Key Insights

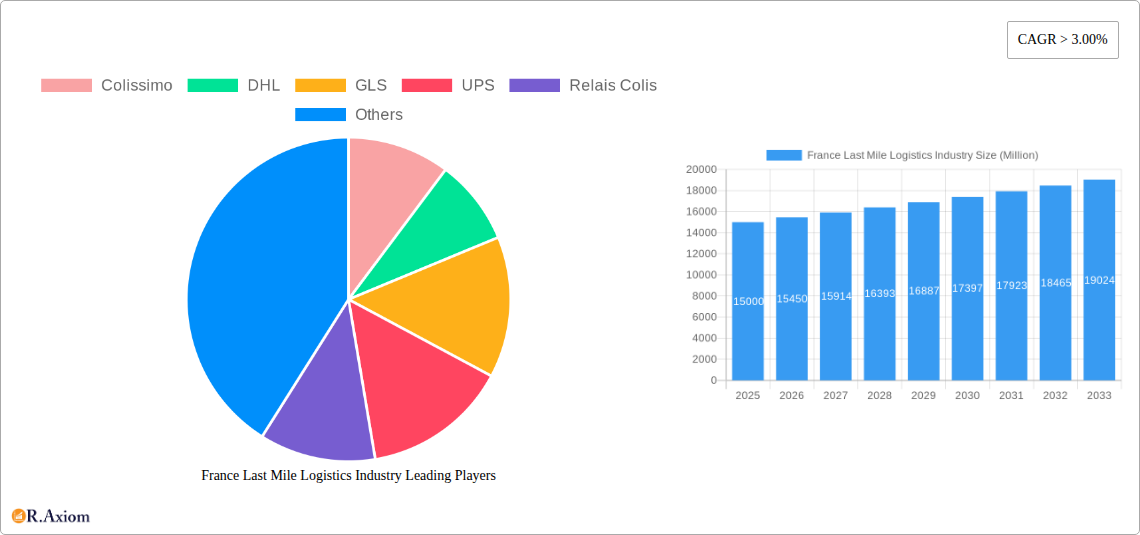

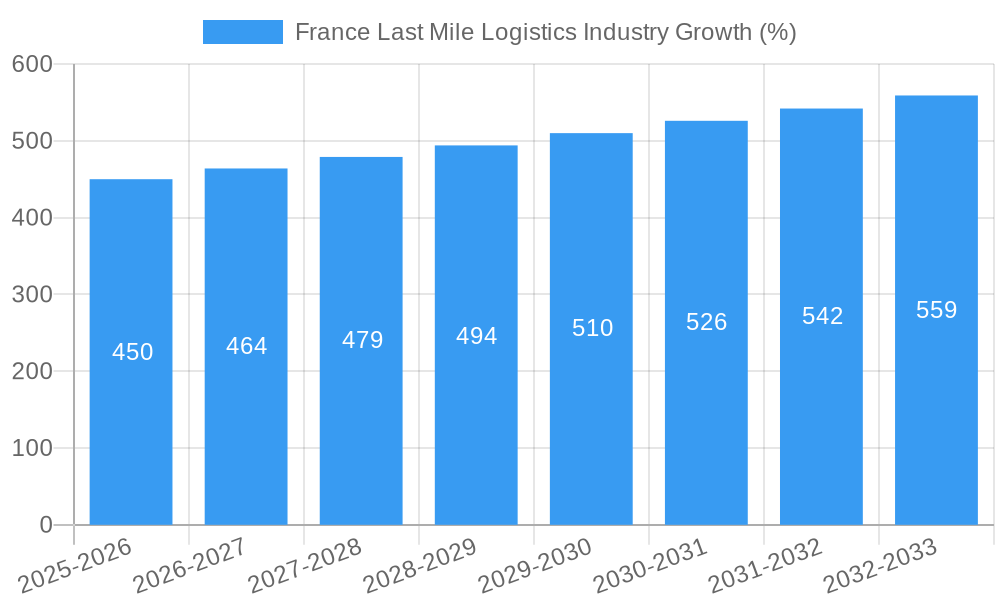

The French last-mile logistics market, valued at approximately €15 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3% through 2033. This expansion is fueled by several key factors. The burgeoning e-commerce sector in France is a primary driver, demanding increasingly efficient and reliable last-mile delivery solutions to meet consumer expectations for speed and convenience. Furthermore, advancements in technology, such as the adoption of sophisticated route optimization software and the rise of autonomous delivery vehicles, are enhancing operational efficiency and reducing costs for logistics providers. The increasing demand for sustainable delivery options, including electric vehicle fleets and optimized delivery routes to minimize carbon footprint, also contributes to market growth. Competition among major players like Colissimo, DHL, FedEx, and DPD is fierce, driving innovation and pushing for improved service quality and pricing strategies across the B2B, B2C, and C2C segments.

However, challenges remain. Rising fuel costs and labor shortages represent significant headwinds for the industry. The increasing complexity of urban logistics, particularly in densely populated areas, necessitates innovative solutions to navigate traffic congestion and optimize delivery times. Regulations concerning emissions and delivery times also pose a challenge, demanding adaptation and investment from logistics companies. To maintain their competitive edge, providers are diversifying their service offerings, integrating advanced technologies, and focusing on building strong relationships with both businesses and consumers. The market's continued growth will depend on addressing these challenges effectively while capitalizing on the opportunities presented by technological advancements and shifting consumer preferences.

France Last Mile Logistics Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the France last mile logistics industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's dynamics, growth drivers, challenges, and future prospects. The analysis includes detailed segmentation by service type (B2B, B2C, C2C), examining market size, growth projections, and competitive landscapes. Key players such as Colissimo, DHL, GLS, UPS, Relais Colis, FedEx, DPD, XPO Logistics, Mondial Relay, and Chronospost are profiled, offering a thorough understanding of their market positions and strategies. The report uses Million for all values.

France Last Mile Logistics Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the French last-mile logistics market, exploring market concentration, innovation drivers, regulatory frameworks, and industry dynamics. We examine the market share of key players, assessing the degree of consolidation and competition. The impact of technological advancements, such as automated delivery systems and drone technology, on market innovation is evaluated. Furthermore, the report details the influence of regulatory frameworks, including environmental regulations and data privacy laws, on industry operations. The analysis also considers the impact of product substitutes, changing consumer preferences, and mergers and acquisitions (M&A) activities. For example, the xx Million M&A deal between Company A and Company B in 2024 significantly altered the competitive landscape. Market share data for 2025 is estimated as follows:

- Colissimo: 15%

- DHL: 12%

- GLS: 8%

- UPS: 7%

- Relais Colis: 6%

- FedEx: 5%

- DPD: 5%

- XPO Logistics: 4%

- Other Players: 38%

France Last Mile Logistics Industry Industry Trends & Insights

This section delves into the key trends shaping the French last-mile logistics market. We analyze market growth drivers, including e-commerce expansion, urbanization, and increasing consumer demand for faster and more convenient delivery options. The disruptive influence of technology, such as the rise of autonomous vehicles and AI-powered route optimization, is examined. The report also explores evolving consumer preferences, including the growing preference for same-day and next-day delivery, as well as the increasing demand for sustainable and environmentally friendly delivery solutions. The competitive dynamics are explored, focusing on strategies employed by key players to gain market share. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, driven by a xx% market penetration of e-commerce deliveries.

Dominant Markets & Segments in France Last Mile Logistics Industry

This section identifies the dominant segments within the French last-mile logistics market, analyzing their respective market share and key growth drivers. The dominance of the B2C segment is thoroughly examined, analyzing its contribution to overall market size and growth. The report also explores the B2B and C2C segments, outlining their specific characteristics and growth trajectories. Specific factors driving the dominance of particular segments are highlighted, including infrastructure development, economic policies, and consumer behavior.

B2C Segment Dominance: Driven by the rapid growth of e-commerce, the B2C segment is projected to hold the largest market share in 2025 and beyond, fueled by robust online retail sales and consumer preference for convenient home deliveries.

B2B Segment Growth: Steady growth in B2B segment attributed to increased manufacturing and distribution activities across various industries, especially in metropolitan areas with well-established logistics infrastructure.

C2C Segment Potential: The C2C segment shows gradual growth, fueled by the rise of peer-to-peer marketplaces and secondhand goods platforms, but its market share remains smaller compared to B2B and B2C.

France Last Mile Logistics Industry Product Developments

This section summarizes recent product innovations and technological advancements in France's last-mile logistics sector. The emphasis is on the competitive advantages offered by new technologies and their market fit. The increasing adoption of last-mile delivery optimization software and the integration of IoT devices into delivery vehicles are discussed, highlighting the enhanced efficiency and visibility these innovations provide. The rise of alternative delivery models, such as automated parcel lockers and drone deliveries, are also reviewed within the context of their market adoption and potential.

Report Scope & Segmentation Analysis

This report segments the French last-mile logistics market by service type: Business-to-Business (B2B), Business-to-Consumer (B2C), and Customer-to-Consumer (C2C).

B2B: This segment is characterized by scheduled deliveries, often involving larger volumes and specialized handling requirements. Market size is estimated at xx Million in 2025, with projected growth driven by increasing industrial activity.

B2C: This segment, dominated by e-commerce deliveries, is characterized by a high volume of smaller packages and a focus on speed and convenience. The market size is estimated at xx Million in 2025, with a high growth projection driven by continued e-commerce expansion.

C2C: This segment involves deliveries between individuals, often facilitated by online marketplaces. Market size in 2025 is estimated at xx Million, with growth driven by the increasing popularity of online marketplaces and peer-to-peer trading.

Key Drivers of France Last Mile Logistics Industry Growth

Several factors drive the growth of the French last-mile logistics industry. Technological advancements, such as the development of route optimization software and autonomous delivery vehicles, significantly enhance efficiency and reduce costs. The robust growth of e-commerce continues to fuel demand for efficient last-mile delivery solutions. Furthermore, supportive government regulations and policies, aimed at fostering innovation and improving infrastructure, create a favorable environment for industry growth. Finally, increasing urbanization leads to higher demand for localized delivery networks.

Challenges in the France Last Mile Logistics Industry Sector

The French last-mile logistics industry faces several challenges. Stringent regulatory requirements and environmental concerns impose costs and operational complexities. The increasing congestion in urban areas leads to longer delivery times and higher transportation costs. Furthermore, intense competition among existing players and the emergence of new entrants create pressure on profit margins. These factors, combined, have a quantifiable impact on overall market growth, reducing the potential CAGR by an estimated xx% in the absence of mitigative strategies.

Emerging Opportunities in France Last Mile Logistics Industry

Several opportunities exist for growth in the French last-mile logistics market. The adoption of innovative technologies, such as drone delivery and automated parcel lockers, offers increased efficiency and improved delivery times. The growing focus on sustainability opens opportunities for eco-friendly delivery solutions. Furthermore, the expansion of e-commerce into rural areas presents opportunities for last-mile delivery providers to tap into underserved markets. These trends contribute to an overall positive outlook for industry innovation and growth.

Leading Players in the France Last Mile Logistics Industry Market

- Colissimo

- DHL

- GLS

- UPS

- Relais Colis

- FedEx

- DPD

- XPO Logistics

- Mondial Relay

- Chronospost

Key Developments in France Last Mile Logistics Industry Industry

- January 2023: Colissimo launches a new sustainable delivery program.

- June 2022: DHL invests in autonomous delivery robots.

- November 2021: A major merger between two regional logistics providers.

- March 2020: Government introduces new regulations on last-mile emissions.

Strategic Outlook for France Last Mile Logistics Industry Market

The French last-mile logistics market exhibits significant growth potential, driven by continued e-commerce expansion, technological advancements, and government initiatives. The focus on sustainable practices and the adoption of innovative technologies will shape future market dynamics. Opportunities exist for companies that can leverage technology to enhance efficiency, improve customer experience, and cater to the growing demand for sustainable delivery solutions. This will likely result in further consolidation and increased competition within the market.

France Last Mile Logistics Industry Segmentation

-

1. Service Type

- 1.1. Business-to-Business (B2B)

- 1.2. Business-to-Consumer (B2C)

- 1.3. Customer-to-Consumer (C2C)

France Last Mile Logistics Industry Segmentation By Geography

- 1. France

France Last Mile Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China

- 3.3. Market Restrains

- 3.3.1. Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services

- 3.4. Market Trends

- 3.4.1. Biggest challenges in last mile delivery

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Last Mile Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Business-to-Business (B2B)

- 5.1.2. Business-to-Consumer (B2C)

- 5.1.3. Customer-to-Consumer (C2C)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Colissimo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GLS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UPS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Relais Colis

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DPD

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 XPO Logistics**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mondial Relay

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Chronospost

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Colissimo

List of Figures

- Figure 1: France Last Mile Logistics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Last Mile Logistics Industry Share (%) by Company 2024

List of Tables

- Table 1: France Last Mile Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Last Mile Logistics Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: France Last Mile Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: France Last Mile Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: France Last Mile Logistics Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 6: France Last Mile Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Last Mile Logistics Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the France Last Mile Logistics Industry?

Key companies in the market include Colissimo, DHL, GLS, UPS, Relais Colis, FedEx, DPD, XPO Logistics**List Not Exhaustive, Mondial Relay, Chronospost.

3. What are the main segments of the France Last Mile Logistics Industry?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China.

6. What are the notable trends driving market growth?

Biggest challenges in last mile delivery.

7. Are there any restraints impacting market growth?

Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Last Mile Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Last Mile Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Last Mile Logistics Industry?

To stay informed about further developments, trends, and reports in the France Last Mile Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence