Key Insights

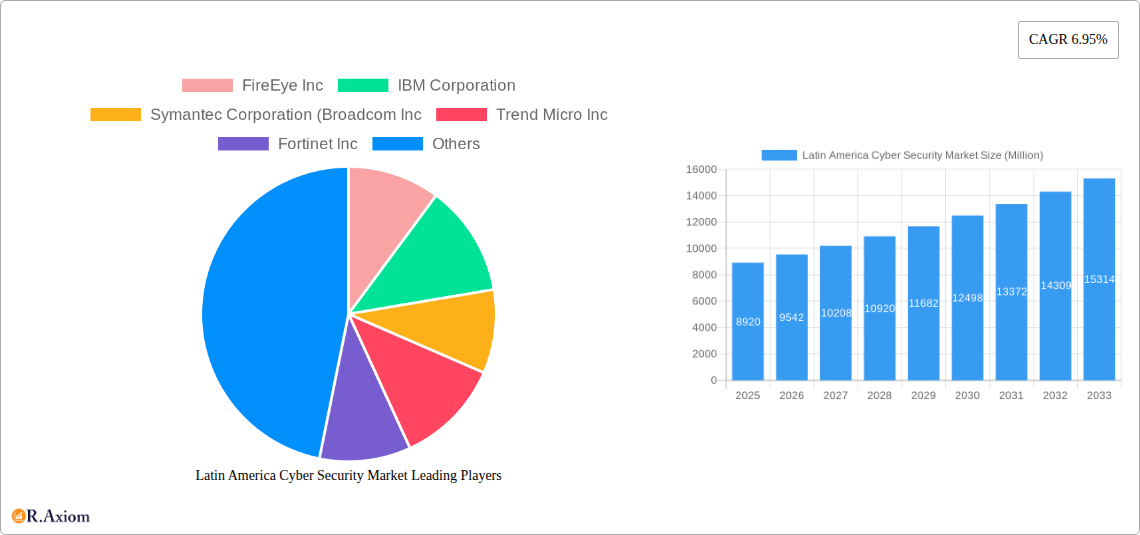

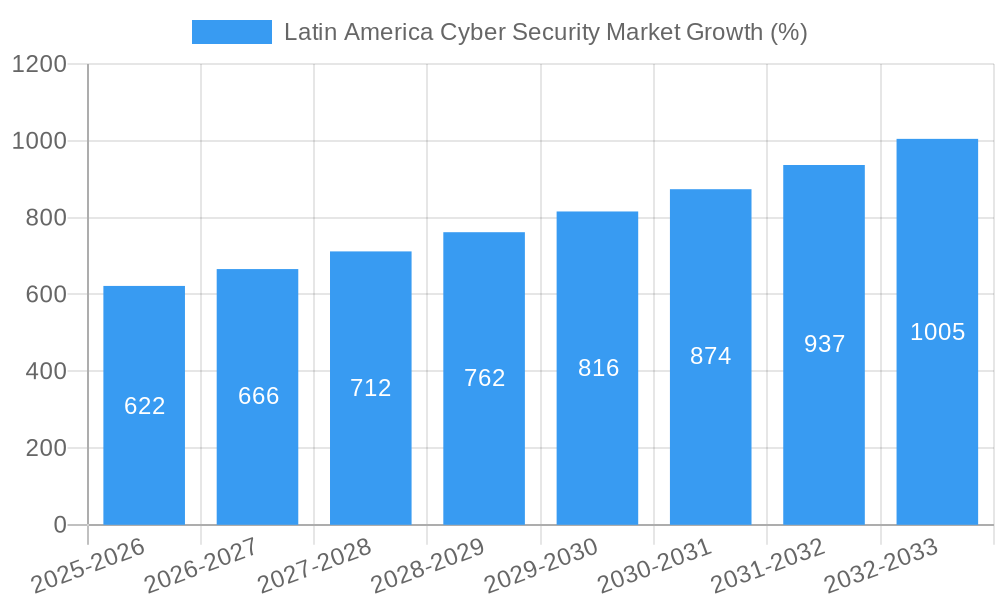

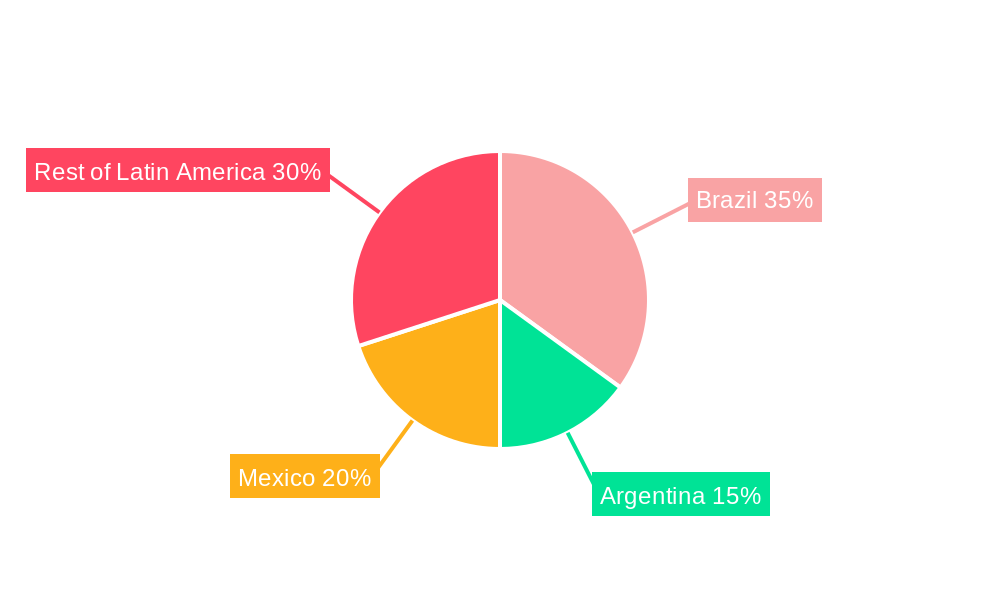

The Latin American cybersecurity market, valued at $8.92 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.95% from 2025 to 2033. This expansion is driven by several key factors. Increasing digitalization across sectors like banking, finance, healthcare, and retail fuels demand for robust security solutions. The rising incidence of cyberattacks targeting Latin American businesses and government institutions necessitates enhanced cybersecurity measures. Furthermore, the growing adoption of cloud computing and the expanding Internet of Things (IoT) ecosystem introduce new vulnerabilities, pushing organizations to invest in cloud security, endpoint security, and wireless network security solutions. Brazil, Argentina, and Mexico represent the largest national markets, reflecting their advanced digital infrastructure and economies. However, the "Rest of Latin America" segment also demonstrates significant growth potential, driven by increasing internet penetration and government initiatives promoting digital transformation. The market is segmented by security type (network, cloud, application, endpoint, wireless), component (hardware, software, services), deployment (cloud, on-premise), and end-user industry. The competitive landscape includes major players like FireEye, IBM, Symantec, Trend Micro, and Fortinet, along with regional and specialized cybersecurity firms.

The market's growth trajectory is expected to be influenced by several trends. The increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) in cybersecurity solutions will enhance threat detection and response capabilities. Government regulations aimed at improving data protection and privacy will further stimulate market demand. However, factors like budget constraints among smaller businesses and a shortage of skilled cybersecurity professionals in the region could potentially restrain market growth. To mitigate these challenges, investments in cybersecurity awareness programs and talent development initiatives will be crucial. The market will likely see an increased focus on proactive security measures and integrated security solutions to address the evolving threat landscape. Furthermore, the growing adoption of managed security services (MSS) is expected to contribute significantly to market growth. The forecast period of 2025-2033 promises substantial opportunities for cybersecurity vendors to capitalize on the growing demand for advanced security solutions within the Latin American region.

Latin America Cybersecurity Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America cybersecurity market, covering the period from 2019 to 2033. It offers actionable insights into market dynamics, segmentation, key players, and future growth prospects, equipping stakeholders with the knowledge needed to navigate this rapidly evolving landscape. The report includes detailed market sizing (in Millions) and forecasts, covering historical data (2019-2024), the base year (2025), and the forecast period (2025-2033).

Latin America Cyber Security Market Concentration & Innovation

The Latin American cybersecurity market exhibits a moderately concentrated landscape, with a handful of multinational corporations holding significant market share. However, the emergence of regional players and specialized niche providers is increasing competition. Innovation is driven by the rising adoption of cloud computing, the growing sophistication of cyber threats, and stringent data privacy regulations. The market is witnessing significant M&A activity, with larger players acquiring smaller firms to expand their product portfolios and geographic reach. Deal values have varied, with some exceeding xx Million while others fall within the xx-xx Million range.

- Market Share: Top 5 players command approximately xx% of the market in 2025.

- M&A Activity: An average of xx M&A deals occurred annually between 2019-2024, with total deal value exceeding xx Million.

- Regulatory Frameworks: Varying data protection laws across Latin American countries are influencing security investments.

- Product Substitutes: Open-source security solutions and cloud-based services are emerging as alternatives to traditional on-premise solutions.

- End-User Trends: Increasing adoption of BYOD policies and cloud services are increasing the attack surface for businesses and driving security spending.

Latin America Cyber Security Market Industry Trends & Insights

The Latin American cybersecurity market is experiencing robust growth, driven by factors such as rising digitalization, increasing cyber threats, and government initiatives to enhance cybersecurity infrastructure. The market is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. This growth is fueled by the increasing adoption of cloud-based security solutions, the expanding use of IoT devices, and the rising awareness of data privacy concerns. The market penetration of cybersecurity solutions, particularly in the banking, financial services, and insurance (BFSI) sectors, is high and continues to rise. Technological disruptions, such as the advent of AI and machine learning in threat detection, are reshaping the competitive landscape, pushing vendors to constantly innovate and offer advanced solutions. Consumer preferences are shifting towards cloud-based solutions and managed security services, which offer scalability and cost-effectiveness. Competitive dynamics are characterized by intense competition among established players and the emergence of innovative startups, creating a vibrant ecosystem of solutions and services.

Dominant Markets & Segments in Latin America Cyber Security Market

Leading Region/Country: Brazil dominates the Latin American cybersecurity market due to its large economy and advanced digital infrastructure. Mexico and Argentina also represent substantial market opportunities.

Dominant Segments:

- Security Type: Network security holds the largest market share, followed by cloud security and endpoint security. The growing adoption of cloud services is driving the growth of cloud security solutions.

- Component: Solutions segment dominates over hardware due to higher demand for managed security services and software-based security solutions.

- Deployment: Cloud deployment is gaining traction, driven by the increasing adoption of cloud services.

- End-user Industry: The BFSI sector represents a significant portion of the market due to the high value of sensitive data and stringent regulatory requirements. The government and IT & telecommunication sectors are also substantial contributors.

Key Drivers:

- Brazil: Strong economic growth, robust digital infrastructure, and increasing government focus on cybersecurity.

- Mexico: Growing e-commerce adoption and government initiatives to promote digital inclusion.

- Argentina: Expanding digital economy and rising adoption of cloud technologies.

- Rest of Latin America: Diverse market with significant growth potential in specific sectors.

Latin America Cyber Security Market Product Developments

Recent product developments showcase a trend towards integrated security solutions, AI-powered threat detection, and cloud-native security platforms. Vendors are focusing on providing user-friendly, scalable, and cost-effective solutions to meet the diverse needs of businesses across various sectors. This is evidenced by the emergence of cloud-integrated firewalls and identity-based security browsers, improving the efficiency and security of hybrid work environments. These advancements offer enhanced threat prevention, improved operational efficiency, and greater protection for businesses across diverse digital landscapes.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Latin American cybersecurity market, segmented by country (Brazil, Argentina, Mexico, Rest of Latin America), security type (Network, Cloud, Application, Endpoint, Wireless, Other), component (Hardware, Solutions, Services), deployment (Cloud, On-premise), and end-user industry (BFSI, Healthcare, Manufacturing, Retail, Government, IT & Telecommunication, Others). Each segment's growth projection, market size (in Millions), and competitive dynamics are thoroughly analyzed. For example, the cloud security segment is expected to show the highest growth in the forecast period, driven by increasing cloud adoption and improved security solutions.

Key Drivers of Latin America Cyber Security Market Growth

The Latin American cybersecurity market is primarily driven by factors such as increasing digitalization across industries, rising cybercrime rates, stringent data protection regulations (e.g., GDPR influence), and government initiatives promoting cybersecurity awareness and infrastructure development. Investments in cloud-based security solutions and increased adoption of managed security services are additional significant drivers.

Challenges in the Latin America Cyber Security Market Sector

Challenges include a shortage of skilled cybersecurity professionals, limited cybersecurity awareness among businesses, particularly SMEs, and a fragmented regulatory landscape across different countries. These factors contribute to slow adoption rates of advanced security technologies and significant financial losses associated with cyberattacks. Budget constraints, especially among smaller enterprises, further impede effective security investments.

Emerging Opportunities in Latin America Cyber Security Market

Emerging opportunities stem from increasing adoption of IoT devices, growing demand for cloud-based security solutions, and the emergence of new cybersecurity threats. The growing focus on digital transformation and the adoption of AI and machine learning in threat detection provide new opportunities for vendors specializing in these technologies. The increasing government support for cybersecurity initiatives and the development of cybersecurity clusters in major cities also represent attractive avenues for expansion.

Leading Players in the Latin America Cyber Security Market Market

- FireEye Inc

- IBM Corporation

- Symantec Corporation (Broadcom Inc)

- Trend Micro Inc

- Fortinet Inc

- Imperva Inc

- Check Point Software Technologies Ltd

- Cisco Systems Inc

- AVG Technologies

- CyberArk Software Ltd

- Dell Technologies Inc

- Intel Corporation

Key Developments in Latin America Cyber Security Market Industry

- May 2023: Check Point Software Technologies Ltd launched its Next-Generation Cloud Firewall integrated with Microsoft Azure Virtual WAN, enhancing cloud security and operational efficiency.

- May 2023: CyberArk Software Ltd introduced a secure browser, improving identity-based security for employee and third-party access to enterprise resources, shaping the future of enterprise browser security.

Strategic Outlook for Latin America Cyber Security Market Market

The Latin American cybersecurity market presents significant growth potential, driven by robust economic expansion, expanding digitalization, and a rising awareness of cyber risks. Opportunities exist in providing advanced security solutions such as AI-powered threat detection, cloud-native security platforms, and managed security services. Focus on addressing the skills gap, promoting cybersecurity awareness, and adapting to the evolving threat landscape will be crucial for sustained growth in the coming years.

Latin America Cyber Security Market Segmentation

-

1. Security Type

- 1.1. Network Security

- 1.2. Cloud Security

- 1.3. Application Security

- 1.4. End-point Security

- 1.5. Wireless Network Security

- 1.6. Other Types of Security

-

2. Component

- 2.1. Hardware

- 2.2. Solution

- 2.3. Services

-

3. Deployment

- 3.1. Cloud

- 3.2. On-premise

-

4. End-user Industry

- 4.1. Banking, Financial Services, and Insurance

- 4.2. Healthcare

- 4.3. Manufacturing

- 4.4. Retail

- 4.5. Government

- 4.6. IT and Telecommunication

- 4.7. Other End-user Industries

Latin America Cyber Security Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Cyber Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.95% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Increasing Cybersecurity Incidents and Regulations Requiring their Reporting; Growing M2M/IoT Connections Demanding Strengthened Cybersecurity in Enterprises

- 3.3. Market Restrains

- 3.3.1. Lack of Cybersecurity Professionals

- 3.4. Market Trends

- 3.4.1. Growing M2M/IoT Connections Demanding Strengthened Cybersecurity in Enterprises

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Cyber Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Security Type

- 5.1.1. Network Security

- 5.1.2. Cloud Security

- 5.1.3. Application Security

- 5.1.4. End-point Security

- 5.1.5. Wireless Network Security

- 5.1.6. Other Types of Security

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Hardware

- 5.2.2. Solution

- 5.2.3. Services

- 5.3. Market Analysis, Insights and Forecast - by Deployment

- 5.3.1. Cloud

- 5.3.2. On-premise

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Banking, Financial Services, and Insurance

- 5.4.2. Healthcare

- 5.4.3. Manufacturing

- 5.4.4. Retail

- 5.4.5. Government

- 5.4.6. IT and Telecommunication

- 5.4.7. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Security Type

- 6. Brazil Latin America Cyber Security Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Cyber Security Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Cyber Security Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Cyber Security Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Cyber Security Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Cyber Security Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 FireEye Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 IBM Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Symantec Corporation (Broadcom Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Trend Micro Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Fortinet Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Imperva Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Check Point Software Technologies Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Cisco Systems Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 AVG Technologies

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Cyber Ark Software Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Dell Technologies Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Intel Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 FireEye Inc

List of Figures

- Figure 1: Latin America Cyber Security Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Cyber Security Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Cyber Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Cyber Security Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Latin America Cyber Security Market Revenue Million Forecast, by Security Type 2019 & 2032

- Table 4: Latin America Cyber Security Market Volume K Unit Forecast, by Security Type 2019 & 2032

- Table 5: Latin America Cyber Security Market Revenue Million Forecast, by Component 2019 & 2032

- Table 6: Latin America Cyber Security Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 7: Latin America Cyber Security Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 8: Latin America Cyber Security Market Volume K Unit Forecast, by Deployment 2019 & 2032

- Table 9: Latin America Cyber Security Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: Latin America Cyber Security Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 11: Latin America Cyber Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Latin America Cyber Security Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: Latin America Cyber Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Latin America Cyber Security Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Brazil Latin America Cyber Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Brazil Latin America Cyber Security Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Argentina Latin America Cyber Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina Latin America Cyber Security Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Mexico Latin America Cyber Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Latin America Cyber Security Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Peru Latin America Cyber Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Peru Latin America Cyber Security Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Chile Latin America Cyber Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Chile Latin America Cyber Security Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Latin America Latin America Cyber Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Latin America Latin America Cyber Security Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Latin America Cyber Security Market Revenue Million Forecast, by Security Type 2019 & 2032

- Table 28: Latin America Cyber Security Market Volume K Unit Forecast, by Security Type 2019 & 2032

- Table 29: Latin America Cyber Security Market Revenue Million Forecast, by Component 2019 & 2032

- Table 30: Latin America Cyber Security Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 31: Latin America Cyber Security Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 32: Latin America Cyber Security Market Volume K Unit Forecast, by Deployment 2019 & 2032

- Table 33: Latin America Cyber Security Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 34: Latin America Cyber Security Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 35: Latin America Cyber Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Latin America Cyber Security Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: Brazil Latin America Cyber Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Brazil Latin America Cyber Security Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Argentina Latin America Cyber Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Argentina Latin America Cyber Security Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Chile Latin America Cyber Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Chile Latin America Cyber Security Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Colombia Latin America Cyber Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Colombia Latin America Cyber Security Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Mexico Latin America Cyber Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Mexico Latin America Cyber Security Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Peru Latin America Cyber Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Peru Latin America Cyber Security Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Venezuela Latin America Cyber Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Venezuela Latin America Cyber Security Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Ecuador Latin America Cyber Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Ecuador Latin America Cyber Security Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Bolivia Latin America Cyber Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Bolivia Latin America Cyber Security Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Paraguay Latin America Cyber Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Paraguay Latin America Cyber Security Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Cyber Security Market?

The projected CAGR is approximately 6.95%.

2. Which companies are prominent players in the Latin America Cyber Security Market?

Key companies in the market include FireEye Inc, IBM Corporation, Symantec Corporation (Broadcom Inc, Trend Micro Inc, Fortinet Inc, Imperva Inc, Check Point Software Technologies Ltd, Cisco Systems Inc, AVG Technologies, Cyber Ark Software Ltd, Dell Technologies Inc, Intel Corporation.

3. What are the main segments of the Latin America Cyber Security Market?

The market segments include Security Type, Component, Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Increasing Cybersecurity Incidents and Regulations Requiring their Reporting; Growing M2M/IoT Connections Demanding Strengthened Cybersecurity in Enterprises.

6. What are the notable trends driving market growth?

Growing M2M/IoT Connections Demanding Strengthened Cybersecurity in Enterprises.

7. Are there any restraints impacting market growth?

Lack of Cybersecurity Professionals.

8. Can you provide examples of recent developments in the market?

May 2023 - Check Point Software Technologies Ltd has announced the general availability of its industry-leading Next-Generation Cloud Firewall natively integrated with Microsoft Azure Virtual WAN to provide customers with top-notch security. The integration offers advanced threat prevention and multi-layered network security across public, private, and hybrid clouds, enabling businesses to migrate confidently to Azure with maximum operational efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Cyber Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Cyber Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Cyber Security Market?

To stay informed about further developments, trends, and reports in the Latin America Cyber Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence