Key Insights

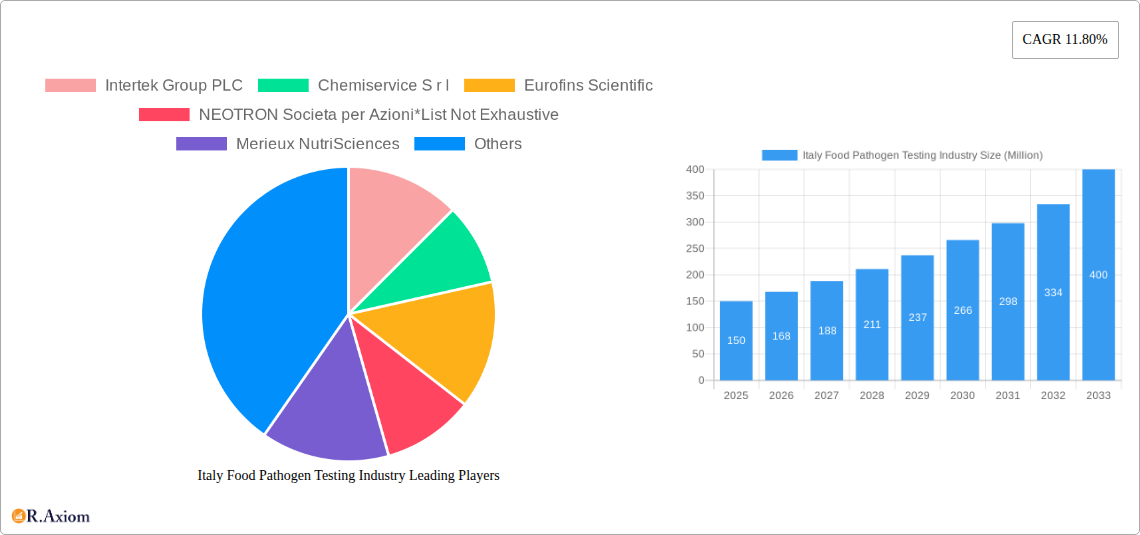

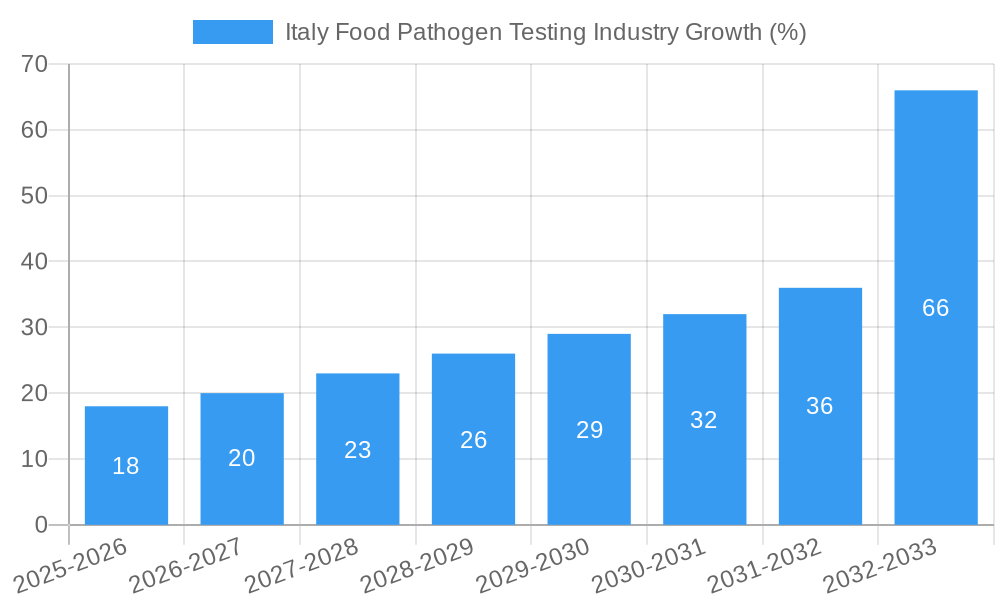

The Italian food pathogen testing market, valued at approximately €150 million in 2025, is experiencing robust growth, projected to reach €400 million by 2033, exhibiting a compound annual growth rate (CAGR) of 11.80%. This expansion is driven by several key factors. Stringent food safety regulations enforced by the Italian government and the European Union are compelling food producers and processors to prioritize rigorous pathogen testing, ensuring compliance and consumer safety. Growing consumer awareness of foodborne illnesses and increasing demand for safe and high-quality food products further fuel market growth. The rise of e-commerce in the food sector necessitates enhanced testing protocols to maintain product integrity throughout the supply chain. Technological advancements in pathogen detection, including rapid and sensitive PCR and immunoassay-based methods, contribute to increased testing efficiency and accuracy, boosting market adoption. Furthermore, the diversification of food products and the expansion of the food processing industry in Italy directly contribute to the increased need for comprehensive pathogen testing.

Market segmentation reveals a strong preference for PCR-based technologies due to their speed and accuracy. The highest demand comes from the pathogen testing segment, reflecting heightened concerns about contamination risks. Within the application segment, animal feed and pet food, along with the food industry itself, are the largest contributors to market growth, given the extensive regulatory requirements within these sectors. Major players like Intertek, Eurofins Scientific, and ALS Limited, with their established infrastructure and expertise, hold significant market share, engaging in intense competition through innovation and strategic partnerships. However, potential market restraints include the high cost of advanced testing technologies, which might limit accessibility for smaller food producers, and potential regulatory changes impacting the testing landscape. Despite these factors, the overall outlook for the Italian food pathogen testing market remains positive, fueled by consistent demand and continuous technological advancements.

Italy Food Pathogen Testing Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Italy food pathogen testing industry, offering invaluable insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. The report covers the period 2019-2033, with a focus on 2025 as the base and estimated year. It examines market concentration, innovation, trends, dominant segments, product developments, and challenges, ultimately providing a strategic outlook for the forecast period (2025-2033). The Italian food pathogen testing market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Italy Food Pathogen Testing Industry Market Concentration & Innovation

The Italian food pathogen testing market exhibits a moderately concentrated structure, with a few large multinational players and several smaller, specialized laboratories vying for market share. Key players like Intertek Group PLC, Eurofins Scientific, Bureau Veritas, ALS Limited, and NSF INTERNATIONAL dominate the landscape, holding a collective market share of approximately xx%. Chemiservice S.r.l, NEOTRON Societa per Azioni, and Merieux NutriSciences also contribute significantly to the overall market.

Innovation is driven by the increasing demand for rapid, accurate, and high-throughput testing methods. Advancements in technologies like Polymerase Chain Reaction (PCR), immunoassay-based techniques, and chromatography/spectrometry are key catalysts. The regulatory framework, particularly stringent EU food safety regulations, strongly influences the adoption of advanced testing technologies. Furthermore, the increasing prevalence of foodborne illnesses drives demand for sophisticated pathogen detection systems. M&A activities have been relatively modest in recent years, with deal values averaging xx Million annually. However, strategic partnerships and collaborations are prevalent, reflecting a focus on technological advancements and expanding service offerings.

Italy Food Pathogen Testing Industry Industry Trends & Insights

The Italian food pathogen testing market is experiencing robust growth, primarily fueled by heightened consumer awareness of food safety, stringent government regulations, and the growing demand for safe and high-quality food products. The increasing prevalence of foodborne illnesses continues to be a significant driver, pushing both producers and regulatory bodies to enhance testing protocols. Technological advancements, particularly the miniaturization and automation of testing processes, are further contributing to market expansion. The market penetration of rapid detection methods, such as PCR-based assays, is steadily rising, exceeding xx% in 2025 and projected to reach xx% by 2033. Consumer preferences are increasingly demanding traceability and transparency in the food supply chain, necessitating comprehensive pathogen testing throughout the production process. The competitive landscape is characterized by both price competition and the differentiation of services, including specialized testing, consultative services, and rapid turnaround times. This trend is expected to continue, driving market fragmentation in the coming years.

Dominant Markets & Segments in Italy Food Pathogen Testing Industry

- Dominant Application Segment: The "Food" segment constitutes the largest share of the market, driven by the extensive food processing industry in Italy and stringent food safety requirements.

- Dominant Contaminant Type: Pathogen testing dominates the market due to the high health risks associated with foodborne pathogens.

- Dominant Technology: PCR-based methods hold the largest market share due to their high sensitivity and specificity.

Key Drivers:

- Stringent EU food safety regulations.

- High consumer awareness regarding food safety.

- A large and diverse food processing and export industry.

- Well-established infrastructure for laboratory testing.

- Supportive government initiatives for food safety.

The dominance of these segments is primarily attributed to the robust food processing and export sectors in Italy, the stringent regulatory framework, and the critical need for accurate and timely pathogen detection. The high prevalence of specific pathogens in certain food categories further enhances market demand for these segments.

Italy Food Pathogen Testing Industry Product Developments

Recent product innovations focus on rapid, point-of-care testing devices, automated sample preparation systems, and advanced molecular diagnostic techniques. These advancements offer faster turnaround times, improved accuracy, and reduced labor costs. The market is witnessing the adoption of next-generation sequencing (NGS) technologies, although PCR remains the dominant technology. These product developments cater to growing demands for high-throughput screening, improved sensitivity, and broader pathogen detection capabilities.

Report Scope & Segmentation Analysis

This report segments the Italian food pathogen testing market across several key parameters:

- Application: Animal Feed and Pet Food, Food (including dairy, meat, poultry, seafood, fruits & vegetables, bakery products, etc.), Dietary Supplements (Crops, Other Foods). Each segment shows varying growth rates, with Food dominating.

- Contaminant Type: Pathogen Testing, Mycotoxin Testing, Pesticide and Residue Testing, GMO Testing, Allergen Testing, Other Contaminants Testing. Pathogen Testing holds the largest market share.

- Technology: Polymerase Chain Reaction (PCR), Immunoassay-based, Chromatography and Spectrometry, Other Technologies. PCR is the dominant technology.

Each segment's size and projected growth are influenced by factors like regulatory requirements, consumer demand, and technological advancements. The competitive landscape within each segment also varies depending on technological expertise and market access.

Key Drivers of Italy Food Pathogen Testing Industry Growth

The growth of the Italy food pathogen testing market is driven by stringent EU food safety regulations, increasing consumer awareness of food safety and hygiene, and technological advancements in pathogen detection methods. The robust Italian food processing and export sectors necessitate comprehensive testing to meet international standards and maintain product safety. Government initiatives promoting food safety and traceability also contribute to this growth.

Challenges in the Italy Food Pathogen Testing Industry Sector

Challenges include the high cost of advanced testing technologies, the need for skilled personnel, and intense competition among testing laboratories. Regulatory complexities and the potential for supply chain disruptions can also impact market growth. Price pressure from competitors and the need to constantly adapt to technological advancements present additional hurdles.

Emerging Opportunities in Italy Food Pathogen Testing Industry

Emerging opportunities lie in the increasing demand for rapid and on-site testing solutions, the integration of advanced technologies like NGS, and the expansion into emerging markets such as organic and functional foods. Growth is also expected in areas like allergen testing and mycotoxin detection.

Leading Players in the Italy Food Pathogen Testing Industry Market

- Intertek Group PLC

- Chemiservice S.r.l

- Eurofins Scientific

- NEOTRON Societa per Azioni

- Merieux NutriSciences

- Bureau Veritas

- ALS Limited

- NSF INTERNATIONAL

Key Developments in Italy Food Pathogen Testing Industry Industry

- 2022: Eurofins Scientific launched a new rapid PCR test for Listeria detection.

- 2023: Intertek Group PLC invested in new high-throughput testing equipment.

- 2024: New EU regulations regarding mycotoxin testing came into effect. (Further developments to be added as they occur).

Strategic Outlook for Italy Food Pathogen Testing Industry Market

The Italy food pathogen testing market is poised for continued growth, driven by a combination of factors: stringent regulations, increasing consumer awareness, technological progress, and the expansion of the food processing and export industries. Strategic investments in advanced technologies, expansion into niche segments, and the development of value-added services will be crucial for success in this dynamic market. The long-term outlook remains positive, with significant opportunities for established players and new entrants alike.

Italy Food Pathogen Testing Industry Segmentation

-

1. Contaminant Type

- 1.1. Pathogen Testing

- 1.2. Mycotoxin Testing

- 1.3. Pesticide and Residue Testing

- 1.4. GMO Testing

- 1.5. Allergen Testing

- 1.6. Other Contaminants Testing

-

2. Technology

- 2.1. Polymerase Chain Reaction (PCR)

- 2.2. Immunoassay-based

-

2.3. Chromatography and Spectrometry

- 2.3.1. HPLC Based

- 2.3.2. LC-MS/MS-Based

- 2.3.3. Other Chromatography and Spectrometry

- 2.4. Other Technologies

-

3. Application

- 3.1. Animal Feed and Pet Food

- 3.2. Meat and Poultry

- 3.3. Dairy

- 3.4. Fruits and Vegetables

- 3.5. Processed Food

- 3.6. Baby Food

- 3.7. Bakery Products

- 3.8. Savory and Sweet Snacks

- 3.9. Dietary Supplements

- 3.10. Crops

- 3.11. Other Foods

Italy Food Pathogen Testing Industry Segmentation By Geography

- 1. Italy

Italy Food Pathogen Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology

- 3.3. Market Restrains

- 3.3.1. Deteriorating Fertility of Agricultural Lands

- 3.4. Market Trends

- 3.4.1. Rising Importance of Food Safety Supporting Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Food Pathogen Testing Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 5.1.1. Pathogen Testing

- 5.1.2. Mycotoxin Testing

- 5.1.3. Pesticide and Residue Testing

- 5.1.4. GMO Testing

- 5.1.5. Allergen Testing

- 5.1.6. Other Contaminants Testing

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Polymerase Chain Reaction (PCR)

- 5.2.2. Immunoassay-based

- 5.2.3. Chromatography and Spectrometry

- 5.2.3.1. HPLC Based

- 5.2.3.2. LC-MS/MS-Based

- 5.2.3.3. Other Chromatography and Spectrometry

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Animal Feed and Pet Food

- 5.3.2. Meat and Poultry

- 5.3.3. Dairy

- 5.3.4. Fruits and Vegetables

- 5.3.5. Processed Food

- 5.3.6. Baby Food

- 5.3.7. Bakery Products

- 5.3.8. Savory and Sweet Snacks

- 5.3.9. Dietary Supplements

- 5.3.10. Crops

- 5.3.11. Other Foods

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Intertek Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chemiservice S r l

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Eurofins Scientific

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NEOTRON Societa per Azioni*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Merieux NutriSciences

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bureau Veritas

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ALS Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NSF INTERNATIONAL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Intertek Group PLC

List of Figures

- Figure 1: Italy Food Pathogen Testing Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Food Pathogen Testing Industry Share (%) by Company 2024

List of Tables

- Table 1: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Contaminant Type 2019 & 2032

- Table 3: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Contaminant Type 2019 & 2032

- Table 8: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 9: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 10: Italy Food Pathogen Testing Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Food Pathogen Testing Industry?

The projected CAGR is approximately 11.80%.

2. Which companies are prominent players in the Italy Food Pathogen Testing Industry?

Key companies in the market include Intertek Group PLC, Chemiservice S r l, Eurofins Scientific, NEOTRON Societa per Azioni*List Not Exhaustive, Merieux NutriSciences, Bureau Veritas, ALS Limited, NSF INTERNATIONAL.

3. What are the main segments of the Italy Food Pathogen Testing Industry?

The market segments include Contaminant Type, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology.

6. What are the notable trends driving market growth?

Rising Importance of Food Safety Supporting Market Demand.

7. Are there any restraints impacting market growth?

Deteriorating Fertility of Agricultural Lands.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Food Pathogen Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Food Pathogen Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Food Pathogen Testing Industry?

To stay informed about further developments, trends, and reports in the Italy Food Pathogen Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence