Key Insights

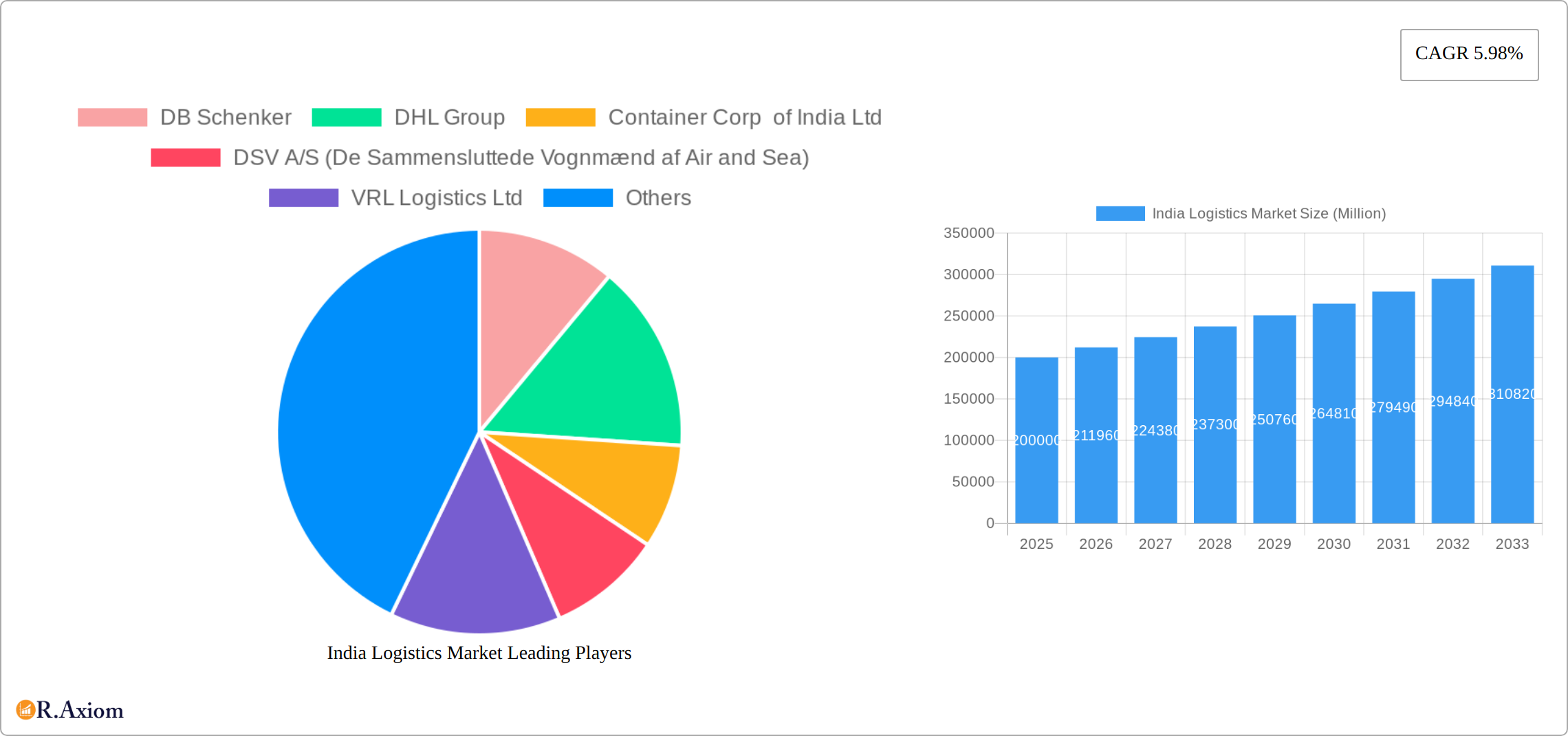

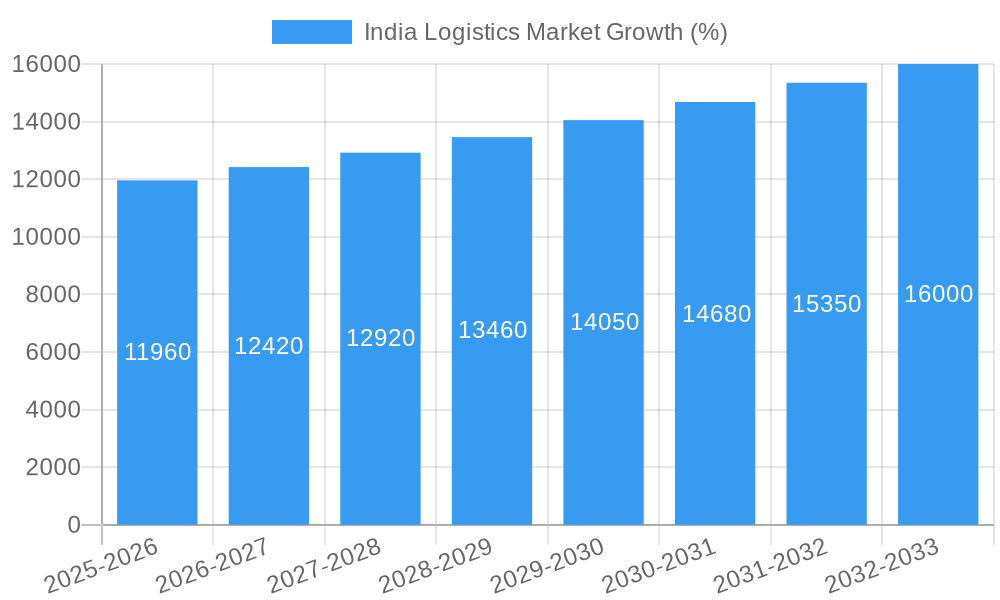

The Indian logistics market, valued at approximately ₹200 billion (estimated based on available data and industry trends) in 2025, is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of 5.98% from 2025 to 2033. This expansion is fueled by several key drivers: the burgeoning e-commerce sector driving demand for express delivery and temperature-controlled logistics; increasing industrialization and manufacturing activity requiring efficient supply chain solutions; and government initiatives focused on infrastructure development, like improved roadways and railways, streamlining logistics operations. Significant growth is observed across segments, with Courier, Express, and Parcel (CEP) services leading the way, followed by temperature-controlled logistics catering to the expanding food and pharmaceutical industries. The construction, manufacturing, and retail sectors are major end-user industries driving demand. However, challenges remain, including infrastructure limitations in certain regions, particularly in last-mile delivery, and the need for technological advancements to enhance supply chain visibility and efficiency. Furthermore, regulatory complexities and skilled labor shortages pose ongoing constraints to market expansion.

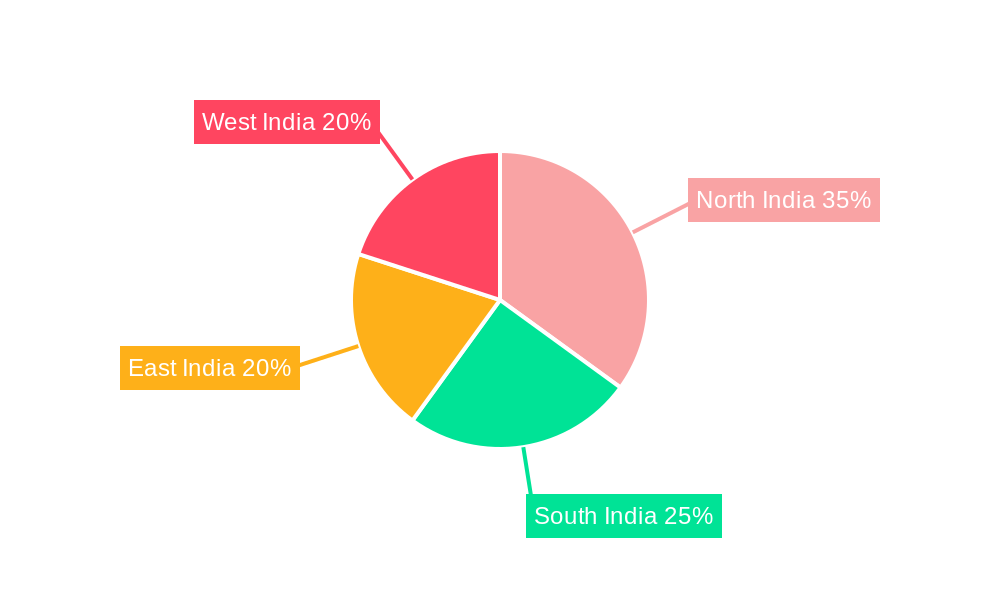

Regional disparities exist within India, with North and West India currently dominating market share due to established industrial hubs and better infrastructure. However, South and East India are poised for significant growth as infrastructure improves and e-commerce penetration increases. Key players like DHL, FedEx, and local giants such as Delhivery and Mahindra Logistics are fiercely competing, investing heavily in technology and expanding their networks to capitalize on the market's potential. This competitive landscape is fostering innovation and driving down costs, further benefiting businesses relying on efficient and cost-effective logistics solutions. The forecast for 2033 projects a market size significantly larger than 2025, indicating continued expansion and solidifying India’s position as a key logistics market in Asia.

India Logistics Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India Logistics Market, covering market size, segmentation, key players, growth drivers, challenges, and future opportunities. With a focus on the period 2019-2033, the report offers valuable insights for industry stakeholders, investors, and businesses operating in or planning to enter this dynamic market. The study encompasses detailed analysis of various segments including end-user industries and logistics functions, incorporating recent industry developments to provide a current and actionable overview.

India Logistics Market Market Concentration & Innovation

The India logistics market exhibits a moderately concentrated structure, with several large players holding significant market share, alongside numerous smaller regional players. While precise market share figures for each player vary and are constantly evolving, companies like DHL Group, FedEx, and Allcargo Logistics Ltd. command substantial portions of the market, particularly in specific segments. The market is characterized by intense competition, driving innovation in technology, services, and operational efficiency. Several factors influence this concentration, including:

- High capital expenditure: The logistics industry requires substantial investments in infrastructure, technology, and fleet management. This barrier to entry limits new entrants and favors established players with strong financial backing.

- Regulatory Framework: Government regulations and policies, while evolving to promote efficiency, can create complexities that favor established companies with the resources to navigate them.

- Technological disruptions: The adoption of technologies like AI, IoT, and blockchain is transforming logistics operations. Early adopters are gaining a competitive edge, while lagging companies face pressure to catch up.

- Mergers & Acquisitions (M&A): The Indian logistics sector has witnessed a significant number of M&A activities in recent years. While precise deal values are proprietary to the involved parties, many acquisitions have been aimed at consolidating market share, enhancing service offerings, and expanding geographical reach. Notable recent deals have involved xx Million in value (Data unavailable for precise figure). The continuous M&A activity will further shape the market concentration.

- Product Substitutes: While direct substitutes for core logistical services are limited, market pressure exists due to advancements in related technologies. For instance, e-commerce platforms integrating their logistics increasingly challenge traditional logistics providers.

India Logistics Market Industry Trends & Insights

The Indian logistics market is experiencing robust growth, driven by several key factors. The increasing e-commerce penetration, rapid industrialization, and government initiatives promoting infrastructure development are key catalysts. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx% (predicted), and is projected to remain strong at xx% (predicted) during the forecast period (2025-2033). Several other trends are shaping the market's trajectory:

- Technological disruptions: The adoption of advanced technologies like Artificial Intelligence (AI) and Internet of Things (IoT) is driving operational efficiency and improving supply chain visibility.

- E-commerce boom: The meteoric rise of e-commerce is fueling demand for faster, more reliable, and cost-effective last-mile delivery solutions. This has led to a surge in investments in logistics infrastructure and technology.

- Consumer preferences: Consumers are increasingly demanding faster delivery times and greater transparency in the shipping process, putting pressure on logistics providers to improve their services.

- Competitive dynamics: The market is highly competitive, with both established players and new entrants vying for market share. This competition is driving innovation and pushing providers to enhance their offerings.

- Market penetration: Although significant progress has been made, considerable untapped potential remains, especially in reaching underserved regions and sectors. The market penetration rate is projected to increase substantially (Specific figures unavailable, requires further research) over the forecast period.

Dominant Markets & Segments in India Logistics Market

The Indian logistics market is geographically diverse, with several regions showing strong growth. However, data limitations prevent the precise identification of the single most dominant region or segment, as data is proprietary for multiple companies. However, we can highlight some key factors:

- End-User Industry Dominance: Manufacturing, wholesale and retail trade, and e-commerce sectors are significant contributors to market growth, given their dependence on efficient logistics for supply chains and timely delivery.

- Logistics Function Dominance: Courier, Express, and Parcel (CEP) services are experiencing rapid growth driven by e-commerce. Temperature-controlled logistics is also gaining traction due to growth in the pharmaceutical and food industries.

Key Drivers for Dominant Segments:

- Economic policies: Government initiatives aimed at improving infrastructure and streamlining regulations positively impact overall logistics.

- Infrastructure development: Investments in infrastructure, including roads, railways, and ports, are crucial for improving connectivity and efficiency.

- Technological advancements: Innovations in warehousing, transportation, and tracking technologies enhance the efficiency and cost-effectiveness of operations.

India Logistics Market Product Developments

Recent product innovations in the Indian logistics market center on technology integration. This includes the development of advanced tracking systems, optimized routing software, and automated warehousing solutions. These improvements aim to enhance efficiency, reduce costs, and improve service delivery. The successful market fit of these developments depends heavily on integration with existing systems, cost-effectiveness, and the ability to address specific customer needs, particularly in terms of last-mile delivery optimization.

Report Scope & Segmentation Analysis

This report segments the India Logistics Market based on:

End-User Industry: Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; Others. Growth projections vary widely between segments, with manufacturing, e-commerce, and wholesale/retail showing the strongest growth potential. Competitive dynamics also vary, with some segments attracting more players than others.

Logistics Function: Courier, Express, and Parcel (CEP); Temperature Controlled; Other Services. The CEP segment is the fastest-growing, driven by e-commerce. Temperature-controlled logistics is also experiencing rapid growth driven by increasing demand for pharmaceuticals and other temperature-sensitive goods. Market size projections for these segments vary significantly based on technology advancement and consumer demands.

Key Drivers of India Logistics Market Growth

The Indian logistics market is propelled by several key factors:

- E-commerce expansion: The rapid growth of e-commerce is generating massive demand for efficient and reliable delivery services.

- Government initiatives: Policies promoting infrastructure development and simplifying regulations are streamlining logistics operations.

- Technological advancements: The adoption of advanced technologies is enhancing efficiency, transparency, and cost-effectiveness.

Challenges in the India Logistics Market Sector

Several challenges hinder the growth of the Indian logistics market:

- Infrastructure gaps: Inadequate infrastructure, particularly in certain regions, hampers efficient transportation and delivery. This leads to increased costs and delivery delays, quantifiable through estimations of lost revenue due to inefficiencies.

- Regulatory complexities: Bureaucratic hurdles and varying regulations across states can complicate operations. Further research is required for a complete quantification of the impact.

- Competition: Intense competition necessitates ongoing investments in technology and service quality to maintain a competitive edge.

Emerging Opportunities in India Logistics Market

Several opportunities are emerging in the Indian logistics market:

- Cold chain logistics: The expanding pharmaceutical and food industries are driving demand for temperature-controlled transportation and storage.

- Technological integration: The adoption of AI, IoT, and blockchain offers opportunities for enhanced efficiency and cost optimization.

- Last-mile delivery: Developing innovative last-mile solutions is crucial for meeting the growing demand for faster and more reliable deliveries.

Leading Players in the India Logistics Market Market

- DB Schenker

- DHL Group

- Container Corp of India Ltd

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- VRL Logistics Ltd

- Allcargo Logistics Ltd (including Gati Express & Supply Chain Private Limited)

- FedEx

- Kuehne + Nagel

- Blue Dart Express Ltd

- Delhivery Limited

- Mahindra Logistics Limited

- Transport Corporation of India Limited (TCI)

- Safexpress Pvt Ltd

Key Developments in India Logistics Market Industry

- January 2024: DHL Express launched its final Boeing 777 freighter at its South Asia Hub in Singapore, significantly increasing its inter-continental connectivity. This impacts market dynamics by improving delivery times and capacity for international shipments.

- January 2024: Kuehne + Nagel introduced its Book & Claim insetting solution for electric vehicles, enhancing its decarbonization efforts. This development could attract environmentally conscious customers and influence future industry standards.

- November 2023: DHL Express launched its expanded Central Asia Hub (CAH) in Hong Kong, representing a EUR 562 million investment. This significant investment underscores confidence in the market and enhances its capacity to handle growing trade volumes.

Strategic Outlook for India Logistics Market Market

The India Logistics Market holds substantial growth potential. Continued investment in infrastructure, technological advancements, and the ongoing expansion of e-commerce are set to drive sustained market expansion. Companies that proactively embrace technological innovation and effectively adapt to changing consumer preferences will be well-positioned to capitalize on the market's opportunities and shape its future trajectory. The strategic focus will need to address challenges like infrastructure gaps and regulatory complexities to fully unlock the market's potential.

India Logistics Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

India Logistics Market Segmentation By Geography

- 1. India

India Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North India India Logistics Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Logistics Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Logistics Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Logistics Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 DB Schenker

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 DHL Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Container Corp of India Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 VRL Logistics Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Allcargo Logistics Ltd (including Gati Express & Supply Chain Private Limited)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 FedEx

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Kuehne + Nagel

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Blue Dart Express Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Delhivery Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Mahindra Logistics Limited

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Transport Corporation of India Limited (TCI)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Safexpress Pvt Ltd

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 DB Schenker

List of Figures

- Figure 1: India Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: India Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: India Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 4: India Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 11: India Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 12: India Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Logistics Market?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the India Logistics Market?

Key companies in the market include DB Schenker, DHL Group, Container Corp of India Ltd, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), VRL Logistics Ltd, Allcargo Logistics Ltd (including Gati Express & Supply Chain Private Limited), FedEx, Kuehne + Nagel, Blue Dart Express Ltd, Delhivery Limited, Mahindra Logistics Limited, Transport Corporation of India Limited (TCI), Safexpress Pvt Ltd.

3. What are the main segments of the India Logistics Market?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

January 2024: DHL Express has commenced services for the final Boeing 777 freighter deployed at the South Asia Hub in Singapore. With a payload capability of 102 tons, the aircraft joins the four other Boeing 777 freighters already deployed in Singapore to boost inter-continental connectivity between the Asia Pacific and the Americas. Sporting a dual DHL-Singapore Airlines (SIA) livery, these five freighters provide a total of 1,224 tons of payload capacity to meet growing customer demand for international express shipping services.January 2024: Kuehne + Nagel has announced its Book & Claim insetting solution for electric vehicles, to improve its decarbonization solutions. Developing Book & Claim insetting solutions for road freight was a strategic priority for Kuehne + Nagel. Customers who use Kuehne + Nagel's road transport services can now claim the carbon reductions of electric trucks when it is not possible to physically move their goods on these vehicles.November 2023: DHL Express has launched its state-of-the-art, expanded Central Asia Hub (CAH) in Hong Kong, amid fast-growing global trade in recent years. The total investment into the Central Asia Hub is EUR 562 million, making it the largest infrastructural investment by DHL Express in Asia Pacific. The Hub is one of three DHL Express global hubs connecting Asia Pacific with the rest of the world and also supports intra-Asia trade.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Logistics Market?

To stay informed about further developments, trends, and reports in the India Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence