Key Insights

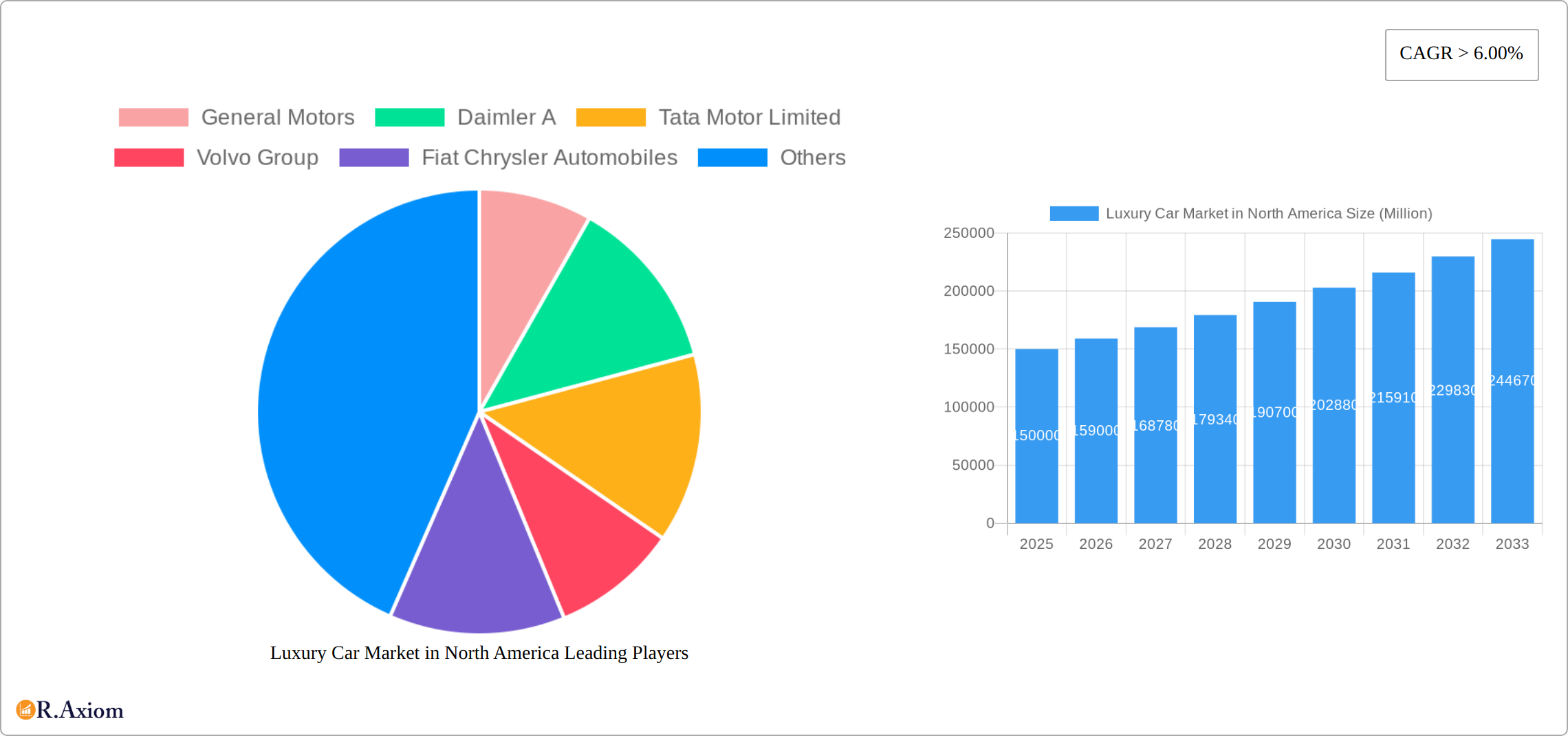

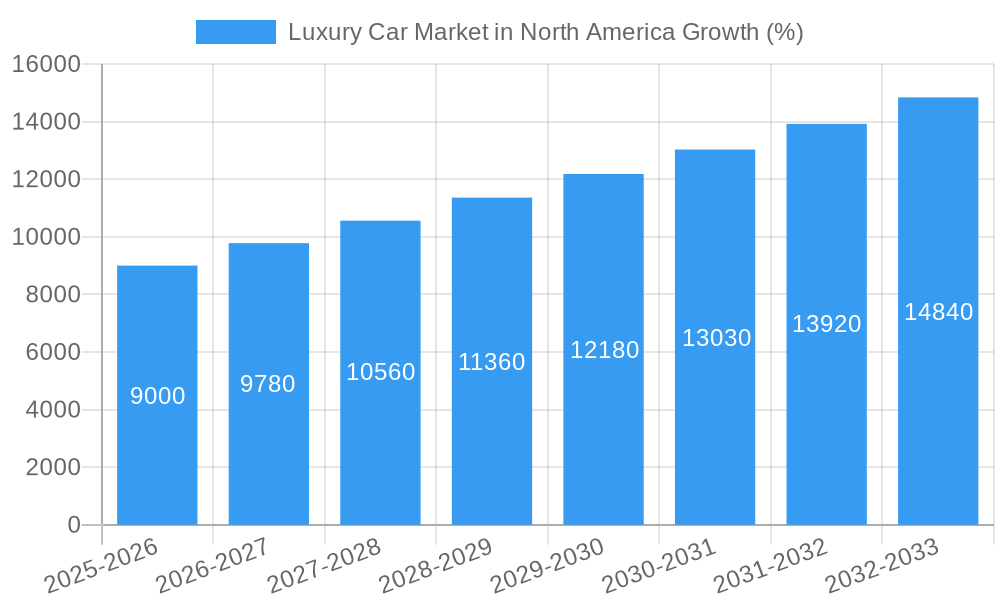

The North American luxury car market, currently valued at approximately $150 billion in 2025, is projected to experience robust growth, exceeding a compound annual growth rate (CAGR) of 6% through 2033. This expansion is driven by several key factors. Increasing disposable incomes among high-net-worth individuals, coupled with a growing preference for premium vehicles offering advanced technology, enhanced comfort, and superior safety features, fuel market demand. The rising popularity of electric vehicles (EVs) within the luxury segment presents a significant opportunity for growth, as manufacturers like Tesla, BMW, and Mercedes-Benz aggressively invest in this sector. Furthermore, evolving consumer preferences toward SUVs and crossovers in the luxury market segment contribute to the overall expansion. However, economic downturns and fluctuations in currency exchange rates pose potential challenges to sustained growth. Competition within the segment remains fierce, with established players like General Motors, Daimler, and BMW continually vying for market share against emerging EV manufacturers. The market segmentation within this space, encompassing vehicle types (hatchbacks, sedans, SUVs) and drive types (internal combustion engine, electric), reflects evolving consumer demand and technological advancements.

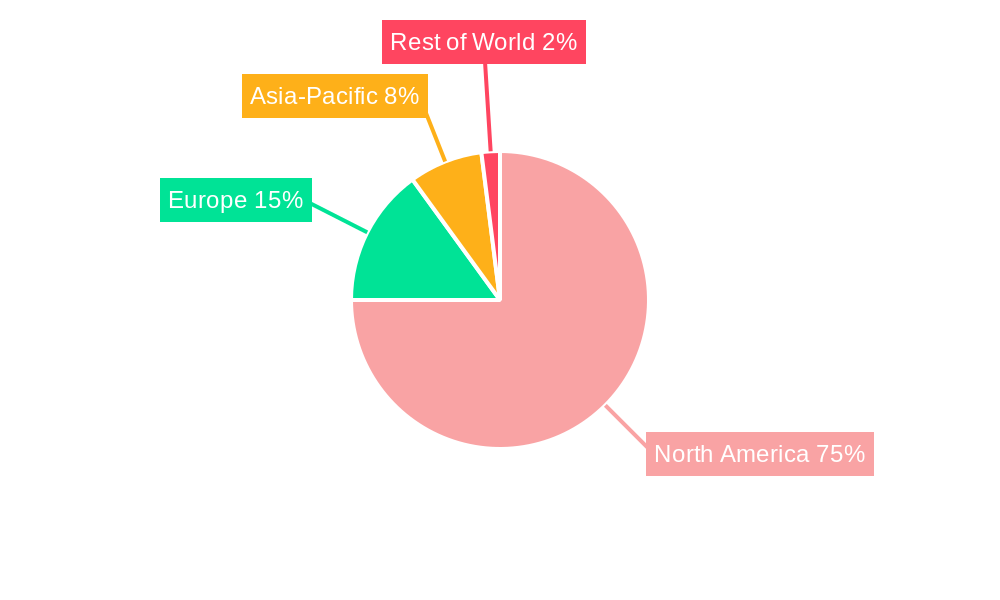

Successful navigation of this dynamic market requires a keen understanding of consumer preferences, technological advancements, and emerging market trends. North America's luxury car market displays significant regional variations. The United States, as the largest economy in the region, holds the lion's share of the market, with significant potential also seen in Canada and Mexico. Strategic partnerships, product diversification, and innovative marketing strategies are crucial for maintaining a competitive edge in this lucrative yet demanding sector. The focus on sustainability and reduced emissions impacts production costs and shapes consumer purchase choices. This creates a unique challenge and opportunity for manufacturers to integrate eco-friendly measures and attract environmentally conscious buyers. The interplay between these factors shapes the trajectory of the luxury car market in North America, presenting both lucrative prospects and considerable challenges.

Luxury Car Market in North America: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the North American luxury car market, covering the period 2019-2033. It offers invaluable insights into market trends, competitive dynamics, and future growth opportunities for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive primary and secondary research, incorporating quantitative data and qualitative analysis to provide a holistic view of this dynamic sector. With a base year of 2025 and an estimated year of 2025, the forecast period spans from 2025 to 2033, providing a long-term perspective on market evolution.

Luxury Car Market in North America Market Concentration & Innovation

The North American luxury car market exhibits a high degree of concentration, with established players like General Motors, Daimler AG, BMW AG, and Tesla Inc commanding significant market share. However, the emergence of new entrants and the rapid technological advancements are shaping the competitive landscape. In 2024, the top 5 players held approximately xx% of the market share, with BMW AG leading at approximately xx%. Innovation drivers include the rising demand for electric vehicles (EVs), autonomous driving technologies, and connected car features. Regulatory frameworks concerning emission standards and safety regulations significantly influence market dynamics. The market witnesses substantial M&A activity, with deal values exceeding $xx Million in the historical period (2019-2024). These mergers and acquisitions are primarily driven by a need to enhance technological capabilities, expand market reach, and consolidate market share. Examples include (but are not limited to) partnerships between established automakers and technology companies to accelerate the development of autonomous driving systems. Consumer trends reveal a growing preference for SUVs and crossovers within the luxury segment, driven by factors like increased family sizes and a desire for enhanced space and versatility. Product substitutes, primarily encompassing high-end models from mainstream brands, pose a challenge to the luxury market's growth.

- Market Share (2024): Top 5 players held approximately xx%

- M&A Deal Value (2019-2024): Over $xx Million

- Key Innovation Drivers: EVs, Autonomous Driving, Connected Car Features

Luxury Car Market in North America Industry Trends & Insights

The North American luxury car market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. Rising disposable incomes, particularly among high-net-worth individuals, underpin increased demand for luxury vehicles. Technological disruptions, such as the adoption of electric powertrains and advanced driver-assistance systems (ADAS), are reshaping consumer preferences and driving product innovation. Consumer preference shifts towards SUVs and crossovers continue to impact the market. Market penetration of electric luxury vehicles is expected to increase significantly, reaching xx% by 2033. Competitive dynamics are intensifying as established automakers face challenges from new entrants in the EV segment, particularly from Tesla Inc's success. The rise of subscription services and flexible ownership models also presents new challenges and opportunities. The market is also facing pressure due to changing consumer priorities, environmental concerns, and increased regulatory scrutiny related to emissions. The luxury segment is also affected by macroeconomic factors like interest rates and inflation.

Dominant Markets & Segments in Luxury Car Market in North America

The United States constitutes the dominant market within North America for luxury cars, driven by a robust economy, high levels of disposable income, and a preference for large vehicles. Within vehicle types, SUVs are currently the leading segment due to their practicality and versatility, followed by Sedans. The shift to Electric vehicles is transforming the drive-type segment, with a projected increase in market share from xx% in 2025 to xx% in 2033.

- Key Drivers for US Dominance:

- Strong Economy

- High Disposable Incomes

- Preference for Larger Vehicles

- SUV Segment Dominance:

- Practicality and Versatility

- Enhanced Space and Features

- Electric Vehicle Growth:

- Increasing Consumer Awareness and Adoption

- Government Incentives and Regulations

Luxury Car Market in North America Product Developments

Product innovations are centered around electrification, autonomous driving, and advanced connectivity features. Automakers are introducing luxury EVs with extended ranges and superior performance, integrating advanced driver-assistance systems, and providing seamless connectivity experiences through integrated infotainment systems. These developments aim to cater to the evolving preferences of luxury car buyers who increasingly prioritize sustainability, technological sophistication, and enhanced convenience. The market fit for these innovations is strong due to the high willingness of this demographic to pay a premium for technologically advanced vehicles.

Report Scope & Segmentation Analysis

The report comprehensively segments the North American luxury car market based on vehicle type (Hatchback, Sedan, SUV) and drive type (IC Engine, Electric). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. For example, the SUV segment is expected to maintain robust growth, driven by continuous demand, while the electric drive type is projected to experience exponential growth due to increasing environmental awareness and technological advancements.

Key Drivers of Luxury Car Market in North America Growth

Several key factors are driving the growth of the North American luxury car market. Technological advancements, such as the introduction of electric and hybrid vehicles, autonomous driving features, and advanced infotainment systems are reshaping consumer preferences and driving demand. A strong economy and rising disposable incomes fuel the market, and favourable government policies such as tax incentives for electric vehicles also play a role. Furthermore, increasing urbanization and the need for personal transportation are factors contributing to growth.

Challenges in the Luxury Car Market in North America Sector

The luxury car market faces several challenges. Stringent emission regulations and increasing fuel efficiency standards impact production costs and vehicle design. Supply chain disruptions and the availability of critical components, especially for EVs, pose significant obstacles. Intense competition from both established automakers and new EV entrants creates pricing pressure. These challenges result in reduced profit margins, increased production costs and a more complex market entry for new players.

Emerging Opportunities in Luxury Car Market in North America

The market presents numerous opportunities. The growing adoption of electric vehicles presents immense potential for automakers to capture significant market share. Technological advancements in autonomous driving and connectivity offer avenues for product differentiation and premium pricing. The expansion of luxury car subscription services unlocks new revenue streams and catering to younger, more tech-savvy consumers.

Leading Players in the Luxury Car Market in North America Market

- General Motors

- Daimler AG

- Tata Motor Limited

- Volvo Group

- Fiat Chrysler Automobiles

- BMW AG

- Tesla Inc

- Ford Motor Company

Key Developments in Luxury Car Market in North America Industry

- January 2023: Tesla announces price reductions for its Model 3 and Model Y vehicles in North America.

- March 2023: General Motors unveils its new electric SUV, the Cadillac Lyriq.

- June 2023: BMW announces a partnership with a technology company to develop next-generation autonomous driving systems.

- October 2023: Ford introduces its all-electric luxury sedan.

Strategic Outlook for Luxury Car Market in North America Market

The future of the North American luxury car market is bright, driven by continued technological advancements, rising disposable incomes, and evolving consumer preferences. Automakers that effectively leverage electrification, autonomous driving, and connectivity technologies, while efficiently managing supply chain challenges and adapting to stricter emission regulations, are poised to achieve significant growth. The market will likely continue to see intense competition and consolidation, favouring companies that can innovate quickly and adapt to the changing needs of their customer base.

Luxury Car Market in North America Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. SUV

-

2. Drive Type

- 2.1. IC Engine

- 2.2. Electric

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

Luxury Car Market in North America Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

Luxury Car Market in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Economy And Infrastructural Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Electric Commercial Vehicle May Hamper the Growth

- 3.4. Market Trends

- 3.4.1. Rise in electrification of vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Luxury Car Market in North America Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. SUV

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. IC Engine

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. United States Luxury Car Market in North America Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Hatchback

- 6.1.2. Sedan

- 6.1.3. SUV

- 6.2. Market Analysis, Insights and Forecast - by Drive Type

- 6.2.1. IC Engine

- 6.2.2. Electric

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Canada Luxury Car Market in North America Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Hatchback

- 7.1.2. Sedan

- 7.1.3. SUV

- 7.2. Market Analysis, Insights and Forecast - by Drive Type

- 7.2.1. IC Engine

- 7.2.2. Electric

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Mexico Luxury Car Market in North America Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Hatchback

- 8.1.2. Sedan

- 8.1.3. SUV

- 8.2. Market Analysis, Insights and Forecast - by Drive Type

- 8.2.1. IC Engine

- 8.2.2. Electric

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of North America Luxury Car Market in North America Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Hatchback

- 9.1.2. Sedan

- 9.1.3. SUV

- 9.2. Market Analysis, Insights and Forecast - by Drive Type

- 9.2.1. IC Engine

- 9.2.2. Electric

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. United States Luxury Car Market in North America Analysis, Insights and Forecast, 2019-2031

- 11. Canada Luxury Car Market in North America Analysis, Insights and Forecast, 2019-2031

- 12. Mexico Luxury Car Market in North America Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America Luxury Car Market in North America Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 General Motors

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Daimler A

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Tata Motor Limited

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Volvo Group

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Fiat Chrysler Automobiles

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 BMW AG

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Tesla Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Ford Motor Company

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.1 General Motors

List of Figures

- Figure 1: Luxury Car Market in North America Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Luxury Car Market in North America Share (%) by Company 2024

List of Tables

- Table 1: Luxury Car Market in North America Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Luxury Car Market in North America Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Luxury Car Market in North America Revenue Million Forecast, by Drive Type 2019 & 2032

- Table 4: Luxury Car Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Luxury Car Market in North America Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Luxury Car Market in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Luxury Car Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Luxury Car Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Luxury Car Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America Luxury Car Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Luxury Car Market in North America Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 12: Luxury Car Market in North America Revenue Million Forecast, by Drive Type 2019 & 2032

- Table 13: Luxury Car Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Luxury Car Market in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Luxury Car Market in North America Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 16: Luxury Car Market in North America Revenue Million Forecast, by Drive Type 2019 & 2032

- Table 17: Luxury Car Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Luxury Car Market in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Luxury Car Market in North America Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 20: Luxury Car Market in North America Revenue Million Forecast, by Drive Type 2019 & 2032

- Table 21: Luxury Car Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: Luxury Car Market in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Luxury Car Market in North America Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 24: Luxury Car Market in North America Revenue Million Forecast, by Drive Type 2019 & 2032

- Table 25: Luxury Car Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Luxury Car Market in North America Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Car Market in North America?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Luxury Car Market in North America?

Key companies in the market include General Motors, Daimler A, Tata Motor Limited, Volvo Group, Fiat Chrysler Automobiles, BMW AG, Tesla Inc, Ford Motor Company.

3. What are the main segments of the Luxury Car Market in North America?

The market segments include Vehicle Type, Drive Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Economy And Infrastructural Growth.

6. What are the notable trends driving market growth?

Rise in electrification of vehicles.

7. Are there any restraints impacting market growth?

High Cost of Electric Commercial Vehicle May Hamper the Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Car Market in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Car Market in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Car Market in North America?

To stay informed about further developments, trends, and reports in the Luxury Car Market in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence