Key Insights

The global hormonal implants market is poised for robust expansion, projected to reach approximately USD 1.12 billion in 2024, and is anticipated to experience a significant Compound Annual Growth Rate (CAGR) of 7.61% from 2025 to 2033. This growth is primarily propelled by the increasing adoption of long-acting reversible contraceptives (LARCs) as women seek more convenient and effective birth control methods. The rising awareness surrounding family planning, coupled with a growing preference for discrete and hassle-free contraception, are key market drivers. Furthermore, advancements in implant technology, leading to improved efficacy and reduced side effects, are also contributing to market momentum. The market is segmented into two primary types: Etonogestrel implants and Levonorgestrel implants, both offering distinct advantages to users.

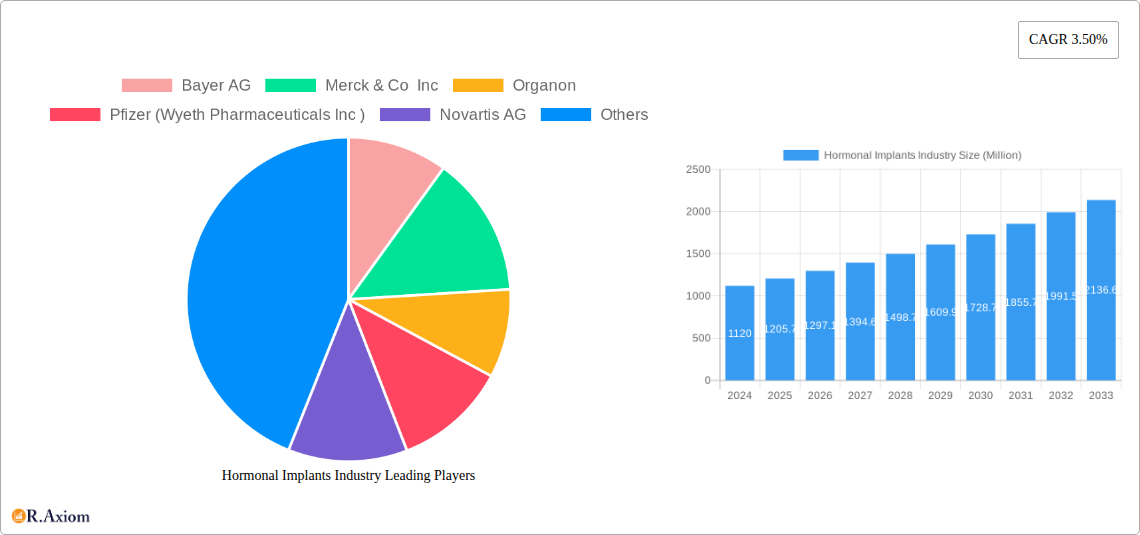

Hormonal Implants Industry Market Size (In Billion)

The sustained growth of the hormonal implants market is further influenced by a favorable regulatory landscape and supportive government initiatives promoting reproductive health. Major companies such as Bayer AG, Merck & Co. Inc., Organon, and Pfizer are actively investing in research and development to innovate and expand their product portfolios, driving competition and market accessibility. While the market shows strong upward trends, potential restraints such as high upfront costs for some individuals and limited availability in certain underserved regions require strategic attention. The Asia Pacific region, particularly China and India, is expected to witness substantial growth due to increasing disposable incomes and a growing emphasis on women's health. North America and Europe will continue to be dominant markets, driven by established healthcare infrastructure and high adoption rates of advanced contraceptives.

Hormonal Implants Industry Company Market Share

Hormonal Implants Industry Market Concentration & Innovation

The global hormonal implants market, projected to reach over 10 billion by 2033, exhibits a moderate level of concentration, with key players like Bayer AG, Merck & Co Inc, Organon, Pfizer (Wyeth Pharmaceuticals Inc), and Novartis AG holding significant market share. Innovation is a critical differentiator, driven by ongoing research and development into more advanced, longer-lasting, and user-friendly contraceptive implant technologies. The regulatory landscape, particularly stringent approvals from bodies like the FDA and EMA, plays a pivotal role in shaping market entry and product lifecycles. Substitutes, including oral contraceptives, IUDs, and sterilization procedures, exert competitive pressure, necessitating continuous product improvement and differentiation. End-user trends are increasingly leaning towards long-acting reversible contraceptives (LARCs) due to their convenience and high efficacy, fueling demand for hormonal implants. Mergers and acquisitions (M&A) are less prevalent due to the established nature of key players, but strategic partnerships and licensing agreements are common avenues for expanding market reach and technological capabilities, with estimated M&A deal values in the hundreds of millions of dollars.

Hormonal Implants Industry Industry Trends & Insights

The hormonal implants industry is poised for robust growth, driven by a confluence of escalating demand for effective and long-acting reversible contraceptives (LARCs), increasing global awareness about family planning, and significant advancements in contraceptive technology. The market is expected to witness a compound annual growth rate (CAGR) of approximately 7.5% from 2025 to 2033. Factors contributing to this upward trajectory include a growing preference among women for methods that offer convenience and reduce the daily burden of contraception, alongside the inherent high efficacy rates of hormonal implants, typically exceeding 99%. Technological disruptions are manifesting in the development of implants with improved drug delivery systems, extended lifespans, and reduced side effects. Furthermore, the expansion of healthcare access in emerging economies and supportive government initiatives promoting reproductive health are significantly boosting market penetration. Competitive dynamics are characterized by a focus on product differentiation, particularly in terms of implant duration, ease of insertion and removal, and the types of hormones utilized. Pharmaceutical giants are investing heavily in research and development to secure a competitive edge and cater to evolving consumer preferences. The integration of digital health solutions, such as apps for tracking implant expiry and scheduling follow-ups, is also emerging as a trend that enhances user experience and adherence. The overall market penetration is projected to increase substantially as awareness campaigns and accessibility improve, particularly in regions with high unmet needs for modern contraceptive methods.

Dominant Markets & Segments in Hormonal Implants Industry

The Etonogestrel Implant segment is currently leading the hormonal implants market, projecting a market size of over 5 billion by 2025. This dominance is attributed to its favorable efficacy, extended duration of action (up to three years), and a well-established safety profile, making it a preferred choice for many healthcare providers and patients. The Levonorgestrel Implant segment, while also significant, is projected to follow closely, with an estimated market size of over 3 billion by 2025. Its market presence is supported by its long history of use and its availability in different formulations and durations, catering to a diverse range of user needs.

Key Drivers of Etonogestrel Implant Dominance:

- Extended Efficacy and Duration: Offers up to three years of continuous contraception, minimizing the need for frequent replacements.

- Patient Convenience: Eliminates the daily hassle of remembering to take oral contraceptives, improving adherence rates.

- High Efficacy Rates: Consistently demonstrates over 99% effectiveness in preventing pregnancy.

- Established Safety Profile: Extensive clinical data supports its safety and tolerability for a wide demographic.

- Healthcare Provider Recommendation: Widely recommended by gynecologists and family planning specialists due to its reliability.

- Technological Advancements: Continued research into formulations and delivery mechanisms enhances user experience and therapeutic outcomes.

Key Drivers of Levonorgestrel Implant Growth:

- Cost-Effectiveness: In certain markets, Levonorgestrel implants may offer a more budget-friendly alternative.

- Variety of Options: Availability of different dosages and durations (e.g., one-year, three-year implants) provides flexibility for users.

- Global Accessibility: Established manufacturing and distribution networks ensure wider availability across various regions.

- Government Health Programs: Inclusion in national family planning initiatives contributes to its market penetration.

- Ongoing Research: Efforts to improve side-effect profiles and user comfort continue to drive its relevance.

Geographically, North America and Europe currently represent the most dominant markets, accounting for over 60% of the global hormonal implants market revenue. This dominance is driven by high disposable incomes, advanced healthcare infrastructure, strong regulatory frameworks that facilitate product approvals, and a well-informed consumer base that actively seeks advanced contraceptive solutions. Government initiatives promoting reproductive health and the widespread availability of healthcare services further bolster market growth in these regions. Emerging markets in Asia Pacific and Latin America are exhibiting substantial growth potential due to increasing awareness about family planning, improving healthcare access, and a growing middle-class population seeking modern contraceptive methods.

Hormonal Implants Industry Product Developments

Product development in the hormonal implants industry is characterized by a strong focus on enhancing efficacy, extending duration of action, and minimizing side effects. Innovations are centered on advanced drug delivery systems that ensure consistent hormone release, leading to prolonged contraceptive cover, such as the Implanon NXT. Research into novel hormonal combinations and fully resorbable materials, like those being evaluated by ProMed Pharma, aims to create implants that are not only effective but also offer improved user experience and reduced invasiveness upon removal. Competitive advantages are being carved out through superior biocompatibility, ease of insertion and removal procedures, and the development of implants tailored to specific demographic needs, ultimately aiming to improve patient compliance and satisfaction in long-term contraception.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global hormonal implants market, segmented by Type, including Etonogestrel Implant and Levonorgestrel Implant. The Etonogestrel Implant segment is projected to reach over 7 billion by 2033, driven by its widespread adoption and proven efficacy. The Levonorgestrel Implant segment is expected to grow to over 4 billion by 2033, benefiting from its established presence and diverse product offerings. The competitive dynamics within each segment are shaped by the innovation pipelines of key players, regulatory approvals, and evolving end-user preferences for long-acting reversible contraceptives.

Key Drivers of Hormonal Implants Industry Growth

The growth of the hormonal implants industry is propelled by several key drivers. Firstly, the increasing global demand for effective and convenient long-acting reversible contraceptives (LARCs) is a primary catalyst, driven by women's desire for autonomy in family planning and reduced daily contraceptive burdens. Secondly, advancements in contraceptive technology, leading to implants with extended lifespans and improved side-effect profiles, are expanding market appeal. Thirdly, government initiatives and non-governmental organizations promoting reproductive health and family planning services globally are crucial in increasing access and awareness. Lastly, a growing emphasis on women's health and reproductive rights worldwide is fostering a more receptive market environment for advanced contraceptive solutions.

Challenges in the Hormonal Implants Industry Sector

Despite significant growth potential, the hormonal implants industry faces several challenges. High initial costs associated with the devices and their insertion can be a barrier to adoption, particularly in low-income regions. Stringent regulatory approval processes, though essential for patient safety, can delay market entry for new products. The availability of skilled healthcare professionals for proper insertion and removal procedures is also a critical factor, and shortages can limit accessibility. Furthermore, potential side effects, although generally manageable, can lead to patient dissatisfaction and discontinuation, impacting market growth. Competitive pressures from other contraceptive methods, including generic alternatives and emerging technologies, also necessitate continuous innovation and cost management.

Emerging Opportunities in Hormonal Implants Industry

Emerging opportunities within the hormonal implants industry are manifold. The untapped potential in developing economies, where access to modern contraception is limited, presents a significant growth avenue as healthcare infrastructure improves. Research into novel drug formulations, including hormone-free or bio-resorbable implants, offers the prospect of addressing unmet needs and expanding the user base. Furthermore, the integration of digital health technologies, such as remote monitoring and personalized contraceptive management apps, can enhance patient engagement and adherence, creating new value propositions. Strategic partnerships with public health organizations and governments can facilitate wider distribution and affordability, further unlocking market potential.

Leading Players in the Hormonal Implants Industry Market

- Bayer AG

- Merck & Co Inc

- Organon

- Pfizer (Wyeth Pharmaceuticals Inc)

- Novartis AG

- Shanghai Dahua Pharmaceutical Co Ltd

Key Developments in Hormonal Implants Industry Industry

- February 2023: The Family Planning Association of India (FPAI) has been promoting the use of a new contraceptive, Implanon NXT. The subdermal single-rod implant (Implanon NXT) is a new reversible contraceptive with a long-term effect. It replaces older types of contraceptive implants such as Norplant, Jadelle, Sino-implant, and Implanon. This development signifies a shift towards more advanced and user-friendly implant technologies in key emerging markets.

- April 2022: ProMed Pharma began preclinical evaluation of a novel, fully resorbable contraceptive implant after getting the funds from the Bill & Melinda Gates Foundation. This indicates a significant step towards developing next-generation implants with improved sustainability and potential for reduced invasiveness.

Strategic Outlook for Hormonal Implants Industry Market

The strategic outlook for the hormonal implants market is highly positive, characterized by continued innovation and expanding global reach. Key growth catalysts include the persistent demand for long-acting reversible contraceptives, driven by global reproductive health initiatives and evolving consumer preferences for convenience and efficacy. The industry will likely see further investment in research and development to introduce implants with extended lifespans, enhanced safety profiles, and potentially hormone-free options. Expansion into underserved emerging markets, coupled with strategic partnerships with healthcare providers and governments, will be crucial for maximizing market penetration. The increasing integration of digital health solutions to improve patient engagement and adherence also presents a significant opportunity for market leaders to differentiate themselves and offer a more holistic contraceptive care experience, projecting a sustained upward trajectory for the industry.

Hormonal Implants Industry Segmentation

-

1. Type

- 1.1. Etonogestrel Implant

- 1.2. Levonorgestrel Implant

Hormonal Implants Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Australia

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Hormonal Implants Industry Regional Market Share

Geographic Coverage of Hormonal Implants Industry

Hormonal Implants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Number of Initiatives to Promote Contraceptive Methods; Increasing Number of Unwanted Pregnancies

- 3.3. Market Restrains

- 3.3.1. Rising Prevalence of Infertility; Lack of Awareness and Adverse Effects of Contraceptive Implants

- 3.4. Market Trends

- 3.4.1. Etonogestrel Implant Segment is Expected to Witness Considerable Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hormonal Implants Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Etonogestrel Implant

- 5.1.2. Levonorgestrel Implant

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hormonal Implants Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Etonogestrel Implant

- 6.1.2. Levonorgestrel Implant

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Hormonal Implants Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Etonogestrel Implant

- 7.1.2. Levonorgestrel Implant

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Hormonal Implants Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Etonogestrel Implant

- 8.1.2. Levonorgestrel Implant

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Hormonal Implants Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Etonogestrel Implant

- 9.1.2. Levonorgestrel Implant

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Bayer AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Merck & Co Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Organon

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Pfizer (Wyeth Pharmaceuticals Inc )

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Novartis AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Shanghai Dahua Pharmaceutical Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Bayer AG

List of Figures

- Figure 1: Global Hormonal Implants Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Hormonal Implants Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Hormonal Implants Industry Revenue (undefined), by Type 2025 & 2033

- Figure 4: North America Hormonal Implants Industry Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Hormonal Implants Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Hormonal Implants Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Hormonal Implants Industry Revenue (undefined), by Country 2025 & 2033

- Figure 8: North America Hormonal Implants Industry Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Hormonal Implants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Hormonal Implants Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Hormonal Implants Industry Revenue (undefined), by Type 2025 & 2033

- Figure 12: Europe Hormonal Implants Industry Volume (K Unit), by Type 2025 & 2033

- Figure 13: Europe Hormonal Implants Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Hormonal Implants Industry Volume Share (%), by Type 2025 & 2033

- Figure 15: Europe Hormonal Implants Industry Revenue (undefined), by Country 2025 & 2033

- Figure 16: Europe Hormonal Implants Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Hormonal Implants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Hormonal Implants Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Hormonal Implants Industry Revenue (undefined), by Type 2025 & 2033

- Figure 20: Asia Pacific Hormonal Implants Industry Volume (K Unit), by Type 2025 & 2033

- Figure 21: Asia Pacific Hormonal Implants Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Hormonal Implants Industry Volume Share (%), by Type 2025 & 2033

- Figure 23: Asia Pacific Hormonal Implants Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: Asia Pacific Hormonal Implants Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific Hormonal Implants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hormonal Implants Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Rest of the World Hormonal Implants Industry Revenue (undefined), by Type 2025 & 2033

- Figure 28: Rest of the World Hormonal Implants Industry Volume (K Unit), by Type 2025 & 2033

- Figure 29: Rest of the World Hormonal Implants Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Rest of the World Hormonal Implants Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Rest of the World Hormonal Implants Industry Revenue (undefined), by Country 2025 & 2033

- Figure 32: Rest of the World Hormonal Implants Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Rest of the World Hormonal Implants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of the World Hormonal Implants Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hormonal Implants Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Hormonal Implants Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Hormonal Implants Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Hormonal Implants Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Hormonal Implants Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Hormonal Implants Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: Global Hormonal Implants Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Global Hormonal Implants Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United States Hormonal Implants Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: United States Hormonal Implants Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Canada Hormonal Implants Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Canada Hormonal Implants Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Mexico Hormonal Implants Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Mexico Hormonal Implants Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Global Hormonal Implants Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 16: Global Hormonal Implants Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 17: Global Hormonal Implants Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Global Hormonal Implants Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Germany Hormonal Implants Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Hormonal Implants Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: United Kingdom Hormonal Implants Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Hormonal Implants Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: France Hormonal Implants Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France Hormonal Implants Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Italy Hormonal Implants Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy Hormonal Implants Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Spain Hormonal Implants Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Spain Hormonal Implants Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Hormonal Implants Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Hormonal Implants Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Global Hormonal Implants Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 32: Global Hormonal Implants Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 33: Global Hormonal Implants Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: Global Hormonal Implants Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 35: China Hormonal Implants Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: China Hormonal Implants Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: India Hormonal Implants Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: India Hormonal Implants Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Australia Hormonal Implants Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Australia Hormonal Implants Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: South Korea Hormonal Implants Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: South Korea Hormonal Implants Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Rest of Asia Pacific Hormonal Implants Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Rest of Asia Pacific Hormonal Implants Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Global Hormonal Implants Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 46: Global Hormonal Implants Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 47: Global Hormonal Implants Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Global Hormonal Implants Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hormonal Implants Industry?

The projected CAGR is approximately 7.61%.

2. Which companies are prominent players in the Hormonal Implants Industry?

Key companies in the market include Bayer AG, Merck & Co Inc, Organon, Pfizer (Wyeth Pharmaceuticals Inc ), Novartis AG, Shanghai Dahua Pharmaceutical Co Ltd.

3. What are the main segments of the Hormonal Implants Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Initiatives to Promote Contraceptive Methods; Increasing Number of Unwanted Pregnancies.

6. What are the notable trends driving market growth?

Etonogestrel Implant Segment is Expected to Witness Considerable Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Rising Prevalence of Infertility; Lack of Awareness and Adverse Effects of Contraceptive Implants.

8. Can you provide examples of recent developments in the market?

February 2023: The Family Planning Association of India (FPAI) has been promoting the use of a new contraceptive, Implanon NXT. The subdermal single-rod implant (Implanon NXT) is a new reversible contraceptive with a long-term effect. It replaces older types of contraceptive implants such as Norplant, Jadelle, Sino-implant, and Implanon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hormonal Implants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hormonal Implants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hormonal Implants Industry?

To stay informed about further developments, trends, and reports in the Hormonal Implants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence