Key Insights

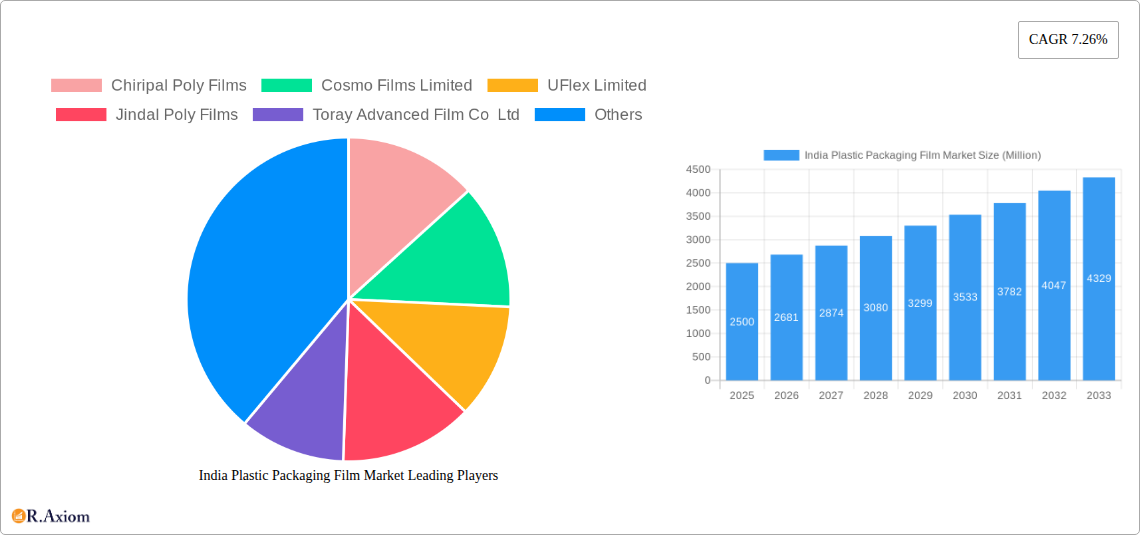

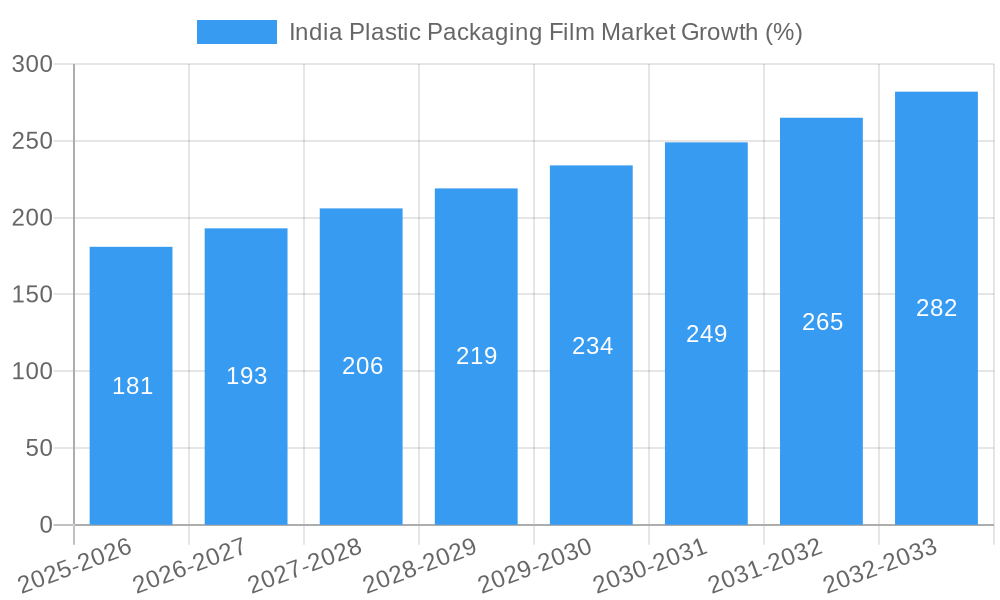

The India plastic packaging film market is experiencing robust growth, driven by the burgeoning food and beverage, consumer goods, and pharmaceutical sectors. A 7.26% CAGR from 2019-2033 signifies substantial expansion, with the market value likely exceeding several billion dollars by 2033 (the exact figure requires the missing market size data for 2019; however, based on industry averages and the given CAGR, a reasonable estimation can be made). Key drivers include increasing disposable incomes leading to higher consumption, a shift towards convenient packaged goods, and the expanding e-commerce sector requiring extensive packaging solutions. Growth is also fueled by advancements in film technology, offering improved barrier properties, recyclability, and sustainability options. However, environmental concerns surrounding plastic waste and fluctuating raw material prices represent significant challenges to the market's continued expansion. Government regulations promoting sustainable packaging practices will likely influence market dynamics in the coming years, favoring companies adopting eco-friendly solutions and driving innovation in biodegradable and compostable film alternatives. The segmentation within the market, although not fully detailed, likely includes various film types (e.g., polyethylene, polypropylene, etc.) categorized by application (food packaging, industrial packaging, etc.). Major players like Chiripal Poly Films, Cosmo Films Limited, and UFlex Limited are well-positioned to benefit from this growth, though competition remains fierce.

The competitive landscape is defined by established players leveraging their manufacturing capabilities and brand recognition, alongside emerging companies focusing on niche applications and sustainable offerings. The regional distribution of the market (data not provided) likely reflects variations in consumption patterns and industrial activity across different Indian states. A strategic focus on innovation, sustainable packaging solutions, and efficient supply chains will be crucial for companies seeking sustained success within the increasingly dynamic India plastic packaging film market. Further market segmentation by film type, application, and region would provide a more granular understanding of growth opportunities and competitive dynamics.

This comprehensive report provides an in-depth analysis of the India plastic packaging film market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, trends, and future growth prospects.

India Plastic Packaging Film Market Concentration & Innovation

The Indian plastic packaging film market exhibits a moderately concentrated structure, with a few large players holding significant market share. Key players like UFlex Limited and Cosmo Films Limited dominate, while several mid-sized and smaller companies contribute to the competitive landscape. Market share data for 2024 indicates UFlex Limited holds approximately xx% market share, followed by Cosmo Films Limited with xx%, and others with xx% combined. The market is characterized by ongoing innovation driven by factors such as:

- Technological advancements: Development of biodegradable and sustainable films, improved barrier properties, and advancements in printing technologies are key innovation drivers.

- Regulatory changes: Stringent environmental regulations are pushing the industry toward eco-friendly solutions, fostering innovation in recyclable and compostable films.

- Product substitution: The market faces pressure from alternative packaging materials like paper and cardboard, driving innovation in cost-effective and performance-enhancing plastic films.

- End-user trends: Growing demand from the food and beverage, consumer goods, and pharmaceutical sectors influences the development of specialized films with customized properties.

- Mergers and Acquisitions (M&A): Consolidation in the industry is driven by the need for scale, technological capabilities, and market expansion. While precise M&A deal values for 2019-2024 are not publicly available, it's observed that smaller companies are frequently acquired by larger players to gain access to new technologies or markets. The total value of M&A deals within the sector during this period is estimated at approximately xx Million.

India Plastic Packaging Film Market Industry Trends & Insights

The India plastic packaging film market is experiencing robust growth, fueled by several key factors. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by:

- Expanding consumer goods sector: Rising disposable incomes and changing lifestyles are driving demand for packaged goods, boosting the need for plastic packaging films.

- E-commerce boom: The rapid growth of e-commerce necessitates increased packaging solutions, fueling demand for flexible and durable films.

- Technological disruptions: Advancements in film manufacturing technologies are enabling the production of high-performance, customized films at competitive prices.

- Consumer preferences: Increasing demand for convenient, tamper-proof, and aesthetically appealing packaging is influencing market trends.

- Competitive dynamics: Intense competition among market players is leading to product differentiation, price optimization, and innovation. Market penetration of flexible packaging is already at xx% and is predicted to increase to xx% by 2033.

Dominant Markets & Segments in India Plastic Packaging Film Market

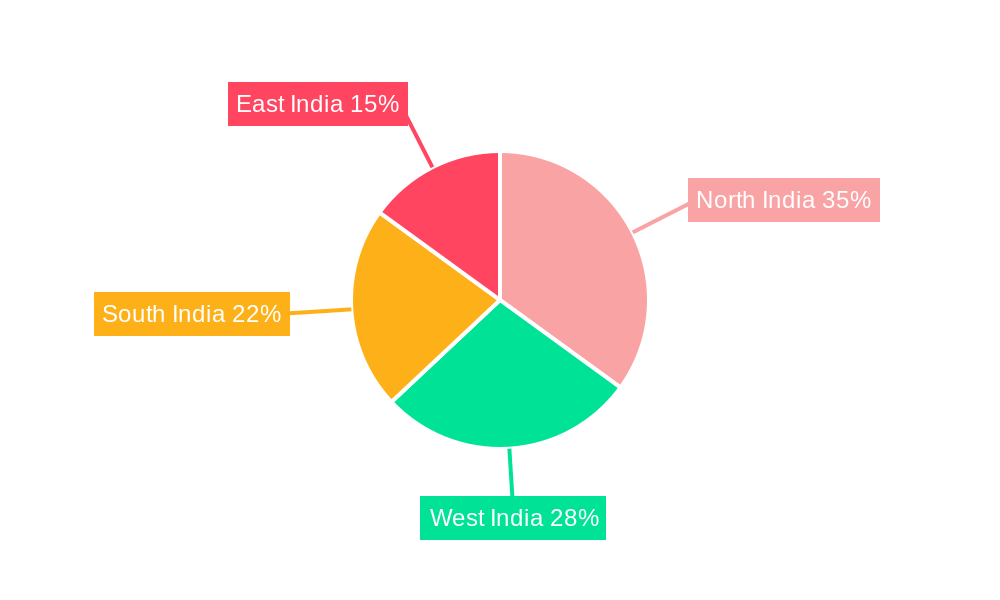

The western and southern regions of India dominate the plastic packaging film market due to higher concentrations of manufacturing and processing industries, along with robust growth in consumer goods and e-commerce sectors. Specifically, Maharashtra and Gujarat are leading states for this market.

- Key Drivers in Dominant Regions:

- Robust Industrial Growth: Strong industrial growth in these regions fuels demand for packaging across diverse sectors.

- Developed Infrastructure: Well-established infrastructure including transportation and logistics networks supports efficient supply chains.

- Government Initiatives: Supportive government policies and initiatives focused on industrial development further contribute to market growth.

- High Population Density: Large populations create significant demand for packaged goods.

This dominance is further cemented by the significant presence of major manufacturing units and supply chains in these areas. The detailed dominance analysis reveals that the western region holds approximately xx% of the market share, while the southern region accounts for about xx%.

India Plastic Packaging Film Market Product Developments

Recent product innovations focus on enhancing barrier properties, improving sustainability, and offering customized solutions. Technological trends include the incorporation of biodegradable materials, development of advanced printing techniques, and the creation of films with improved oxygen and moisture barrier properties to extend shelf life. These advancements cater to the growing demand for eco-friendly and high-performance packaging across various applications.

Report Scope & Segmentation Analysis

This report segments the India plastic packaging film market based on:

- Material Type: BOPP, PET, PVC, PE, and others, with BOPP currently holding the largest share due to its versatility and cost-effectiveness. Growth projections for each segment vary, with BOPP showing a CAGR of xx% and PET of xx% for the forecast period.

- Application: Food and beverage, consumer goods, pharmaceuticals, industrial goods, and others. The food and beverage sector is the dominant application segment, with its share expected to reach xx% in 2033.

- Thickness: Different thicknesses are used for various applications, impacting performance characteristics and cost.

- Region: The market is further divided into geographic regions, with detailed analysis for each.

Each segment exhibits varying growth dynamics and competitive landscapes, influenced by specific market needs and technological advancements.

Key Drivers of India Plastic Packaging Film Market Growth

Several factors contribute to the market's growth trajectory:

- Increasing disposable incomes: A rising middle class is driving demand for packaged goods.

- Government initiatives: Government support for the manufacturing sector fosters growth.

- Advancements in packaging technology: Innovative films are constantly being developed, improving performance and sustainability.

- Growth of e-commerce: The surge in online shopping boosts demand for packaging solutions.

Challenges in the India Plastic Packaging Film Market Sector

The industry faces challenges, including:

- Fluctuating raw material prices: Prices for polymers and other materials impact profitability.

- Environmental concerns: Growing awareness of plastic pollution necessitates the development of sustainable alternatives.

- Stringent regulatory environment: Environmental regulations can increase operational costs.

- Intense competition: The market is fiercely competitive, putting pressure on margins.

Emerging Opportunities in India Plastic Packaging Film Market

The market offers several emerging opportunities:

- Growth of sustainable packaging: Demand for eco-friendly films is increasing rapidly.

- Focus on advanced barrier films: Improved shelf life and enhanced product protection are driving demand.

- Expansion into new applications: Exploring new markets for specialized packaging is a key opportunity.

Leading Players in the India Plastic Packaging Film Market Market

- Chiripal Poly Films

- Cosmo Films Limited (Cosmo Films Limited)

- UFlex Limited (UFlex Limited)

- Jindal Poly Films

- Toray Advanced Film Co Ltd

- Ecoplast Ltd

- TOPPAN Inc (TOPPAN Inc)

- Sealed Air Corporation (Sealed Air Corporation)

- Berry Global Inc (Berry Global Inc)

- Vishakha Polyfab Pvt Ltd

- Supreme Industries Ltd *List Not Exhaustive

Key Developments in India Plastic Packaging Film Market Industry

- March 2024: Toppan Packaging Service Co. Ltd. and TOPPAN Speciality Films Private Limited launched GL-SP, a new BOPP barrier film.

- April 2024: UFlex commenced commercial operations at its new polyester chip plant in Panipat, significantly expanding its capacity.

Strategic Outlook for India Plastic Packaging Film Market Market

The Indian plastic packaging film market is poised for sustained growth, driven by increasing consumer demand, technological advancements, and government support. Companies focusing on sustainable solutions, advanced material properties, and customized packaging will be well-positioned to capitalize on the market's potential. The shift toward eco-friendly packaging solutions will present significant opportunities for innovation and market leadership.

India Plastic Packaging Film Market Segmentation

-

1. Type

- 1.1. Polyprop

- 1.2. Polyethy

- 1.3. Polyethy

- 1.4. Polystyrene

- 1.5. Bio-Based

- 1.6. PVC, EVOH, PETG, and Other Film Types

-

2. End User

-

2.1. Food

- 2.1.1. Candy & Confectionery

- 2.1.2. Frozen Foods

- 2.1.3. Fresh Produce

- 2.1.4. Dairy Products

- 2.1.5. Dry Foods

- 2.1.6. Meat, Poultry, And Seafood

- 2.1.7. Pet Food

- 2.1.8. Other Food Products

- 2.2. Healthcare

- 2.3. Personal Care & Home Care

- 2.4. Industrial Packaging

- 2.5. Other End-use Industry

-

2.1. Food

India Plastic Packaging Film Market Segmentation By Geography

- 1. India

India Plastic Packaging Film Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand For Light-Weight and Sustainable Packaging Across Industries; Robust Demand From the Food and Pharmaceutical Sector Aids Growth

- 3.3. Market Restrains

- 3.3.1. Rising Demand For Light-Weight and Sustainable Packaging Across Industries; Robust Demand From the Food and Pharmaceutical Sector Aids Growth

- 3.4. Market Trends

- 3.4.1. Demand for BOPET Films is Expected to Increase

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Plastic Packaging Film Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polyprop

- 5.1.2. Polyethy

- 5.1.3. Polyethy

- 5.1.4. Polystyrene

- 5.1.5. Bio-Based

- 5.1.6. PVC, EVOH, PETG, and Other Film Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Food

- 5.2.1.1. Candy & Confectionery

- 5.2.1.2. Frozen Foods

- 5.2.1.3. Fresh Produce

- 5.2.1.4. Dairy Products

- 5.2.1.5. Dry Foods

- 5.2.1.6. Meat, Poultry, And Seafood

- 5.2.1.7. Pet Food

- 5.2.1.8. Other Food Products

- 5.2.2. Healthcare

- 5.2.3. Personal Care & Home Care

- 5.2.4. Industrial Packaging

- 5.2.5. Other End-use Industry

- 5.2.1. Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Chiripal Poly Films

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cosmo Films Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 UFlex Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jindal Poly Films

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toray Advanced Film Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ecoplast Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TOPPAN Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sealed Air Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Berry Global Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vishakha Polyfab Pvt Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Supreme Industries Ltd*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Chiripal Poly Films

List of Figures

- Figure 1: India Plastic Packaging Film Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Plastic Packaging Film Market Share (%) by Company 2024

List of Tables

- Table 1: India Plastic Packaging Film Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Plastic Packaging Film Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Plastic Packaging Film Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: India Plastic Packaging Film Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Plastic Packaging Film Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: India Plastic Packaging Film Market Revenue Million Forecast, by End User 2019 & 2032

- Table 7: India Plastic Packaging Film Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Plastic Packaging Film Market?

The projected CAGR is approximately 7.26%.

2. Which companies are prominent players in the India Plastic Packaging Film Market?

Key companies in the market include Chiripal Poly Films, Cosmo Films Limited, UFlex Limited, Jindal Poly Films, Toray Advanced Film Co Ltd, Ecoplast Ltd, TOPPAN Inc, Sealed Air Corporation, Berry Global Inc, Vishakha Polyfab Pvt Ltd, Supreme Industries Ltd*List Not Exhaustive.

3. What are the main segments of the India Plastic Packaging Film Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand For Light-Weight and Sustainable Packaging Across Industries; Robust Demand From the Food and Pharmaceutical Sector Aids Growth.

6. What are the notable trends driving market growth?

Demand for BOPET Films is Expected to Increase.

7. Are there any restraints impacting market growth?

Rising Demand For Light-Weight and Sustainable Packaging Across Industries; Robust Demand From the Food and Pharmaceutical Sector Aids Growth.

8. Can you provide examples of recent developments in the market?

March 2024: Toppan Packaging Service Co. Ltd, a wholly-owned subsidiary of TOPPAN Holdings Inc., in collaboration with India's TOPPAN Speciality Films Private Limited (TSF), unveiled GL-SP, a cutting-edge barrier film utilizing biaxially oriented polypropylene (BOPP) as its base. This innovative product is set to join the TOPPAN Group's renowned GL BARRIER1 series, which is known for its transparent vapor-deposited barrier films with a significant global market share. TOPPAN and TSF were expected to commence sales of GL-SP from April 2024, targeting the packaging of dry goods, primarily in India and other key Asian markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Plastic Packaging Film Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Plastic Packaging Film Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Plastic Packaging Film Market?

To stay informed about further developments, trends, and reports in the India Plastic Packaging Film Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence