Key Insights

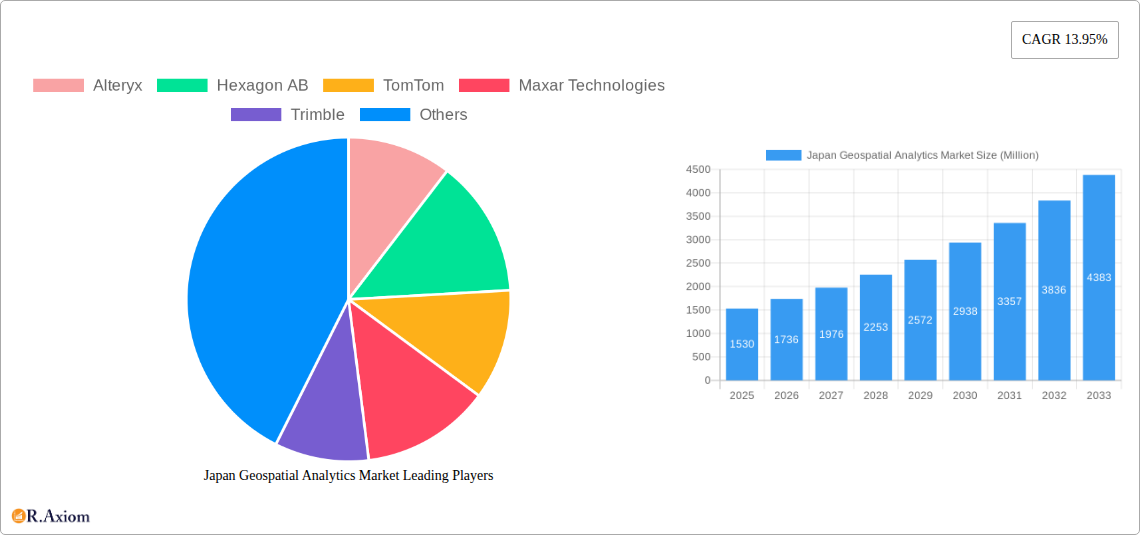

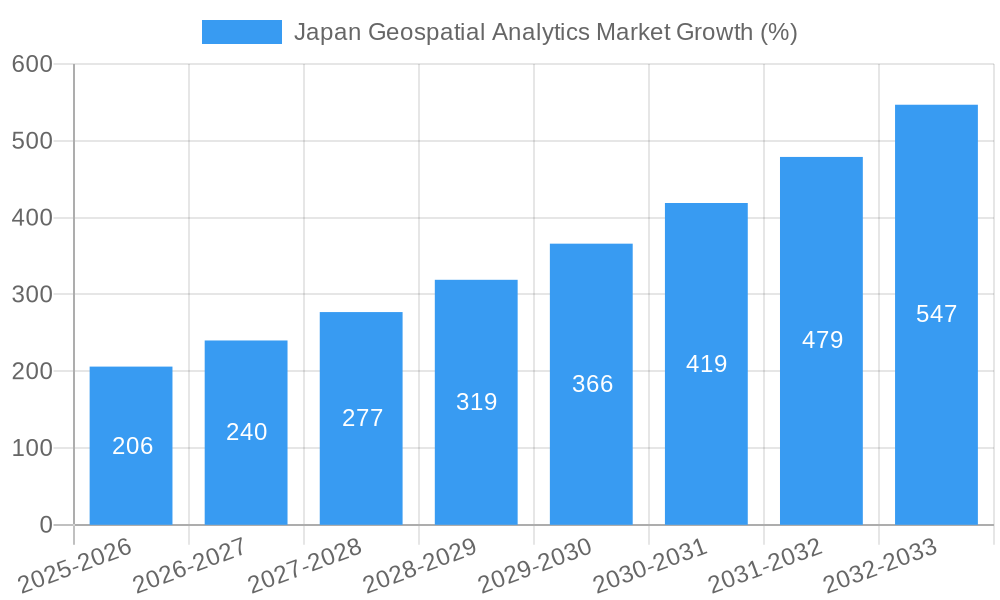

The Japan Geospatial Analytics Market is experiencing robust growth, projected to reach a market size of $1.53 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 13.95% from 2019 to 2033. This significant expansion is driven by several key factors. The increasing adoption of advanced technologies like AI and machine learning in geospatial analysis is fueling demand for sophisticated solutions across various sectors. Furthermore, the Japanese government's emphasis on infrastructure development and smart city initiatives necessitates advanced geospatial data analysis for effective urban planning and resource management. The rising need for precise location intelligence in logistics, agriculture, and disaster management also contributes substantially to market growth. While data privacy concerns and the high initial investment costs associated with implementing geospatial analytics solutions present some restraints, the overall market outlook remains positive, driven by the accelerating digital transformation across various industries in Japan.

The market segmentation, although not explicitly provided, can be reasonably inferred. We can anticipate strong demand within government agencies (national mapping, disaster preparedness), the construction and infrastructure industry (project planning, site analysis), the transportation sector (route optimization, traffic management), and the utilities sector (network management). Key players like Alteryx, Hexagon AB, TomTom, Maxar Technologies, Trimble, ESRI, and others are actively competing in this growing market, providing a diverse range of software, hardware, and services. Regional variations within Japan may exist, with larger metropolitan areas showing higher adoption rates than rural regions. The forecast period of 2025-2033 suggests further substantial market growth, propelled by ongoing technological advancements and increased data accessibility. The continued integration of geospatial analytics with other data sources (e.g., demographic, economic) will further enhance its analytical capabilities and drive wider adoption across various sectors.

This comprehensive report provides an in-depth analysis of the Japan Geospatial Analytics Market, covering the period from 2019 to 2033. It offers actionable insights for industry stakeholders, investors, and businesses operating within or planning to enter this dynamic market. With a focus on market trends, competitive dynamics, and future growth potential, this report serves as an invaluable resource for strategic decision-making. The report utilizes a robust methodology, incorporating data from various sources and incorporating expert analysis to deliver a precise and insightful view of the market landscape.

Japan Geospatial Analytics Market Market Concentration & Innovation

The Japan Geospatial Analytics market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. However, the market is also characterized by a high degree of innovation, driven by advancements in technologies like AI, cloud computing, and IoT. Market share data from 2024 indicates that the top five players (Alteryx, Hexagon AB, TomTom, Maxar Technologies, and Trimble) collectively hold approximately XX% of the market. This concentration is further influenced by the substantial capital investment required for research and development, data acquisition, and sophisticated software development.

Regulatory frameworks, particularly those related to data privacy and security, play a vital role in shaping market dynamics. Compliance with regulations, such as those governing the handling of sensitive geospatial data, presents both challenges and opportunities for market participants. The emergence of substitute technologies, such as open-source geospatial software, is gradually impacting the market share of established players. However, these substitutes often lack the advanced functionalities and comprehensive support systems offered by leading vendors. End-user trends reveal a growing preference for cloud-based solutions and integrated platforms that offer seamless data integration and analysis capabilities. M&A activities are becoming increasingly frequent, with deal values averaging approximately USD XX Million in recent years. This indicates consolidation within the market, driven by a desire for increased market share, technological advancements, and diversification of product portfolios.

Japan Geospatial Analytics Market Industry Trends & Insights

The Japan Geospatial Analytics market is experiencing robust growth, driven by several factors. The increasing adoption of geospatial technologies across diverse sectors, such as infrastructure development, urban planning, agriculture, and disaster management, fuels market expansion. Technological disruptions, including the integration of AI, machine learning, and big data analytics into geospatial tools, are significantly enhancing the efficiency and accuracy of spatial data analysis. Consumer preferences are shifting towards cloud-based solutions, mobile applications, and user-friendly interfaces, demanding greater accessibility and ease of use.

The competitive landscape is marked by ongoing innovation and strategic partnerships. Established players are actively investing in R&D, focusing on developing cutting-edge solutions and expanding their service offerings. New entrants are entering the market by leveraging niche technologies or specialized expertise. The CAGR for the Japan Geospatial Analytics Market during the forecast period (2025-2033) is estimated to be XX%, driven by the factors mentioned above. Market penetration of geospatial analytics solutions across various industries is steadily increasing, with particularly strong growth in sectors like smart cities and precision agriculture.

Dominant Markets & Segments in Japan Geospatial Analytics Market

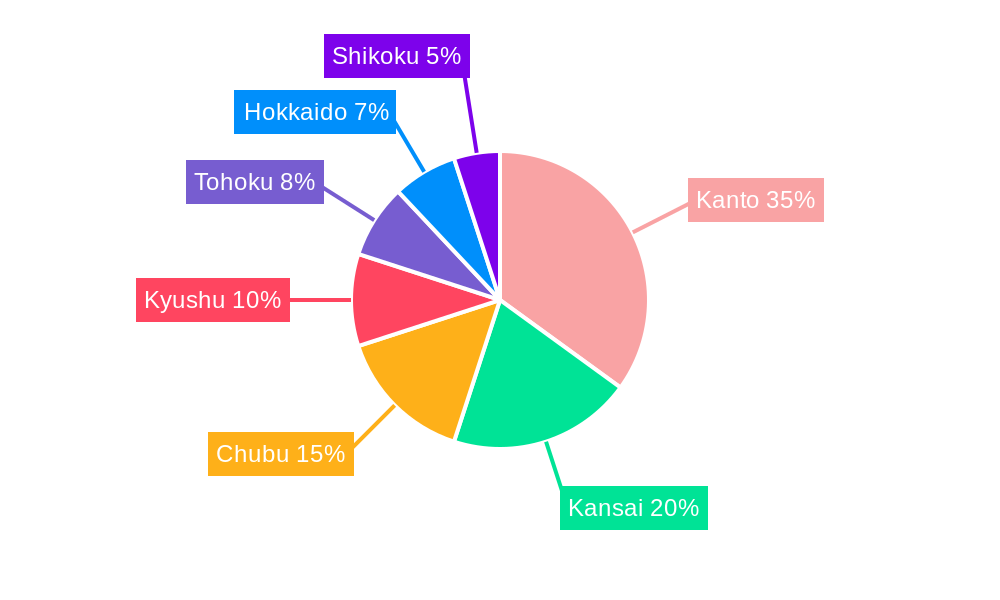

The Kanto region, encompassing Tokyo and surrounding prefectures, dominates the Japan Geospatial Analytics market. This dominance is attributed to the concentration of major industries, advanced technological infrastructure, and high density of urban development.

- Key Drivers of Kanto Region Dominance:

- High concentration of key industry players.

- Extensive technological infrastructure and digital literacy.

- Robust government support for infrastructure development and smart city initiatives.

- Large-scale geospatial data availability.

This region’s robust economy and advanced digital infrastructure significantly drive the demand for sophisticated geospatial analysis capabilities. The government's active involvement in promoting smart city initiatives, infrastructure modernization, and disaster resilience further fuels market growth. Consequently, the Kanto region remains the most significant consumer of geospatial analytics solutions. Other regions in Japan, however, are rapidly adopting these technologies, albeit at a slower pace due to factors such as lower levels of technological adoption, less advanced infrastructure and a less concentrated industry base.

Japan Geospatial Analytics Market Product Developments

Recent product innovations focus on enhancing the efficiency and user-friendliness of geospatial analytics tools. The integration of AI and machine learning capabilities enables automated data processing, advanced predictive modeling, and improved decision-making. Applications are expanding across various sectors, including autonomous vehicles, smart agriculture, environmental monitoring, and disaster management. Competitive advantages are increasingly determined by the level of data integration, analytical sophistication, and ease of use provided by geospatial analytics platforms. These trends reflect the industry's focus on offering powerful yet accessible tools that cater to a broader range of users and applications.

Report Scope & Segmentation Analysis

This report segments the Japan Geospatial Analytics market based on several key parameters: by component (hardware, software, and services); by deployment (cloud, on-premise); by application (environmental management, urban planning, transportation, agriculture, and others); and by end-user (government, enterprises, and academic institutions). Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed. Growth in cloud-based deployments is projected to surpass on-premise solutions, driven by the scalability, cost-effectiveness, and accessibility benefits offered by cloud computing. The government and enterprise segments are expected to experience significant growth, propelled by the increasing adoption of geospatial analytics for informed decision-making.

Key Drivers of Japan Geospatial Analytics Market Growth

Several factors are driving the growth of the Japan Geospatial Analytics market. Firstly, the government's ongoing initiatives to develop smart cities and enhance infrastructure are increasing demand for geospatial technologies. Secondly, the rising adoption of IoT devices is generating massive amounts of geospatial data, providing valuable insights for various sectors. Thirdly, the increasing focus on precision agriculture, requiring accurate land management and resource allocation, is driving the adoption of geospatial analytics. Lastly, the private sector’s growing need to optimize logistics and supply chains fuels the market's growth.

Challenges in the Japan Geospatial Analytics Market Sector

The Japan Geospatial Analytics market faces several challenges. High initial investment costs for implementing geospatial technologies can act as a barrier for smaller companies and organizations. Data security and privacy concerns, especially concerning the use of sensitive geospatial data, require robust security measures, potentially increasing costs. Competition among established players and the emergence of new entrants create a dynamic market with pressures on pricing and innovation. The market's reliance on advanced technological infrastructure highlights potential challenges of ensuring consistent access and compatibility. These factors influence the growth rate and require strategic adaptations by market participants.

Emerging Opportunities in Japan Geospatial Analytics Market

Several emerging opportunities are shaping the future of the Japan Geospatial Analytics market. The rising adoption of 5G and the development of 6G networks enhance data transmission speed and bandwidth, facilitating real-time data analysis. The growing integration of AI and machine learning capabilities empowers more accurate predictions and automated data processing. The use of geospatial data in developing sustainable solutions, particularly in urban planning and environmental management, presents substantial market potential. Finally, the government's increased focus on digital transformation initiatives further fuels demand for geospatial analytics.

Leading Players in the Japan Geospatial Analytics Market Market

- Alteryx

- Hexagon AB (Hexagon AB)

- TomTom (TomTom)

- Maxar Technologies (Maxar Technologies)

- Trimble (Trimble)

- ESRI (ESRI)

- Caliper Corporation

- General Electric (General Electric)

- Bentley Systems Co (Bentley Systems Co)

- Fugro (Fugro)

Key Developments in Japan Geospatial Analytics Market Industry

April 2024: Microsoft announced a significant investment of USD 2.9 Billion over the next two years to enhance its hyperscale cloud computing and AI infrastructure in Japan. This investment will significantly improve the availability of advanced cloud-based geospatial analytics tools and services. The company's commitment to digital skilling programs will also help cultivate a skilled workforce, further boosting market adoption.

May 2024: The European Union and Japan initiated their Digital Partnership, focusing on cooperation in critical digital technologies, including AI, 5G/6G, and high-performance computing. This collaboration fosters innovation and technology transfer, potentially accelerating the development and adoption of advanced geospatial analytics technologies in Japan.

Strategic Outlook for Japan Geospatial Analytics Market Market

The Japan Geospatial Analytics market is poised for continued growth, driven by technological advancements, government initiatives, and increasing private sector adoption. The integration of AI, cloud computing, and IoT will further enhance the capabilities of geospatial analytics tools, leading to improved decision-making across various sectors. Opportunities exist for companies focusing on niche applications, developing user-friendly solutions, and offering comprehensive data integration and management services. The market's future hinges on addressing challenges related to data security, infrastructure development, and cultivating a skilled workforce. Long-term growth prospects remain strong, indicating a significant market potential for businesses that strategically position themselves within this expanding sector.

Japan Geospatial Analytics Market Segmentation

-

1. Type

- 1.1. Surface Analysis

- 1.2. Network Analysis

- 1.3. Geovisualization

-

2. End-user Vertical

- 2.1. Agricultural

- 2.2. Utility and Communication

- 2.3. Defense and Intelligence

- 2.4. Government

- 2.5. Mining and Natural Resources

- 2.6. Automotive and Transportation

- 2.7. Healthcare

- 2.8. Real Estate and Construction

- 2.9. Other End-user Verticals

Japan Geospatial Analytics Market Segmentation By Geography

- 1. Japan

Japan Geospatial Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.95% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase In Adoption of Smart City Development; Introduction of 5G to Boost Market Growth

- 3.3. Market Restrains

- 3.3.1. Increase In Adoption of Smart City Development; Introduction of 5G to Boost Market Growth

- 3.4. Market Trends

- 3.4.1. Disaster Risk Reduction and Management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Geospatial Analytics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Analysis

- 5.1.2. Network Analysis

- 5.1.3. Geovisualization

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Agricultural

- 5.2.2. Utility and Communication

- 5.2.3. Defense and Intelligence

- 5.2.4. Government

- 5.2.5. Mining and Natural Resources

- 5.2.6. Automotive and Transportation

- 5.2.7. Healthcare

- 5.2.8. Real Estate and Construction

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Alteryx

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hexagon AB

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TomTom

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Maxar Technologies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Trimble

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ESRI

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Caliper Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bentley Systems Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fugr

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Alteryx

List of Figures

- Figure 1: Japan Geospatial Analytics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Geospatial Analytics Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Geospatial Analytics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Geospatial Analytics Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Japan Geospatial Analytics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Japan Geospatial Analytics Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Japan Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 6: Japan Geospatial Analytics Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 7: Japan Geospatial Analytics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Japan Geospatial Analytics Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Japan Geospatial Analytics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Japan Geospatial Analytics Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Japan Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 12: Japan Geospatial Analytics Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 13: Japan Geospatial Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Japan Geospatial Analytics Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Geospatial Analytics Market?

The projected CAGR is approximately 13.95%.

2. Which companies are prominent players in the Japan Geospatial Analytics Market?

Key companies in the market include Alteryx, Hexagon AB, TomTom, Maxar Technologies, Trimble, ESRI, Caliper Corporation, General Electric, Bentley Systems Co, Fugr.

3. What are the main segments of the Japan Geospatial Analytics Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase In Adoption of Smart City Development; Introduction of 5G to Boost Market Growth.

6. What are the notable trends driving market growth?

Disaster Risk Reduction and Management.

7. Are there any restraints impacting market growth?

Increase In Adoption of Smart City Development; Introduction of 5G to Boost Market Growth.

8. Can you provide examples of recent developments in the market?

April 2024: Microsoft announced a significant investment of USD 2.9 billion over the next two years to enhance its hyperscale cloud computing and AI infrastructure in Japan. The company will also expand its digital skilling programs to provide AI training to over 3 million individuals within the next three years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Geospatial Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Geospatial Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Geospatial Analytics Market?

To stay informed about further developments, trends, and reports in the Japan Geospatial Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence