Key Insights

The Japanese neurology devices market is poised for robust expansion, with a projected market size of $893.8 million in 2025, growing at a compound annual growth rate (CAGR) of 4.85% through 2033. This growth is primarily fueled by an aging population, increasing prevalence of neurological disorders such as Alzheimer's, Parkinson's, and stroke, and a growing demand for advanced diagnostic and therapeutic solutions. The continuous innovation in interventional neurology, neurostimulation, and neurosurgery devices, coupled with rising healthcare expenditure and government initiatives to improve neurological care access, are significant drivers. Key trends include the miniaturization and enhanced accuracy of devices, the integration of AI and machine learning for diagnostics, and the expanding adoption of minimally invasive procedures. The market is witnessing a surge in demand for Cerebrospinal Fluid (CSF) management devices, driven by the need to manage conditions like hydrocephalus, and a strong focus on interventional neurology devices for stroke management and aneurysm treatment.

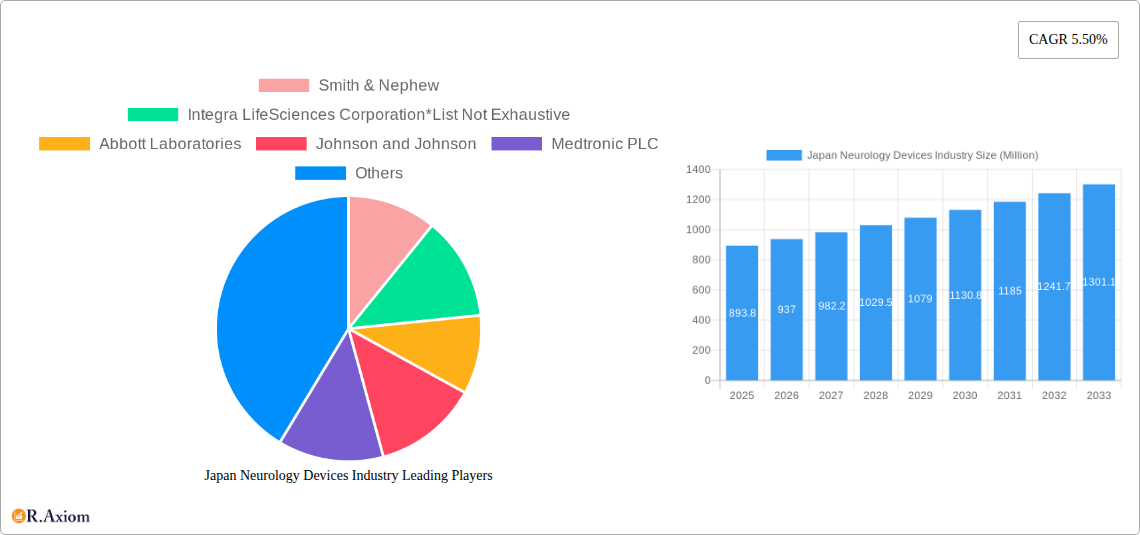

Japan Neurology Devices Industry Market Size (In Million)

The market's trajectory is also influenced by the increasing adoption of neurostimulation devices for chronic pain management and movement disorders, alongside advancements in neurosurgery devices offering greater precision and reduced patient trauma. While the market exhibits a positive outlook, certain restraints such as the high cost of advanced neurological devices and the need for specialized training for healthcare professionals could pose challenges. However, strategic collaborations, mergers, and acquisitions among leading players like Medtronic PLC, Abbott Laboratories, and Johnson & Johnson are expected to drive innovation and market penetration. The increasing awareness about neurological conditions and the availability of reimbursement policies further bolster market growth. Japan's commitment to cutting-edge healthcare technology, coupled with a sophisticated healthcare infrastructure, positions it as a key market for neurology device manufacturers aiming to address the growing burden of neurological diseases.

Japan Neurology Devices Industry Company Market Share

The Japan neurology devices industry is characterized by a moderately concentrated market, with key players like Medtronic PLC, Johnson and Johnson, Abbott Laboratories, and Nihon Kohden Corporation holding significant market share. Innovation remains a primary driver, fueled by substantial R&D investments in areas such as advanced neurostimulation for chronic pain and neurological disorders, minimally invasive neurosurgical tools, and sophisticated neuroimaging and diagnostic equipment. Regulatory frameworks, overseen by bodies like the Pharmaceuticals and Medical Devices Agency (PMDA), are robust, prioritizing patient safety and product efficacy, which can sometimes lead to extended approval timelines. The threat of product substitutes exists, particularly from less invasive therapeutic approaches or pharmacological treatments, but the demand for specialized neurological devices continues to grow. End-user trends are increasingly focused on patient-centric solutions, including wearable neurotechnology, personalized treatment plans, and devices that facilitate remote patient monitoring. Mergers and acquisitions (M&A) activity, while not always of the magnitude seen in global markets, plays a role in consolidating market positions and acquiring novel technologies. For instance, strategic partnerships and smaller acquisition deals, valued in the tens to hundreds of millions, are common for acquiring niche technologies or expanding market reach within Japan.

Japan Neurology Devices Industry Industry Trends & Insights

The Japan neurology devices industry is poised for substantial growth, driven by a confluence of factors including an aging population, increasing prevalence of neurological disorders, and rapid technological advancements. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.8% during the forecast period of 2025–2033, a testament to the sustained demand for innovative neurological solutions. This growth is underpinned by a rising incidence of conditions such as stroke, Alzheimer's disease, Parkinson's disease, epilepsy, and chronic pain, all of which necessitate specialized medical devices for diagnosis, treatment, and management. Technological disruptions are at the forefront, with the integration of artificial intelligence (AI) in diagnostics, robotics in neurosurgery, and the development of advanced implantable devices. For example, the increasing sophistication of deep brain stimulation (DBS) systems and spinal cord stimulation (SCS) devices is expanding their therapeutic applications, leading to higher market penetration in these segments. Consumer preferences are shifting towards less invasive procedures and devices that offer improved patient outcomes and enhanced quality of life. This includes a growing demand for neuromodulation technologies and neurorehabiliation devices that can be used in both clinical and home settings. The competitive dynamics within the industry are intense, with both global giants and specialized Japanese manufacturers vying for market share. Companies are investing heavily in research and development to bring next-generation products to market, focusing on miniaturization, enhanced connectivity, and improved efficacy. Furthermore, the increasing awareness and early diagnosis of neurological conditions, coupled with supportive government initiatives and healthcare reforms aimed at improving neurological care, are further propelling market expansion. The overall market penetration of advanced neurology devices is expected to deepen as accessibility improves and healthcare providers increasingly adopt these cutting-edge technologies.

Dominant Markets & Segments in Japan Neurology Devices Industry

The Neurostimulation Devices segment is a dominant force within the Japan neurology devices industry, exhibiting remarkable growth and significant market penetration. This dominance is fueled by the increasing prevalence of chronic pain conditions, movement disorders like Parkinson's disease, and other neurological ailments that benefit from electrical stimulation therapies. Within this broad segment, Spinal Cord Stimulation Devices and Deep Brain Stimulation Devices stand out as key revenue generators. The market for spinal cord stimulators is propelled by the aging population and the persistent challenge of managing refractory back and leg pain, where traditional treatments prove insufficient. Similarly, the demand for deep brain stimulation systems is on the rise, driven by advancements in surgical techniques and expanding indications for treating conditions such as essential tremor, dystonia, and depression.

Key drivers for the dominance of neurostimulation devices include:

- Aging Demographics: Japan's rapidly aging population presents a growing patient pool for neurological conditions requiring advanced interventions.

- Technological Advancements: Continuous innovation in implantable pulse generators, lead designs, and programming capabilities enhances efficacy and patient comfort, leading to wider adoption.

- Increasing Prevalence of Neurological Disorders: A higher incidence of conditions like chronic pain, Parkinson's disease, and epilepsy directly translates to increased demand for neurostimulation solutions.

- Favorable Reimbursement Policies: Government and private insurance policies often support the use of proven neurostimulation therapies, making them more accessible to patients.

- Minimally Invasive Procedures: The trend towards less invasive surgical approaches favors implantable devices like neurostimulators, offering reduced recovery times and patient risk.

Interventional Neurology Devices also represent a crucial and growing segment, particularly Neurothrombectomy Devices and Carotid Artery Stents. The increasing incidence of ischemic stroke, coupled with advancements in endovascular techniques for clot retrieval and vessel recanalization, has significantly boosted the demand for these products. The development of more sophisticated and user-friendly thrombectomy devices, designed for improved navigation and clot capture, is a key factor contributing to this segment's growth. The market for carotid artery stents is driven by the need to prevent stroke in patients with significant carotid artery stenosis, especially those who are high-risk candidates for traditional surgical intervention.

The Neurosurgery Devices segment, encompassing Neuroendoscopes and Stereotactic Systems, plays a vital role in enabling precise and minimally invasive surgical interventions for brain tumors, aneurysms, and other intracranial pathologies. The development of high-definition neuroendoscopes and advanced robotic-assisted stereotactic systems allows surgeons to perform complex procedures with greater accuracy and reduced patient trauma.

Cerebrospinal Fluid (CSF) Management Devices, while perhaps a smaller segment in terms of market value compared to neurostimulation, are critical for managing conditions like hydrocephalus and normal pressure hydrocephalus. Shunts, valves, and other CSF drainage systems are essential for maintaining intracranial pressure and preventing neurological damage, ensuring a steady demand for these life-saving devices.

Overall, the dominance of these segments reflects the evolving landscape of neurological care in Japan, where technological innovation, demographic shifts, and an increasing focus on patient outcomes are driving demand for advanced medical devices.

Japan Neurology Devices Industry Product Developments

Product development in the Japan neurology devices industry is characterized by a strong emphasis on innovation, addressing unmet clinical needs, and enhancing patient outcomes. Key trends include the miniaturization of implantable devices, the integration of AI for advanced diagnostics and treatment planning, and the development of sophisticated neurosurgical instruments for minimally invasive procedures. For instance, advancements in neurostimulation technology are leading to smaller, more powerful, and wirelessly rechargeable devices, offering greater patient comfort and longer therapeutic lifespans. In interventional neurology, novel thrombectomy devices with improved clot capture capabilities and enhanced maneuverability are emerging, improving stroke treatment success rates. Furthermore, the development of advanced neuroendoscopes with enhanced visualization and therapeutic tools is revolutionizing the surgical approach to various brain pathologies, offering less invasive alternatives to traditional open surgery. These product developments are driven by the need for greater precision, reduced invasiveness, and improved patient quality of life, solidifying Japan's position as a hub for cutting-edge neurological device innovation.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Japan neurology devices industry, focusing on key market segments and their growth projections. The market is segmented by Type of Device, including Cerebrospinal Fluid Management Devices, Interventional Neurology Devices (comprising Interventional/Surgical Simulators, Neurothrombectomy Devices, Carotid Artery Stents, and Others), Neurosurgery Devices (including Neuroendoscopes, Stereotactic Systems, and Other Neurosurgery Devices), Neurostimulation Devices (encompassing Spinal Cord Stimulation Devices, Deep Brain Stimulation Devices, Sacral Nerve Stimulation Devices, and Other Neurostimulation Devices), and Other Types of Devices.

Cerebrospinal Fluid Management Devices are essential for managing conditions like hydrocephalus and will see steady growth driven by an aging population and advancements in shunt technology.

Interventional Neurology Devices are poised for robust expansion, fueled by increasing stroke incidence and the adoption of advanced endovascular techniques, with neurothrombectomy devices and carotid artery stents being key growth drivers.

Neurosurgery Devices will continue to evolve with a focus on minimally invasive solutions, with neuroendoscopes and stereotactic systems enabling more precise and less traumatic surgical interventions.

Neurostimulation Devices, particularly Spinal Cord Stimulation and Deep Brain Stimulation, represent a significant and rapidly growing segment due to their efficacy in treating chronic pain and movement disorders.

Other Types of Devices will capture niche markets and emerging technologies within the broader neurology space.

Key Drivers of Japan Neurology Devices Industry Growth

The Japan neurology devices industry's growth is propelled by several key factors. Firstly, the aging population in Japan significantly increases the incidence of age-related neurological disorders such as stroke, Alzheimer's, and Parkinson's disease, driving demand for advanced diagnostic and therapeutic devices. Secondly, continuous technological innovation in areas like neurostimulation, minimally invasive surgery, and AI-powered diagnostics allows for more effective and less invasive treatments, expanding the scope of treatable conditions and improving patient outcomes. Thirdly, a supportive regulatory environment that encourages innovation while ensuring patient safety, coupled with increasing healthcare expenditure and favorable reimbursement policies for advanced neurological treatments, further fuels market expansion. Lastly, growing public awareness and patient demand for better neurological care contribute to the adoption of sophisticated medical devices.

Challenges in the Japan Neurology Devices Industry Sector

Despite robust growth prospects, the Japan neurology devices industry faces several challenges. Strict regulatory approval processes by the PMDA, while ensuring quality, can lead to extended market entry timelines for new devices, impacting the pace of innovation adoption. High research and development costs associated with developing cutting-edge neurological technologies require substantial financial investment, posing a barrier for smaller companies. Reimbursement complexities for novel or niche devices can sometimes limit their accessibility and adoption by healthcare providers. Furthermore, shortages of skilled neurosurgeons and neurologists capable of operating complex devices can hinder widespread implementation. The competitive landscape, with both domestic and international players, intensifies price pressures and necessitates continuous innovation to maintain market share.

Emerging Opportunities in Japan Neurology Devices Industry

Emerging opportunities in the Japan neurology devices industry lie in the continued advancement of personalized medicine and targeted therapies. The development of AI-driven diagnostic tools that can predict disease progression and tailor treatment plans offers immense potential. Wearable and remote monitoring devices for neurological conditions are gaining traction, enabling continuous patient oversight and early intervention. The expanding applications of neuromodulation technologies, beyond traditional pain management to include mental health disorders and neurorehabilitation, present significant growth avenues. Furthermore, increased investment in regenerative medicine and neuro-restorative therapies, often in conjunction with advanced devices, signals a promising future. Collaborations between device manufacturers, research institutions, and pharmaceutical companies to develop integrated treatment solutions will also unlock new market potential.

Leading Players in the Japan Neurology Devices Industry Market

- Smith & Nephew

- Integra LifeSciences Corporation

- Abbott Laboratories

- Johnson and Johnson

- Medtronic PLC

- Elekta AB

- B Braun Melsungen AG

- Stryker Corporation

- Boston Scientific Corporation

- Nihon Kohden Corporation

Key Developments in Japan Neurology Devices Industry Industry

- September 2022: Shionogi & Co., Ltd. and Pixie Dust Technologies, Inc. announced a business partnership agreement to launch a business involving brain activation through sound stimulation.

- December 2020: Terumo Corporation (Japan) launched the WEB Embolization System, an intravascular aneurysm treatment device, in Japan, providing new treatment options for difficult-to-treat brain aneurysm cases.

Strategic Outlook for Japan Neurology Devices Industry Market

The strategic outlook for the Japan neurology devices industry is highly positive, driven by an aging population, the escalating burden of neurological diseases, and persistent technological advancements. The market is expected to witness significant growth fueled by increased adoption of minimally invasive neurosurgical techniques, sophisticated neurostimulation devices for pain and movement disorder management, and advanced interventional neurology tools for stroke treatment. Strategic initiatives by key players will focus on expanding product portfolios through R&D and potential M&A, enhancing digital integration for improved patient monitoring and data analytics, and forging collaborations to develop comprehensive therapeutic solutions. Emphasis on patient-centric innovations, aimed at improving quality of life and reducing healthcare costs, will be paramount. The market's future trajectory is also influenced by supportive government policies aimed at advancing healthcare infrastructure and promoting medical technology adoption.

Japan Neurology Devices Industry Segmentation

-

1. Type of Device

- 1.1. Cerebrospinal Fluid Management Devices

-

1.2. Interventional Neurology Devices

- 1.2.1. Interventional/Surgical Simulators

- 1.2.2. Neurothrombectomy Devices

- 1.2.3. Carotid Artery Stents

- 1.2.4. Others

-

1.3. Neurosurgery Devices

- 1.3.1. Neuroendoscopes

- 1.3.2. Stereotactic Systems

- 1.3.3. Other Neurosurgery Devices

-

1.4. Neurostimulation Devices

- 1.4.1. Spinal Cord Stimulation Devices

- 1.4.2. Deep Brain Stimulation Devices

- 1.4.3. Sacral Nerve Stimulation Devices

- 1.4.4. Other Neurostimulation Devices

- 1.5. Other Types of Devices

Japan Neurology Devices Industry Segmentation By Geography

- 1. Japan

Japan Neurology Devices Industry Regional Market Share

Geographic Coverage of Japan Neurology Devices Industry

Japan Neurology Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Incidence of Neurological Disorders; Huge Investments by Private Players in Neurology Devices; Increase in R&D in the Field of Neurotherapies

- 3.3. Market Restrains

- 3.3.1. High Cost of Equipment; Stringent FDA Validation and Guidelines for New Devices

- 3.4. Market Trends

- 3.4.1. Cerebrospinal Fluid Management Device is Expected to Hold Significant Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Neurology Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Cerebrospinal Fluid Management Devices

- 5.1.2. Interventional Neurology Devices

- 5.1.2.1. Interventional/Surgical Simulators

- 5.1.2.2. Neurothrombectomy Devices

- 5.1.2.3. Carotid Artery Stents

- 5.1.2.4. Others

- 5.1.3. Neurosurgery Devices

- 5.1.3.1. Neuroendoscopes

- 5.1.3.2. Stereotactic Systems

- 5.1.3.3. Other Neurosurgery Devices

- 5.1.4. Neurostimulation Devices

- 5.1.4.1. Spinal Cord Stimulation Devices

- 5.1.4.2. Deep Brain Stimulation Devices

- 5.1.4.3. Sacral Nerve Stimulation Devices

- 5.1.4.4. Other Neurostimulation Devices

- 5.1.5. Other Types of Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Smith & Nephew

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Integra LifeSciences Corporation*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Abbott Laboratories

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Johnson and Johnson

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Elekta AB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 B Braun Melsungen AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stryker Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Boston Scientific Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nihon Kohden Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Smith & Nephew

List of Figures

- Figure 1: Japan Neurology Devices Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Japan Neurology Devices Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Neurology Devices Industry Revenue undefined Forecast, by Type of Device 2020 & 2033

- Table 2: Japan Neurology Devices Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Japan Neurology Devices Industry Revenue undefined Forecast, by Type of Device 2020 & 2033

- Table 4: Japan Neurology Devices Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Neurology Devices Industry?

The projected CAGR is approximately 4.85%.

2. Which companies are prominent players in the Japan Neurology Devices Industry?

Key companies in the market include Smith & Nephew, Integra LifeSciences Corporation*List Not Exhaustive, Abbott Laboratories, Johnson and Johnson, Medtronic PLC, Elekta AB, B Braun Melsungen AG, Stryker Corporation, Boston Scientific Corporation, Nihon Kohden Corporation.

3. What are the main segments of the Japan Neurology Devices Industry?

The market segments include Type of Device.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in Incidence of Neurological Disorders; Huge Investments by Private Players in Neurology Devices; Increase in R&D in the Field of Neurotherapies.

6. What are the notable trends driving market growth?

Cerebrospinal Fluid Management Device is Expected to Hold Significant Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Equipment; Stringent FDA Validation and Guidelines for New Devices.

8. Can you provide examples of recent developments in the market?

September 2022: Shionogi & Co., Ltd. and Pixie Dust Technologies, Inc. announced that they have entered into a business partnership agreement (hereafter 'the Partnership Agreement') to launch a business involving brain activation through sound stimulation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Neurology Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Neurology Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Neurology Devices Industry?

To stay informed about further developments, trends, and reports in the Japan Neurology Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence