Key Insights

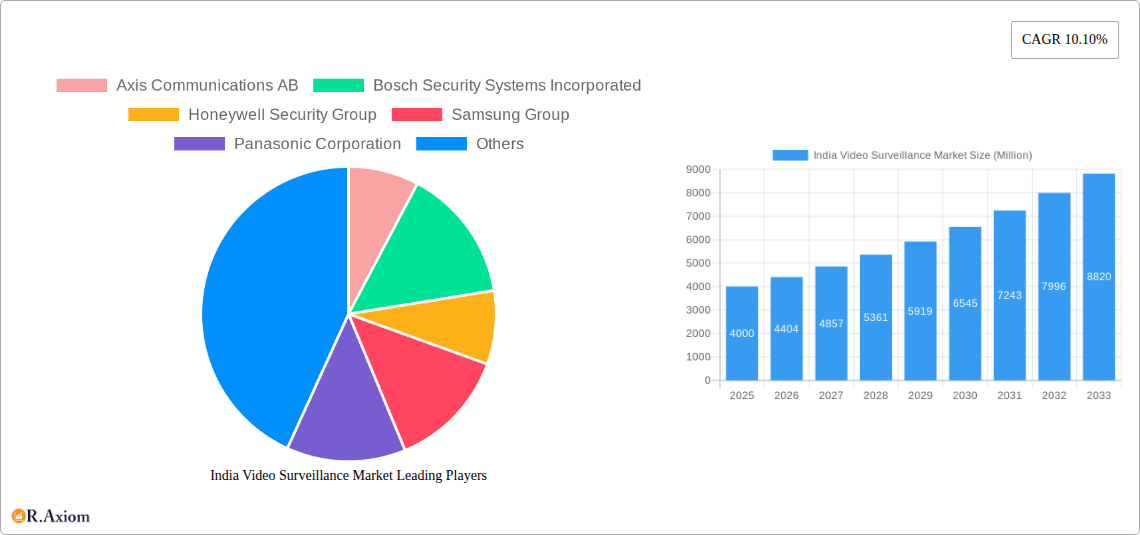

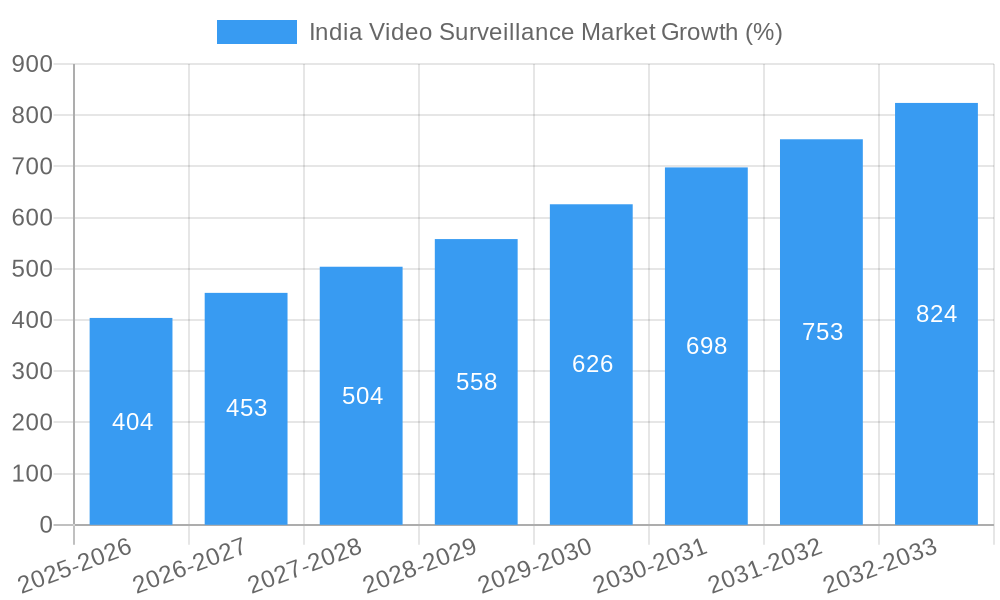

The India video surveillance market is experiencing robust growth, driven by increasing concerns over security, rising adoption of smart city initiatives, and the expanding use of Internet of Things (IoT) technologies. The market, currently valued at approximately ₹4 billion (assuming "Million" refers to Indian Rupees and adjusting for potential currency fluctuations), exhibits a Compound Annual Growth Rate (CAGR) of 10.10%, indicating significant expansion through 2033. Key drivers include the government's emphasis on public safety, particularly in urban areas, the increasing affordability of surveillance technologies, and the rising demand for advanced features like analytics and cloud-based solutions. The market is segmented based on technology (IP-based, analog), application (residential, commercial, government), and geography. While specific segment data is unavailable, the strong overall growth suggests substantial expansion across all segments. The competitive landscape is fragmented, with both international players (Axis Communications, Bosch, Honeywell, Samsung, Panasonic) and domestic companies (Aditya Infotech, Videocon, Zicom, Godrej) vying for market share. Increased competition is likely to spur innovation and price reductions, further boosting market accessibility.

The continuous advancements in video analytics capabilities are transforming the industry, shifting from basic surveillance to intelligent systems capable of predictive analysis and automated incident response. The adoption of cloud-based solutions enhances accessibility, scalability, and remote monitoring capabilities. However, challenges remain, including concerns over data privacy and security, infrastructure limitations in certain regions, and the need for skilled workforce to manage and maintain complex surveillance systems. The government's initiatives promoting digitalization and smart cities, coupled with growing private sector investments, will likely mitigate some of these restraints and further fuel market expansion in the coming years. The market's trajectory suggests sustained growth, potentially exceeding ₹10 billion by 2033, driven by technological innovations and heightened security awareness across various sectors.

India Video Surveillance Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India video surveillance market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report projects market trends through to 2033. It encompasses historical data (2019-2024) and provides actionable forecasts for the future. The report leverages high-traffic keywords like "India video surveillance market," "CCTV market India," "IP camera market India," and "surveillance technology India" to enhance search visibility.

India Video Surveillance Market Concentration & Innovation

The Indian video surveillance market exhibits a moderately concentrated landscape, with both global and domestic players vying for market share. While a few large multinational corporations hold significant positions, numerous smaller, specialized companies cater to niche segments. Market share data for 2024 suggests Axis Communications AB and Bosch Security Systems Incorporated hold approximately xx% and xx% respectively, followed by Honeywell Security Group with xx%. The remaining market share is distributed among numerous regional and local players like Dahua Technology India Pvt Ltd, CP PLUS, and others.

Innovation is driven by increasing demand for advanced features such as AI-powered analytics, cloud-based solutions, and improved image quality. Government initiatives promoting smart cities and enhancing national security are significant catalysts. Regulatory frameworks like data privacy regulations (e.g., the Personal Data Protection Bill) influence market dynamics, pushing for data security enhancements within surveillance systems. Product substitution is minimal, with IP-based systems gradually replacing older analog systems. End-user trends indicate a growing preference for integrated solutions offering seamless monitoring and analytics. M&A activity in the sector has been moderate, with deal values ranging from xx Million to xx Million in recent years, primarily focused on strategic acquisitions aimed at technological expansion and market reach.

India Video Surveillance Market Industry Trends & Insights

The India video surveillance market exhibits robust growth, driven by rising urbanization, escalating security concerns, and increasing government investments in smart city initiatives. The market is experiencing a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by technological disruptions, like the introduction of AI-powered video analytics, enabling improved threat detection and proactive security measures. Consumer preferences are shifting towards advanced features, including facial recognition, license plate recognition, and real-time alerts. Competitive dynamics are intense, with both established players and emerging companies innovating to offer cost-effective, high-performance solutions. Market penetration for IP-based systems continues to increase, surpassing xx% in 2024 and expected to reach xx% by 2033.

Dominant Markets & Segments in India Video Surveillance Market

The metropolitan areas of major cities such as Mumbai, Delhi, Bengaluru, and Hyderabad represent dominant markets within the India video surveillance sector. These cities' rapid urbanization, large populations, and robust economic activity fuel high demand for security solutions.

- Key Drivers:

- Rapid urbanization and infrastructure development.

- Growing adoption of smart city initiatives.

- Increasing government spending on public safety.

- Rising concerns about crime and terrorism.

The government sector, including law enforcement and transportation, is a leading segment, driven by large-scale projects. The private sector, encompassing retail, banking, and industrial facilities, is also a significant segment experiencing consistent growth. Residential surveillance systems represent a growing market segment fueled by increased awareness of home security.

India Video Surveillance Market Product Developments

Recent product developments focus on AI-powered analytics, enhanced image quality, and improved user interfaces. The integration of cloud-based platforms offers scalability and remote management capabilities. Competitiveness hinges on offering solutions that combine advanced features with affordability and ease of use, catering to the diverse needs of various market segments. The shift towards cost-effective, yet high-performance, solutions is a major technological trend.

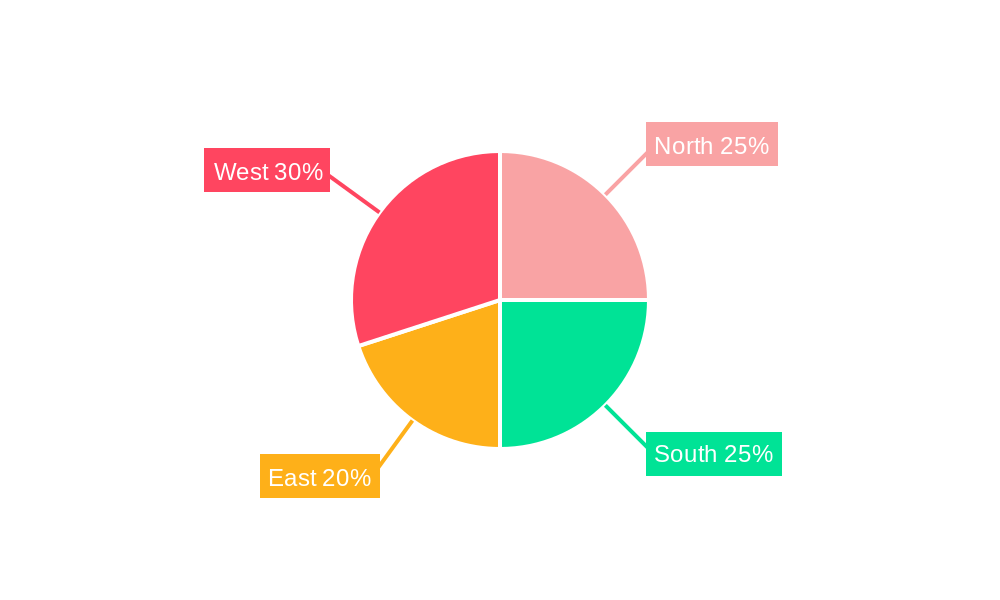

Report Scope & Segmentation Analysis

The report segments the India video surveillance market by product type (CCTV cameras, IP cameras, video analytics software, video management systems (VMS), access control systems), by application (residential, commercial, industrial, government, transportation), by technology (analog, IP), and by region (North, South, East, West). Each segment's growth projections, market size, and competitive dynamics are detailed in the report. For instance, the IP camera segment is expected to exhibit the highest CAGR, driven by increasing demand for advanced features. The government sector is anticipated to dominate the application segment owing to significant government investments in security infrastructure.

Key Drivers of India Video Surveillance Market Growth

Several factors drive market growth:

- Technological advancements: The development of AI-powered analytics, cloud-based solutions, and high-resolution cameras enhances the capabilities and value proposition of video surveillance systems.

- Government initiatives: Smart city projects and increased focus on public safety are creating substantial demand for surveillance solutions.

- Economic growth: Rising disposable incomes and increased awareness of security concerns are contributing to the market's expansion.

Challenges in the India Video Surveillance Market Sector

The market faces challenges such as:

- Regulatory hurdles: Data privacy concerns and regulations are increasing the complexity of implementing and managing surveillance systems.

- Supply chain issues: Global supply chain disruptions can impact the availability and cost of components, affecting market dynamics.

- Competitive pressures: Intense competition from both domestic and international players necessitates continuous innovation and cost optimization. Price wars in certain segments may pressure margins.

Emerging Opportunities in India Video Surveillance Market

Emerging opportunities include:

- Expansion into rural areas: Growing awareness of security concerns in rural areas creates potential for market expansion.

- Integration with IoT devices: The convergence of video surveillance with other IoT devices opens up new applications and revenue streams.

- Adoption of advanced analytics: Increased adoption of AI and machine learning enhances the effectiveness of video surveillance systems, creating new business opportunities.

Leading Players in the India Video Surveillance Market Market

- Axis Communications AB

- Bosch Security Systems Incorporated

- Honeywell Security Group

- Samsung Group

- Panasonic Corporation

- FLIR Systems Inc

- Schneider Electric SE

- Aditya Infotech Ltd

- Videocon Industries Ltd

- Zicom Electronic Security Systems

- Dahua Technology India Pvt Ltd

- D-Link India Limited

- Godrej Security Solution

- Digitals India Security Products Pvt Ltd

- Total Surveillance Solutions Pvt Ltd

- *List Not Exhaustive

Key Developments in India Video Surveillance Market Industry

- January 2024: Transline Technologies secured a contract from Indian Oil Corporation (IOCL) for implementing an IP-based CCTV surveillance system in Telangana and Andhra Pradesh. This highlights the growing demand for advanced surveillance solutions in the energy sector.

- October 2023: Hikvision launched its industry-first 2 MP analog cameras with F1.0 aperture, significantly enhancing low-light imaging capabilities and offering an affordable upgrade path for existing analog systems. This signals a continued innovation in analog technology, extending its lifespan in the market.

Strategic Outlook for India Video Surveillance Market Market

The India video surveillance market is poised for continued robust growth, driven by technological advancements, increasing government investments, and rising security concerns. Opportunities exist in leveraging AI and IoT technologies to create innovative, integrated solutions. Companies focused on providing cost-effective, high-performance solutions tailored to the specific needs of the diverse Indian market are best positioned for success. The market's future potential is significant, with continued expansion across various sectors and geographical regions.

India Video Surveillance Market Segmentation

-

1. Type

-

1.1. Hardware

-

1.1.1. Camera

- 1.1.1.1. Analog

- 1.1.1.2. IP Cameras

- 1.1.1.3. Hybrid

- 1.1.2. Storage

-

1.1.1. Camera

-

1.2. Software

- 1.2.1. Video Analytics

- 1.2.2. Video Management Software

- 1.3. Services (VSaaS)

-

1.1. Hardware

-

2. End-user Vertical

- 2.1. Commercial

- 2.2. Infrastructure

- 2.3. Institutional

- 2.4. Industrial

- 2.5. Defense

- 2.6. Residential

India Video Surveillance Market Segmentation By Geography

- 1. India

India Video Surveillance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented Demand of IP Cameras; Emergence of Video Surveillance-as-a-Service; Increasing Demand for Video Analytics

- 3.3. Market Restrains

- 3.3.1. Augmented Demand of IP Cameras; Emergence of Video Surveillance-as-a-Service; Increasing Demand for Video Analytics

- 3.4. Market Trends

- 3.4.1. Rising Smart City Initiatives is Driving the Demand for Video Surveillance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Video Surveillance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. Camera

- 5.1.1.1.1. Analog

- 5.1.1.1.2. IP Cameras

- 5.1.1.1.3. Hybrid

- 5.1.1.2. Storage

- 5.1.1.1. Camera

- 5.1.2. Software

- 5.1.2.1. Video Analytics

- 5.1.2.2. Video Management Software

- 5.1.3. Services (VSaaS)

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Commercial

- 5.2.2. Infrastructure

- 5.2.3. Institutional

- 5.2.4. Industrial

- 5.2.5. Defense

- 5.2.6. Residential

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Axis Communications AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bosch Security Systems Incorporated

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honeywell Security Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Samsung Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Panasonic Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FLIR Systems Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aditya Infotech Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Videocon Industries Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zicom Electronic Security Systems

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dahua Technology India Pvt Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 D-Link India Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Godrej Security Solution

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Digitals India Security Products Pvt Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Total Surveillance Solutions Pvt Ltd*List Not Exhaustive

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Axis Communications AB

List of Figures

- Figure 1: India Video Surveillance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Video Surveillance Market Share (%) by Company 2024

List of Tables

- Table 1: India Video Surveillance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Video Surveillance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: India Video Surveillance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: India Video Surveillance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: India Video Surveillance Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 6: India Video Surveillance Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 7: India Video Surveillance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Video Surveillance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: India Video Surveillance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: India Video Surveillance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: India Video Surveillance Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 12: India Video Surveillance Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 13: India Video Surveillance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: India Video Surveillance Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Video Surveillance Market?

The projected CAGR is approximately 10.10%.

2. Which companies are prominent players in the India Video Surveillance Market?

Key companies in the market include Axis Communications AB, Bosch Security Systems Incorporated, Honeywell Security Group, Samsung Group, Panasonic Corporation, FLIR Systems Inc, Schneider Electric SE, Aditya Infotech Ltd, Videocon Industries Ltd, Zicom Electronic Security Systems, Dahua Technology India Pvt Ltd, D-Link India Limited, Godrej Security Solution, Digitals India Security Products Pvt Ltd, Total Surveillance Solutions Pvt Ltd*List Not Exhaustive.

3. What are the main segments of the India Video Surveillance Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 4 Million as of 2022.

5. What are some drivers contributing to market growth?

Augmented Demand of IP Cameras; Emergence of Video Surveillance-as-a-Service; Increasing Demand for Video Analytics.

6. What are the notable trends driving market growth?

Rising Smart City Initiatives is Driving the Demand for Video Surveillance.

7. Are there any restraints impacting market growth?

Augmented Demand of IP Cameras; Emergence of Video Surveillance-as-a-Service; Increasing Demand for Video Analytics.

8. Can you provide examples of recent developments in the market?

January 2024: The Delhi-based tech company Transline Technologies announced receiving a contract from Indian Oil Corporation (IOCL) to implement an IP-based CCTV surveillance system in Telangana and Andhra Pradesh. The company will be responsible for the designing, supplying, installing, testing, and commissioning of the surveillance system, which will include explosion-proof cameras with advanced analytics, servers, high-definition LEDs, redundant servers, client workstations, storage devices, networking components, poles, display monitors, LED floodlights, VMS, and analytic software.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Video Surveillance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Video Surveillance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Video Surveillance Market?

To stay informed about further developments, trends, and reports in the India Video Surveillance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence