Key Insights

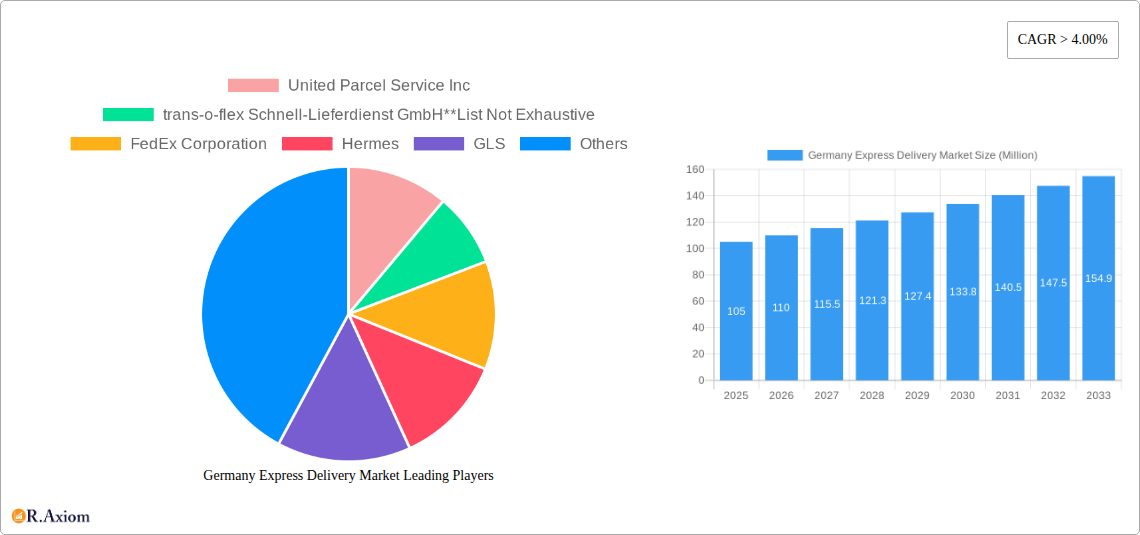

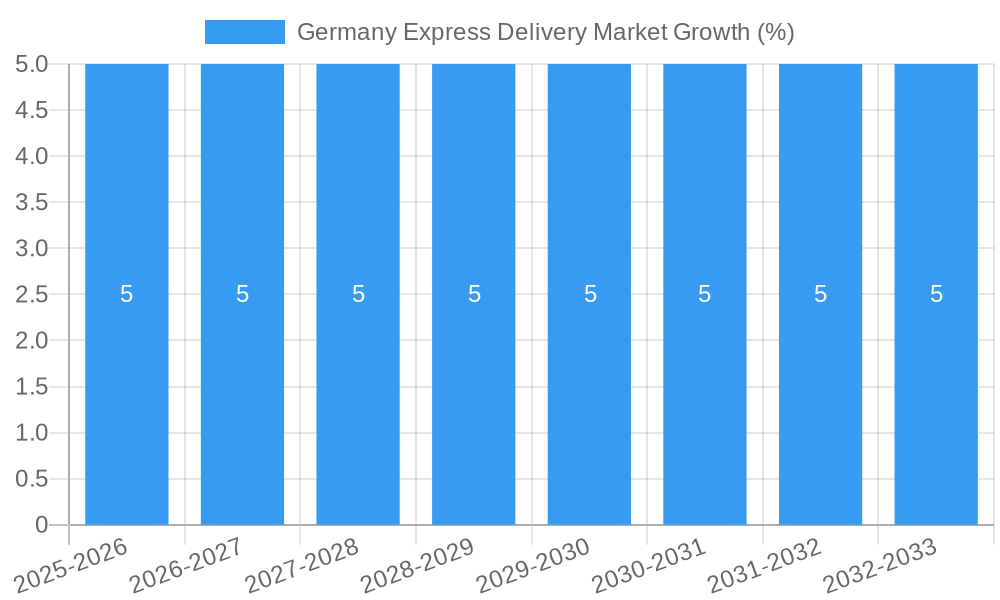

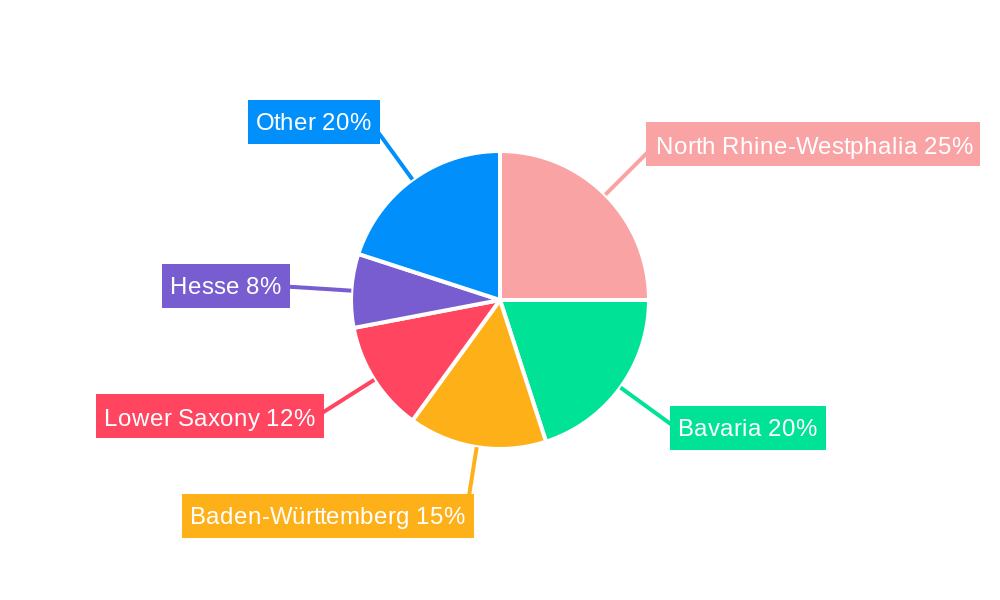

The German express delivery market, valued at approximately €[Estimate based on market size XX and value unit Million. For example, if XX = 100, then the value would be €100 million in 2025] million in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 4.00% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector, particularly within the B2C segment, is a significant catalyst, demanding faster and more reliable delivery solutions. Simultaneously, the growth of B2B express delivery services, driven by the needs of manufacturing, wholesale and retail trade, and the BFSI sectors (Banking, Financial Services, and Insurance), contributes significantly to market expansion. Furthermore, increasing urbanization and consumer demand for next-day and same-day delivery options are further propelling market growth. While robust infrastructure and a highly developed logistics network are advantageous, potential restraints include rising fuel costs, increasing labor expenses, and the need for constant technological upgrades to maintain efficiency and competitiveness. The market is segmented by destination (domestic and international), end-user (BFSI, wholesale & retail, manufacturing, construction & utilities, primary industries), and business type (B2B and B2C). Key players such as United Parcel Service (UPS), FedEx, DHL, and Hermes fiercely compete within this dynamic market, each employing strategies to capture market share and cater to specific customer needs across the various regions of Germany, including North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse. The continued expansion of e-commerce and the focus on supply chain optimization will continue to shape the market landscape over the forecast period.

The regional concentration within Germany reflects the distribution of economic activity and population density. North Rhine-Westphalia and Bavaria, being the most populous states, are likely to dominate the market. However, other regions such as Baden-Württemberg and Lower Saxony, with strong industrial sectors, will also exhibit significant express delivery market activity. Competitive intensity is high, with established players continually investing in technology and expanding their service offerings to maintain their competitive edge and cater to the evolving demands of the diverse customer base. The forecast period (2025-2033) presents significant opportunities for market participants to leverage technological advancements, optimize logistics operations, and offer innovative solutions to maintain growth within the competitive landscape.

Germany Express Delivery Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany express delivery market, covering its historical performance (2019-2024), current state (2025), and future projections (2025-2033). The report leverages extensive market research and data analysis to offer actionable insights for industry stakeholders, including established players and new entrants. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report's focus is on understanding market dynamics, identifying growth opportunities, and assessing competitive landscapes. The total market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Germany Express Delivery Market Concentration & Innovation

This section analyzes the competitive landscape of the German express delivery market, examining market concentration, innovation drivers, regulatory influences, and the impact of mergers and acquisitions (M&A) activities. The market is characterized by a high level of concentration, with key players such as Deutsche Post DHL Group, DPD Group, and FedEx Corporation holding significant market shares. However, smaller, specialized companies like trans-o-flex Schnell-Lieferdienst GmbH also play a crucial role.

Market Concentration: The Herfindahl-Hirschman Index (HHI) for the German express delivery market is estimated at xx, indicating a moderately concentrated market. Deutsche Post DHL Group holds an estimated xx% market share, followed by DPD Group with xx% and FedEx Corporation with xx%.

Innovation Drivers: Technological advancements such as automated sorting systems, route optimization software, and the increasing adoption of electric vehicles are driving innovation. Furthermore, the rise of e-commerce is pushing for faster and more efficient delivery solutions, fostering competition and innovation in last-mile delivery.

Regulatory Framework: The German government's regulations regarding data privacy, environmental protection, and labor laws impact the operations of express delivery companies. Compliance with these regulations represents a significant operational cost and influences market dynamics.

Product Substitutes: While express delivery services are often considered essential, alternatives exist, such as standard postal services and freight forwarding for less time-sensitive shipments. The competitive landscape is influenced by the price-performance tradeoff between these alternatives.

End-User Trends: The growing preference for faster and more reliable delivery options, especially amongst e-commerce consumers, is driving demand for express delivery services. This demand creates opportunities for companies to offer specialized services like same-day delivery and temperature-controlled transportation.

M&A Activities: Recent significant M&A activities include GEODIS's acquisition of trans-o-flex in December 2022, highlighting the consolidation trend within the market. The deal value was estimated at xx Million, reflecting the strategic importance of specialized express delivery services. Further M&A activity is expected as larger companies seek to expand their market share and service offerings. The average deal value for M&A transactions in this sector during the historical period was xx Million.

Germany Express Delivery Market Industry Trends & Insights

The German express delivery market is experiencing robust growth fueled by several key factors. The expansion of e-commerce, particularly B2C, is a major catalyst. The increasing demand for faster and more reliable deliveries necessitates investments in infrastructure and technology. The market has also witnessed a rise in the demand for specialized services, like those offered by trans-o-flex, focusing on temperature-controlled transportation for pharmaceuticals and high-value goods. This segmentation caters to specific industry needs, driving market diversification.

Technological advancements are transforming the industry, including the implementation of advanced tracking systems, autonomous vehicles for last-mile delivery, and the use of big data analytics for route optimization and predictive maintenance. This contributes to increased efficiency, reduced costs, and improved customer satisfaction. Consumer preferences are shifting towards enhanced convenience and transparency in the delivery process, pushing companies to adopt innovative solutions such as real-time tracking and flexible delivery options. The competitive dynamics are marked by ongoing consolidation, with larger players acquiring smaller firms to expand their service offerings and geographic reach. This trend leads to enhanced market concentration. The projected market size is expected to reach xx Million by 2033.

Dominant Markets & Segments in Germany Express Delivery Market

The German express delivery market is dominated by the domestic segment, which accounts for the largest share of the market due to the high volume of intra-country shipments driven by robust domestic e-commerce and industrial activity. The B2C segment also holds a significant portion, propelled by the rising popularity of online shopping. Within the end-user segments, Wholesale and Retail Trade (E-commerce) is the most dominant, followed by the Manufacturing sector.

Key Drivers of Domestic Dominance: Strong domestic e-commerce growth, well-established logistics infrastructure, and high consumer spending.

Key Drivers of B2C Segment Dominance: The surge in online shopping and consumer preference for home delivery.

Key Drivers of Wholesale and Retail Trade (E-commerce) Dominance: Rapid growth of e-commerce, increasing consumer expectations for fast delivery, and efficient logistics networks.

Key Drivers of Manufacturing Segment Dominance: Just-in-time manufacturing practices, reliance on quick delivery of parts and components, and the need for efficient supply chains.

The international segment, while smaller, is experiencing growth driven by Germany's role as a key exporter and importer in Europe and globally. The B2B segment, although sizable, shows slightly slower growth compared to B2C due to more established logistical arrangements and longer delivery timeframes often accepted by businesses.

Germany Express Delivery Market Product Developments

Recent product innovations focus on enhancing delivery speed, efficiency, and transparency. Companies are investing in sophisticated tracking systems, offering real-time updates to customers. The integration of AI and machine learning is optimizing delivery routes, improving last-mile efficiency, and predicting potential delays. The market also sees an increase in specialized services, such as temperature-controlled transportation for pharmaceuticals and high-value goods, catering to niche market requirements. These advancements provide companies with a competitive edge, enabling them to better meet customer needs and increase market share.

Report Scope & Segmentation Analysis

This report segments the German express delivery market based on destination (domestic, international), end-user (services, wholesale and retail trade, manufacturing, construction and utilities, primary industries), and business type (B2B, B2C). Growth projections and market sizes are provided for each segment, along with an analysis of competitive dynamics.

By Destination: The domestic market is projected to grow at a CAGR of xx% during the forecast period, while the international market is expected to grow at a CAGR of xx%.

By End-User: The Wholesale and Retail Trade segment is expected to witness the highest growth, followed by the Manufacturing segment.

By Business Type: The B2C segment is projected to experience faster growth than the B2B segment due to the rapid expansion of e-commerce.

Key Drivers of Germany Express Delivery Market Growth

The German express delivery market's growth is driven by several interconnected factors. The exponential growth of e-commerce significantly increases demand for fast and reliable delivery services. Technological advancements, such as automation and AI-powered route optimization, improve efficiency and reduce costs. Furthermore, favorable government regulations and supportive infrastructure enhance the sector's overall development. The expanding logistics infrastructure, particularly in urban areas, helps manage the increasing delivery volume.

Challenges in the Germany Express Delivery Market Sector

The German express delivery market faces several challenges, including increasing fuel costs and driver shortages impacting operational efficiency and profitability. Stringent environmental regulations necessitate investment in sustainable delivery solutions, increasing operational expenses. Intense competition among established and emerging players intensifies price pressure, reducing profit margins. The rising demand during peak seasons creates capacity constraints and potentially delays deliveries, affecting customer satisfaction.

Emerging Opportunities in Germany Express Delivery Market

The growing demand for sustainable and eco-friendly delivery solutions presents significant opportunities for companies to invest in electric vehicle fleets and optimize delivery routes to minimize environmental impact. The increasing adoption of advanced technologies like drones and autonomous vehicles offers potential for greater efficiency and reduced costs. Furthermore, the expansion of e-commerce into new markets and customer segments presents untapped potential for growth, particularly in rural areas.

Leading Players in the Germany Express Delivery Market Market

- United Parcel Service Inc

- Deutsche Post DHL Group

- DPD Group

- FedEx Corporation

- Hermes

- GLS

- Go! Express

- Atlantic International Express

- trans-o-flex Schnell-Lieferdienst GmbH

Key Developments in Germany Express Delivery Market Industry

December 2022: GEODIS acquired trans-o-flex, expanding its presence in the premium express sector and specialized temperature-controlled logistics. This significantly altered the competitive landscape within the high-value and pharmaceutical segments.

May 2023: NCAB Group's acquisition of DB Electronic strengthened its quick-turnaround PCB manufacturing capabilities. This development indirectly impacts the express delivery market by increasing demand for speedy and reliable delivery services for smaller PCB orders within Europe.

Strategic Outlook for Germany Express Delivery Market Market

The German express delivery market is poised for sustained growth, driven by the continued expansion of e-commerce, technological advancements, and increasing demand for specialized services. Companies that invest in automation, sustainable solutions, and advanced technologies will be well-positioned to capitalize on future opportunities. The focus on enhancing customer experience and offering flexible delivery options will be crucial for success in this competitive market. Further consolidation and strategic partnerships are expected as companies seek to expand their market reach and service offerings.

Germany Express Delivery Market Segmentation

-

1. Business

- 1.1. B2B (Business-to-Business)

- 1.2. B2C (Business-to-Consumer)

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. End User

- 3.1. Services

- 3.2. Wholesale and Retail Trade (E-commerce)

- 3.3. Manufacturing, Construction, and Utilities

- 3.4. Primary

Germany Express Delivery Market Segmentation By Geography

- 1. Germany

Germany Express Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; The UAE government's efforts to diversify its economy away from oil dependency have led to increased investment4.; The UAE has been investing in manufacturing sectors such as aerospace

- 3.2.2 automotive

- 3.2.3 and pharmaceuticals.

- 3.3. Market Restrains

- 3.3.1 4.; The geopolitical situation in the Middle East can create security concerns for logistics operations

- 3.3.2 4.; Regulations and customs procedures can be complex and subject to change.

- 3.4. Market Trends

- 3.4.1. Increased E-commerce Sales Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Business

- 5.1.1. B2B (Business-to-Business)

- 5.1.2. B2C (Business-to-Consumer)

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Services

- 5.3.2. Wholesale and Retail Trade (E-commerce)

- 5.3.3. Manufacturing, Construction, and Utilities

- 5.3.4. Primary

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Business

- 6. North Rhine-Westphalia Germany Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 United Parcel Service Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 trans-o-flex Schnell-Lieferdienst GmbH**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FedEx Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hermes

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GLS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Deutsche Post DHL Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DPD Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Go! Express

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Atlantic International Express

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 United Parcel Service Inc

List of Figures

- Figure 1: Germany Express Delivery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Express Delivery Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Express Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Express Delivery Market Revenue Million Forecast, by Business 2019 & 2032

- Table 3: Germany Express Delivery Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Germany Express Delivery Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Germany Express Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Germany Express Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North Rhine-Westphalia Germany Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Bavaria Germany Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Baden-Württemberg Germany Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Lower Saxony Germany Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Hesse Germany Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Express Delivery Market Revenue Million Forecast, by Business 2019 & 2032

- Table 13: Germany Express Delivery Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 14: Germany Express Delivery Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Germany Express Delivery Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Express Delivery Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Germany Express Delivery Market?

Key companies in the market include United Parcel Service Inc, trans-o-flex Schnell-Lieferdienst GmbH**List Not Exhaustive, FedEx Corporation, Hermes, GLS, Deutsche Post DHL Group, DPD Group, Go! Express, Atlantic International Express.

3. What are the main segments of the Germany Express Delivery Market?

The market segments include Business, Destination, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The UAE government's efforts to diversify its economy away from oil dependency have led to increased investment4.; The UAE has been investing in manufacturing sectors such as aerospace. automotive. and pharmaceuticals..

6. What are the notable trends driving market growth?

Increased E-commerce Sales Driving the Market.

7. Are there any restraints impacting market growth?

4.; The geopolitical situation in the Middle East can create security concerns for logistics operations. 4.; Regulations and customs procedures can be complex and subject to change..

8. Can you provide examples of recent developments in the market?

May 2023: NCAB Group, a PCB provider, has expanded further with the acquisition of DB Electronic, situated in Waldshut-Tiengen in southern Germany, DB Electronic AG in Switzerland, and DB Electronic SAS in France. As of today, the three companies have been merged into NCAB Group. db electronic focuses mostly on so-called Quick turnarounds, or smaller series with quick delivery times, which complement NCAB's offering in Europe. Their primary source of PCBs is South Korean factories.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Express Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Express Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Express Delivery Market?

To stay informed about further developments, trends, and reports in the Germany Express Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence