Key Insights

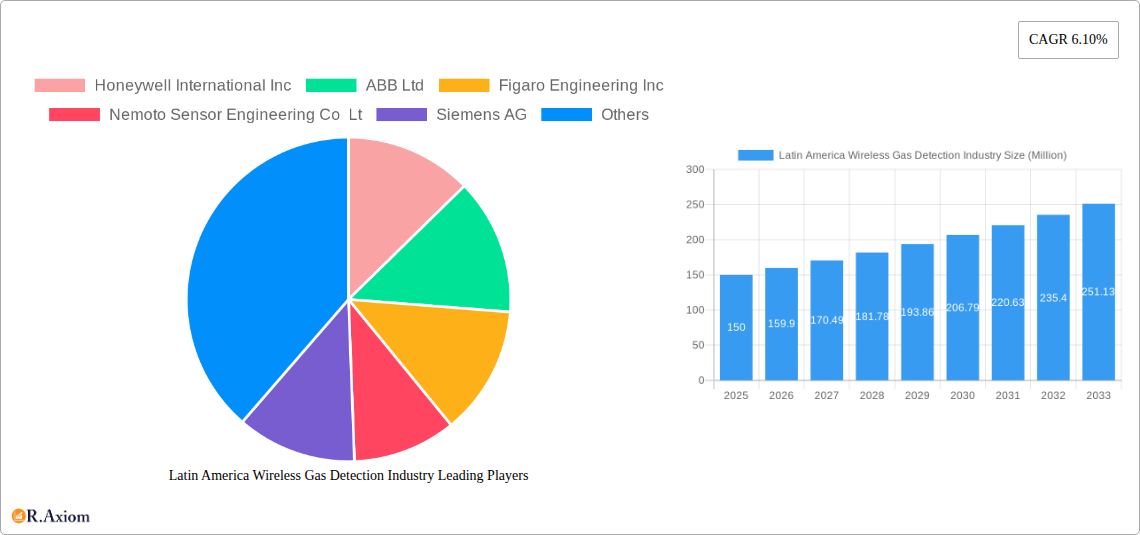

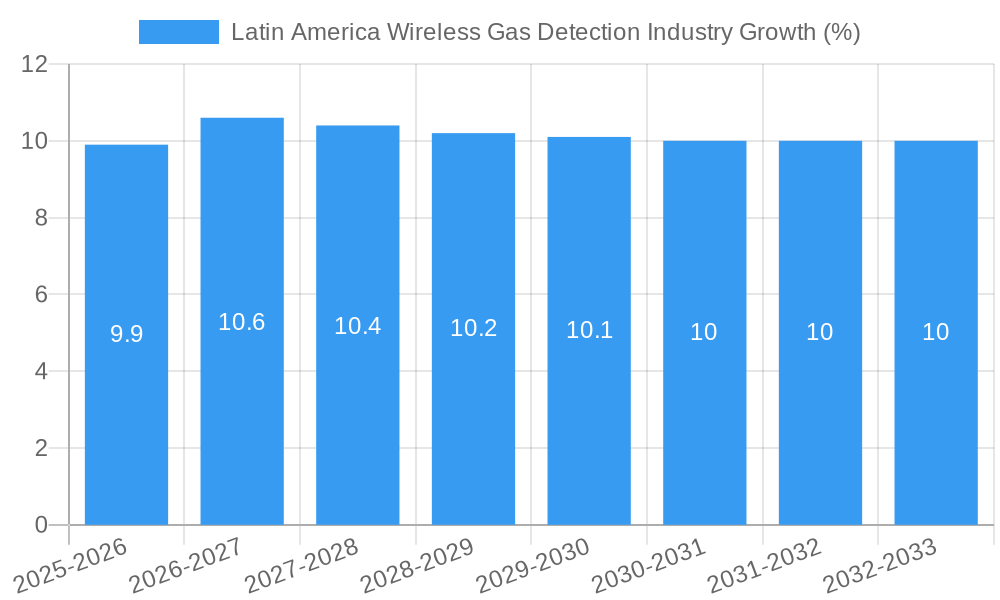

The Latin American wireless gas detection market, valued at approximately $XX million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.10% from 2025 to 2033. This expansion is driven by several key factors. Stringent safety regulations across various industries, particularly in the burgeoning automotive and industrial sectors within Brazil, Mexico, and Argentina, are mandating the adoption of advanced gas detection technologies. Furthermore, increasing awareness of the risks associated with gas leaks and the subsequent demand for reliable, real-time monitoring solutions are fueling market growth. The rising adoption of wireless technologies for enhanced monitoring and remote accessibility, coupled with the decreasing cost of sensors and improved sensor technology, contributes significantly to market expansion. Growth is further segmented by gas type, with Carbon Monoxide, Methane, and Hydrogen sensors leading the demand due to their applications in industrial settings and the ongoing focus on environmental safety.

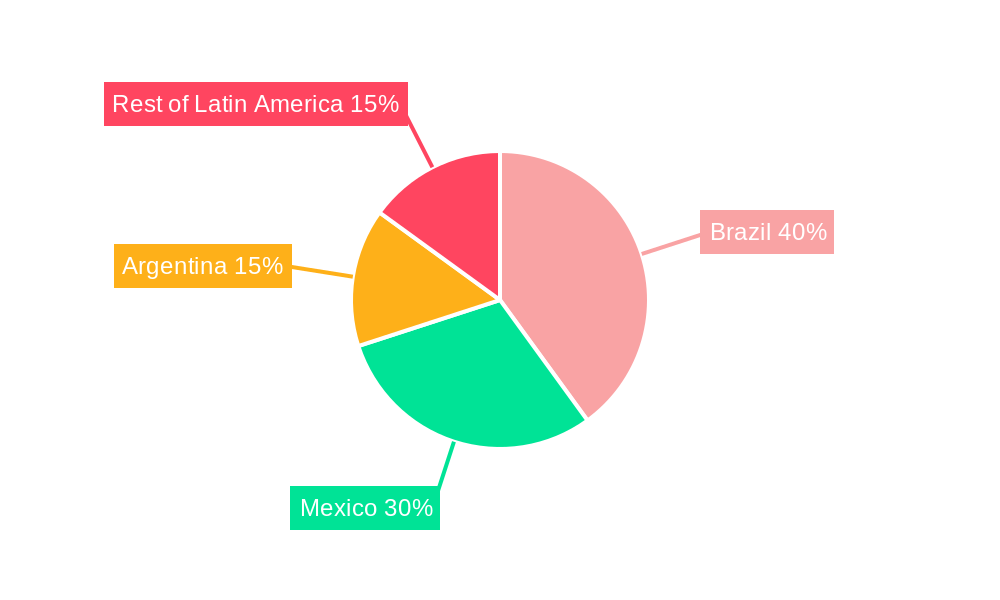

Technological advancements, particularly in infrared, electrochemical, and metal oxide-based gas sensors, are also playing a crucial role in shaping the market landscape. The preference for wireless gas detection systems stems from their ability to provide broader coverage, improved flexibility in deployment, and reduced installation costs compared to traditional wired systems. However, factors such as the high initial investment costs associated with some wireless systems and concerns about data security and reliability can act as restraints, potentially hindering broader adoption in specific regions or within certain industries. Nevertheless, ongoing innovation and the increasing focus on cost-effective solutions are mitigating these challenges, paving the way for sustained market expansion throughout the forecast period. Brazil, Mexico, and Argentina represent the largest regional markets within Latin America, reflecting their higher industrial activity and regulatory pressures.

Latin America Wireless Gas Detection Industry: 2019-2033 Market Analysis and Forecast

This comprehensive report provides an in-depth analysis of the Latin America wireless gas detection industry, covering the period 2019-2033. It offers crucial insights into market size, segmentation, growth drivers, challenges, and key players, equipping stakeholders with actionable intelligence for strategic decision-making. The report utilizes data from the historical period (2019-2024), a base year of 2025, and forecasts the market until 2033. All financial values are expressed in Millions.

Latin America Wireless Gas Detection Industry Market Concentration & Innovation

The Latin American wireless gas detection market exhibits a moderately concentrated landscape, with key players like Honeywell International Inc, ABB Ltd, and Siemens AG holding significant market share. However, the presence of several regional and specialized companies indicates opportunities for growth and market entry. Market share for these leading players is estimated at xx% collectively in 2025, with Honeywell holding an estimated xx% and ABB holding an estimated xx%. Innovation in sensor technology, particularly the advancement of miniaturization and wireless communication capabilities, is a major driver. Stringent safety regulations across various end-user industries, including industrial manufacturing and energy, fuel demand for advanced gas detection systems. The regulatory landscape, however, varies across Latin American countries, creating both opportunities and challenges. Product substitutes, such as traditional wired systems, are facing decreasing market penetration due to the increasing preference for wireless solutions. M&A activity in the sector has been relatively moderate over the past five years, with total deal values estimated at $xx Million, indicating a trend of strategic consolidation among players. End-user trends favor solutions providing real-time monitoring, data analytics, and remote accessibility for improved safety and operational efficiency.

Latin America Wireless Gas Detection Industry Industry Trends & Insights

The Latin American wireless gas detection market is projected to witness robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by increasing industrialization across the region, rising safety concerns, and the adoption of stringent environmental regulations. Technological disruptions, such as the integration of AI and IoT in gas detection systems, are transforming the industry, leading to improved accuracy, remote monitoring, and predictive maintenance capabilities. Consumer preferences are shifting towards cost-effective, user-friendly, and reliable solutions. The competitive dynamics are intense, with companies focusing on product innovation, strategic partnerships, and expansion into new geographical areas to gain a competitive edge. Market penetration of wireless gas detection systems is gradually increasing, projected to reach xx% by 2033, driven by the advantages offered by wireless technology over traditional wired systems.

Dominant Markets & Segments in Latin America Wireless Gas Detection Industry

- Leading Country: Brazil, owing to its large industrial sector and expanding infrastructure projects.

- Leading Gas Type: Methane, driven by the growth of the oil and gas sector and concerns related to fugitive emissions.

- Leading Technology: Electrochemical gas sensors due to their cost-effectiveness and reliability for various gas detection applications.

- Leading End-User Industry: Industrial sector, due to the rising focus on workplace safety and environmental regulations.

Key Drivers:

- Brazil: Significant investments in infrastructure development, particularly in the energy and industrial sectors, are driving demand.

- Mexico: Growing automotive and manufacturing industries are contributing to the adoption of gas detection systems.

- Argentina: Expanding oil and gas exploration and production activities fuel the market.

- Rest of Latin America: Increasing industrial activity and government regulations are boosting growth.

Brazil's dominance stems from its robust industrial base, leading to a higher demand for safety equipment. The electrochemical sensor segment's leadership reflects its widespread applicability and comparatively lower cost. The industrial sector's dominance stems from the critical need for safety measures in workplaces, driven by stringent regulatory frameworks and a strong emphasis on worker safety.

Latin America Wireless Gas Detection Industry Product Developments

Recent advancements in wireless gas detection include the integration of IoT and cloud computing for remote monitoring and predictive analytics. Miniaturization of sensors and development of long-lasting power sources enhance portability and extend operational life. Companies are focusing on developing user-friendly interfaces and providing comprehensive data analytics to meet growing customer demands. This focus on user-friendliness and data analytics is crucial for achieving higher market penetration and competitiveness.

Report Scope & Segmentation Analysis

This report segments the Latin American wireless gas detection market by country (Brazil, Mexico, Argentina, Rest of Latin America), gas type (Carbon Monoxide, Methane, Hydrogen, Oxygen, Carbon Dioxide, Other Gases), technology (Infrared Gas Sensor, Photo Ionization Sensor, Electrochemical Gas Sensor, Thermal Conductivity Gas sensor, Metal Oxide based Gas Sensor, Catalytic Gas Sensor), and end-user industry (Defense and Military, Healthcare, Consumer Electronics, Automotive and Transportation, Industrial, Other End-User Industries). Each segment's market size, growth projections, and competitive landscape are analyzed in detail. For instance, the industrial sector is expected to showcase the highest growth, with a CAGR of xx% driven by rising safety concerns.

Key Drivers of Latin America Wireless Gas Detection Industry Growth

Stringent safety regulations implemented across various industries are a key growth driver, forcing companies to adopt advanced gas detection systems. The burgeoning industrial sector, particularly in Brazil and Mexico, is creating significant demand. Furthermore, government initiatives to promote industrial safety and environmental protection are further stimulating market growth. Technological advancements, such as the integration of AI and IoT, enhance monitoring and reduce false alarms, boosting market adoption.

Challenges in the Latin America Wireless Gas Detection Industry Sector

High initial investment costs for advanced systems can be a barrier to entry for smaller companies. The fluctuating prices of raw materials used in sensor manufacturing can affect profitability. Furthermore, the lack of standardized safety regulations across all Latin American countries presents challenges for manufacturers. The impact of these challenges is estimated at xx% reduction in market growth in the short term.

Emerging Opportunities in Latin America Wireless Gas Detection Industry

The integration of AI-powered predictive analytics offers considerable potential for improving safety and reducing operational downtime. Growth in the renewable energy sector, particularly solar and wind power, is creating demand for specialized gas detection systems. The increasing adoption of smart city initiatives presents opportunities for integrating gas detection systems into urban infrastructure.

Leading Players in the Latin America Wireless Gas Detection Industry Market

- Honeywell International Inc

- ABB Ltd

- Figaro Engineering Inc

- Nemoto Sensor Engineering Co Lt

- Siemens AG

- Trolex Ltd

- Robert Bosch GmbH

- Amphenol Advanced Sensors

- Dynament Ltd

Key Developments in Latin America Wireless Gas Detection Industry Industry

- April 2021: ABB launched HoverGuard, a drone-based gas leak detection system, enhancing leak detection speed and accuracy. This significantly impacted the market by showcasing advanced technology for efficient leak detection and reducing operational downtime and environmental hazards.

Strategic Outlook for Latin America Wireless Gas Detection Industry Market

The Latin American wireless gas detection market is poised for sustained growth, driven by ongoing industrialization, technological innovation, and a heightened emphasis on safety and environmental regulations. Future market potential lies in the integration of advanced technologies such as AI and IoT, along with the expansion into new applications within the renewable energy and smart city sectors. The focus on developing cost-effective and user-friendly solutions will be crucial for capturing a larger market share.

Latin America Wireless Gas Detection Industry Segmentation

-

1. Gas Type

- 1.1. Carbon Monoxide

- 1.2. Methane

- 1.3. Hydrogen

- 1.4. Oxygen

- 1.5. Carbon Dioxide

- 1.6. Other Gases

-

2. Technology

- 2.1. Infrared Gas Sensor

- 2.2. Photo Ionization Sensor

- 2.3. Electrochemical Gas Sensor

- 2.4. Thermal Conductivity Gas sensor

- 2.5. Metal Oxide based Gas Sensor

- 2.6. Catalytic Gas Sensor

-

3. End-User Industry

- 3.1. Defense and Military

- 3.2. Healthcare

- 3.3. Consumer Electronics

- 3.4. Automotive and Transportation

- 3.5. Industrial

- 3.6. Other End-User Industries

Latin America Wireless Gas Detection Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Wireless Gas Detection Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence for gas sensors in HVAC system; Increasing need for air quality monitoring in smart cities; Growth in government standards and regulations concerning emission control; Rising Demand for Safety Systems in the Oil and Gas Industry

- 3.3. Market Restrains

- 3.3.1. High initial cost of the device

- 3.4. Market Trends

- 3.4.1. Increasing Demand in HVAC and Smart City Projects is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Wireless Gas Detection Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Gas Type

- 5.1.1. Carbon Monoxide

- 5.1.2. Methane

- 5.1.3. Hydrogen

- 5.1.4. Oxygen

- 5.1.5. Carbon Dioxide

- 5.1.6. Other Gases

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Infrared Gas Sensor

- 5.2.2. Photo Ionization Sensor

- 5.2.3. Electrochemical Gas Sensor

- 5.2.4. Thermal Conductivity Gas sensor

- 5.2.5. Metal Oxide based Gas Sensor

- 5.2.6. Catalytic Gas Sensor

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Defense and Military

- 5.3.2. Healthcare

- 5.3.3. Consumer Electronics

- 5.3.4. Automotive and Transportation

- 5.3.5. Industrial

- 5.3.6. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Gas Type

- 6. Latin America Latin America Wireless Gas Detection Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1. undefined

- 7. Brazil Latin America Wireless Gas Detection Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1. undefined

- 8. Argentina Latin America Wireless Gas Detection Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1. undefined

- 9. Mexico Latin America Wireless Gas Detection Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1. undefined

- 10. Peru Latin America Wireless Gas Detection Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1. undefined

- 11. Chile Latin America Wireless Gas Detection Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Honeywell International Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 ABB Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Figaro Engineering Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nemoto Sensor Engineering Co Lt

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Siemens AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Trolex Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Robert Bosch GmbH

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Amphenol Advanced Sensors

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Dynament Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Honeywell International Inc

List of Figures

- Figure 1: Latin America Wireless Gas Detection Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Wireless Gas Detection Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Wireless Gas Detection Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Wireless Gas Detection Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Latin America Wireless Gas Detection Industry Revenue Million Forecast, by Gas Type 2019 & 2032

- Table 4: Latin America Wireless Gas Detection Industry Volume K Unit Forecast, by Gas Type 2019 & 2032

- Table 5: Latin America Wireless Gas Detection Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Latin America Wireless Gas Detection Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 7: Latin America Wireless Gas Detection Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 8: Latin America Wireless Gas Detection Industry Volume K Unit Forecast, by End-User Industry 2019 & 2032

- Table 9: Latin America Wireless Gas Detection Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Latin America Wireless Gas Detection Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Latin America Wireless Gas Detection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Latin America Wireless Gas Detection Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Latin America Wireless Gas Detection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Latin America Wireless Gas Detection Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Latin America Wireless Gas Detection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Latin America Wireless Gas Detection Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Latin America Wireless Gas Detection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Latin America Wireless Gas Detection Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Latin America Wireless Gas Detection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Latin America Wireless Gas Detection Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Latin America Wireless Gas Detection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Latin America Wireless Gas Detection Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 23: Latin America Wireless Gas Detection Industry Revenue Million Forecast, by Gas Type 2019 & 2032

- Table 24: Latin America Wireless Gas Detection Industry Volume K Unit Forecast, by Gas Type 2019 & 2032

- Table 25: Latin America Wireless Gas Detection Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 26: Latin America Wireless Gas Detection Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 27: Latin America Wireless Gas Detection Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 28: Latin America Wireless Gas Detection Industry Volume K Unit Forecast, by End-User Industry 2019 & 2032

- Table 29: Latin America Wireless Gas Detection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Latin America Wireless Gas Detection Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: Brazil Latin America Wireless Gas Detection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Brazil Latin America Wireless Gas Detection Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Argentina Latin America Wireless Gas Detection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Latin America Wireless Gas Detection Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Chile Latin America Wireless Gas Detection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Latin America Wireless Gas Detection Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Colombia Latin America Wireless Gas Detection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Colombia Latin America Wireless Gas Detection Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Mexico Latin America Wireless Gas Detection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Mexico Latin America Wireless Gas Detection Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Peru Latin America Wireless Gas Detection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Peru Latin America Wireless Gas Detection Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Venezuela Latin America Wireless Gas Detection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Venezuela Latin America Wireless Gas Detection Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Ecuador Latin America Wireless Gas Detection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Ecuador Latin America Wireless Gas Detection Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Bolivia Latin America Wireless Gas Detection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Bolivia Latin America Wireless Gas Detection Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Paraguay Latin America Wireless Gas Detection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Paraguay Latin America Wireless Gas Detection Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Wireless Gas Detection Industry?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Latin America Wireless Gas Detection Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Figaro Engineering Inc, Nemoto Sensor Engineering Co Lt, Siemens AG, Trolex Ltd, Robert Bosch GmbH, Amphenol Advanced Sensors, Dynament Ltd.

3. What are the main segments of the Latin America Wireless Gas Detection Industry?

The market segments include Gas Type, Technology, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence for gas sensors in HVAC system; Increasing need for air quality monitoring in smart cities; Growth in government standards and regulations concerning emission control; Rising Demand for Safety Systems in the Oil and Gas Industry.

6. What are the notable trends driving market growth?

Increasing Demand in HVAC and Smart City Projects is Driving the Market Growth.

7. Are there any restraints impacting market growth?

High initial cost of the device.

8. Can you provide examples of recent developments in the market?

April 2021 - ABB launched a sensitive, fast drone-based gas leak detection and greenhouse gas measuring system. ABB's latest addition to its ABB AbilityMobile Gas Leak Detection System, HoverGuard, provides the solution by finding leaks faster and more reliably. HoverGuard quickly detects, quantifies, and maps leaks up to 100 meters in length from natural gas distribution and transmission pipelines, gathering lines, storage facilities, and other potential sources. It generates comprehensive digital reports that summarise results and can be shared within minutes of completing a survey.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Wireless Gas Detection Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Wireless Gas Detection Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Wireless Gas Detection Industry?

To stay informed about further developments, trends, and reports in the Latin America Wireless Gas Detection Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence