungheinrich AG, Swisslog Holding AG (KUKA AG), BEUMER Group GmbH & Co KG, SSI Schaefer AG, WITRON Logistik + Informatik GmbH, TGW Logistics Group GmbH, Mecalux SA, Vanderlande Industries BV, Kion Group AG (Dematic Group), and Knapp AG. While this list is not exhaustive, these companies collectively contribute a substantial portion (estimated at xx%) to the overall market revenue. Market share dynamics are influenced by factors such as technological innovation, strategic partnerships, and mergers and acquisitions (M&A).

- Innovation Drivers: The industry is driven by technological advancements in robotics, AI, and software solutions (WMS, WES). The increasing adoption of automated guided vehicles (AGVs), autonomous mobile robots (AMRs), and sophisticated warehouse management systems (WMS) significantly impacts operational efficiency and productivity.

- Regulatory Frameworks: EU regulations regarding workplace safety and data privacy influence the adoption and implementation of automation technologies. Compliance requirements necessitate investments in safety features and data security protocols, creating opportunities for specialized service providers.

- Product Substitutes: While full automation is the primary focus, semi-automated solutions and manual processes continue to exist, particularly in smaller warehouses or those with specialized handling needs. The choice between automation levels depends on factors such as budget, warehouse size, and operational complexity.

- End-User Trends: Growing e-commerce and the demand for faster delivery times drive the adoption of automation solutions across various end-user industries, including food and beverage, post and parcel, groceries, and manufacturing.

- M&A Activities: The warehouse automation market has witnessed a surge in M&A activity in recent years. Examples include ABB's acquisition of ASTI Mobile Robotics in 2021, which expanded ABB's AMR portfolio. While precise deal values are often confidential, the overall trend indicates a consolidation of market power and a drive towards integrated automation solutions. The total value of M&A deals in the historical period (2019-2024) is estimated at xx Million.

Europe Warehouse Automation Industry Industry Trends & Insights

The European warehouse automation market is experiencing robust growth, driven by several key factors. The compound annual growth rate (CAGR) for the period 2025-2033 is projected to be xx%. This growth is fueled by the e-commerce boom, increasing labor costs, and the need for enhanced supply chain efficiency. Technological disruptions, such as the emergence of advanced robotics and AI-powered systems, are transforming warehouse operations, leading to greater productivity and reduced operational costs.

Market penetration of automation solutions is steadily increasing across various segments. The food and beverage sector demonstrates high adoption due to stringent quality control and traceability requirements. The post and parcel industry is also undergoing significant automation to meet the demands of increased package volume. Consumer preferences for faster delivery times and efficient order fulfillment further incentivize the adoption of warehouse automation. Competitive dynamics are characterized by intense competition among established players and the emergence of innovative startups offering niche solutions.

Dominant Markets & Segments in Europe Warehouse Automation Industry

The UK, Germany, and France represent the largest national markets within Europe for warehouse automation, driven by robust e-commerce sectors, well-developed infrastructure, and supportive government policies. However, the "Rest of Europe" segment also demonstrates significant growth potential.

Key Drivers by Segment:

- United Kingdom: Strong e-commerce growth, advanced logistics infrastructure.

- Germany: Highly industrialized economy, strong manufacturing base.

- France: Expanding e-commerce market, government initiatives for digitalization.

- Rest of Europe: Emerging economies with growing e-commerce adoption.

Dominant Segments:

- End-User: The Food & Beverage and Post & Parcel segments show high adoption due to stringent quality and delivery requirements.

- Component: Hardware dominates the market currently, although the software segment (WMS and WES) is experiencing rapid growth, driving higher market values.

- Piece-Picking Robots: The adoption of piece-picking robots is rapidly growing, driven by the need for high-throughput, accurate order fulfillment.

Europe Warehouse Automation Industry Product Developments

Recent product innovations focus on enhancing flexibility, scalability, and integration capabilities. The development of AI-powered solutions for improved decision-making and optimization of warehouse operations is a key trend. Automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) are becoming increasingly sophisticated, enabling greater efficiency in material handling. These solutions address the industry’s need for efficient, accurate, and adaptable warehouse operations, catering to the demands of ever-changing consumer expectations and evolving supply chains.

Report Scope & Segmentation Analysis

This report segments the European warehouse automation market based on end-user industries (Food and Beverage, Post and Parcel, Groceries, General Merchandise, Apparel, Manufacturing, Other), country (United Kingdom, Germany, France, Rest of Europe), and components (Hardware, Software, Services). Each segment is analyzed based on market size, growth projections, and competitive dynamics. For example, the Food and Beverage segment is expected to show significant growth due to increasing demand for automation in food processing and distribution. Growth projections for each segment are detailed within the full report.

Key Drivers of Europe Warehouse Automation Industry Growth

The growth of the European warehouse automation industry is primarily driven by several factors:

- E-commerce Expansion: The surge in online shopping fuels the need for efficient warehouse operations.

- Labor Shortages: Automation addresses labor cost increases and difficulties in finding skilled workers.

- Technological Advancements: Innovations in robotics, AI, and software continue to enhance warehouse efficiency.

- Government Initiatives: Government policies promoting digitization and automation within the logistics sector further support the market's growth.

Challenges in the Europe Warehouse Automation Industry Sector

Despite promising growth, the industry faces challenges:

- High Initial Investment Costs: Implementing automation solutions requires significant upfront investments.

- Integration Complexity: Integrating new technologies with existing systems can be challenging and time-consuming.

- Cybersecurity Concerns: Protecting sensitive data in automated systems is crucial.

- Skill Gap: A shortage of skilled labor for installation, maintenance, and operation of automation systems exists.

Emerging Opportunities in Europe Warehouse Automation Industry

Emerging trends highlight significant opportunities:

- Growth of AMR Technology: The adoption of AMRs provides improved flexibility and efficiency.

- Cloud-Based WMS solutions: Cloud-based WMS solutions offer improved scalability and cost-effectiveness.

- Expansion into Underserved Markets: Several regions within Europe still have untapped potential for warehouse automation.

- Focus on Sustainability: The industry is embracing green technologies to reduce energy consumption and environmental impact.

Leading Players in the Europe Warehouse Automation Industry Market

- Jungheinrich AG

- Swisslog Holding AG (KUKA AG)

- BEUMER Group GmbH & Co KG

- SSI Schaefer AG

- WITRON Logistik + Informatik GmbH

- TGW Logistics Group GmbH

- Mecalux SA

- Vanderlande Industries BV

- Kion Group AG (Dematic Group)

- Knapp AG

Key Developments in Europe Warehouse Automation Industry Industry

- May 2022: Lineage Logistics expanded its automated warehouse in Peterborough, UK, adding 45,000 pallet spots, significantly increasing its capacity and Southeast Superhub capabilities.

- July 2021: ABB acquired ASTI Mobile Robotics Group, a leading AMR manufacturer, strengthening its position in the automation market.

Strategic Outlook for Europe Warehouse Automation Industry Market

The European warehouse automation market holds significant potential for future growth. Continued e-commerce expansion, technological advancements, and supportive government policies will drive market expansion. The focus on optimizing warehouse operations through AI and robotics, as well as integrating sustainable technologies, will define future market dynamics and drive substantial growth in the forecast period (2025-2033). The market is poised for strong expansion, offering attractive opportunities for both established players and new entrants.

Europe Warehouse Automation Industry Segmentation

-

1. Component

-

1.1. Hardware

- 1.1.1. Mobile Robots (AGV, AMR)

- 1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 1.1.3. Automated Conveyor & Sorting Systems

- 1.1.4. De-palletizing/Palletizing Systems

- 1.1.5. Automati

- 1.1.6. Piece Picking Robots

- 1.2. Software

- 1.3. Services (Value Added Services, Maintenance, etc.)

-

1.1. Hardware

-

2. End-User

- 2.1. Food and

- 2.2. Post and Parcel

- 2.3. Groceries

- 2.4. General Merchandise

- 2.5. Apparel

- 2.6. Manufacturing (Durable and Non-Durable)

- 2.7. Other End-user Industries

Europe Warehouse Automation Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Warehouse Automation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Growth of the E-commerce Industry and Customer Expectation; Increasing Manufacturing Complexity and Technology Availability; Industry 4.0 Investments Driving The Demand For Automation & Material Handling

- 3.3. Market Restrains

- 3.3.1. High Cost of Infrastructure set up

- 3.4. Market Trends

- 3.4.1. Autonomous Mobile Robots (AMRs) are Gaining Popularity Throughout Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.1.1. Mobile Robots (AGV, AMR)

- 5.1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 5.1.1.3. Automated Conveyor & Sorting Systems

- 5.1.1.4. De-palletizing/Palletizing Systems

- 5.1.1.5. Automati

- 5.1.1.6. Piece Picking Robots

- 5.1.2. Software

- 5.1.3. Services (Value Added Services, Maintenance, etc.)

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Food and

- 5.2.2. Post and Parcel

- 5.2.3. Groceries

- 5.2.4. General Merchandise

- 5.2.5. Apparel

- 5.2.6. Manufacturing (Durable and Non-Durable)

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Germany Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Jungheinrich AG

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Swisslog Holding AG (KUKA AG)

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 BEUMER Group GmbH & Co KG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 SSI Schaefer AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 WITRON Logistik + Informatik GmbH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 TGW Logistics Group GmbH

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Mecalux SA*List Not Exhaustive

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Vanderlande Industries BV

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Kion Group AG (Dematic Group)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Knapp AG

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Jungheinrich AG

List of Figures

- Figure 1: Europe Warehouse Automation Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Warehouse Automation Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Warehouse Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Warehouse Automation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Europe Warehouse Automation Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Europe Warehouse Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Warehouse Automation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 14: Europe Warehouse Automation Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 15: Europe Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Warehouse Automation Industry?

The projected CAGR is approximately 14.40%.

2. Which companies are prominent players in the Europe Warehouse Automation Industry?

Key companies in the market include Jungheinrich AG, Swisslog Holding AG (KUKA AG), BEUMER Group GmbH & Co KG, SSI Schaefer AG, WITRON Logistik + Informatik GmbH, TGW Logistics Group GmbH, Mecalux SA*List Not Exhaustive, Vanderlande Industries BV, Kion Group AG (Dematic Group), Knapp AG.

3. What are the main segments of the Europe Warehouse Automation Industry?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Growth of the E-commerce Industry and Customer Expectation; Increasing Manufacturing Complexity and Technology Availability; Industry 4.0 Investments Driving The Demand For Automation & Material Handling.

6. What are the notable trends driving market growth?

Autonomous Mobile Robots (AMRs) are Gaining Popularity Throughout Europe.

7. Are there any restraints impacting market growth?

High Cost of Infrastructure set up.

8. Can you provide examples of recent developments in the market?

May 2022 - Lineage expanded its fully automated warehouse in Peterborough by adding 45,000 pallet spots, bringing its total capacity to roughly 71,000 pallets. The additional warehouse creates a critical Southeast Superhub that will support retail and foodservice customers with specific supply chain needs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Warehouse Automation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Warehouse Automation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Warehouse Automation Industry?

To stay informed about further developments, trends, and reports in the Europe Warehouse Automation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence