Key Insights

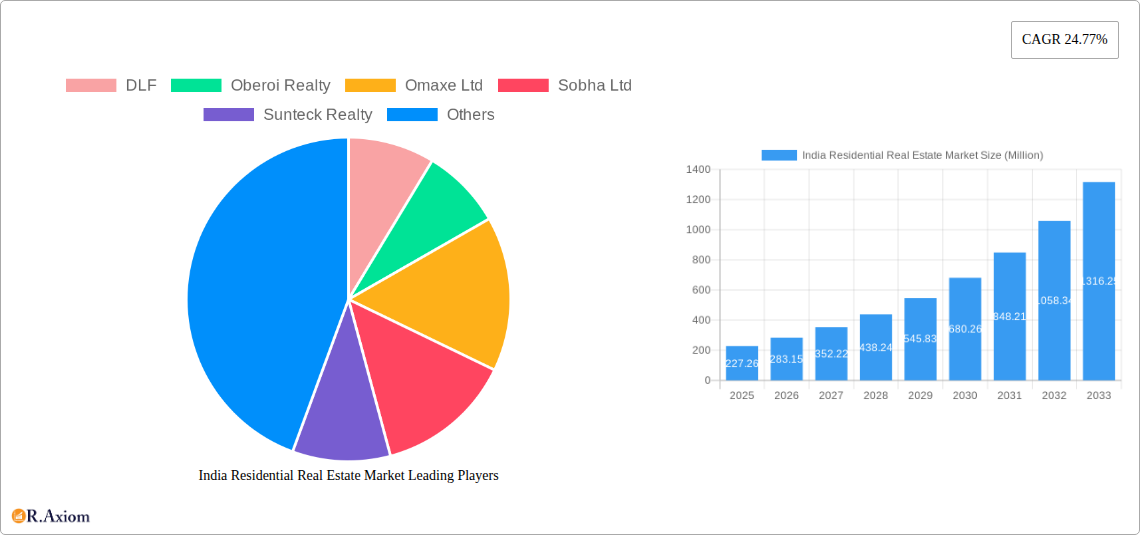

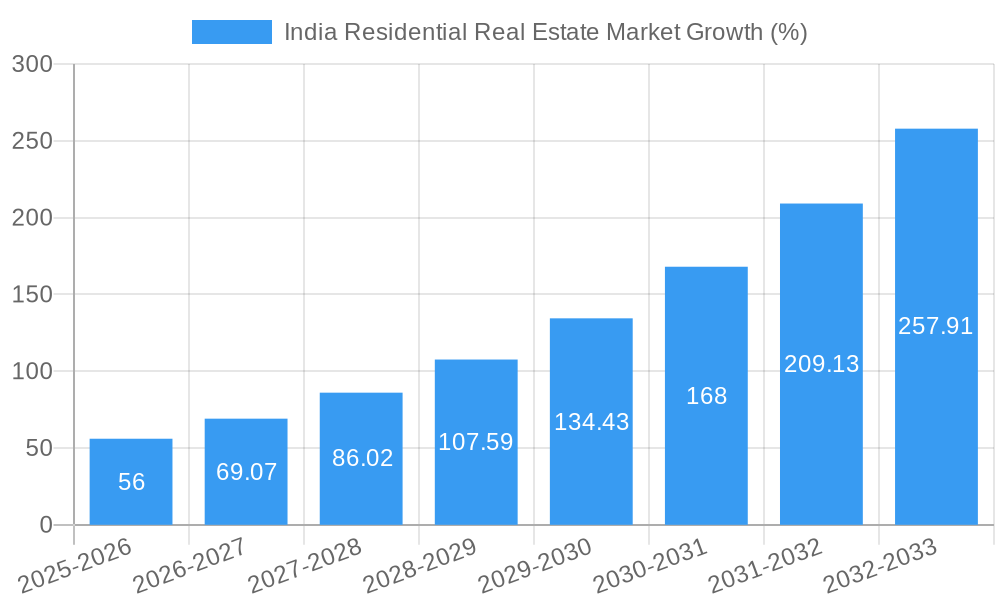

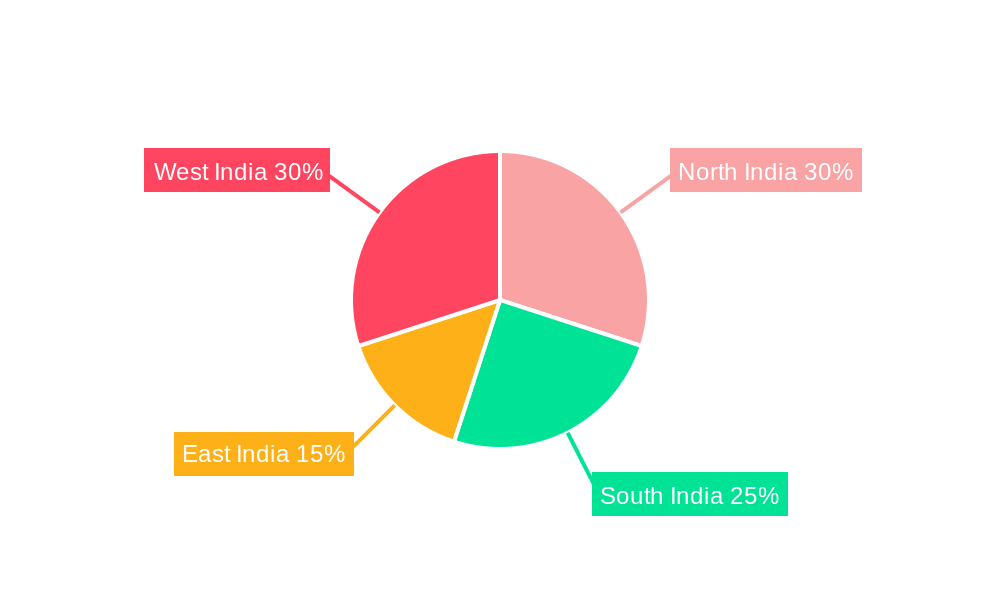

The India residential real estate market, valued at $227.26 million in 2025, exhibits robust growth potential, projected to expand significantly over the forecast period (2025-2033). A Compound Annual Growth Rate (CAGR) of 24.77% underscores this positive trajectory, driven by several key factors. Increasing urbanization, rising disposable incomes, and a burgeoning middle class fuel strong demand for housing across various segments. Government initiatives aimed at affordable housing and infrastructure development further stimulate market activity. The market is segmented by property type (condominiums, villas, and other types), with condominiums likely dominating due to their affordability and suitability for urban settings. Regional variations exist, with South and West India potentially experiencing faster growth due to robust economic activity and infrastructural improvements in those regions. While factors like fluctuating interest rates and material costs pose challenges, the overall market outlook remains optimistic, fueled by long-term demographic trends and sustained economic growth.

The competitive landscape is characterized by a mix of established players like DLF, Oberoi Realty, and Godrej Properties, alongside emerging developers. These companies are strategically focusing on different segments and geographical locations to capitalize on market opportunities. The market's growth is likely to be influenced by the ongoing development of smart cities and initiatives promoting sustainable housing. The increasing adoption of technology in the real estate sector, such as online property portals and virtual tours, is also contributing to market efficiency and transparency. However, challenges remain, including regulatory hurdles and the need for improved infrastructure in certain regions. Despite these challenges, the long-term prospects for the India residential real estate market remain strong, making it an attractive investment destination.

India Residential Real Estate Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the India residential real estate market, covering the period 2019-2033, with a focus on market dynamics, key players, and future growth opportunities. The report leverages extensive market research and data analysis to provide actionable insights for industry stakeholders, investors, and businesses operating in this dynamic sector. The base year is 2025, with estimations for 2025 and forecasts extending to 2033. The historical period analyzed is 2019-2024.

India Residential Real Estate Market Concentration & Innovation

The Indian residential real estate market exhibits a moderately concentrated landscape, with a few large players commanding significant market share. DLF, Oberoi Realty, and Godrej Properties consistently rank among the top players. However, a large number of smaller and regional developers also contribute substantially to the overall market volume. Market share data for 2024 indicates DLF holding approximately xx% market share, followed by Oberoi Realty at xx% and Godrej Properties at xx%. Mergers and acquisitions (M&A) activity has played a significant role in shaping market concentration. Recent deals, such as the INR 500 crore (USD 608.98 million) investment platform formed by Shriram Properties and ASK Property Fund in October 2022, highlight the ongoing consolidation trend. The total value of M&A deals in the sector during 2022 was approximately USD xx billion.

Innovation is driven by factors such as increasing urbanization, evolving consumer preferences, technological advancements (e.g., smart home technology, proptech solutions), and government initiatives promoting affordable housing. Regulatory frameworks, including RERA (Real Estate Regulatory Authority), aim to improve transparency and protect buyer interests, influencing market practices and innovation. Product substitutes are limited, but the growth of rental markets presents a degree of indirect competition. End-user trends showcase a preference for sustainable and technologically advanced housing, driving developers to incorporate these features in new projects.

India Residential Real Estate Market Industry Trends & Insights

The Indian residential real estate market is witnessing robust growth, fueled by several factors. The CAGR for the period 2025-2033 is projected to be xx%, driven primarily by rising urbanization, a growing middle class with increased disposable income, and favorable government policies aimed at affordable housing. Technological disruption is evident through the emergence of proptech platforms improving transparency and efficiency in transactions. Consumer preferences are shifting towards larger, more sustainable, and technologically integrated homes, particularly in Tier 1 cities. Market penetration of smart home technology remains relatively low but is expected to experience significant growth in the forecast period. Competitive dynamics are characterized by intense competition among established players and a growing number of new entrants, leading to price wars and innovative product offerings.

Dominant Markets & Segments in India Residential Real Estate Market

The Mumbai Metropolitan Region (MMR) and the National Capital Region (NCR) continue to dominate the Indian residential real estate market, driven by robust economic activity, strong infrastructure development, and a large pool of potential buyers. Within segments, condominiums represent the largest share of the market, followed by villas and other types of residential properties.

Key Drivers of Dominance:

- Economic Policies: Favorable government policies, including tax benefits and infrastructure investments, have significantly contributed to the growth of these regions.

- Infrastructure: Well-developed infrastructure, including transportation networks and utilities, enhances the desirability of these areas.

- Employment Opportunities: A high concentration of employment opportunities attracts a large workforce, boosting housing demand.

The dominance of MMR and NCR is expected to continue, although other Tier 1 and Tier 2 cities are showing increasing signs of growth. The condominium segment benefits from higher affordability and ease of maintenance, driving its prominence.

India Residential Real Estate Market Product Developments

Product innovations focus on incorporating sustainable features (e.g., green building materials, energy-efficient designs), smart home technologies (e.g., automated lighting, security systems), and improved amenities to cater to evolving consumer preferences. These innovations offer competitive advantages, particularly in premium segments. Technological trends such as Building Information Modeling (BIM) are improving project efficiency and quality. The market fit for these innovations is strong, given the increasing demand for modern, sustainable, and technologically advanced housing.

Report Scope & Segmentation Analysis

This report segments the Indian residential real estate market by property type: Condominiums, Villas, and Other Types.

Condominiums: This segment dominates the market, characterized by high demand in urban areas due to affordability and convenience. Growth is projected at xx% CAGR during the forecast period.

Villas: This segment caters to the high-end market, with growth driven by increasing disposable incomes and a preference for spacious living. Growth is expected at xx% CAGR.

Other Types: This includes various property types like apartments, townhouses, and independent houses, with a moderate growth projection of xx% CAGR during the forecast period. Competitive dynamics vary across segments, with intensified competition in the condominium segment.

Key Drivers of India Residential Real Estate Market Growth

Several factors drive the growth of the India residential real estate market:

- Rapid Urbanization: The ongoing migration from rural to urban areas creates substantial housing demand.

- Growing Middle Class: An expanding middle class with higher disposable incomes fuels the demand for improved housing.

- Government Initiatives: Affordable housing schemes and infrastructure development projects provide significant impetus to market growth. Technological advancements further drive efficiency and innovation.

Challenges in the India Residential Real Estate Market Sector

The Indian residential real estate market faces challenges including:

- Regulatory Hurdles: Complex regulatory procedures and approvals can delay project completion and increase costs.

- Supply Chain Issues: Fluctuations in raw material prices and labor shortages can impact project timelines and profitability. This has led to an estimated xx% increase in construction costs in 2024.

- Competitive Pressures: Intense competition among developers can lead to price wars, impacting profitability.

Emerging Opportunities in India Residential Real Estate Market

Emerging opportunities include:

- Affordable Housing: The large unmet demand for affordable housing presents significant growth potential.

- Green Building: The rising awareness of sustainability creates opportunities for green building technologies and practices.

- PropTech Integration: The integration of technology into real estate transactions and management improves efficiency and transparency.

Leading Players in the India Residential Real Estate Market Market

- DLF

- Oberoi Realty

- Omaxe Ltd

- Sobha Ltd

- Sunteck Realty

- Prestige Estate

- Brigade Enterprises

- Indiabulls Real Estate

- NBCC (India)

- Dlip Buildcon

- Ansal Properties and Infrastructure Ltd

- Godrej Properties

- L&T Realty Ltd

- Phoenix Mills

Key Developments in India Residential Real Estate Market Industry

- October 2022: Shriram Properties Ltd and ASK Property Fund announced a USD 608.98 million investment platform to acquire residential projects in Bengaluru, Chennai, and Hyderabad. This signifies a significant push towards consolidation in the sector.

- October 2022: Magnolia Quality Development Corporation (MQDC) initiated talks to acquire land for a luxury residential project in the NCR, indicating increased interest from international players in the Indian luxury market.

Strategic Outlook for India Residential Real Estate Market Market

The Indian residential real estate market is poised for sustained growth, driven by urbanization, rising incomes, and government support. The focus on affordable housing, sustainable development, and technological integration will shape the future of the market. Opportunities exist for companies that can innovate and adapt to evolving consumer preferences while navigating regulatory and supply-chain challenges. The market's long-term outlook remains positive, with considerable potential for both domestic and international players.

India Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Condominiums and Apartments

- 1.2. Villas and Landed House

India Residential Real Estate Market Segmentation By Geography

- 1. India

India Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.77% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing urban population driving the growth of transportation infrastructure.; Sultanate's Economic Diversification Plan (Vision 2040) to provide new growth to the market

- 3.3. Market Restrains

- 3.3.1. Delay in project approvals; High cost of materials

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Big Residential Spaces Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condominiums and Apartments

- 5.1.2. Villas and Landed House

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 DLF

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Oberoi Realty

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Omaxe Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sobha Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Sunteck Realty

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Prestige Estate

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Brigade Enterprises**List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Indiabulls Real Estate

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 NBCC (India)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Dlip Buildcon

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Ansal Properties and Infrastructure Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Godrej Properties

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 L&T Realty Ltd

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Phoenix Mills

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 DLF

List of Figures

- Figure 1: India Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Residential Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: India Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: India Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North India India Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: South India India Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: East India India Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: West India India Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: India Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Residential Real Estate Market?

The projected CAGR is approximately 24.77%.

2. Which companies are prominent players in the India Residential Real Estate Market?

Key companies in the market include DLF, Oberoi Realty, Omaxe Ltd, Sobha Ltd, Sunteck Realty, Prestige Estate, Brigade Enterprises**List Not Exhaustive, Indiabulls Real Estate, NBCC (India), Dlip Buildcon, Ansal Properties and Infrastructure Ltd, Godrej Properties, L&T Realty Ltd, Phoenix Mills.

3. What are the main segments of the India Residential Real Estate Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 227.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing urban population driving the growth of transportation infrastructure.; Sultanate's Economic Diversification Plan (Vision 2040) to provide new growth to the market.

6. What are the notable trends driving market growth?

Increasing Demand for Big Residential Spaces Driving the Market.

7. Are there any restraints impacting market growth?

Delay in project approvals; High cost of materials.

8. Can you provide examples of recent developments in the market?

October 2022- Shriram Properties Ltd and ASK Property Fund agreed to establish an INR 500 crore (USD 608.98 million) investment platform to acquire housing projects. Both companies have signed an agreement to establish an investment platform to acquire residential real estate projects. Shriram and ASK will co-invest in plotted residential development projects in Bengaluru, Chennai, and Hyderabad as part of the platform agreement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the India Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence