Key Insights

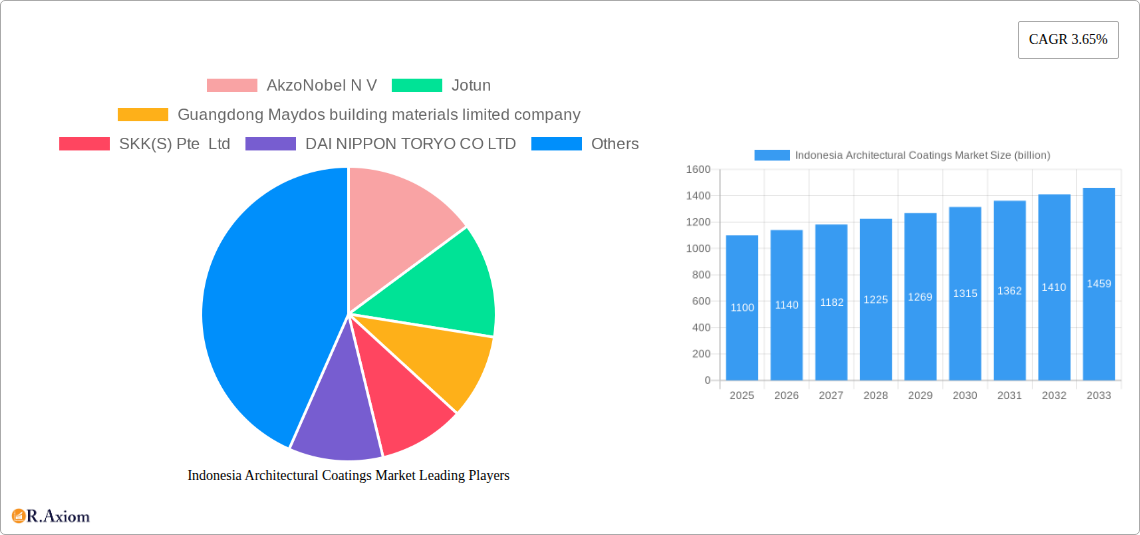

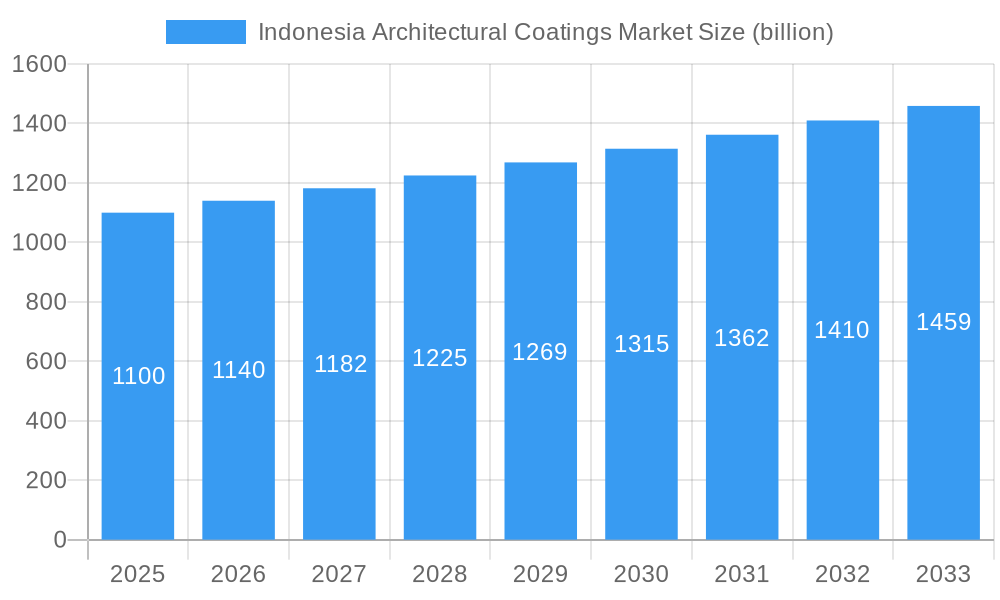

The Indonesian architectural coatings market is poised for robust growth, projecting a market size of USD 1.1 billion in 2025 and a Compound Annual Growth Rate (CAGR) of 3.65% through 2033. This expansion is fueled by a burgeoning construction sector, driven by increasing urbanization, a growing middle class with higher disposable incomes, and significant government investments in infrastructure development and housing projects. The residential segment is expected to remain the dominant end-user, benefiting from new constructions and the ongoing trend of home renovation and beautification. Simultaneously, the commercial segment is witnessing steady progress with the development of retail spaces, offices, and hospitality venues, all contributing to sustained demand for decorative and protective coatings.

Indonesia Architectural Coatings Market Market Size (In Billion)

The market is witnessing a significant shift towards more environmentally friendly solutions. While solventborne coatings still hold a considerable share due to their cost-effectiveness and performance characteristics, waterborne coatings are rapidly gaining traction. This shift is propelled by increasing environmental regulations, growing consumer awareness regarding indoor air quality, and the availability of advanced waterborne formulations that offer comparable performance to their solventborne counterparts. Acrylic and polyurethane resins are expected to lead the resin segment, owing to their versatility, durability, and aesthetic appeal in various applications. However, ongoing research and development in epoxy and alkyd resins are also contributing to market innovation and catering to specific performance demands in both residential and commercial applications.

Indonesia Architectural Coatings Market Company Market Share

Here's the SEO-optimized, detailed report description for the Indonesia Architectural Coatings Market:

Indonesia Architectural Coatings Market Market Concentration & Innovation

The Indonesia Architectural Coatings Market exhibits a moderate to high level of market concentration, with a few key global and regional players dominating a significant portion of the market share. AkzoNobel N.V., Jotun, Nippon Paint Holdings Co., Ltd., and TOA Paint Public Company Limited are prominent figures driving innovation through continuous product development and the introduction of advanced technologies. The market is fueled by an increasing demand for eco-friendly and high-performance coatings, particularly waterborne and low-VOC (Volatile Organic Compound) solutions. Regulatory frameworks, such as environmental standards and building codes, play a crucial role in shaping product offerings and driving the adoption of sustainable coatings. Product substitutes, including wallpaper and other interior finishing materials, present a competitive challenge, but the superior protective and aesthetic qualities of architectural coatings often give them an edge. End-user trends are heavily influenced by the burgeoning construction sector, urbanization, and a growing middle class with a preference for aesthetically pleasing and durable homes and commercial spaces. Merger and acquisition (M&A) activities, while not extensively publicized, are strategic moves by larger players to consolidate market presence, acquire new technologies, and expand their product portfolios. For instance, hypothetical M&A deals in the range of hundreds of millions of dollars could reshape the competitive landscape, enhancing market share for acquiring entities and integrating specialized product lines. Innovation drivers include advancements in resin technology, such as the development of high-performance epoxy and polyurethane coatings for specialized applications, and the ongoing research into novel additives for enhanced durability, weather resistance, and self-cleaning properties.

Indonesia Architectural Coatings Market Industry Trends & Insights

The Indonesia Architectural Coatings Market is poised for significant growth, driven by a confluence of robust economic development, rapid urbanization, and a burgeoning construction industry. The projected Compound Annual Growth Rate (CAGR) for the forecast period 2025–2033 is robust, estimated to be in the range of 7.5% to 9.0%. This growth is underpinned by increasing disposable incomes, a growing middle-class population demanding improved living standards, and substantial government investment in infrastructure projects, including residential housing, commercial complexes, and public amenities. The Indonesia architectural coatings market is witnessing a pronounced shift towards waterborne coatings, driven by environmental regulations and a heightened consumer awareness regarding health and safety. These eco-friendly alternatives offer lower VOC emissions, making them a preferred choice for both interior and exterior applications. The solventborne coatings segment, while historically dominant, is gradually being replaced by waterborne technologies, particularly in residential and commercial applications where air quality and occupant well-being are paramount. Technological disruptions are playing a pivotal role, with manufacturers investing heavily in research and development to introduce innovative products. This includes coatings with enhanced functionalities such as anti-bacterial properties, fire retardancy, improved thermal insulation, and self-healing capabilities. The acrylic resin segment is expected to maintain its leading position due to its versatility, durability, and cost-effectiveness, finding widespread application across various sub-segments.

Consumer preferences are increasingly leaning towards aesthetic appeal, durability, and sustainable products. This is evident in the growing demand for a wider palette of colors, textured finishes, and premium coatings that offer long-lasting protection against the tropical climate of Indonesia. The competitive dynamics within the architectural coatings market in Indonesia are characterized by the presence of both multinational corporations and strong local players. Companies like AkzoNobel N.V., Jotun, Nippon Paint Holdings Co., Ltd., and PT Propan Raya are actively expanding their market presence through strategic distribution networks, localized product offerings, and targeted marketing campaigns. The residential segment continues to be the largest end-user, fueled by new home construction and the extensive renovation market. However, the commercial segment, encompassing hospitality, healthcare, and retail spaces, is exhibiting a higher growth rate due to significant new project developments and a focus on creating attractive and functional environments. The penetration of advanced coating technologies is steadily increasing as developers and homeowners become more aware of the long-term benefits of investing in high-quality architectural coatings. The alkyd resin segment, while still relevant for certain applications, is facing increasing competition from acrylic and epoxy resins due to environmental concerns and performance limitations in some outdoor applications. The epoxy resin segment is gaining traction for its exceptional durability and chemical resistance, particularly in industrial and high-traffic commercial areas. The overall trend indicates a mature yet dynamic market, with innovation and sustainability as key differentiators for success.

Dominant Markets & Segments in Indonesia Architectural Coatings Market

The Indonesia Architectural Coatings Market showcases distinct dominance across various geographical regions and product segments, driven by economic development, urbanization patterns, and specific end-user demands. Geographically, Java, as the most populous island and the economic heartland of Indonesia, represents the dominant market. Its high concentration of urban centers like Jakarta, Surabaya, and Bandung, coupled with extensive infrastructure development, fuels substantial demand for architectural coatings in both residential and commercial construction projects. The economic policies supporting infrastructure development and the significant influx of foreign and domestic investment into the property sector in Java are key drivers of this dominance.

Sub End User Dominance:

Residential: This segment consistently holds the largest market share. The primary drivers include:

- Growing Urbanization: A significant portion of the Indonesian population is migrating to urban areas, leading to continuous demand for new housing units.

- Rising Disposable Incomes: Increased purchasing power allows homeowners to invest in premium and aesthetically pleasing coatings for their homes.

- Renovation and Refurbishment: A substantial existing housing stock requires regular maintenance and upgrades, contributing to consistent demand.

- Government Housing Initiatives: Programs aimed at providing affordable housing further boost the demand for residential coatings.

Commercial: While currently holding a smaller share than residential, the commercial segment is exhibiting a higher growth trajectory. Key drivers include:

- Infrastructure Development: Expansion of hotels, malls, office buildings, hospitals, and educational institutions in key urban areas.

- Tourism Growth: Increasing tourist arrivals necessitate the development and refurbishment of hospitality infrastructure.

- Foreign Direct Investment: Influx of FDI into commercial real estate projects.

- Focus on Aesthetics and Functionality: Commercial spaces require durable and visually appealing coatings that align with brand identities and operational needs.

Technology Dominance:

Waterborne: This technology is rapidly gaining market share and is projected to become the dominant force. The drivers are:

- Stringent Environmental Regulations: Increasing awareness and enforcement of VOC emission standards.

- Health and Safety Concerns: Consumer preference for low-odor and healthier indoor environments.

- Technological Advancements: Improved performance and durability of waterborne formulations matching or exceeding solventborne alternatives.

- Government Support for Green Building: Initiatives promoting sustainable construction practices.

Solventborne: While still significant, its market share is gradually declining, particularly in interior applications. It retains relevance in specific exterior applications and for certain industrial finishes where its properties are critical.

Resin Dominance:

Acrylic: This resin type is the most dominant due to its versatility, excellent adhesion, durability, and weather resistance. It finds extensive use across both residential and commercial segments for primers, topcoats, and decorative finishes.

- Cost-Effectiveness: Relatively lower cost compared to some other high-performance resins.

- Adaptability: Can be formulated for a wide range of properties, including gloss, sheen, and texture.

Alkyd: Historically significant, alkyd resins are still used, particularly for wood finishes and certain primer applications, owing to their good adhesion and gloss retention. However, their use is diminishing due to slower drying times and higher VOC content compared to acrylics.

Epoxy: This resin type is experiencing strong growth, driven by its exceptional adhesion, chemical resistance, and durability. Its dominance is increasing in:

- High-Traffic Commercial Areas: Floors in malls, hospitals, and industrial facilities.

- Protective Coatings: For concrete and metal surfaces requiring robust protection.

Polyurethane: Known for its superior hardness, flexibility, and abrasion resistance, polyurethane coatings are gaining traction in premium residential and high-end commercial applications, including furniture finishes and exterior protective coatings.

The dominance of commercial applications is expected to accelerate due to ongoing large-scale infrastructure and urban development projects. In terms of technology, waterborne coatings are set to eclipse solventborne due to increasing environmental consciousness and regulatory pressure. Among resins, acrylic will likely maintain its lead due to its broad applicability and cost-effectiveness, while epoxy and polyurethane will see significant growth in specialized and high-performance segments.

Indonesia Architectural Coatings Market Product Developments

Product developments in the Indonesia Architectural Coatings Market are increasingly focused on sustainability, enhanced functionality, and aesthetic appeal. Companies are actively launching new collections that cater to evolving consumer preferences, such as collections designed for the "Home decor" category, offering a wider array of colors, textures, and finishes. For instance, a key development in June 2022 saw a significant company launching new architectural coatings collections specifically tailored for household applications, emphasizing aesthetic versatility and ease of use for consumers seeking to enhance their living spaces. These innovations often incorporate advanced technologies, such as low-VOC formulations, improved durability, and enhanced weather resistance to combat Indonesia's tropical climate. Furthermore, competitive advantages are being built through offering user-friendly application systems and coatings that provide added benefits like anti-bacterial properties for health-conscious consumers or special effects for unique design statements.

Report Scope & Segmentation Analysis

The Indonesia Architectural Coatings Market is meticulously segmented to provide a granular analysis of its diverse landscape. The Sub End User segmentation encompasses Commercial and Residential applications, each presenting unique growth drivers and market dynamics. The Commercial segment is driven by large-scale infrastructure projects, hospitality, and retail expansion, while the Residential segment is fueled by urbanization and new housing construction.

In terms of Technology, the market is divided into Solventborne and Waterborne coatings. While solventborne retains some niche applications, waterborne coatings are projected for significant growth due to environmental regulations and health consciousness.

The Resin segmentation is comprehensive, including Acrylic, Alkyd, Epoxy, Polyester, and Polyurethane, alongside Other Resin Types. Acrylic resins are expected to maintain a dominant share due to their versatility. Epoxy and Polyurethane are projected for strong growth in high-performance applications, while Alkyd and Polyester find use in specific existing applications. Each segment’s growth is influenced by technological advancements, regulatory landscapes, and specific end-user requirements, providing a detailed outlook on market size and competitive positioning.

Key Drivers of Indonesia Architectural Coatings Market Growth

The Indonesia Architectural Coatings Market growth is propelled by several interconnected factors. Primarily, the robust economic development and rapid urbanization across the archipelago are leading to a significant increase in construction activities, both residential and commercial. Government initiatives focusing on infrastructure development, including affordable housing schemes and urban renewal projects, further stimulate demand. Rising disposable incomes and a burgeoning middle class are driving consumer spending on home improvement and aesthetic enhancements, leading to a preference for high-quality and visually appealing coatings. Technological advancements in the formulation of coatings, particularly the shift towards environmentally friendly waterborne technologies with low VOC emissions, align with increasing global and local environmental awareness and regulations, creating a demand for sustainable solutions. The growing awareness of health and safety among consumers also favors the adoption of low-toxicity coatings.

Challenges in the Indonesia Architectural Coatings Market Sector

Despite robust growth, the Indonesia Architectural Coatings Market faces several challenges. Intense price competition among numerous local and international players can compress profit margins, especially for commoditized product lines. Fluctuations in raw material prices, particularly petrochemical derivatives like titanium dioxide and various resins, can impact manufacturing costs and product pricing. The informal sector and the prevalence of counterfeit products pose a threat to legitimate manufacturers by offering lower-quality, cheaper alternatives and damaging brand reputation. Navigating the complex regulatory landscape, which can include evolving environmental standards and product certifications, requires continuous adaptation and investment. Supply chain disruptions, influenced by logistical challenges within the vast Indonesian archipelago and global trade dynamics, can affect the availability and timely delivery of raw materials and finished goods.

Emerging Opportunities in Indonesia Architectural Coatings Market

The Indonesia Architectural Coatings Market is ripe with emerging opportunities driven by evolving consumer demands and technological advancements. The growing emphasis on green building and sustainable construction presents a significant opportunity for manufacturers offering eco-friendly, low-VOC, and energy-efficient coatings. The increasing urbanization and the demand for aesthetically pleasing living spaces are fueling opportunities in decorative and specialty coatings, including textured finishes, metallic paints, and coatings with enhanced functional properties like anti-microbial or self-cleaning capabilities. The expansion of the hospitality and tourism sectors creates demand for durable, high-performance coatings for hotels, resorts, and entertainment venues that can withstand heavy usage and specific environmental conditions. Furthermore, the increasing adoption of digital technologies in construction and renovation, such as augmented reality apps for visualizing paint colors, presents opportunities for innovative marketing and customer engagement strategies.

Leading Players in the Indonesia Architectural Coatings Market Market

- AkzoNobel N.V.

- Jotun

- Guangdong Maydos building materials limited company

- SKK(S) Pte Ltd

- DAI NIPPON TORYO CO LTD

- PT Propan Raya

- Nippon Paint Holdings Co Ltd

- TOA Paint Public Company Limited

- Asian paints

- Avian Brands

- Kansai Paint Co Ltd

- Mowilex

Key Developments in Indonesia Architectural Coatings Market Industry

- June 2022: A company launched new collections for architectural coatings in household applications under the Home decor category, focusing on enhanced aesthetic options and ease of application for consumers.

- January 2021: A company introduced the Dulux Promise Guarantee program, ensuring easy replacement of Dulux products, aimed at enhancing customer trust and product reliability.

Strategic Outlook for Indonesia Architectural Coatings Market Market

The strategic outlook for the Indonesia Architectural Coatings Market is exceptionally positive, driven by sustained economic growth, increasing urbanization, and a growing middle class demanding enhanced living and working environments. Key growth catalysts include the continued expansion of the construction sector, fueled by government investments in infrastructure and housing. The burgeoning demand for sustainable and eco-friendly solutions will further propel the adoption of waterborne coatings and low-VOC products. Innovations in resin technology, leading to coatings with superior durability, functionality (such as anti-bacterial or self-cleaning properties), and aesthetic appeal, will remain critical differentiators. Companies that can effectively leverage digital marketing and distribution channels to reach a diverse consumer base across the archipelago, while also focusing on localized product development and strong brand building, are poised for significant success. The market's future trajectory will be shaped by a blend of technological innovation, environmental consciousness, and a deep understanding of evolving consumer preferences.

Indonesia Architectural Coatings Market Segmentation

-

1. Sub End User

- 1.1. Commercial

- 1.2. Residential

-

2. Technology

- 2.1. Solventborne

- 2.2. Waterborne

-

3. Resin

- 3.1. Acrylic

- 3.2. Alkyd

- 3.3. Epoxy

- 3.4. Polyester

- 3.5. Polyurethane

- 3.6. Other Resin Types

Indonesia Architectural Coatings Market Segmentation By Geography

- 1. Indonesia

Indonesia Architectural Coatings Market Regional Market Share

Geographic Coverage of Indonesia Architectural Coatings Market

Indonesia Architectural Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surging Demand for Frothers in Copper and Molybdenum Sulfide Ores; Increasing Demand for Surface Coating Applications

- 3.3. Market Restrains

- 3.3.1. Growing Awareness about the Toxic Effects of MIBC; Other Restraints

- 3.4. Market Trends

- 3.4.1. Residential is the largest segment by Sub End User.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Architectural Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Solventborne

- 5.2.2. Waterborne

- 5.3. Market Analysis, Insights and Forecast - by Resin

- 5.3.1. Acrylic

- 5.3.2. Alkyd

- 5.3.3. Epoxy

- 5.3.4. Polyester

- 5.3.5. Polyurethane

- 5.3.6. Other Resin Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AkzoNobel N V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jotun

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Guangdong Maydos building materials limited company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SKK(S) Pte Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DAI NIPPON TORYO CO LTD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Propan Raya

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nippon Paint Holdings Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TOA Paint Public Company Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Asian paints

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Avian Brands

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kansai Paint Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mowilex

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 AkzoNobel N V

List of Figures

- Figure 1: Indonesia Architectural Coatings Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia Architectural Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Architectural Coatings Market Revenue billion Forecast, by Sub End User 2020 & 2033

- Table 2: Indonesia Architectural Coatings Market Volume liter Forecast, by Sub End User 2020 & 2033

- Table 3: Indonesia Architectural Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Indonesia Architectural Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 5: Indonesia Architectural Coatings Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 6: Indonesia Architectural Coatings Market Volume liter Forecast, by Resin 2020 & 2033

- Table 7: Indonesia Architectural Coatings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Indonesia Architectural Coatings Market Volume liter Forecast, by Region 2020 & 2033

- Table 9: Indonesia Architectural Coatings Market Revenue billion Forecast, by Sub End User 2020 & 2033

- Table 10: Indonesia Architectural Coatings Market Volume liter Forecast, by Sub End User 2020 & 2033

- Table 11: Indonesia Architectural Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 12: Indonesia Architectural Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 13: Indonesia Architectural Coatings Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 14: Indonesia Architectural Coatings Market Volume liter Forecast, by Resin 2020 & 2033

- Table 15: Indonesia Architectural Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Indonesia Architectural Coatings Market Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Architectural Coatings Market?

The projected CAGR is approximately 3.65%.

2. Which companies are prominent players in the Indonesia Architectural Coatings Market?

Key companies in the market include AkzoNobel N V, Jotun, Guangdong Maydos building materials limited company, SKK(S) Pte Ltd, DAI NIPPON TORYO CO LTD, PT Propan Raya, Nippon Paint Holdings Co Ltd, TOA Paint Public Company Limited, Asian paints, Avian Brands, Kansai Paint Co Ltd, Mowilex.

3. What are the main segments of the Indonesia Architectural Coatings Market?

The market segments include Sub End User, Technology, Resin.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Surging Demand for Frothers in Copper and Molybdenum Sulfide Ores; Increasing Demand for Surface Coating Applications.

6. What are the notable trends driving market growth?

Residential is the largest segment by Sub End User..

7. Are there any restraints impacting market growth?

Growing Awareness about the Toxic Effects of MIBC; Other Restraints.

8. Can you provide examples of recent developments in the market?

June 2022: The company has launched new collections for architectural coatings in household applications under Home decor category.January 2021: The company introduced Dulux Promise Guarantee program which ensures easy replacement of dulux products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Architectural Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Architectural Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Architectural Coatings Market?

To stay informed about further developments, trends, and reports in the Indonesia Architectural Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence