Key Insights

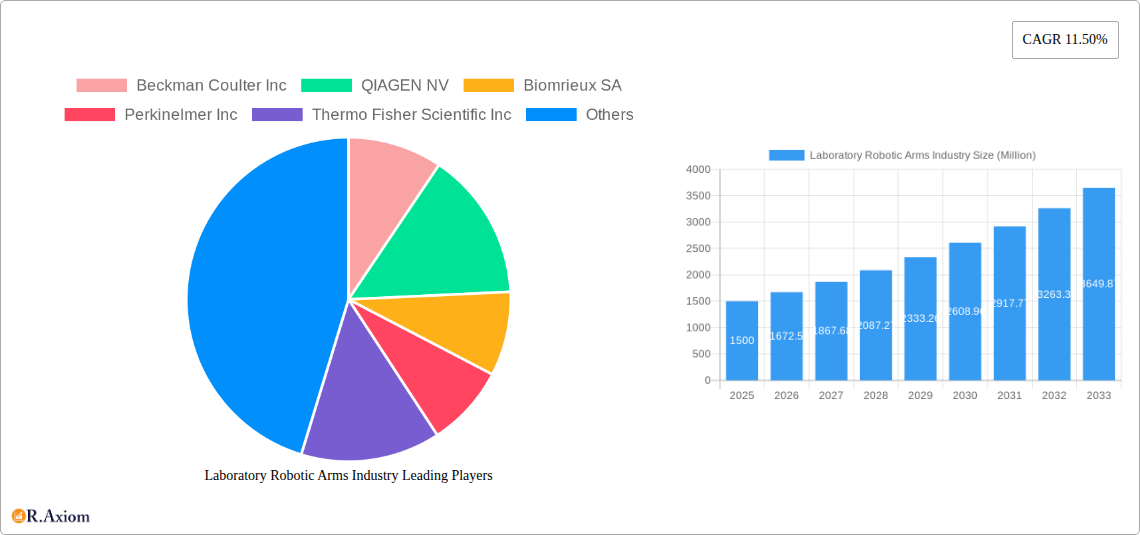

The Laboratory Robotic Arms market is experiencing robust growth, driven by the increasing automation needs within various laboratory settings. The market, valued at approximately $XX million in 2025 (assuming a logical estimation based on the provided CAGR of 11.50% and a historical period from 2019-2024), is projected to reach a significantly larger size by 2033, fueled by a compound annual growth rate of 11.50%. Key drivers include the rising demand for high-throughput screening in drug discovery, the growing adoption of automation in genomics and proteomics research, and the increasing need for improved efficiency and reduced human error in clinical diagnostics. The diverse application areas, encompassing drug discovery, digital imaging, genomics & proteomics, clinical diagnostics, and systems biology, contribute to the market's expansion. Technological advancements in robotic arm designs, such as articulated, dual arm, and parallel link configurations, further enhance the market's appeal. Market segmentation by type and application allows for tailored solutions to meet specific laboratory requirements. While data on regional market share is not provided, it's reasonable to assume that North America and Europe will initially hold a larger share, given their established research infrastructure. However, rapid growth is anticipated in Asia-Pacific regions driven by increasing investments in healthcare infrastructure and research. The competitive landscape is comprised of key players such as Beckman Coulter Inc, QIAGEN NV, Biomérieux SA, and others, each striving to innovate and meet the evolving demands of the sector.

The restraints to market growth could include the high initial investment costs associated with procuring and implementing robotic arms, the need for skilled personnel for operation and maintenance, and the potential for regulatory hurdles in certain regions. However, these challenges are likely to be outweighed by the long-term benefits of increased efficiency, reduced operational costs, and improved data quality offered by laboratory robotic arms. The continued advancements in artificial intelligence and machine learning are poised to further revolutionize the capabilities of these systems, opening new possibilities for automation and accelerating research progress across various scientific disciplines. This market presents a promising investment opportunity for companies that can successfully develop, integrate, and support robust and reliable robotic arm solutions for laboratories worldwide.

Laboratory Robotic Arms Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Laboratory Robotic Arms industry, offering valuable insights for stakeholders, investors, and industry professionals. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report projects robust growth, driven by technological advancements and increasing automation in laboratory settings. The market is valued at xx Million in 2025 and is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Laboratory Robotic Arms Industry Market Concentration & Innovation

The laboratory robotic arms market exhibits moderate concentration, with several key players commanding significant market share. Beckman Coulter Inc, QIAGEN NV, Biomrieux SA, Perkinelmer Inc, Thermo Fisher Scientific Inc, Siemens Healthineers AG, Anton Paar GmbH, Abbott Laboratories, Hamilton Company, Tecan Group, and Hudson Robotics Inc are some of the prominent companies shaping the landscape. While precise market share data for each company is proprietary, it is estimated that the top 5 players hold approximately 60% of the market. Innovation is a key driver, fueled by the need for increased precision, throughput, and automation in various laboratory applications. The regulatory landscape, particularly concerning safety and compliance, significantly impacts market dynamics. Product substitution is limited, as the unique capabilities of robotic arms are difficult to replicate with alternative technologies. End-user trends point towards a growing preference for automated systems that enhance efficiency and reduce human error. The frequency of mergers and acquisitions (M&A) in the sector is moderate. Recent deal values are not publicly available for all transactions but estimations place the total M&A value in the last 5 years for this sector at approximately xx Million.

- Key Players: Beckman Coulter Inc, QIAGEN NV, Biomrieux SA, Perkinelmer Inc, Thermo Fisher Scientific Inc, Siemens Healthineers AG, Anton Paar GmbH, Abbott Laboratories, Hamilton Company, Tecan Group, Hudson Robotics Inc.

- Market Concentration: Moderately concentrated, with top 5 players holding ~60% market share.

- Innovation Drivers: Increased precision, higher throughput, enhanced automation.

- Regulatory Framework: Stringent safety and compliance regulations.

- M&A Activity: Moderate, with estimated total deal value of xx Million in the last five years.

Laboratory Robotic Arms Industry Industry Trends & Insights

The laboratory robotic arms market is experiencing significant growth driven by several factors. The increasing demand for high-throughput screening in drug discovery and genomics research fuels the adoption of automated systems. Technological advancements, such as improved dexterity, integrated vision systems, and advanced software controls, are enhancing the capabilities and usability of robotic arms. Consumer preference is shifting toward systems that offer enhanced precision, reduced operational costs, and improved data analysis. The market is highly competitive, with companies focusing on product differentiation through unique features and functionalities, as well as strategic partnerships to expand their reach. Market penetration is steadily increasing across various applications, particularly in clinical diagnostics and life sciences research. The global market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a strong growth trajectory throughout the forecast period.

Dominant Markets & Segments in Laboratory Robotic Arms Industry

The North American region currently holds the largest market share in the laboratory robotic arms industry, driven by a robust life sciences sector and significant investments in research and development. Within the segment breakdown:

By Type:

- Articulated Arm: This segment holds the largest market share due to its versatility and suitability for a wide range of laboratory tasks. Key growth drivers include increasing automation needs in drug discovery, and clinical diagnostics.

- Dual Arm: This segment is witnessing rapid growth due to its ability to handle complex tasks that require simultaneous manipulation. Further market penetration is expected due to advancements in control systems and software integration.

- Parallel Link Arm: This segment offers high speed and precision. Growth is propelled by increasing demand for high-throughput applications in genomics and proteomics.

- Others: This segment includes specialized robotic arms with unique functionalities. Growth is likely to be driven by niche applications and customized solutions.

By Application:

Drug Discovery: This segment is a major driver of growth due to the increasing demand for high-throughput screening and automation in pharmaceutical research. Further growth is expected as the field of drug discovery continues to advance.

Clinical Diagnostics: This segment witnesses strong growth as laboratories seek improved speed, accuracy, and efficiency in diagnostics. Increased automation adoption rates is a major growth driver.

Genomics & Proteomics: This segment shows significant growth due to the rising adoption of automated systems in large-scale genomics and proteomics research.

System Biology: Growth in this segment is driven by the increasing complexity of systems biology research, requiring automation for data collection and analysis.

Digital Imaging: This sector demonstrates moderate growth as the application of robotic arms in digital imaging tasks in labs continues to expand.

Others: This segment includes other niche applications. The growth in this segment is expected to be driven by the emerging applications of robotic arms.

Key Drivers (Regional Dominance): Strong life sciences sector, high R&D investment, favorable regulatory environment (for North America).

Laboratory Robotic Arms Industry Product Developments

Recent product innovations include collaborative robots with enhanced dexterity and improved safety features, and integrated vision systems providing real-time feedback. These improvements expand applications, particularly in handling delicate samples and complex tasks. The integration of advanced software and AI algorithms is further enhancing the capabilities of robotic arms, enabling increased autonomy and precision in laboratory processes. These developments are driving market growth by improving efficiency, reducing errors, and enabling new research possibilities.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the laboratory robotic arms market based on type (articulated arm, dual arm, parallel link arm, others) and application (drug discovery, digital imaging, genomics & proteomics, clinical diagnostics, systems biology, others). Each segment is analyzed based on historical data (2019-2024), current market size (2025), and growth projections (2025-2033). The competitive dynamics of each segment are also explored, focusing on key players, market share, and strategic initiatives.

Key Drivers of Laboratory Robotic Arms Industry Growth

Technological advancements, including improved dexterity, vision systems, and AI integration, are significant drivers. The rising demand for high-throughput screening and automation in research and diagnostics is another crucial factor. Favorable regulatory environments in key regions support market expansion. Increasing investments in life sciences research and the rising prevalence of chronic diseases further fuel market growth.

Challenges in the Laboratory Robotic Arms Industry Sector

High initial investment costs can hinder adoption, particularly for smaller laboratories. The complexity of integrating robotic arms into existing laboratory workflows poses another challenge. Competition from established players and emerging entrants can create price pressures. Supply chain disruptions can impact production and delivery times. Regulatory compliance requirements in specific geographic markets and evolving regulatory demands present a challenge in ensuring market access and continuing successful operation. Estimated impact of these factors on market growth is xx% reduction during the forecast period.

Emerging Opportunities in Laboratory Robotic Arms Industry

The integration of AI and machine learning for enhanced autonomy and decision-making presents significant opportunities. Expansion into new applications, such as personalized medicine and point-of-care diagnostics, offers considerable potential. Miniaturization of robotic arms for use in microfluidic devices and other specialized applications is a growing trend. The development of collaborative robots for safer and more efficient human-robot interaction represents a key opportunity.

Leading Players in the Laboratory Robotic Arms Industry Market

- Beckman Coulter Inc

- QIAGEN NV

- Biomrieux SA

- Perkinelmer Inc

- Thermo Fisher Scientific Inc

- Siemens Healthineers AG

- Anton Paar GmbH

- Abbott Laboratories

- Hamilton Company

- Tecan Group

- Hudson Robotics Inc

Key Developments in Laboratory Robotic Arms Industry Industry

- August 2022: Researchers at Northwestern University developed Omnid Mocobots, collaborative mobile robots designed for handling delicate payloads. This advancement enhances human-robot collaboration and expands the potential applications of robotic arms in laboratories.

- July 2022: Comau launched the Racer-5SE, a six-axis articulated robot for the pharmaceutical sector. This product launch strengthens the presence of advanced robotic solutions in the pharmaceutical industry, enhancing manufacturing efficiency and precision.

Strategic Outlook for Laboratory Robotic Arms Industry Market

The laboratory robotic arms market is poised for significant growth, driven by technological advancements, increasing demand for automation, and the expansion of applications across various sectors. Opportunities exist in AI integration, new application development, and miniaturization. Companies focusing on innovation, strategic partnerships, and customer-centric solutions will be best positioned for success. The long-term outlook is exceptionally positive given the ongoing trend toward increased automation in both research and clinical environments.

Laboratory Robotic Arms Industry Segmentation

-

1. Type

- 1.1. Articulated Arm

- 1.2. Dual Arm

- 1.3. Parallel Link Arm

- 1.4. Others

-

2. Application

- 2.1. Drug Discovery

- 2.2. Digital Imaging

- 2.3. Genomics & Proteomics

- 2.4. Clinical Diagnostics,

- 2.5. System Biology

- 2.6. Others

Laboratory Robotic Arms Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Laboratory Robotic Arms Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend of Lab automation; Increasing Focus Towards Work-safety in Laboratories

- 3.3. Market Restrains

- 3.3.1. Expensive Initial Setup

- 3.4. Market Trends

- 3.4.1. Genomics and Proteomics Application is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Articulated Arm

- 5.1.2. Dual Arm

- 5.1.3. Parallel Link Arm

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Drug Discovery

- 5.2.2. Digital Imaging

- 5.2.3. Genomics & Proteomics

- 5.2.4. Clinical Diagnostics,

- 5.2.5. System Biology

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Articulated Arm

- 6.1.2. Dual Arm

- 6.1.3. Parallel Link Arm

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Drug Discovery

- 6.2.2. Digital Imaging

- 6.2.3. Genomics & Proteomics

- 6.2.4. Clinical Diagnostics,

- 6.2.5. System Biology

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Articulated Arm

- 7.1.2. Dual Arm

- 7.1.3. Parallel Link Arm

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Drug Discovery

- 7.2.2. Digital Imaging

- 7.2.3. Genomics & Proteomics

- 7.2.4. Clinical Diagnostics,

- 7.2.5. System Biology

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Articulated Arm

- 8.1.2. Dual Arm

- 8.1.3. Parallel Link Arm

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Drug Discovery

- 8.2.2. Digital Imaging

- 8.2.3. Genomics & Proteomics

- 8.2.4. Clinical Diagnostics,

- 8.2.5. System Biology

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Articulated Arm

- 9.1.2. Dual Arm

- 9.1.3. Parallel Link Arm

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Drug Discovery

- 9.2.2. Digital Imaging

- 9.2.3. Genomics & Proteomics

- 9.2.4. Clinical Diagnostics,

- 9.2.5. System Biology

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Articulated Arm

- 10.1.2. Dual Arm

- 10.1.3. Parallel Link Arm

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Drug Discovery

- 10.2.2. Digital Imaging

- 10.2.3. Genomics & Proteomics

- 10.2.4. Clinical Diagnostics,

- 10.2.5. System Biology

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Articulated Arm

- 11.1.2. Dual Arm

- 11.1.3. Parallel Link Arm

- 11.1.4. Others

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Drug Discovery

- 11.2.2. Digital Imaging

- 11.2.3. Genomics & Proteomics

- 11.2.4. Clinical Diagnostics,

- 11.2.5. System Biology

- 11.2.6. Others

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. North America Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Beckman Coulter Inc

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 QIAGEN NV

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Biomrieux SA

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Perkinelmer Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Thermo Fisher Scientific Inc

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Siemens Healthineers AG

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Anton Paar GmbH

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Abbott Laboratorie

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Hamilton Company

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Tecan Group

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Hudson Robotics Inc

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.1 Beckman Coulter Inc

List of Figures

- Figure 1: Global Laboratory Robotic Arms Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Laboratory Robotic Arms Industry Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Laboratory Robotic Arms Industry Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Laboratory Robotic Arms Industry Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Laboratory Robotic Arms Industry Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Laboratory Robotic Arms Industry Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Laboratory Robotic Arms Industry Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Laboratory Robotic Arms Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Laboratory Robotic Arms Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Laboratory Robotic Arms Industry Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Laboratory Robotic Arms Industry Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Laboratory Robotic Arms Industry Revenue (Million), by Application 2024 & 2032

- Figure 29: Asia Laboratory Robotic Arms Industry Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Australia and New Zealand Laboratory Robotic Arms Industry Revenue (Million), by Type 2024 & 2032

- Figure 33: Australia and New Zealand Laboratory Robotic Arms Industry Revenue Share (%), by Type 2024 & 2032

- Figure 34: Australia and New Zealand Laboratory Robotic Arms Industry Revenue (Million), by Application 2024 & 2032

- Figure 35: Australia and New Zealand Laboratory Robotic Arms Industry Revenue Share (%), by Application 2024 & 2032

- Figure 36: Australia and New Zealand Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Australia and New Zealand Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Laboratory Robotic Arms Industry Revenue (Million), by Type 2024 & 2032

- Figure 39: Latin America Laboratory Robotic Arms Industry Revenue Share (%), by Type 2024 & 2032

- Figure 40: Latin America Laboratory Robotic Arms Industry Revenue (Million), by Application 2024 & 2032

- Figure 41: Latin America Laboratory Robotic Arms Industry Revenue Share (%), by Application 2024 & 2032

- Figure 42: Latin America Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Laboratory Robotic Arms Industry Revenue (Million), by Type 2024 & 2032

- Figure 45: Middle East and Africa Laboratory Robotic Arms Industry Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East and Africa Laboratory Robotic Arms Industry Revenue (Million), by Application 2024 & 2032

- Figure 47: Middle East and Africa Laboratory Robotic Arms Industry Revenue Share (%), by Application 2024 & 2032

- Figure 48: Middle East and Africa Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 49: Middle East and Africa Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Laboratory Robotic Arms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Laboratory Robotic Arms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Laboratory Robotic Arms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Laboratory Robotic Arms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Laboratory Robotic Arms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Laboratory Robotic Arms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Laboratory Robotic Arms Industry?

The projected CAGR is approximately 11.50%.

2. Which companies are prominent players in the Laboratory Robotic Arms Industry?

Key companies in the market include Beckman Coulter Inc, QIAGEN NV, Biomrieux SA, Perkinelmer Inc, Thermo Fisher Scientific Inc, Siemens Healthineers AG, Anton Paar GmbH, Abbott Laboratorie, Hamilton Company, Tecan Group, Hudson Robotics Inc.

3. What are the main segments of the Laboratory Robotic Arms Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend of Lab automation; Increasing Focus Towards Work-safety in Laboratories.

6. What are the notable trends driving market growth?

Genomics and Proteomics Application is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Expensive Initial Setup.

8. Can you provide examples of recent developments in the market?

August 2022 - Researchers at Northwestern University's Center for Robotics and Biosystems developed new collaborative mobile robots dubbed Omnid Mocobots. They are designed to cooperate with humans to pick up, handle, and transport delicate and flexible payloads. The unique robotic system has a mobile base and a robotic arm. It has three essential features that set it apart from other robots. The first is the robot arms with built-in mechanical compliance. Second, the robot arms have precisely controlled forces at their grippers. Third, the control laws governing the mobile base and manipulator allow teams of Omnids to render a large object weightless to the human.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Laboratory Robotic Arms Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Laboratory Robotic Arms Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Laboratory Robotic Arms Industry?

To stay informed about further developments, trends, and reports in the Laboratory Robotic Arms Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence