Key Insights

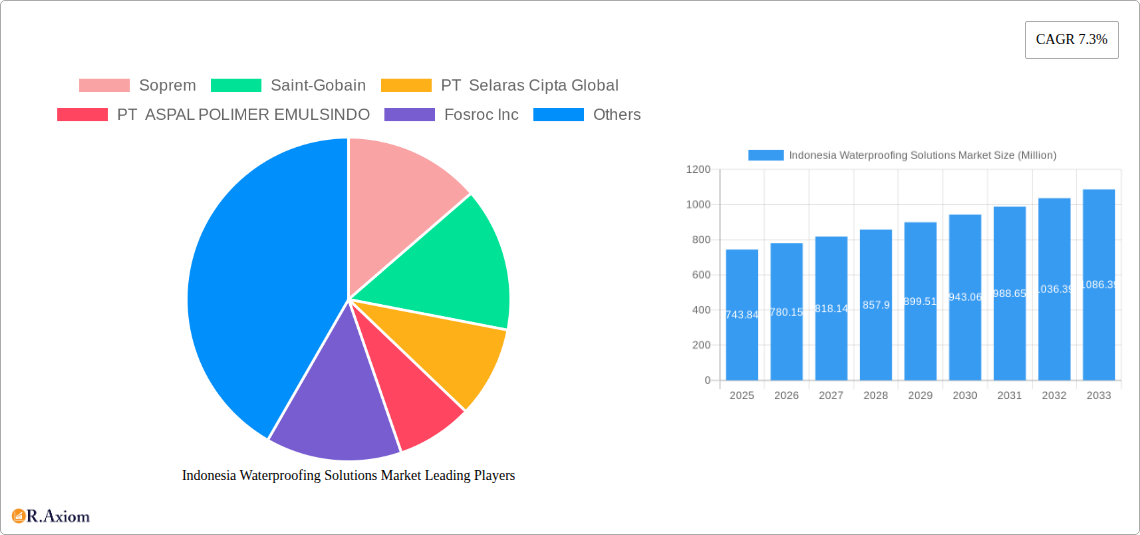

The Indonesian waterproofing solutions market is poised for robust growth, with an estimated market size of $743.84 million in 2025, and is projected to expand at a compound annual growth rate (CAGR) of 4.9% through 2033. This expansion is primarily driven by the burgeoning construction sector, fueled by significant infrastructure development, including smart city initiatives, transportation networks, and housing projects across the archipelago. The increasing emphasis on sustainable and durable construction practices, coupled with rising awareness about the detrimental effects of water damage on structural integrity and longevity, further propels the demand for advanced waterproofing solutions. The commercial and residential sectors are expected to remain dominant end-use segments, benefiting from urbanization and a growing middle class with higher disposable incomes. Moreover, the industrial sector’s ongoing expansion and the need to protect critical assets from environmental degradation will continue to be significant contributors to market growth.

Indonesia Waterproofing Solutions Market Market Size (In Million)

The market's trajectory is further shaped by several key trends, including the growing adoption of advanced technologies such as epoxy-based and polyurethane-based waterproofing systems, which offer superior performance and durability. The surge in demand for pre-fabricated and easy-to-apply membrane solutions, like cold liquid-applied and fully adhered sheets, caters to the need for faster construction timelines and skilled labor efficiency. Despite these positive drivers and trends, certain restraints, such as the fluctuating raw material prices and the presence of unorganized players offering lower-quality, cost-effective alternatives, could present challenges. However, the long-term outlook remains optimistic, with continuous innovation in product development and a strong focus on environmental compliance expected to sustain the market's upward momentum. The Indonesian government's proactive policies promoting construction and infrastructure development will continue to provide a fertile ground for the waterproofing solutions market.

Indonesia Waterproofing Solutions Market Company Market Share

This in-depth report provides a detailed analysis of the Indonesia waterproofing solutions market, a vital sector supporting the nation's robust construction and infrastructure development. Examining the period from 2019 to 2033, with a base year of 2025, this research delves into market dynamics, emerging trends, key players, and future growth trajectories. The Indonesian construction market continues its expansion, driven by increasing urbanization, government investments in infrastructure, and a growing awareness of building longevity and resilience. Waterproofing solutions are paramount in protecting structures from moisture damage, enhancing their lifespan, and ensuring occupant comfort and safety.

This report offers actionable insights for construction companies, material suppliers, architects, real estate developers, and investors seeking to capitalize on the evolving Indonesian waterproofing market. With an estimated market size of xx million USD in 2025, the market is poised for significant growth, fueled by demand across diverse sectors including commercial, industrial and institutional, infrastructure, and residential projects. The report meticulously analyzes sub-segments such as chemicals (Epoxy-based, Polyurethane-based, Water-based, Other Technologies) and membranes (Cold Liquid Applied, Fully Adhered Sheet, Hot Liquid Applied, Loose Laid Sheet), providing a granular view of market penetration and technological adoption.

Indonesia Waterproofing Solutions Market Market Concentration & Innovation

The Indonesia waterproofing solutions market is characterized by a moderate level of market concentration, with a few dominant global players alongside a growing number of local manufacturers and distributors. Innovation is a key driver, fueled by the need for more sustainable, durable, and easy-to-apply waterproofing products. Advancements in polyurethane-based and water-based technologies are gaining traction due to their environmental benefits and improved performance. Regulatory frameworks, while evolving, are increasingly emphasizing building codes that mandate effective waterproofing to enhance structural integrity and energy efficiency. Product substitutes, such as traditional damp-proofing methods, are gradually being replaced by advanced chemical waterproofing and membrane solutions. End-user trends are shifting towards integrated solutions that offer long-term protection and aesthetic appeal, particularly in high-value commercial and residential projects. Mergers and acquisitions (M&A) are significant, with recent high-profile deals indicating consolidation and expansion strategies. For instance, the Sika AG acquisition of the MBCC Group in May 2023 for an undisclosed sum significantly reshaped the global construction chemicals landscape, including waterproofing. Similarly, Saint-Gobain's acquisition of GCP Applied Technologies Inc. in September 2022 aimed to bolster its presence in infrastructure and building materials, indirectly impacting the waterproofing segment. These M&A activities underscore a trend towards larger entities leveraging economies of scale and broader product portfolios.

Indonesia Waterproofing Solutions Market Industry Trends & Insights

The Indonesia waterproofing solutions market is experiencing robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This upward trajectory is primarily propelled by the nation's ambitious infrastructure development projects, including roads, bridges, dams, and airports, which inherently require comprehensive waterproofing to ensure longevity and prevent costly repairs. The burgeoning residential construction sector, driven by a growing middle class and increasing demand for modern housing, also presents substantial opportunities for waterproofing solutions. Furthermore, the expansion of commercial and industrial facilities, encompassing shopping malls, office buildings, factories, and warehouses, necessitates advanced waterproofing to protect valuable assets and ensure operational continuity. Technological disruptions are playing a crucial role, with a noticeable shift towards more environmentally friendly and high-performance waterproofing chemicals like epoxy-based and polyurethane-based formulations. These advanced materials offer superior adhesion, flexibility, and resistance to chemical and physical damage compared to older technologies. The adoption of water-based waterproofing solutions is also on the rise, aligning with global sustainability initiatives and stricter environmental regulations within Indonesia. Consumer preferences are evolving, with an increasing demand for reliable, long-lasting waterproofing that minimizes maintenance costs and enhances the overall value of properties. The competitive dynamics within the market are intensifying, with both global and local players vying for market share through product innovation, strategic partnerships, and aggressive marketing strategies. The market penetration of advanced waterproofing technologies is expected to deepen as awareness of their benefits and long-term cost-effectiveness grows among developers and end-users. The estimated market size for waterproofing solutions in Indonesia is projected to reach xx million USD in 2025, indicating a substantial and growing market ripe for investment and innovation.

Dominant Markets & Segments in Indonesia Waterproofing Solutions Market

The Indonesia waterproofing solutions market exhibits distinct dominance across various segments, driven by specific economic, developmental, and infrastructural factors. The Infrastructure end-use sector stands out as a primary growth engine, largely due to the Indonesian government's continuous focus on developing and upgrading its national infrastructure. This includes extensive investments in transportation networks (highways, railways, airports), water management systems (dams, canals), and energy facilities, all of which demand high-performance and durable waterproofing solutions to withstand harsh environmental conditions and heavy usage. The Residential sector also holds significant weight, fueled by a rapidly growing population and an expanding middle class with increasing disposable incomes, leading to consistent demand for new housing construction and renovation.

Within the Sub Product segmentation, Membranes play a crucial role, particularly Cold Liquid Applied and Fully Adhered Sheet membranes. These are widely preferred for their ease of application, seamless finish, and reliable performance in various environmental settings. Their dominance is further amplified in large-scale infrastructure and commercial projects where consistent and robust waterproofing is paramount. However, Chemicals, specifically Polyurethane-based and Water-based technologies, are witnessing substantial growth. The increasing emphasis on sustainability and environmental regulations is propelling the adoption of water-based solutions, while polyurethane-based products are favored for their superior elasticity, chemical resistance, and durability in demanding applications. Epoxy-based chemicals also maintain a strong presence, particularly in industrial settings requiring high chemical resistance.

Key drivers for the dominance of these segments include:

- Government Infrastructure Spending: The Indonesian government's commitment to large-scale infrastructure projects directly boosts demand for high-performance waterproofing materials, especially in the Infrastructure and Membranes segments.

- Urbanization and Population Growth: A rising urban population fuels demand for new housing and commercial spaces, driving growth in the Residential and Commercial sectors, and consequently, the use of various Chemicals and Membranes.

- Growing Environmental Awareness: The push for sustainable construction practices is increasing the preference for Water-based chemical technologies.

- Technological Advancements: Innovations leading to more efficient and durable waterproofing solutions, like advanced Cold Liquid Applied membranes and Polyurethane-based chemicals, are gaining market traction.

- Economic Stability and Investment: A stable economic environment encourages investment in construction and infrastructure, further bolstering the demand across all segments.

The Commercial, Industrial and Institutional sector also contributes significantly, driven by the need to protect commercial buildings, factories, and public institutions from moisture ingress, ensuring structural integrity and operational efficiency. The interplay of these factors creates a dynamic and expanding market for waterproofing solutions in Indonesia.

Indonesia Waterproofing Solutions Market Product Developments

Product innovation in the Indonesia waterproofing solutions market is characterized by a focus on enhanced performance, sustainability, and ease of application. Manufacturers are developing advanced chemical waterproofing solutions, including next-generation polyurethane-based and epoxy-based formulations offering superior adhesion, crack-bridging capabilities, and resistance to extreme weather conditions. The development of water-based technologies is also a significant trend, driven by environmental regulations and a growing demand for eco-friendly construction materials. In January 2022, SOPREMA introduced Alsan Flashing Neo, a novel waterproofing chemical designed for universal substrate application without the need for a primer, showcasing a move towards simplified and more efficient installation processes. Membrane technologies are also evolving, with advancements in cold liquid applied and fully adhered sheet membranes offering improved flexibility, UV resistance, and faster curing times, making them ideal for diverse construction projects. These product developments aim to provide long-lasting protection, reduce maintenance costs, and meet the specific demands of Indonesia's varied climatic conditions and construction practices.

Report Scope & Segmentation Analysis

The Indonesia waterproofing solutions market is meticulously segmented to provide a comprehensive understanding of its dynamics. The End Use Sector segmentation encompasses Commercial, Industrial and Institutional, Infrastructure, and Residential applications, each representing distinct demand drivers and growth potentials. The Sub Product segmentation is further divided into Chemicals, categorized by technology as Epoxy-based, Polyurethane-based, Water-based, and Other Technologies. The Membranes segment includes Cold Liquid Applied, Fully Adhered Sheet, Hot Liquid Applied, and Loose Laid Sheet types. For the Commercial sector, growth is projected at XX% with an estimated market size of xx million USD in 2025, driven by new commercial building construction and renovations. The Industrial and Institutional segment is expected to grow at XX%, with an estimated xx million USD in 2025, supported by factory expansions and institutional building upgrades. The Infrastructure segment is anticipated to expand at a robust XX%, reaching xx million USD in 2025, fueled by government development initiatives. The Residential sector is projected for XX% growth, with an estimated xx million USD in 2025, driven by housing demand. Within Chemicals, Polyurethane-based is expected to dominate with XX% market share, while Water-based shows the highest growth rate at XX%. For Membranes, Cold Liquid Applied and Fully Adhered Sheet are anticipated to hold significant market shares due to their widespread application and performance.

Key Drivers of Indonesia Waterproofing Solutions Market Growth

Several key drivers are propelling the Indonesia waterproofing solutions market forward. Firstly, the robust pace of infrastructure development, including the construction of roads, bridges, dams, and public facilities, inherently necessitates extensive waterproofing applications for durability and longevity. Secondly, a rapidly growing urban population and increasing middle class are fueling a surge in residential construction and the demand for modern housing, creating a consistent need for reliable waterproofing systems. Thirdly, the expansion of the commercial and industrial sectors, with new office buildings, shopping complexes, and manufacturing facilities, further amplifies the demand for high-performance waterproofing to protect valuable assets. Technological advancements are also crucial, with the introduction of more sustainable and efficient water-based and polyurethane-based waterproofing solutions catering to evolving environmental regulations and performance expectations. The increasing awareness among builders and consumers regarding the long-term benefits of effective waterproofing, such as reduced maintenance costs and enhanced building lifespan, also acts as a significant growth catalyst.

Challenges in the Indonesia Waterproofing Solutions Market Sector

Despite the promising growth, the Indonesia waterproofing solutions market faces several challenges. Price sensitivity remains a significant barrier, with some developers opting for cheaper, less durable alternatives, particularly in smaller projects or budget-constrained segments. Lack of awareness and understanding among some end-users regarding the importance of quality waterproofing and its long-term cost-effectiveness can hinder the adoption of premium solutions. Skilled labor shortages for the proper application of advanced waterproofing systems can also lead to performance issues and reputational damage for certain products. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of raw materials, affecting production and pricing. Furthermore, inconsistent enforcement of building codes and regulations related to waterproofing standards across different regions of Indonesia can create an uneven playing field and impact market growth.

Emerging Opportunities in Indonesia Waterproofing Solutions Market

The Indonesia waterproofing solutions market is ripe with emerging opportunities. The increasing focus on sustainable construction practices presents a significant opportunity for manufacturers offering eco-friendly water-based and low-VOC (Volatile Organic Compound) waterproofing chemicals. The growing trend of green building certifications and the demand for energy-efficient structures will further drive the adoption of advanced waterproofing solutions that contribute to building performance. The ongoing urbanization and infrastructure development initiatives, particularly in secondary cities and developing regions, offer untapped market potential for various waterproofing products. Furthermore, the rising demand for high-performance and specialized waterproofing solutions for critical infrastructure like tunnels, bridges, and high-rise buildings creates a niche market for innovative and durable products. The increasing adoption of digital technologies, such as BIM (Building Information Modeling), can also create opportunities for integrated waterproofing solutions and smart application technologies.

Leading Players in the Indonesia Waterproofing Solutions Market Market

- Soprem

- Saint-Gobain

- PT Selaras Cipta Global

- PT ASPAL POLIMER EMULSINDO

- Fosroc Inc

- Ardex Group

- MAPEI S p A

- Sika AG

- Avian Brands

- Normet

Key Developments in Indonesia Waterproofing Solutions Market Industry

- May 2023: Sika AG, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand. This strategic acquisition significantly consolidated Sika's market position and expanded its product portfolio in the waterproofing segment.

- September 2022: Saint-Gobain acquired GCP Applied Technologies Inc. to strengthen its market presence through a global platform with extensive expertise in cement additives, concrete admixtures, infrastructure, and commercial and residential building materials. This move aimed to enhance Saint-Gobain's offerings in construction chemicals and materials, indirectly bolstering its waterproofing capabilities.

- January 2022: SOPREMA has developed a next-generation waterproofing chemical called Alsan Flashing Neo, which can waterproof any substrate without a primer. This product innovation addresses the need for simplified application processes and broad substrate compatibility, offering a competitive edge in the market.

Strategic Outlook for Indonesia Waterproofing Solutions Market Market

The strategic outlook for the Indonesia waterproofing solutions market remains highly positive, driven by a confluence of sustained infrastructure investments, burgeoning urbanization, and a growing emphasis on building durability and sustainability. The market is expected to witness continued expansion as more developers and consumers recognize the long-term value and cost-effectiveness of high-quality waterproofing. Key growth catalysts will include the ongoing government push for infrastructure modernization, the increasing demand for energy-efficient and eco-friendly buildings, and technological advancements leading to more specialized and high-performance waterproofing products. Companies that focus on innovation, particularly in sustainable and advanced chemical and membrane solutions, and strategically expand their distribution networks to reach developing regions, are poised for significant success. The market will likely see further consolidation through strategic M&A activities as major players seek to enhance their market share and product offerings. Emphasis on educating the market about the benefits of superior waterproofing will be crucial for overcoming price sensitivities and unlocking the full potential of this dynamic sector.

Indonesia Waterproofing Solutions Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Sub Product

-

2.1. Chemicals

-

2.1.1. By Technology

- 2.1.1.1. Epoxy-based

- 2.1.1.2. Polyurethane-based

- 2.1.1.3. Water-based

- 2.1.1.4. Other Technologies

-

2.1.1. By Technology

-

2.2. Membranes

- 2.2.1. Cold Liquid Applied

- 2.2.2. Fully Adhered Sheet

- 2.2.3. Hot Liquid Applied

- 2.2.4. Loose Laid Sheet

-

2.1. Chemicals

Indonesia Waterproofing Solutions Market Segmentation By Geography

- 1. Indonesia

Indonesia Waterproofing Solutions Market Regional Market Share

Geographic Coverage of Indonesia Waterproofing Solutions Market

Indonesia Waterproofing Solutions Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Banning/ Limiting Use of Plastics used in packaging applications

- 3.3. Market Restrains

- 3.3.1. ; Harmful Amines in Dyes; Paperless Green Initiatives

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Waterproofing Solutions Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Sub Product

- 5.2.1. Chemicals

- 5.2.1.1. By Technology

- 5.2.1.1.1. Epoxy-based

- 5.2.1.1.2. Polyurethane-based

- 5.2.1.1.3. Water-based

- 5.2.1.1.4. Other Technologies

- 5.2.1.1. By Technology

- 5.2.2. Membranes

- 5.2.2.1. Cold Liquid Applied

- 5.2.2.2. Fully Adhered Sheet

- 5.2.2.3. Hot Liquid Applied

- 5.2.2.4. Loose Laid Sheet

- 5.2.1. Chemicals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Soprem

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Saint-Gobain

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Selaras Cipta Global

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT ASPAL POLIMER EMULSINDO

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fosroc Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ardex Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MAPEI S p A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sika AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Avian Brands

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Normet

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Soprem

List of Figures

- Figure 1: Indonesia Waterproofing Solutions Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Indonesia Waterproofing Solutions Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Waterproofing Solutions Market Revenue undefined Forecast, by End Use Sector 2020 & 2033

- Table 2: Indonesia Waterproofing Solutions Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 3: Indonesia Waterproofing Solutions Market Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 4: Indonesia Waterproofing Solutions Market Volume K Tons Forecast, by Sub Product 2020 & 2033

- Table 5: Indonesia Waterproofing Solutions Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Indonesia Waterproofing Solutions Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Indonesia Waterproofing Solutions Market Revenue undefined Forecast, by End Use Sector 2020 & 2033

- Table 8: Indonesia Waterproofing Solutions Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 9: Indonesia Waterproofing Solutions Market Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 10: Indonesia Waterproofing Solutions Market Volume K Tons Forecast, by Sub Product 2020 & 2033

- Table 11: Indonesia Waterproofing Solutions Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Indonesia Waterproofing Solutions Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Waterproofing Solutions Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Indonesia Waterproofing Solutions Market?

Key companies in the market include Soprem, Saint-Gobain, PT Selaras Cipta Global, PT ASPAL POLIMER EMULSINDO, Fosroc Inc, Ardex Group, MAPEI S p A, Sika AG, Avian Brands, Normet.

3. What are the main segments of the Indonesia Waterproofing Solutions Market?

The market segments include End Use Sector, Sub Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Banning/ Limiting Use of Plastics used in packaging applications.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Harmful Amines in Dyes; Paperless Green Initiatives.

8. Can you provide examples of recent developments in the market?

May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.September 2022: Saint-Gobain acquired GCP Applied Technologies Inc. to strengthen its market presence through a global platform with extensive expertise in cement additives, concrete admixtures, infrastructure, and commercial and residential building materials.January 2022: SOPREMA has developed a next-generation waterproofing chemical called Alsan Flashing Neo, which can waterproof any substrate without a primer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Waterproofing Solutions Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Waterproofing Solutions Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Waterproofing Solutions Market?

To stay informed about further developments, trends, and reports in the Indonesia Waterproofing Solutions Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence