Key Insights

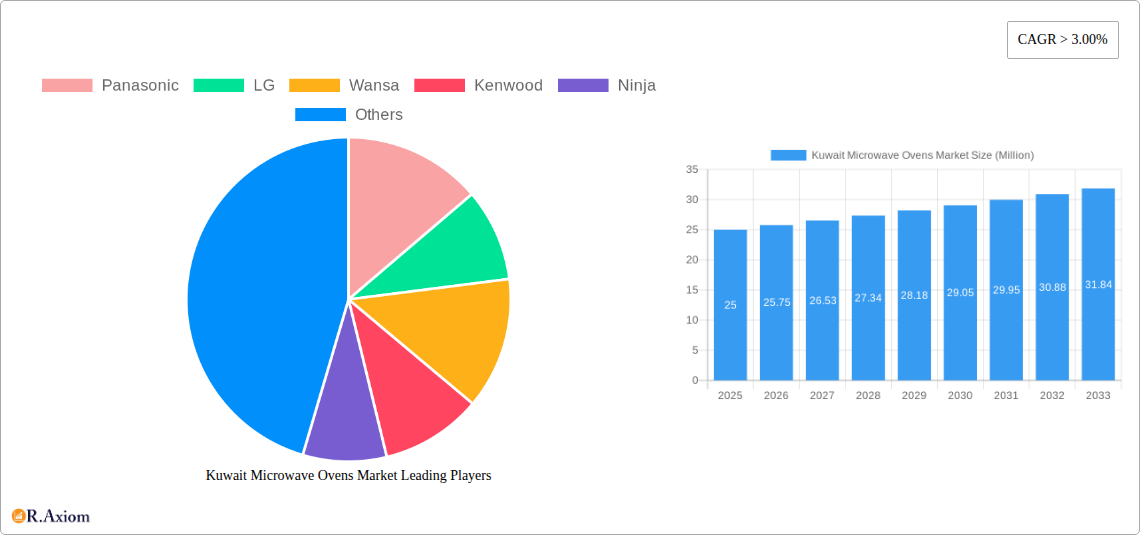

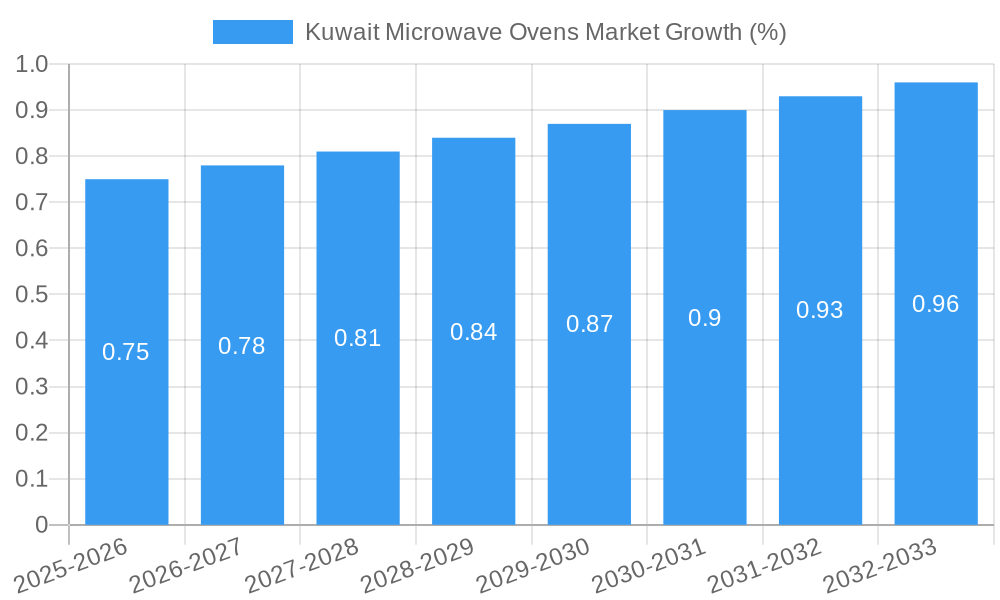

The Kuwait microwave oven market, valued at approximately $XX million in 2025, is projected to experience robust growth, exceeding a 3% compound annual growth rate (CAGR) from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes within Kuwait are fueling increased consumer spending on home appliances, including microwave ovens. The convenience offered by microwave ovens, particularly for busy lifestyles, is a major driver, further enhanced by the increasing popularity of quick and easy meal preparation methods. Moreover, the market is witnessing a shift towards technologically advanced models featuring features like convection cooking and smart functionalities, catering to the growing demand for versatility and convenience in the kitchen. The diverse range of models available, encompassing conventional, grill, and solo options from leading brands such as Panasonic, LG, Samsung, and others, cater to varying consumer needs and budgets. Growth is also fueled by increased urbanization and the rise of smaller living spaces, making space-saving appliances like microwave ovens highly desirable.

However, certain restraints exist. The relatively high cost of premium microwave oven models might limit accessibility for a segment of the population. Competition among various brands also presents challenges, with brands actively engaging in pricing strategies and marketing efforts to gain market share. Furthermore, evolving consumer preferences and technological advancements require manufacturers to continuously innovate and adapt to stay competitive. Nevertheless, the overall positive economic outlook in Kuwait, coupled with rising consumer demand for convenience and technological advancements in microwave oven technology, are anticipated to support the continued growth of this market throughout the forecast period. The segmentation by distribution channels (multi-branded stores, exclusive stores, online stores) reflects changing consumer purchasing habits, with online channels poised for significant growth in the coming years.

Kuwait Microwave Ovens Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Kuwait microwave ovens market, offering valuable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic landscape. The report covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033, using 2025 as the base year. The market is segmented by distribution channel (multi-branded stores, exclusive stores, online stores, other distribution channels), type (conventional, grill, solo), and end-user (residential, commercial). Key players analyzed include Panasonic, LG, Wansa, Kenwood, Ninja, Daewoo, Comfee, Toshiba, Samsung, and Midea. The report projects a market size of XX Million by 2033, with a CAGR of XX% during the forecast period.

Kuwait Microwave Ovens Market Concentration & Innovation

The Kuwait microwave ovens market exhibits a moderately concentrated structure, with a few major players holding significant market share. Panasonic, Samsung, and LG collectively account for approximately XX% of the market, while regional players like Wansa also hold substantial positions. Market concentration is influenced by brand recognition, distribution networks, and technological advancements. Innovation is a key driver, with manufacturers continuously introducing new models featuring enhanced functionalities, such as smart connectivity, improved energy efficiency, and advanced cooking options. Regulatory frameworks, including safety standards and energy efficiency regulations, also play a crucial role in shaping market dynamics. Product substitution remains limited, with microwave ovens primarily competing with other cooking appliances like conventional ovens. End-user trends show a rising demand for smart and energy-efficient models, particularly in the residential sector. M&A activities have been relatively limited in recent years, with deal values totaling approximately XX Million in the last five years, primarily focused on expanding distribution networks and strengthening market presence.

- Market Share: Panasonic (XX%), Samsung (XX%), LG (XX%), Others (XX%)

- M&A Activity: XX Million in deal value (2019-2024)

- Key Innovation Drivers: Smart connectivity, energy efficiency, advanced cooking features.

Kuwait Microwave Ovens Market Industry Trends & Insights

The Kuwait microwave oven market is experiencing steady growth, driven by several factors. Rising disposable incomes, increasing urbanization, and changing lifestyles are contributing to the higher adoption of microwave ovens, particularly in residential settings. The convenience and speed offered by microwave ovens are highly valued by busy households. Technological disruptions, such as the integration of smart features and improved energy efficiency, are further boosting market growth. Consumer preferences are shifting towards larger capacity models, offering versatility in cooking options, and sophisticated features like automated cooking programs and built-in sensors. Competitive dynamics are intense, with manufacturers focusing on product differentiation, branding, and aggressive pricing strategies. The market is witnessing the emergence of new entrants offering innovative models, challenging the dominance of established players. The overall market growth is expected to continue, with a projected CAGR of XX% from 2025 to 2033, reaching a market size of XX Million by 2033. Market penetration for microwave ovens is currently at approximately XX% within households in Kuwait.

Dominant Markets & Segments in Kuwait Microwave Ovens Market

The residential segment dominates the Kuwait microwave ovens market, accounting for approximately XX% of total sales. This is driven by increasing household formation and rising consumer demand for convenient cooking appliances. Within distribution channels, multi-branded stores hold the largest market share, benefiting from extensive reach and established customer bases. The conventional microwave oven type remains the most popular, driven by its affordability and functionality.

Key Drivers for Residential Segment: Rising disposable income, urbanization, and preference for convenience.

Key Drivers for Multi-Branded Stores: Wide reach, established customer base, and competitive pricing.

Key Drivers for Conventional Type: Affordability, functionality and widespread availability.

Dominant Region: Kuwait City, with its higher population density and higher per capita income.

Kuwait Microwave Ovens Market Product Developments

Recent product developments in the Kuwait microwave ovens market have focused on integrating smart features, enhancing cooking capabilities, and improving energy efficiency. Manufacturers are incorporating smart connectivity features, allowing users to control and monitor their microwave ovens remotely through smartphone apps. Advanced cooking options like auto-cook settings and sensor technology are becoming increasingly common. Companies are also emphasizing energy efficiency to appeal to environmentally conscious consumers. These improvements enhance the overall user experience, offering convenience, versatility, and cost savings.

Report Scope & Segmentation Analysis

This report segments the Kuwait microwave ovens market by distribution channel, type, and end-user. The distribution channel segment includes multi-branded stores, exclusive stores, online stores, and other distribution channels. Each segment’s growth projections are based on detailed analysis and market size estimations. The type segment encompasses conventional, grill, and solo microwaves, each exhibiting distinct market dynamics. The end-user segment focuses on residential and commercial applications, analyzing their respective market sizes and growth trajectories. Competitive dynamics within each segment are examined, highlighting major players and their market strategies.

Key Drivers of Kuwait Microwave Ovens Market Growth

The Kuwait microwave ovens market's growth is driven by several key factors: rising disposable incomes enabling increased consumer spending on home appliances; increasing urbanization and smaller household sizes that emphasize convenience; technological advancements including smart features and improved energy efficiency; changing lifestyles and eating habits favoring quick meal preparation. Government initiatives promoting energy efficiency further contribute to market growth.

Challenges in the Kuwait Microwave Ovens Market Sector

Challenges facing the Kuwait microwave ovens market include intense competition from established players and new entrants, leading to price pressures. Supply chain disruptions can affect product availability and cost. Fluctuations in the global economy might impact consumer purchasing power, thus potentially slowing market growth.

Emerging Opportunities in Kuwait Microwave Ovens Market

Emerging opportunities lie in the growing demand for smart and energy-efficient microwaves, catering to environmentally conscious consumers. Expansion into online sales channels can increase market reach and accessibility. The increasing popularity of healthy cooking practices presents a growth opportunity for models with advanced features like steaming and grilling capabilities.

Leading Players in the Kuwait Microwave Ovens Market Market

Key Developments in Kuwait Microwave Ovens Market Industry

- December 2021: LG launched its InstaView Double Oven Gas Slide-in Range and Over-the-Range Microwave Oven, integrating with the LG ThinQ Recipe app. This enhanced the user experience by offering guided cooking and recipe suggestions, potentially increasing the appeal of LG microwave ovens.

- March 2021: Samsung expanded its kitchen appliance range with the "Baker Series Microwaves," featuring steaming, grilling, and frying capabilities. This innovative product catered to the growing trend of home cooking and healthy eating, enhancing Samsung's competitiveness.

Strategic Outlook for Kuwait Microwave Ovens Market Market

The Kuwait microwave ovens market presents significant growth potential, driven by increasing urbanization, changing lifestyles, and rising disposable incomes. Opportunities exist for manufacturers to introduce innovative products with smart features and advanced cooking capabilities, catering to evolving consumer preferences. Strategic partnerships and investments in distribution networks are crucial for capturing market share. The market is expected to experience sustained growth over the forecast period, presenting attractive investment opportunities for businesses in the sector.

Kuwait Microwave Ovens Market Segmentation

-

1. Type

- 1.1. Convectional

- 1.2. Grill

- 1.3. Solo

-

2. End-User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Multi-Branded Stores

- 3.2. Exclusive Stores

- 3.3. Online Stores

- 3.4. Other Distribution Channels

Kuwait Microwave Ovens Market Segmentation By Geography

- 1. Kuwait

Kuwait Microwave Ovens Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in Vehicle Safety

- 3.2.2 Emission

- 3.2.3 and Fleet Management Regulations; Advancements Such as Route Calculation

- 3.2.4 Vehicle Tracking

- 3.2.5 and Fuel Pilferage

- 3.3. Market Restrains

- 3.3.1. High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity

- 3.4. Market Trends

- 3.4.1. Increase in the percentage of Sales through Online mode

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Microwave Ovens Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Convectional

- 5.1.2. Grill

- 5.1.3. Solo

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Multi-Branded Stores

- 5.3.2. Exclusive Stores

- 5.3.3. Online Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wansa

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kenwood

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ninja

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Daewoo

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Comfee

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toshiba

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Samsung

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Midea

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Kuwait Microwave Ovens Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kuwait Microwave Ovens Market Share (%) by Company 2024

List of Tables

- Table 1: Kuwait Microwave Ovens Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Kuwait Microwave Ovens Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Kuwait Microwave Ovens Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: Kuwait Microwave Ovens Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 7: Kuwait Microwave Ovens Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 9: Kuwait Microwave Ovens Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Kuwait Microwave Ovens Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Kuwait Microwave Ovens Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 15: Kuwait Microwave Ovens Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: Kuwait Microwave Ovens Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 17: Kuwait Microwave Ovens Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 18: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 19: Kuwait Microwave Ovens Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Microwave Ovens Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Kuwait Microwave Ovens Market?

Key companies in the market include Panasonic, LG, Wansa, Kenwood, Ninja, Daewoo, Comfee, Toshiba, Samsung, Midea.

3. What are the main segments of the Kuwait Microwave Ovens Market?

The market segments include Type, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Vehicle Safety. Emission. and Fleet Management Regulations; Advancements Such as Route Calculation. Vehicle Tracking. and Fuel Pilferage.

6. What are the notable trends driving market growth?

Increase in the percentage of Sales through Online mode.

7. Are there any restraints impacting market growth?

High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity.

8. Can you provide examples of recent developments in the market?

On December 2021, LG has launched LG's InstaView Double Oven Gas Slide-in Range and the Over-the-Range Microwave Oven connect with the LG ThinQ Recipe app which will allow owners to find recipes and cook thousands of step-by-step recipes with guidance from their appliances.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Microwave Ovens Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Microwave Ovens Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Microwave Ovens Market?

To stay informed about further developments, trends, and reports in the Kuwait Microwave Ovens Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence