Key Insights

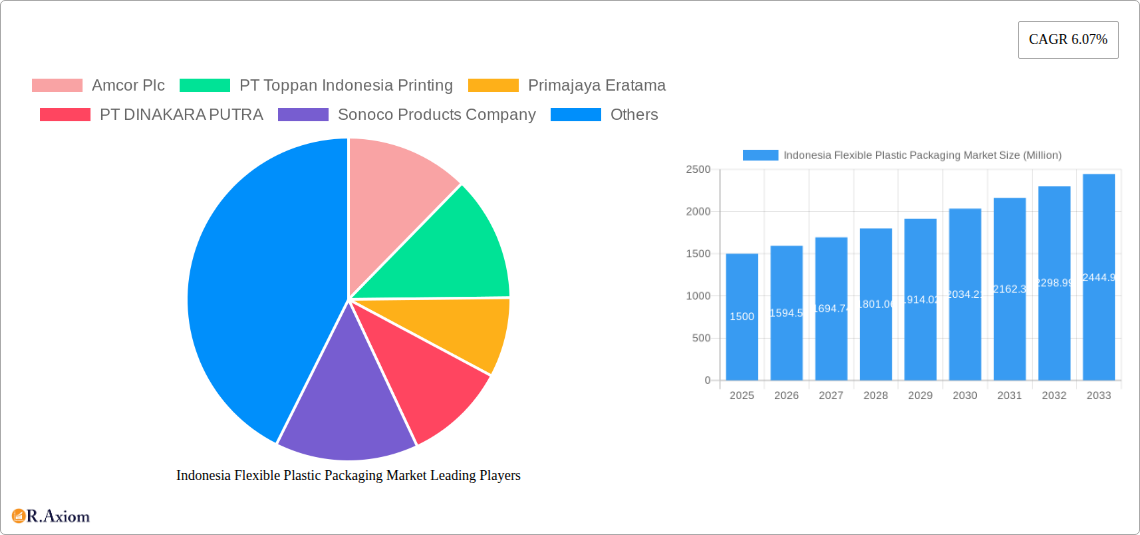

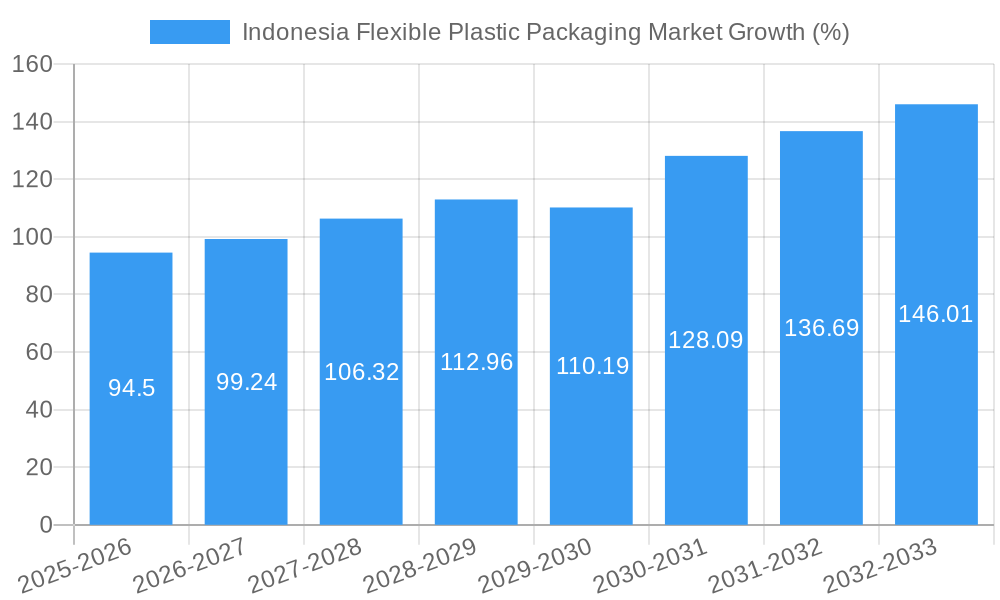

The Indonesian flexible plastic packaging market, valued at approximately $X million in 2025 (estimated based on the provided CAGR of 6.07% and a known market size at an unspecified prior year), is projected to experience robust growth, driven by the nation's expanding food and beverage sector, rising consumer demand, and increasing e-commerce activities. The convenience and cost-effectiveness of flexible packaging make it a preferred choice for various products, from food items and personal care products to pharmaceuticals. Key growth drivers include advancements in packaging technology, offering enhanced barrier properties, improved shelf life, and sustainable solutions. Furthermore, the increasing preference for lightweight and portable packaging formats fuels market expansion. However, environmental concerns surrounding plastic waste and the increasing adoption of sustainable alternatives like biodegradable packaging pose a significant restraint. Regulations aimed at reducing plastic pollution could also impact market dynamics in the coming years. The market is segmented based on packaging type (e.g., pouches, films, bags), material (e.g., polyethylene, polypropylene), and application (e.g., food, beverages, pharmaceuticals). Leading players like Amcor Plc, PT Toppan Indonesia Printing, and Sonoco Products Company are actively shaping the competitive landscape through strategic partnerships, innovation, and capacity expansion.

The forecast period (2025-2033) anticipates a steady growth trajectory for the Indonesian flexible plastic packaging market, with a projected market value exceeding $Y million by 2033 (estimated based on the provided CAGR and forecast period). This positive outlook is supported by the continuous expansion of the Indonesian economy and its growing middle class, which translates into increased consumer spending and higher demand for packaged goods. However, maintaining this growth will require addressing the environmental challenges associated with plastic waste through innovation in sustainable packaging materials and improved waste management infrastructure. Companies are likely to focus on developing eco-friendly alternatives and adopting circular economy principles to mitigate regulatory risks and maintain market competitiveness. Market segmentation will become even more crucial in catering to specific consumer demands and industry requirements.

Indonesia Flexible Plastic Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indonesia Flexible Plastic Packaging Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and emerging opportunities. The study includes detailed segmentation analysis, competitive landscape mapping, and key industry developments.

Indonesia Flexible Plastic Packaging Market Concentration & Innovation

The Indonesian flexible plastic packaging market exhibits a moderately concentrated landscape, with a few key players holding significant market share. Amcor Plc, PT Toppan Indonesia Printing, Primajaya Eratama, PT DINAKARA PUTRA, Sonoco Products Company, PT ePac Flexibles Indonesia, PT ARTEC PACKAGE INDONESIA, and PT Plasindo Lestari are prominent examples. Market share data for 2024 indicates Amcor Plc holds approximately xx% market share, followed by PT Toppan Indonesia Printing at xx%, and the remaining players sharing the remaining xx%. Innovation is driven by increasing demand for sustainable and eco-friendly packaging solutions, alongside advancements in material science and printing technologies. The regulatory framework, particularly concerning plastic waste management, is evolving, influencing product development and packaging choices. The market witnesses considerable M&A activity, with deal values in 2024 totaling approximately xx Million USD. Examples include smaller acquisitions focused on enhancing regional reach and specialized capabilities. End-user trends favor lightweight, flexible packaging for improved logistics efficiency. Product substitutes, such as biodegradable and compostable packaging materials, are gaining traction, though their market penetration remains relatively low at xx% in 2024.

Indonesia Flexible Plastic Packaging Market Industry Trends & Insights

The Indonesian flexible plastic packaging market is projected to experience robust growth, with a CAGR of xx% during the forecast period (2025-2033). This growth is primarily fueled by rising consumer spending, expanding food and beverage sector, and increasing e-commerce penetration, all contributing to elevated packaging demand. Technological advancements, particularly in flexible packaging materials (e.g., multilayer films for enhanced barrier properties), and printing technologies (e.g., high-definition flexographic printing) are reshaping the industry. Consumer preferences lean toward convenient and aesthetically appealing packaging, driving innovation in design and functionality. Competitive dynamics are intense, with both domestic and international players vying for market share. Market penetration of sustainable packaging options remains limited, presenting opportunities for players focusing on eco-friendly solutions. The total market size in 2024 was estimated at xx Million USD, and projections suggest a market size of xx Million USD by 2033.

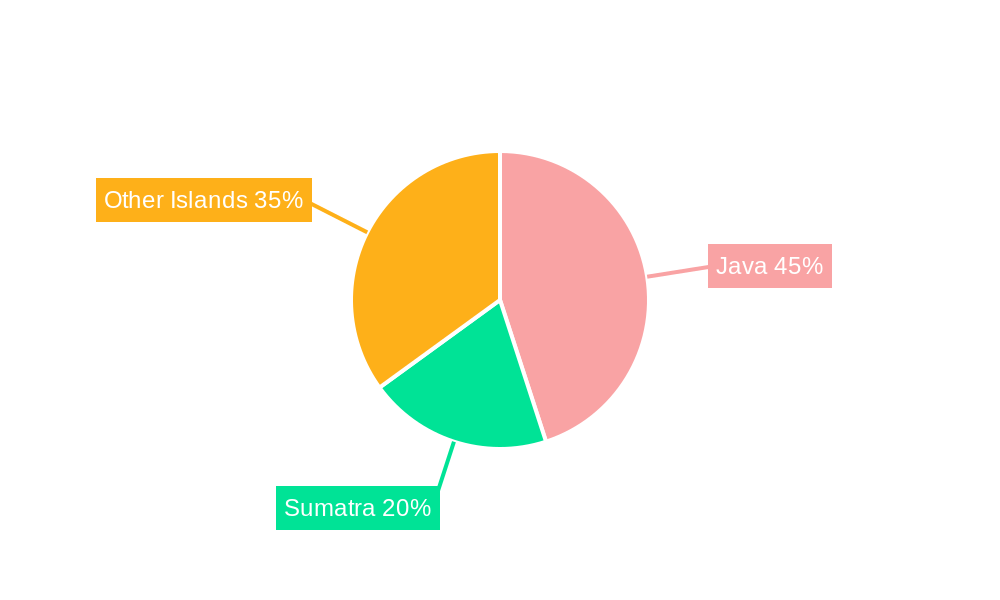

Dominant Markets & Segments in Indonesia Flexible Plastic Packaging Market

The Java Island region dominates the Indonesian flexible plastic packaging market due to higher population density, established industrial clusters, and well-developed infrastructure. This dominance is further amplified by the presence of major food and beverage manufacturers and retailers within this region.

- Key Drivers of Java's Dominance:

- High population density and consumer base

- Concentrated manufacturing and distribution hubs

- Extensive retail network and e-commerce infrastructure

- Government support for industrial development

Jakarta, as the capital and largest city, acts as the central market hub, driving significant demand. The food and beverage sector constitutes the largest segment, accounting for xx% of market share in 2024, driven by its vast consumer base and diverse product offerings. Other significant segments include personal care and household products, with steady but comparatively slower growth. Government policies aimed at promoting domestic manufacturing and import substitution contribute to market growth.

Indonesia Flexible Plastic Packaging Market Product Developments

Recent product innovations focus on enhancing barrier properties, improving shelf life, and promoting sustainability. This includes the introduction of recyclable and compostable materials, alongside advancements in printing technologies to create visually appealing and informative packaging. These developments cater to increasing consumer demand for eco-friendly packaging and enhanced product protection. Competition centers on offering superior barrier properties, cost-effective solutions, and innovative packaging designs that improve shelf appeal.

Report Scope & Segmentation Analysis

This report segments the Indonesian flexible plastic packaging market based on material type (polyethylene, polypropylene, etc.), packaging type (pouches, bags, films), end-use industry (food and beverage, personal care, etc.), and region (Java, Sumatra, etc.). Each segment's market size, growth projections, and competitive dynamics are analyzed, providing a granular understanding of market opportunities. For example, the food and beverage segment is expected to witness significant growth due to increasing demand for packaged food products. The polyethylene segment dominates based on its cost-effectiveness and versatility.

Key Drivers of Indonesia Flexible Plastic Packaging Market Growth

Several factors fuel the market's growth, including the booming food and beverage industry, increased consumer spending, expanding e-commerce sector, and favorable government policies. Technological advancements like improved barrier films and sustainable packaging options further propel market expansion. The growing middle class and rising disposable incomes are also key contributors.

Challenges in the Indonesia Flexible Plastic Packaging Market Sector

The market faces challenges such as stringent environmental regulations related to plastic waste management, fluctuating raw material prices, and increasing competition from both domestic and international players. Supply chain disruptions, including logistical challenges, impact production efficiency and cost. Addressing these challenges effectively is crucial for sustained market growth.

Emerging Opportunities in Indonesia Flexible Plastic Packaging Market

Growing demand for sustainable and eco-friendly packaging presents significant opportunities. The increasing adoption of e-commerce is driving demand for convenient and tamper-proof packaging solutions. Innovation in flexible packaging materials, such as biodegradable plastics, offers further growth prospects.

Leading Players in the Indonesia Flexible Plastic Packaging Market Market

- Amcor Plc [Amcor Plc]

- PT Toppan Indonesia Printing

- Primajaya Eratama

- PT DINAKARA PUTRA

- Sonoco Products Company [Sonoco Products Company]

- PT ePac Flexibles Indonesia

- PT ARTEC PACKAGE INDONESIA

- PT Plasindo Lestari

Key Developments in Indonesia Flexible Plastic Packaging Market Industry

- August 2023: PepsiCo's USD 200 Million investment in a new Indonesian production facility signals a renewed commitment to the market and increased demand for packaging.

- May 2024: PT United Harvest Indonesia's entry into the Chinese snack food market highlights Indonesia's role as a key provider of goods and the associated packaging needs.

Strategic Outlook for Indonesia Flexible Plastic Packaging Market Market

The Indonesian flexible plastic packaging market holds substantial growth potential, driven by consistent economic growth, rising consumer demand, and ongoing technological advancements. Companies focusing on sustainable packaging solutions and adapting to evolving consumer preferences are poised to capture significant market share. Further expansion is anticipated across various segments, with a particular focus on innovative materials and enhanced packaging technologies.

Indonesia Flexible Plastic Packaging Market Segmentation

-

1. Material Type

- 1.1. Polyethene (PE)

- 1.2. Bi-oriented Polypropylene (BOPP)

- 1.3. Cast Polypropylene (CPP)

- 1.4. Polyvinyl Chloride (PVC)

- 1.5. Ethylene Vinyl Alcohol (EVOH)

- 1.6. Other Ma

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types (Blister Packs, Liners, etc)

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

Indonesia Flexible Plastic Packaging Market Segmentation By Geography

- 1. Indonesia

Indonesia Flexible Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift Towards Light Weight and Small Packaging Aids to Demand

- 3.3. Market Restrains

- 3.3.1. Shift Towards Light Weight and Small Packaging Aids to Demand

- 3.4. Market Trends

- 3.4.1. Lightweight and Convenient Packaging is Expected to Aid the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Flexible Plastic Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Polyethene (PE)

- 5.1.2. Bi-oriented Polypropylene (BOPP)

- 5.1.3. Cast Polypropylene (CPP)

- 5.1.4. Polyvinyl Chloride (PVC)

- 5.1.5. Ethylene Vinyl Alcohol (EVOH)

- 5.1.6. Other Ma

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types (Blister Packs, Liners, etc)

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Amcor Plc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT Toppan Indonesia Printing

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Primajaya Eratama

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT DINAKARA PUTRA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT ePac Flexibles Indonesia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT ARTEC PACKAGE INDONESIA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Plasindo Lestari7 2 Heat Map Analysi

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Amcor Plc

List of Figures

- Figure 1: Indonesia Flexible Plastic Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Flexible Plastic Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Flexible Plastic Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Flexible Plastic Packaging Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: Indonesia Flexible Plastic Packaging Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Indonesia Flexible Plastic Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: Indonesia Flexible Plastic Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Indonesia Flexible Plastic Packaging Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 7: Indonesia Flexible Plastic Packaging Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 8: Indonesia Flexible Plastic Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 9: Indonesia Flexible Plastic Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Flexible Plastic Packaging Market?

The projected CAGR is approximately 6.07%.

2. Which companies are prominent players in the Indonesia Flexible Plastic Packaging Market?

Key companies in the market include Amcor Plc, PT Toppan Indonesia Printing, Primajaya Eratama, PT DINAKARA PUTRA, Sonoco Products Company, PT ePac Flexibles Indonesia, PT ARTEC PACKAGE INDONESIA, PT Plasindo Lestari7 2 Heat Map Analysi.

3. What are the main segments of the Indonesia Flexible Plastic Packaging Market?

The market segments include Material Type, Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Shift Towards Light Weight and Small Packaging Aids to Demand.

6. What are the notable trends driving market growth?

Lightweight and Convenient Packaging is Expected to Aid the Demand.

7. Are there any restraints impacting market growth?

Shift Towards Light Weight and Small Packaging Aids to Demand.

8. Can you provide examples of recent developments in the market?

May 2024: PT United Harvest Indonesia, a prominent Indonesian food processor, entered the Chinese snack food market by introducing a line of shrimp crackers. Headquartered in Jakarta, the company rolled out its 'Deep Ocean Treasure' brand of dried shrimp snacks, targeting retailers in northern China. Indonesia, benefiting from duty-free privileges in China as an ASEAN member, became a key provider of primary goods to its top trading partner, China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Flexible Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Flexible Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Flexible Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Indonesia Flexible Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence