Key Insights

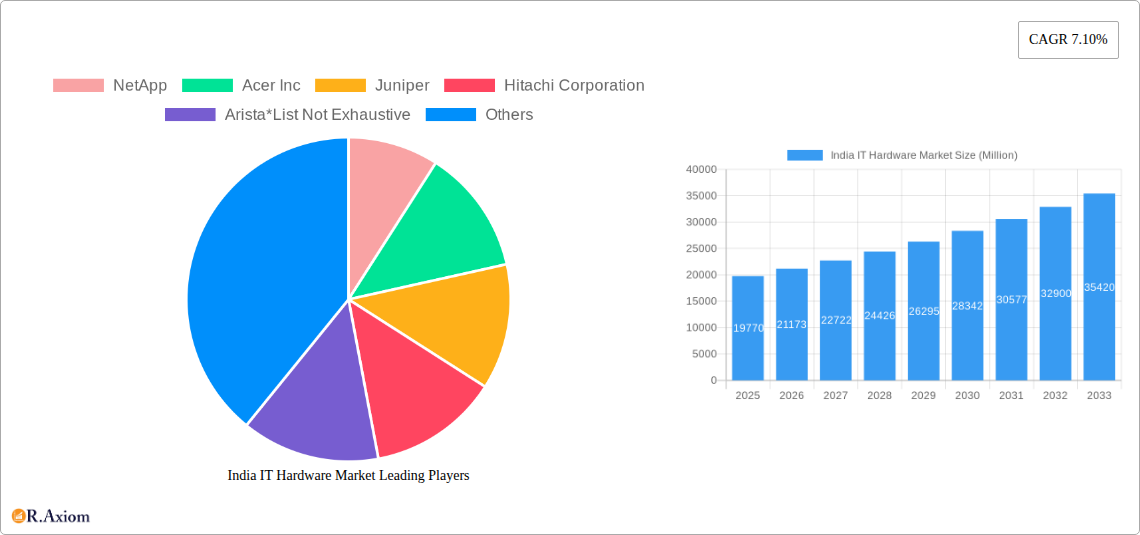

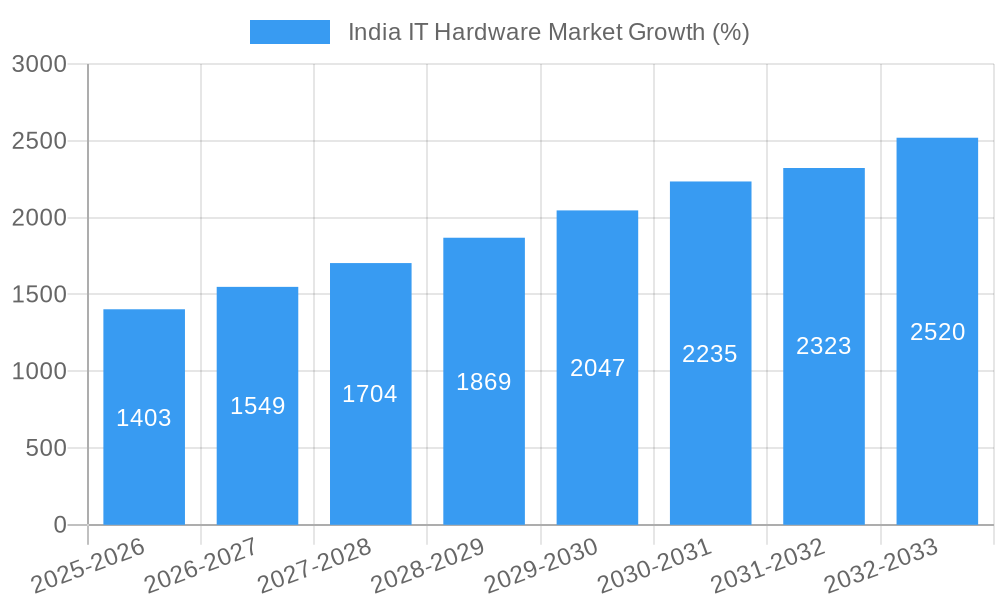

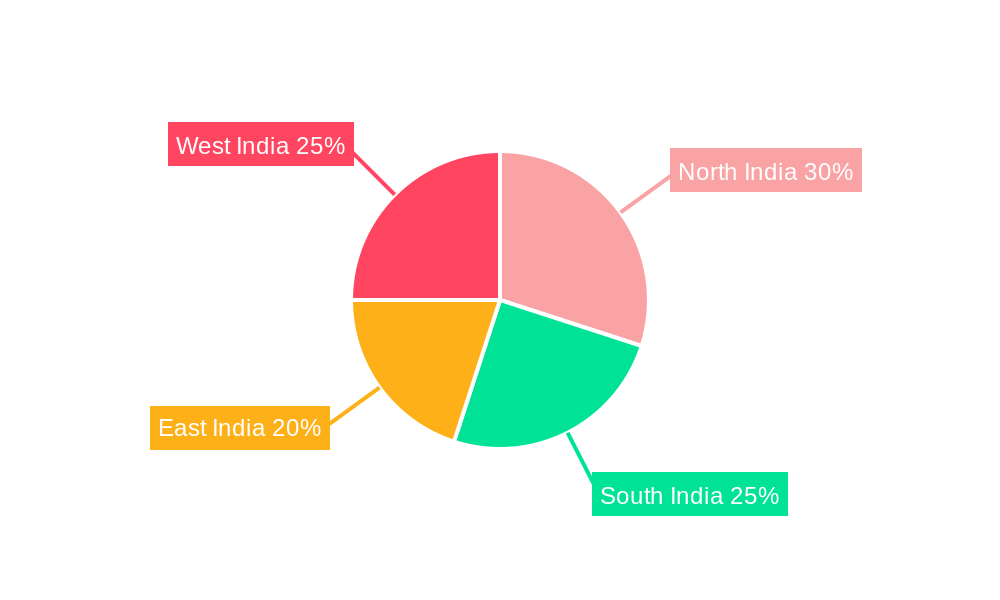

The India IT hardware market, valued at $19.77 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 7.10% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning BFSI (Banking, Financial Services, and Insurance) sector's increasing adoption of advanced technologies necessitates substantial IT infrastructure investments, including servers, enterprise storage, and networking hardware. Simultaneously, the rapid growth of the retail and IT/telecom industries fuels demand for PCs, workstations, and peripherals. Government initiatives promoting digitalization further contribute to this market's dynamism. The market is segmented geographically, with significant contributions from North, South, East, and West India. Large enterprises are the dominant consumers of high-end IT hardware, while SMEs contribute to the overall demand, particularly in the PC and peripheral segments. Key vendors such as Dell, HP, Lenovo, Cisco, and NetApp are fiercely competitive, constantly innovating to meet evolving market needs. While the market enjoys substantial growth, potential restraints include fluctuating currency exchange rates and global economic uncertainties that may affect IT spending. However, the strong fundamentals of the Indian economy and the continuous digital transformation across various sectors suggest continued market expansion throughout the forecast period.

The market's segmentation offers opportunities for specialized vendors. For example, the growing adoption of cloud technologies and data analytics presents opportunities for companies specializing in enterprise storage and networking solutions. The increasing penetration of smartphones and internet connectivity in rural areas also opens up opportunities for companies selling consumer-grade hardware and peripherals. Furthermore, the government's focus on developing smart cities and digital infrastructure is expected to boost demand for specialized IT hardware in urban areas. Competition within the market is intense, with established players battling for market share and new entrants introducing innovative products and services. Success will depend on offering competitive pricing, strong customer support, and a robust distribution network. The forecast period will likely see a shift towards more sustainable and energy-efficient IT hardware, aligning with global environmental concerns.

India IT Hardware Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India IT Hardware Market, covering the period 2019-2033. It offers actionable insights into market size, segmentation, growth drivers, challenges, and opportunities, empowering businesses to make informed strategic decisions. The report leverages extensive data analysis and incorporates the latest industry developments to present a robust and up-to-date market perspective. The Base Year is 2025, with the Estimated Year also being 2025, and a Forecast Period spanning 2025-2033. The Historical Period analyzed is 2019-2024.

India IT Hardware Market Market Concentration & Innovation

The India IT Hardware Market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. However, the market also shows signs of increasing competition, driven by the entry of new players and the expansion of existing ones. Market share data for key players like Dell Technologies Inc, HP Inc, Lenovo Group Ltd, and others will be detailed in the full report. Innovation is a key driver, with companies continuously developing new products and solutions to meet evolving customer needs. The regulatory framework, while generally supportive of market growth, presents certain challenges in areas such as data protection and cybersecurity. The report will delve into the impact of these regulations, along with an assessment of product substitutes and their market penetration. Mergers and Acquisitions (M&A) activities play a significant role in shaping the market landscape, with deal values ranging from xx Million to xx Million in recent years. The full report will provide a detailed analysis of recent M&A activities and their impact on market consolidation and innovation. End-user trends, especially the increasing adoption of cloud computing and the demand for advanced technologies, are shaping the market's future.

- Key Metrics: Market share of top players, M&A deal values, product substitution rates, and end-user adoption rates.

- Innovation Drivers: Technological advancements, government initiatives, and growing customer demand for advanced solutions.

- Regulatory Framework: Analysis of impact of relevant regulations and compliance requirements.

India IT Hardware Market Industry Trends & Insights

The India IT Hardware Market is experiencing robust growth, driven by factors such as increasing digitalization, rising government spending on IT infrastructure, and growing adoption of technology across various sectors. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Technological disruptions, including the emergence of cloud computing, Artificial Intelligence (AI), and the Internet of Things (IoT), are reshaping the market dynamics. Consumer preferences are shifting towards more energy-efficient, user-friendly, and cost-effective hardware solutions. Competitive dynamics are intense, with companies focusing on differentiation through product innovation, strategic partnerships, and aggressive pricing strategies. Market penetration rates for various IT hardware segments will be analyzed in detail within the full report, providing a comprehensive overview of market trends and insights.

Dominant Markets & Segments in India IT Hardware Market

The India IT Hardware Market is characterized by a geographically diverse demand with varying levels of saturation. Within the industry segments, the IT and Telecom sector dominates, followed by BFSI (Banking, Financial Services, and Insurance), with Retail and Other Industries exhibiting steady growth. Market dominance is further analyzed by region, with South India currently exhibiting the largest market share, followed closely by West and Central India. The full report includes detailed regional breakdowns for each segment, including PCs and Workstations, Enterprise Storage Devices, Servers, Enterprise Networking Hardware, and Other Hardware.

Key Drivers:

- Economic Policies: Government initiatives promoting digitalization and technological adoption.

- Infrastructure Development: Investments in data centers and network infrastructure.

- Technological Advancements: Adoption of cloud computing, AI, and IoT technologies.

Dominance Analysis: Detailed analysis of market share, growth rates, and competitive dynamics for each region and segment. Specific vendor dominance within each segment will be highlighted.

Region-Specific Insights: The report delves deep into each region (North, East, West & Central, South) to pinpoint segment-specific trends and growth factors, along with identifying leading vendors within those regional pockets.

Examples of Leading Vendors by Segment:

- Enterprise Storage Devices: NetApp, Dell Technologies Inc, HP Inc, etc.

- Servers: HP Inc, Dell Technologies Inc, Lenovo Group Ltd, etc.

- PCs and Workstations: HP Inc, Dell Technologies Inc, Lenovo Group Ltd, Acer Inc, etc.

- Enterprise Networking Hardware: Cisco Systems Inc, Juniper, Arista, etc.

- Other Hardware: HP Inc, Samsung Electronics Co Ltd, Panasonic Corporation, etc.

India IT Hardware Market Product Developments

Recent product innovations focus on enhanced performance, energy efficiency, and improved security features. The market is witnessing a surge in demand for cloud-ready hardware, AI-powered solutions, and devices with enhanced data analytics capabilities. These developments are aimed at meeting the evolving needs of businesses and consumers alike, ensuring better market fit and a competitive advantage. The report will detail specific examples of these product innovations and their impact on the market.

Report Scope & Segmentation Analysis

This report offers a granular segmentation of the India IT Hardware Market, including:

- By Industry: BFSI, Retail, IT and Telecom, Other Industries. Each industry segment will have individual growth projections, market sizes, and competitive landscape analyses.

- By Region: North India, East India, West and Central India, South India. Regional variations in growth, adoption rates, and competitive dynamics will be highlighted.

- By Enterprise Size: SMEs and Large Enterprises. The report will analyze specific hardware requirements and purchasing patterns for each enterprise size.

- By Hardware Type: Enterprise Storage Devices (Enterprise), Servers (Enterprise), PCs and Workstations (End-user and Enterprise), Other Hardware (Printers, Copiers etc.), Enterprise Networking Hardware (Enterprise). Each type is segmented further, where applicable (e.g., by enterprise size).

- List of Major Vendors in each Segment: Detailed information regarding major players in each segment will be provided.

Key Drivers of India IT Hardware Market Growth

Several factors are driving growth in the India IT Hardware Market. Government initiatives promoting digital India are significantly impacting market growth. Increasing investments in IT infrastructure, particularly in data centers, contribute significantly to the growth. The rising adoption of cloud computing and other advanced technologies is fueling the demand for new hardware. The increasing need for digital transformation across various sectors further boosts this growth.

Challenges in the India IT Hardware Market Sector

The market faces challenges such as supply chain disruptions, impacting the timely delivery of hardware components. Fluctuations in currency exchange rates pose a significant risk. Intense competition among vendors can lead to price wars. Stringent regulatory compliance requirements add to operational complexity for businesses.

Emerging Opportunities in India IT Hardware Market

Growth opportunities exist in emerging technologies, such as AI, IoT, and edge computing. Expansion into underserved rural markets presents a significant untapped potential. The increasing demand for cybersecurity solutions creates opportunities for specialized hardware vendors. The growing adoption of hybrid and multi-cloud environments will propel the demand for compatible IT hardware solutions.

Leading Players in the India IT Hardware Market Market

- NetApp

- Acer Inc

- Juniper

- Hitachi Corporation

- Arista

- Samsung Electronics Co Ltd

- Cisco Systems Inc

- HP Inc

- Dell Technologies Inc

- Lenovo Group Ltd

- Panasonic Corporation

- IBM

Key Developments in India IT Hardware Market Industry

- September 2023: Tech Data (TD SYNNEX subsidiary) partnered with Allied Telesis, becoming the premium distributor for Allied Telesis India Pvt Ltd, boosting networking solutions market growth.

- February 2023: Bharti Airtel and Vultr partnered to offer cloud solutions hosted in Airtel's data centers, providing businesses with access to advanced technologies.

Strategic Outlook for India IT Hardware Market Market

The India IT Hardware Market is poised for continued growth, driven by technological advancements and expanding digital adoption. Strategic partnerships, investments in R&D, and focusing on customer-centric solutions will be crucial for success. The market's future potential is significant, especially with the government's continued support for digitalization initiatives.

India IT Hardware Market Segmentation

-

1. Other Ha

- 1.1. List of Major Vendors in the Segment

India IT Hardware Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

India IT Hardware Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Growth in Demand for Laptops to Accommodate Hybrid Work Policies; High Demand for Technology Integration and Efficient Computing Systems; Increasing Digitization of the Public Sector

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Inflation Impacting the Market

- 3.4. Market Trends

- 3.4.1. PC and Workstations to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global India IT Hardware Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Other Ha

- 5.1.1. List of Major Vendors in the Segment

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Other Ha

- 6. North America India IT Hardware Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Other Ha

- 6.1.1. List of Major Vendors in the Segment

- 6.1. Market Analysis, Insights and Forecast - by Other Ha

- 7. South America India IT Hardware Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Other Ha

- 7.1.1. List of Major Vendors in the Segment

- 7.1. Market Analysis, Insights and Forecast - by Other Ha

- 8. Europe India IT Hardware Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Other Ha

- 8.1.1. List of Major Vendors in the Segment

- 8.1. Market Analysis, Insights and Forecast - by Other Ha

- 9. Middle East & Africa India IT Hardware Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Other Ha

- 9.1.1. List of Major Vendors in the Segment

- 9.1. Market Analysis, Insights and Forecast - by Other Ha

- 10. Asia Pacific India IT Hardware Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Other Ha

- 10.1.1. List of Major Vendors in the Segment

- 10.1. Market Analysis, Insights and Forecast - by Other Ha

- 11. North India India IT Hardware Market Analysis, Insights and Forecast, 2019-2031

- 12. South India India IT Hardware Market Analysis, Insights and Forecast, 2019-2031

- 13. East India India IT Hardware Market Analysis, Insights and Forecast, 2019-2031

- 14. West India India IT Hardware Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 NetApp

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Acer Inc

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Juniper

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Hitachi Corporation

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Arista*List Not Exhaustive

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Samsung Electronics Co Ltd

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Cisco Systems Inc

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 HP Inc

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Dell Technologies Inc

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Lenovo Group Ltd

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Panasonic Corporation

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.12 IBM

- 15.2.12.1. Overview

- 15.2.12.2. Products

- 15.2.12.3. SWOT Analysis

- 15.2.12.4. Recent Developments

- 15.2.12.5. Financials (Based on Availability)

- 15.2.1 NetApp

List of Figures

- Figure 1: Global India IT Hardware Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: India India IT Hardware Market Revenue (Million), by Country 2024 & 2032

- Figure 3: India India IT Hardware Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America India IT Hardware Market Revenue (Million), by Other Ha 2024 & 2032

- Figure 5: North America India IT Hardware Market Revenue Share (%), by Other Ha 2024 & 2032

- Figure 6: North America India IT Hardware Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America India IT Hardware Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America India IT Hardware Market Revenue (Million), by Other Ha 2024 & 2032

- Figure 9: South America India IT Hardware Market Revenue Share (%), by Other Ha 2024 & 2032

- Figure 10: South America India IT Hardware Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America India IT Hardware Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe India IT Hardware Market Revenue (Million), by Other Ha 2024 & 2032

- Figure 13: Europe India IT Hardware Market Revenue Share (%), by Other Ha 2024 & 2032

- Figure 14: Europe India IT Hardware Market Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe India IT Hardware Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa India IT Hardware Market Revenue (Million), by Other Ha 2024 & 2032

- Figure 17: Middle East & Africa India IT Hardware Market Revenue Share (%), by Other Ha 2024 & 2032

- Figure 18: Middle East & Africa India IT Hardware Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa India IT Hardware Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific India IT Hardware Market Revenue (Million), by Other Ha 2024 & 2032

- Figure 21: Asia Pacific India IT Hardware Market Revenue Share (%), by Other Ha 2024 & 2032

- Figure 22: Asia Pacific India IT Hardware Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific India IT Hardware Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global India IT Hardware Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global India IT Hardware Market Revenue Million Forecast, by Other Ha 2019 & 2032

- Table 3: Global India IT Hardware Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global India IT Hardware Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North India India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: South India India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: East India India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: West India India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global India IT Hardware Market Revenue Million Forecast, by Other Ha 2019 & 2032

- Table 10: Global India IT Hardware Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global India IT Hardware Market Revenue Million Forecast, by Other Ha 2019 & 2032

- Table 15: Global India IT Hardware Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Brazil India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Argentina India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of South America India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global India IT Hardware Market Revenue Million Forecast, by Other Ha 2019 & 2032

- Table 20: Global India IT Hardware Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global India IT Hardware Market Revenue Million Forecast, by Other Ha 2019 & 2032

- Table 31: Global India IT Hardware Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global India IT Hardware Market Revenue Million Forecast, by Other Ha 2019 & 2032

- Table 39: Global India IT Hardware Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: China India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: India India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Japan India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: South Korea India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: ASEAN India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Oceania India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Asia Pacific India IT Hardware Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India IT Hardware Market?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the India IT Hardware Market?

Key companies in the market include NetApp, Acer Inc, Juniper, Hitachi Corporation, Arista*List Not Exhaustive, Samsung Electronics Co Ltd, Cisco Systems Inc, HP Inc, Dell Technologies Inc, Lenovo Group Ltd, Panasonic Corporation, IBM.

3. What are the main segments of the India IT Hardware Market?

The market segments include Other Ha.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Growth in Demand for Laptops to Accommodate Hybrid Work Policies; High Demand for Technology Integration and Efficient Computing Systems; Increasing Digitization of the Public Sector.

6. What are the notable trends driving market growth?

PC and Workstations to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Adverse Effects of Inflation Impacting the Market.

8. Can you provide examples of recent developments in the market?

September 2023 - Tech Data, a subsidiary of TD SYNNEX, extended a partnership with Allied Telesis, a connectivity solutions and smart networks provider. As a result, Tech Data became the premium distributor for Allied Telesis India Pvt Ltd based in Mumbai, India, as part of the collaboration to enhance the country's burgeoning market for networking solutions. Allied Telesis solutions offer network control, reducing downtime and streamlining operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is " India IT Hardware Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India IT Hardware Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India IT Hardware Market?

To stay informed about further developments, trends, and reports in the India IT Hardware Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence