Key Insights

The high-tech logistics industry, encompassing the specialized transportation and warehousing of sensitive electronics, semiconductors, and related technologies, is experiencing robust growth. A compound annual growth rate (CAGR) exceeding 3.00% suggests a market poised for significant expansion from its current size (let's assume a 2025 market size of $150 billion, a reasonable estimate given the substantial value of goods involved). Key drivers include the burgeoning e-commerce sector, increasing demand for faster delivery times, rising globalization of technology manufacturing and distribution, and the growth of data centers requiring sophisticated logistics for server equipment. Trends such as automation in warehousing, the adoption of blockchain technology for enhanced supply chain transparency, and a focus on sustainability within operations are shaping the industry landscape. While challenges exist, such as the complexity of handling delicate high-tech products and navigating geopolitical uncertainties impacting international trade, these are being addressed through strategic partnerships and technological advancements. The segmentation of the market by product category (consumer electronics, semiconductors, computers and peripherals, telecommunication equipment) and service type (transportation, warehousing, value-added services) reflects the industry's specialization and the diverse needs of its clients. Leading companies like DB Schenker, Maersk, DHL, and Kuehne + Nagel are investing heavily in technology and infrastructure to meet this growing demand and maintain their competitive edge. This competitive landscape, alongside emerging players, ensures a dynamic and evolving industry that will continue its upward trajectory over the next decade.

High-tech Logistics Industry Market Size (In Billion)

The forecast period (2025-2033) promises further growth driven by technological innovation and expanding global markets. The Asia-Pacific region, with its large and growing technology manufacturing base and consumer market, is expected to dominate, followed by North America and Europe. While the exact regional market shares require further data, the global nature of the high-tech industry necessitates robust international logistics networks. The increasing reliance on just-in-time inventory management models further emphasizes the need for efficient, reliable, and secure high-tech logistics solutions. This necessitates advanced technological integration throughout the supply chain, from order placement to final delivery. The industry will continue to face challenges related to cybersecurity and data privacy given the sensitive nature of the goods handled, but robust security measures and regulatory compliance will be vital in mitigating these risks. Overall, the high-tech logistics market presents significant opportunities for businesses that can offer innovative solutions and adapt to the ever-evolving demands of the technology sector.

High-tech Logistics Industry Company Market Share

High-Tech Logistics Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the high-tech logistics industry, offering valuable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report examines market concentration, innovation, trends, dominant segments, and future growth opportunities. The report leverages extensive data and analysis to present a clear and actionable picture of this dynamic sector. The total market size in 2025 is estimated at $XX Million.

High-tech Logistics Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the high-tech logistics industry, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. We evaluate the market share of key players such as DB Schenker, AP Moller- Maersk, Ceva Logistics, CH Robinson, DHL Global Forwarding, Agility Logistics, GEFCO Group, Kuehne + Nagel, Kerry Logistics, Geodis, Aramex, BLG Logistics, Rhenus Logistics, and DSV Panalpina. The report quantifies market concentration using metrics like the Herfindahl-Hirschman Index (HHI) and analyzes the impact of mergers and acquisitions (M&A) on market structure. The total value of M&A deals in the high-tech logistics sector between 2019 and 2024 is estimated at $XX Million.

- Market Share Analysis: Detailed breakdown of market share held by leading players, illustrating the level of competition and market dominance.

- Innovation Drivers: Analysis of factors driving innovation, such as technological advancements, changing customer demands, and regulatory pressures.

- Regulatory Frameworks: Examination of the regulatory environment and its influence on market dynamics, including compliance costs and market access restrictions.

- Product Substitutes: Assessment of potential substitute products or services and their impact on market competition.

- End-User Trends: Exploration of evolving end-user needs and preferences, shaping demand for high-tech logistics solutions.

- M&A Activity: Review of significant M&A activities, analyzing their motivations, impact, and future implications.

High-tech Logistics Industry Industry Trends & Insights

This section explores key trends shaping the high-tech logistics industry. We analyze market growth drivers, technological disruptions, evolving consumer preferences, and the competitive dynamics influencing industry evolution. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at XX%, indicating substantial growth potential. Market penetration of advanced technologies such as AI and blockchain in logistics is also assessed, projecting a XX% penetration rate by 2033.

- Market growth is driven by factors like the increasing demand for faster delivery times, rising e-commerce, globalization, and the growing adoption of automation.

- Technological disruptions, including the use of AI, IoT, and robotics are revolutionizing operations, boosting efficiency and enhancing visibility across the supply chain.

- Consumer preference for customized and transparent logistics solutions is changing how services are designed and delivered.

- Intense competition among players necessitates continuous innovation and strategic partnerships to maintain a competitive edge.

Dominant Markets & Segments in High-tech Logistics Industry

This section identifies the dominant regions, countries, and market segments within the high-tech logistics industry. We analyze the leading segments by product category (Consumer Electronics, Semiconductors, Computers and Peripherals, Telecommunication and Network Equipment) and by service (Transportation, Warehousing and Inventory Management, Value-added Warehousing and Distribution).

- By Product Category: The consumer electronics segment is expected to remain the dominant product category throughout the forecast period, due to high demand and constant product launches.

- By Service: Transportation services constitute the largest segment by value, driven by the need for efficient global movement of goods.

- Key Drivers:

- Economic Policies: Government regulations and incentives influencing investments in infrastructure and logistics.

- Infrastructure: Availability and quality of transportation networks, warehousing facilities, and supporting infrastructure.

- Labor Costs: Impact of labor costs and availability on the overall cost of logistics services.

- Technological advancements: Adoption rates of advanced technologies impacting efficiency and costs.

High-tech Logistics Industry Product Developments

This section summarizes recent product innovations, applications, and competitive advantages within the industry, emphasizing technological trends and market fit. The integration of AI, IoT, and blockchain technologies is driving significant advancements in areas like route optimization, predictive maintenance, and enhanced supply chain visibility.

Report Scope & Segmentation Analysis

This report segments the high-tech logistics market by product category (Consumer Electronics, Semiconductors, Computers and Peripherals, Telecommunication and Network Equipment) and by service (Transportation, Warehousing and Inventory Management, Value-added Warehousing and Distribution). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail, providing a granular understanding of the market structure and opportunities.

Key Drivers of High-tech Logistics Industry Growth

Growth in the high-tech logistics sector is primarily driven by the increasing demand for faster and more efficient delivery, fueled by the growth of e-commerce. Technological advancements, such as automation and AI, further enhance efficiency and reduce costs. Favorable government regulations and infrastructure investments also contribute to the industry's expansion.

Challenges in the High-tech Logistics Industry Sector

The high-tech logistics sector faces challenges including rising fuel costs, fluctuating exchange rates, and the complexities of managing global supply chains. Stringent regulatory compliance requirements and the need for constant technological upgrades add further complexities. The increasing pressure to reduce carbon emissions and enhance sustainability also presents significant challenges. The impact of these challenges could lead to a $XX Million loss annually by 2030.

Emerging Opportunities in High-tech Logistics Industry

Emerging opportunities include the expansion into new markets, particularly in developing economies, and the adoption of new technologies, including drone delivery, autonomous vehicles, and blockchain-based solutions for enhanced transparency and security. The rising demand for sustainable logistics practices also presents significant growth opportunities.

Leading Players in the High-tech Logistics Industry Market

- DB Schenker

- AP Moller- Maersk

- Ceva Logistics

- CH Robinson

- DHL Global Forwarding

- Agility Logistics

- GEFCO Group

- Kuehne + Nagel

- Kerry Logistics

- Geodis

- Aramex

- BLG Logistics

- Rhenus Logistics

- DSV Panalpina

Key Developments in High-tech Logistics Industry Industry

- January 2023: DHL announces the expansion of its drone delivery network in Europe.

- March 2022: AP Moller- Maersk invests in a new automated warehouse facility in the United States.

- June 2021: Ceva Logistics partners with a technology provider to implement AI-powered route optimization. (Further developments will be added to the final report)

Strategic Outlook for High-tech Logistics Industry Market

The high-tech logistics market is poised for continued growth, driven by technological advancements, increasing e-commerce adoption, and the expansion of global trade. Opportunities exist in areas such as sustainable logistics, automation, and the development of advanced supply chain management solutions. The market's future trajectory is positive, with significant potential for innovation and expansion in the coming years.

High-tech Logistics Industry Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory Management

- 1.3. Value-added Warehousing and Distribution

-

2. Product Category

- 2.1. Consumer Electronics

- 2.2. Semiconductors

- 2.3. Computers and Peripherals

- 2.4. Telecommunication and Network Equipment

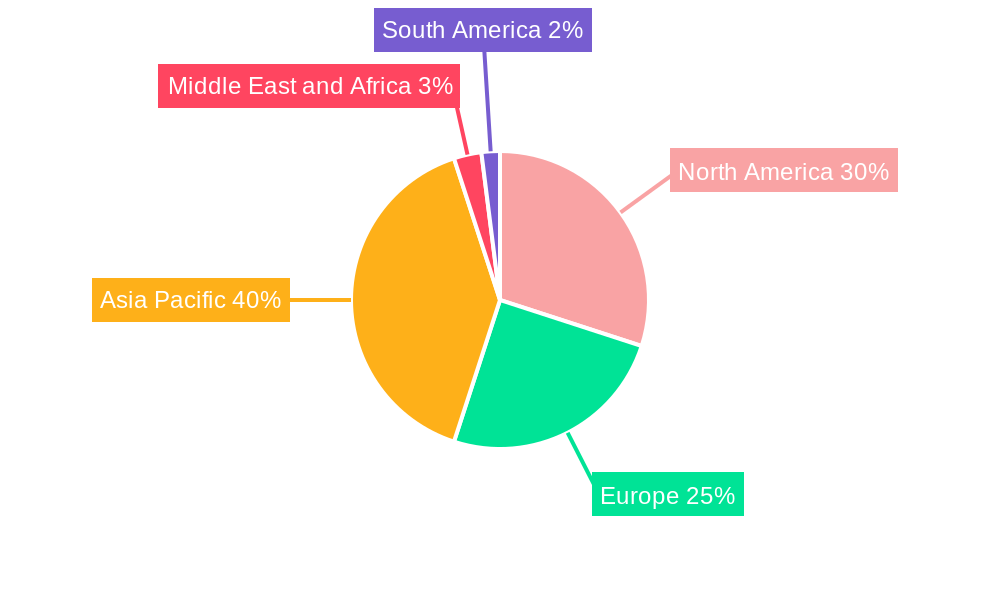

High-tech Logistics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. South America

High-tech Logistics Industry Regional Market Share

Geographic Coverage of High-tech Logistics Industry

High-tech Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics

- 3.3. Market Restrains

- 3.3.1. Damaged Goods; Increasing Transportation Cost

- 3.4. Market Trends

- 3.4.1. Growth in the High-tech Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High-tech Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by Product Category

- 5.2.1. Consumer Electronics

- 5.2.2. Semiconductors

- 5.2.3. Computers and Peripherals

- 5.2.4. Telecommunication and Network Equipment

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America High-tech Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehousing and Inventory Management

- 6.1.3. Value-added Warehousing and Distribution

- 6.2. Market Analysis, Insights and Forecast - by Product Category

- 6.2.1. Consumer Electronics

- 6.2.2. Semiconductors

- 6.2.3. Computers and Peripherals

- 6.2.4. Telecommunication and Network Equipment

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe High-tech Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehousing and Inventory Management

- 7.1.3. Value-added Warehousing and Distribution

- 7.2. Market Analysis, Insights and Forecast - by Product Category

- 7.2.1. Consumer Electronics

- 7.2.2. Semiconductors

- 7.2.3. Computers and Peripherals

- 7.2.4. Telecommunication and Network Equipment

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific High-tech Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehousing and Inventory Management

- 8.1.3. Value-added Warehousing and Distribution

- 8.2. Market Analysis, Insights and Forecast - by Product Category

- 8.2.1. Consumer Electronics

- 8.2.2. Semiconductors

- 8.2.3. Computers and Peripherals

- 8.2.4. Telecommunication and Network Equipment

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East and Africa High-tech Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehousing and Inventory Management

- 9.1.3. Value-added Warehousing and Distribution

- 9.2. Market Analysis, Insights and Forecast - by Product Category

- 9.2.1. Consumer Electronics

- 9.2.2. Semiconductors

- 9.2.3. Computers and Peripherals

- 9.2.4. Telecommunication and Network Equipment

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. South America High-tech Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Warehousing and Inventory Management

- 10.1.3. Value-added Warehousing and Distribution

- 10.2. Market Analysis, Insights and Forecast - by Product Category

- 10.2.1. Consumer Electronics

- 10.2.2. Semiconductors

- 10.2.3. Computers and Peripherals

- 10.2.4. Telecommunication and Network Equipment

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AP Moller- Maersk

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ceva Logistics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CH Robinson

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DHL Global Forwarding

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Agility Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GEFCO Group**List Not Exhaustive 7 3 Other Companies (Key Information/Overview

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kuehne + Nagel

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kerry Logistics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Geodis

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Aramex

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BLG Logistics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Rhenus Logistics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 DSV Panalpina

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global High-tech Logistics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America High-tech Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 3: North America High-tech Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America High-tech Logistics Industry Revenue (Million), by Product Category 2025 & 2033

- Figure 5: North America High-tech Logistics Industry Revenue Share (%), by Product Category 2025 & 2033

- Figure 6: North America High-tech Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America High-tech Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe High-tech Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 9: Europe High-tech Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 10: Europe High-tech Logistics Industry Revenue (Million), by Product Category 2025 & 2033

- Figure 11: Europe High-tech Logistics Industry Revenue Share (%), by Product Category 2025 & 2033

- Figure 12: Europe High-tech Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe High-tech Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific High-tech Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 15: Asia Pacific High-tech Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 16: Asia Pacific High-tech Logistics Industry Revenue (Million), by Product Category 2025 & 2033

- Figure 17: Asia Pacific High-tech Logistics Industry Revenue Share (%), by Product Category 2025 & 2033

- Figure 18: Asia Pacific High-tech Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific High-tech Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa High-tech Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 21: Middle East and Africa High-tech Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 22: Middle East and Africa High-tech Logistics Industry Revenue (Million), by Product Category 2025 & 2033

- Figure 23: Middle East and Africa High-tech Logistics Industry Revenue Share (%), by Product Category 2025 & 2033

- Figure 24: Middle East and Africa High-tech Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa High-tech Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America High-tech Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 27: South America High-tech Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 28: South America High-tech Logistics Industry Revenue (Million), by Product Category 2025 & 2033

- Figure 29: South America High-tech Logistics Industry Revenue Share (%), by Product Category 2025 & 2033

- Figure 30: South America High-tech Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: South America High-tech Logistics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High-tech Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global High-tech Logistics Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 3: Global High-tech Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global High-tech Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Global High-tech Logistics Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 6: Global High-tech Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global High-tech Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Global High-tech Logistics Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 9: Global High-tech Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global High-tech Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 11: Global High-tech Logistics Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 12: Global High-tech Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global High-tech Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 14: Global High-tech Logistics Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 15: Global High-tech Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global High-tech Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 17: Global High-tech Logistics Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 18: Global High-tech Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High-tech Logistics Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the High-tech Logistics Industry?

Key companies in the market include DB Schenker, AP Moller- Maersk, Ceva Logistics, CH Robinson, DHL Global Forwarding, Agility Logistics, GEFCO Group**List Not Exhaustive 7 3 Other Companies (Key Information/Overview, Kuehne + Nagel, Kerry Logistics, Geodis, Aramex, BLG Logistics, Rhenus Logistics, DSV Panalpina.

3. What are the main segments of the High-tech Logistics Industry?

The market segments include Service, Product Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics.

6. What are the notable trends driving market growth?

Growth in the High-tech Industry.

7. Are there any restraints impacting market growth?

Damaged Goods; Increasing Transportation Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High-tech Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High-tech Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High-tech Logistics Industry?

To stay informed about further developments, trends, and reports in the High-tech Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence