Key Insights

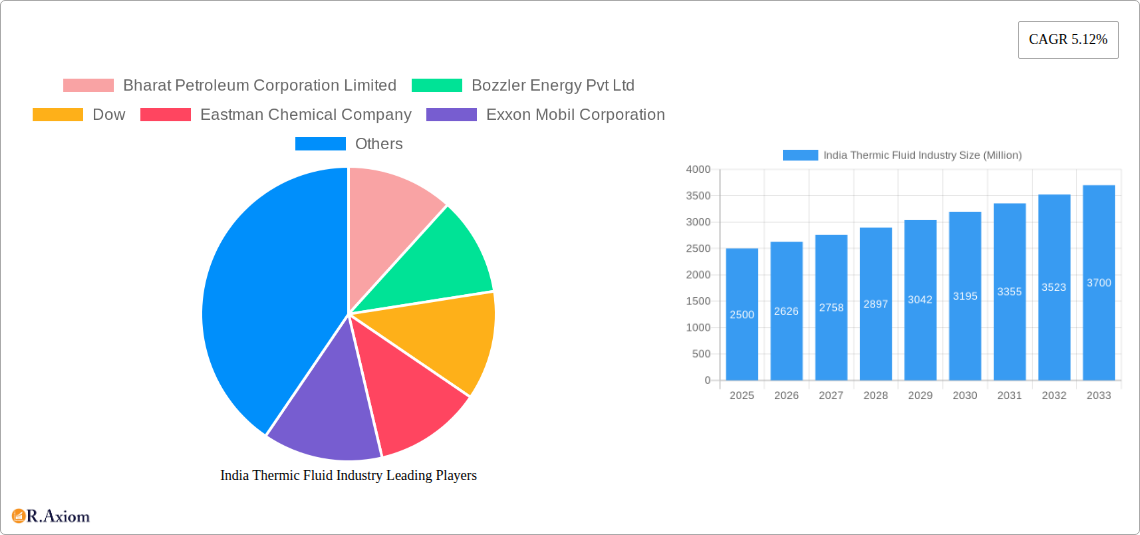

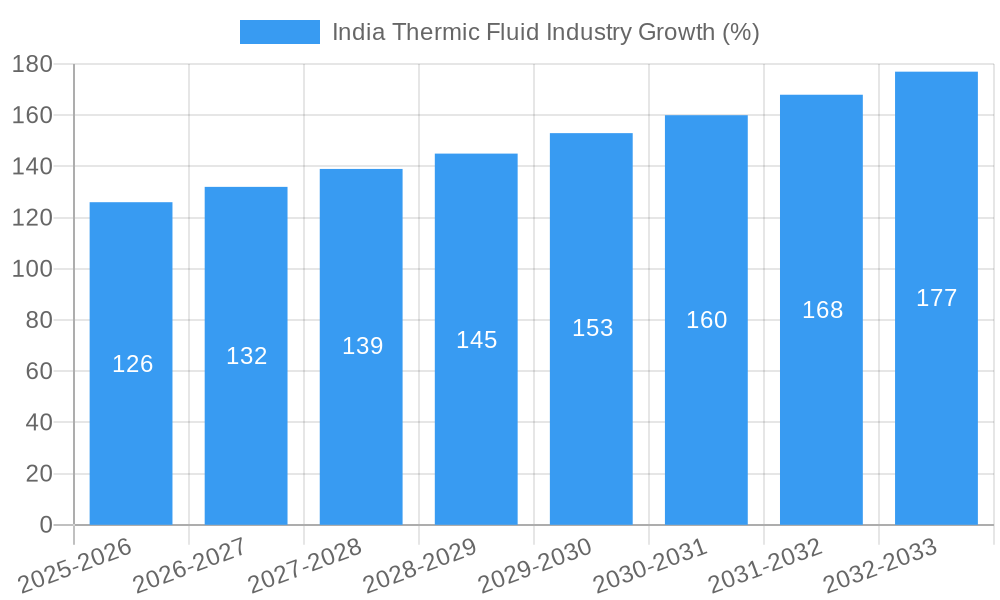

The India thermic fluid market, exhibiting a Compound Annual Growth Rate (CAGR) of 5.12% between 2019 and 2024, is poised for sustained expansion throughout the forecast period (2025-2033). This growth is driven by several key factors. Firstly, the burgeoning industrial sector, particularly in manufacturing, power generation, and petrochemicals, necessitates efficient and reliable heat transfer solutions, fueling demand for high-performance thermic fluids. Secondly, increasing awareness of energy efficiency and the adoption of sustainable practices are pushing industries to optimize their thermal processes, leading to a preference for thermic fluids over traditional methods. Furthermore, technological advancements in thermic fluid formulations, resulting in improved thermal stability, corrosion resistance, and longer operational lifespans, are contributing to market expansion. Key players like Bharat Petroleum Corporation Limited, Indian Oil Corporation Ltd, and Shell plc are strategically investing in research and development, and expanding their product portfolios to cater to this growing demand. While regulatory changes and potential price fluctuations in raw materials pose challenges, the overall market outlook remains positive, projected to reach a significant market size by 2033.

The competitive landscape is characterized by a mix of both domestic and international players. Established companies enjoy strong brand recognition and extensive distribution networks. However, smaller, agile companies are also emerging, offering specialized thermic fluids and innovative solutions. This competitive dynamic fosters innovation and ensures a diverse range of products to meet the specific needs of various industries. Geographic expansion, particularly into underserved regions, presents a significant opportunity for market participants. Strategic partnerships, mergers, and acquisitions are also likely to play a crucial role in shaping the market's future trajectory. The market's robust growth potential is further enhanced by the government's initiatives promoting industrial growth and energy efficiency in India, creating a favorable regulatory environment for the industry's continued expansion.

India Thermic Fluid Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the India Thermic Fluid Industry, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, growth drivers, challenges, and emerging opportunities within the Indian thermic fluid landscape. The report's findings are based on rigorous research and data analysis, providing actionable intelligence to navigate the dynamic market effectively.

India Thermic Fluid Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Indian thermic fluid market, exploring market concentration, innovation drivers, regulatory influences, and recent M&A activities. The market is moderately concentrated, with several key players holding significant market share. However, the presence of numerous smaller players also indicates a competitive environment.

- Market Concentration: The top 5 players hold an estimated xx% of the market share in 2024, indicating a moderately concentrated market. Further detailed market share data for individual players is available in the full report.

- Innovation Drivers: The increasing demand for energy-efficient and environmentally friendly thermic fluids is a major driver of innovation. This is pushing companies to develop new formulations with improved thermal properties and reduced environmental impact.

- Regulatory Framework: Indian regulations regarding environmental protection and safety standards are influencing the development and adoption of thermic fluids. Compliance with these regulations is crucial for market players.

- Product Substitutes: While thermic fluids have established applications, the emergence of alternative heat transfer technologies might pose a competitive challenge. The report analyzes these potential substitutes and their impact on the market.

- End-User Trends: The growth of various end-use industries, such as manufacturing and power generation, is driving demand for thermic fluids. Changes in end-user preferences and technological advancements are carefully considered.

- M&A Activities: The report analyzes past and recent mergers and acquisitions in the industry, including deal values and their impact on market consolidation. For example, (xx Million) worth of M&A deals occurred between 2020 and 2024, impacting market dynamics.

India Thermic Fluid Industry Industry Trends & Insights

This section delves into the key trends and insights shaping the Indian thermic fluid market, encompassing growth drivers, technological advancements, and competitive dynamics. The Indian thermic fluid market exhibits a robust growth trajectory, fueled by several key factors.

The market is witnessing significant growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by expanding industrialization, increasing energy demand, and rising adoption of thermic fluids in various applications. Technological advancements, such as the development of high-performance and eco-friendly fluids, are further boosting market expansion. Consumer preference is shifting towards sustainable and efficient solutions, creating a demand for innovative and environmentally conscious thermic fluids. Competitive dynamics are marked by the presence of both established international and domestic players, leading to intense competition and a focus on product differentiation and innovation. Market penetration is steadily increasing, with xx% market coverage expected by 2033.

Dominant Markets & Segments in India Thermic Fluid Industry

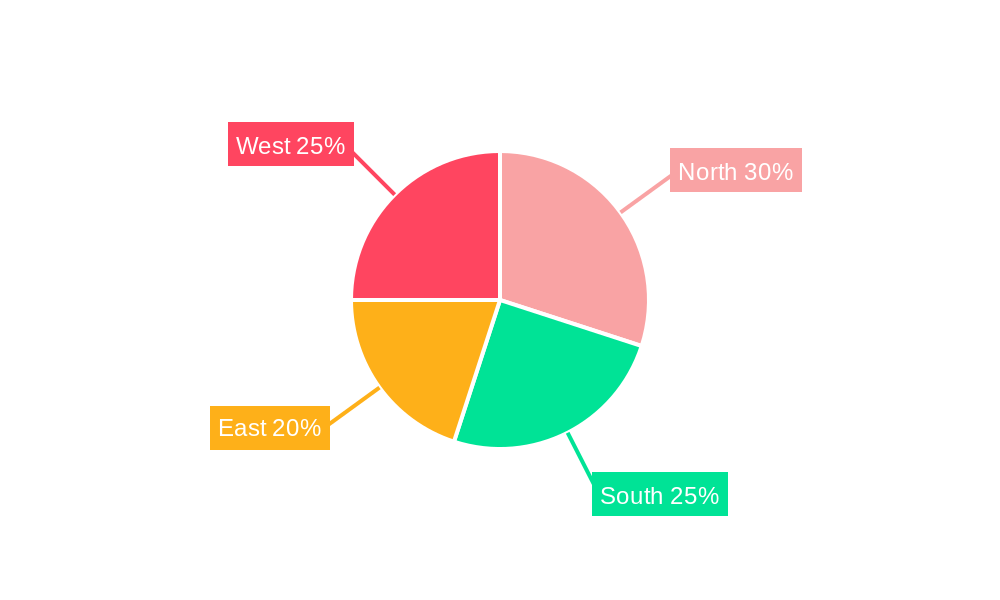

This section identifies the leading regions, countries, or segments within the Indian thermic fluid market and analyzes the factors driving their dominance.

Key Drivers for Dominant Segments:

- Favorable Government Policies: Supportive government initiatives aimed at promoting industrial growth and infrastructure development contribute significantly to the dominance of certain regions and segments.

- Robust Infrastructure: Well-developed infrastructure, including transportation and energy networks, facilitates the growth and dominance of specific market segments.

- Concentrated End-User Industries: The presence of large and concentrated end-user industries, such as manufacturing plants and power generation facilities, drives significant demand in certain regions.

Dominance Analysis: The Western region currently holds the largest market share, primarily due to the presence of a high concentration of manufacturing industries and robust infrastructure. However, other regions are also witnessing significant growth, with the Southern and Northern regions expected to gain considerable market share in the coming years. The detailed analysis within the full report provides a granular view of regional and segmental performance.

India Thermic Fluid Industry Product Developments

The Indian thermic fluid market showcases continuous product innovation, driven by the need for enhanced efficiency, safety, and environmental friendliness. Companies are focusing on developing high-performance thermic fluids with improved thermal stability, reduced viscosity, and enhanced corrosion resistance. These advancements cater to the evolving demands of various end-use industries, enhancing operational efficiency and minimizing environmental impact. The focus on sustainable and eco-friendly formulations is prominent, reflecting the growing environmental concerns within the industry. The market is witnessing the emergence of specialized thermic fluids for niche applications, further expanding the product portfolio and catering to diverse customer requirements.

Report Scope & Segmentation Analysis

This report segments the Indian thermic fluid market based on several key factors, providing a comprehensive understanding of market dynamics across various segments. The key segmentation parameters are:

- By Type: This includes various types of thermic fluids available in the market, such as synthetic and mineral-based fluids, each with its unique properties and applications. Detailed growth projections and market sizes for each type are provided in the full report.

- By Application: This segment categorizes thermic fluids based on their end-use applications, such as industrial heating, power generation, and others. The competitive dynamics within each application segment are analyzed.

- By Region: The report provides a regional breakdown of the market, encompassing key regions within India, with a detailed assessment of market size, growth potential, and competitive dynamics.

Key Drivers of India Thermic Fluid Industry Growth

The growth of the Indian thermic fluid industry is driven by several key factors, including rapid industrialization, increasing energy demands across various sectors, and the adoption of advanced technologies for enhanced operational efficiency. Government initiatives promoting energy efficiency and environmental sustainability are further bolstering market growth. The rise of renewable energy sources and the growing need for efficient heat transfer solutions in these applications create significant opportunities for the thermic fluid market.

Challenges in the India Thermic Fluid Industry Sector

The Indian thermic fluid industry faces several challenges, including stringent environmental regulations which necessitate compliance with strict emission standards. Supply chain disruptions can impact the availability and cost of raw materials, affecting production and profitability. Intense competition among established players and new entrants adds pressure on pricing and margins. Fluctuations in crude oil prices directly impact the cost of production and overall market dynamics.

Emerging Opportunities in India Thermic Fluid Industry

Emerging opportunities are shaping the future of the Indian thermic fluid market. The increasing adoption of renewable energy sources, such as solar thermal power plants, offers significant growth potential for specialized thermic fluids. Advancements in nanotechnology and the development of high-performance nanofluids present exciting opportunities for improved heat transfer efficiency. The growing demand for sustainable and eco-friendly solutions drives the development and adoption of biodegradable and environmentally benign thermic fluids.

Leading Players in the India Thermic Fluid Industry Market

- Bharat Petroleum Corporation Limited

- Bozzler Energy Pvt Ltd

- Dow (Dow)

- Eastman Chemical Company (Eastman Chemical Company)

- Exxon Mobil Corporation (ExxonMobil)

- GS Caltex India

- Hitech Solution (Generation Four Engitech Ltd)

- HP Lubricants (HP Lubricants)

- Indian Oil Corporation Ltd (Indian Oil Corporation)

- Paras Lubricants Ltd

- Shell plc (Shell)

- Savita Oil Technologies Limited

- Tide Water Oil Co (India) Ltd

Key Developments in India Thermic Fluid Industry Industry

- August 2022: Shell lubricants announced the launch of Electric Vehicle battery coolants (heat transfer fluids) in India, initially through imports, with plans for local manufacturing. This signifies the growing interest in electric vehicle technologies and the potential for thermic fluids in this sector.

- September 2022: Bozzler Energy Pvt Ltd showcased new designs of Thermic Fluid Heaters at the Boiler India 2022 exhibition, emphasizing environmental friendliness and health benefits. This highlights the industry’s focus on sustainable and eco-friendly solutions.

Strategic Outlook for India Thermic Fluid Industry Market

The Indian thermic fluid market presents significant growth potential driven by industrial expansion, rising energy demands, and a focus on energy efficiency. Technological advancements, particularly in the area of sustainable and high-performance fluids, will shape market dynamics. Strategic partnerships, investments in research and development, and a focus on environmental compliance will be critical for success in this competitive and evolving market. The market is expected to witness continued expansion, driven by the factors outlined above, offering substantial opportunities for industry participants.

India Thermic Fluid Industry Segmentation

-

1. Type

- 1.1. Mineral Oil

- 1.2. Silicon And Aromatics

- 1.3. Glycols

- 1.4. Other Types

-

2. End-user Industry

- 2.1. Food and Beverage

- 2.2. Chemicals

- 2.3. Pharmaceuticals

- 2.4. Oil and Gas

- 2.5. Concentrated Solar Power

- 2.6. Other End-user Industries

India Thermic Fluid Industry Segmentation By Geography

- 1. India

India Thermic Fluid Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Extensive Demand from the Oil and Gas Sector; Increasing Use in Concentrated Solar Power

- 3.3. Market Restrains

- 3.3.1. Extensive Demand from the Oil and Gas Sector; Increasing Use in Concentrated Solar Power

- 3.4. Market Trends

- 3.4.1. Rising Demand for Mineral Oil Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Thermic Fluid Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mineral Oil

- 5.1.2. Silicon And Aromatics

- 5.1.3. Glycols

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food and Beverage

- 5.2.2. Chemicals

- 5.2.3. Pharmaceuticals

- 5.2.4. Oil and Gas

- 5.2.5. Concentrated Solar Power

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bharat Petroleum Corporation Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bozzler Energy Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dow

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eastman Chemical Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Exxon Mobil Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GS Caltex India

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hitech Solution (Generation Four Engitech Ltd)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HP Lubricants

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Indian Oil Corporation Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Paras Lubricants Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Shell plc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Savita Oil Technologies Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Tide Water Oil Co (India) Ltd *List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Bharat Petroleum Corporation Limited

List of Figures

- Figure 1: India Thermic Fluid Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Thermic Fluid Industry Share (%) by Company 2024

List of Tables

- Table 1: India Thermic Fluid Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Thermic Fluid Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Thermic Fluid Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: India Thermic Fluid Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Thermic Fluid Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 6: India Thermic Fluid Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 7: India Thermic Fluid Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Thermic Fluid Industry?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the India Thermic Fluid Industry?

Key companies in the market include Bharat Petroleum Corporation Limited, Bozzler Energy Pvt Ltd, Dow, Eastman Chemical Company, Exxon Mobil Corporation, GS Caltex India, Hitech Solution (Generation Four Engitech Ltd), HP Lubricants, Indian Oil Corporation Ltd, Paras Lubricants Ltd, Shell plc, Savita Oil Technologies Limited, Tide Water Oil Co (India) Ltd *List Not Exhaustive.

3. What are the main segments of the India Thermic Fluid Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Extensive Demand from the Oil and Gas Sector; Increasing Use in Concentrated Solar Power.

6. What are the notable trends driving market growth?

Rising Demand for Mineral Oil Segment.

7. Are there any restraints impacting market growth?

Extensive Demand from the Oil and Gas Sector; Increasing Use in Concentrated Solar Power.

8. Can you provide examples of recent developments in the market?

September 2022: Bozzler Energy Pvt Ltd announced that the company would be showcasing its new designs of Thermic Fluid Heaters at the Boiler India 2022 exhibition organized by Orangebeak Technologies, which was to be held at CIDCO Exhibition Centre, Navi Mumbai. The new designs are expected to be highly suitable for environmental health and eco-friendly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Thermic Fluid Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Thermic Fluid Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Thermic Fluid Industry?

To stay informed about further developments, trends, and reports in the India Thermic Fluid Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence