Key Insights

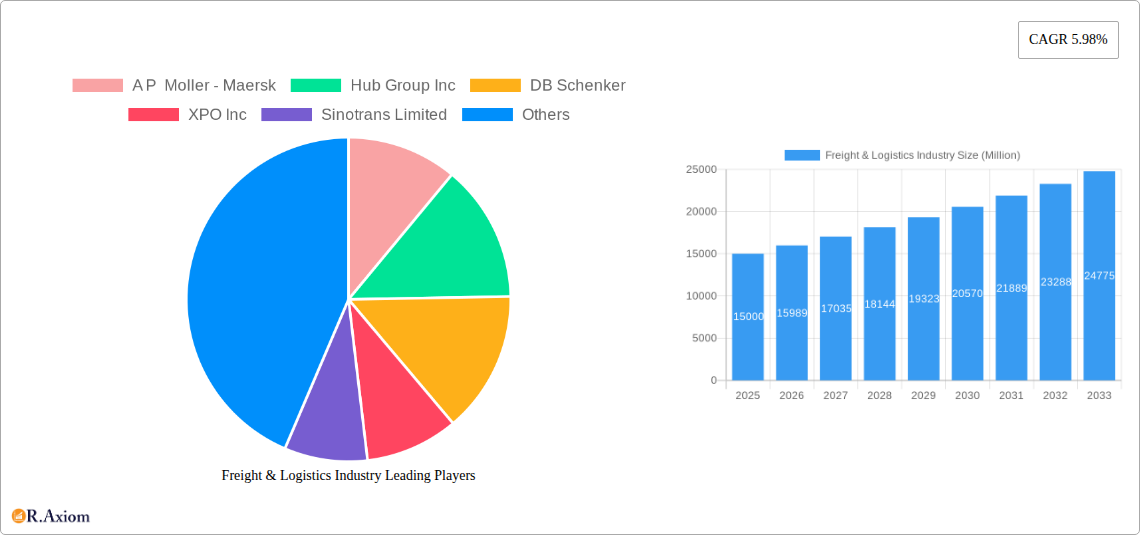

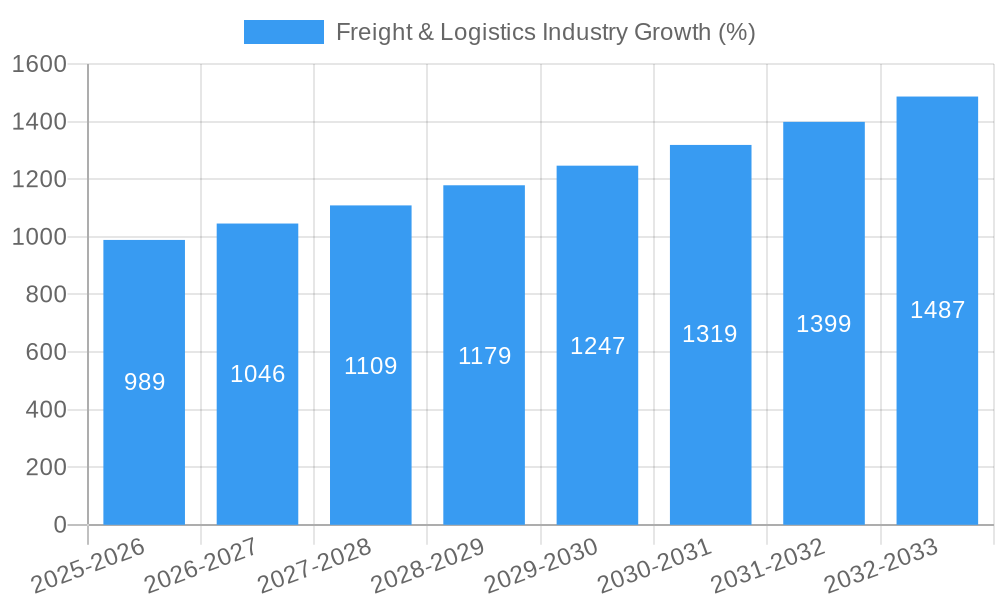

The global freight and logistics industry, exhibiting a robust Compound Annual Growth Rate (CAGR) of 5.98%, is poised for significant expansion. Driven by the increasing global trade, e-commerce boom, and the imperative for efficient supply chain management, this sector is experiencing dynamic growth across various segments. The temperature-controlled segment, crucial for transporting perishable goods, holds considerable market share, fueled by the expansion of the food and pharmaceutical industries. The diverse end-user industries, including agriculture, manufacturing, and oil & gas, each contribute significantly to the overall market size, with manufacturing and e-commerce driving particularly strong demand. Furthermore, the rise of specialized logistics functions like Courier, Express, and Parcel (CEP) services highlights the industry's adaptation to evolving consumer demands and the need for speed and traceability. Key players like Maersk, DHL, and FedEx are leveraging technological advancements like automation and data analytics to enhance efficiency and optimize their operations, while simultaneously facing challenges like fluctuating fuel prices, geopolitical instability, and labor shortages.

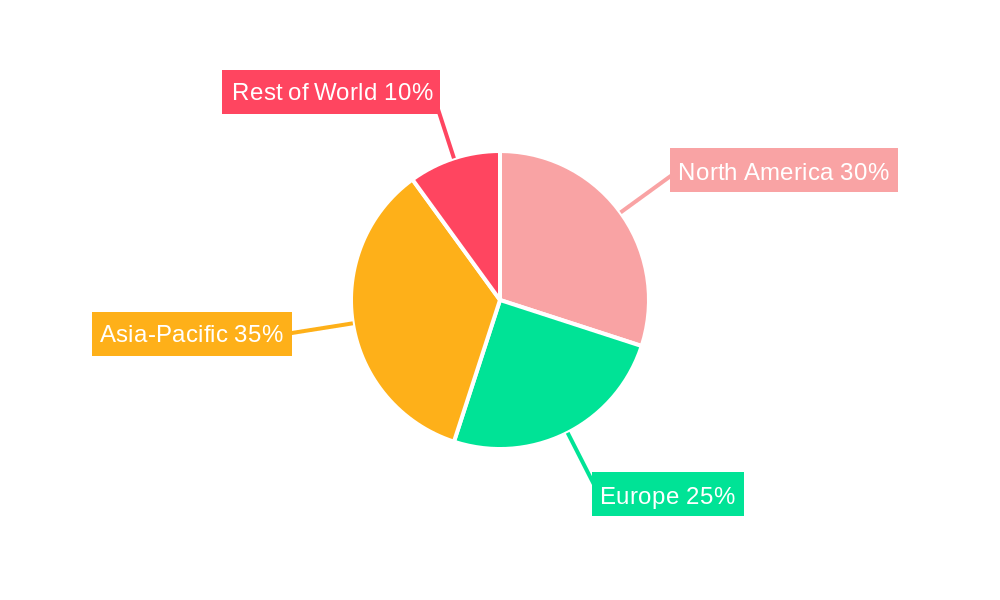

The forecast period of 2025-2033 promises further growth, primarily propelled by the continued expansion of e-commerce, the adoption of sustainable practices within the supply chain (driven by environmental concerns), and the increasing focus on real-time tracking and visibility for improved supply chain management. While challenges such as global economic uncertainty and supply chain disruptions persist, the industry’s adaptability and its crucial role in global trade ensure its continued growth trajectory. The segmentation by logistics function (CEP, freight forwarding, etc.) provides valuable insights into specific market niches and opportunities for focused growth strategies. Competition among major players remains intense, necessitating continuous innovation and strategic alliances to maintain market share and profitability. Regional variations in market growth are expected, with emerging markets potentially experiencing faster growth than established economies, presenting opportunities for both established and new players.

Freight & Logistics Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides a detailed analysis of the global freight & logistics industry, encompassing market size, segmentation, trends, and competitive landscape from 2019 to 2033. The report leverages extensive primary and secondary research to deliver actionable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The report features a granular analysis of key players, including A.P. Moller - Maersk, Hub Group Inc., DB Schenker, and many more, providing valuable insights into their market share, strategies, and future outlook. The global market is projected to reach xx Million by 2033.

Freight & Logistics Industry Market Concentration & Innovation

The freight and logistics industry exhibits a moderately concentrated structure, with a few dominant players controlling a significant market share. However, the landscape is dynamic, with increasing competition from smaller, specialized firms and the emergence of new technologies. A.P. Moller - Maersk, DHL Group, and FedEx hold considerable market share, but their dominance is challenged by regional players and specialized service providers. The industry's innovation is driven by technological advancements in areas such as automation, AI, and data analytics, resulting in improved efficiency, transparency, and cost optimization. Regulatory frameworks, varying across regions, significantly impact operations and compliance costs. Product substitutes, such as autonomous vehicles and drone delivery services, are emerging and gradually influencing the market.

- Market Concentration: The top 10 players collectively hold an estimated xx% market share in 2025.

- M&A Activity: The value of M&A deals in the sector totalled approximately $xx Million in 2024, indicating ongoing consolidation.

- Innovation Drivers: Automation, AI, blockchain technology, and sustainable logistics solutions are key drivers.

- Regulatory Frameworks: Varying regulations across regions impact operational efficiency and costs.

- End-User Trends: Increased demand for e-commerce fulfillment and supply chain transparency.

Freight & Logistics Industry Industry Trends & Insights

The freight and logistics industry is experiencing significant growth, driven by factors like global trade expansion, e-commerce proliferation, and advancements in technology. The industry's Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological disruptions, including the adoption of AI and machine learning, are optimizing logistics processes and enhancing efficiency. Consumer preferences are increasingly focused on speed, transparency, and sustainability, impacting the demand for faster delivery services and eco-friendly logistics solutions. Competitive dynamics are characterized by increasing competition, strategic partnerships, and consolidation. Market penetration of technology-driven solutions is expected to increase significantly, with xx% adoption by 2033.

Dominant Markets & Segments in Freight & Logistics Industry

The Asia-Pacific region is projected to be the dominant market for freight and logistics services, driven by rapid economic growth, expanding e-commerce, and robust infrastructure development in several countries. Within segments, Temperature Controlled logistics experiences high growth due to increasing demand for perishable goods and pharmaceuticals, with the market size estimated at xx Million in 2025. The 'Other Services' segment includes warehousing, last mile delivery and others and is also anticipated to experience substantial growth due to increasing demand and technological advancements. The end-user industry with the largest market share is Wholesale and Retail Trade, fueled by e-commerce expansion. The Courier, Express, and Parcel (CEP) segment shows impressive growth, driven by consumer demand for faster deliveries.

- Key Drivers for Asia-Pacific Dominance: Rapid economic growth, expanding e-commerce, improving infrastructure.

- Temperature Controlled: Driven by the need for efficient handling of perishable goods and pharmaceuticals.

- Other Services: Growth driven by diverse industry needs and technological advancements.

- Wholesale and Retail Trade: Dominant segment fueled by the expansion of e-commerce and rising consumer demand.

- Courier, Express, and Parcel (CEP): High growth due to consumer preference for fast and reliable delivery.

Freight & Logistics Industry Product Developments

Significant advancements in technology are reshaping the freight and logistics industry. The development and integration of AI-powered route optimization software, predictive analytics for inventory management, and automated warehousing systems significantly enhance efficiency, reduce costs, and improve delivery times. These advancements offer substantial competitive advantages to companies that successfully adopt and implement them, allowing for better service offerings, improved customer satisfaction, and increased profitability.

Report Scope & Segmentation Analysis

This report segments the freight & logistics market based on temperature-controlled services (market size xx Million in 2025, projected growth xx%), other services (market size xx Million in 2025, projected growth xx%), end-user industries (Agriculture, Fishing & Forestry; Construction; Manufacturing; Oil & Gas; Mining & Quarrying; Wholesale & Retail Trade; Others), and logistics functions (Courier, Express & Parcel (CEP)). Each segment is analyzed with respect to its growth projections, market size, and competitive dynamics. Growth projections vary across segments, driven by industry-specific factors and technological advancements.

Key Drivers of Freight & Logistics Industry Growth

The freight & logistics industry’s growth is propelled by several factors. E-commerce expansion fuels demand for faster and more reliable delivery services. Globalization and increasing international trade necessitate efficient cross-border logistics solutions. Technological advancements, like AI and automation, boost operational efficiency and reduce costs. Government investments in infrastructure improvements, such as ports and transportation networks, further enhance the industry's capacity and connectivity.

Challenges in the Freight & Logistics Industry Sector

The industry faces several significant challenges. Supply chain disruptions, caused by geopolitical instability and natural disasters, impact delivery timelines and increase costs. Regulatory compliance requirements vary across regions, increasing operational complexities and costs. Fluctuations in fuel prices, driver shortages, and intense competition from numerous players put pressure on profit margins. These factors cumulatively reduce the industry’s profitability and growth potential.

Emerging Opportunities in Freight & Logistics Industry

The freight & logistics industry presents significant growth opportunities. The increasing adoption of sustainable practices, such as electric vehicles and eco-friendly packaging, creates a market for green logistics solutions. The development of smart logistics solutions, integrating technologies like IoT and AI, offers significant efficiency improvements and cost reductions. Expansion into underserved markets and the development of specialized logistics services cater to niche industry needs and boost revenue streams.

Leading Players in the Freight & Logistics Industry Market

- A.P. Moller - Maersk

- Hub Group Inc

- DB Schenker

- XPO Inc

- Sinotrans Limited

- Hellmann Worldwide Logistics

- Bollore logistics

- Orient Overseas Container Line (OOCL Logistics)

- Total Quality Logistics

- Landstar System Inc

- JD Logistics

- C.H. Robinson

- NYK (Nippon Yusen Kaisha) Line

- Culina Group

- Yamato Holdings Co Ltd

- DHL Group

- Uber Technologies Inc

- LOGWIN

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- CTS Logistics Group

- Poste Italiane

- GEODIS

- Dachser

- Penske Logistics

- Mainfreight

- LX International Corp

- FedEx

- GXO Logistics

- Kintetsu World Express

- Savino Del Bene

- Kuehne + Nagel

- United Parcel Service of America Inc (UPS)

- International Distributions Services

- Americold

- La Poste Group

- CJ Logistics

- TIBA Group

- Aramex

- Allcargo Logistics Ltd

- NFI Industries

- Japan Post Holdings Co Ltd

- J B Hunt Transport Inc

- KEX Express (US) LLC

- DP World

- Expeditors International of Washington Inc

- Ryder System Inc

- CMA CGM Group

Key Developments in Freight & Logistics Industry Industry

- March 2024: Aramex inaugurated a new regional office in Riyadh, Saudi Arabia, expanding its regional presence and contributing to Saudi Arabia's Vision 2030 logistics goals.

- March 2024: Aramex introduced a fleet of electric motorcycles in the UAE, advancing its sustainability goals and aiming for a 98% electric vehicle fleet by 2030.

- February 2024: C.H. Robinson launched AI-powered appointment scheduling technology, significantly improving freight shipping efficiency.

Strategic Outlook for Freight & Logistics Industry Market

The freight and logistics industry is poised for continued growth, driven by technological advancements, expanding e-commerce, and increasing global trade. Companies that embrace innovation, invest in sustainable practices, and adapt to evolving consumer preferences are well-positioned to capitalize on emerging opportunities. The industry's future is characterized by increased automation, data-driven decision-making, and a greater focus on sustainability and supply chain resilience. The market is expected to witness substantial growth in the coming years, propelled by these factors.

Freight & Logistics Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Freight & Logistics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Freight & Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Freight & Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America Freight & Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Logistics Function

- 6.2.1. Courier, Express, and Parcel (CEP)

- 6.2.1.1. By Destination Type

- 6.2.1.1.1. Domestic

- 6.2.1.1.2. International

- 6.2.1.1. By Destination Type

- 6.2.2. Freight Forwarding

- 6.2.2.1. By Mode Of Transport

- 6.2.2.1.1. Air

- 6.2.2.1.2. Sea and Inland Waterways

- 6.2.2.1.3. Others

- 6.2.2.1. By Mode Of Transport

- 6.2.3. Freight Transport

- 6.2.3.1. Pipelines

- 6.2.3.2. Rail

- 6.2.3.3. Road

- 6.2.4. Warehousing and Storage

- 6.2.4.1. By Temperature Control

- 6.2.4.1.1. Non-Temperature Controlled

- 6.2.4.1. By Temperature Control

- 6.2.5. Other Services

- 6.2.1. Courier, Express, and Parcel (CEP)

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America Freight & Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Logistics Function

- 7.2.1. Courier, Express, and Parcel (CEP)

- 7.2.1.1. By Destination Type

- 7.2.1.1.1. Domestic

- 7.2.1.1.2. International

- 7.2.1.1. By Destination Type

- 7.2.2. Freight Forwarding

- 7.2.2.1. By Mode Of Transport

- 7.2.2.1.1. Air

- 7.2.2.1.2. Sea and Inland Waterways

- 7.2.2.1.3. Others

- 7.2.2.1. By Mode Of Transport

- 7.2.3. Freight Transport

- 7.2.3.1. Pipelines

- 7.2.3.2. Rail

- 7.2.3.3. Road

- 7.2.4. Warehousing and Storage

- 7.2.4.1. By Temperature Control

- 7.2.4.1.1. Non-Temperature Controlled

- 7.2.4.1. By Temperature Control

- 7.2.5. Other Services

- 7.2.1. Courier, Express, and Parcel (CEP)

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe Freight & Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Logistics Function

- 8.2.1. Courier, Express, and Parcel (CEP)

- 8.2.1.1. By Destination Type

- 8.2.1.1.1. Domestic

- 8.2.1.1.2. International

- 8.2.1.1. By Destination Type

- 8.2.2. Freight Forwarding

- 8.2.2.1. By Mode Of Transport

- 8.2.2.1.1. Air

- 8.2.2.1.2. Sea and Inland Waterways

- 8.2.2.1.3. Others

- 8.2.2.1. By Mode Of Transport

- 8.2.3. Freight Transport

- 8.2.3.1. Pipelines

- 8.2.3.2. Rail

- 8.2.3.3. Road

- 8.2.4. Warehousing and Storage

- 8.2.4.1. By Temperature Control

- 8.2.4.1.1. Non-Temperature Controlled

- 8.2.4.1. By Temperature Control

- 8.2.5. Other Services

- 8.2.1. Courier, Express, and Parcel (CEP)

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa Freight & Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Logistics Function

- 9.2.1. Courier, Express, and Parcel (CEP)

- 9.2.1.1. By Destination Type

- 9.2.1.1.1. Domestic

- 9.2.1.1.2. International

- 9.2.1.1. By Destination Type

- 9.2.2. Freight Forwarding

- 9.2.2.1. By Mode Of Transport

- 9.2.2.1.1. Air

- 9.2.2.1.2. Sea and Inland Waterways

- 9.2.2.1.3. Others

- 9.2.2.1. By Mode Of Transport

- 9.2.3. Freight Transport

- 9.2.3.1. Pipelines

- 9.2.3.2. Rail

- 9.2.3.3. Road

- 9.2.4. Warehousing and Storage

- 9.2.4.1. By Temperature Control

- 9.2.4.1.1. Non-Temperature Controlled

- 9.2.4.1. By Temperature Control

- 9.2.5. Other Services

- 9.2.1. Courier, Express, and Parcel (CEP)

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific Freight & Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Logistics Function

- 10.2.1. Courier, Express, and Parcel (CEP)

- 10.2.1.1. By Destination Type

- 10.2.1.1.1. Domestic

- 10.2.1.1.2. International

- 10.2.1.1. By Destination Type

- 10.2.2. Freight Forwarding

- 10.2.2.1. By Mode Of Transport

- 10.2.2.1.1. Air

- 10.2.2.1.2. Sea and Inland Waterways

- 10.2.2.1.3. Others

- 10.2.2.1. By Mode Of Transport

- 10.2.3. Freight Transport

- 10.2.3.1. Pipelines

- 10.2.3.2. Rail

- 10.2.3.3. Road

- 10.2.4. Warehousing and Storage

- 10.2.4.1. By Temperature Control

- 10.2.4.1.1. Non-Temperature Controlled

- 10.2.4.1. By Temperature Control

- 10.2.5. Other Services

- 10.2.1. Courier, Express, and Parcel (CEP)

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 A P Moller - Maersk

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hub Group Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DB Schenker

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 XPO Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sinotrans Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hellmann Worldwide Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bollore logistics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Orient Overseas Container Line (OOCL Logistics)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Total Quality Logistics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Landstar System Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 JD Logistics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 C H Robinson

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 NYK (Nippon Yusen Kaisha) Line

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Culina Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Yamato Holdings Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 DHL Group

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Uber Technologies Inc

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 LOGWIN

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 CTS Logistics Group

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Poste Italiane

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 GEODIS

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Dachser

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Penske Logistics

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Mainfreight

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 LX International Corp

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 FedEx

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 GXO Logistics

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Kintetsu World Express

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 Savino Del Bene

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.31 Kuehne + Nagel

- 11.2.31.1. Overview

- 11.2.31.2. Products

- 11.2.31.3. SWOT Analysis

- 11.2.31.4. Recent Developments

- 11.2.31.5. Financials (Based on Availability)

- 11.2.32 United Parcel Service of America Inc (UPS)

- 11.2.32.1. Overview

- 11.2.32.2. Products

- 11.2.32.3. SWOT Analysis

- 11.2.32.4. Recent Developments

- 11.2.32.5. Financials (Based on Availability)

- 11.2.33 International Distributions Services

- 11.2.33.1. Overview

- 11.2.33.2. Products

- 11.2.33.3. SWOT Analysis

- 11.2.33.4. Recent Developments

- 11.2.33.5. Financials (Based on Availability)

- 11.2.34 Americold

- 11.2.34.1. Overview

- 11.2.34.2. Products

- 11.2.34.3. SWOT Analysis

- 11.2.34.4. Recent Developments

- 11.2.34.5. Financials (Based on Availability)

- 11.2.35 La Poste Group

- 11.2.35.1. Overview

- 11.2.35.2. Products

- 11.2.35.3. SWOT Analysis

- 11.2.35.4. Recent Developments

- 11.2.35.5. Financials (Based on Availability)

- 11.2.36 CJ Logistics

- 11.2.36.1. Overview

- 11.2.36.2. Products

- 11.2.36.3. SWOT Analysis

- 11.2.36.4. Recent Developments

- 11.2.36.5. Financials (Based on Availability)

- 11.2.37 TIBA Group

- 11.2.37.1. Overview

- 11.2.37.2. Products

- 11.2.37.3. SWOT Analysis

- 11.2.37.4. Recent Developments

- 11.2.37.5. Financials (Based on Availability)

- 11.2.38 Aramex

- 11.2.38.1. Overview

- 11.2.38.2. Products

- 11.2.38.3. SWOT Analysis

- 11.2.38.4. Recent Developments

- 11.2.38.5. Financials (Based on Availability)

- 11.2.39 Allcargo Logistics Ltd

- 11.2.39.1. Overview

- 11.2.39.2. Products

- 11.2.39.3. SWOT Analysis

- 11.2.39.4. Recent Developments

- 11.2.39.5. Financials (Based on Availability)

- 11.2.40 NFI Industries

- 11.2.40.1. Overview

- 11.2.40.2. Products

- 11.2.40.3. SWOT Analysis

- 11.2.40.4. Recent Developments

- 11.2.40.5. Financials (Based on Availability)

- 11.2.41 Japan Post Holdings Co Ltd

- 11.2.41.1. Overview

- 11.2.41.2. Products

- 11.2.41.3. SWOT Analysis

- 11.2.41.4. Recent Developments

- 11.2.41.5. Financials (Based on Availability)

- 11.2.42 J B Hunt Transport Inc

- 11.2.42.1. Overview

- 11.2.42.2. Products

- 11.2.42.3. SWOT Analysis

- 11.2.42.4. Recent Developments

- 11.2.42.5. Financials (Based on Availability)

- 11.2.43 KEX Express (US) LLC

- 11.2.43.1. Overview

- 11.2.43.2. Products

- 11.2.43.3. SWOT Analysis

- 11.2.43.4. Recent Developments

- 11.2.43.5. Financials (Based on Availability)

- 11.2.44 DP World

- 11.2.44.1. Overview

- 11.2.44.2. Products

- 11.2.44.3. SWOT Analysis

- 11.2.44.4. Recent Developments

- 11.2.44.5. Financials (Based on Availability)

- 11.2.45 Expeditors International of Washington Inc

- 11.2.45.1. Overview

- 11.2.45.2. Products

- 11.2.45.3. SWOT Analysis

- 11.2.45.4. Recent Developments

- 11.2.45.5. Financials (Based on Availability)

- 11.2.46 Ryder System Inc

- 11.2.46.1. Overview

- 11.2.46.2. Products

- 11.2.46.3. SWOT Analysis

- 11.2.46.4. Recent Developments

- 11.2.46.5. Financials (Based on Availability)

- 11.2.47 CMA CGM Group

- 11.2.47.1. Overview

- 11.2.47.2. Products

- 11.2.47.3. SWOT Analysis

- 11.2.47.4. Recent Developments

- 11.2.47.5. Financials (Based on Availability)

- 11.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Global Freight & Logistics Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Freight & Logistics Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 3: North America Freight & Logistics Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 4: North America Freight & Logistics Industry Revenue (Million), by Logistics Function 2024 & 2032

- Figure 5: North America Freight & Logistics Industry Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 6: North America Freight & Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Freight & Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Freight & Logistics Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 9: South America Freight & Logistics Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 10: South America Freight & Logistics Industry Revenue (Million), by Logistics Function 2024 & 2032

- Figure 11: South America Freight & Logistics Industry Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 12: South America Freight & Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: South America Freight & Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Freight & Logistics Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 15: Europe Freight & Logistics Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 16: Europe Freight & Logistics Industry Revenue (Million), by Logistics Function 2024 & 2032

- Figure 17: Europe Freight & Logistics Industry Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 18: Europe Freight & Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Freight & Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Freight & Logistics Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 21: Middle East & Africa Freight & Logistics Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 22: Middle East & Africa Freight & Logistics Industry Revenue (Million), by Logistics Function 2024 & 2032

- Figure 23: Middle East & Africa Freight & Logistics Industry Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 24: Middle East & Africa Freight & Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Freight & Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Freight & Logistics Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 27: Asia Pacific Freight & Logistics Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 28: Asia Pacific Freight & Logistics Industry Revenue (Million), by Logistics Function 2024 & 2032

- Figure 29: Asia Pacific Freight & Logistics Industry Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 30: Asia Pacific Freight & Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Freight & Logistics Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Freight & Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Freight & Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Global Freight & Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 4: Global Freight & Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Freight & Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 6: Global Freight & Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 7: Global Freight & Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Freight & Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 12: Global Freight & Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 13: Global Freight & Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Freight & Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 18: Global Freight & Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 19: Global Freight & Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Russia Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Freight & Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 30: Global Freight & Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 31: Global Freight & Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Freight & Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 39: Global Freight & Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 40: Global Freight & Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Freight & Logistics Industry?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Freight & Logistics Industry?

Key companies in the market include A P Moller - Maersk, Hub Group Inc, DB Schenker, XPO Inc, Sinotrans Limited, Hellmann Worldwide Logistics, Bollore logistics, Orient Overseas Container Line (OOCL Logistics), Total Quality Logistics, Landstar System Inc, JD Logistics, C H Robinson, NYK (Nippon Yusen Kaisha) Line, Culina Group, Yamato Holdings Co Ltd, DHL Group, Uber Technologies Inc, LOGWIN, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), CTS Logistics Group, Poste Italiane, GEODIS, Dachser, Penske Logistics, Mainfreight, LX International Corp, FedEx, GXO Logistics, Kintetsu World Express, Savino Del Bene, Kuehne + Nagel, United Parcel Service of America Inc (UPS), International Distributions Services, Americold, La Poste Group, CJ Logistics, TIBA Group, Aramex, Allcargo Logistics Ltd, NFI Industries, Japan Post Holdings Co Ltd, J B Hunt Transport Inc, KEX Express (US) LLC, DP World, Expeditors International of Washington Inc, Ryder System Inc, CMA CGM Group.

3. What are the main segments of the Freight & Logistics Industry?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

March 2024: Aramex had strengthened its presence in Saudi Arabia with the inauguration of a new regional office in Riyadh, to significantly enhance Aramex's capabilities to serve new and existing businesses across the region and also to boost the Kingdom's logistics infrastructure and to contribute to the Vision 2030 goal of establishing Saudi Arabia as a global logistics hub.March 2024: Aramex had introduced a fleet of fully electric motorcycles to its last-mile delivery vehicles in the United Arab Emirates (UAE). This initiative is part of Aramex’s long-term strategic goal to achieve a total fleet of 98% Electric Vehicles (EVs) by 2030, aligned with Science Based Targets initiative (SBTi) target that Aramex is committed to. The e-bikes were introduced after intensive testing of several different models and manufacturers, and Aramex finalized the selected model based on its enduring performance and stability, particularly in local weather conditions.February 2024: C.H. Robinson has developed a new technology that creates a major efficiency in freight shipping: removing the work of scheduling an appointment at the place where a load needs to be picked up and scheduling another appointment where the load needs to be delivered. The technology also uses artificial intelligence to determine the optimal appointment, based on transit-time data from C.H. Robinson’s millions of shipments across 300,000 shipping lanes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Freight & Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Freight & Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Freight & Logistics Industry?

To stay informed about further developments, trends, and reports in the Freight & Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence