Key Insights

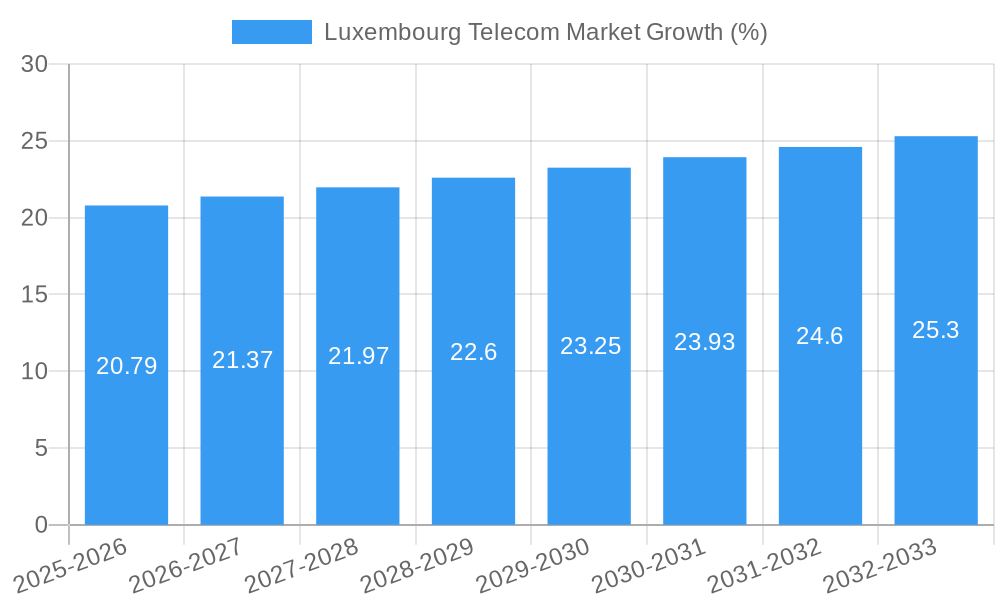

The Luxembourg telecom market, valued at €663.18 million in 2025, is projected to experience steady growth, driven primarily by increasing broadband penetration, rising smartphone usage, and the expanding adoption of 5G technology. The market's Compound Annual Growth Rate (CAGR) of 3.05% from 2019-2033 indicates a consistent, albeit moderate, expansion. Key players like POST Luxembourg, Tango SA, and Orange Luxembourg are fiercely competing, focusing on innovative service offerings and network infrastructure improvements to maintain market share. The growth is further propelled by the country's strong digital economy and government initiatives promoting digitalization across various sectors. While factors like price competition and the saturation of the mobile market could act as potential restraints, the increasing demand for high-speed internet and advanced data services is expected to counterbalance these challenges. The market segmentation (although not explicitly provided) is likely composed of fixed-line services, mobile services, broadband internet, and potentially specialized services like cloud computing and IoT solutions, all of which will contribute to overall growth.

Looking forward to 2033, the Luxembourg telecom sector is poised for continued expansion, albeit at a pace moderated by market maturity. The ongoing investments in 5G infrastructure are expected to create opportunities for new services and applications, driving growth. However, competitive pressures and potential regulatory changes will require operators to adopt agile strategies and prioritize customer experience to sustain profitability. The market's relatively small size compared to regional giants might limit individual player growth rates. Nonetheless, the consistent demand for reliable and high-speed connectivity ensures the long-term viability and sustainability of this market. Furthermore, successful partnerships and diversification into adjacent technological areas will be critical for growth and expansion within the Luxembourg telecom market.

Luxembourg Telecom Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Luxembourg Telecom Market, covering the period 2019-2033, with a focus on market dynamics, key players, and future growth prospects. The report utilizes data from the historical period (2019-2024), the base year (2025), and provides detailed forecasts for the period 2025-2033. This research is invaluable for industry stakeholders, investors, and businesses seeking to understand and navigate this dynamic market.

Luxembourg Telecom Market Concentration & Innovation

The Luxembourg telecom market exhibits a moderate level of concentration, with a few dominant players and a number of smaller niche operators. POST Luxembourg holds a significant market share, followed by Tango SA, Orange Luxembourg, and others. However, the market is characterized by ongoing innovation, driven by technological advancements and evolving customer preferences. The regulatory framework, while supportive of competition, also plays a role in shaping market dynamics. Product substitution, particularly with the rise of VoIP services and over-the-top (OTT) communication platforms, is a notable factor. End-user trends indicate a growing demand for high-speed internet, mobile data, and advanced communication services.

- Market Share: POST Luxembourg (xx%), Tango SA (xx%), Orange Luxembourg (xx%), Others (xx%)

- M&A Activity: The recent USD 3.1 billion (EUR 2.8 billion) acquisition of Intelsat by SES in April 2024 highlights significant consolidation activity and the pursuit of broader market reach and technological capabilities. Other M&A deal values in recent years totaled approximately xx Million EUR.

Luxembourg Telecom Market Industry Trends & Insights

The Luxembourg telecom market is experiencing robust growth, driven by factors such as increasing smartphone penetration, rising demand for high-speed internet, and the expanding adoption of digital services. The CAGR for the forecast period (2025-2033) is estimated at xx%. Technological disruptions, including the rollout of 5G networks and the increasing importance of cloud computing, are transforming the industry landscape. Consumer preferences are shifting towards bundled services, greater personalization, and enhanced security features. Competitive dynamics are characterized by ongoing investments in infrastructure, innovative service offerings, and strategic partnerships. Market penetration of 5G is projected to reach xx% by 2033.

Dominant Markets & Segments in Luxembourg Telecom Market

The Luxembourg telecom market is largely dominated by the national market itself, with minimal cross-border activity. The key drivers behind this dominance include robust economic conditions, a well-developed digital infrastructure, and supportive government policies.

- Key Drivers:

- Strong economic growth fueling demand for advanced telecom services.

- Government initiatives supporting digitalization and infrastructure development.

- High levels of internet and mobile penetration.

- Pro-business environment attracting telecom investments.

The market is segmented by service type (mobile, fixed-line, broadband, etc.), technology (4G, 5G, fiber), and customer segment (residential, business). While all segments exhibit growth, the mobile and broadband segments are currently experiencing the highest growth rates.

Luxembourg Telecom Market Product Developments

Recent product innovations in the Luxembourg telecom market focus on enhanced mobile data speeds with 5G, advanced broadband offerings leveraging fiber optics, and the integration of IoT technologies. Competition is driving companies to offer bundled packages incorporating various services, including television, security solutions, and cloud storage. The market fit for these products is strong, reflecting growing consumer demand for integrated and comprehensive communication solutions.

Report Scope & Segmentation Analysis

This report segments the Luxembourg telecom market by service type (mobile, fixed-line, broadband internet, IPTV, etc.), technology (3G, 4G, 5G, fiber optics), customer segment (residential, enterprise, government), and geographic location (national). Each segment displays distinct growth characteristics and competitive dynamics. For example, the 5G segment is anticipated to showcase the fastest growth, while the fiber broadband segment boasts the largest market size. The competitive landscape varies across each segment, with specific players excelling in different areas.

Key Drivers of Luxembourg Telecom Market Growth

The growth of the Luxembourg telecom market is fueled by several key factors. These include:

- Technological advancements: The rollout of 5G networks, increased fiber optic deployment, and the development of innovative communication technologies are driving market expansion.

- Economic growth: A strong economy supports higher consumer spending on telecom services.

- Government support: Government policies promoting digitalization and infrastructure investment are creating a favorable environment for market growth. The recent joint call for 5G projects exemplifies this commitment.

Challenges in the Luxembourg Telecom Market Sector

The Luxembourg telecom market faces challenges, including:

- High infrastructure costs: Investing in advanced network infrastructure requires significant capital expenditure.

- Competition: Intense competition among established and emerging players creates pricing pressures.

- Regulatory environment: Navigating regulatory frameworks can be complex and potentially limit market expansion in certain areas.

Emerging Opportunities in Luxembourg Telecom Market

Emerging opportunities include:

- Growth of the IoT market: Connecting devices through telecom networks presents significant potential for growth.

- Expansion of 5G services: The full potential of 5G technology remains to be exploited.

- Development of cloud-based solutions: Demand for secure and reliable cloud services is increasing rapidly.

Leading Players in the Luxembourg Telecom Market Market

- POST Luxembourg

- Tango SA

- Orange Luxembourg

- Eltrona Luxembourg

- Luxembourg Online SA

- Mixvoip SA

- Telindus Luxembourg

- Vodafone Luxembourg

- List Not Exhaustive

Key Developments in Luxembourg Telecom Market Industry

- November 2023: Luxembourg's government launched a joint call for projects focusing on 5G technologies, signaling a commitment to supporting the advancement of next-generation mobile networks and related applications in fields like AI and IoT.

- April 2024: SES's acquisition of Intelsat for USD 3.1 billion (EUR 2.8 billion) represents a major consolidation event, significantly reshaping the satellite communication landscape and potentially influencing the wider telecom market through enhanced coverage and services.

Strategic Outlook for Luxembourg Telecom Market Market

The Luxembourg telecom market holds significant growth potential. The continued rollout of 5G, rising demand for high-speed internet, and the government's support for digitalization will drive expansion in the coming years. Opportunities exist in the IoT, cloud computing, and enterprise segments. The market is expected to see further consolidation through mergers and acquisitions as companies strive for economies of scale and broader service portfolios. The focus on innovation and customer experience will remain crucial for success in this competitive and rapidly evolving market.

Luxembourg Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and Messaging Services

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Luxembourg Telecom Market Segmentation By Geography

- 1. Luxembourg

Luxembourg Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for 5G; Growth of IoT Usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Rising Demand for 5G; Growth of IoT Usage in Telecom

- 3.4. Market Trends

- 3.4.1. Wireless Service is Expected to Register Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Luxembourg Telecom Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and Messaging Services

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Luxembourg

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 POST Luxembourg

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tango SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Orange Luxembourg

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eltrona Luxembourg

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Luxembourg Online SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mixvoip SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Telindus Luxembourg

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vodafone Luxembourg*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 POST Luxembourg

List of Figures

- Figure 1: Luxembourg Telecom Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Luxembourg Telecom Market Share (%) by Company 2024

List of Tables

- Table 1: Luxembourg Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Luxembourg Telecom Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Luxembourg Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 4: Luxembourg Telecom Market Volume Million Forecast, by Services 2019 & 2032

- Table 5: Luxembourg Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Luxembourg Telecom Market Volume Million Forecast, by Region 2019 & 2032

- Table 7: Luxembourg Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 8: Luxembourg Telecom Market Volume Million Forecast, by Services 2019 & 2032

- Table 9: Luxembourg Telecom Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Luxembourg Telecom Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxembourg Telecom Market?

The projected CAGR is approximately 3.05%.

2. Which companies are prominent players in the Luxembourg Telecom Market?

Key companies in the market include POST Luxembourg, Tango SA, Orange Luxembourg, Eltrona Luxembourg, Luxembourg Online SA, Mixvoip SA, Telindus Luxembourg, Vodafone Luxembourg*List Not Exhaustive.

3. What are the main segments of the Luxembourg Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 663.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for 5G; Growth of IoT Usage in Telecom.

6. What are the notable trends driving market growth?

Wireless Service is Expected to Register Significant Market Growth.

7. Are there any restraints impacting market growth?

Rising Demand for 5G; Growth of IoT Usage in Telecom.

8. Can you provide examples of recent developments in the market?

April 2024: Luxembourg-headquartered satellite telecoms provider SES agreed to a USD 3.1 billion (EUR 2.8 billion) deal to buy US-based Intelsat. SES said the combination would create a stronger multi-orbit operator with greater coverage, improved resilience, expanded solutions, and enhanced resources.November 2023: Luxembourg's Ministry of State, the Department of Media, Connectivity and Digital Policy, the Ministry of the Economy, the National Research Fund (FNR), and Luxinnovation launched a joint call for projects in the area of 5G communication technologies. The partners behind this call for projects noted that 5G communication technologies will enable powerful applications in emerging fields such as data-driven decision-making, AI, IoT, and automation, along with offering promising impacts in terms of competitiveness and resilience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxembourg Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxembourg Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxembourg Telecom Market?

To stay informed about further developments, trends, and reports in the Luxembourg Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence