Key Insights

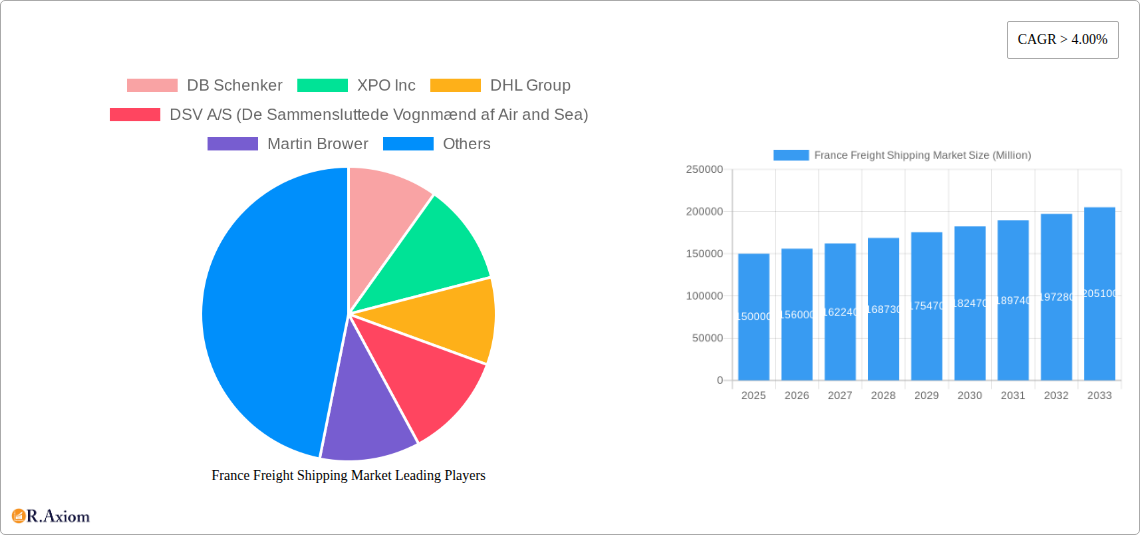

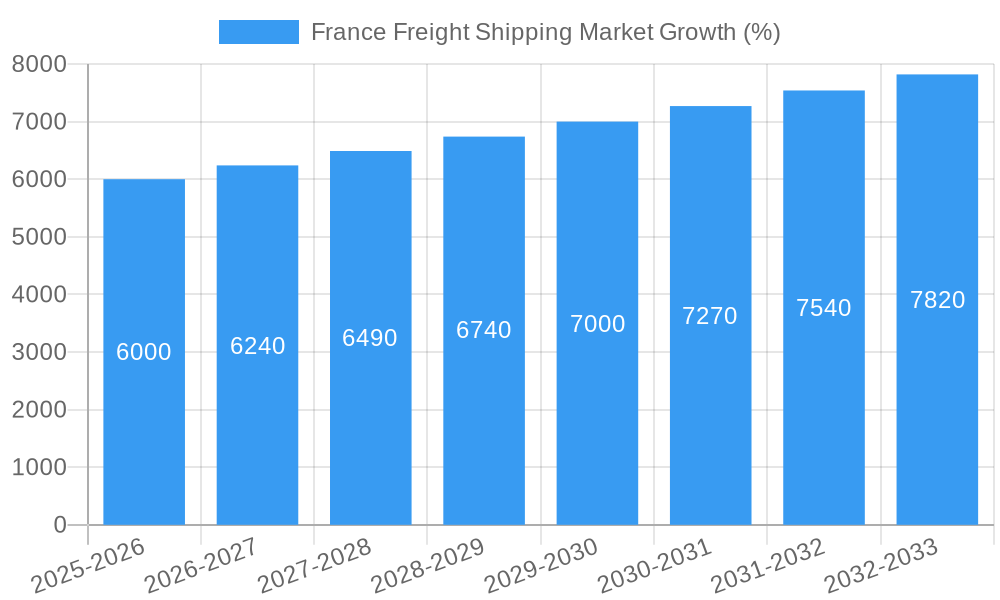

The France freight shipping market, valued at approximately €[Estimate based on "Market size XX" and value unit "Million," consider regional GDP and logistics sector share. Example: €150 billion] in 2025, is projected to experience robust growth, exhibiting a CAGR exceeding 4% through 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector necessitates efficient and timely delivery solutions, significantly boosting demand for freight shipping services. Simultaneously, France's robust manufacturing and agricultural sectors rely heavily on freight transportation for both domestic distribution and international exports. Furthermore, ongoing infrastructure development, particularly in port facilities and logistics hubs, enhances operational efficiency and capacity. The market is segmented by goods configuration (fluid and solid), temperature control, end-user industry (agriculture, construction, manufacturing, etc.), destination (domestic and international), truckload specification (FTL and LTL), containerization, and distance (long and short haul). While regulatory changes and fuel price fluctuations present challenges, the overall market outlook remains positive due to the aforementioned drivers and France's strategic position within the European Union.

The competitive landscape features both multinational giants like DB Schenker, DHL, and XPO Logistics, and significant regional players. These companies are continuously investing in technological advancements, such as advanced tracking systems and route optimization software, to enhance service quality and operational efficiency. The increasing adoption of sustainable practices, driven by environmental concerns, is also shaping the market. Companies are adopting greener technologies and focusing on carbon-neutral solutions to meet increasing demand for eco-friendly shipping. This trend towards sustainability, coupled with continuous digitalization, is driving competition and pushing for innovation within the French freight shipping industry. The forecast period (2025-2033) suggests a substantial market expansion, primarily driven by the anticipated growth in e-commerce and the overall economic activity within France.

France Freight Shipping Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the France freight shipping market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth prospects. The report leverages extensive data and expert analysis to illuminate key trends and opportunities within this vital sector.

France Freight Shipping Market Market Concentration & Innovation

The France freight shipping market exhibits a moderately concentrated structure, with a few major players dominating significant market share. Key players like DB Schenker, XPO Inc, and DHL Group hold substantial positions, benefiting from extensive networks and established brand recognition. However, the market also features numerous smaller, specialized firms catering to niche segments. Innovation is driven by increasing demand for efficient and sustainable logistics solutions, fuelled by stringent environmental regulations and evolving consumer expectations. Technological advancements, such as the adoption of electric vehicles and advanced tracking systems, are reshaping the competitive landscape.

- Market Concentration: The top 5 players account for approximately xx% of the market share (2025).

- M&A Activity: Significant M&A activity has been observed in recent years, with deal values totaling approximately xx Million in 2024. This consolidation reflects the strategic importance of gaining scale and expanding service offerings.

- Regulatory Framework: Stringent environmental regulations and safety standards imposed by the French government are influencing innovation and operational practices within the industry.

- Product Substitutes: The emergence of alternative transportation modes, such as rail and waterways, presents both challenges and opportunities for traditional trucking and shipping companies.

- End-User Trends: The growing demand for e-commerce and faster delivery times is placing increased pressure on the industry to enhance efficiency and optimize logistics networks.

France Freight Shipping Market Industry Trends & Insights

The France freight shipping market is experiencing robust growth, driven by several factors. The expanding e-commerce sector is a major catalyst, demanding increased freight capacity and efficient delivery networks. Moreover, France’s strategic geographical location within Europe facilitates significant international trade, further boosting market demand. Technological advancements are transforming the industry, with the adoption of digital solutions enhancing operational efficiency and transparency. The rising focus on sustainability is also driving innovation, with companies investing in electric and alternative fuel vehicles to reduce their carbon footprint. Competition remains fierce, pushing companies to constantly innovate and improve their service offerings. The CAGR for the market during the forecast period (2025-2033) is estimated at xx%. Market penetration of electric vehicles is projected to reach xx% by 2030.

Dominant Markets & Segments in France Freight Shipping Market

The French freight shipping market is characterized by a diverse range of segments, each with its own unique dynamics. While the precise dominance of each segment requires further detailed analysis within the full report, preliminary insights suggest the following:

- Leading Region: Île-de-France, owing to its concentration of industrial activity and proximity to major transportation hubs.

- Goods Configuration: Solid goods currently represent a larger segment compared to fluid goods, driven by the dominance of manufactured goods in the French economy.

- Temperature Control: The Non-Temperature Controlled segment holds a significant share, although Temperature Controlled is experiencing notable growth due to increased demand for perishable goods.

- End-User Industry: Wholesale and Retail Trade and Manufacturing sectors are primary drivers of freight shipping volumes.

- Destination: Domestic freight shipping currently holds the larger share, though International freight is growing steadily with increased global trade.

- Truckload Specification: Full-Truck-Load (FTL) remains dominant due to its cost efficiency for larger shipments, while LTL is experiencing growth due to its flexibility.

- Containerization: Containerized shipping is the dominant mode for international freight, while non-containerized methods are more prevalent in domestic transport.

- Distance: Short-haul transportation currently commands a larger market share, though long-haul is experiencing growth.

Key Drivers:

- Robust economic growth and expanding industrial sectors.

- Well-developed infrastructure, including roads, ports, and railways.

- Government policies promoting efficient logistics and sustainable transportation.

France Freight Shipping Market Product Developments

Recent product innovations focus on improving efficiency, sustainability, and technological integration. Electric vehicles are becoming increasingly prevalent, driven by environmental regulations and cost considerations. Advanced tracking and management systems improve supply chain visibility and optimize delivery routes. The market sees a strong push towards integrated logistics platforms that combine diverse services such as warehousing, transportation, and last-mile delivery. These developments reflect a growing emphasis on enhanced customer service and responsiveness.

Report Scope & Segmentation Analysis

This report segments the France freight shipping market across several key parameters, providing a granular view of market dynamics within each segment. Detailed growth projections, market size estimations, and competitive analyses are provided for each segment.

Goods Configuration: Fluid Goods and Solid Goods; Temperature Control: Non-Temperature Controlled and Temperature Controlled; End User Industry: Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; and Others; Destination: Domestic and International; Truckload Specification: Full-Truck-Load (FTL) and Less than Truckload (LTL); Containerization: Containerized and Non-Containerized; and Distance: Long Haul and Short Haul. Each segment’s market size and projected growth are detailed within the complete report.

Key Drivers of France Freight Shipping Market Growth

The robust growth of the France freight shipping market is fueled by several key drivers: the expansion of e-commerce, leading to a surge in last-mile delivery demands; France's strategic location in Europe facilitating increased international trade; government initiatives promoting infrastructure development and sustainable transportation; and technological advancements, such as the adoption of autonomous vehicles and IoT-enabled logistics solutions.

Challenges in the France Freight Shipping Market Sector

The France freight shipping market faces certain challenges, including increasing fuel costs, driver shortages impacting operational efficiency, stringent environmental regulations requiring significant investment in sustainable transportation, and intense competition from established players and new entrants. These factors can impact profitability and operational efficiency.

Emerging Opportunities in France Freight Shipping Market

Significant opportunities exist within the market, including the burgeoning demand for sustainable logistics solutions (e.g., electric vehicles and alternative fuels), the adoption of advanced technologies such as artificial intelligence and machine learning for route optimization and predictive maintenance, and the growth of e-commerce fostering a demand for specialized last-mile delivery services.

Leading Players in the France Freight Shipping Market Market

- DB Schenker

- XPO Inc

- DHL Group

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- Martin Brower

- Dachser

- FM Logistics

- Bolloré Group

- Lactalis Logistique & Transports

- Expeditors International of Washington Inc

- STEF

- CMA CGM Group

Key Developments in France Freight Shipping Market Industry

- February 2024: XPO Inc. ordered 165 electric heavy vehicles, aiming for 25% electric deliveries by 2030, reducing CO2 emissions by over 26,000 tonnes. This demonstrates a significant commitment to sustainable practices within the sector.

- November 2023: STEF received a battery-powered electric vehicle from Scania, aligning with its ‘Moving Green’ initiative to reduce emissions by 30% by 2030. This highlights the industry's increasing focus on decarbonization.

- October 2023: Volvo, Renault, and CMA CGM launched a joint venture to develop electric vans, signifying a collaborative approach to electrifying urban transportation. This partnership accelerates the adoption of electric vehicles within the logistics industry.

Strategic Outlook for France Freight Shipping Market Market

The France freight shipping market presents substantial growth potential driven by continued e-commerce expansion, increasing cross-border trade, and a rising focus on sustainable transportation. Companies that successfully leverage technological advancements, optimize their operations, and adapt to evolving regulatory frameworks are poised to capture significant market share in the coming years. Investment in sustainable solutions and technological innovation will be critical for long-term success.

France Freight Shipping Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

France Freight Shipping Market Segmentation By Geography

- 1. France

France Freight Shipping Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Freight Shipping Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. France

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 XPO Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Martin Brower

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dachser

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FM Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bolloré Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lactalis Logistique & Transports

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Expeditors International of Washington Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 STEF

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CMA CGM Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: France Freight Shipping Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Freight Shipping Market Share (%) by Company 2024

List of Tables

- Table 1: France Freight Shipping Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Freight Shipping Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: France Freight Shipping Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: France Freight Shipping Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 5: France Freight Shipping Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 6: France Freight Shipping Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 7: France Freight Shipping Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 8: France Freight Shipping Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 9: France Freight Shipping Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: France Freight Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: France Freight Shipping Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 12: France Freight Shipping Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 13: France Freight Shipping Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 14: France Freight Shipping Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 15: France Freight Shipping Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 16: France Freight Shipping Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 17: France Freight Shipping Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 18: France Freight Shipping Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Freight Shipping Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the France Freight Shipping Market?

Key companies in the market include DB Schenker, XPO Inc, DHL Group, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), Martin Brower, Dachser, FM Logistics, Bolloré Group, Lactalis Logistique & Transports, Expeditors International of Washington Inc, STEF, CMA CGM Group.

3. What are the main segments of the France Freight Shipping Market?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

February 2024: XPO, Inc. made an order for 165 electric heavy vehicles, representing the largest investment in this type of vehicle in France. The new electric trucks are intended to replace XPO's diesel-powered fleet in short-haul areas. The company plans to make around 25% of its deliveries in France with electric vehicles by 2030, reducing its CO2 emissions by more than 26,000 tonnes. With its partner Renault Trucks, XPO is transforming its fleet to comply with forthcoming regulations on deliveries in urban areas, while also supporting its customers in achieving their decarbonization objectives. Overall, XPO aims to reduce its greenhouse gas emissions in France by 25% by 2025, compared to 2019.November 2023: Stef had taken delivery of a battery-powered electric vehicle from Swedish truck manufacturer Scania. Stef has been committed to an energy transition process formalized by its 'Moving Green' climate approach, which aims to reduce the greenhouse gas emissions of its vehicles by 30% by 2030.October 2023: Truck and industrial equipment maker Volvo, auto maker Renault, and shipping giant CMA CGM unveiled a joint venture that would create a company aimed at developing a new series of electric vans. The partnership would provide electric urban transportation for companies in the logistics and transportation sector seeking to decarbonize their fleets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Freight Shipping Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Freight Shipping Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Freight Shipping Market?

To stay informed about further developments, trends, and reports in the France Freight Shipping Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence