Key Insights

The India Uninterruptible Power Supply (UPS) market, valued at 277.8 million in 2024, is projected for substantial expansion. This growth is propelled by escalating electricity demand, the increasing deployment of data centers and telecommunications infrastructure, and the critical need for reliable power backup solutions in healthcare and industrial sectors. The market is forecast to grow at a Compound Annual Growth Rate (CAGR) of 4.4% between 2024 and 2033. Analysis of market segmentation highlights key opportunities across various capacity ranges (under 10 kVA, 10-100 kVA, over 100 kVA) and UPS types (standby, online, line-interactive). The online UPS segment is anticipated to dominate due to its superior performance and reliability. Geographically, the South and West regions of India, fueled by rapid urbanization and industrialization, are expected to lead market growth. However, significant initial investment costs and limited awareness in specific sectors present potential challenges.

India Uninterruptible Power Supply Market Market Size (In Million)

Key players such as Riello Elettronica, ABB, Delta Electronics, and Schneider Electric are actively pursuing product innovation and market expansion to leverage this growth potential. Government initiatives supporting renewable energy integration and digital infrastructure development are expected to further stimulate the market. The increasing adoption of IT infrastructure and data centers, particularly in major urban centers, will drive demand for high-capacity UPS systems. The healthcare sector's growing reliance on advanced medical equipment, which requires uninterrupted power, will also be a significant contributor. Furthermore, the expansion of manufacturing and industrial sectors will boost UPS demand across diverse applications. Challenges include the availability of cost-effective and efficient UPS solutions for Small and Medium-sized Enterprises (SMEs) and the necessity for increased awareness regarding the importance of power backup. Intensifying competition among established and emerging companies necessitates innovative strategies, including strategic alliances, technological advancements, and value-added services to maintain a competitive advantage.

India Uninterruptible Power Supply Market Company Market Share

India Uninterruptible Power Supply (UPS) Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India Uninterruptible Power Supply (UPS) market, covering market size, segmentation, growth drivers, challenges, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is invaluable for industry stakeholders, investors, and businesses seeking to understand and capitalize on the opportunities within this dynamic market.

India Uninterruptible Power Supply Market Market Concentration & Innovation

The Indian UPS market exhibits a moderately concentrated landscape, with a handful of multinational corporations and domestic players commanding significant market share. The top ten companies, including Riello Elettronica SpA, ABB Ltd, Delta Electronics Inc, Hitachi Ltd, Emerson Electric Co, Mitsubishi Electric Corporation, Schneider Electric SE, EATON Corporation PLC, General Electric Company, and Cyber Power Systems Inc, collectively hold an estimated xx% of the market. However, the market also witnesses significant participation from smaller, specialized players focusing on niche applications or technological advancements.

Market concentration is influenced by factors such as brand recognition, established distribution networks, and technological capabilities. Innovation in UPS technology is driven by the increasing demand for reliable power solutions across various sectors. Key innovation drivers include the adoption of lithium-ion batteries, advancements in power electronics (like IGBT technology showcased by Su-vastika), and the integration of smart features for remote monitoring and predictive maintenance.

Regulatory frameworks, while not excessively restrictive, play a role in shaping the market. Stringent safety standards and energy efficiency regulations influence product development and adoption. The availability of substitutes, such as diesel generators, presents competition, though the increasing environmental concerns and fluctuating fuel prices are pushing the market towards UPS systems. End-user trends favor higher efficiency, greater capacity, and integrated solutions that address specific sector needs (e.g., data center UPS systems with enhanced redundancy and cooling). M&A activities in the sector remain moderate, with deal values averaging approximately xx Million annually, primarily focusing on enhancing technological capabilities or expanding market reach.

India Uninterruptible Power Supply Market Industry Trends & Insights

The Indian UPS market is experiencing robust growth, driven by the increasing demand for uninterrupted power across diverse sectors. The market’s Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was estimated at xx%, and is projected to reach xx% during the forecast period (2025-2033). This growth is fueled by several factors: expanding IT infrastructure, particularly data centers; growing adoption of UPS systems in healthcare facilities for critical medical equipment; increasing industrial automation and process control requirements; and the rising adoption of renewable energy sources, necessitating efficient energy storage and management solutions.

Technological disruptions, particularly advancements in battery technology (lithium-ion batteries are gaining traction), power electronics, and digital connectivity, are reshaping the competitive landscape. Consumer preferences are shifting towards more efficient, reliable, and technologically advanced UPS systems with remote monitoring capabilities. The market exhibits strong competitive dynamics, with established players continuously innovating to maintain their market share and new entrants focusing on niche applications and cost-effective solutions. Market penetration of UPS systems in residential and SME segments is steadily increasing due to rising awareness of power outages and their impact.

Dominant Markets & Segments in India Uninterruptible Power Supply Market

The Indian UPS market shows significant regional variations, with major metropolitan areas and industrial hubs exhibiting higher demand. Within the market segmentation:

Capacity: The 10-100 kVA segment currently dominates the market, driven by robust demand from small and medium-sized businesses (SMEs) and commercial establishments. The above 100 kVA segment is experiencing notable growth due to the increasing demand from large data centers and industrial facilities. The less than 10 kVA segment caters to residential and small office needs.

Type: Online UPS systems are gaining popularity due to their superior performance and reliability, although standby and line-interactive UPS systems remain significant in certain applications due to their cost-effectiveness.

Application: Data centers are the largest consumer of UPS systems, followed by telecommunications and the healthcare sector. The industrial sector shows steady growth, driven by increased automation and process control needs. Other applications, such as residential and educational institutions, are experiencing increasing adoption rates.

Key drivers for dominance in specific segments include:

- Economic policies: Government initiatives promoting digital infrastructure and industrial growth significantly influence market demand.

- Infrastructure development: Ongoing expansion of IT infrastructure and power grids creates greater demand for reliable power solutions.

- Technological advancements: Innovations in battery technology, power electronics, and system integration drive market adoption of specific UPS types.

India Uninterruptible Power Supply Market Product Developments

Recent product developments reflect a strong focus on higher efficiency, enhanced reliability, and intelligent features. Manufacturers are incorporating advanced battery technologies (e.g., lithium-ion) and power electronics to improve system performance and reduce energy consumption. Integration of remote monitoring and predictive maintenance capabilities enhances system management and reduces downtime. The introduction of modular UPS systems offers flexibility and scalability to meet evolving power requirements, while eco-friendly designs address growing environmental concerns. The competitive advantage lies in providing integrated solutions that address the specific power requirements and challenges of different end-users.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the India UPS market across various segments:

Capacity: Less than 10 kVA (market size xx Million in 2025, projected growth xx%), 10-100 kVA (market size xx Million in 2025, projected growth xx%), Above 100 kVA (market size xx Million in 2025, projected growth xx%).

Type: Standby UPS System (market size xx Million in 2025, projected growth xx%), Online UPS System (market size xx Million in 2025, projected growth xx%), Line-interactive UPS System (market size xx Million in 2025, projected growth xx%).

Application: Data Centers (market size xx Million in 2025, projected growth xx%), Telecommunications (market size xx Million in 2025, projected growth xx%), Healthcare (market size xx Million in 2025, projected growth xx%), Industrial (market size xx Million in 2025, projected growth xx%), Other Applications (market size xx Million in 2025, projected growth xx%). Competitive dynamics vary across segments, reflecting the specific technological and cost considerations of each application.

Key Drivers of India Uninterruptible Power Supply Market Growth

Several factors fuel the growth of the Indian UPS market. Firstly, the rapid expansion of data centers and IT infrastructure demands reliable power backup solutions. Secondly, rising industrial automation and the increasing reliance on critical equipment across various sectors necessitate uninterrupted power supply. Thirdly, government initiatives aimed at improving power infrastructure and promoting renewable energy adoption indirectly stimulate demand for efficient energy storage solutions such as UPS systems. Lastly, growing awareness about power outages and their economic consequences among consumers and businesses drives market growth.

Challenges in the India Uninterruptible Power Supply Market Sector

The Indian UPS market faces several challenges. Fluctuations in raw material prices and supply chain disruptions can impact production costs and availability. Intense competition from both established multinational companies and domestic players puts pressure on pricing and profitability. Furthermore, the presence of cheaper alternatives, like diesel generators, in certain segments presents competitive hurdles. Addressing concerns about energy efficiency and environmental impact requires continuous innovation in battery technology and system design.

Emerging Opportunities in India Uninterruptible Power Supply Market

Emerging opportunities lie in several areas. The increasing adoption of renewable energy sources presents a significant opportunity for UPS systems with integrated solar or wind power integration. Growth in the smart grid and the Internet of Things (IoT) is creating demand for intelligent UPS systems with remote monitoring and management capabilities. Expanding into rural and semi-urban areas presents significant untapped market potential. Focus on energy-efficient and environmentally friendly solutions can attract environmentally conscious consumers and businesses.

Leading Players in the India Uninterruptible Power Supply Market Market

- Riello Elettronica SpA

- ABB Ltd (ABB Ltd)

- Delta Electronics Inc (Delta Electronics Inc)

- Hitachi Ltd (Hitachi Ltd)

- Emerson Electric Co (Emerson Electric Co)

- Mitsubishi Electric Corporation (Mitsubishi Electric Corporation)

- Schneider Electric SE (Schneider Electric SE)

- EATON Corporation PLC (EATON Corporation PLC)

- General Electric Company (General Electric Company)

- Cyber Power Systems Inc (Cyber Power Systems Inc)

Key Developments in India Uninterruptible Power Supply Market Industry

October 2022: Su-vastika launched a lithium battery-based three-phase UPS system (10-500 kVA) using IGBT technology, offering a cleaner alternative to diesel generators. This development significantly impacts the market by offering a more sustainable and efficient UPS solution, particularly for larger-scale applications.

June 2022: Vertiv launched new UPS solutions (Vertiv Liebert ITA2 - 30 kVA and Vertiv Liebert EXM2) during its Xpress Power Drive roadshow. This highlights the company's commitment to expanding its market presence in India and providing a broader range of UPS solutions to diverse customer needs.

Strategic Outlook for India Uninterruptible Power Supply Market Market

The Indian UPS market is poised for sustained growth, driven by continuous technological advancements, increasing infrastructure investments, and rising demand for reliable power across various sectors. The focus on energy efficiency, sustainability, and smart features will shape the future competitive landscape. Companies that can adapt to changing consumer preferences, embrace technological innovation, and effectively navigate the challenges of supply chain management and competition will be well-positioned to capitalize on the market's significant growth potential.

India Uninterruptible Power Supply Market Segmentation

-

1. Capacity

- 1.1. Less than 10 kVA

- 1.2. 10-100 kVA

- 1.3. Above 100kVA

-

2. Type

- 2.1. Standby UPS System

- 2.2. Online UPS System

- 2.3. Line-interactive UPS System

-

3. Application

- 3.1. Data Centers

- 3.2. Telecommunications

- 3.3. Healthcare (Hospitals, Clinics, etc.)

- 3.4. Industrial

- 3.5. Other Applications

India Uninterruptible Power Supply Market Segmentation By Geography

- 1. India

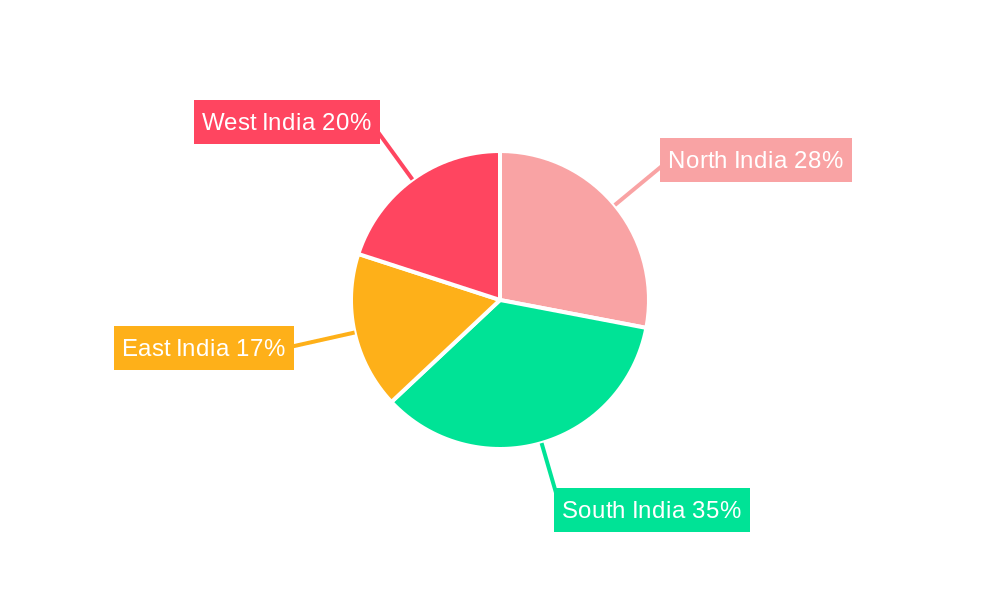

India Uninterruptible Power Supply Market Regional Market Share

Geographic Coverage of India Uninterruptible Power Supply Market

India Uninterruptible Power Supply Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Declining Price of Solar Panels and Installation Costs4.; Increasing Adoption of Solar PV Systems4.; Rising Environmental Concerns About the Use of Fossil Fuels

- 3.3. Market Restrains

- 3.3.1. 4.; Transmission and Distribution Losses4.; A Lack of a Solidified Renewable Energy Policy

- 3.4. Market Trends

- 3.4.1. Data Centers Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Uninterruptible Power Supply Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 5.1.1. Less than 10 kVA

- 5.1.2. 10-100 kVA

- 5.1.3. Above 100kVA

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Standby UPS System

- 5.2.2. Online UPS System

- 5.2.3. Line-interactive UPS System

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Data Centers

- 5.3.2. Telecommunications

- 5.3.3. Healthcare (Hospitals, Clinics, etc.)

- 5.3.4. Industrial

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Riello Elettronica SpA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Delta Electronics Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hitachi Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Emerson Electric Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EATON Corporation PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 General Electric Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cyber Power Systems Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Riello Elettronica SpA

List of Figures

- Figure 1: India Uninterruptible Power Supply Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Uninterruptible Power Supply Market Share (%) by Company 2025

List of Tables

- Table 1: India Uninterruptible Power Supply Market Revenue million Forecast, by Capacity 2020 & 2033

- Table 2: India Uninterruptible Power Supply Market Volume kilowatts Forecast, by Capacity 2020 & 2033

- Table 3: India Uninterruptible Power Supply Market Revenue million Forecast, by Type 2020 & 2033

- Table 4: India Uninterruptible Power Supply Market Volume kilowatts Forecast, by Type 2020 & 2033

- Table 5: India Uninterruptible Power Supply Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: India Uninterruptible Power Supply Market Volume kilowatts Forecast, by Application 2020 & 2033

- Table 7: India Uninterruptible Power Supply Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: India Uninterruptible Power Supply Market Volume kilowatts Forecast, by Region 2020 & 2033

- Table 9: India Uninterruptible Power Supply Market Revenue million Forecast, by Capacity 2020 & 2033

- Table 10: India Uninterruptible Power Supply Market Volume kilowatts Forecast, by Capacity 2020 & 2033

- Table 11: India Uninterruptible Power Supply Market Revenue million Forecast, by Type 2020 & 2033

- Table 12: India Uninterruptible Power Supply Market Volume kilowatts Forecast, by Type 2020 & 2033

- Table 13: India Uninterruptible Power Supply Market Revenue million Forecast, by Application 2020 & 2033

- Table 14: India Uninterruptible Power Supply Market Volume kilowatts Forecast, by Application 2020 & 2033

- Table 15: India Uninterruptible Power Supply Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: India Uninterruptible Power Supply Market Volume kilowatts Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Uninterruptible Power Supply Market?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the India Uninterruptible Power Supply Market?

Key companies in the market include Riello Elettronica SpA, ABB Ltd, Delta Electronics Inc, Hitachi Ltd, Emerson Electric Co, Mitsubishi Electric Corporation, Schneider Electric SE, EATON Corporation PLC, General Electric Company, Cyber Power Systems Inc.

3. What are the main segments of the India Uninterruptible Power Supply Market?

The market segments include Capacity , Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 277.8 million as of 2022.

5. What are some drivers contributing to market growth?

4.; The Declining Price of Solar Panels and Installation Costs4.; Increasing Adoption of Solar PV Systems4.; Rising Environmental Concerns About the Use of Fossil Fuels.

6. What are the notable trends driving market growth?

Data Centers Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Transmission and Distribution Losses4.; A Lack of a Solidified Renewable Energy Policy.

8. Can you provide examples of recent developments in the market?

October 2022: Gurugram-based solar startup Su-vastika launched a lithium battery-based three-phase uninterruptible power supply (UPS) system that can be widely used as an alternative to polluting diesel generators (DGs) from residential and commercial buildings to educational facilities, hospitals, and shopping malls. The UPS system has power ratings of 10 kVA to 500 kVA and can work on a bi-directional technology based on an insulated-gate bipolar transistor (IGBT).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in kilowatts.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Uninterruptible Power Supply Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Uninterruptible Power Supply Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Uninterruptible Power Supply Market?

To stay informed about further developments, trends, and reports in the India Uninterruptible Power Supply Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence