Key Insights

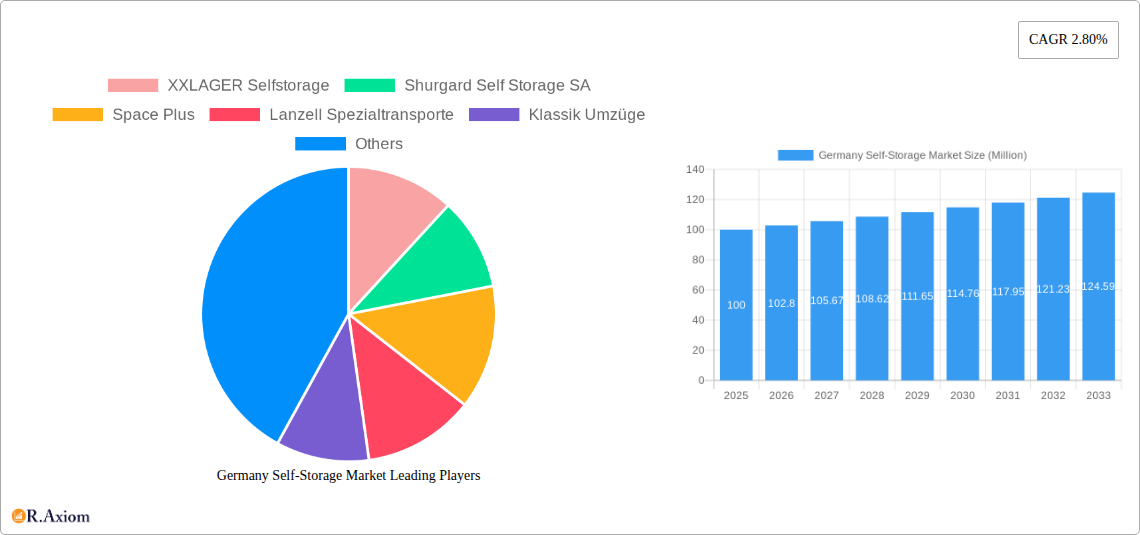

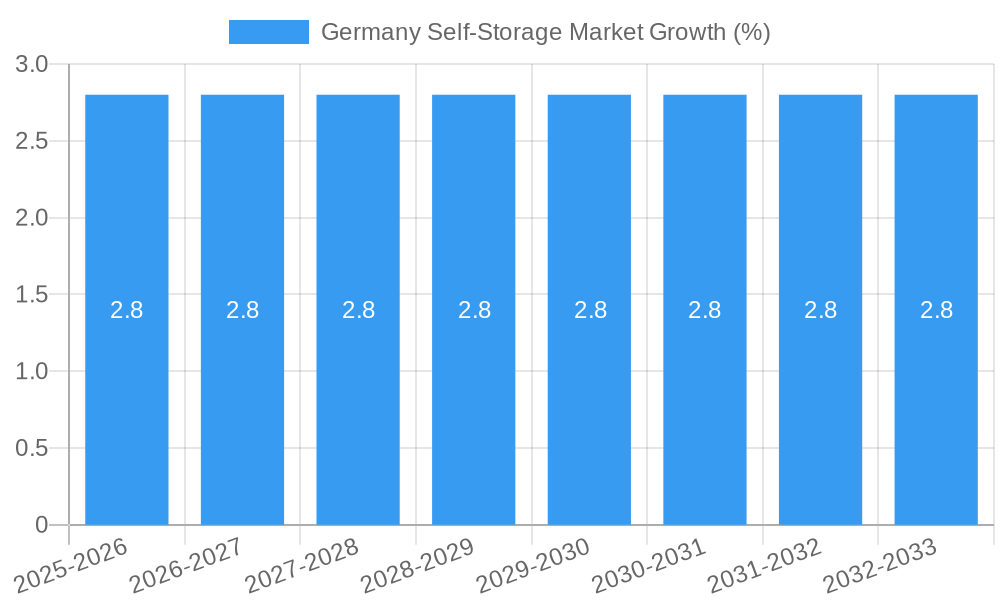

The German self-storage market, valued at approximately €[Estimate based on market size XX and value unit Million, assuming a reasonable value for XX. For example, if XX represents 100, the value would be €100 million in 2025] million in 2025, is experiencing steady growth, projected at a CAGR of 2.80% from 2025 to 2033. This expansion is driven by several key factors. Increasing urbanization in major German cities like Berlin, Munich, and Hamburg leads to a higher demand for flexible storage solutions, particularly among young professionals and individuals relocating frequently. The rise of e-commerce and the growth of online businesses also contribute to the need for additional warehousing space, boosting the business segment of the self-storage market. Furthermore, the improving logistics infrastructure and the increasing awareness of self-storage as a convenient and cost-effective solution compared to traditional storage methods are significant drivers.

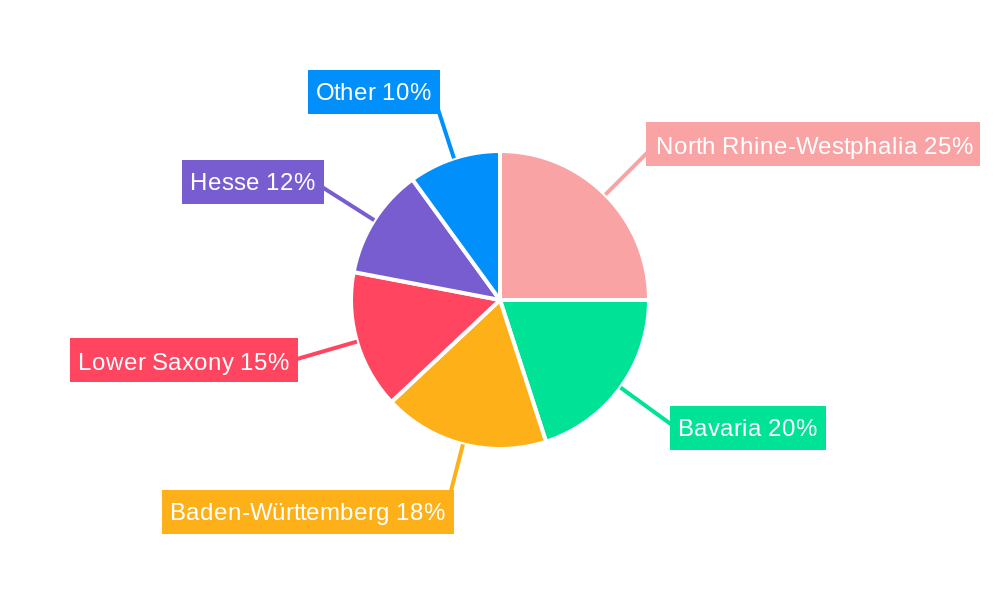

However, the market faces certain constraints. Competition among established players like XXLAGER Selfstorage, Shurgard Self Storage SA, and smaller regional providers can intensify price wars and limit profitability. Economic fluctuations and potential changes in interest rates also influence the market's growth trajectory. Despite these challenges, the market's segmentation, catering to both personal and business needs, presents opportunities for targeted marketing and specialized service offerings. The regional concentration in states like North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse underscores the importance of strategically locating facilities in these high-demand areas. Future growth will depend on addressing the identified constraints while capitalizing on the expanding urban populations and the evolving needs of both individuals and businesses in Germany.

Germany Self-Storage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany self-storage market, encompassing market size, segmentation, competitive landscape, key drivers, challenges, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is essential for industry stakeholders, investors, and businesses seeking to understand and navigate this dynamic market.

Germany Self-Storage Market Market Concentration & Innovation

The German self-storage market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the market also features numerous smaller, regional operators. XXLAGER Selfstorage, Shurgard Self Storage SA, and Space Plus are among the leading companies, although precise market share data remains proprietary. Consolidation through mergers and acquisitions (M&A) is a key trend, with recent deals valued at approximately €xx Million. Innovation is driven by technological advancements, such as online booking platforms and enhanced security features. Regulatory frameworks at the federal and state levels influence market operations and expansion. Product substitutes, like traditional warehousing, remain relevant, yet self-storage's convenience and flexibility continue to fuel growth. End-user trends show increasing demand from both personal and business clients. Furthermore, sustainable practices and environmentally conscious facilities are gaining traction, shaping future market developments.

- Market Concentration: Moderately concentrated, with a few dominant players and numerous smaller operators.

- M&A Activity: Ongoing consolidation, with recent deals totaling approximately €xx Million.

- Innovation Drivers: Technological advancements (online platforms, security), sustainable practices.

- Regulatory Framework: Federal and state regulations impact market operations and expansions.

- End-User Trends: Growing demand from personal and business users, focus on sustainability.

Germany Self-Storage Market Industry Trends & Insights

The German self-storage market demonstrates robust growth, projected to reach €xx Million by 2033, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is relatively high in urban areas, while potential for growth exists in smaller cities and rural regions. Technological disruptions, particularly the adoption of digital platforms for booking and management, are reshaping the customer experience and operational efficiency. Consumer preferences favor convenient locations, secure facilities, and flexible lease terms. Competitive dynamics are shaped by price competition, service differentiation, and strategic expansion strategies. The market's growth is fueled by factors such as increasing urbanization, population growth, e-commerce expansion, and the growing number of mobile and transient workers.

Dominant Markets & Segments in Germany Self-Storage Market

The largest segment within the German self-storage market is the personal storage sector, driven by factors like urbanization, mobility, and the increasing need for flexible storage solutions. The business segment also displays substantial growth, fueled by the requirements of small and medium-sized enterprises (SMEs). Large metropolitan areas, particularly in western Germany, exhibit the highest market concentration due to higher population density, greater economic activity, and established infrastructure.

Key Drivers for Personal Storage:

- Increasing urbanization and population density in major cities.

- Rising mobility and transient lifestyles.

- Demand for convenient and flexible storage options.

- Growth in e-commerce leading to increased home deliveries and storage needs.

Key Drivers for Business Storage:

- Growth of SMEs and startups.

- Increasing demand for flexible workspace solutions.

- Need for secure storage of inventory and documents.

- Cost-effectiveness compared to traditional warehousing.

Dominant Regions: Major metropolitan areas such as Berlin, Munich, Hamburg, Frankfurt, Cologne, Stuttgart, and Düsseldorf show the highest concentration of self-storage facilities and demand. This is driven by high population densities, strong economic activity and better infrastructure.

Germany Self-Storage Market Product Developments

Recent product innovations focus on enhancing security features (e.g., advanced surveillance systems), improving accessibility (e.g., online booking and 24/7 access), and offering specialized storage solutions (e.g., climate-controlled units for sensitive items). These developments reflect technological trends and the market’s evolving needs for convenience, security, and specialized storage options. The integration of technology, such as mobile apps for facility access and payment, provides a competitive advantage and enhances the customer experience.

Report Scope & Segmentation Analysis

This report segments the German self-storage market by user type: Personal and Business.

Personal: The personal segment includes individuals using self-storage for household goods, personal belongings, or recreational equipment. This segment exhibits consistent growth, driven by factors such as urbanization and mobility. The market size for personal storage is projected to reach €xx Million by 2033. Competitive dynamics in this segment are primarily driven by pricing, location, and facility amenities.

Business: The business segment encompasses companies using self-storage for inventory, archives, or equipment. This segment experiences substantial growth due to increasing numbers of SMEs and the demand for flexible workspace solutions. The market size for business storage is expected to reach €xx Million by 2033. Competitive dynamics in this segment focus on facility size, security features, and specialized storage options.

Key Drivers of Germany Self-Storage Market Growth

The German self-storage market's expansion is driven by several interconnected factors:

- Urbanization: Increased population density in cities boosts demand for space-saving solutions.

- E-commerce: The boom in online retail creates a need for storage of inventory and returned goods for businesses.

- Mobility: A transient population requires flexible, short-term storage options.

- Economic growth: Increased disposable income fuels demand for convenient storage solutions.

- Technological advancements: Innovative features enhance customer experience and operational efficiency.

Challenges in the Germany Self-Storage Market Sector

The German self-storage market faces some challenges, including:

- Land scarcity and high property costs in urban areas limit expansion opportunities.

- Intense competition among established and emerging players necessitates strong differentiation strategies.

- Regulatory hurdles concerning zoning and environmental regulations can impede new facility developments.

Emerging Opportunities in Germany Self-Storage Market

Emerging opportunities include:

- Expansion into underserved rural areas: This offers potential for growth beyond saturated urban markets.

- Development of specialized storage solutions: Catering to specific needs (e.g., climate-controlled units, art storage) can attract niche markets.

- Sustainable and eco-friendly facilities: Growing environmental awareness increases demand for green self-storage solutions.

Leading Players in the Germany Self-Storage Market Market

- XXLAGER Selfstorage

- Shurgard Self Storage SA (Shurgard Global Website)

- Space Plus

- Lanzell Spezialtransporte

- Klassik Umzüge

- Hertling GmbH & Co KG

- Rousselet Group (HOMEBOX)

- SelfStorage Dein Lagerraum GmbH (My Place Storage)

- BOXIE

- Pickens Selfstorage GmbH

Key Developments in Germany Self-Storage Market Industry

- November 2023: Shurgard receives planning permission for a new 5,800 sqm facility in Düsseldorf, set to open in 2024.

- March 2023: MyPlace-Self Storage launches "exchange room," a sustainability initiative promoting secondhand goods and local products.

Strategic Outlook for Germany Self-Storage Market Market

The German self-storage market is poised for continued growth, driven by ongoing urbanization, e-commerce expansion, and the increasing demand for flexible storage solutions. Strategic investments in technology, sustainable practices, and expansion into underserved markets will be crucial for success. The focus on providing convenient, secure, and innovative storage solutions will be key to capturing market share and maintaining profitability in this competitive landscape.

Germany Self-Storage Market Segmentation

-

1. User Type

- 1.1. Personal

- 1.2. Business

Germany Self-Storage Market Segmentation By Geography

- 1. Germany

Germany Self-Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Greater Urbanization Coupled with Smaller Living Spaces; Changing Business Practices and COVID-19 Consumer Behavior

- 3.3. Market Restrains

- 3.3.1. Government Regulations on Storage

- 3.4. Market Trends

- 3.4.1. Rising Urbanization and Smaller Living Spaces Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by User Type

- 5.1.1. Personal

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by User Type

- 6. North Rhine-Westphalia Germany Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 XXLAGER Selfstorage

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shurgard Self Storage SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Space Plus

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lanzell Spezialtransporte

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Klassik Umzüge

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hertling GmbH & Co KG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rousselet Group (HOMEBOX)*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SelfStorage Dein Lagerraum GmbH (My Place Storage)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BOXIE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pickens Selfstorage GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 XXLAGER Selfstorage

List of Figures

- Figure 1: Germany Self-Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Self-Storage Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Self-Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Self-Storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 3: Germany Self-Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Germany Self-Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North Rhine-Westphalia Germany Self-Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Bavaria Germany Self-Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Baden-Württemberg Germany Self-Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Lower Saxony Germany Self-Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Hesse Germany Self-Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Self-Storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 11: Germany Self-Storage Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Self-Storage Market?

The projected CAGR is approximately 2.80%.

2. Which companies are prominent players in the Germany Self-Storage Market?

Key companies in the market include XXLAGER Selfstorage, Shurgard Self Storage SA, Space Plus, Lanzell Spezialtransporte, Klassik Umzüge, Hertling GmbH & Co KG, Rousselet Group (HOMEBOX)*List Not Exhaustive, SelfStorage Dein Lagerraum GmbH (My Place Storage), BOXIE, Pickens Selfstorage GmbH.

3. What are the main segments of the Germany Self-Storage Market?

The market segments include User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Greater Urbanization Coupled with Smaller Living Spaces; Changing Business Practices and COVID-19 Consumer Behavior.

6. What are the notable trends driving market growth?

Rising Urbanization and Smaller Living Spaces Drive the Market.

7. Are there any restraints impacting market growth?

Government Regulations on Storage.

8. Can you provide examples of recent developments in the market?

November 2023 - Shurgard, one of the largest developers and operators of self-storage centers in Europe, has received planning permission for a self-storage facility in the Dusseldorf region, one of Germany’s “Big Seven” cities, Where the future c. 5,800 Sqm purpose-built self-storage facility is set to open in 2024 and will offer approximately 750 clean and secure self-storage units to local residents and businesses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Self-Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Self-Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Self-Storage Market?

To stay informed about further developments, trends, and reports in the Germany Self-Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence