Key Insights

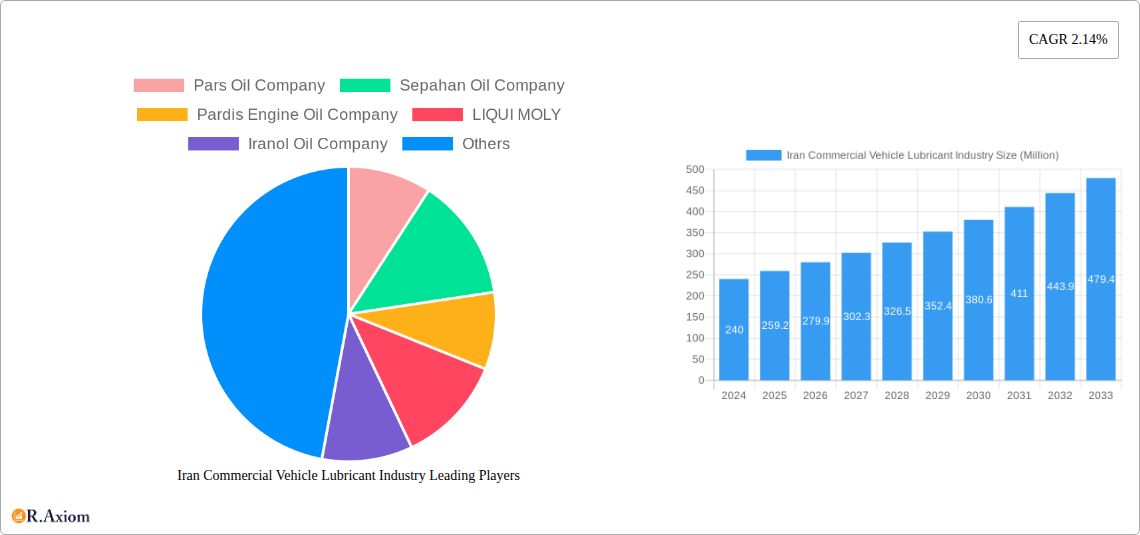

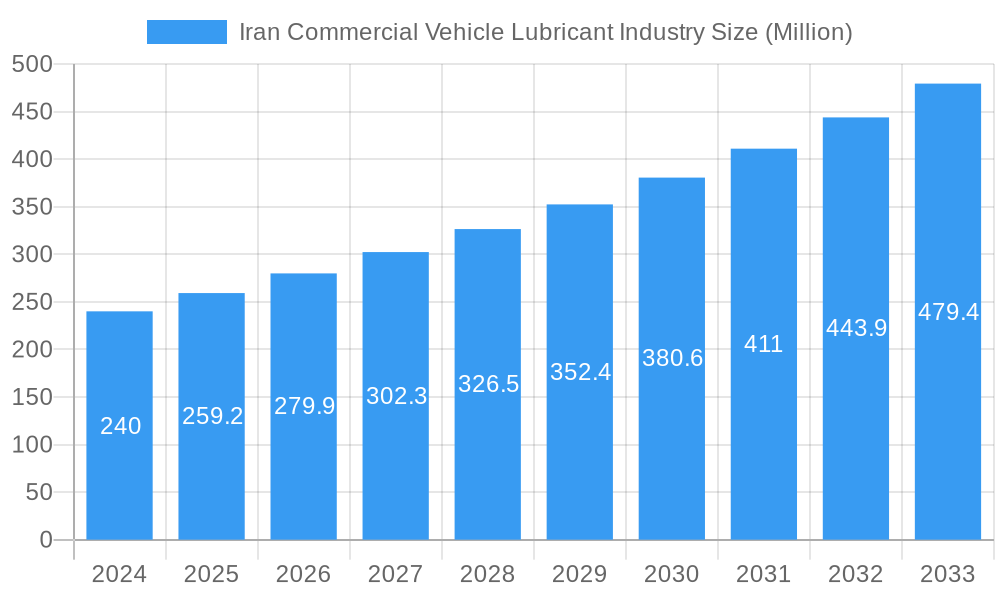

The Iran Commercial Vehicle Lubricant Industry is poised for significant expansion, driven by a burgeoning transportation sector and increasing demand for high-performance lubricants. The market, currently valued at an estimated $240 million in 2024, is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 8% during the forecast period of 2025-2033. This upward trajectory is primarily fueled by the expanding fleet of commercial vehicles, including trucks, buses, and heavy-duty equipment, essential for the nation's infrastructure development and trade activities. Furthermore, evolving emission standards and a growing emphasis on fuel efficiency are compelling fleet operators to adopt advanced lubricant formulations that offer enhanced protection and extended drain intervals. The "drivers" section, though not explicitly detailed, can be logically inferred to encompass government initiatives promoting domestic manufacturing, increased construction projects, and a recovery in industrial output, all of which contribute to higher commercial vehicle utilization and lubricant consumption.

Iran Commercial Vehicle Lubricant Industry Market Size (In Million)

The market is segmented into key product types, with Engine Oils dominating the landscape due to their indispensable role in maintaining the operational integrity of commercial vehicle engines. Greases, Hydraulic Fluids, and Transmission & Gear Oils also represent crucial segments, catering to the specific lubrication needs of various vehicle components and operational demands. Despite a generally positive outlook, the industry may face certain "restrains," which could include fluctuations in crude oil prices affecting raw material costs for lubricant manufacturers, and potential geopolitical uncertainties impacting import/export dynamics. However, the strong presence of both domestic players like Pars Oil Company and Sepahan Oil Company, alongside international giants such as LIQUI MOLY and FUCHS, fosters a competitive environment that drives innovation and product quality. This competitive landscape, coupled with an increasing awareness of the benefits of premium lubricants, is expected to largely offset potential challenges, ensuring continued market growth and evolution.

Iran Commercial Vehicle Lubricant Industry Company Market Share

This comprehensive report delves into the intricacies of the Iran Commercial Vehicle Lubricant Industry, providing an in-depth analysis of market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. We examine the overarching industry trends, technological disruptions, consumer preferences, and competitive dynamics shaping the market, alongside detailed insights into dominant markets and segments. Crucially, the report highlights key product developments, growth drivers, prevailing challenges, and emerging opportunities, offering a strategic outlook for stakeholders. The study period spans from 2019 to 2033, with 2025 as the base and estimated year, and a forecast period of 2025–2033, building upon historical data from 2019–2024.

Iran Commercial Vehicle Lubricant Industry Market Concentration & Innovation

The Iran Commercial Vehicle Lubricant Industry exhibits a moderate level of market concentration, with a mix of established domestic players and a growing presence of international brands. Pars Oil Company, Sepahan Oil Company, Pardis Engine Oil Company, Iranol Oil Company, AZAR RAVAN SAZ (Petronol), Ghatran Kaveh Motor Oil Co, and Behran Oil Company represent key domestic entities, collectively holding a significant market share. International players like LIQUI MOLY and TotalEnergies are also making inroads, bringing advanced formulations and global expertise. Innovation in this sector is primarily driven by the need to meet increasingly stringent emission standards, enhance fuel efficiency, and extend equipment lifespan. The development of synthetic and semi-synthetic lubricants, along with specialized formulations for heavy-duty applications, are prominent innovation areas. Regulatory frameworks, particularly those related to environmental compliance and quality standards, play a crucial role in shaping innovation trajectories. Product substitutes, such as alternative fuels or improved engine technologies that reduce lubricant demand, represent a potential long-term challenge. End-user trends are leaning towards higher-performance lubricants that offer greater durability and reduced maintenance costs. While M&A activity has been relatively subdued in recent years, any potential consolidation or strategic partnerships could significantly alter the market landscape, with estimated M&A deal values remaining to be fully quantified.

Iran Commercial Vehicle Lubricant Industry Industry Trends & Insights

The Iran Commercial Vehicle Lubricant Industry is poised for significant growth, driven by a confluence of factors that underscore its resilience and evolving nature. The estimated Compound Annual Growth Rate (CAGR) for the forecast period is projected to be around 5.8%, reflecting sustained demand from the expanding commercial vehicle fleet and a growing emphasis on vehicle maintenance and longevity. Key growth drivers include the ongoing demand for reliable transportation of goods and passengers, the need to comply with evolving environmental regulations, and the increasing adoption of advanced engine technologies that require specialized lubricants. The market penetration of high-performance synthetic lubricants is expected to rise as fleet operators recognize their long-term cost benefits, including extended drain intervals and reduced wear and tear on critical engine components. Technological disruptions are primarily manifesting in the form of lubricant formulations designed for modern, high-efficiency engines, including those that utilize exhaust gas recirculation (EGR) and selective catalytic reduction (SCR) systems. Furthermore, the development of lubricants that offer enhanced thermal stability and oxidation resistance is crucial for engines operating under demanding conditions. Consumer preferences are shifting towards lubricants that not only protect engines but also contribute to fuel economy. This trend is particularly pronounced among large fleet operators who are constantly seeking ways to optimize operational costs. The competitive dynamics are characterized by intense price competition among domestic manufacturers and a strategic positioning by international players focusing on premium product offerings and technical support. The robust growth of the logistics sector, fueled by e-commerce expansion and domestic trade, directly translates into a sustained demand for commercial vehicle lubricants.

Dominant Markets & Segments in Iran Commercial Vehicle Lubricant Industry

The Engine Oils segment is the undisputed leader within the Iran Commercial Vehicle Lubricant Industry, commanding an estimated 65% market share. This dominance is attributed to the sheer volume of commercial vehicles operating across the country, from light-duty trucks to heavy-duty semi-trailers and buses, all of which rely on engine oils for essential lubrication and protection.

- Key Drivers for Engine Oils Dominance:

- Vehicle Population: A large and continuously expanding fleet of commercial vehicles necessitates a constant supply of engine oils.

- Maintenance Cycles: Regular oil changes are a fundamental aspect of commercial vehicle maintenance, ensuring operational efficiency and longevity.

- Technological Advancements: The introduction of newer engine technologies, such as turbocharging and direct injection, requires increasingly sophisticated engine oil formulations to meet performance demands and emission standards.

The Transmission & Gear Oils segment represents the second-largest market, accounting for approximately 20% market share. These lubricants are critical for the efficient operation of gearboxes and transmissions in heavy-duty vehicles, subject to immense stress and heat.

- Key Drivers for Transmission & Gear Oils Dominance:

- Heavy-Duty Applications: The frequent gear changes and heavy loads in commercial vehicle transmissions demand specialized lubricants.

- Component Protection: These oils are vital for preventing wear and tear on gears, bearings, and synchronizers, extending the life of expensive transmission components.

- Fuel Efficiency: Optimized gear oils can contribute to improved fuel economy by reducing frictional losses within the drivetrain.

Hydraulic Fluids constitute a significant segment, holding an estimated 10% market share. These fluids are essential for various hydraulic systems in commercial vehicles, including power steering, braking systems, and specialized equipment like cranes and tippers.

- Key Drivers for Hydraulic Fluids Dominance:

- Power Steering Systems: The prevalence of power steering in larger commercial vehicles drives demand for hydraulic fluids.

- Braking Systems: Many modern commercial vehicles utilize hydraulic braking systems, requiring reliable hydraulic fluid performance.

- Specialized Equipment: Vehicles equipped with hydraulic lifts, cranes, or tippers necessitate dedicated hydraulic fluid solutions.

The Greases segment, though smaller, is crucial, representing around 5% market share. Greases are used in various applications such as wheel bearings, chassis lubrication, and universal joints, providing long-lasting lubrication in extreme conditions.

- Key Drivers for Greases Dominance:

- Chassis Lubrication: Essential for reducing friction and wear on suspension and steering components.

- Bearing Protection: High-performance greases are vital for lubricating wheel bearings and other critical rotating components.

- Harsh Operating Environments: Commercial vehicles often operate in dusty, wet, or extreme temperature conditions, where greases provide superior protection.

Geographically, the urban and industrial centers of Iran, such as Tehran, Isfahan, and Mashhad, represent the dominant markets due to their higher concentration of commercial vehicle fleets and related industries. Economic policies supporting domestic manufacturing and infrastructure development further bolster the demand in these regions.

Iran Commercial Vehicle Lubricant Industry Product Developments

Product development in the Iran Commercial Vehicle Lubricant Industry is characterized by a strong focus on meeting stringent environmental regulations and enhancing vehicle performance. Companies are actively innovating to create lubricants that offer extended drain intervals, superior wear protection for heavy-duty engines, and improved fuel efficiency. The introduction of synthetic and semi-synthetic formulations designed for Euro 5 emission standards and beyond is a key trend, ensuring compatibility with modern engine technology. The competitive advantage lies in developing products that deliver exceptional performance under extreme operating conditions, reduce maintenance costs, and contribute to a lower total cost of ownership for fleet operators.

Report Scope & Segmentation Analysis

The Iran Commercial Vehicle Lubricant Industry is segmented by product type, encompassing a range of critical fluid and semi-solid lubricants.

- Engine Oils: This segment comprises lubricants formulated for internal combustion engines in trucks, buses, and other commercial vehicles. Growth projections are robust, driven by the sheer volume of vehicles and increasing demand for high-performance formulations, with an estimated market size of $450 million in the base year 2025. Competitive dynamics are shaped by a blend of price-sensitive domestic brands and quality-focused international players.

- Greases: This segment includes semi-solid lubricants used for components like bearings and chassis points. While smaller in market size, estimated at $35 million in 2025, it is crucial for specialized applications requiring long-lasting lubrication and protection against extreme pressures and temperatures.

- Hydraulic Fluids: This segment covers fluids essential for power steering, braking, and other hydraulic systems. The market size is estimated at $70 million in 2025, with steady growth anticipated due to the widespread use of hydraulic systems in heavy-duty commercial vehicles.

- Transmission & Gear Oils: This segment includes lubricants designed for vehicle transmissions and differentials, vital for heavy-duty applications. The market size is estimated at $140 million in 2025, with significant growth potential driven by the need for robust protection and efficiency in drivelines.

Key Drivers of Iran Commercial Vehicle Lubricant Industry Growth

The growth of the Iran Commercial Vehicle Lubricant Industry is propelled by several key factors. Firstly, the robust expansion of the logistics and transportation sector, fueled by increasing domestic trade and e-commerce, directly translates into higher demand for commercial vehicles and their associated lubricants. Secondly, the continuous need to maintain and extend the operational life of existing vehicle fleets, especially in the face of import restrictions and the desire to maximize asset utilization, drives consistent demand for high-quality lubricants. Furthermore, the gradual adoption of more advanced engine technologies that adhere to stricter emission standards necessitates the use of premium lubricants, creating a market for sophisticated formulations. Government initiatives aimed at supporting domestic manufacturing and incentivizing industrial growth also contribute to a favorable environment for the lubricant industry.

Challenges in the Iran Commercial Vehicle Lubricant Industry Sector

Despite its growth potential, the Iran Commercial Vehicle Lubricant Industry faces several significant challenges. Sanctions and international trade restrictions continue to pose a hurdle, impacting the availability of raw materials, advanced additive packages, and cutting-edge blending technologies, potentially leading to increased import costs and supply chain disruptions. The volatility of crude oil prices also influences the cost of base oils, a primary component of lubricants, creating price instability. Furthermore, intense price competition among numerous domestic players can erode profit margins, particularly for smaller manufacturers. The lack of widespread access to advanced technological know-how and R&D infrastructure compared to global leaders limits the pace of innovation for some local companies.

Emerging Opportunities in Iran Commercial Vehicle Lubricant Industry

The Iran Commercial Vehicle Lubricant Industry is ripe with emerging opportunities. The increasing demand for environmentally friendly and energy-efficient lubricants presents a significant avenue for growth, aligning with global sustainability trends. The development and adoption of bio-based or biodegradable lubricants could cater to a niche but growing market segment. The ongoing need to service and maintain the aging commercial vehicle fleet opens up opportunities for aftermarket lubricant suppliers offering cost-effective yet reliable solutions. Furthermore, strategic partnerships with international lubricant manufacturers could facilitate the transfer of technology and enhance the product portfolios of domestic players. The growing focus on digitalization and smart lubrication technologies, though nascent, could offer future opportunities for advanced monitoring and predictive maintenance solutions.

Leading Players in the Iran Commercial Vehicle Lubricant Industry Market

- Pars Oil Company

- Sepahan Oil Company

- Pardis Engine Oil Company

- LIQUI MOLY

- Iranol Oil Company

- FUCHS

- AZAR RAVAN SAZ (Petronol)

- Ghatran Kaveh Motor Oil Co

- TotalEnergies

- Behran Oil Company

Key Developments in Iran Commercial Vehicle Lubricant Industry Industry

- January 2021: All of Iranol's products became available on the Iran Mercantile Exchange and Iran Energy Exchange, resulting in greater financial transparency for the company and a significant contribution to the country's financial stability.

- August 2020: Iranol Oil Co. unveiled its latest product, Euro Diesel, that is designed for use in large diesel engines and meets the Euro 5 emission standard or below.

Strategic Outlook for Iran Commercial Vehicle Lubricant Industry Market

The strategic outlook for the Iran Commercial Vehicle Lubricant Industry is one of continued resilience and evolving opportunities. The market is expected to witness sustained growth driven by the fundamental demand for transportation and logistics services. Key growth catalysts will include the ongoing push towards higher-performance lubricants that enhance fuel efficiency and reduce emissions, aligning with both regulatory pressures and operational cost-saving objectives for fleet operators. Investments in research and development to create next-generation formulations capable of withstanding the demands of modern, high-efficiency engines will be crucial. Furthermore, domestic manufacturers have an opportunity to strengthen their competitive position by focusing on quality assurance, adopting advanced blending technologies, and potentially forging strategic alliances to enhance their product offerings and market reach. The industry's ability to navigate sanctions and adapt to evolving global lubricant standards will be paramount to its long-term success.

Iran Commercial Vehicle Lubricant Industry Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

Iran Commercial Vehicle Lubricant Industry Segmentation By Geography

- 1. Iran

Iran Commercial Vehicle Lubricant Industry Regional Market Share

Geographic Coverage of Iran Commercial Vehicle Lubricant Industry

Iran Commercial Vehicle Lubricant Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Construction Activities in Saudi Arabia; Booming Tourism in the Middle Eastern Countries

- 3.3. Market Restrains

- 3.3.1. Prone to Water Damage; Other Restraints

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Commercial Vehicle Lubricant Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pars Oil Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sepahan Oil Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pardis Engine Oil Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LIQUI MOLY

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Iranol Oil Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FUCHS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AZAR RAVAN SAZ (Petronol)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ghatran Kaveh Motor Oil Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TotalEnergie

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Behran Oil Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Pars Oil Company

List of Figures

- Figure 1: Iran Commercial Vehicle Lubricant Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Iran Commercial Vehicle Lubricant Industry Share (%) by Company 2025

List of Tables

- Table 1: Iran Commercial Vehicle Lubricant Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Iran Commercial Vehicle Lubricant Industry Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: Iran Commercial Vehicle Lubricant Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Iran Commercial Vehicle Lubricant Industry Volume Million Forecast, by Region 2020 & 2033

- Table 5: Iran Commercial Vehicle Lubricant Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Iran Commercial Vehicle Lubricant Industry Volume Million Forecast, by Product Type 2020 & 2033

- Table 7: Iran Commercial Vehicle Lubricant Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Iran Commercial Vehicle Lubricant Industry Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Commercial Vehicle Lubricant Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Iran Commercial Vehicle Lubricant Industry?

Key companies in the market include Pars Oil Company, Sepahan Oil Company, Pardis Engine Oil Company, LIQUI MOLY, Iranol Oil Company, FUCHS, AZAR RAVAN SAZ (Petronol), Ghatran Kaveh Motor Oil Co, TotalEnergie, Behran Oil Company.

3. What are the main segments of the Iran Commercial Vehicle Lubricant Industry?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Construction Activities in Saudi Arabia; Booming Tourism in the Middle Eastern Countries.

6. What are the notable trends driving market growth?

Largest Segment By Product Type : <span style="font-family: 'regular_bold';color:#0e7db3;">Engine Oils</span>.

7. Are there any restraints impacting market growth?

Prone to Water Damage; Other Restraints.

8. Can you provide examples of recent developments in the market?

January 2021: All of Iranol's products would be available on the Iran Mercantile Exchange and Iran Energy Exchange, resulting in greater financial transparency for the company and a significant contribution to the country's financial stability.August 2020: Iranol Oil Co. unveiled its latest product, Euro Diesel, that is designed for use in large diesel engines and meets the Euro 5 emission standard or below.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Commercial Vehicle Lubricant Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Commercial Vehicle Lubricant Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Commercial Vehicle Lubricant Industry?

To stay informed about further developments, trends, and reports in the Iran Commercial Vehicle Lubricant Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence