Key Insights

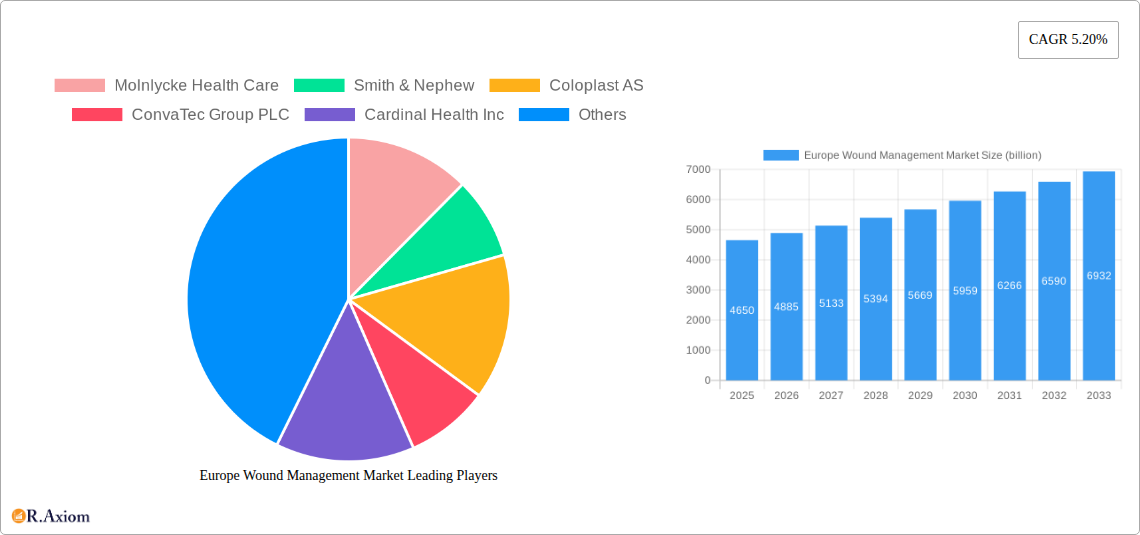

The European wound management market is poised for significant expansion, projected to reach an estimated USD 4.65 billion in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 5.05% through 2033. This growth is propelled by an aging population, increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions, and a rising number of surgical procedures. Advanced wound care products, including sophisticated dressings, topical agents, and innovative wound care devices, are at the forefront of this market surge. The demand for efficient wound closure solutions, such as sutures, staples, and advanced tissue adhesives, also contributes to market dynamism, particularly in acute wound management stemming from surgical interventions and burns. Europe's well-established healthcare infrastructure and increasing patient awareness regarding effective wound treatment further underpin this positive market trajectory.

Europe Wound Management Market Market Size (In Billion)

Key drivers for the European wound management market include the growing burden of chronic wounds like diabetic foot ulcers, pressure ulcers, and venous leg ulcers, necessitating advanced and prolonged care. Technological advancements in wound healing, such as the development of bioactive dressings, negative pressure wound therapy (NPWT) devices, and smart wound monitoring systems, are revolutionizing treatment protocols and enhancing patient outcomes. The increasing focus on reducing hospital readmissions and improving the quality of life for patients with complex wounds also fuels the adoption of these innovative solutions. While the market enjoys strong growth, potential restraints include the high cost of advanced wound care products and reimbursement challenges in certain European countries. However, the clear benefits in terms of faster healing, reduced infection rates, and lower overall healthcare expenditure are expected to outweigh these challenges, solidifying the market's upward trend.

Europe Wound Management Market Company Market Share

This in-depth report provides an exhaustive analysis of the Europe Wound Management Market, offering critical insights for industry stakeholders, investors, and decision-makers. Covering the historical period of 2019–2024 and projecting forward to 2033 with a base year of 2025, this study delves into market dynamics, segmentation, key trends, and future growth opportunities. The European wound management landscape is poised for significant expansion, driven by an aging population, increasing prevalence of chronic diseases, and advancements in wound care technologies. The report meticulously examines various segments, including wound dressings, bandages, topical agents, wound care devices, sutures, staplers, tissue adhesives, sealants, and glues, as well as specific wound types such as diabetic foot ulcers, pressure ulcers, arterial and venous ulcers, surgical wounds, and burns.

Europe Wound Management Market Market Concentration & Innovation

The Europe Wound Management Market is characterized by a moderate to high degree of concentration, with a few key players holding substantial market shares. Leading companies like Molnlycke Health Care, Smith & Nephew, Coloplast AS, ConvaTec Group PLC, and Cardinal Health Inc. are at the forefront of innovation and market penetration. Innovation drivers include the development of advanced wound dressings with enhanced healing properties, smart wound monitoring devices leveraging AI and IoT, and minimally invasive wound closure techniques. Regulatory frameworks, such as those established by the European Medicines Agency (EMA) and country-specific health authorities, play a crucial role in shaping product approvals and market access. While product substitutes exist, the development of novel technologies and specialized wound care solutions continues to differentiate market offerings. End-user trends lean towards patient-centric care, demand for cost-effective solutions, and a preference for products that promote faster healing and reduce complications. Mergers and acquisitions (M&A) activities are strategically employed by major players to expand product portfolios, gain access to new technologies, and consolidate market presence. For instance, recent M&A deals in the broader healthcare sector hint at a potential for consolidation in the wound management space, with deal values often ranging in the hundreds of millions of dollars.

Europe Wound Management Market Industry Trends & Insights

The Europe Wound Management Market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033, reaching an estimated market size of over $25 billion by 2033. This expansion is fueled by a confluence of factors including the escalating incidence of chronic wounds, particularly diabetic foot ulcers and pressure ulcers, which are becoming more prevalent with an aging European population and the rising rates of diabetes and obesity. Technological advancements are profoundly reshaping the industry. The integration of artificial intelligence (AI) in wound assessment and monitoring, as evidenced by Tissue Analytics' CE Mark approval, signifies a shift towards data-driven and more precise wound care. Furthermore, the development of bioengineered skin substitutes, advanced hydrocolloids, and antimicrobial dressings are significantly improving healing outcomes and reducing infection rates. Consumer preferences are increasingly geared towards home-based wound care solutions and products that offer enhanced patient comfort and ease of use, thereby reducing the burden on healthcare systems. The competitive landscape is dynamic, with established players investing heavily in research and development to introduce next-generation products. Emerging companies are also carving out niches through innovative digital health solutions and specialized therapeutic approaches, further intensifying competition. The market penetration of advanced wound care technologies is steadily increasing as healthcare providers recognize their efficacy in improving patient quality of life and reducing overall treatment costs.

Dominant Markets & Segments in Europe Wound Management Market

The Europe Wound Management Market exhibits significant dominance across several key segments. In terms of product type, Wound Care Dressings are the largest segment, accounting for an estimated 40% of the market value in 2025, projected to grow steadily due to the increasing demand for advanced dressings like foam, hydrogel, and alginate dressings. Within wound dressings, Dressings themselves represent the most significant sub-segment, driven by the need for effective management of chronic and acute wounds. Bandages also hold a substantial share, particularly elastic and compression bandages used for venous leg ulcers and post-operative care. Topical Agents, including antimicrobial solutions and growth factors, are crucial for accelerating healing and preventing infection, contributing significantly to market growth. Wound Care Devices, such as negative pressure wound therapy (NPWT) systems and ultrasound devices, are gaining traction due to their proven efficacy in managing complex wounds, representing a high-growth area.

In the Wound Closure segment, Sutures continue to be a dominant force, widely used in surgical procedures. However, Staplers, Tissue Adhesives, and Sealants are witnessing increasing adoption due to their faster application times and improved cosmetic outcomes, especially in minimally invasive surgeries.

The Wound Type segmentation highlights the overwhelming impact of Chronic Wounds, which constitute over 70% of the market. Diabetic Foot Ulcers are a primary driver within this category, given the rising global prevalence of diabetes. Pressure Ulcers, particularly in elderly and immobile patients, and Arterial and Venous Ulcers are also significant contributors. Other Chronic Wounds, including post-surgical chronic wounds, further bolster this segment. Acute Wounds, while smaller in market share, represent a consistent demand, with Surgical Wounds being the largest sub-segment, followed by Burns. Economic policies promoting better diabetes management and initiatives to reduce hospital-acquired infections are key drivers for the growth of chronic wound segments. Infrastructure development in healthcare, especially in Eastern European countries, is also enhancing access to advanced wound care products and services.

Europe Wound Management Market Product Developments

Product developments in the Europe Wound Management Market are characterized by a relentless pursuit of enhanced efficacy, patient comfort, and cost-effectiveness. Innovations are focused on advanced material science, such as incorporating silver ions for antimicrobial properties, utilizing hydrocolloids and hydrogels for optimal moisture balance, and developing bio-engineered tissues for regenerative medicine. Smart dressings equipped with sensors for real-time monitoring of wound parameters and AI-powered analytics platforms are emerging as game-changers, enabling personalized treatment plans and early detection of complications. These advancements offer significant competitive advantages by improving healing rates, reducing pain, and minimizing the need for frequent dressing changes, thereby enhancing the overall patient experience and healthcare provider efficiency.

Report Scope & Segmentation Analysis

This report provides a granular analysis of the Europe Wound Management Market, segmented across Product: By Wound Care (Dressings, Bandages, Topical Agents, Wound Care Devices), By Wound Closure (Suture, Staplers, Tissue Adhesive, Sealant, and Glue), and Wound Type: Chronic Wound (Diabetic Foot Ulcer, Pressure Ulcer, Arterial and Venous Ulcer, Other Chronic Wounds), By Acute Wound (Surgical Wounds, Burns, Other Acute Wounds). The Wound Care Dressings segment is projected to hold the largest market share, driven by increasing demand for advanced dressings. The Chronic Wound segment, particularly Diabetic Foot Ulcer management, is anticipated to exhibit substantial growth due to rising diabetes prevalence. The Wound Closure market is witnessing a gradual shift towards less invasive methods like tissue adhesives and sealants, complementing traditional sutures and staplers. Competitive dynamics within each segment are influenced by technological innovation, pricing strategies, and the ability to meet stringent regulatory requirements.

Key Drivers of Europe Wound Management Market Growth

The Europe Wound Management Market is propelled by several key drivers. The aging demographic across Europe leads to a higher incidence of chronic diseases, consequently increasing the demand for wound management solutions. The escalating prevalence of diabetes and obesity, major contributors to chronic wounds like diabetic foot ulcers and pressure ulcers, further fuels market expansion. Technological advancements, including the development of AI-powered wound assessment tools, smart dressings, and bio-engineered skin substitutes, are revolutionizing treatment efficacy and patient outcomes. Government initiatives focused on reducing healthcare costs associated with chronic wounds and improving patient quality of life also contribute significantly. Furthermore, increasing awareness among healthcare professionals and patients about the benefits of advanced wound care products is driving market adoption.

Challenges in the Europe Wound Management Market Sector

Despite robust growth prospects, the Europe Wound Management Market faces several challenges. Stringent regulatory hurdles for new product approvals across different European countries can be time-consuming and costly, impacting the pace of innovation and market entry. The high cost of advanced wound care technologies and specialized dressings can be a barrier for adoption in resource-limited healthcare settings and for certain patient populations. Reimbursement policies, which vary significantly across member states, can also pose challenges to widespread access to these advanced treatments. Moreover, the competitive landscape is intense, with established players and emerging companies vying for market share, necessitating continuous innovation and strategic pricing. Supply chain disruptions, as witnessed globally, can also impact the availability and cost of raw materials and finished products.

Emerging Opportunities in Europe Wound Management Market

The Europe Wound Management Market presents several emerging opportunities. The increasing adoption of telemedicine and digital health platforms offers a significant avenue for remote wound monitoring and management, particularly for chronic wounds. The development of personalized wound care solutions, leveraging genetic profiling and advanced diagnostics, holds immense potential for improving treatment outcomes. Growth in the home healthcare sector and the demand for convenient, patient-friendly wound care products present further opportunities for market expansion. Untapped markets within Eastern Europe, with their growing healthcare expenditures and improving infrastructure, represent significant expansion potential. Furthermore, the focus on regenerative medicine and the development of novel biologics for wound healing are poised to create new market segments and therapeutic avenues.

Leading Players in the Europe Wound Management Market Market

- Molnlycke Health Care

- Smith & Nephew

- Coloplast AS

- ConvaTec Group PLC

- Cardinal Health Inc

- 3M Company

- Medtronic PLC

- B Braun Melsungen AG

- Paul Hartmann AG

- Integra Lifesciences

Key Developments in Europe Wound Management Market Industry

- June 2021: Tissue Analytics, a Net Health company, announced that it had been awarded the European Union (EU) Class I(m) CE Mark for its AI-based mobile wound imaging and analytics solution, enabling its marketing and sale within EU member countries.

- May 2022: SolasCure, a Cambridge-based biotech company, reported that its novel wound-cleaning technology had been used in its first trial patient treatment.

Strategic Outlook for Europe Wound Management Market Market

The strategic outlook for the Europe Wound Management Market remains exceptionally positive, driven by an ever-increasing demand for effective and innovative solutions. Future growth catalysts will be centered around the continued integration of digital health technologies for enhanced patient monitoring and data analytics, enabling more precise and personalized wound care. The development of advanced biomaterials and regenerative therapies will further enhance healing capabilities, particularly for complex chronic wounds. Strategic partnerships and collaborations between technology providers, pharmaceutical companies, and healthcare institutions will be crucial for accelerating product development and market penetration. Furthermore, a growing emphasis on preventative wound care strategies and patient education will contribute to reducing the overall burden of wound-related complications and healthcare costs, thereby shaping a more sustainable and efficient wound management ecosystem across Europe.

Europe Wound Management Market Segmentation

-

1. Product

-

1.1. By Wound Care

- 1.1.1. Dressings

- 1.1.2. Bandages

- 1.1.3. Topical Agents

- 1.1.4. Wound Care Devices

-

1.2. By Wound Closure

- 1.2.1. Suture

- 1.2.2. Staplers

- 1.2.3. Tissue Adhesive, Sealant, and Glue

-

1.1. By Wound Care

-

2. Wound Type

-

2.1. Chronic Wound

- 2.1.1. Diabetic Foot Ulcer

- 2.1.2. Pressure Ulcer

- 2.1.3. Arterial and Venous Ulcer

- 2.1.4. Other Chronic Wounds

-

2.2. By Acute Wound

- 2.2.1. Surgical Wounds

- 2.2.2. Burns

- 2.2.3. Other Acute Wounds

-

2.1. Chronic Wound

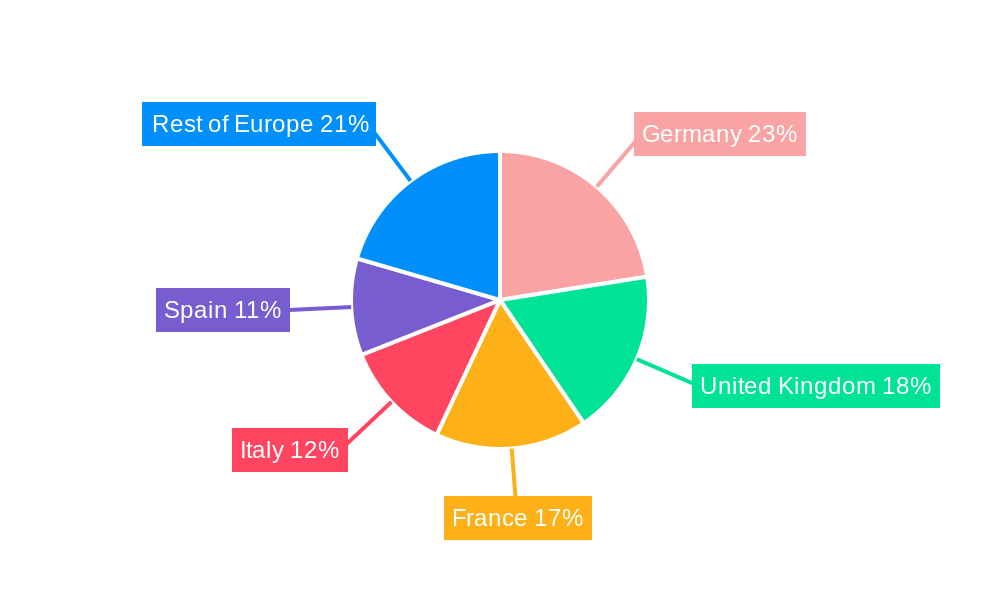

Europe Wound Management Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Wound Management Market Regional Market Share

Geographic Coverage of Europe Wound Management Market

Europe Wound Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Incidences of Chronic Wounds

- 3.2.2 Ulcers

- 3.2.3 and Diabetic Ulcers; Increase in Volume of Surgical Procedures; Rising Geriatric Population

- 3.3. Market Restrains

- 3.3.1. Reimbursement Issues Associated with Advanced Wound Care Products; High Treatment Costs

- 3.4. Market Trends

- 3.4.1. Surgical staplers (Wound Closure Products) are the largest product segment of the Europe wound management market to witness the highest growth over the forecast period .

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Wound Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Wound Care

- 5.1.1.1. Dressings

- 5.1.1.2. Bandages

- 5.1.1.3. Topical Agents

- 5.1.1.4. Wound Care Devices

- 5.1.2. By Wound Closure

- 5.1.2.1. Suture

- 5.1.2.2. Staplers

- 5.1.2.3. Tissue Adhesive, Sealant, and Glue

- 5.1.1. By Wound Care

- 5.2. Market Analysis, Insights and Forecast - by Wound Type

- 5.2.1. Chronic Wound

- 5.2.1.1. Diabetic Foot Ulcer

- 5.2.1.2. Pressure Ulcer

- 5.2.1.3. Arterial and Venous Ulcer

- 5.2.1.4. Other Chronic Wounds

- 5.2.2. By Acute Wound

- 5.2.2.1. Surgical Wounds

- 5.2.2.2. Burns

- 5.2.2.3. Other Acute Wounds

- 5.2.1. Chronic Wound

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany Europe Wound Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. By Wound Care

- 6.1.1.1. Dressings

- 6.1.1.2. Bandages

- 6.1.1.3. Topical Agents

- 6.1.1.4. Wound Care Devices

- 6.1.2. By Wound Closure

- 6.1.2.1. Suture

- 6.1.2.2. Staplers

- 6.1.2.3. Tissue Adhesive, Sealant, and Glue

- 6.1.1. By Wound Care

- 6.2. Market Analysis, Insights and Forecast - by Wound Type

- 6.2.1. Chronic Wound

- 6.2.1.1. Diabetic Foot Ulcer

- 6.2.1.2. Pressure Ulcer

- 6.2.1.3. Arterial and Venous Ulcer

- 6.2.1.4. Other Chronic Wounds

- 6.2.2. By Acute Wound

- 6.2.2.1. Surgical Wounds

- 6.2.2.2. Burns

- 6.2.2.3. Other Acute Wounds

- 6.2.1. Chronic Wound

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. United Kingdom Europe Wound Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. By Wound Care

- 7.1.1.1. Dressings

- 7.1.1.2. Bandages

- 7.1.1.3. Topical Agents

- 7.1.1.4. Wound Care Devices

- 7.1.2. By Wound Closure

- 7.1.2.1. Suture

- 7.1.2.2. Staplers

- 7.1.2.3. Tissue Adhesive, Sealant, and Glue

- 7.1.1. By Wound Care

- 7.2. Market Analysis, Insights and Forecast - by Wound Type

- 7.2.1. Chronic Wound

- 7.2.1.1. Diabetic Foot Ulcer

- 7.2.1.2. Pressure Ulcer

- 7.2.1.3. Arterial and Venous Ulcer

- 7.2.1.4. Other Chronic Wounds

- 7.2.2. By Acute Wound

- 7.2.2.1. Surgical Wounds

- 7.2.2.2. Burns

- 7.2.2.3. Other Acute Wounds

- 7.2.1. Chronic Wound

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. France Europe Wound Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. By Wound Care

- 8.1.1.1. Dressings

- 8.1.1.2. Bandages

- 8.1.1.3. Topical Agents

- 8.1.1.4. Wound Care Devices

- 8.1.2. By Wound Closure

- 8.1.2.1. Suture

- 8.1.2.2. Staplers

- 8.1.2.3. Tissue Adhesive, Sealant, and Glue

- 8.1.1. By Wound Care

- 8.2. Market Analysis, Insights and Forecast - by Wound Type

- 8.2.1. Chronic Wound

- 8.2.1.1. Diabetic Foot Ulcer

- 8.2.1.2. Pressure Ulcer

- 8.2.1.3. Arterial and Venous Ulcer

- 8.2.1.4. Other Chronic Wounds

- 8.2.2. By Acute Wound

- 8.2.2.1. Surgical Wounds

- 8.2.2.2. Burns

- 8.2.2.3. Other Acute Wounds

- 8.2.1. Chronic Wound

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Italy Europe Wound Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. By Wound Care

- 9.1.1.1. Dressings

- 9.1.1.2. Bandages

- 9.1.1.3. Topical Agents

- 9.1.1.4. Wound Care Devices

- 9.1.2. By Wound Closure

- 9.1.2.1. Suture

- 9.1.2.2. Staplers

- 9.1.2.3. Tissue Adhesive, Sealant, and Glue

- 9.1.1. By Wound Care

- 9.2. Market Analysis, Insights and Forecast - by Wound Type

- 9.2.1. Chronic Wound

- 9.2.1.1. Diabetic Foot Ulcer

- 9.2.1.2. Pressure Ulcer

- 9.2.1.3. Arterial and Venous Ulcer

- 9.2.1.4. Other Chronic Wounds

- 9.2.2. By Acute Wound

- 9.2.2.1. Surgical Wounds

- 9.2.2.2. Burns

- 9.2.2.3. Other Acute Wounds

- 9.2.1. Chronic Wound

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Spain Europe Wound Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. By Wound Care

- 10.1.1.1. Dressings

- 10.1.1.2. Bandages

- 10.1.1.3. Topical Agents

- 10.1.1.4. Wound Care Devices

- 10.1.2. By Wound Closure

- 10.1.2.1. Suture

- 10.1.2.2. Staplers

- 10.1.2.3. Tissue Adhesive, Sealant, and Glue

- 10.1.1. By Wound Care

- 10.2. Market Analysis, Insights and Forecast - by Wound Type

- 10.2.1. Chronic Wound

- 10.2.1.1. Diabetic Foot Ulcer

- 10.2.1.2. Pressure Ulcer

- 10.2.1.3. Arterial and Venous Ulcer

- 10.2.1.4. Other Chronic Wounds

- 10.2.2. By Acute Wound

- 10.2.2.1. Surgical Wounds

- 10.2.2.2. Burns

- 10.2.2.3. Other Acute Wounds

- 10.2.1. Chronic Wound

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Europe Europe Wound Management Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. By Wound Care

- 11.1.1.1. Dressings

- 11.1.1.2. Bandages

- 11.1.1.3. Topical Agents

- 11.1.1.4. Wound Care Devices

- 11.1.2. By Wound Closure

- 11.1.2.1. Suture

- 11.1.2.2. Staplers

- 11.1.2.3. Tissue Adhesive, Sealant, and Glue

- 11.1.1. By Wound Care

- 11.2. Market Analysis, Insights and Forecast - by Wound Type

- 11.2.1. Chronic Wound

- 11.2.1.1. Diabetic Foot Ulcer

- 11.2.1.2. Pressure Ulcer

- 11.2.1.3. Arterial and Venous Ulcer

- 11.2.1.4. Other Chronic Wounds

- 11.2.2. By Acute Wound

- 11.2.2.1. Surgical Wounds

- 11.2.2.2. Burns

- 11.2.2.3. Other Acute Wounds

- 11.2.1. Chronic Wound

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Molnlycke Health Care

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Smith & Nephew

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Coloplast AS

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 ConvaTec Group PLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Cardinal Health Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 3M Company

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Medtronic PLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 B Braun Melsungen AG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Paul Hartmann AG

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Integra Lifesciences

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Molnlycke Health Care

List of Figures

- Figure 1: Europe Wound Management Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Wound Management Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Wound Management Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Europe Wound Management Market Revenue undefined Forecast, by Wound Type 2020 & 2033

- Table 3: Europe Wound Management Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Wound Management Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 5: Europe Wound Management Market Revenue undefined Forecast, by Wound Type 2020 & 2033

- Table 6: Europe Wound Management Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Europe Wound Management Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 8: Europe Wound Management Market Revenue undefined Forecast, by Wound Type 2020 & 2033

- Table 9: Europe Wound Management Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Europe Wound Management Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 11: Europe Wound Management Market Revenue undefined Forecast, by Wound Type 2020 & 2033

- Table 12: Europe Wound Management Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Europe Wound Management Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 14: Europe Wound Management Market Revenue undefined Forecast, by Wound Type 2020 & 2033

- Table 15: Europe Wound Management Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Europe Wound Management Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 17: Europe Wound Management Market Revenue undefined Forecast, by Wound Type 2020 & 2033

- Table 18: Europe Wound Management Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: Europe Wound Management Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 20: Europe Wound Management Market Revenue undefined Forecast, by Wound Type 2020 & 2033

- Table 21: Europe Wound Management Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Wound Management Market?

The projected CAGR is approximately 5.05%.

2. Which companies are prominent players in the Europe Wound Management Market?

Key companies in the market include Molnlycke Health Care, Smith & Nephew, Coloplast AS, ConvaTec Group PLC, Cardinal Health Inc, 3M Company, Medtronic PLC, B Braun Melsungen AG, Paul Hartmann AG, Integra Lifesciences.

3. What are the main segments of the Europe Wound Management Market?

The market segments include Product, Wound Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Chronic Wounds. Ulcers. and Diabetic Ulcers; Increase in Volume of Surgical Procedures; Rising Geriatric Population.

6. What are the notable trends driving market growth?

Surgical staplers (Wound Closure Products) are the largest product segment of the Europe wound management market to witness the highest growth over the forecast period ..

7. Are there any restraints impacting market growth?

Reimbursement Issues Associated with Advanced Wound Care Products; High Treatment Costs.

8. Can you provide examples of recent developments in the market?

In June 2021, Pittsburgh established itself as a global provider of artificial intelligence (AI)-based technology for wound care, Tissue Analytics, a Net Health company, announced that it had been awarded the European Union (EU) Class I(m) CE Mark. The highly sought-after designation allows the company to market and sells its mobile wound imaging and analytics solution to healthcare organizations based in EU member countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Wound Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Wound Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Wound Management Market?

To stay informed about further developments, trends, and reports in the Europe Wound Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence