Key Insights

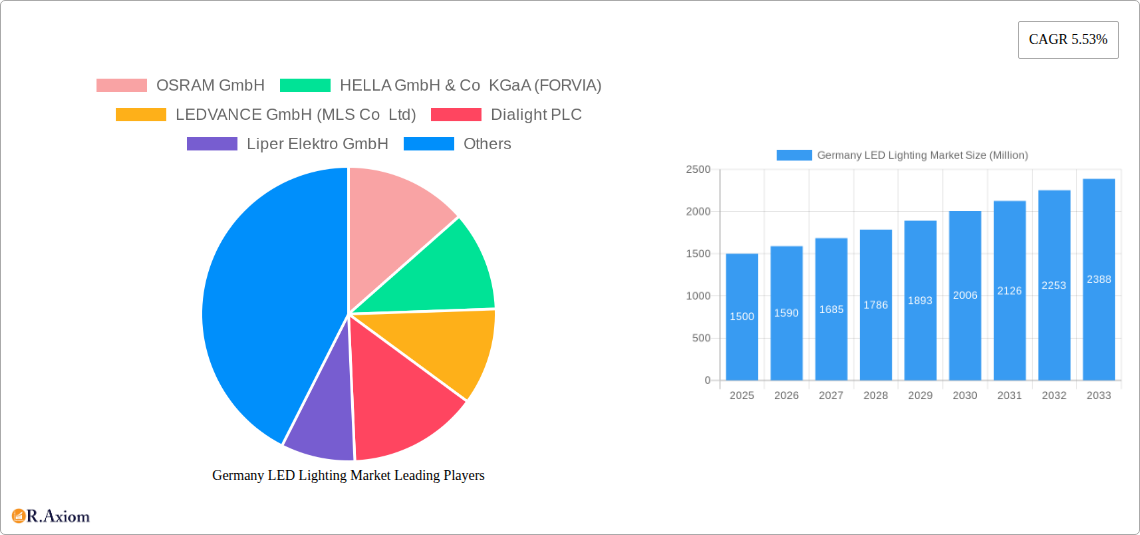

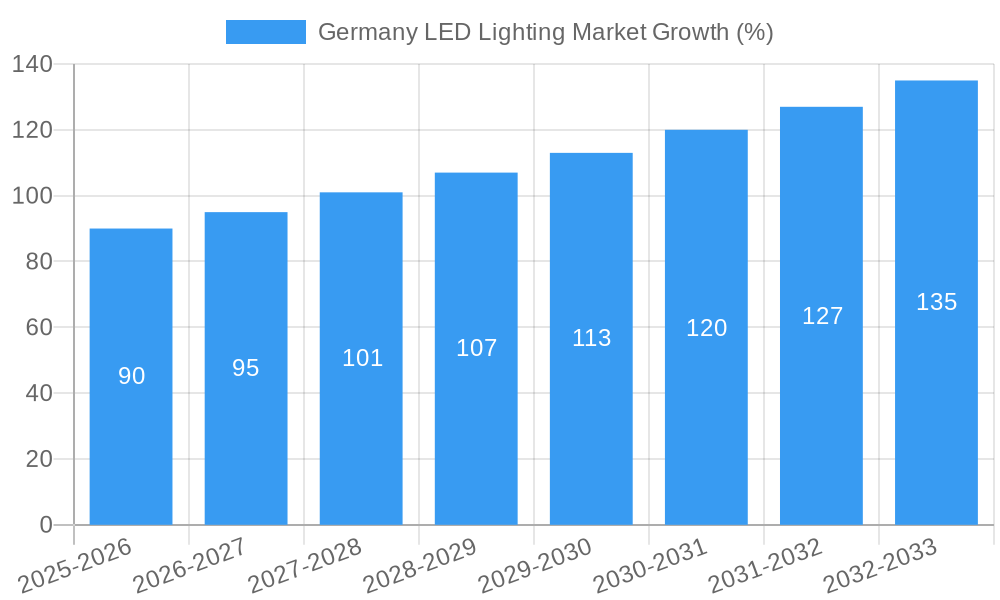

The German LED lighting market, valued at approximately €X million in 2025 (estimated based on provided CAGR and market size), is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 5.53% from 2025 to 2033. This growth is fueled by several key drivers. Stringent government regulations promoting energy efficiency, coupled with increasing environmental awareness among consumers and businesses, are significantly boosting the adoption of energy-saving LED lighting solutions across various sectors. Furthermore, advancements in LED technology, leading to improved lumen output, longer lifespans, and reduced costs, are making LED lighting increasingly competitive compared to traditional lighting options. The automotive sector, particularly passenger cars and commercial vehicles, presents a significant growth opportunity, driven by the increasing integration of advanced lighting features like DRLs and adaptive headlights. The strong presence of leading automotive lighting manufacturers in Germany further contributes to market expansion in this segment. While the market faces some restraints such as high initial investment costs for LED installations and potential challenges in waste management for end-of-life LED products, the long-term benefits of energy efficiency and reduced operational costs are outweighing these concerns, driving overall market growth.

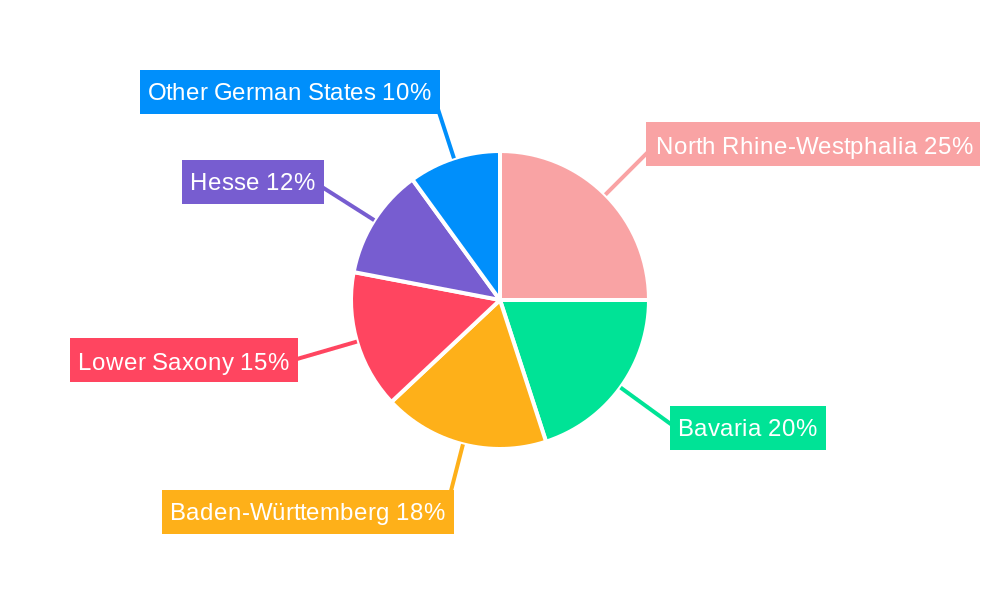

The German LED lighting market shows strong regional variation, with states like North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse leading the adoption of LED technologies due to their established industrial base and higher consumer spending power. The segmentation reveals the dominance of automotive lighting, particularly within the passenger car and commercial vehicle segments, followed by industrial and warehouse lighting applications. Residential lighting is also a substantial segment, albeit showing potentially slower growth compared to the industrial and automotive sectors. The presence of major players like OSRAM, Hella, and Signify underscores Germany's position as a significant global hub for LED lighting manufacturing and innovation. The forecast period (2025-2033) suggests continued expansion, with steady growth across all segments driven by sustained technological advancements, government policies, and the growing demand for energy-efficient and sustainable lighting solutions.

Germany LED Lighting Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany LED lighting market, covering market size, segmentation, key players, industry trends, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base year and forecast period extending to 2033. This report is essential for industry stakeholders, investors, and market analysts seeking actionable insights into this dynamic sector.

Germany LED Lighting Market Concentration & Innovation

This section analyzes the competitive landscape of the German LED lighting market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market is characterized by a mix of large multinational corporations and smaller, specialized players.

Market Concentration: The German LED lighting market exhibits a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2025. This concentration is expected to remain relatively stable over the forecast period.

Innovation Drivers: Stringent energy efficiency regulations, coupled with growing consumer demand for smart and sustainable lighting solutions, are driving innovation in the market. Significant R&D investments by major players are leading to advancements in LED technology, including improved energy efficiency, longer lifespan, and enhanced smart functionalities.

Regulatory Framework: The German government's commitment to energy efficiency and sustainability has resulted in the implementation of stringent regulations promoting the adoption of LED lighting. These regulations, along with EU-wide initiatives, are creating a favorable environment for market growth.

Product Substitutes: While LED lighting is rapidly replacing traditional lighting technologies, some niche applications may still utilize alternative options. However, the cost-effectiveness and superior performance of LEDs are expected to continue their market dominance.

End-User Trends: Increasing awareness of energy efficiency and environmental sustainability among consumers and businesses is driving the demand for energy-efficient LED lighting solutions. Smart lighting systems, offering remote control and automation features, are gaining significant traction.

M&A Activities: The German LED lighting market has witnessed several M&A activities in recent years, with deal values totaling an estimated xx Million in the period 2019-2024. These activities reflect the consolidation trend within the industry and the strategic acquisitions of smaller players by larger corporations to expand their product portfolios and market reach.

Germany LED Lighting Market Industry Trends & Insights

This section delves into the key trends and insights shaping the German LED lighting market. The market is experiencing robust growth driven by multiple factors, resulting in a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of LED lighting is expected to reach xx% by 2033.

The growth is fueled by increasing government initiatives focused on energy efficiency and sustainability, coupled with a rising consumer preference for smart, energy-saving lighting solutions. Technological advancements like improved LED chip efficiency, innovative lighting designs, and the integration of smart home technologies are further stimulating market expansion. The competitive landscape is highly dynamic, with major players continuously investing in R&D to enhance their product offerings and stay ahead of the curve. The rise of smart lighting and IoT integration represents a significant disruption, transforming consumer experiences and opening up new avenues for innovation. Furthermore, the increasing adoption of LED lighting in diverse sectors, including residential, commercial, industrial, and automotive, contributes to the market's overall expansion.

Dominant Markets & Segments in Germany LED Lighting Market

This section identifies the leading segments and regions within the German LED lighting market. The analysis reveals that the automotive lighting segment, particularly automotive utility lighting (headlights, tail lights, etc.), holds a significant market share. This dominance is attributable to stringent automotive lighting regulations, coupled with the integration of advanced LED technologies offering improved visibility and safety features. The indoor lighting segment (commercial and industrial applications) also exhibits strong growth potential, driven by the increasing adoption of energy-efficient and smart lighting solutions in commercial buildings and industrial facilities.

Key Drivers for Automotive Lighting Dominance:

- Stringent safety regulations requiring advanced lighting systems.

- Growing demand for improved vehicle aesthetics and design.

- Integration of advanced LED technologies offering superior performance and energy efficiency.

Key Drivers for Indoor Lighting Growth:

- Increasing demand for energy-efficient lighting solutions in commercial and industrial settings.

- Growing adoption of smart lighting systems offering enhanced control and automation features.

- Government incentives and energy efficiency regulations encouraging energy-saving upgrades.

The residential segment also contributes significantly to the market, driven by increasing consumer awareness of energy efficiency and the affordability of LED lighting. While the outdoor lighting segment shows steady growth, its expansion may be limited by factors like initial investment costs and project implementation times.

Germany LED Lighting Market Product Developments

Recent product innovations focus on enhancing energy efficiency, smart functionalities, and design aesthetics. The introduction of A-class LED tubes, consuming up to 60% less energy than traditional LEDs, showcases the industry's commitment to sustainability. Smart lighting systems incorporating features like motion detection and remote control are gaining popularity, enhancing user convenience and enabling energy optimization. These advancements cater to evolving consumer demands for energy-efficient, smart, and aesthetically pleasing lighting solutions, ensuring a strong market fit.

Report Scope & Segmentation Analysis

This report segments the German LED lighting market based on application and lighting type:

1. Indoor Lighting: This segment encompasses commercial, agricultural, and residential applications, with growth driven by energy efficiency mandates and increasing demand for smart lighting solutions. The market size is projected to reach xx Million by 2033. Competitive dynamics are characterized by intense rivalry among established players and emerging innovators.

2. Outdoor Lighting: Including public places, streets, roadways, and other outdoor applications. This segment benefits from governmental initiatives for smart city infrastructure, resulting in a projected market size of xx Million by 2033. Competition involves both established lighting companies and specialized outdoor lighting providers.

3. Automotive Lighting: Comprising utility lighting (DRLs, headlights, etc.) and vehicle lighting (passenger cars, commercial vehicles, two-wheelers). This segment's growth is linked to vehicle manufacturing trends and stringent safety regulations, projecting a market value of xx Million by 2033. The market is dominated by established automotive lighting suppliers.

Key Drivers of Germany LED Lighting Market Growth

The German LED lighting market growth is propelled by several key factors:

Stringent Energy Efficiency Regulations: Government policies promoting energy conservation drive the adoption of energy-efficient LED lighting.

Technological Advancements: Continuous improvements in LED technology, resulting in higher efficiency, longer lifespan, and enhanced features, fuel market expansion.

Rising Consumer Awareness: Increased consumer awareness of energy savings and environmental benefits contributes significantly to market growth.

Smart Lighting Adoption: The integration of smart technologies in lighting systems boosts demand, enhancing convenience and energy management.

Challenges in the Germany LED Lighting Market Sector

The German LED lighting market faces several challenges:

High Initial Investment Costs: The initial investment required for LED lighting installations can be a barrier for some consumers and businesses.

Supply Chain Disruptions: Global supply chain disruptions can affect the availability and pricing of LED components and finished products.

Intense Competition: The market is characterized by intense competition among numerous players, requiring companies to constantly innovate to maintain a competitive edge.

Recycling and Disposal Challenges: Proper disposal and recycling of end-of-life LEDs remain a concern.

Emerging Opportunities in Germany LED Lighting Market

Emerging opportunities exist in:

Smart City Initiatives: The increasing implementation of smart city initiatives presents growth potential for smart LED street lighting and traffic management systems.

Internet of Things (IoT) Integration: The integration of LED lighting with IoT platforms opens doors for innovative applications in smart homes and buildings.

Human-centric Lighting: The development of lighting solutions that cater to human biological rhythms and improve well-being is a promising area.

Specialized Lighting Applications: There is growing demand for specialized LED lighting solutions in various industries, such as healthcare and agriculture.

Leading Players in the Germany LED Lighting Market Market

- OSRAM GmbH

- HELLA GmbH & Co KGaA (FORVIA)

- LEDVANCE GmbH (MLS Co Ltd)

- Dialight PLC

- Liper Elektro GmbH

- TRILUX GmbH & Co KG

- GRUPO ANTOLIN IRAUSA S A

- Marelli Holdings Co Ltd

- Vale

- Signify (Philips)

Key Developments in Germany LED Lighting Market Industry

September 2023: Signify launched a new app, features, and products for its WiZ smart lighting system, including SpaceSense motion detection technology. This enhances the user experience and expands the smart lighting market.

September 2023: Signify launched its Philips Smart LED bulbs globally, leveraging its 2019 acquisition of Wiz. This expands the company's smart lighting portfolio and strengthens its market position.

August 2023: Signify introduced an A-class LED tube, significantly reducing energy consumption. This demonstrates the company's commitment to sustainability and compliance with new EU regulations.

Strategic Outlook for Germany LED Lighting Market Market

The German LED lighting market is poised for continued growth driven by technological advancements, supportive government policies, and increasing consumer demand for energy-efficient and smart lighting solutions. Emerging technologies like LiFi and the integration of LED lighting with IoT platforms promise further innovation and expansion. The market's long-term outlook remains positive, with significant opportunities for players who can adapt to evolving consumer preferences and technological advancements.

Germany LED Lighting Market Segmentation

-

1. Indoor Lighting

- 1.1. Agricultural Lighting

-

1.2. Commercial

- 1.2.1. Office

- 1.2.2. Retail

- 1.2.3. Others

- 1.3. Industrial and Warehouse

- 1.4. Residential

-

2. Outdoor Lighting

- 2.1. Public Places

- 2.2. Streets and Roadways

- 2.3. Others

-

3. Automotive Utility Lighting

- 3.1. Daytime Running Lights (DRL)

- 3.2. Directional Signal Lights

- 3.3. Headlights

- 3.4. Reverse Light

- 3.5. Stop Light

- 3.6. Tail Light

- 3.7. Others

-

4. Automotive Vehicle Lighting

- 4.1. 2 Wheelers

- 4.2. Commercial Vehicles

- 4.3. Passenger Cars

Germany LED Lighting Market Segmentation By Geography

- 1. Germany

Germany LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 5G Deployments Bolster the Market Growth; High Regional Demand for Broadband

- 3.3. Market Restrains

- 3.3.1. Lack of awareness about serious games among end-users

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 5.1.1. Agricultural Lighting

- 5.1.2. Commercial

- 5.1.2.1. Office

- 5.1.2.2. Retail

- 5.1.2.3. Others

- 5.1.3. Industrial and Warehouse

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 5.2.1. Public Places

- 5.2.2. Streets and Roadways

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 5.3.1. Daytime Running Lights (DRL)

- 5.3.2. Directional Signal Lights

- 5.3.3. Headlights

- 5.3.4. Reverse Light

- 5.3.5. Stop Light

- 5.3.6. Tail Light

- 5.3.7. Others

- 5.4. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 5.4.1. 2 Wheelers

- 5.4.2. Commercial Vehicles

- 5.4.3. Passenger Cars

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 6. North Rhine-Westphalia Germany LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 OSRAM GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 HELLA GmbH & Co KGaA (FORVIA)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LEDVANCE GmbH (MLS Co Ltd)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dialight PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Liper Elektro GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TRILUX GmbH & Co KG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GRUPO ANTOLIN IRAUSA S A

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Marelli Holdings Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Vale

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Signify (Philips)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 OSRAM GmbH

List of Figures

- Figure 1: Germany LED Lighting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany LED Lighting Market Share (%) by Company 2024

List of Tables

- Table 1: Germany LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 3: Germany LED Lighting Market Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 4: Germany LED Lighting Market Revenue Million Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 5: Germany LED Lighting Market Revenue Million Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 6: Germany LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Germany LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: North Rhine-Westphalia Germany LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Bavaria Germany LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Baden-Württemberg Germany LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Lower Saxony Germany LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Hesse Germany LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Germany LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 14: Germany LED Lighting Market Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 15: Germany LED Lighting Market Revenue Million Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 16: Germany LED Lighting Market Revenue Million Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 17: Germany LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany LED Lighting Market?

The projected CAGR is approximately 5.53%.

2. Which companies are prominent players in the Germany LED Lighting Market?

Key companies in the market include OSRAM GmbH, HELLA GmbH & Co KGaA (FORVIA), LEDVANCE GmbH (MLS Co Ltd), Dialight PLC, Liper Elektro GmbH, TRILUX GmbH & Co KG, GRUPO ANTOLIN IRAUSA S A, Marelli Holdings Co Ltd, Vale, Signify (Philips).

3. What are the main segments of the Germany LED Lighting Market?

The market segments include Indoor Lighting, Outdoor Lighting, Automotive Utility Lighting, Automotive Vehicle Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

5G Deployments Bolster the Market Growth; High Regional Demand for Broadband.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Lack of awareness about serious games among end-users.

8. Can you provide examples of recent developments in the market?

September 2023: Signify introduced a new app, features, and products for its WiZ smart lighting system to enhance users’ daily convenience. The new offerings include SpaceSense, a motion detection technology for lighting systems that don’t require any sensor to be installed.September 2023: Signify, the owner of the Philips Hue brand has announced the global launch of its Philips Smart LED bulbs. The new portfolio is the result of Signify's 2019 acquisition of Wiz, and it is distinguished from Hue products by the "Wiz Connected" badge on its blue box.August 2023: Signify introduced an A-class LED tube, which consumes 60% less energy than a standard Philips LED. The MASTER LEDtube UE expands the energy-efficient products that meet the A-grade criteria of the new EU energy labeling and eco-design framework through technological innovation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany LED Lighting Market?

To stay informed about further developments, trends, and reports in the Germany LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence