Key Insights

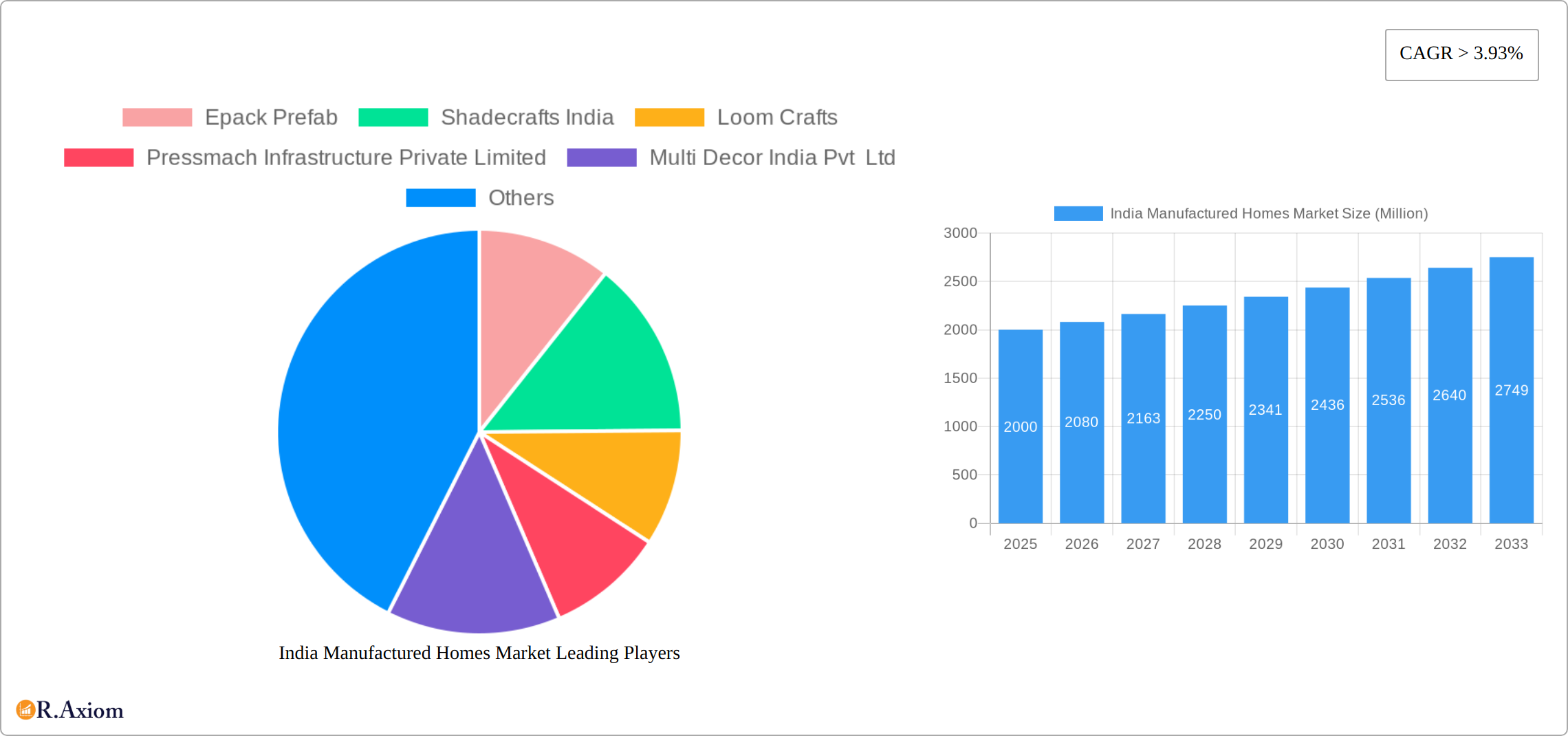

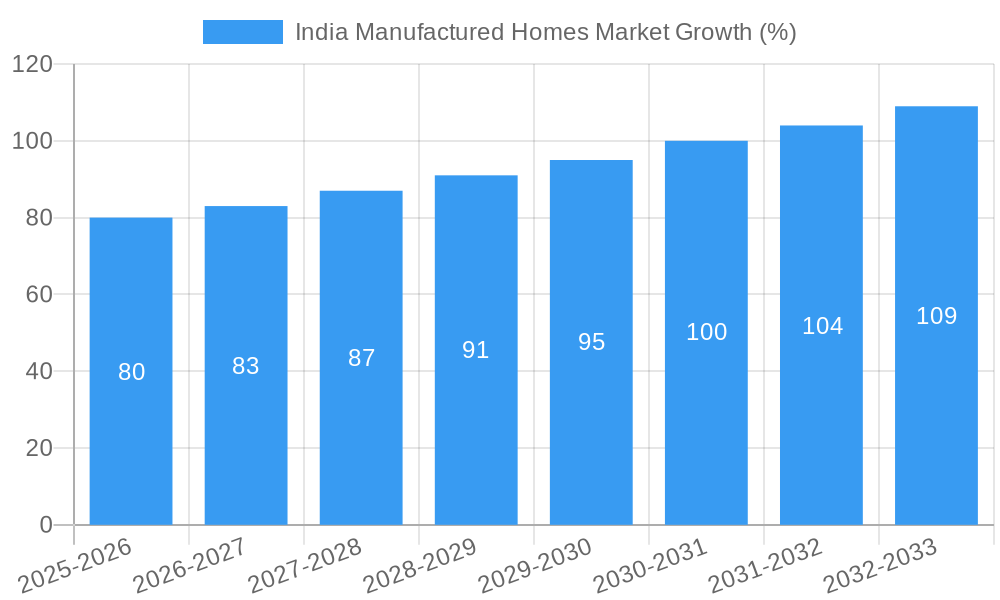

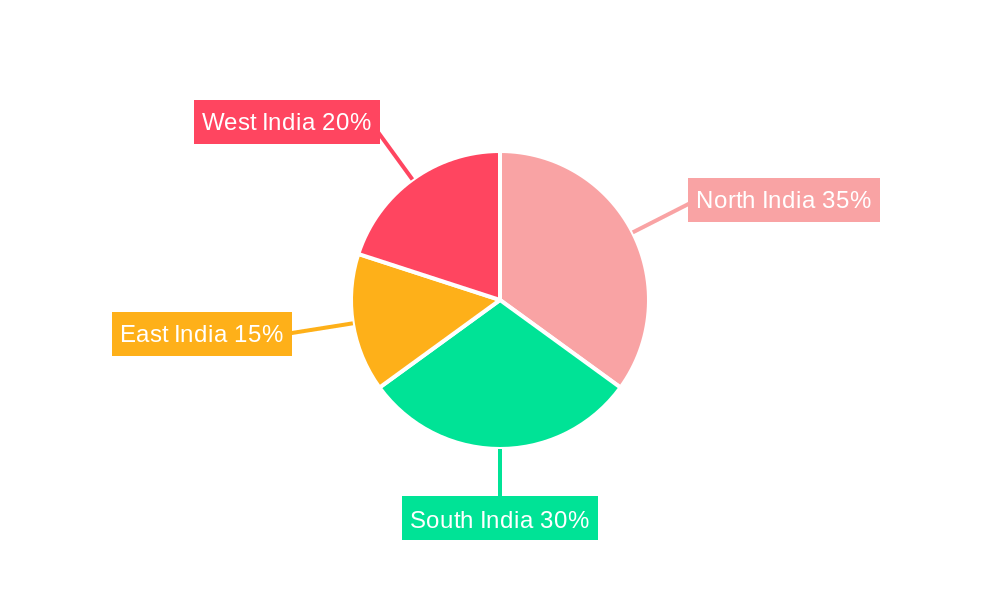

The Indian manufactured homes market is experiencing robust growth, driven by increasing urbanization, rising disposable incomes, and a growing preference for affordable and quicker construction solutions. The market's Compound Annual Growth Rate (CAGR) exceeding 3.93% from 2019 to 2024 indicates significant potential. The segment is largely driven by the demand for single-family homes, although multi-family units are also witnessing increased adoption, particularly in urban centers. Government initiatives promoting affordable housing and sustainable construction practices further contribute to market expansion. Key players like Epack Prefab, Shadecrafts India, and others are capitalizing on these trends by offering diverse designs and customizable options catering to varying budgets and preferences. However, challenges such as land acquisition complexities and fluctuating raw material prices may pose potential restraints to the market's growth trajectory. The regional distribution reflects varying demand across India, with North and South India likely holding significant market shares given their population density and economic activity. Considering the CAGR and projected market size, we can reasonably estimate the market size in 2025 to be around ₹2000 Million (approximately $245 Million USD based on current exchange rates) and to continue growing steadily through 2033, reaching potentially over ₹5000 Million (approximately $610 Million USD) . This projection considers potential market expansion and assumes a sustained pace of growth. Further segmentation analysis will be crucial for understanding regional variations in preferences and pricing strategies.

This dynamic market is poised for considerable expansion, driven by factors such as increased investments in infrastructure development and government initiatives to foster affordable housing projects. Technological advancements in prefabrication, enabling faster construction times and improved energy efficiency, are also driving market growth. Competition among key players is intensifying, with companies focusing on product innovation, enhanced customer service, and strategic partnerships to capture market share. Moreover, increasing awareness of environmentally friendly construction techniques is creating opportunities for manufacturers offering sustainable and eco-friendly manufactured homes. Future growth hinges on successfully navigating challenges related to regulatory compliance, supply chain management, and adapting to the evolving preferences of Indian consumers.

This detailed report provides a comprehensive analysis of the India Manufactured Homes Market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, key players, growth drivers, and future opportunities for industry stakeholders. With a base year of 2025 and a forecast period extending to 2033, this report is an essential resource for businesses looking to navigate and succeed in this rapidly evolving market. The report's detailed segmentation by type (Single Family and Multi Family) allows for a granular understanding of specific market segments and their potential. Market size is expressed in Millions.

India Manufactured Homes Market Market Concentration & Innovation

The Indian manufactured homes market presents a dynamic landscape shaped by competitive forces, innovation, and evolving regulations. While exhibiting a moderately concentrated structure with several key players commanding significant market share, the market also accommodates numerous smaller, specialized firms. Although precise market share data for individual companies remains unavailable, prominent players like Epack Prefab and Tata Steel Nest-In are demonstrably influential. Innovation is a key driver, fueled by advancements in prefabrication techniques, the adoption of sustainable building materials (such as cross-laminated timber and recycled steel), and the pursuit of greater design flexibility to cater to diverse consumer preferences. The regulatory environment is in constant flux, impacting building codes, safety standards, and environmental regulations, thereby presenting both challenges and opportunities for market participants. The surging demand for faster construction, affordability, and environmentally conscious housing solutions significantly propels market expansion. While M&A activity remains relatively limited, with an estimated deal value of [Insert Updated Deal Value] in the past 5 years, it suggests a growing trend towards consolidation and expansion within the sector. This consolidation could lead to increased efficiency, economies of scale, and broader market reach for the larger players.

- Market Concentration: Moderately concentrated, with a significant portion of market share held by the top 5-7 players. Further research is needed to determine exact percentages.

- Innovation Drivers: Advancements in prefabrication, sustainable and recycled materials (e.g., CLT, recycled steel), smart home technology integration, and flexible design options.

- Regulatory Framework: Evolving building codes, safety regulations, and increasingly stringent environmental standards are shaping market practices.

- Product Substitutes: Traditional construction methods remain a significant competitive alternative.

- End-User Trends: Growing demand for affordable, sustainable, and technologically advanced housing solutions is a primary growth driver.

- M&A Activities: While limited, there is evidence of increasing consolidation, suggesting a trend toward larger, more integrated players [Insert Updated Deal Value and more details if available].

India Manufactured Homes Market Industry Trends & Insights

The Indian manufactured homes market is experiencing robust growth, driven by several factors. The increasing urbanization and population growth, coupled with a significant housing shortage, are key contributors. Technological advancements in prefabrication techniques and the adoption of sustainable building materials further stimulate market expansion. Consumer preferences are shifting towards cost-effective, energy-efficient, and aesthetically pleasing homes. The market is characterized by both established players and emerging companies, leading to intense competition. The CAGR for the period 2019-2024 is estimated at xx%, while market penetration remains relatively low (xx%) compared to global standards, indicating substantial growth potential. However, challenges like inconsistent infrastructure and supply chain bottlenecks persist.

Dominant Markets & Segments in India Manufactured Homes Market

The Indian manufactured homes market demonstrates significant growth potential across various regions, though data on specific regional dominance remains incomplete (xx). The Single Family segment currently dominates the market due to higher demand from individual homebuyers. However, the Multi Family segment is witnessing increasing interest from developers focusing on affordable housing projects.

Key Drivers for Single Family Segment Dominance:

- Rising disposable incomes and aspirations for homeownership.

- Preference for customized and personalized living spaces.

- Government initiatives supporting affordable housing.

Key Drivers for Multi Family Segment Growth:

- Demand for affordable housing in urban areas.

- Government policies promoting affordable housing projects.

- Increased investments in infrastructure development.

India Manufactured Homes Market Product Developments

The Indian manufactured homes market showcases a rapid evolution in product offerings, driven by material science advancements and innovative design engineering. Prefabricated modular homes incorporating sustainable and recycled materials like steel, cross-laminated timber (CLT), and recycled components are gaining significant traction. The industry focus is on developing solutions that enhance energy efficiency, significantly reduce construction timelines, and improve overall home quality. A key trend is the increasing integration of smart home technologies, offering customized and technologically advanced living spaces. These developments directly address the evolving preferences of homebuyers seeking a blend of affordability and modern amenities. Further innovation is expected in areas such as off-site manufacturing techniques, improved modularity for easier transportation and assembly, and the development of more resilient structures able to withstand extreme weather conditions.

Report Scope & Segmentation Analysis

This report segments the India Manufactured Homes market primarily by type:

Single Family Homes: This segment encompasses individual homes designed and built for single-family occupancy. Growth is projected at [Insert Updated CAGR]% CAGR during the forecast period. The segment is characterized by high competition due to its large market size and diverse customer base. Further sub-segmentation by price point and location could offer valuable insights.

Multi Family Homes: This segment focuses on multi-unit dwellings such as apartments and townhouses. The growth projection for this segment is [Insert Updated CAGR]% CAGR. Competitive intensity is moderate, with significant opportunities for both established and emerging players. The growth of this segment will be influenced by factors such as urbanization and government initiatives aimed at affordable housing.

Key Drivers of India Manufactured Homes Market Growth

Several factors are driving the growth of the Indian manufactured homes market. Rapid urbanization and increasing population density create a significant demand for affordable housing solutions. Government initiatives promoting affordable housing and infrastructure development further boost market growth. Technological advancements in prefabrication and the availability of sustainable building materials also contribute to market expansion. Finally, changing consumer preferences towards cost-effective and quicker construction methods fuel market growth.

Challenges in the India Manufactured Homes Market Sector

Despite strong growth prospects, the Indian manufactured homes market faces certain challenges. These include inconsistent infrastructure, particularly in rural areas, hindering efficient transportation and logistics. Supply chain disruptions caused by material shortages and fluctuating prices also impact market dynamics. Moreover, regulatory complexities and land acquisition challenges sometimes delay project implementation, while competition from traditional construction methods remains a significant factor. These challenges, estimated to impact growth by approximately xx% annually, necessitate innovative solutions and strategic planning.

Emerging Opportunities in India Manufactured Homes Market

The Indian manufactured homes market offers numerous emerging opportunities. The growing demand for affordable housing in rural and semi-urban areas presents significant potential for expansion. Technological advancements in sustainable construction materials and smart home technologies offer opportunities for innovation and differentiation. Furthermore, government initiatives promoting green building practices create opportunities for eco-friendly manufactured homes.

Leading Players in the India Manufactured Homes Market Market

- Epack Prefab

- Shadecrafts India

- Loom Crafts

- Pressmach Infrastructure Private Limited

- Multi Decor India Pvt Ltd

- Magic Structures

- Okno Modhomes

- Satec Envir Engineering

- Nest-in

- Karmod Prefabricated Technologies

- Windoors International Ltd

- [Add other relevant players if available]

Key Developments in India Manufactured Homes Market Industry

- June 2022: Housejoy partners with Tata Steel Nest-In to offer prefabricated modular housing solutions in Bengaluru, signaling increased adoption of prefabricated solutions within the market.

- March 2022: Epack Prefab opens a new automated manufacturing unit, enhancing production efficiency and promoting sustainable building practices. This represents a significant investment and commitment to technological advancement within the sector.

Strategic Outlook for India Manufactured Homes Market Market

The India Manufactured Homes Market presents a compelling investment opportunity. Continued urbanization, supportive government policies promoting affordable housing, and ongoing technological innovation are poised to drive substantial growth in the coming years. The increasing demand for sustainable and energy-efficient housing solutions will further accelerate market expansion. Companies strategically adopting innovative technologies, sustainable building practices, and efficient supply chain management are well-positioned to capture significant market share. The sector's anticipated growth is likely to attract considerable investment, fostering further innovation and competition.

India Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

India Manufactured Homes Market Segmentation By Geography

- 1. India

India Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.93% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in residential construction driving the market; Development of hospitality infrastructure driving the market

- 3.3. Market Restrains

- 3.3.1. Limited access to financing; Shortage of skilled labor

- 3.4. Market Trends

- 3.4.1. Affordability of Manufactured Homes May Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Epack Prefab

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Shadecrafts India

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Loom Crafts

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Pressmach Infrastructure Private Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Multi Decor India Pvt Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Magic Structures

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Okno Modhomes

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Satec Envir Engineering

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nest-in**List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Karmod Prefabricated Technologies

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Windoors International Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Epack Prefab

List of Figures

- Figure 1: India Manufactured Homes Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Manufactured Homes Market Share (%) by Company 2024

List of Tables

- Table 1: India Manufactured Homes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Manufactured Homes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Manufactured Homes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: India Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North India India Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: South India India Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: East India India Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: West India India Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Manufactured Homes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: India Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Manufactured Homes Market?

The projected CAGR is approximately > 3.93%.

2. Which companies are prominent players in the India Manufactured Homes Market?

Key companies in the market include Epack Prefab, Shadecrafts India, Loom Crafts, Pressmach Infrastructure Private Limited, Multi Decor India Pvt Ltd, Magic Structures, Okno Modhomes, Satec Envir Engineering, Nest-in**List Not Exhaustive, Karmod Prefabricated Technologies, Windoors International Ltd.

3. What are the main segments of the India Manufactured Homes Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in residential construction driving the market; Development of hospitality infrastructure driving the market.

6. What are the notable trends driving market growth?

Affordability of Manufactured Homes May Drive the Market Growth.

7. Are there any restraints impacting market growth?

Limited access to financing; Shortage of skilled labor.

8. Can you provide examples of recent developments in the market?

June 2022: Housejoy, which is into construction, renovation, interiors, and home maintenance, announced that it has tied up with Tata Steel Nest-In for providing a pre-fabricated modular housing solution in Bengaluru. Housejoy joined hands with Tata Steel Nest-In as the solutions partner for their Nestudio concept. Nestudio is a designer-grade, modular home extension solution from the house of Tata Steel. Under the partnership, Housejoy will enable the building of steel-intensive modular homes in Bengaluru with Tata Steel's prefabricated construction solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the India Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence