Key Insights

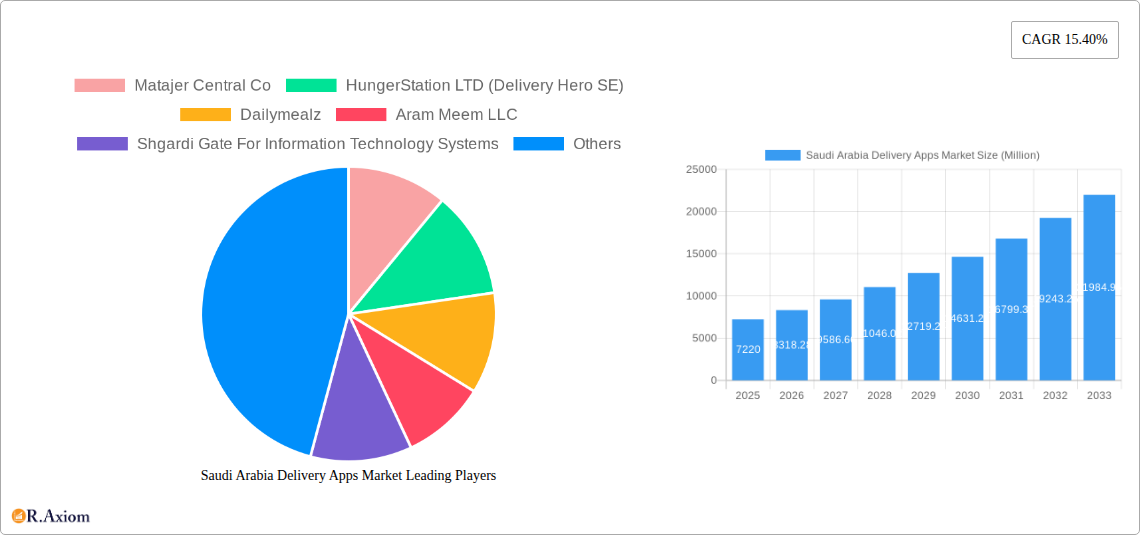

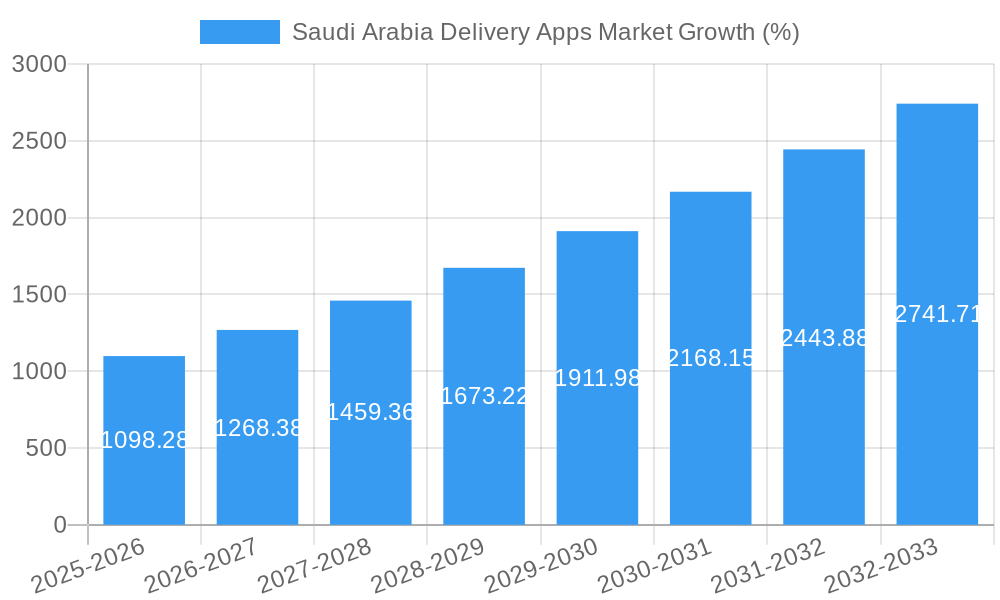

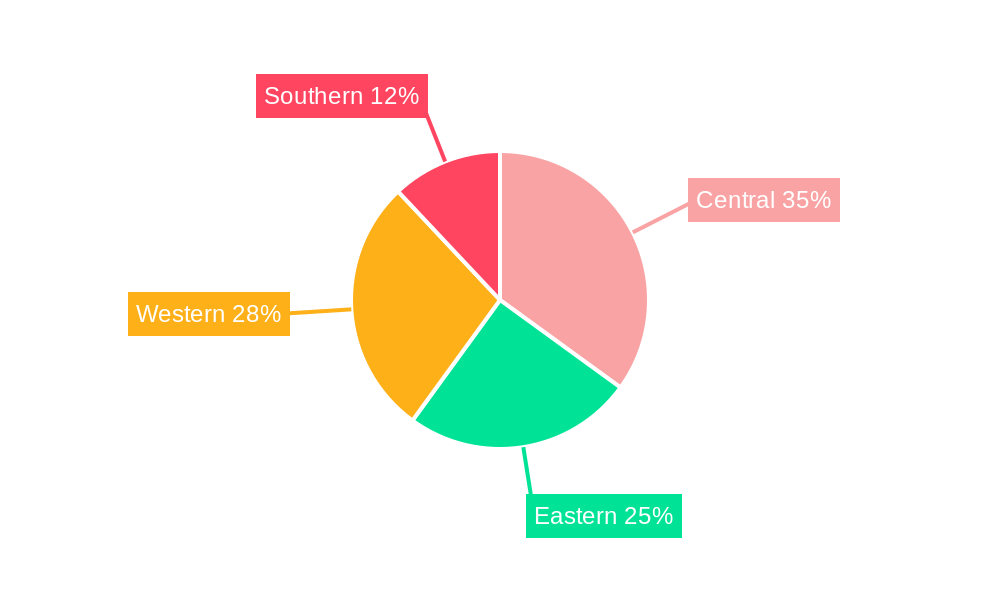

The Saudi Arabia on-demand delivery apps market, valued at $7.22 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 15.40% from 2025 to 2033. This surge is fueled by several key factors. The increasing smartphone penetration and internet access across the Kingdom are creating a vast pool of potential users comfortable with digital transactions. Furthermore, a burgeoning young population with high disposable incomes and a preference for convenience is driving demand for food, grocery, and pharmacy delivery services. The government's initiatives to promote digitalization and e-commerce further bolster market growth. Competition among established players like Talabat, HungerStation, and Jahez, alongside new entrants, is fostering innovation and enhancing service offerings, including faster delivery times, wider selection, and attractive promotional offers. The market segmentation reveals significant potential across all service types, with food delivery currently dominating, but grocery and pharmacy delivery segments experiencing rapid expansion. Regional variations are expected, with urban centers like Riyadh and Jeddah showing higher adoption rates compared to more rural areas. However, challenges remain, including infrastructure limitations in certain regions and the need for enhanced logistics to ensure efficient and timely deliveries across the country.

The continuous expansion of this market is likely to attract further investments, leading to technological advancements in delivery optimization, route planning, and customer service. The market's future will depend on addressing these challenges while capitalizing on opportunities presented by the rapidly evolving digital landscape. Increased focus on last-mile delivery solutions and strategic partnerships with logistics providers will be crucial for sustained growth. The incorporation of advanced technologies such as AI and machine learning for enhanced customer experience and operational efficiency will play a defining role in shaping the competitive landscape and market leadership in the coming years. The integration of diverse payment gateways and enhanced cybersecurity measures will also be critical in building customer trust and confidence.

Saudi Arabia Delivery Apps Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Saudi Arabia delivery apps market, encompassing market size, segmentation, competitive landscape, growth drivers, challenges, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is an invaluable resource for industry stakeholders, investors, and businesses seeking to understand and capitalize on the opportunities within this rapidly evolving market. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of XX%.

Saudi Arabia Delivery Apps Market Market Concentration & Innovation

The Saudi Arabian delivery apps market exhibits a moderately concentrated structure, with several key players dominating various segments. Market share data for 2025 reveals that Talabat (Delivery Hero SE) and HungerStation LTD (Delivery Hero SE) hold a combined market share of approximately XX%, indicating significant market dominance in the food delivery sector. Other major players like MRSOOL Inc and Jahez International Company For Information Systems Technology also possess substantial shares. However, the market also displays a significant level of innovation, driven by factors such as increasing smartphone penetration, rising disposable incomes, and government support for digital transformation initiatives. The regulatory framework, while evolving, generally fosters competition and innovation. Product substitutes, such as traditional delivery services, remain present but are gradually losing ground to the convenience and efficiency of delivery apps. End-user trends show a preference for multi-service apps, driving consolidation within the sector. Recent M&A activities have been characterized by strategic acquisitions aimed at expanding service offerings and geographic reach. For example, the merger between X and Y in 2023 resulted in a combined market value of approximately XX Million. Further consolidation is anticipated, with larger players seeking to acquire smaller, specialized companies to broaden their service portfolios.

- Market Leaders: Talabat (Delivery Hero SE), HungerStation LTD (Delivery Hero SE), MRSOOL Inc.

- Market Concentration: Moderately concentrated, with a few dominant players.

- M&A Activity: Significant activity driven by strategic expansion and market consolidation.

- Innovation Drivers: Smartphone penetration, rising incomes, government support for digital transformation.

Saudi Arabia Delivery Apps Market Industry Trends & Insights

The Saudi Arabian delivery apps market is experiencing robust growth, fueled by several key factors. The rising adoption of smartphones and increasing internet penetration have significantly expanded the market's addressable base. Furthermore, changing consumer lifestyles and preferences are driving the demand for convenience and speed, making delivery apps increasingly attractive. Technological disruptions, such as the implementation of advanced logistics solutions and AI-powered delivery optimization, are enhancing efficiency and customer experience. These factors have contributed to a significant increase in market penetration, with XX% of the population now using delivery apps regularly in 2025. The competitive landscape is highly dynamic, with existing players constantly innovating and new entrants emerging, creating a competitive and innovative market. This competition results in better services, lower prices and a wider range of offerings for the customer. The CAGR for the period 2025-2033 is estimated at XX%, reflecting the market's strong growth trajectory. Consumer preferences are shifting towards multi-service platforms, integrating food, grocery, and pharmacy deliveries into a single app, creating new opportunities for market expansion.

Dominant Markets & Segments in Saudi Arabia Delivery Apps Market

The food delivery segment currently dominates the Saudi Arabian delivery apps market, accounting for approximately XX% of the total market value in 2025. This dominance is driven by several key factors:

- High Demand: A large and growing population with rising disposable incomes and a preference for convenience.

- Wide Variety of Restaurants: A diverse culinary scene catering to various tastes and budgets.

- Effective Marketing: Aggressive marketing campaigns by major players leading to high consumer awareness.

The grocery delivery segment is experiencing rapid growth and is projected to be a significant contributor in the coming years, with projected market share of XX% in 2033. Key drivers include:

- Growing Urban Population: Increased demand for home delivery in densely populated urban areas.

- E-commerce Growth: The broader growth of the e-commerce sector fuels demand for grocery delivery.

- Government Initiatives: Support for digital transformation and e-commerce development.

The pharmacy delivery segment is witnessing considerable expansion, boosted by factors such as:

- Increased Healthcare Awareness: Rising awareness of the importance of timely medication delivery.

- Convenience for Patients: Elderly individuals and those with mobility issues particularly benefit.

- Technological Advancements: Efficient logistics and reliable tracking systems.

Other on-demand delivery apps, encompassing diverse services like courier services and specialized product deliveries, hold a smaller market share but are poised for growth.

Saudi Arabia Delivery Apps Market Product Developments

Recent product innovations have focused on enhancing user experience and operational efficiency. Features such as real-time tracking, multiple payment options, and personalized recommendations have become standard. The integration of AI and machine learning into delivery optimization algorithms is improving delivery speeds and reducing costs. Furthermore, the introduction of features like pre-ordering and subscription services is enhancing customer loyalty and providing predictable revenue streams. These developments are driving increased market penetration and fostering fierce competition amongst various providers.

Report Scope & Segmentation Analysis

This report segments the Saudi Arabia delivery apps market by service type:

- Food Delivery Apps: This segment encompasses apps facilitating the delivery of food from restaurants and eateries. The market is characterized by intense competition and rapid innovation, driven by consumer preference for variety and convenience.

- Grocery Delivery Apps: This segment includes apps providing grocery delivery services directly from supermarkets or specialized online grocery stores. The market is experiencing significant growth due to changing consumer habits and increased adoption of online shopping.

- Pharmacy Delivery Apps: This segment focuses on apps specializing in delivering prescription and over-the-counter medications. Market growth is propelled by the convenience factor for patients and the growing elderly population.

- Other On-demand Delivery Apps: This segment encompasses apps delivering various products such as flowers, electronics, and other goods. This sector demonstrates potential for diverse growth but often requires niche specialization.

Key Drivers of Saudi Arabia Delivery Apps Market Growth

The Saudi Arabian delivery apps market is driven by several key factors: rapidly increasing smartphone penetration, rising disposable incomes and changing consumer preferences towards convenience. Government initiatives to support digital transformation and investments in improving logistics infrastructure also significantly fuel market growth. Furthermore, the growing urban population concentrated in major cities increases the addressable market. The expansion of e-commerce and online shopping further supports the growth of the sector.

Challenges in the Saudi Arabia Delivery Apps Market Sector

The Saudi Arabian delivery apps market faces challenges such as regulatory hurdles pertaining to licensing, data privacy, and food safety. Supply chain inefficiencies, including traffic congestion and limited delivery infrastructure in some areas, can also impact operational efficiency and delivery times. Intense competition puts downward pressure on prices and necessitates ongoing innovation to maintain market share. These factors collectively influence profitability and the overall growth trajectory of the industry.

Emerging Opportunities in Saudi Arabia Delivery Apps Market

Emerging opportunities include expanding into underserved markets, leveraging emerging technologies like drone delivery and autonomous vehicles, and targeting niche market segments with specialized delivery services. Developing robust payment gateways and incorporating loyalty programs are also key to attracting customers. The integration of delivery services with other platforms and services presents further avenues for expansion. Incorporating sustainable practices and adopting eco-friendly delivery methods can capture the growing market of environmentally conscious consumers.

Leading Players in the Saudi Arabia Delivery Apps Market Market

- Talabat (Delivery Hero SE)

- HungerStation LTD (Delivery Hero SE)

- MRSOOL Inc

- Jahez International Company For Information Systems Technology

- Matajer Central Co

- Dailymealz

- Aram Meem LLC

- Shgardi Gate For Information Technology Systems

- The Chefz (Jahez International Company For Information Systems Technology)

- Shatirah House Restaurant Co

- Carrefour Ksa (Majid Al Futtaim Retail)

- Lugmety

- Al Dawaa Medical Services Company

- Nahdi Medical Company

- Careem Networks FZ-LLC (Uber Technologies Inc)

- Bindawood Holding

Key Developments in Saudi Arabia Delivery Apps Market Industry

- Jan 2023: Talabat launches a new loyalty program.

- Apr 2023: HungerStation expands its delivery network to new cities.

- Jul 2023: MRSOOL partners with a major logistics company.

- Oct 2023: Jahez implements a new AI-powered delivery optimization system.

Strategic Outlook for Saudi Arabia Delivery Apps Market Market

The Saudi Arabia delivery apps market is poised for continued strong growth, driven by sustained increases in smartphone penetration, expanding e-commerce activity, and favorable government policies. The focus on technological advancements, efficient logistics, and customer-centric services will remain vital for success. Opportunities exist in expanding into smaller cities, serving underserved populations, and developing innovative delivery models to further enhance customer experience and efficiency. The market is ripe for consolidation as major players seek to expand their market share and leverage economies of scale.

Saudi Arabia Delivery Apps Market Segmentation

-

1. Service Type

- 1.1. Food Delivery Apps

- 1.2. Grocery Delivery Apps

- 1.3. Pharmacy Delivery Apps

- 1.4. Other On-demand Delivery Apps

Saudi Arabia Delivery Apps Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Delivery Apps Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Smartphone Penetration Fueled the Growth of the Market; Convenient Payment Gateways Play a Pivotal Role in Augmenting the Growth of Delivery Apps in Saudi Arabia

- 3.3. Market Restrains

- 3.3.1. Consumers Desire for Fine Dining Experience

- 3.4. Market Trends

- 3.4.1. Rise in Smartphone Penetration to Fuel the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Delivery Apps Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Food Delivery Apps

- 5.1.2. Grocery Delivery Apps

- 5.1.3. Pharmacy Delivery Apps

- 5.1.4. Other On-demand Delivery Apps

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Central Saudi Arabia Delivery Apps Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Delivery Apps Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Delivery Apps Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Delivery Apps Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Matajer Central Co

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 HungerStation LTD (Delivery Hero SE)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Dailymealz

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aram Meem LLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Shgardi Gate For Information Technology Systems

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The Chefz (Jahez International Company For Information Systems Technology)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Jahez International Company For Information Systems Technology

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Shatirah House Restaurant Co

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 MRSOOL Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Carrefour Ksa (Majid Al Futtaim Retail)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Lugmety

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Al Dawaa Medical Services Company

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Nahdi Medical Company

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Careem Networks FZ-LLC (Uber Technologies Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Bindawood Holding

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Talabat (Delivery Hero SE)

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 Matajer Central Co

List of Figures

- Figure 1: Saudi Arabia Delivery Apps Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Delivery Apps Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Delivery Apps Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Delivery Apps Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Saudi Arabia Delivery Apps Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Saudi Arabia Delivery Apps Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Central Saudi Arabia Delivery Apps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Eastern Saudi Arabia Delivery Apps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Saudi Arabia Delivery Apps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Saudi Arabia Delivery Apps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Delivery Apps Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 10: Saudi Arabia Delivery Apps Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Delivery Apps Market?

The projected CAGR is approximately 15.40%.

2. Which companies are prominent players in the Saudi Arabia Delivery Apps Market?

Key companies in the market include Matajer Central Co, HungerStation LTD (Delivery Hero SE), Dailymealz, Aram Meem LLC, Shgardi Gate For Information Technology Systems, The Chefz (Jahez International Company For Information Systems Technology), Jahez International Company For Information Systems Technology, Shatirah House Restaurant Co, MRSOOL Inc, Carrefour Ksa (Majid Al Futtaim Retail), Lugmety, Al Dawaa Medical Services Company, Nahdi Medical Company, Careem Networks FZ-LLC (Uber Technologies Inc, Bindawood Holding, Talabat (Delivery Hero SE).

3. What are the main segments of the Saudi Arabia Delivery Apps Market?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Smartphone Penetration Fueled the Growth of the Market; Convenient Payment Gateways Play a Pivotal Role in Augmenting the Growth of Delivery Apps in Saudi Arabia.

6. What are the notable trends driving market growth?

Rise in Smartphone Penetration to Fuel the Growth of the Market.

7. Are there any restraints impacting market growth?

Consumers Desire for Fine Dining Experience.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Delivery Apps Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Delivery Apps Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Delivery Apps Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Delivery Apps Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence