Key Insights

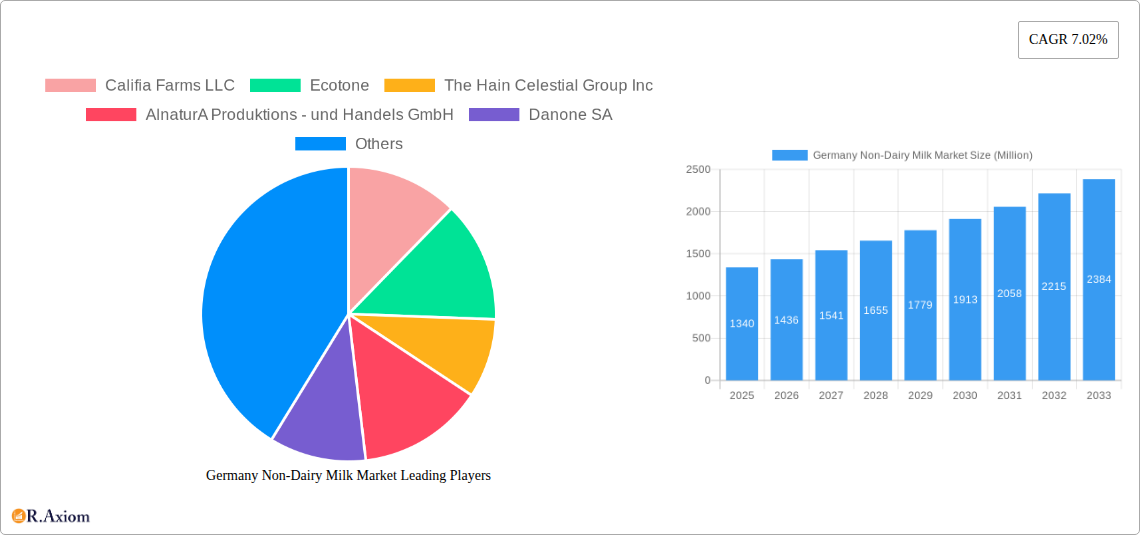

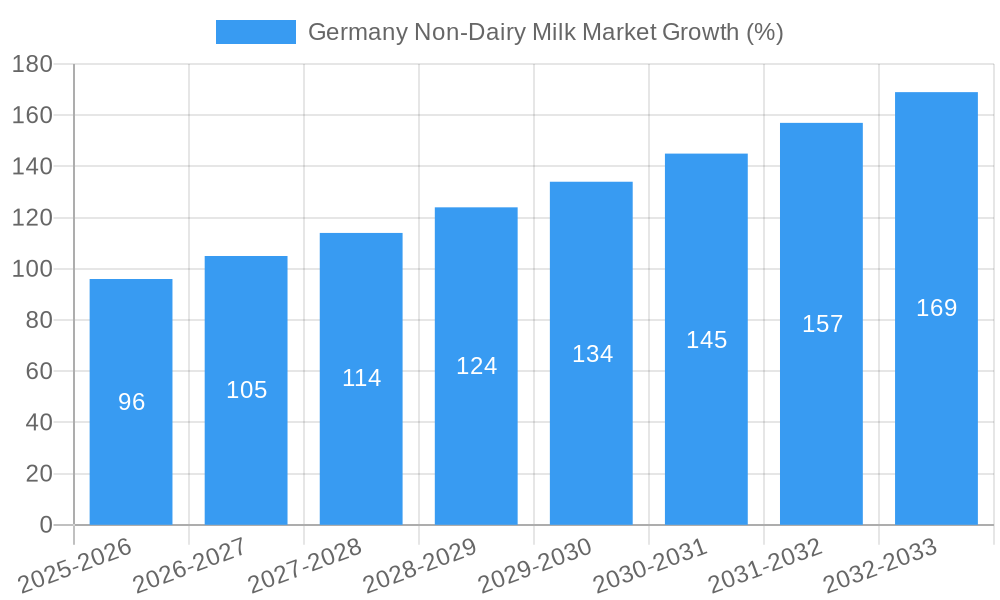

The German non-dairy milk market, valued at approximately €1.34 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.02% from 2025 to 2033. This surge is driven by several key factors. Increasing consumer awareness of the health benefits associated with plant-based diets, including reduced cholesterol and saturated fat intake, is a significant driver. Furthermore, the rising prevalence of lactose intolerance and dairy allergies is fueling demand for dairy-free alternatives. The growing popularity of veganism and flexitarian lifestyles, coupled with increasing concerns about animal welfare and environmental sustainability, further contributes to market expansion. Strong distribution channels, encompassing retail stores, supermarkets, hypermarkets, and foodservice outlets, ensure broad market penetration. Product diversification, with almond, cashew, coconut, hazelnut, hemp, oat, and soy milk leading the way, caters to a wide range of consumer preferences and dietary needs. Competitive pressures among established players like Califia Farms, Oatly, and Danone, along with regional brands, drive innovation and affordability, ensuring ongoing market dynamism.

Within the German market, oat milk and almond milk are currently the most popular segments, capturing significant market share. However, other alternatives like cashew and coconut milk are witnessing strong growth, fuelled by innovative product development and expanding consumer interest in diverse flavor profiles and nutritional benefits. The on-trade sector, encompassing foodservice establishments like cafes and restaurants, is showcasing particularly strong growth potential, driven by increasing menu diversification and consumer demand for plant-based options in out-of-home settings. Future market expansion will likely be influenced by factors such as evolving consumer preferences, innovative product launches, increasing price competitiveness, and effective marketing campaigns emphasizing the health, ethical, and environmental advantages of non-dairy milk. The sustained growth trajectory points to a promising future for this market sector in Germany.

Germany Non-Dairy Milk Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Germany non-dairy milk market, covering the period from 2019 to 2033. It offers invaluable insights for industry stakeholders, including manufacturers, distributors, investors, and market researchers. The report leverages extensive data analysis to forecast market trends and identify lucrative growth opportunities. With a focus on key segments, competitive dynamics, and emerging trends, this report is an essential resource for navigating the evolving landscape of the German non-dairy milk market.

Germany Non-Dairy Milk Market Concentration & Innovation

This section analyzes the competitive landscape of the German non-dairy milk market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market exhibits moderate concentration, with several key players holding significant market share. For example, Oatly Group AB and Danone SA are estimated to hold xx% and yy% market share respectively in 2025, while other players like Califia Farms LLC and Alnatura Produktions - und Handels GmbH contribute significantly to the remaining market share.

Innovation is a key driver, with companies constantly introducing new product variations, such as flavored oat milks, barista blends, and those fortified with vitamins and minerals. The regulatory framework, including labeling requirements and food safety standards, significantly influences market dynamics. Plant-based milk alternatives, such as soy milk and almond milk, are the primary substitutes for dairy milk. Growing consumer awareness of health and sustainability is driving demand, while increasing disposable incomes are contributing to market expansion. Recent M&A activities have been xx Million in value over the period 2019-2024, mainly focused on expanding product portfolios and market reach.

- Market Share: Oatly Group AB (xx%), Danone SA (yy%), Califia Farms LLC (zz%), others (rest).

- M&A Activity: Total deal value (2019-2024): xx Million. Focus: Portfolio expansion, market reach.

- Innovation Drivers: New product variations, improved taste and texture, health and sustainability benefits.

- Regulatory Framework: EU food safety regulations, labeling requirements.

Germany Non-Dairy Milk Market Industry Trends & Insights

The German non-dairy milk market is experiencing robust growth, driven by several key factors. The increasing adoption of vegan and vegetarian lifestyles, growing health consciousness among consumers, and the perception of non-dairy milk as a healthier alternative to traditional dairy milk are significantly impacting market growth. Technological advancements, particularly in production processes and product formulations, are contributing to improved taste and texture, making these alternatives more appealing to consumers. Furthermore, the rising popularity of plant-based diets is fueling demand for non-dairy milk across various demographics. The market is witnessing a shift towards premium and specialized products, including organic and functional non-dairy milks.

The CAGR for the Germany non-dairy milk market is projected to be xx% during the forecast period (2025-2033), driven by increasing consumer preference for plant-based alternatives. Market penetration is currently estimated at xx% in 2025 and is expected to reach yy% by 2033. Competitive dynamics are intense, with established players and new entrants vying for market share through product innovation, strategic partnerships, and marketing campaigns.

The on-trade segment presents considerable growth potential due to the increasing demand for plant-based options in cafes, restaurants and other foodservice establishments. However, price volatility of raw materials and supply chain disruptions pose significant challenges.

Dominant Markets & Segments in Germany Non-Dairy Milk Market

The German non-dairy milk market shows strong growth across various segments and regions. Oat milk is the dominant product type, currently capturing the largest market share at xx% due to its versatility, creamy texture, and nutritional value. Other significant segments include soy milk, almond milk, and coconut milk. The off-trade distribution channel (retail stores, supermarkets, hypermarkets) accounts for the significant portion of sales, demonstrating the strong penetration of non-dairy milk in retail settings. However, the on-trade channel (foodservice) is poised for significant growth, fueled by the increasing popularity of plant-based options in cafes and restaurants.

- Key Drivers for Oat Milk Dominance: Versatility, creamy texture, nutritional value, relatively low price point.

- Key Drivers for Off-Trade Channel Dominance: Extensive retail presence, established distribution networks.

- Key Drivers for On-Trade Channel Growth: Rising demand for plant-based options in foodservice establishments, menu diversification.

Germany Non-Dairy Milk Market Product Developments

Recent product innovations include the introduction of barista blends specifically formulated for coffee, flavored varieties catering to diverse consumer preferences, and organic options catering to the growing demand for sustainable products. These developments reflect the industry’s focus on enhancing product quality, taste and meeting evolving consumer demands. Technological advancements in production processes have led to more efficient and sustainable manufacturing practices, further contributing to market growth. Key competitive advantages include unique product formulations, strong branding, and efficient distribution networks.

Report Scope & Segmentation Analysis

This report segments the German non-dairy milk market by product type (Almond Milk, Cashew Milk, Coconut Milk, Hazelnut Milk, Hemp Milk, Oat Milk, Soy Milk) and distribution channel (Off-Trade, On-Trade, Others). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. The oat milk segment is projected to experience the highest growth, followed by almond milk and soy milk. The off-trade channel holds the largest market share but the on-trade channel is projected to have a higher growth rate. Competitive dynamics vary across segments, with some dominated by a few major players while others show greater fragmentation.

Key Drivers of Germany Non-Dairy Milk Market Growth

The growth of the German non-dairy milk market is driven by several key factors. The increasing prevalence of lactose intolerance and dairy allergies is creating a significant demand for dairy-free alternatives. Moreover, the growing awareness of the health and environmental benefits of plant-based diets is boosting the consumption of non-dairy milk. Government initiatives promoting sustainable food choices further support market expansion. Technological advancements leading to improvements in product quality and affordability are also key drivers.

Challenges in the Germany Non-Dairy Milk Market Sector

The German non-dairy milk market faces several challenges. Price fluctuations in raw materials, particularly for certain nuts and grains, can impact production costs and profitability. Supply chain disruptions can affect the availability of products. Intense competition from established dairy companies and emerging players creates a dynamic and competitive landscape. Regulatory hurdles, including labeling requirements and food safety standards, can also pose challenges.

Emerging Opportunities in Germany Non-Dairy Milk Market

Emerging opportunities include the growing demand for functional non-dairy milks enriched with vitamins, minerals, and probiotics. The increasing popularity of plant-based yogurts and desserts using non-dairy milks as a base represents another growth opportunity. Expanding into new distribution channels, such as online retailers and direct-to-consumer platforms, can unlock further market potential. Innovations in product packaging, such as sustainable and eco-friendly options, can also attract environmentally conscious consumers.

Leading Players in the Germany Non-Dairy Milk Market Market

- Califia Farms LLC

- Ecotone

- The Hain Celestial Group Inc

- Alnatura Produktions - und Handels GmbH

- Danone SA

- Oatly Group AB

- Granarolo SpA

- Triballat Noyal Sa

Key Developments in Germany Non-Dairy Milk Market Industry

- April 2022: Califia Farms launched an unsweetened Oat Milk.

- May 2022: Oatly Group launched one-hour delivery in Los Angeles and New York City.

- August 2022: Califia Farms expanded its portfolio with a Pumpkin Spice Oat Barista.

Strategic Outlook for Germany Non-Dairy Milk Market Market

The German non-dairy milk market is poised for continued growth, driven by sustained demand for plant-based alternatives and innovations in product development. The focus on sustainability, health benefits, and convenience will shape future market trends. Companies focusing on product differentiation, efficient supply chains, and effective marketing strategies are well-positioned to capture significant market share. The expansion of the on-trade segment presents particularly attractive opportunities.

Germany Non-Dairy Milk Market Segmentation

-

1. Product Type

- 1.1. Almond Milk

- 1.2. Cashew Milk

- 1.3. Coconut Milk

- 1.4. Hazelnut Milk

- 1.5. Hemp Milk

- 1.6. Oat Milk

- 1.7. Soy Milk

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

Germany Non-Dairy Milk Market Segmentation By Geography

- 1. Germany

Germany Non-Dairy Milk Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products

- 3.3. Market Restrains

- 3.3.1. Presence of Preservatives in Ready Meals may Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Non-Dairy Milk Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Almond Milk

- 5.1.2. Cashew Milk

- 5.1.3. Coconut Milk

- 5.1.4. Hazelnut Milk

- 5.1.5. Hemp Milk

- 5.1.6. Oat Milk

- 5.1.7. Soy Milk

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Germany Non-Dairy Milk Market Analysis, Insights and Forecast, 2019-2031

- 7. France Germany Non-Dairy Milk Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Germany Non-Dairy Milk Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Germany Non-Dairy Milk Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Germany Non-Dairy Milk Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Europe Germany Non-Dairy Milk Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Califia Farms LLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Ecotone

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 The Hain Celestial Group Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 AlnaturA Produktions - und Handels GmbH

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Danone SA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Oatly Group AB

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Granarolo SpA

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Triballat Noyal Sa

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Califia Farms LLC

List of Figures

- Figure 1: Germany Non-Dairy Milk Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Non-Dairy Milk Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Non-Dairy Milk Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Non-Dairy Milk Market Volume Liters Forecast, by Region 2019 & 2032

- Table 3: Germany Non-Dairy Milk Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Germany Non-Dairy Milk Market Volume Liters Forecast, by Product Type 2019 & 2032

- Table 5: Germany Non-Dairy Milk Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Germany Non-Dairy Milk Market Volume Liters Forecast, by Distribution Channel 2019 & 2032

- Table 7: Germany Non-Dairy Milk Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Germany Non-Dairy Milk Market Volume Liters Forecast, by Region 2019 & 2032

- Table 9: Germany Non-Dairy Milk Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Non-Dairy Milk Market Volume Liters Forecast, by Country 2019 & 2032

- Table 11: Germany Germany Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Germany Non-Dairy Milk Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 13: France Germany Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Germany Non-Dairy Milk Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 15: Italy Germany Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Germany Non-Dairy Milk Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Germany Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Germany Non-Dairy Milk Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Germany Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Germany Non-Dairy Milk Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Germany Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Germany Non-Dairy Milk Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 23: Germany Non-Dairy Milk Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: Germany Non-Dairy Milk Market Volume Liters Forecast, by Product Type 2019 & 2032

- Table 25: Germany Non-Dairy Milk Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 26: Germany Non-Dairy Milk Market Volume Liters Forecast, by Distribution Channel 2019 & 2032

- Table 27: Germany Non-Dairy Milk Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Germany Non-Dairy Milk Market Volume Liters Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Non-Dairy Milk Market?

The projected CAGR is approximately 7.02%.

2. Which companies are prominent players in the Germany Non-Dairy Milk Market?

Key companies in the market include Califia Farms LLC, Ecotone, The Hain Celestial Group Inc, AlnaturA Produktions - und Handels GmbH, Danone SA, Oatly Group AB, Granarolo SpA, Triballat Noyal Sa.

3. What are the main segments of the Germany Non-Dairy Milk Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Preservatives in Ready Meals may Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

August 2022: Califia Farms expanded its portfolio by launching a dairy-free product, the Pumpkin Spice Oat Barista.May 2022: Oatly Group launched its one-hour delivery for its bestselling oat-based products, including oat milk, and frozen non-dairy dessert pints and novelties in Los Angeles and New York City through popular food delivery apps.April 2022: Califia Farms launched an unsweetened Oat Milk designed for at-home consumption and purchase in natural, specialty, and grocery retailers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Liters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Non-Dairy Milk Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Non-Dairy Milk Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Non-Dairy Milk Market?

To stay informed about further developments, trends, and reports in the Germany Non-Dairy Milk Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence