Key Insights

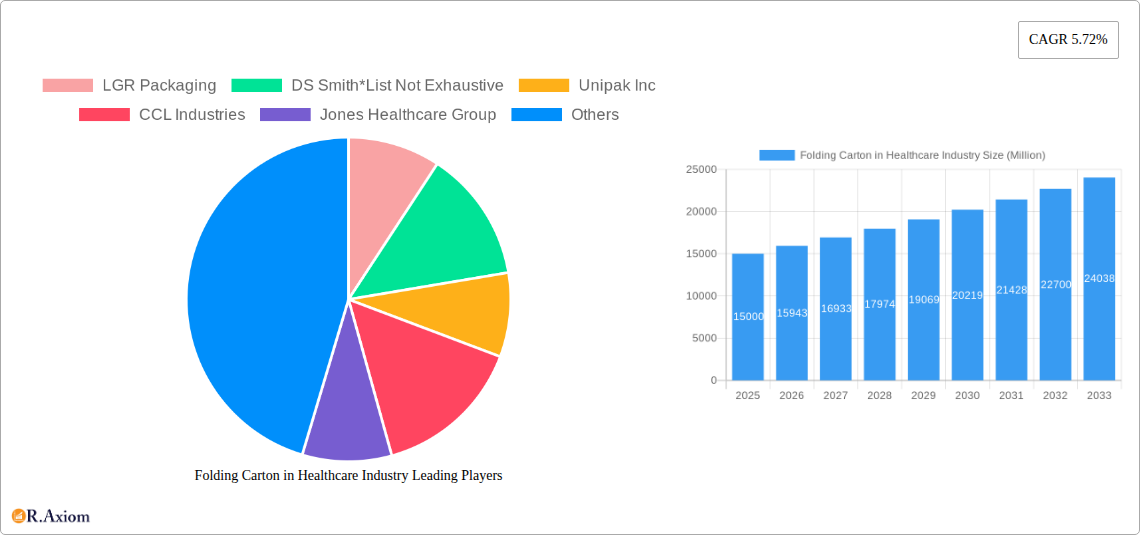

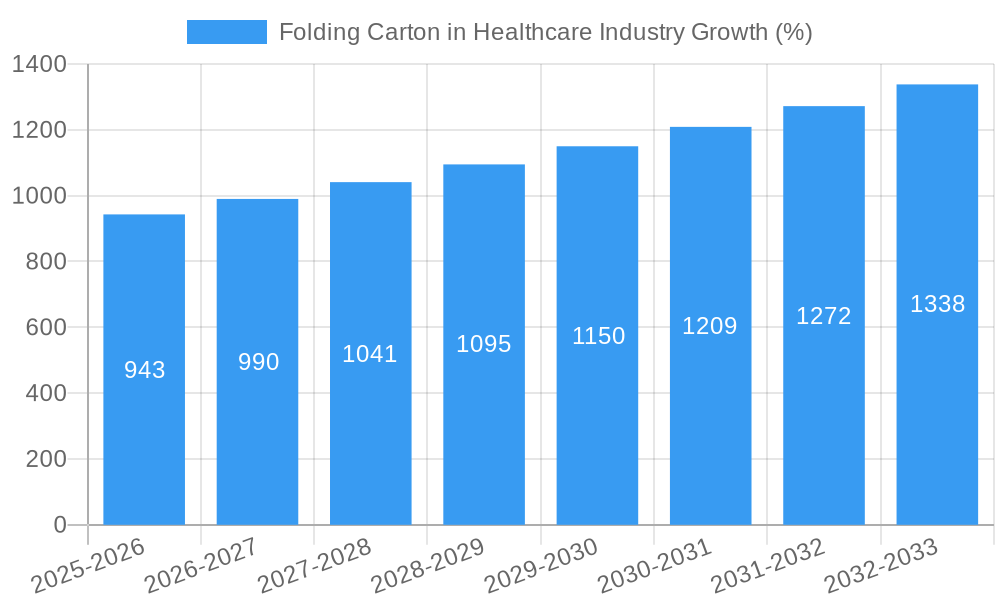

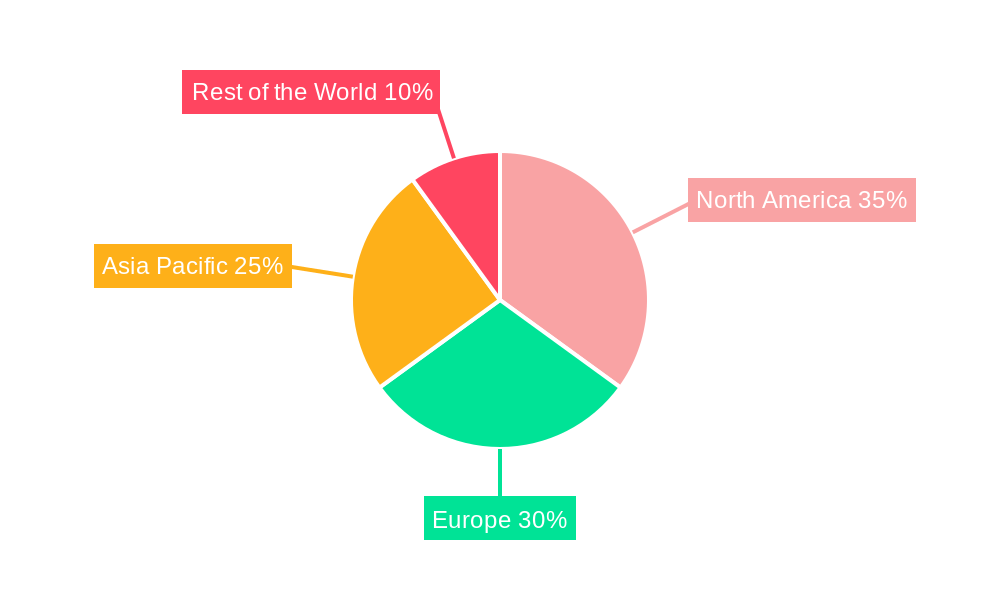

The global healthcare folding carton market is experiencing robust growth, driven by the increasing demand for pharmaceutical and medical device packaging. A 5.72% CAGR from 2019 to 2024 suggests a significant market expansion, projected to continue into the forecast period (2025-2033). This growth is fueled by several key factors. Advancements in printing technologies, such as digital and flexography printing, enable higher-quality, more intricate designs and improved branding opportunities for pharmaceutical companies. Stringent regulations imposed by agencies like the FDA and the implementation of IMRDF (International Medical Device Regulators Forum) standards necessitate sophisticated and compliant packaging solutions, driving demand for specialized folding cartons. Furthermore, the increasing popularity of blister packs, vials, ampoules, and injectable drug packaging contributes significantly to market expansion. The market is segmented by product type (blister packs, vials & ampoules, injectables, other medical devices) and labelling type, reflecting diverse packaging needs across the healthcare industry. Major players like LGR Packaging, DS Smith, Unipak Inc, CCL Industries, and Jones Healthcare Group are shaping the market landscape through innovation and strategic partnerships. The geographic distribution of the market is likely skewed towards North America and Europe, given their established healthcare infrastructure and regulatory frameworks, but the Asia Pacific region is expected to witness substantial growth due to rising healthcare expenditure and increasing pharmaceutical production in the region.

The competitive landscape is moderately consolidated, with several large multinational companies and regional players vying for market share. Competition is primarily driven by factors such as pricing, innovation in packaging designs, sustainable material utilization, and the ability to comply with stringent regulatory requirements. Future growth will depend on continued technological advancements in printing and material science, expanding regulatory compliance across diverse healthcare segments, and the adoption of sustainable packaging materials to meet growing environmental concerns. The market is predicted to witness ongoing consolidation as companies seek to expand their product portfolios and geographic reach through mergers, acquisitions, and strategic alliances. Key market trends suggest an increase in demand for customized and personalized packaging, driven by the growing need for enhanced product identification and anti-counterfeiting measures.

Folding Carton in Healthcare Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Folding Carton in Healthcare Industry, offering valuable insights into market dynamics, competitive landscapes, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. The report delves into various segments, including product types (Blisters, Vials & Ampoules, Injectables, Other Medical Devices), labeling types, and advancements in the labeling industry (digital printing, flexography). Key players such as LGR Packaging, DS Smith, Unipak Inc, CCL Industries, Jones Healthcare Group, August Faller GmbH & Co. KG, Nosco Inc, Edelmann Group, AR Packaging, Stora Enso Group, Big Valley Packaging, Essentra PLC, Keystone Folding Box Company, and Multi Packaging Solutions (WestRock) are profiled, providing a detailed competitive analysis. The report forecasts a market valued at $XX Million by 2033, driven by key factors discussed within.

Folding Carton in Healthcare Industry Market Concentration & Innovation

The Folding Carton in Healthcare Industry exhibits a moderately concentrated market structure. While a few large multinational players like DS Smith and WestRock hold significant market share, numerous smaller regional and specialized companies cater to niche segments. Market share data from 2024 suggests that the top 5 players hold approximately 35% of the global market, with the remaining 65% shared among numerous smaller players. The industry is characterized by ongoing innovation, driven by the demand for sustainable packaging solutions and advancements in printing technologies such as digital printing and flexography, improving product quality and traceability. Regulatory frameworks like those established by the FDA and IMDRF significantly impact industry practices, particularly regarding labeling regulations. Substitutes for folding cartons, such as plastic containers, exist, but the inherent advantages of folding cartons in terms of cost-effectiveness, recyclability, and printability maintain their market relevance. Increasing demand for personalized healthcare products and the growing adoption of e-commerce within the healthcare sector fuel demand for customized folding cartons. M&A activities have increased in recent years with a total deal value of approximately $XX Million in 2024, primarily focusing on enhancing geographical reach and integrating new technologies.

Folding Carton in Healthcare Industry Industry Trends & Insights

The Folding Carton in Healthcare Industry is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This growth is fueled by several key factors: the rising global prevalence of chronic diseases, the increasing demand for pharmaceutical products, and the growing emphasis on patient safety and compliance. Technological disruptions, such as the adoption of smart packaging and digital printing technologies, are transforming the industry, improving efficiency and product traceability. Consumer preferences are shifting towards eco-friendly and sustainable packaging options, pushing manufacturers to adopt sustainable materials and practices. Competitive dynamics are influenced by factors like pricing pressures, technological innovation, and regulations. Market penetration of sustainable folding cartons is increasing, currently estimated at XX% in 2025 and projected to reach XX% by 2033. These trends create both opportunities and challenges for companies operating in this industry.

Dominant Markets & Segments in Folding Carton in Healthcare Industry

The North American market currently dominates the global Folding Carton in Healthcare Industry, driven by factors such as robust healthcare infrastructure, high pharmaceutical consumption, and stringent regulatory standards. The European market is also significant, though slightly behind North America due to a variety of factors such as more stringent regulation. However, the Asia-Pacific region is expected to witness the fastest growth during the forecast period due to factors such as a rapidly growing population, increasing healthcare spending, and rising demand for pharmaceutical and medical device packaging.

- Key Drivers in North America: Strong healthcare infrastructure, high pharmaceutical consumption, stringent regulatory environment.

- Key Drivers in Europe: Established healthcare systems, stringent quality control, increasing demand for sustainable packaging.

- Key Drivers in Asia-Pacific: Rapid population growth, rising healthcare spending, increasing demand for pharmaceutical and medical device packaging.

Within product segments, injectable packaging currently holds the largest market share, followed by blisters and vials & ampoules. However, the "Other Product Types" segment, encompassing medical devices and other healthcare products, is projected to experience the most significant growth due to the diverse applications of folding cartons in this area. In the labelling segment, the growing adoption of digital printing and flexography is transforming the industry. Key regulations, like those from the FDA and IMDRF, influence the labelling standards and practices. Major players in the labelling segment include (list of manufacturers would be included here).

Folding Carton in Healthcare Industry Product Developments

Recent product innovations focus on enhancing sustainability, security features (e.g., tamper-evident designs), and improved printing capabilities (e.g., high-definition graphics and variable data printing). These advancements cater to rising consumer demand for eco-friendly packaging and improve product traceability and brand recognition. The competitive advantage lies in offering innovative, cost-effective, and sustainable packaging solutions that meet the stringent regulatory requirements of the healthcare industry. The industry is constantly adapting to new materials, printing technologies, and design features to enhance product presentation and consumer experience.

Report Scope & Segmentation Analysis

This report segments the Folding Carton in Healthcare Industry based on product type (Blisters, Vials & Ampoules, Injectables, Other Product Types), labelling type (including advancements in digital and flexography printing), and geographical region. Each segment provides detailed analysis of market size, growth projections, and competitive landscape. For example, the "Injectables" segment demonstrates a strong growth potential driven by the increasing use of injectables in various therapies. The “Other Product Types” segment includes a vast array of products, and will show significant growth. Advancements in labeling technologies, particularly digital printing, provide increased customization and improve traceability throughout the supply chain. Each geographic region presents unique market characteristics influenced by local regulations, healthcare infrastructure, and consumer preferences.

Key Drivers of Folding Carton in Healthcare Industry Growth

The growth of the Folding Carton in Healthcare Industry is driven by several factors: increasing demand for pharmaceuticals and medical devices globally; stricter regulations requiring higher quality and safer packaging; growth in e-commerce driving demand for customized packaging; advances in printing and packaging technologies, particularly the adoption of sustainable materials and digital printing; rising focus on brand building and product differentiation within the healthcare sector.

Challenges in the Folding Carton in Healthcare Industry Sector

The industry faces challenges such as fluctuating raw material prices, stringent regulatory compliance requirements (resulting in high compliance costs), increased competition from alternative packaging materials, supply chain disruptions, and the need for constant innovation to stay ahead of the competition. These challenges can significantly impact profitability and market share.

Emerging Opportunities in Folding Carton in Healthcare Industry

Emerging opportunities include the growing adoption of sustainable and eco-friendly packaging materials; increasing demand for personalized medicine leading to specialized packaging solutions; expansion into emerging markets with significant healthcare growth potential; the integration of smart packaging technologies for enhanced product traceability and security; further advancement and adoption of digital printing technologies for efficient and cost-effective packaging solutions.

Leading Players in the Folding Carton in Healthcare Industry Market

- LGR Packaging

- DS Smith

- Unipak Inc

- CCL Industries

- Jones Healthcare Group

- August Faller GmbH & co KG

- Nosco Inc

- Edelmann Group

- AR Packaging

- Stora Enso Group

- Big Valley Packaging

- Essentra PLC

- Keystone Folding Box Company

- Multi Packaging Solutions (WestRock)

Key Developments in Folding Carton in Healthcare Industry Industry

- 2023 Q4: WestRock announced a significant investment in a new sustainable packaging facility.

- 2024 Q1: DS Smith launched a new line of recyclable folding cartons for pharmaceuticals.

- 2024 Q3: CCL Industries acquired a smaller packaging company specializing in digital printing.

- (Further key developments with dates and impacts will be detailed in the full report.)

Strategic Outlook for Folding Carton in Healthcare Industry Market

The Folding Carton in Healthcare Industry is poised for continued growth, driven by the factors outlined in this report. Strategic opportunities lie in embracing sustainability, investing in advanced technologies (particularly digital printing), focusing on niche markets, and expanding into emerging economies. Companies that can effectively adapt to evolving consumer preferences, regulatory landscapes, and technological advancements will be best positioned for long-term success in this dynamic market.

Folding Carton in Healthcare Industry Segmentation

-

1. Product Type

- 1.1. Blisters

- 1.2. Vials & Ampoules

- 1.3. Injectables

- 1.4. Other Product Types (Medical Devices, etc)

-

2. Labelling

-

2.1. Labelling Type

- 2.1.1. Pressure Sensitive

- 2.1.2. In-Mold

- 2.1.3. Shrink-Sleeve

- 2.1.4. Glue-Applied

- 2.1.5. Others (Custom Die-cut, etc.)

- 2.2. Advancem

- 2.3. Key regu

-

2.4. Key specific manufacturers in Labelling

- 2.4.1. WS Packaging

- 2.4.2. Schreiner Group

- 2.4.3. Faubel & Co

- 2.4.4. OPM Group

-

2.1. Labelling Type

Folding Carton in Healthcare Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Folding Carton in Healthcare Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.72% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Stringent regulations related to discerning key product related information in the field of medical devices; Growing emphasis of monitoring & assisting patient medication; Focus on traceability & anti-counterfeiting in the healthcare sector; Product & Material-based innovations driven by major packaging manufacturers to drive demand

- 3.3. Market Restrains

- 3.3.1. ; High Inventory Costs and Premium Pricing

- 3.4. Market Trends

- 3.4.1. Growing Emphasis of Monitoring and Assisting Patient Medication

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Blisters

- 5.1.2. Vials & Ampoules

- 5.1.3. Injectables

- 5.1.4. Other Product Types (Medical Devices, etc)

- 5.2. Market Analysis, Insights and Forecast - by Labelling

- 5.2.1. Labelling Type

- 5.2.1.1. Pressure Sensitive

- 5.2.1.2. In-Mold

- 5.2.1.3. Shrink-Sleeve

- 5.2.1.4. Glue-Applied

- 5.2.1.5. Others (Custom Die-cut, etc.)

- 5.2.2. Advancem

- 5.2.3. Key regu

- 5.2.4. Key specific manufacturers in Labelling

- 5.2.4.1. WS Packaging

- 5.2.4.2. Schreiner Group

- 5.2.4.3. Faubel & Co

- 5.2.4.4. OPM Group

- 5.2.1. Labelling Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Blisters

- 6.1.2. Vials & Ampoules

- 6.1.3. Injectables

- 6.1.4. Other Product Types (Medical Devices, etc)

- 6.2. Market Analysis, Insights and Forecast - by Labelling

- 6.2.1. Labelling Type

- 6.2.1.1. Pressure Sensitive

- 6.2.1.2. In-Mold

- 6.2.1.3. Shrink-Sleeve

- 6.2.1.4. Glue-Applied

- 6.2.1.5. Others (Custom Die-cut, etc.)

- 6.2.2. Advancem

- 6.2.3. Key regu

- 6.2.4. Key specific manufacturers in Labelling

- 6.2.4.1. WS Packaging

- 6.2.4.2. Schreiner Group

- 6.2.4.3. Faubel & Co

- 6.2.4.4. OPM Group

- 6.2.1. Labelling Type

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Blisters

- 7.1.2. Vials & Ampoules

- 7.1.3. Injectables

- 7.1.4. Other Product Types (Medical Devices, etc)

- 7.2. Market Analysis, Insights and Forecast - by Labelling

- 7.2.1. Labelling Type

- 7.2.1.1. Pressure Sensitive

- 7.2.1.2. In-Mold

- 7.2.1.3. Shrink-Sleeve

- 7.2.1.4. Glue-Applied

- 7.2.1.5. Others (Custom Die-cut, etc.)

- 7.2.2. Advancem

- 7.2.3. Key regu

- 7.2.4. Key specific manufacturers in Labelling

- 7.2.4.1. WS Packaging

- 7.2.4.2. Schreiner Group

- 7.2.4.3. Faubel & Co

- 7.2.4.4. OPM Group

- 7.2.1. Labelling Type

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Blisters

- 8.1.2. Vials & Ampoules

- 8.1.3. Injectables

- 8.1.4. Other Product Types (Medical Devices, etc)

- 8.2. Market Analysis, Insights and Forecast - by Labelling

- 8.2.1. Labelling Type

- 8.2.1.1. Pressure Sensitive

- 8.2.1.2. In-Mold

- 8.2.1.3. Shrink-Sleeve

- 8.2.1.4. Glue-Applied

- 8.2.1.5. Others (Custom Die-cut, etc.)

- 8.2.2. Advancem

- 8.2.3. Key regu

- 8.2.4. Key specific manufacturers in Labelling

- 8.2.4.1. WS Packaging

- 8.2.4.2. Schreiner Group

- 8.2.4.3. Faubel & Co

- 8.2.4.4. OPM Group

- 8.2.1. Labelling Type

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Blisters

- 9.1.2. Vials & Ampoules

- 9.1.3. Injectables

- 9.1.4. Other Product Types (Medical Devices, etc)

- 9.2. Market Analysis, Insights and Forecast - by Labelling

- 9.2.1. Labelling Type

- 9.2.1.1. Pressure Sensitive

- 9.2.1.2. In-Mold

- 9.2.1.3. Shrink-Sleeve

- 9.2.1.4. Glue-Applied

- 9.2.1.5. Others (Custom Die-cut, etc.)

- 9.2.2. Advancem

- 9.2.3. Key regu

- 9.2.4. Key specific manufacturers in Labelling

- 9.2.4.1. WS Packaging

- 9.2.4.2. Schreiner Group

- 9.2.4.3. Faubel & Co

- 9.2.4.4. OPM Group

- 9.2.1. Labelling Type

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. North America Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 LGR Packaging

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 DS Smith*List Not Exhaustive

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Unipak Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 CCL Industries

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Jones Healthcare Group

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 August Faller GmbH & co KG

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 8 COMPETITIVE LANDSCAPE 8 1 COMPANY PROFILES

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Nosco Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Edelmann Group

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 AR Packaging

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Stora Enso Group

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Big Valley Packaging

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Essentra PLC Keystone Folding Box Company

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Multi Packaging Solutions (WestRock)

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.1 LGR Packaging

List of Figures

- Figure 1: Global Folding Carton in Healthcare Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Folding Carton in Healthcare Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Folding Carton in Healthcare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Folding Carton in Healthcare Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Folding Carton in Healthcare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Folding Carton in Healthcare Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Folding Carton in Healthcare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Folding Carton in Healthcare Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Folding Carton in Healthcare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Folding Carton in Healthcare Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 11: North America Folding Carton in Healthcare Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: North America Folding Carton in Healthcare Industry Revenue (Million), by Labelling 2024 & 2032

- Figure 13: North America Folding Carton in Healthcare Industry Revenue Share (%), by Labelling 2024 & 2032

- Figure 14: North America Folding Carton in Healthcare Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Folding Carton in Healthcare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Folding Carton in Healthcare Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 17: Europe Folding Carton in Healthcare Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: Europe Folding Carton in Healthcare Industry Revenue (Million), by Labelling 2024 & 2032

- Figure 19: Europe Folding Carton in Healthcare Industry Revenue Share (%), by Labelling 2024 & 2032

- Figure 20: Europe Folding Carton in Healthcare Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Folding Carton in Healthcare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Folding Carton in Healthcare Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Asia Pacific Folding Carton in Healthcare Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Asia Pacific Folding Carton in Healthcare Industry Revenue (Million), by Labelling 2024 & 2032

- Figure 25: Asia Pacific Folding Carton in Healthcare Industry Revenue Share (%), by Labelling 2024 & 2032

- Figure 26: Asia Pacific Folding Carton in Healthcare Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Folding Carton in Healthcare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Folding Carton in Healthcare Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Rest of the World Folding Carton in Healthcare Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Rest of the World Folding Carton in Healthcare Industry Revenue (Million), by Labelling 2024 & 2032

- Figure 31: Rest of the World Folding Carton in Healthcare Industry Revenue Share (%), by Labelling 2024 & 2032

- Figure 32: Rest of the World Folding Carton in Healthcare Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Folding Carton in Healthcare Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Labelling 2019 & 2032

- Table 4: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Folding Carton in Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Folding Carton in Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Folding Carton in Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Folding Carton in Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Labelling 2019 & 2032

- Table 15: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Labelling 2019 & 2032

- Table 18: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Labelling 2019 & 2032

- Table 21: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Labelling 2019 & 2032

- Table 24: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Folding Carton in Healthcare Industry?

The projected CAGR is approximately 5.72%.

2. Which companies are prominent players in the Folding Carton in Healthcare Industry?

Key companies in the market include LGR Packaging, DS Smith*List Not Exhaustive, Unipak Inc, CCL Industries, Jones Healthcare Group, August Faller GmbH & co KG, 8 COMPETITIVE LANDSCAPE 8 1 COMPANY PROFILES, Nosco Inc, Edelmann Group, AR Packaging, Stora Enso Group, Big Valley Packaging, Essentra PLC Keystone Folding Box Company, Multi Packaging Solutions (WestRock).

3. What are the main segments of the Folding Carton in Healthcare Industry?

The market segments include Product Type, Labelling.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Stringent regulations related to discerning key product related information in the field of medical devices; Growing emphasis of monitoring & assisting patient medication; Focus on traceability & anti-counterfeiting in the healthcare sector; Product & Material-based innovations driven by major packaging manufacturers to drive demand.

6. What are the notable trends driving market growth?

Growing Emphasis of Monitoring and Assisting Patient Medication.

7. Are there any restraints impacting market growth?

; High Inventory Costs and Premium Pricing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Folding Carton in Healthcare Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Folding Carton in Healthcare Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Folding Carton in Healthcare Industry?

To stay informed about further developments, trends, and reports in the Folding Carton in Healthcare Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence