Key Insights

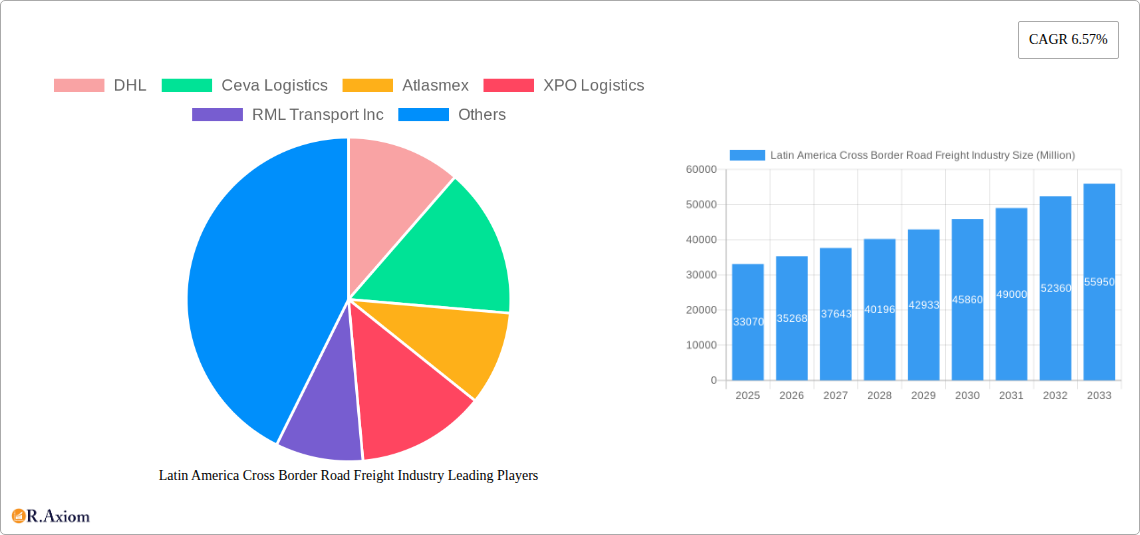

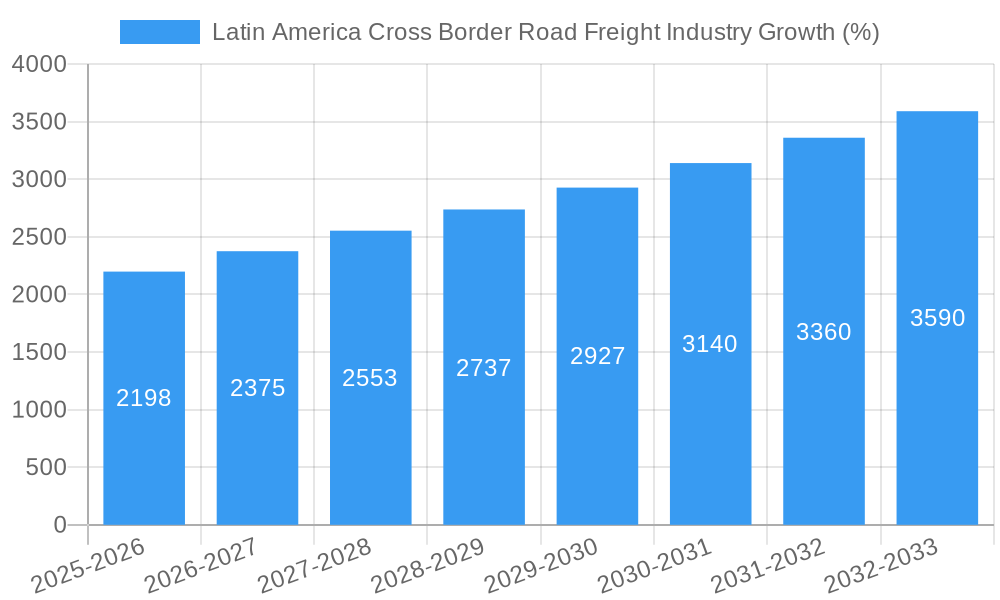

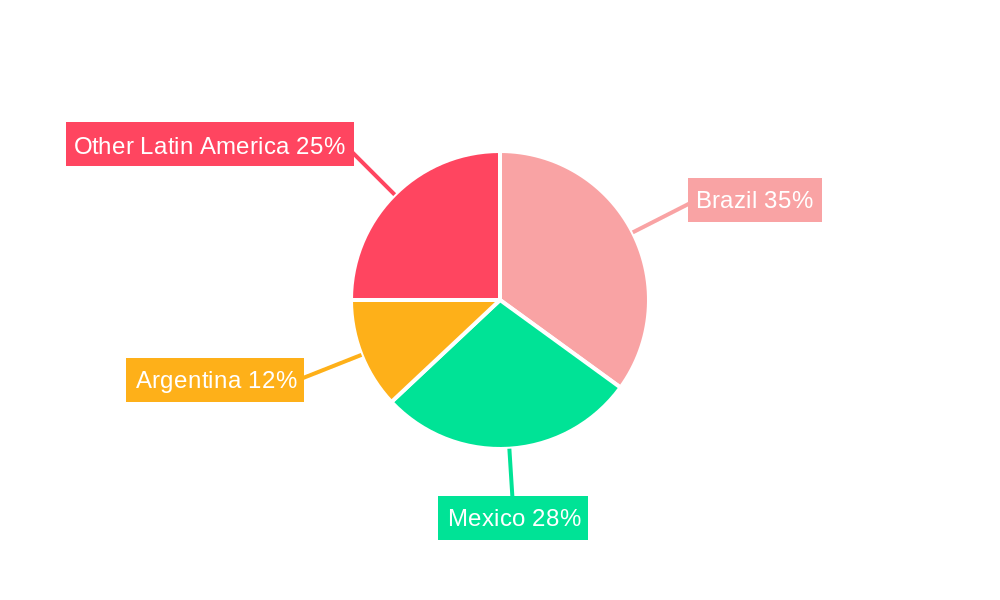

The Latin American cross-border road freight market, valued at $33.07 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.57% from 2025 to 2033. This expansion is fueled by several key factors. Increasing cross-border trade within Latin America, spurred by regional trade agreements like MERCOSUR and the Pacific Alliance, stimulates demand for efficient and reliable road freight solutions. The growth of e-commerce and the need for faster delivery times further propel this market. Furthermore, the development of improved infrastructure, including highways and border crossings, is facilitating smoother transportation flows and reducing transit times. The market is segmented by function (FTL, LTL, CEP) and end-user (chemicals, agriculture, construction, pharmaceuticals, manufacturing, etc.), with FTL and LTL likely dominating due to their cost-effectiveness for bulk shipments. Major players like DHL, Ceva Logistics, Kuehne + Nagel, and XPO Logistics are actively shaping the market through technological investments and strategic partnerships. However, challenges remain, including fluctuating fuel prices, border complexities, and infrastructure limitations in certain regions, potentially affecting growth trajectory. Despite these challenges, the market's growth trajectory remains positive, driven by the region's expanding economies and growing integration in global trade. Brazil, Mexico, and Argentina are key regional players due to their substantial economies and geographic locations.

The forecast for the Latin American cross-border road freight industry indicates continued expansion through 2033. Growth will be largely influenced by economic conditions within individual Latin American countries, the success of ongoing infrastructure development projects, and advancements in logistics technology, such as real-time tracking and optimized routing systems. The pharmaceutical and healthcare sector is likely to show particularly strong growth, driven by increasing demand for timely delivery of temperature-sensitive goods. Similarly, the e-commerce boom continues to boost the CEP segment's demand for quick, reliable delivery. Competitive pressures among major logistics providers will likely drive innovation and efficiency improvements throughout the forecast period. While regulatory hurdles and geopolitical factors may introduce some volatility, the overall outlook for this market remains positive, driven by fundamental economic and logistical trends within Latin America.

This comprehensive report provides an in-depth analysis of the Latin America cross-border road freight industry, covering the period from 2019 to 2033. It offers actionable insights into market dynamics, competitive landscapes, and future growth potential, making it an invaluable resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive data analysis to project a market valued at $XX Million by 2025 and anticipates a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033.

Latin America Cross Border Road Freight Industry Market Concentration & Innovation

This section analyzes the competitive intensity of the Latin American cross-border road freight market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report assesses the market share of key players including DHL, Ceva Logistics, Atlasmex, XPO Logistics, RML Transport Inc, Kuehne Nagel, Gefco Logistica, CH Robinson Worldwide Inc, Dibiagi Transporte Internacional, FC Cargo, and others. We analyze the impact of technological advancements, such as telematics and route optimization software, on market concentration and efficiency. Regulatory frameworks, including cross-border permits and customs regulations, are also evaluated for their influence on market access and operational costs. Furthermore, the report explores the impact of product substitutes, such as rail and air freight, and assesses the growing influence of e-commerce on the industry. Finally, the report analyzes recent M&A activities, providing details on deal values and their implications for market consolidation. The market share held by the top 5 players is estimated at approximately XX%, indicating a moderately consolidated market with opportunities for both organic growth and strategic acquisitions. M&A deal values in the past five years have totaled approximately $XX Million, reflecting a significant level of industry consolidation.

Latin America Cross Border Road Freight Industry Industry Trends & Insights

This section delves into the key trends and insights shaping the Latin American cross-border road freight industry. The analysis examines the growth drivers, including the expanding e-commerce sector, increasing cross-border trade, and infrastructure development in key regions. The impact of technological disruptions, such as the adoption of digital freight platforms and autonomous vehicles, is thoroughly explored. The report analyzes consumer preferences, focusing on the growing demand for faster delivery times, increased transparency, and enhanced security. Competitive dynamics are also examined, focusing on pricing strategies, service offerings, and the emergence of new business models. We also explore the impact of macroeconomic factors, such as fluctuating fuel prices and economic growth rates, on market performance. The industry exhibits a robust growth trajectory, driven by expanding trade within and outside Latin America. The report's detailed analysis includes regional variations and a breakdown by segment, providing a holistic view of the market’s dynamic structure. Market penetration for digital freight platforms is estimated at approximately XX% in 2025, highlighting the ongoing digital transformation within the industry.

Dominant Markets & Segments in Latin America Cross Border Road Freight Industry

This section identifies the dominant markets and segments within the Latin American cross-border road freight industry. We analyze market performance by region, country, and segment, using both the "By Function" (Full Truck Load (FTL), Less than Truck Load (LTL), Courier, Express, and Parcel (CEP)) and "By End User" (Chemicals, Agriculture, Fishing, and Forestry, Construction, Distributive Trade, Pharmaceutical and Healthcare, Manufacturing and Automotive) classifications.

Dominant Regions/Countries:

- Mexico: Benefits from its proximity to the US market and robust manufacturing sector.

- Brazil: Largest economy in Latin America, driving significant freight volumes.

- Colombia: Strategic location for cross-border trade within the Andean region.

Dominant Segments:

- By Function: FTL remains the dominant segment, due to its efficiency for large shipments. LTL is experiencing growth due to its cost-effectiveness for smaller businesses. The CEP segment is booming due to the rise of e-commerce.

- By End User: The manufacturing and automotive sectors drive significant freight volumes, followed by the distributive trade and chemical industries. Growth in the pharmaceutical and healthcare sector is also notable.

Key Drivers:

- Economic Growth: Expanding economies drive increased trade and freight volumes.

- Infrastructure Development: Improvements to roads and border crossings enhance efficiency and reduce transit times.

- Government Policies: Favorable trade agreements and regulatory frameworks encourage cross-border trade.

Latin America Cross Border Road Freight Industry Product Developments

The Latin American cross-border road freight industry is experiencing significant product innovation, driven by technological advancements and evolving customer needs. This includes the integration of advanced telematics systems for real-time tracking and monitoring, the development of sophisticated route optimization software to improve efficiency and reduce fuel consumption, and the implementation of digital freight platforms that streamline logistics processes and enhance transparency across the supply chain. Furthermore, advancements in cold chain logistics are improving the transport of temperature-sensitive goods. These innovations enhance operational efficiency, improve delivery reliability, and increase transparency for clients, resulting in enhanced competitiveness and improved market fit.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Latin American cross-border road freight market, segmented by function and end-user.

By Function:

- FTL: The FTL segment accounts for XX% of the market in 2025, and is projected to grow at a CAGR of XX% during the forecast period.

- LTL: The LTL segment comprises XX% of the market in 2025, experiencing a CAGR of XX%.

- CEP: The CEP segment is a fast-growing sector, with XX% market share in 2025 and projected CAGR of XX%.

By End User:

Each end-user segment displays unique growth characteristics reflecting industry-specific dynamics and trade patterns across the region. Specific market sizes and growth projections are detailed within the full report.

Key Drivers of Latin America Cross Border Road Freight Industry Growth

The growth of the Latin American cross-border road freight industry is propelled by several key factors. Increased intra-regional trade spurred by economic growth in several countries is a significant driver. Furthermore, the expansion of e-commerce is creating strong demand for efficient and reliable delivery services. Technological advancements, such as the adoption of digital freight platforms and telematics, are enhancing operational efficiency and transparency. Finally, government initiatives aimed at improving infrastructure and streamlining cross-border regulations are supporting industry growth.

Challenges in the Latin America Cross Border Road Freight Industry Sector

The Latin American cross-border road freight industry faces several challenges. Infrastructure deficiencies in certain regions, including poorly maintained roads and limited border crossing capacity, lead to increased transit times and higher costs. Bureaucratic processes and inconsistent regulations across different countries create operational complexities. Fluctuations in fuel prices and currency exchange rates impact profitability. Finally, intense competition among numerous players, including both established logistics providers and smaller regional operators, adds to the challenges faced by the industry. These challenges contribute to increased operational costs and reduce overall profitability for many companies within the market.

Emerging Opportunities in Latin America Cross Border Road Freight Industry

The Latin American cross-border road freight industry presents significant emerging opportunities. The continued growth of e-commerce across the region necessitates efficient last-mile delivery solutions. The increasing adoption of technology, particularly blockchain for enhanced security and transparency, offers opportunities for innovation. Moreover, the development of sustainable transportation solutions, such as the use of alternative fuels and electric vehicles, presents opportunities for companies to differentiate themselves and meet growing environmental concerns. Further opportunities lie in the expansion of trade relationships and the development of key infrastructure projects across the region.

Leading Players in the Latin America Cross Border Road Freight Industry Market

- DHL

- Ceva Logistics

- Atlasmex

- XPO Logistics

- RML Transport Inc

- Kuehne Nagel

- Gefco Logistica

- CH Robinson Worldwide Inc

- Dibiagi Transporte Internacional

- FC Cargo

Key Developments in Latin America Cross Border Road Freight Industry Industry

- 2022 Q4: DHL launches a new cross-border trucking service between Mexico and the United States, enhancing its service offerings.

- 2023 Q1: Several major players invest heavily in digital freight platforms, improving operational efficiency.

- 2023 Q2: New cross-border regulations in Colombia impact transit times for certain goods.

(Further developments will be detailed within the full report)

Strategic Outlook for Latin America Cross Border Road Freight Industry Market

The Latin American cross-border road freight industry is poised for continued growth, driven by sustained economic development, the expansion of e-commerce, and technological advancements. Opportunities abound for companies that can adapt to changing market dynamics, embrace innovation, and effectively navigate the challenges posed by infrastructure limitations and regulatory hurdles. Focus on enhancing efficiency, providing enhanced transparency, and meeting growing sustainability expectations are key strategic elements for success in this dynamic and evolving market. The market is expected to experience a period of sustained expansion, with significant opportunities for both existing players and new entrants.

Latin America Cross Border Road Freight Industry Segmentation

-

1. Function

- 1.1. Full Truck Load (FTL)

- 1.2. Less than Truck Load (LTL)

- 1.3. Courier, Express, and Parcel (CEP)

-

2. End User

- 2.1. Chemicals

- 2.2. Agriculture, Fishing, and Forestry

- 2.3. Construction

- 2.4. Distributive Trade

- 2.5. Pharmaceutical and Healthcare

- 2.6. Manufacturing and Automotive

-

3. Geography

- 3.1. Mexico

- 3.2. Brazil

- 3.3. Argentina

- 3.4. Chile

- 3.5. Colombia

- 3.6. Rest of Latin America

Latin America Cross Border Road Freight Industry Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Argentina

- 4. Chile

- 5. Colombia

- 6. Rest of Latin America

Latin America Cross Border Road Freight Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market

- 3.3. Market Restrains

- 3.3.1. 4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Oil and Gas Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Full Truck Load (FTL)

- 5.1.2. Less than Truck Load (LTL)

- 5.1.3. Courier, Express, and Parcel (CEP)

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Chemicals

- 5.2.2. Agriculture, Fishing, and Forestry

- 5.2.3. Construction

- 5.2.4. Distributive Trade

- 5.2.5. Pharmaceutical and Healthcare

- 5.2.6. Manufacturing and Automotive

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Mexico

- 5.3.2. Brazil

- 5.3.3. Argentina

- 5.3.4. Chile

- 5.3.5. Colombia

- 5.3.6. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.4.2. Brazil

- 5.4.3. Argentina

- 5.4.4. Chile

- 5.4.5. Colombia

- 5.4.6. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Mexico Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Function

- 6.1.1. Full Truck Load (FTL)

- 6.1.2. Less than Truck Load (LTL)

- 6.1.3. Courier, Express, and Parcel (CEP)

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Chemicals

- 6.2.2. Agriculture, Fishing, and Forestry

- 6.2.3. Construction

- 6.2.4. Distributive Trade

- 6.2.5. Pharmaceutical and Healthcare

- 6.2.6. Manufacturing and Automotive

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Mexico

- 6.3.2. Brazil

- 6.3.3. Argentina

- 6.3.4. Chile

- 6.3.5. Colombia

- 6.3.6. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Function

- 7. Brazil Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Function

- 7.1.1. Full Truck Load (FTL)

- 7.1.2. Less than Truck Load (LTL)

- 7.1.3. Courier, Express, and Parcel (CEP)

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Chemicals

- 7.2.2. Agriculture, Fishing, and Forestry

- 7.2.3. Construction

- 7.2.4. Distributive Trade

- 7.2.5. Pharmaceutical and Healthcare

- 7.2.6. Manufacturing and Automotive

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Mexico

- 7.3.2. Brazil

- 7.3.3. Argentina

- 7.3.4. Chile

- 7.3.5. Colombia

- 7.3.6. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Function

- 8. Argentina Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Function

- 8.1.1. Full Truck Load (FTL)

- 8.1.2. Less than Truck Load (LTL)

- 8.1.3. Courier, Express, and Parcel (CEP)

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Chemicals

- 8.2.2. Agriculture, Fishing, and Forestry

- 8.2.3. Construction

- 8.2.4. Distributive Trade

- 8.2.5. Pharmaceutical and Healthcare

- 8.2.6. Manufacturing and Automotive

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Mexico

- 8.3.2. Brazil

- 8.3.3. Argentina

- 8.3.4. Chile

- 8.3.5. Colombia

- 8.3.6. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Function

- 9. Chile Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Function

- 9.1.1. Full Truck Load (FTL)

- 9.1.2. Less than Truck Load (LTL)

- 9.1.3. Courier, Express, and Parcel (CEP)

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Chemicals

- 9.2.2. Agriculture, Fishing, and Forestry

- 9.2.3. Construction

- 9.2.4. Distributive Trade

- 9.2.5. Pharmaceutical and Healthcare

- 9.2.6. Manufacturing and Automotive

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Mexico

- 9.3.2. Brazil

- 9.3.3. Argentina

- 9.3.4. Chile

- 9.3.5. Colombia

- 9.3.6. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Function

- 10. Colombia Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Function

- 10.1.1. Full Truck Load (FTL)

- 10.1.2. Less than Truck Load (LTL)

- 10.1.3. Courier, Express, and Parcel (CEP)

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Chemicals

- 10.2.2. Agriculture, Fishing, and Forestry

- 10.2.3. Construction

- 10.2.4. Distributive Trade

- 10.2.5. Pharmaceutical and Healthcare

- 10.2.6. Manufacturing and Automotive

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Mexico

- 10.3.2. Brazil

- 10.3.3. Argentina

- 10.3.4. Chile

- 10.3.5. Colombia

- 10.3.6. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Function

- 11. Rest of Latin America Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Function

- 11.1.1. Full Truck Load (FTL)

- 11.1.2. Less than Truck Load (LTL)

- 11.1.3. Courier, Express, and Parcel (CEP)

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Chemicals

- 11.2.2. Agriculture, Fishing, and Forestry

- 11.2.3. Construction

- 11.2.4. Distributive Trade

- 11.2.5. Pharmaceutical and Healthcare

- 11.2.6. Manufacturing and Automotive

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Mexico

- 11.3.2. Brazil

- 11.3.3. Argentina

- 11.3.4. Chile

- 11.3.5. Colombia

- 11.3.6. Rest of Latin America

- 11.1. Market Analysis, Insights and Forecast - by Function

- 12. Brazil Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 13. Argentina Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 14. Mexico Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 15. Peru Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 16. Chile Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Latin America Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 DHL

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Ceva Logistics

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Atlasmex

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 XPO Logistics

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 RML Transport Inc

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Kuehne Nagel

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Gefco Logistica

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 CH Robinson Worldwide Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Dibiagi Transporte Internacional**List Not Exhaustive

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 FC Cargo

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 DHL

List of Figures

- Figure 1: Latin America Cross Border Road Freight Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Cross Border Road Freight Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 3: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil Latin America Cross Border Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina Latin America Cross Border Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Latin America Cross Border Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Peru Latin America Cross Border Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Chile Latin America Cross Border Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Latin America Latin America Cross Border Road Freight Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 14: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 18: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 19: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 22: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 23: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 26: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 27: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 30: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 31: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 34: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 35: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 36: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Cross Border Road Freight Industry?

The projected CAGR is approximately 6.57%.

2. Which companies are prominent players in the Latin America Cross Border Road Freight Industry?

Key companies in the market include DHL, Ceva Logistics, Atlasmex, XPO Logistics, RML Transport Inc, Kuehne Nagel, Gefco Logistica, CH Robinson Worldwide Inc, Dibiagi Transporte Internacional**List Not Exhaustive, FC Cargo.

3. What are the main segments of the Latin America Cross Border Road Freight Industry?

The market segments include Function, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.07 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market.

6. What are the notable trends driving market growth?

Increasing Demand from the Oil and Gas Industry.

7. Are there any restraints impacting market growth?

4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Cross Border Road Freight Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Cross Border Road Freight Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Cross Border Road Freight Industry?

To stay informed about further developments, trends, and reports in the Latin America Cross Border Road Freight Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence