Key Insights

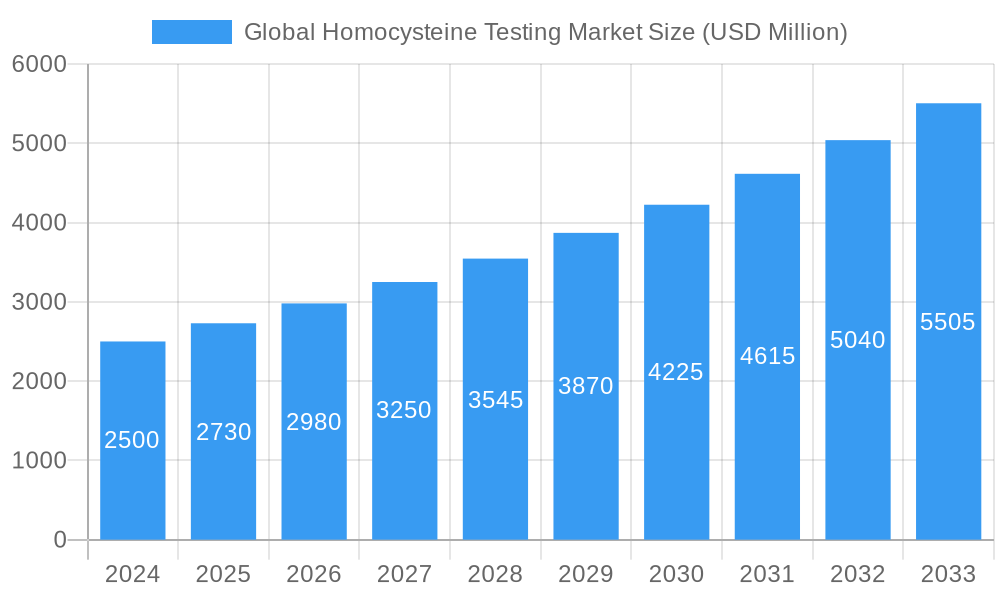

The Global Homocysteine Testing Market is poised for significant expansion, projected to reach an estimated USD 2.5 billion in 2024 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 9.2% through 2033. This dynamic growth is fueled by an increasing awareness of homocysteine's role as a crucial biomarker for cardiovascular diseases, neurological disorders, and pregnancy complications. Advancements in diagnostic technologies, leading to more accurate and accessible testing methods, further accelerate market adoption. The growing prevalence of conditions linked to elevated homocysteine levels, such as cardiovascular disease and stroke, coupled with an aging global population, are primary demand drivers. Furthermore, rising healthcare expenditures and a proactive approach towards preventive healthcare are creating a fertile ground for market expansion. The market is segmented by type, with Folic Acid, Pyridoxine, and Cobalamin tests being pivotal, and by form, with tablets and syrups dominating the therapeutic landscape. Distribution channels like hospital pharmacies and drug stores play a critical role in ensuring widespread availability.

Global Homocysteine Testing Market Market Size (In Billion)

The market's trajectory is further shaped by key trends including the integration of point-of-care testing for rapid diagnostics and the increasing focus on personalized medicine approaches where homocysteine levels guide treatment strategies. While the market presents substantial opportunities, certain restraints, such as the cost of advanced diagnostic equipment and the need for skilled laboratory personnel, could pose challenges. However, ongoing research and development efforts are aimed at mitigating these limitations. Geographically, North America and Europe currently lead the market, driven by established healthcare infrastructures and high diagnostic rates. The Asia Pacific region, however, is emerging as a high-growth market due to increasing healthcare investments and a rising incidence of lifestyle-related diseases. Companies like Pfizer Inc., Mckesson Corporation, and F Hoffmann La Roche are at the forefront, actively innovating and expanding their product portfolios to cater to the evolving demands of this critical diagnostic market.

Global Homocysteine Testing Market Company Market Share

Certainly! Here is the SEO-optimized, detailed report description for the Global Homocysteine Testing Market, incorporating high-traffic keywords and structured as requested.

Global Homocysteine Testing Market Market Concentration & Innovation

The Global Homocysteine Testing Market exhibits a moderate level of concentration, with key players like Pfizer Inc., McKesson Corporation, F. Hoffmann-La Roche, and Cardinal Health Inc. holding significant market shares. Innovation is a primary driver, fueled by advancements in diagnostic technologies, particularly in immunoassay and LC-MS/MS methods, leading to more accurate and efficient homocysteine level detection. Regulatory frameworks, such as those overseen by the FDA and EMA, play a crucial role in approving new testing kits and devices, ensuring quality and safety. Product substitutes, while not direct, include alternative cardiovascular risk assessment methods, emphasizing the need for continued innovation in homocysteine testing to maintain its competitive edge. End-user trends point towards an increasing demand for point-of-care testing and home-use diagnostic kits, driven by convenience and early disease detection. Mergers and acquisitions (M&A) are anticipated to shape the market landscape, with potential deal values in the hundreds of millions to billions of dollars, aimed at expanding product portfolios and geographic reach. For instance, a hypothetical acquisition of a smaller diagnostics firm by a major player could consolidate market share and foster further innovation, with estimated deal values reaching approximately $500 million to $1.2 billion.

Global Homocysteine Testing Market Industry Trends & Insights

The Global Homocysteine Testing Market is poised for substantial growth, driven by an escalating prevalence of cardiovascular diseases (CVDs) and the growing recognition of homocysteine as a significant risk factor. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 6.5% to 8.0% during the forecast period of 2025–2033, reaching an estimated market size of over $3.5 billion by 2033. Technological disruptions, including the development of high-throughput automated analyzers and more sensitive immunoassay kits, are enhancing diagnostic accuracy and efficiency, thereby increasing market penetration. Consumer preferences are shifting towards proactive health management and early disease detection, leading to a greater demand for homocysteine testing, especially among individuals with a family history of CVD or those exhibiting risk factors like hypertension and hyperlipidemia. Competitive dynamics are characterized by fierce R&D investments, strategic partnerships, and a focus on expanding distribution networks to cater to diverse healthcare settings globally. The integration of artificial intelligence (AI) and machine learning (ML) in interpreting test results and predicting disease risk presents a significant future trend, promising to further revolutionize homocysteine testing. Furthermore, the increasing adoption of personalized medicine approaches underscores the value of homocysteine testing as a biomarker for tailoring treatment strategies. The market penetration for homocysteine testing in developed economies is already significant, projected to reach over 55% of the target population by 2030, while emerging economies present substantial untapped potential.

Dominant Markets & Segments in Global Homocysteine Testing Market

The Global Homocysteine Testing Market is witnessing dominance in North America, largely driven by its advanced healthcare infrastructure, high prevalence of cardiovascular diseases, and robust R&D investments. The United States, in particular, represents a significant market share, estimated to be around 35% of the global market. Key drivers for this dominance include substantial government funding for healthcare research, widespread adoption of advanced diagnostic technologies, and strong awareness among both healthcare professionals and the public regarding the importance of homocysteine testing for cardiovascular risk assessment.

Type: Folic Acid The Folic Acid segment is a major driver within the homocysteine testing landscape. The clear correlation between folic acid deficiency and elevated homocysteine levels makes this segment critical for diagnosis and management.

- Key Drivers: Increased public awareness campaigns promoting the role of folic acid in preventing birth defects and cardiovascular issues, government initiatives mandating folic acid fortification in staple foods, and the widespread availability of folic acid supplements contribute to the demand for testing.

- Dominance Analysis: The demand for folic acid testing is amplified by its dual role in prenatal care and cardiovascular health, creating a consistent and significant market.

Form: Tablet The Tablet form factor is particularly prevalent for reagents and supplements used in conjunction with homocysteine testing or for managing elevated levels.

- Key Drivers: Ease of administration, extended shelf life, and cost-effectiveness make tablets a preferred choice for both patients and healthcare providers. The convenience of oral intake aligns with patient compliance.

- Dominance Analysis: The established manufacturing processes and consumer familiarity with tablet-based medications and supplements contribute to its market leadership.

Distribution Channel: Hospital Pharmacies Hospital pharmacies represent a crucial distribution channel due to the critical nature of homocysteine testing in managing acute and chronic cardiovascular conditions.

- Key Drivers: Hospitals serve as central hubs for advanced diagnostics and patient care, ensuring direct access to testing facilities and expert medical guidance. The presence of specialized cardiology departments further bolsters demand.

- Dominance Analysis: The concentration of diagnostic laboratories and healthcare professionals within hospital settings makes them primary points for homocysteine testing, driving significant revenue for this channel.

Global Homocysteine Testing Market Product Developments

Product developments in the Global Homocysteine Testing Market are focused on enhancing accuracy, speed, and accessibility. Innovations include the development of more sensitive immunoassay kits that offer faster turnaround times and improved detection limits. Furthermore, advancements in point-of-care (POC) devices are enabling rapid homocysteine level assessment at the physician's office or even in remote settings, offering significant competitive advantages by facilitating immediate clinical decisions. The integration of automation in laboratory testing platforms by companies like ARUP Laboratories is also a key trend, leading to increased throughput and reduced human error. These developments are crucial for meeting the growing demand for timely and reliable cardiovascular risk assessment.

Report Scope & Segmentation Analysis

This comprehensive report analyzes the Global Homocysteine Testing Market across various critical segments to provide an in-depth understanding of its dynamics. The market is segmented by Type, including Folic Acid, Pyridoxine, and Cobalamin, each playing a distinct role in homocysteine metabolism and cardiovascular health. The Form segment encompasses Tablets, Syrups, and Others, reflecting the diverse delivery mechanisms for related diagnostic reagents and therapeutic interventions. Distribution Channels are categorized into Hospital Pharmacies, Drug Stores, and Others, highlighting the varied access points for these testing solutions. Growth projections and market sizes for each segment are meticulously detailed, with a focus on competitive landscapes and the specific growth catalysts influencing each area.

Key Drivers of Global Homocysteine Testing Market Growth

The Global Homocysteine Testing Market is propelled by a confluence of powerful drivers. The escalating global burden of cardiovascular diseases is a primary impetus, as elevated homocysteine levels are increasingly recognized as a significant risk factor. Technological advancements in diagnostic methodologies, such as the development of more sensitive and automated immunoassay techniques, are enhancing the accuracy and efficiency of testing, making it more accessible and reliable. Growing awareness among healthcare professionals and the general public about the implications of hyperhomocysteinemia for cardiovascular health is fostering greater demand for routine testing. Government initiatives promoting preventive healthcare and early disease detection further support market expansion. For instance, the increased focus on personalized medicine approaches necessitates precise biomarker assessment, with homocysteine playing a vital role.

Challenges in the Global Homocysteine Testing Market Sector

Despite robust growth, the Global Homocysteine Testing Market faces several challenges. The lack of standardized diagnostic protocols and reference ranges across different laboratories can lead to variability in test results, impacting clinical interpretation and patient management. High costs associated with advanced testing equipment and reagents can be a barrier, particularly in resource-limited settings. Stringent regulatory approvals for new diagnostic kits and devices can also slow down market entry for innovative products. Moreover, while homocysteine is a recognized risk factor, its specific role in cardiovascular disease is still a subject of ongoing research, leading to occasional debates regarding its sole predictive power, which can affect physician prescribing habits. Competitive pressures from established players and the emergence of alternative risk assessment tools also pose challenges, requiring continuous innovation and cost-effectiveness.

Emerging Opportunities in Global Homocysteine Testing Market

The Global Homocysteine Testing Market is ripe with emerging opportunities, primarily driven by the growing focus on precision medicine and preventive healthcare. The development of more integrated diagnostic platforms that combine homocysteine testing with other cardiovascular risk biomarkers presents a significant avenue for growth. Expansion into emerging economies with increasing healthcare expenditure and a rising prevalence of lifestyle-related diseases offers substantial untapped market potential. The advancement of point-of-care (POC) testing technologies is opening doors for at-home diagnostic kits and rapid testing in primary care settings, catering to patient convenience and early intervention. Furthermore, the increasing use of artificial intelligence (AI) and machine learning (ML) for analyzing complex biomarker data, including homocysteine levels, for more accurate risk prediction and personalized treatment recommendations, represents a transformative opportunity.

Leading Players in the Global Homocysteine Testing Market Market

- Pfizer Inc.

- McKesson Corporation

- Machaon Diagnostics

- F. Hoffmann-La Roche

- Cardinal Health Inc.

- Teligent Inc.

- Sekisui Diagnostics

- Kripps Pharmacy Ltd

- ARUP Laboratories

- Jamp Pharma Corporation

Key Developments in Global Homocysteine Testing Market Industry

- June 2021: ARUP Laboratories officially opened its four-story, 220,000-square-foot laboratory in Salt Lake City, designed to optimize quality laboratory testing. It features total lab automation to further increase testing capacity and accommodate growth at ARUP.

- April 2021: Cardinal Health was awarded a USD 57.8 million contract, including options that could be exercised by the United States Department of Health and Human Services to reach USD 91.6 million.

Strategic Outlook for Global Homocysteine Testing Market Market

The strategic outlook for the Global Homocysteine Testing Market is highly promising, driven by persistent growth catalysts. The increasing adoption of personalized medicine and the ongoing expansion of diagnostic capabilities in emerging markets will continue to fuel demand. Key strategies for stakeholders include investing in R&D to develop more accurate, rapid, and cost-effective testing solutions, particularly for point-of-care applications. Strategic partnerships and collaborations between diagnostic companies, pharmaceutical firms, and healthcare providers will be crucial for market penetration and expanding the reach of homocysteine testing. Focus on user-friendly interfaces for both laboratory professionals and end-users, coupled with robust educational initiatives to enhance awareness about the significance of homocysteine testing in cardiovascular risk stratification, will be paramount for sustained market leadership and growth, estimated to reach over $4.0 billion by 2033.

Global Homocysteine Testing Market Segmentation

-

1. Type

- 1.1. Folic Acid

- 1.2. Pyridoxine

- 1.3. Cobalamin

-

2. Form

- 2.1. Tablet

- 2.2. Syrup

- 2.3. Others

-

3. Distribution Channel

- 3.1. Hospital Pharmacies

- 3.2. Drug Stores

- 3.3. Others

Global Homocysteine Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Homocysteine Testing Market Regional Market Share

Geographic Coverage of Global Homocysteine Testing Market

Global Homocysteine Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Increasing life style habits leading to risks of heart and renal diseases

- 3.3. Market Restrains

- 3.3.1. Lack of awareness regarding the deficiency of vitamins in blood

- 3.4. Market Trends

- 3.4.1. The Folic Acid Segment is Expected to Hold a Major Market Share in the Homocysteine Testing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Homocysteine Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Folic Acid

- 5.1.2. Pyridoxine

- 5.1.3. Cobalamin

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Tablet

- 5.2.2. Syrup

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hospital Pharmacies

- 5.3.2. Drug Stores

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Global Homocysteine Testing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Folic Acid

- 6.1.2. Pyridoxine

- 6.1.3. Cobalamin

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Tablet

- 6.2.2. Syrup

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hospital Pharmacies

- 6.3.2. Drug Stores

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Global Homocysteine Testing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Folic Acid

- 7.1.2. Pyridoxine

- 7.1.3. Cobalamin

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Tablet

- 7.2.2. Syrup

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hospital Pharmacies

- 7.3.2. Drug Stores

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Global Homocysteine Testing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Folic Acid

- 8.1.2. Pyridoxine

- 8.1.3. Cobalamin

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Tablet

- 8.2.2. Syrup

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hospital Pharmacies

- 8.3.2. Drug Stores

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Global Homocysteine Testing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Folic Acid

- 9.1.2. Pyridoxine

- 9.1.3. Cobalamin

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Tablet

- 9.2.2. Syrup

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hospital Pharmacies

- 9.3.2. Drug Stores

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Global Homocysteine Testing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Folic Acid

- 10.1.2. Pyridoxine

- 10.1.3. Cobalamin

- 10.2. Market Analysis, Insights and Forecast - by Form

- 10.2.1. Tablet

- 10.2.2. Syrup

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Hospital Pharmacies

- 10.3.2. Drug Stores

- 10.3.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Pfizer Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mckesson Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Machaon Diagnostics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 F Hoffmann La Roche

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cardinal Health Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Teligent Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sekisui Diagnostics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kripps Pharmacy Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ARUP laboratories

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Jamp Pharma Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Pfizer Inc

List of Figures

- Figure 1: Global Global Homocysteine Testing Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Global Homocysteine Testing Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Global Homocysteine Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Global Homocysteine Testing Market Revenue (undefined), by Form 2025 & 2033

- Figure 5: North America Global Homocysteine Testing Market Revenue Share (%), by Form 2025 & 2033

- Figure 6: North America Global Homocysteine Testing Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 7: North America Global Homocysteine Testing Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Global Homocysteine Testing Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Global Homocysteine Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Global Homocysteine Testing Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Europe Global Homocysteine Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Global Homocysteine Testing Market Revenue (undefined), by Form 2025 & 2033

- Figure 13: Europe Global Homocysteine Testing Market Revenue Share (%), by Form 2025 & 2033

- Figure 14: Europe Global Homocysteine Testing Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 15: Europe Global Homocysteine Testing Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Global Homocysteine Testing Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Global Homocysteine Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Global Homocysteine Testing Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Asia Pacific Global Homocysteine Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Global Homocysteine Testing Market Revenue (undefined), by Form 2025 & 2033

- Figure 21: Asia Pacific Global Homocysteine Testing Market Revenue Share (%), by Form 2025 & 2033

- Figure 22: Asia Pacific Global Homocysteine Testing Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Global Homocysteine Testing Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Global Homocysteine Testing Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Global Homocysteine Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Global Homocysteine Testing Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Global Homocysteine Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Global Homocysteine Testing Market Revenue (undefined), by Form 2025 & 2033

- Figure 29: Middle East and Africa Global Homocysteine Testing Market Revenue Share (%), by Form 2025 & 2033

- Figure 30: Middle East and Africa Global Homocysteine Testing Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 31: Middle East and Africa Global Homocysteine Testing Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East and Africa Global Homocysteine Testing Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Global Homocysteine Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Global Homocysteine Testing Market Revenue (undefined), by Type 2025 & 2033

- Figure 35: South America Global Homocysteine Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America Global Homocysteine Testing Market Revenue (undefined), by Form 2025 & 2033

- Figure 37: South America Global Homocysteine Testing Market Revenue Share (%), by Form 2025 & 2033

- Figure 38: South America Global Homocysteine Testing Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 39: South America Global Homocysteine Testing Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: South America Global Homocysteine Testing Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Global Homocysteine Testing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Homocysteine Testing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Homocysteine Testing Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 3: Global Homocysteine Testing Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Homocysteine Testing Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Homocysteine Testing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Homocysteine Testing Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 7: Global Homocysteine Testing Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Homocysteine Testing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Homocysteine Testing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global Homocysteine Testing Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 14: Global Homocysteine Testing Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Homocysteine Testing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Homocysteine Testing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 23: Global Homocysteine Testing Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 24: Global Homocysteine Testing Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Homocysteine Testing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Homocysteine Testing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global Homocysteine Testing Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 34: Global Homocysteine Testing Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Homocysteine Testing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global Homocysteine Testing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 40: Global Homocysteine Testing Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 41: Global Homocysteine Testing Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Homocysteine Testing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Homocysteine Testing Market?

The projected CAGR is approximately 9.2%.

2. Which companies are prominent players in the Global Homocysteine Testing Market?

Key companies in the market include Pfizer Inc, Mckesson Corporation, Machaon Diagnostics, F Hoffmann La Roche, Cardinal Health Inc, Teligent Inc, Sekisui Diagnostics, Kripps Pharmacy Ltd, ARUP laboratories, Jamp Pharma Corporation.

3. What are the main segments of the Global Homocysteine Testing Market?

The market segments include Type, Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Increasing life style habits leading to risks of heart and renal diseases.

6. What are the notable trends driving market growth?

The Folic Acid Segment is Expected to Hold a Major Market Share in the Homocysteine Testing Market.

7. Are there any restraints impacting market growth?

Lack of awareness regarding the deficiency of vitamins in blood.

8. Can you provide examples of recent developments in the market?

In June 2021, ARUP laboratories officially opened its four-story, 220,000-square-foot laboratory in Salt Lake City. It is designed to optimize quality laboratory testing, it features total lab automation to further increase testing capacity and accommodate growth at ARUP.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Homocysteine Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Homocysteine Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Homocysteine Testing Market?

To stay informed about further developments, trends, and reports in the Global Homocysteine Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence