Key Insights

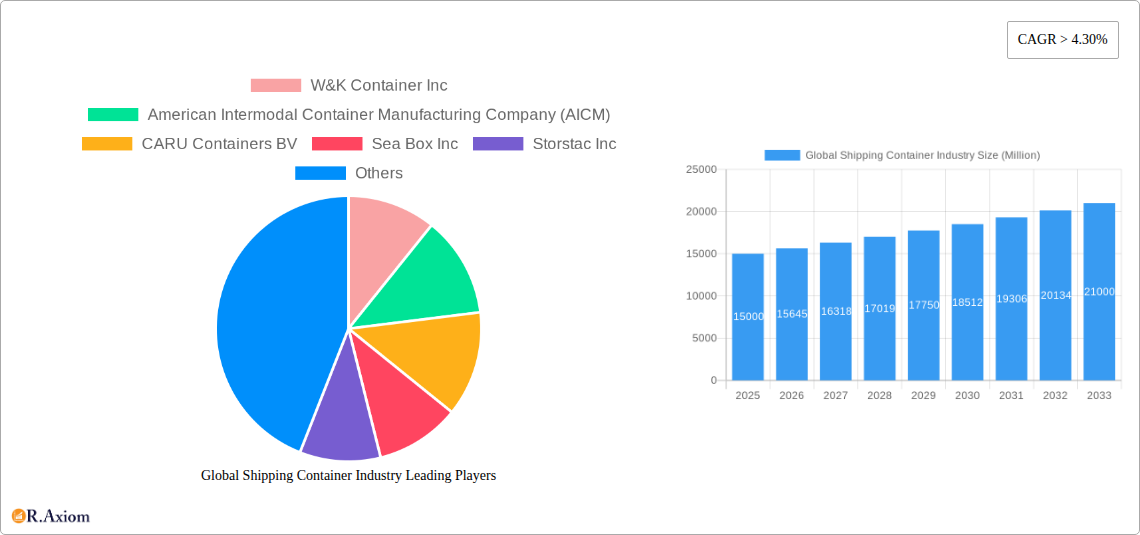

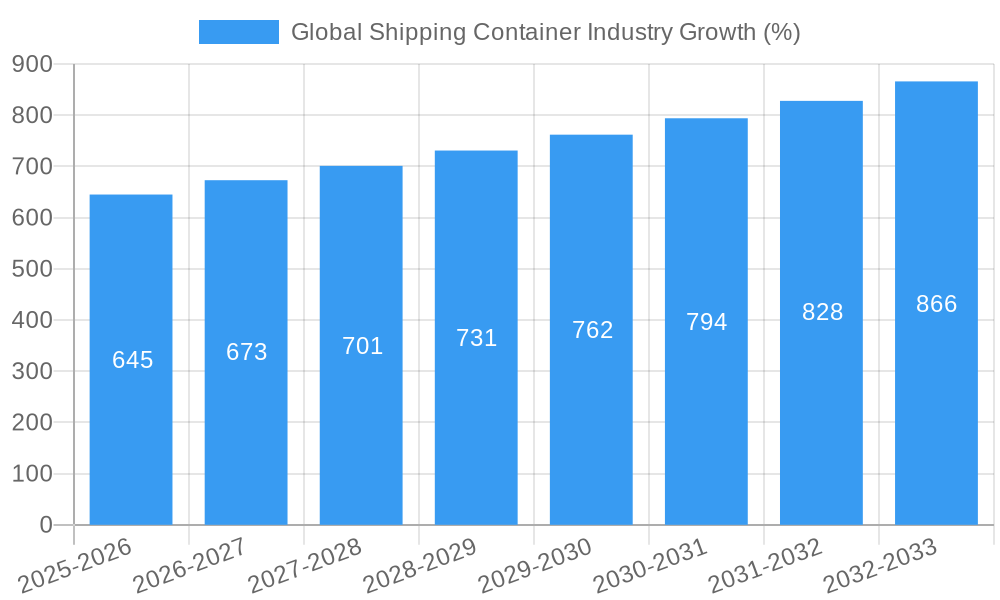

The global shipping container industry, currently valued at approximately $XX million (estimated based on available CAGR and market trends), is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4.30% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning global trade necessitates efficient and cost-effective cargo transportation, solidifying the demand for shipping containers. Increased e-commerce activity further intensifies this demand, as the flow of goods from manufacturers to consumers relies heavily on containerized shipping. Technological advancements in container design, such as the introduction of more durable and technologically advanced refrigerated and tank containers, contribute to improved efficiency and reduced losses. Furthermore, the growth of specialized containers caters to diverse cargo needs, encompassing everything from hazardous materials to perishable goods. However, challenges remain. Fluctuations in global fuel prices significantly impact transportation costs, potentially hindering growth. Geopolitical instability and port congestion can lead to delays and disruptions, adding complexity to supply chains. Environmental concerns also present a significant restraint, pushing the industry towards sustainable practices and potentially increasing production costs.

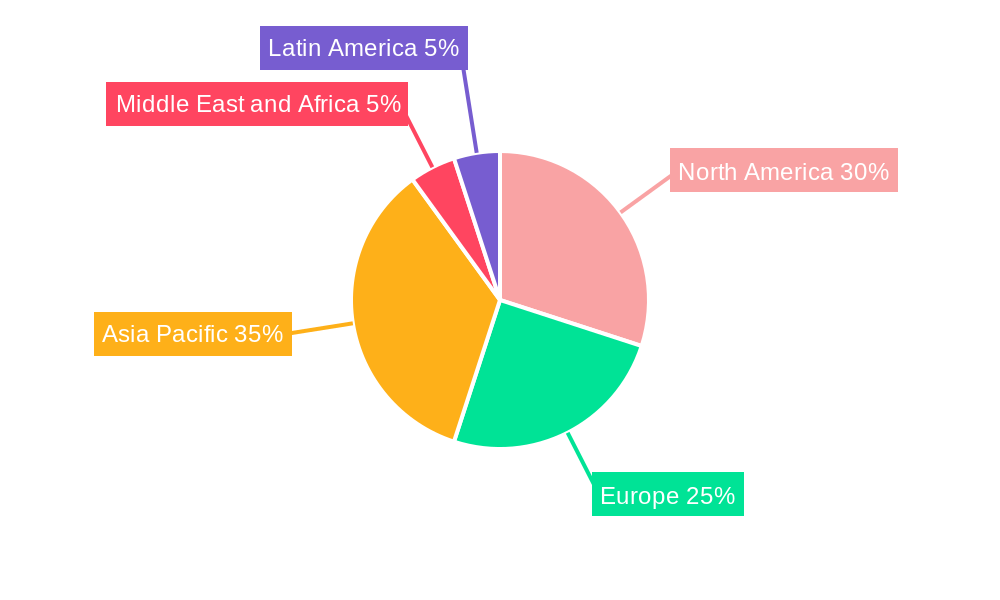

The market segmentation reveals a varied landscape. Large 40-foot containers dominate the market due to their high cargo capacity, although demand for smaller 20-foot and high-cube containers persists for niche applications and varying cargo sizes. The type of container significantly impacts the market. Dry storage containers represent the largest segment, but refrigerated containers (reefers) and tank containers experience substantial growth due to increased global demand for perishable goods and liquids. Key players in the industry, including Maersk Container Industry, Singamas Container Holdings, and others listed, compete based on factors like container quality, pricing, and delivery timelines. Regional analysis reveals significant market presence in North America, Europe, and Asia-Pacific, reflecting major trade hubs and manufacturing centers. Future growth is expected to be driven by emerging economies in Asia and Africa, accompanied by sustained demand from established markets. Consequently, a strategic focus on innovation, sustainable practices, and efficient supply chain management will be crucial for sustained success within this dynamic and competitive industry.

This in-depth report provides a comprehensive analysis of the global shipping container industry, covering market dynamics, competitive landscape, and future growth prospects from 2019 to 2033. The report leverages extensive primary and secondary research to offer actionable insights for industry stakeholders, including manufacturers, shippers, investors, and policymakers. With a focus on key trends, challenges, and opportunities, this report is an essential resource for navigating the complexities of this crucial sector of the global supply chain.

Global Shipping Container Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities within the global shipping container industry. The highly consolidated nature of the market is examined, with key players holding significant market share. The report quantifies this concentration, providing specific market share data for leading companies like Maersk Container Industry AS, CIMC, and Singamas Container Holdings Limited (values are unavailable for this report and will be included in the full report).

Market Concentration: The industry exhibits high concentration with a few dominant players controlling a significant portion of the global market. This is further examined through the lens of Herfindahl-Hirschman Index (HHI) and other relevant metrics. The report also assesses the impact of mergers and acquisitions on market concentration.

Innovation Drivers: Technological advancements, such as the development of smart containers with integrated sensors and IoT capabilities, are driving innovation. Furthermore, the increasing demand for specialized containers (refrigerated, tank containers) pushes innovation in design and material science.

Regulatory Frameworks: International and regional regulations impacting safety, environmental compliance (e.g., emissions), and trade policies influence market dynamics. The impact of these regulations is analyzed in detail within this report.

Product Substitutes: While limited direct substitutes exist, the report examines alternative transportation modes (rail, trucking) and their impact on market share.

End-User Trends: Growth in e-commerce and globalization drive demand for efficient and reliable shipping containers. The report analyzes shifting consumer preferences and their influence on container specifications and features.

M&A Activities: Recent mergers and acquisitions, including the abandoned CIMC-Maersk merger (USD 987.3 Million), are analyzed for their impact on market structure and future consolidation. The report also includes an analysis of the deal values of successful mergers and acquisitions in the industry, predicting a xx Million USD value in M&A activity for the forecast period.

Global Shipping Container Industry Industry Trends & Insights

This section delves into the key trends and insights shaping the global shipping container industry. We will explore the factors driving market growth, analyze technological disruptions, assess consumer preferences, and evaluate competitive dynamics. Specific metrics such as CAGR and market penetration will be provided. The forecast period shows a projected Compound Annual Growth Rate (CAGR) of xx% for the global shipping container market from 2025 to 2033. This growth is attributed to several key factors, including the expansion of global trade, increasing demand for efficient logistics solutions, and the ongoing adoption of innovative container technologies. The market penetration of refrigerated containers is also expected to significantly increase in the forecast period. The ongoing demand for specialized containers will increase market penetration. The report will analyze the factors that lead to the competition dynamics and how that affects the industry.

Dominant Markets & Segments in Global Shipping Container Industry

This section identifies the leading regions, countries, and segments within the global shipping container industry. The analysis considers both container size (20-foot, 40-foot, high cube) and container type (dry storage, refrigerated, tank).

By Size: The 40-foot container segment holds the largest market share, driven by the increasing demand for efficient bulk transportation. High cube containers demonstrate faster growth due to their increased cargo capacity. The 20-foot container segment retains a substantial market share, particularly in niche applications.

By Type: Refrigerated containers represent a significant and rapidly growing segment, fueled by the global expansion of perishable goods trade. Dry storage containers maintain the largest market share owing to their versatility and broad applications. Tank containers show consistent, although slower, growth due to the transportation needs of liquid and gaseous goods.

Key Drivers:

- Economic Policies: Trade agreements and economic growth significantly influence container demand.

- Infrastructure: Port infrastructure and logistics networks play a vital role in supporting industry growth.

- Technological Advancements: Smart containers and improved handling technology drive efficiency and market expansion.

The report will provide in-depth analysis of the dominant markets and factors that contribute to their dominance.

Global Shipping Container Industry Product Developments

The global shipping container industry is witnessing significant product innovations, driven by the need for enhanced efficiency, safety, and sustainability. Recent developments include the integration of IoT sensors for real-time tracking and condition monitoring, as well as the use of advanced materials to improve durability and reduce weight. These innovations enhance supply chain transparency and improve operational efficiency, making them highly attractive to customers in a competitive market.

Report Scope & Segmentation Analysis

This report segments the global shipping container market by size (20-foot, 40-foot, high cube) and type (dry storage, refrigerated, tank). Each segment's growth projections, market size (in Millions), and competitive dynamics are analyzed in detail. Market size estimations for each segment are provided for the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033).

Key Drivers of Global Shipping Container Industry Growth

The growth of the global shipping container industry is propelled by several key factors. Global trade expansion necessitates efficient and cost-effective container shipping. Technological advancements such as smart containers and improved handling equipment boost operational efficiency and reduce costs. Furthermore, favorable government policies and investments in port infrastructure support industry development. The increasing demand for specialized containers, such as refrigerated and tank containers, further fuels market expansion.

Challenges in the Global Shipping Container Industry Sector

The shipping container industry faces various challenges, including fluctuations in global trade patterns, supply chain disruptions (with a quantified impact on xx Million units of lost capacity in 2023), and intense competition. Regulatory hurdles and environmental concerns also pose significant challenges to industry growth. The report also quantifies the impact of these challenges on the industry's financial performance.

Emerging Opportunities in Global Shipping Container Industry

Emerging opportunities abound within the industry. The increasing adoption of digital technologies, including blockchain for improved supply chain visibility, presents substantial potential. The growing demand for sustainable shipping solutions, such as containers made from recycled materials, presents significant growth opportunities. Expansion into new markets and the development of specialized containers for emerging industries will also drive growth.

Leading Players in the Global Shipping Container Industry Market

- W&K Container Inc

- American Intermodal Container Manufacturing Company (AICM)

- CARU Containers BV

- Sea Box Inc

- Storstac Inc

- China International Marine Containers Co Ltd

- Singamas Container Holdings Limited

- Valisons & Co

- CXIC (Changzhou Xinhuachang Int'l Containers) Co Ltd

- YMC Container Solutions

- Ritveyraaj Cargo Shipping Containers

- Maersk Container Industry AS

- TLS Offshore Containers International Pvt Ltd

- Dong Fang International Container (Hong Kong) Co Ltd

- China Eastern Containers

Key Developments in Global Shipping Container Industry Industry

August 2022: The abandoned merger between China International Marine Containers and Maersk Container Industry highlights the regulatory challenges in industry consolidation. This deal, initially valued at USD 987.3 Million, underscores the complexities of large-scale mergers in the sector.

May 2022: Mazagon Dock Shipbuilders' entry into the container manufacturing business in India, driven by a CONCOR order for 2,500 containers (USD 12.18 Million), signals a move towards local production and addresses previous container shortages.

Strategic Outlook for Global Shipping Container Industry Market

The global shipping container industry is poised for sustained growth, driven by the ongoing expansion of global trade, technological advancements, and increased demand for specialized containers. The focus on sustainability and digitalization will further shape industry trends and create new opportunities. The strategic outlook is optimistic, projecting a continued expansion of the market throughout the forecast period, with significant potential for new entrants and innovative solutions.

Global Shipping Container Industry Segmentation

-

1. Size

- 1.1. Small Container (20 Feet)

- 1.2. Large Container (40 Feet)

- 1.3. High Cube Container

-

2. Type

- 2.1. Dry Storage Container

- 2.2. Refrigerated Container

- 2.3. Tank Container

Global Shipping Container Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. South Africa

- 4.2. United Arab Emirates

- 4.3. Saudi Arabia

- 4.4. Rest of the Middle East and Africa

-

5. Latin America

- 5.1. Mexico

- 5.2. Brazil

- 5.3. Argentina

- 5.4. Rest of the Latin America

Global Shipping Container Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Consumption of Frozen Food Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Constantly Increasing Fuel Costs

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Cargo Transportation through Ships Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Shipping Container Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Size

- 5.1.1. Small Container (20 Feet)

- 5.1.2. Large Container (40 Feet)

- 5.1.3. High Cube Container

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Dry Storage Container

- 5.2.2. Refrigerated Container

- 5.2.3. Tank Container

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Size

- 6. North America Global Shipping Container Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Size

- 6.1.1. Small Container (20 Feet)

- 6.1.2. Large Container (40 Feet)

- 6.1.3. High Cube Container

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Dry Storage Container

- 6.2.2. Refrigerated Container

- 6.2.3. Tank Container

- 6.1. Market Analysis, Insights and Forecast - by Size

- 7. Europe Global Shipping Container Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Size

- 7.1.1. Small Container (20 Feet)

- 7.1.2. Large Container (40 Feet)

- 7.1.3. High Cube Container

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Dry Storage Container

- 7.2.2. Refrigerated Container

- 7.2.3. Tank Container

- 7.1. Market Analysis, Insights and Forecast - by Size

- 8. Asia Pacific Global Shipping Container Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Size

- 8.1.1. Small Container (20 Feet)

- 8.1.2. Large Container (40 Feet)

- 8.1.3. High Cube Container

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Dry Storage Container

- 8.2.2. Refrigerated Container

- 8.2.3. Tank Container

- 8.1. Market Analysis, Insights and Forecast - by Size

- 9. Middle East and Africa Global Shipping Container Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Size

- 9.1.1. Small Container (20 Feet)

- 9.1.2. Large Container (40 Feet)

- 9.1.3. High Cube Container

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Dry Storage Container

- 9.2.2. Refrigerated Container

- 9.2.3. Tank Container

- 9.1. Market Analysis, Insights and Forecast - by Size

- 10. Latin America Global Shipping Container Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Size

- 10.1.1. Small Container (20 Feet)

- 10.1.2. Large Container (40 Feet)

- 10.1.3. High Cube Container

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Dry Storage Container

- 10.2.2. Refrigerated Container

- 10.2.3. Tank Container

- 10.1. Market Analysis, Insights and Forecast - by Size

- 11. North America Global Shipping Container Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Global Shipping Container Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Rest of Europe

- 13. Asia Pacific Global Shipping Container Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Rest of Asia Pacific

- 14. Middle East and Africa Global Shipping Container Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 South Africa

- 14.1.2 United Arab Emirates

- 14.1.3 Saudi Arabia

- 14.1.4 Rest of the Middle East and Africa

- 15. Latin America Global Shipping Container Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Mexico

- 15.1.2 Brazil

- 15.1.3 Argentina

- 15.1.4 Rest of the Latin America

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 W&K Container Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 American Intermodal Container Manufacturing Company (AICM)

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 CARU Containers BV

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Sea Box Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Storstac Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 China International Marine Containers Co Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Singamas Container Holdings Limited

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Valisons & Co

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 CXIC (Changzhou Xinhuachang Int'l Containers) Co Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 YMC Container Solutions

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Ritveyraaj Cargo Shipping Containers**List Not Exhaustive

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Maersk Container Industry AS

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 TLS Offshore Containers International Pvt Ltd

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Dong Fang International Container (Hong Kong) Co Ltd

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 China Eastern Containers

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.1 W&K Container Inc

List of Figures

- Figure 1: Global Global Shipping Container Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Global Shipping Container Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Global Shipping Container Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Global Shipping Container Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Global Shipping Container Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Global Shipping Container Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Global Shipping Container Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Global Shipping Container Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Global Shipping Container Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Global Shipping Container Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Global Shipping Container Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Global Shipping Container Industry Revenue (Million), by Size 2024 & 2032

- Figure 13: North America Global Shipping Container Industry Revenue Share (%), by Size 2024 & 2032

- Figure 14: North America Global Shipping Container Industry Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Global Shipping Container Industry Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Global Shipping Container Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Global Shipping Container Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Global Shipping Container Industry Revenue (Million), by Size 2024 & 2032

- Figure 19: Europe Global Shipping Container Industry Revenue Share (%), by Size 2024 & 2032

- Figure 20: Europe Global Shipping Container Industry Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Global Shipping Container Industry Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Global Shipping Container Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Global Shipping Container Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Global Shipping Container Industry Revenue (Million), by Size 2024 & 2032

- Figure 25: Asia Pacific Global Shipping Container Industry Revenue Share (%), by Size 2024 & 2032

- Figure 26: Asia Pacific Global Shipping Container Industry Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Global Shipping Container Industry Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Global Shipping Container Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Global Shipping Container Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Global Shipping Container Industry Revenue (Million), by Size 2024 & 2032

- Figure 31: Middle East and Africa Global Shipping Container Industry Revenue Share (%), by Size 2024 & 2032

- Figure 32: Middle East and Africa Global Shipping Container Industry Revenue (Million), by Type 2024 & 2032

- Figure 33: Middle East and Africa Global Shipping Container Industry Revenue Share (%), by Type 2024 & 2032

- Figure 34: Middle East and Africa Global Shipping Container Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Global Shipping Container Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Global Shipping Container Industry Revenue (Million), by Size 2024 & 2032

- Figure 37: Latin America Global Shipping Container Industry Revenue Share (%), by Size 2024 & 2032

- Figure 38: Latin America Global Shipping Container Industry Revenue (Million), by Type 2024 & 2032

- Figure 39: Latin America Global Shipping Container Industry Revenue Share (%), by Type 2024 & 2032

- Figure 40: Latin America Global Shipping Container Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Latin America Global Shipping Container Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Shipping Container Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Shipping Container Industry Revenue Million Forecast, by Size 2019 & 2032

- Table 3: Global Shipping Container Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Shipping Container Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Shipping Container Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Shipping Container Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Shipping Container Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Asia Pacific Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Shipping Container Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: South Africa Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United Arab Emirates Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Saudi Arabia Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of the Middle East and Africa Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Shipping Container Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Mexico Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Brazil Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of the Latin America Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Shipping Container Industry Revenue Million Forecast, by Size 2019 & 2032

- Table 29: Global Shipping Container Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Global Shipping Container Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 31: United States Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Shipping Container Industry Revenue Million Forecast, by Size 2019 & 2032

- Table 34: Global Shipping Container Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global Shipping Container Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Germany Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: United Kingdom Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: France Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of Europe Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Shipping Container Industry Revenue Million Forecast, by Size 2019 & 2032

- Table 41: Global Shipping Container Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 42: Global Shipping Container Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: China Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: India Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Asia Pacific Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Shipping Container Industry Revenue Million Forecast, by Size 2019 & 2032

- Table 48: Global Shipping Container Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 49: Global Shipping Container Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: South Africa Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: United Arab Emirates Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Saudi Arabia Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of the Middle East and Africa Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Global Shipping Container Industry Revenue Million Forecast, by Size 2019 & 2032

- Table 55: Global Shipping Container Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 56: Global Shipping Container Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 57: Mexico Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Brazil Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Argentina Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of the Latin America Global Shipping Container Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Shipping Container Industry?

The projected CAGR is approximately > 4.30%.

2. Which companies are prominent players in the Global Shipping Container Industry?

Key companies in the market include W&K Container Inc, American Intermodal Container Manufacturing Company (AICM), CARU Containers BV, Sea Box Inc, Storstac Inc, China International Marine Containers Co Ltd, Singamas Container Holdings Limited, Valisons & Co, CXIC (Changzhou Xinhuachang Int'l Containers) Co Ltd, YMC Container Solutions, Ritveyraaj Cargo Shipping Containers**List Not Exhaustive, Maersk Container Industry AS, TLS Offshore Containers International Pvt Ltd, Dong Fang International Container (Hong Kong) Co Ltd, China Eastern Containers.

3. What are the main segments of the Global Shipping Container Industry?

The market segments include Size, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Consumption of Frozen Food Driving the Market.

6. What are the notable trends driving market growth?

Increase in Demand for Cargo Transportation through Ships Driving the Market.

7. Are there any restraints impacting market growth?

4.; Constantly Increasing Fuel Costs.

8. Can you provide examples of recent developments in the market?

August 2022: Global shipping container suppliers China International Marine Containers and Maersk Container Industry in a joint statement said they have abandoned a merger plan, citing significant regulatory challenges. China International Marine Containers (CIMC) in September 2021 had agreed to buy the Danish shipping company AP Moeller - Maersk refrigerated containers maker for USD 987.3 million. The U.S. Justice Department said the deal would have combined two of the world's four suppliers of refrigerated shipping containers and further concentrated the global cold supply chain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Shipping Container Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Shipping Container Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Shipping Container Industry?

To stay informed about further developments, trends, and reports in the Global Shipping Container Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence