Key Insights

The Global Patient-Derived Xenograft (PDX) Models Market is poised for significant expansion, driven by a projected Compound Annual Growth Rate (CAGR) of 17.01%. This robust growth trajectory anticipates the market reaching a substantial valuation by 2025, estimated at 319 million. The increasing global burden of cancer underscores the critical need for advanced preclinical models in drug development and personalized medicine. PDX models, offering superior translational relevance compared to traditional cell lines, are becoming essential for accelerating drug discovery and enhancing treatment efficacy. Growing demand for personalized oncology therapies, coupled with increased R&D investments, further fuels this market expansion. Key tumor types like gastrointestinal, gynecological, and respiratory cancers are significant contributors, with widespread adoption across pharmaceutical & biotechnology companies and academic & research institutions.

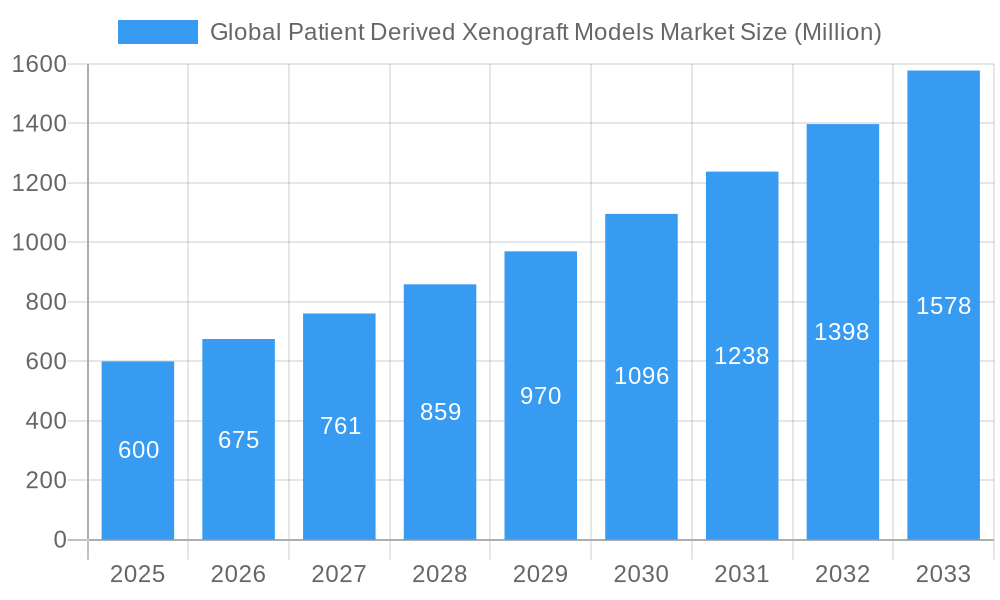

Global Patient Derived Xenograft Models Market Market Size (In Million)

Market segmentation highlights a strong specialization in model types (mice and rats) and tumor types. Geographically, North America and Europe are expected to lead due to established research infrastructure and regulatory frameworks. However, Asia-Pacific, particularly China and India, presents significant growth opportunities with their rapidly expanding economies. Potential market restraints include the high cost and complexity of developing and standardizing PDX models. Nevertheless, continuous technological advancements and the recognized predictive capabilities of PDX models are anticipated to overcome these challenges, ensuring sustained market growth through the forecast period, with a base year of 2025.

Global Patient Derived Xenograft Models Market Company Market Share

This comprehensive market analysis provides actionable insights into the Global Patient-Derived Xenograft (PDX) Models Market for the period 2025-2033. It covers market size, segmentation, growth drivers, challenges, and future opportunities, offering a precise and up-to-date understanding for stakeholders in the pharmaceutical, biotechnology, and research sectors.

Global Patient Derived Xenograft Models Market Market Concentration & Innovation

The global PDX models market exhibits a moderately concentrated landscape, with key players like Champions Oncology Inc, Xentech, Pharmatest Services Ltd, Crown Bioscience Inc, Oncodesign, EPO Berlin-Buch GmbH, Charles River Laboratories Inc, Urolead, and Hera BioLabs vying for market share. Market concentration is influenced by factors such as technological advancements, regulatory approvals, and strategic partnerships. Precise market share data for each player requires further analysis and isn't readily available for this report description; however, industry estimates suggest a few major players control xx% of the market, while the remaining xx% is shared by smaller companies and emerging players. The market's innovative landscape is fueled by advancements in gene editing technologies (like CRISPR), development of more sophisticated and disease-relevant models, and increasing demand for personalized medicine.

Regulatory frameworks, including those set by agencies like the FDA, significantly influence market growth and product development. While PDX models offer significant advantages, substituting them with alternative preclinical models remains a factor. However, the unique ability of PDX models to accurately reflect human tumor heterogeneity and response to treatment is gradually establishing them as the gold standard in many research applications. The increasing adoption of PDX models by pharmaceutical and biotechnology companies and academic institutions is a major driving force. Significant M&A activities, while specific deal values are unavailable for inclusion here, have also shaped market dynamics in recent years, consolidating market presence and influencing technological innovation. Examples include licensing agreements as detailed below in the Key Developments section.

Global Patient Derived Xenograft Models Market Industry Trends & Insights

The global Patient Derived Xenograft Models market is experiencing robust growth, propelled by several key factors. The rising prevalence of cancer globally and the increasing need for effective cancer therapies are major drivers. The demand for personalized medicine, which tailors treatment strategies to individual patient characteristics, is another significant factor. PDX models play a crucial role in this approach, facilitating the development of targeted therapies and improving drug efficacy predictions. The market is witnessing significant technological disruptions, with advancements in gene editing and other molecular technologies enabling the creation of more precise and sophisticated PDX models. This is leading to improved experimental reproducibility and more accurate preclinical data. The market's growth is projected to continue with a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, with significant market penetration projected in areas like oncology drug discovery and development. Increasing government funding for cancer research and the growing number of collaborations between pharmaceutical companies and research institutions are also contributing to market expansion.

Dominant Markets & Segments in Global Patient Derived Xenograft Models Market

The North American region is currently the dominant market for PDX models, driven by robust healthcare infrastructure, significant investments in R&D, and a large number of pharmaceutical and biotech companies. Within this market, the Mice Model segment dominates the Type segment, due to the widespread availability and established use of mice in preclinical studies. However, the Rats Model segment is experiencing growth due to its relevance in certain disease models.

- Key Drivers for North American Dominance:

- Strong regulatory framework supporting preclinical research

- High level of venture capital and private equity investments in biotech

- Presence of major pharmaceutical and biotech companies

- Established infrastructure for preclinical research and development

Within Tumor Type, the Gastrointestinal Tumor Model holds a significant share due to the high prevalence of gastrointestinal cancers. However, other tumor types, such as Gynecological Tumor Model, Respiratory Tumor Model, and Other Tumor Model segments are witnessing increasing demand due to rising cancer incidences in those areas. The Pharmaceutical & Biotechnology Companies segment accounts for the largest share within the End User segment, owing to their substantial investment in drug discovery and development. However, the Academic & Research Institutions segment exhibits considerable growth, driven by rising research activities in cancer biology.

Global Patient Derived Xenograft Models Market Product Developments

Recent product innovations focus on enhancing model fidelity and expanding their applications. Advances in gene editing, such as CRISPR-Cas9 technology, have enabled the creation of more precise and customized PDX models that mimic specific genetic mutations and phenotypic characteristics observed in patients. This allows for better prediction of drug efficacy and identification of biomarkers associated with treatment response. Furthermore, the integration of "omics" technologies (genomics, proteomics) enhances the data derived from PDX studies, allowing for comprehensive analysis of tumor biology and response to therapy. This increased data richness and accuracy of the models are becoming major competitive advantages for companies involved in their development and commercialization.

Report Scope & Segmentation Analysis

This report segments the PDX models market by Type (Mice Model, Rats Model), Tumor Type (Gastrointestinal Tumor Model, Gynecological Tumor Model, Respiratory Tumor Model, Other Tumor Model), and End User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutions, Others). Each segment’s market size is assessed for the historical period (2019-2024), base year (2025), estimated year (2025), and forecast period (2025-2033). The report analyzes growth projections, market size, and competitive dynamics for each segment, taking into account technological advancements, regulatory developments, and emerging trends. For example, the Mice Model segment is expected to maintain dominance due to its established use and extensive resources, while the Rats Model segment is poised for growth in specific applications. Similar analyses are conducted across Tumor Type and End-User segments.

Key Drivers of Global Patient Derived Xenograft Models Market Growth

The global PDX models market is driven by several factors. The growing prevalence of cancer worldwide necessitates the development of more effective therapies, fueling the demand for reliable preclinical models. Advancements in gene editing and other molecular technologies have significantly improved the accuracy and reproducibility of PDX models, making them a preferred choice for researchers. Furthermore, increasing government funding for cancer research and collaborations between pharmaceutical companies and academic institutions have boosted the development and adoption of PDX models. The rising demand for personalized medicine is another crucial driver, as PDX models allow researchers to test the efficacy of targeted therapies on patient-specific tumor samples.

Challenges in the Global Patient Derived Xenograft Models Market Sector

The PDX models market faces challenges. High costs associated with establishing and maintaining PDX models can hinder wider adoption, especially by smaller research institutions. The complexity of PDX model development and maintenance requires specialized expertise and infrastructure, representing another barrier to entry. Regulatory hurdles and stringent guidelines surrounding the use of animal models in research can also impact market growth. Lastly, competition from alternative preclinical models, while less accurate, presents another challenge to widespread PDX model adoption. These factors collectively limit market expansion to some degree.

Emerging Opportunities in Global Patient Derived Xenograft Models Market

The increasing use of advanced technologies like AI and machine learning to analyze PDX data presents significant opportunities for market expansion. The development of PDX models that incorporate immune components to better reflect the complexity of the tumor microenvironment offers exciting prospects for improving drug development efficiency. Moreover, exploring the application of PDX models in areas beyond oncology, such as infectious diseases and immunology, could unlock new growth avenues. Finally, the growing interest in organoid and other 3D cell culture models, coupled with PDX models, could lead to a more comprehensive and accurate preclinical evaluation approach.

Leading Players in the Global Patient Derived Xenograft Models Market Market

- Champions Oncology Inc

- Xentech

- Pharmatest Services Ltd

- Crown Bioscience Inc

- Oncodesign

- EPO Berlin-Buch GmbH

- Charles River Laboratories Inc

- Urolead

- Hera BioLabs

Key Developments in Global Patient Derived Xenograft Models Market Industry

- July 2022: GemPharmatech (GemPharmatech Co., Ltd.) and Charles River Laboratories, Inc. announced a strategic licensing agreement for the exclusive distribution of GemPharmatech's next-generation NOD CRISPR Prkdc Il2r gamma (NCG) mouse lines in North America, impacting market access and competition.

- April 2022: Professor Kamimura's research group at Niigata University established a novel pancreatic carcinogenesis model in wild-type rats, advancing modeling capabilities and potential applications in preclinical research.

Strategic Outlook for Global Patient Derived Xenograft Models Market Market

The future of the PDX models market is bright. Continued technological advancements, increased demand for personalized medicine, and growing government funding for cancer research will drive market expansion. Strategic partnerships between pharmaceutical companies, biotechnology firms, and academic institutions will play a pivotal role in fostering innovation and accelerating the development and adoption of improved PDX models. The integration of advanced technologies and the expansion of PDX model applications beyond oncology are set to create significant growth opportunities in the coming years, ensuring sustained market progress.

Global Patient Derived Xenograft Models Market Segmentation

-

1. Type

- 1.1. Mice Model

- 1.2. Rats Model

-

2. Tumor Type

- 2.1. Gastrointestinal Tumor Model

- 2.2. Gynecological Tumor Model

- 2.3. Respiratory Tumor Model

- 2.4. Other Tumor Model

-

3. End User

- 3.1. Pharmaceutical & Biotechnology Companies

- 3.2. Academic & Research Institutions

- 3.3. Others

Global Patient Derived Xenograft Models Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Global Patient Derived Xenograft Models Market Regional Market Share

Geographic Coverage of Global Patient Derived Xenograft Models Market

Global Patient Derived Xenograft Models Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Cases of Cancer; Rising R&D Activities in the Pharmaceutical Industry; Continuous Support for Cancer Research From Public as Well as Private Sector

- 3.3. Market Restrains

- 3.3.1. High Cost of Personalized Patient Derived Xenograft Models; Stringent Regulations Towards Use of Animals Models

- 3.4. Market Trends

- 3.4.1. Mice Model Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Patient Derived Xenograft Models Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mice Model

- 5.1.2. Rats Model

- 5.2. Market Analysis, Insights and Forecast - by Tumor Type

- 5.2.1. Gastrointestinal Tumor Model

- 5.2.2. Gynecological Tumor Model

- 5.2.3. Respiratory Tumor Model

- 5.2.4. Other Tumor Model

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pharmaceutical & Biotechnology Companies

- 5.3.2. Academic & Research Institutions

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Global Patient Derived Xenograft Models Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mice Model

- 6.1.2. Rats Model

- 6.2. Market Analysis, Insights and Forecast - by Tumor Type

- 6.2.1. Gastrointestinal Tumor Model

- 6.2.2. Gynecological Tumor Model

- 6.2.3. Respiratory Tumor Model

- 6.2.4. Other Tumor Model

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pharmaceutical & Biotechnology Companies

- 6.3.2. Academic & Research Institutions

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Global Patient Derived Xenograft Models Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mice Model

- 7.1.2. Rats Model

- 7.2. Market Analysis, Insights and Forecast - by Tumor Type

- 7.2.1. Gastrointestinal Tumor Model

- 7.2.2. Gynecological Tumor Model

- 7.2.3. Respiratory Tumor Model

- 7.2.4. Other Tumor Model

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pharmaceutical & Biotechnology Companies

- 7.3.2. Academic & Research Institutions

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Global Patient Derived Xenograft Models Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mice Model

- 8.1.2. Rats Model

- 8.2. Market Analysis, Insights and Forecast - by Tumor Type

- 8.2.1. Gastrointestinal Tumor Model

- 8.2.2. Gynecological Tumor Model

- 8.2.3. Respiratory Tumor Model

- 8.2.4. Other Tumor Model

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pharmaceutical & Biotechnology Companies

- 8.3.2. Academic & Research Institutions

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Global Patient Derived Xenograft Models Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mice Model

- 9.1.2. Rats Model

- 9.2. Market Analysis, Insights and Forecast - by Tumor Type

- 9.2.1. Gastrointestinal Tumor Model

- 9.2.2. Gynecological Tumor Model

- 9.2.3. Respiratory Tumor Model

- 9.2.4. Other Tumor Model

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Pharmaceutical & Biotechnology Companies

- 9.3.2. Academic & Research Institutions

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Champions Oncology Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Xentech

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Pharmatest Services Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Crown Bioscience Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Oncodesign

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 EPO Berlin-Buch GmbH

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Charles River Laboratories Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Urolead

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hera BioLabs

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Champions Oncology Inc

List of Figures

- Figure 1: Global Global Patient Derived Xenograft Models Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Global Patient Derived Xenograft Models Market Revenue (million), by Type 2025 & 2033

- Figure 3: North America Global Patient Derived Xenograft Models Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Global Patient Derived Xenograft Models Market Revenue (million), by Tumor Type 2025 & 2033

- Figure 5: North America Global Patient Derived Xenograft Models Market Revenue Share (%), by Tumor Type 2025 & 2033

- Figure 6: North America Global Patient Derived Xenograft Models Market Revenue (million), by End User 2025 & 2033

- Figure 7: North America Global Patient Derived Xenograft Models Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Global Patient Derived Xenograft Models Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Global Patient Derived Xenograft Models Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Global Patient Derived Xenograft Models Market Revenue (million), by Type 2025 & 2033

- Figure 11: Europe Global Patient Derived Xenograft Models Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Global Patient Derived Xenograft Models Market Revenue (million), by Tumor Type 2025 & 2033

- Figure 13: Europe Global Patient Derived Xenograft Models Market Revenue Share (%), by Tumor Type 2025 & 2033

- Figure 14: Europe Global Patient Derived Xenograft Models Market Revenue (million), by End User 2025 & 2033

- Figure 15: Europe Global Patient Derived Xenograft Models Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Global Patient Derived Xenograft Models Market Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Global Patient Derived Xenograft Models Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Global Patient Derived Xenograft Models Market Revenue (million), by Type 2025 & 2033

- Figure 19: Asia Pacific Global Patient Derived Xenograft Models Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Global Patient Derived Xenograft Models Market Revenue (million), by Tumor Type 2025 & 2033

- Figure 21: Asia Pacific Global Patient Derived Xenograft Models Market Revenue Share (%), by Tumor Type 2025 & 2033

- Figure 22: Asia Pacific Global Patient Derived Xenograft Models Market Revenue (million), by End User 2025 & 2033

- Figure 23: Asia Pacific Global Patient Derived Xenograft Models Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Global Patient Derived Xenograft Models Market Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Global Patient Derived Xenograft Models Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Global Patient Derived Xenograft Models Market Revenue (million), by Type 2025 & 2033

- Figure 27: Rest of the World Global Patient Derived Xenograft Models Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Global Patient Derived Xenograft Models Market Revenue (million), by Tumor Type 2025 & 2033

- Figure 29: Rest of the World Global Patient Derived Xenograft Models Market Revenue Share (%), by Tumor Type 2025 & 2033

- Figure 30: Rest of the World Global Patient Derived Xenograft Models Market Revenue (million), by End User 2025 & 2033

- Figure 31: Rest of the World Global Patient Derived Xenograft Models Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Rest of the World Global Patient Derived Xenograft Models Market Revenue (million), by Country 2025 & 2033

- Figure 33: Rest of the World Global Patient Derived Xenograft Models Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Tumor Type 2020 & 2033

- Table 3: Global Patient Derived Xenograft Models Market Revenue million Forecast, by End User 2020 & 2033

- Table 4: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Tumor Type 2020 & 2033

- Table 7: Global Patient Derived Xenograft Models Market Revenue million Forecast, by End User 2020 & 2033

- Table 8: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Type 2020 & 2033

- Table 13: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Tumor Type 2020 & 2033

- Table 14: Global Patient Derived Xenograft Models Market Revenue million Forecast, by End User 2020 & 2033

- Table 15: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Germany Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Spain Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Type 2020 & 2033

- Table 23: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Tumor Type 2020 & 2033

- Table 24: Global Patient Derived Xenograft Models Market Revenue million Forecast, by End User 2020 & 2033

- Table 25: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Country 2020 & 2033

- Table 26: China Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Japan Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: India Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Australia Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Type 2020 & 2033

- Table 33: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Tumor Type 2020 & 2033

- Table 34: Global Patient Derived Xenograft Models Market Revenue million Forecast, by End User 2020 & 2033

- Table 35: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Patient Derived Xenograft Models Market?

The projected CAGR is approximately 17.01%.

2. Which companies are prominent players in the Global Patient Derived Xenograft Models Market?

Key companies in the market include Champions Oncology Inc, Xentech, Pharmatest Services Ltd, Crown Bioscience Inc, Oncodesign, EPO Berlin-Buch GmbH, Charles River Laboratories Inc, Urolead, Hera BioLabs.

3. What are the main segments of the Global Patient Derived Xenograft Models Market?

The market segments include Type, Tumor Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 319 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Cases of Cancer; Rising R&D Activities in the Pharmaceutical Industry; Continuous Support for Cancer Research From Public as Well as Private Sector.

6. What are the notable trends driving market growth?

Mice Model Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Personalized Patient Derived Xenograft Models; Stringent Regulations Towards Use of Animals Models.

8. Can you provide examples of recent developments in the market?

July 2022: GemPharmatech (GemPharmatech Co., Ltd.) announced that it has entered into a strategic license agreement with Charles River Laboratories, Inc. for exclusive distribution of its next-generation NOD CRISPR Prkdc Il2r gamma (NCG) mouse lines in North America. Charles River will establish foundation colonies with models to be commercially available beginning in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Patient Derived Xenograft Models Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Patient Derived Xenograft Models Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Patient Derived Xenograft Models Market?

To stay informed about further developments, trends, and reports in the Global Patient Derived Xenograft Models Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence