Key Insights

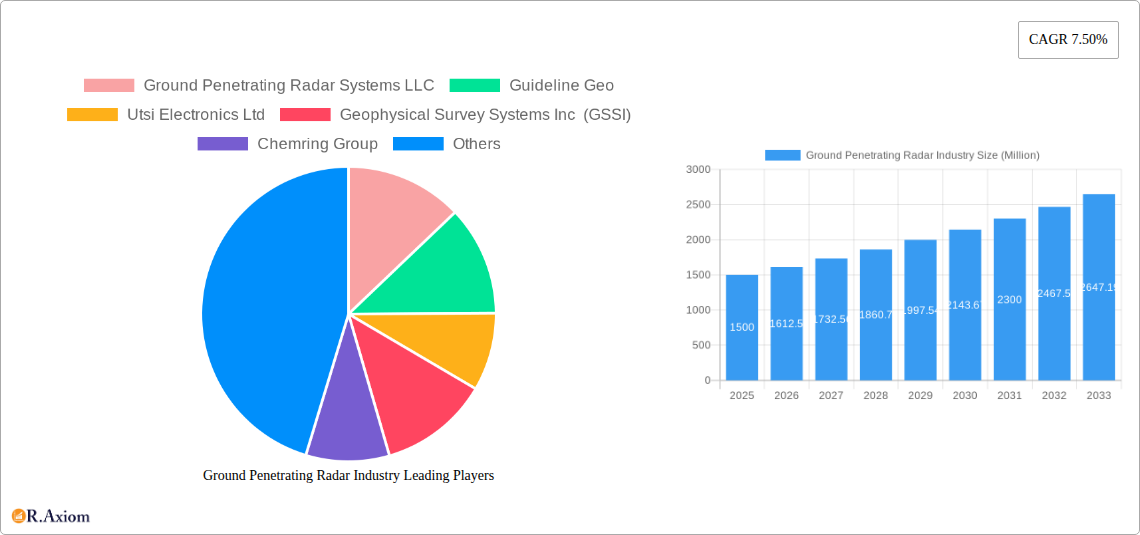

The ground penetrating radar (GPR) market is experiencing robust growth, driven by increasing demand across diverse sectors. The market, valued at approximately $XX million in 2025, is projected to expand at a compound annual growth rate (CAGR) of 7.50% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the rising need for efficient and non-destructive testing methods in infrastructure development and maintenance is a significant catalyst. Utility detection, a major application segment, is experiencing significant growth due to the increasing complexity of underground utility networks and the need to prevent costly damage during excavation projects. Furthermore, the expanding adoption of GPR in concrete investigation for structural assessments and forensic applications, particularly in archaeology and crime scene investigations, contributes substantially to market growth. Technological advancements, such as the development of higher-frequency antennas and improved data processing software, are also enhancing the accuracy and efficiency of GPR systems, furthering market adoption. Finally, the growing awareness of environmental concerns and the need for sustainable infrastructure solutions are promoting the use of GPR in geotechnical and environmental assessments.

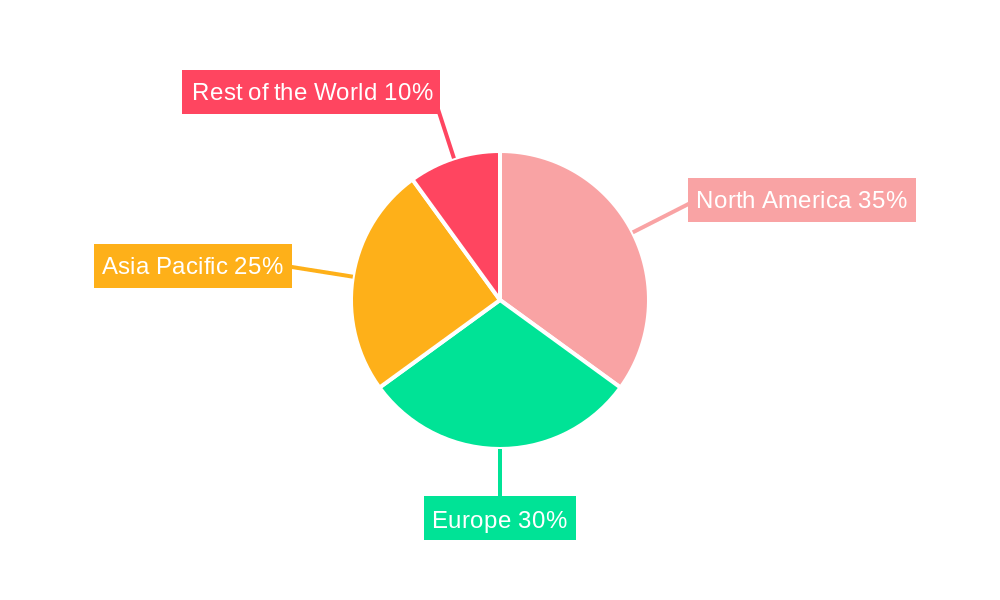

The market segmentation reveals significant opportunities across various offerings and application areas. While equipment sales represent a substantial portion of the market, the services segment, encompassing data acquisition, processing, and interpretation, is also expanding rapidly, driven by the need for specialized expertise in GPR data analysis. Within product types, handheld GPR units cater to smaller-scale projects and ease of use, while cart-based and vehicle-mounted GPR systems are preferred for larger-scale projects requiring greater coverage and speed. Geographically, North America and Europe currently hold a significant market share, fueled by advanced infrastructure development and a robust regulatory framework encouraging non-destructive testing. However, the Asia-Pacific region is poised for substantial growth, driven by increasing infrastructure investment and urbanization in developing economies. Competitive landscape analysis indicates the presence of both established players and emerging technology providers. Companies are focusing on product innovation, strategic partnerships, and geographic expansion to gain a competitive edge. The overall market outlook for GPR is highly positive, indicating continued expansion and diversification in the coming years. Market challenges include the relatively high initial investment costs of GPR equipment and the need for skilled personnel to operate and interpret the data effectively.

Ground Penetrating Radar (GPR) Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Ground Penetrating Radar (GPR) industry, offering valuable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, competitive dynamics, and future growth prospects. The global GPR market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Ground Penetrating Radar Industry Market Concentration & Innovation

The Ground Penetrating Radar (GPR) market exhibits a moderately concentrated landscape, with key players such as Geophysical Survey Systems Inc (GSSI), Sensors & Software Inc, and IDS Georadar holding significant market share. Market concentration is influenced by factors like technological advancements, economies of scale, and brand recognition. Innovation within the sector is driven by the development of higher-frequency antennas for improved resolution, advanced data processing algorithms for clearer image interpretation, and integration of GPS and other technologies for enhanced accuracy and efficiency.

- Market Share: GSSI holds an estimated xx% market share in 2025, followed by Sensors & Software Inc at xx% and IDS Georadar at xx%. The remaining market share is distributed among numerous smaller players.

- M&A Activity: The industry has witnessed a moderate level of M&A activity in recent years, with deal values averaging xx Million per transaction during 2019-2024. These activities primarily focus on expanding geographical reach, acquiring specialized technologies, and strengthening market position. Examples include [Insert specific examples of M&A activity with deal values if available, otherwise state "Specific deal information is confidential or unavailable"].

- Regulatory Frameworks: Government regulations concerning infrastructure development and environmental protection significantly impact the GPR market, creating demand for utility detection and geotechnical applications.

- Product Substitutes: Alternative technologies such as electromagnetic induction (EMI) and ground-penetrating lidar (GPL) present some level of competition, though GPR remains the dominant method for many applications due to its versatility and resolution capabilities.

- End-User Trends: Growing demand for non-destructive testing (NDT) methods across various industries drives market growth. Increasing awareness of subsurface infrastructure integrity and environmental concerns also fuels demand for GPR services.

Ground Penetrating Radar Industry Industry Trends & Insights

The GPR industry is experiencing robust growth fueled by several key factors. Increased investments in infrastructure projects globally, particularly in transportation and utilities, are driving demand for GPR-based utility detection and pavement assessment services. The growing focus on sustainable construction practices and environmental remediation is also stimulating market expansion. Technological advancements, such as the development of higher-resolution sensors and advanced data processing software, are enhancing the capabilities and efficiency of GPR systems, further propelling market growth. Competition within the industry is intense, with companies focusing on innovation, product differentiation, and expanding their service portfolios to maintain a competitive edge. The market is expected to witness significant growth in emerging economies due to rising infrastructure development and urbanization. The industry is witnessing a shift towards integrated solutions combining GPR data with other geophysical techniques for comprehensive subsurface characterization. This trend is supported by a growing number of partnerships and collaborations between GPR manufacturers and data analysis companies.

Dominant Markets & Segments in Ground Penetrating Radar Industry

The North American region holds the largest market share in the GPR industry, driven by significant investments in infrastructure projects, stringent regulations regarding utility location, and a robust construction sector. Within the product type segment, handheld GPR systems dominate due to their portability and ease of use in various applications. The utility detection application segment holds the largest market share, driven by the critical need to accurately locate underground utilities before excavation to prevent accidents and service disruptions.

- Key Drivers for North American Dominance:

- High investment in infrastructure development and maintenance

- Stringent safety regulations regarding utility location

- Strong construction sector activity

- Adoption of advanced GPR technologies

- Dominant Application Segment: Utility Detection – Driven by the need for safe and efficient excavation and the prevention of damage to underground utilities.

- Dominant Product Type: Handheld GPR – Favored for its portability and ease of use in various terrains and applications.

Other leading segments include:

- Transportation Infrastructure: Driven by demand for road and bridge assessments, and railway inspections.

- Geotechnical & Environmental: Growing demand for environmental site assessments, landfill monitoring, and groundwater studies.

Ground Penetrating Radar Industry Product Developments

Recent product innovations focus on enhancing GPR system portability, improving data acquisition speed, and refining data processing algorithms for improved subsurface image interpretation. Miniaturized sensors, integrated GPS, and advanced software packages featuring automated data analysis tools are key advancements. These developments enable faster data processing, improved resolution, and easier data interpretation, enhancing the overall efficiency and effectiveness of GPR applications across various sectors. The integration of artificial intelligence and machine learning techniques is emerging as a key area of innovation, promising to automate data analysis and improve accuracy further.

Report Scope & Segmentation Analysis

This report segments the GPR market by offering (Equipment and Services), product type (Handheld GPR, Cart-Based GPR, Vehicle-Mounted GPR), and application (Utility Detection, Concrete Investigation, Forensics & Archaeology, Transportation Infrastructure, Geotechnical & Environment, Other Applications). Each segment is analyzed based on its market size, growth rate, competitive landscape, and key drivers. Growth projections for each segment are provided for the forecast period (2025-2033), considering technological advancements, industry trends, and regulatory changes. The report also assesses the competitive intensity within each segment, identifying key players and their market strategies.

Key Drivers of Ground Penetrating Radar Industry Growth

Several factors contribute to the growth of the GPR industry. These include the increasing demand for non-destructive testing methods in various sectors, driven by safety concerns and the need for efficient infrastructure management. Advancements in GPR technology, leading to improved image resolution and data processing capabilities, also fuel market growth. Government regulations mandating subsurface utility engineering (SUE) and promoting sustainable infrastructure development further boost demand. Finally, growing urbanization and infrastructure development globally create significant opportunities for GPR applications.

Challenges in the Ground Penetrating Radar Industry Sector

The GPR industry faces challenges such as high initial investment costs for advanced systems, the need for skilled personnel to operate and interpret data, and competition from alternative technologies. Supply chain disruptions and the impact of global economic fluctuations can also affect market growth. Regulatory complexities in different regions may also pose challenges for market expansion and adoption. These factors can impact overall market growth and profitability.

Emerging Opportunities in Ground Penetrating Radar Industry

Emerging opportunities in the GPR industry include the expansion into new applications, such as mining and agriculture, and the integration of GPR with other technologies, such as LiDAR and GIS, to create comprehensive subsurface mapping solutions. The development of more user-friendly software and data analysis tools will broaden the appeal of GPR technology to a wider range of users. Furthermore, the increasing adoption of cloud-based data processing and storage solutions presents new avenues for growth and efficiency.

Leading Players in the Ground Penetrating Radar Industry Market

- Ground Penetrating Radar Systems LLC

- Guideline Geo

- Utsi Electronics Ltd

- Geophysical Survey Systems Inc (GSSI)

- Chemring Group

- Hilti

- Sensors & Software Inc

- Geoscanners

- Pipehawk PLC

- IDS Georadar

Key Developments in Ground Penetrating Radar Industry Industry

- 2022 Q4: Sensors & Software Inc launched a new line of high-resolution GPR antennas.

- 2023 Q1: Geophysical Survey Systems Inc (GSSI) acquired a smaller GPR technology company, expanding its product portfolio.

- 2024 Q2: IDS Georadar introduced AI-powered data processing software for improved image interpretation.

- [Add more developments with specific years and months as available]

Strategic Outlook for Ground Penetrating Radar Industry Market

The GPR industry is poised for continued growth, driven by increasing infrastructure development, technological advancements, and expanding application areas. The growing demand for non-destructive testing and the integration of GPR with other technologies will create significant opportunities for market expansion. Companies focusing on innovation, developing user-friendly solutions, and expanding their service portfolios will be well-positioned to capitalize on these opportunities. The market is projected to experience significant growth in emerging economies, particularly in Asia and the Middle East, driven by rapid urbanization and infrastructure development.

Ground Penetrating Radar Industry Segmentation

-

1. Offering

- 1.1. Equipment

- 1.2. Services

-

2. Product type

- 2.1. Handheld GPR

- 2.2. Cart-Based GPR

- 2.3. Vehicle-Mounted GPR

-

3. Application

- 3.1. Utility Detection

- 3.2. Concrete Investigation

- 3.3. Forensics & Archaeology

- 3.4. Transportation Infrastructure

- 3.5. Geotechnical & Environment

- 3.6. Other Applications

Ground Penetrating Radar Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Ground Penetrating Radar Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Rapid growth of underground transportation infrastructure; Demand for improved

- 3.2.2 advanced and efficient scanner for detection of aging infrastructure

- 3.3. Market Restrains

- 3.3.1. ; High cost of GPR equipment

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ground Penetrating Radar Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Product type

- 5.2.1. Handheld GPR

- 5.2.2. Cart-Based GPR

- 5.2.3. Vehicle-Mounted GPR

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Utility Detection

- 5.3.2. Concrete Investigation

- 5.3.3. Forensics & Archaeology

- 5.3.4. Transportation Infrastructure

- 5.3.5. Geotechnical & Environment

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Ground Penetrating Radar Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Equipment

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Product type

- 6.2.1. Handheld GPR

- 6.2.2. Cart-Based GPR

- 6.2.3. Vehicle-Mounted GPR

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Utility Detection

- 6.3.2. Concrete Investigation

- 6.3.3. Forensics & Archaeology

- 6.3.4. Transportation Infrastructure

- 6.3.5. Geotechnical & Environment

- 6.3.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. Europe Ground Penetrating Radar Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Equipment

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Product type

- 7.2.1. Handheld GPR

- 7.2.2. Cart-Based GPR

- 7.2.3. Vehicle-Mounted GPR

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Utility Detection

- 7.3.2. Concrete Investigation

- 7.3.3. Forensics & Archaeology

- 7.3.4. Transportation Infrastructure

- 7.3.5. Geotechnical & Environment

- 7.3.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Asia Pacific Ground Penetrating Radar Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Equipment

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Product type

- 8.2.1. Handheld GPR

- 8.2.2. Cart-Based GPR

- 8.2.3. Vehicle-Mounted GPR

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Utility Detection

- 8.3.2. Concrete Investigation

- 8.3.3. Forensics & Archaeology

- 8.3.4. Transportation Infrastructure

- 8.3.5. Geotechnical & Environment

- 8.3.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Rest of the World Ground Penetrating Radar Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Equipment

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Product type

- 9.2.1. Handheld GPR

- 9.2.2. Cart-Based GPR

- 9.2.3. Vehicle-Mounted GPR

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Utility Detection

- 9.3.2. Concrete Investigation

- 9.3.3. Forensics & Archaeology

- 9.3.4. Transportation Infrastructure

- 9.3.5. Geotechnical & Environment

- 9.3.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. North America Ground Penetrating Radar Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Ground Penetrating Radar Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Ground Penetrating Radar Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Ground Penetrating Radar Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Ground Penetrating Radar Systems LLC

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Guideline Geo

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Utsi Electronics Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Geophysical Survey Systems Inc (GSSI)

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Chemring Group

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Hilti*List Not Exhaustive

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Sensors & Software Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Geoscanners

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Pipehawk PLC

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 IDS Georadar

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Ground Penetrating Radar Systems LLC

List of Figures

- Figure 1: Global Ground Penetrating Radar Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Ground Penetrating Radar Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Ground Penetrating Radar Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Ground Penetrating Radar Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Ground Penetrating Radar Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Ground Penetrating Radar Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Ground Penetrating Radar Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Ground Penetrating Radar Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Ground Penetrating Radar Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Ground Penetrating Radar Industry Revenue (Million), by Offering 2024 & 2032

- Figure 11: North America Ground Penetrating Radar Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 12: North America Ground Penetrating Radar Industry Revenue (Million), by Product type 2024 & 2032

- Figure 13: North America Ground Penetrating Radar Industry Revenue Share (%), by Product type 2024 & 2032

- Figure 14: North America Ground Penetrating Radar Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Ground Penetrating Radar Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Ground Penetrating Radar Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Ground Penetrating Radar Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Ground Penetrating Radar Industry Revenue (Million), by Offering 2024 & 2032

- Figure 19: Europe Ground Penetrating Radar Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 20: Europe Ground Penetrating Radar Industry Revenue (Million), by Product type 2024 & 2032

- Figure 21: Europe Ground Penetrating Radar Industry Revenue Share (%), by Product type 2024 & 2032

- Figure 22: Europe Ground Penetrating Radar Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Ground Penetrating Radar Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Ground Penetrating Radar Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Ground Penetrating Radar Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Ground Penetrating Radar Industry Revenue (Million), by Offering 2024 & 2032

- Figure 27: Asia Pacific Ground Penetrating Radar Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 28: Asia Pacific Ground Penetrating Radar Industry Revenue (Million), by Product type 2024 & 2032

- Figure 29: Asia Pacific Ground Penetrating Radar Industry Revenue Share (%), by Product type 2024 & 2032

- Figure 30: Asia Pacific Ground Penetrating Radar Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Pacific Ground Penetrating Radar Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Pacific Ground Penetrating Radar Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Ground Penetrating Radar Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Ground Penetrating Radar Industry Revenue (Million), by Offering 2024 & 2032

- Figure 35: Rest of the World Ground Penetrating Radar Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 36: Rest of the World Ground Penetrating Radar Industry Revenue (Million), by Product type 2024 & 2032

- Figure 37: Rest of the World Ground Penetrating Radar Industry Revenue Share (%), by Product type 2024 & 2032

- Figure 38: Rest of the World Ground Penetrating Radar Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Rest of the World Ground Penetrating Radar Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Rest of the World Ground Penetrating Radar Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Ground Penetrating Radar Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 3: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 4: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Ground Penetrating Radar Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Ground Penetrating Radar Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Ground Penetrating Radar Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Ground Penetrating Radar Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 15: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 16: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 19: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 20: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 23: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 24: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 27: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 28: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Ground Penetrating Radar Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ground Penetrating Radar Industry?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the Ground Penetrating Radar Industry?

Key companies in the market include Ground Penetrating Radar Systems LLC, Guideline Geo, Utsi Electronics Ltd, Geophysical Survey Systems Inc (GSSI), Chemring Group, Hilti*List Not Exhaustive, Sensors & Software Inc, Geoscanners, Pipehawk PLC, IDS Georadar.

3. What are the main segments of the Ground Penetrating Radar Industry?

The market segments include Offering , Product type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Rapid growth of underground transportation infrastructure; Demand for improved. advanced and efficient scanner for detection of aging infrastructure.

6. What are the notable trends driving market growth?

Oil and Gas Industry to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; High cost of GPR equipment.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ground Penetrating Radar Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ground Penetrating Radar Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ground Penetrating Radar Industry?

To stay informed about further developments, trends, and reports in the Ground Penetrating Radar Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence