Key Insights

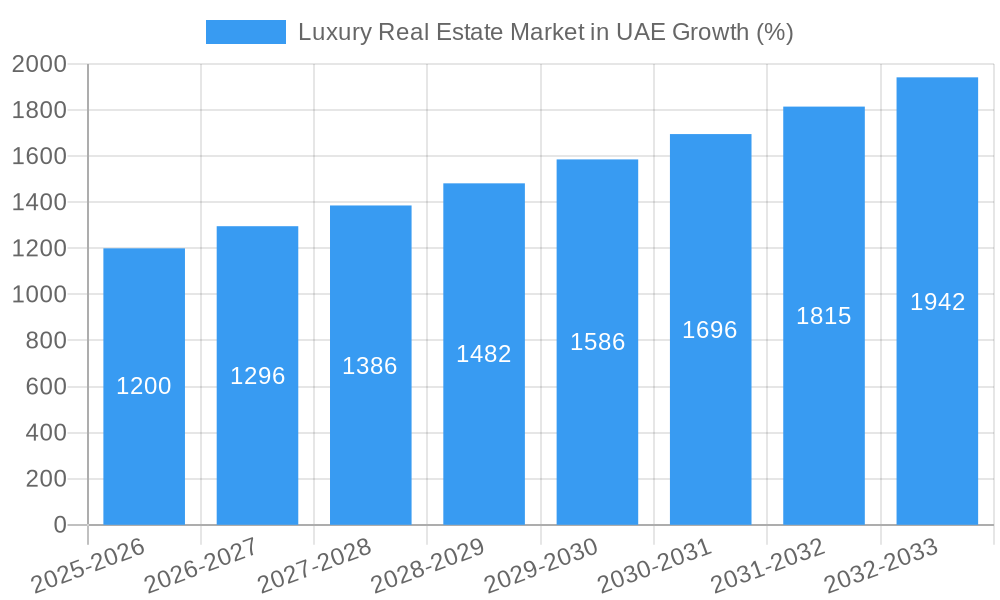

The UAE's luxury real estate market, encompassing apartments, condominiums, villas, and landed houses across major cities like Dubai, Abu Dhabi, and Sharjah, is experiencing robust growth. The market size in 2025 is estimated at $XX million (replace XX with a reasonable estimate based on available market research data for similar markets and adjusting for the UAE context; for example, if you find similar market data for a comparable region with a market size of $Y million and a similar CAGR, you can project the UAE market size proportionally based on population and economic indicators), exhibiting a Compound Annual Growth Rate (CAGR) exceeding 8.0% from 2025 to 2033. This expansion is fueled by several key drivers, including a significant influx of high-net-worth individuals (HNWIs) seeking second homes or investment opportunities in the region, a stable political and economic environment, and ongoing government initiatives promoting tourism and infrastructure development. Furthermore, the rising popularity of luxury lifestyle amenities, sustainable construction practices, and the increasing demand for exclusive, high-end properties contribute to the sector's sustained growth.

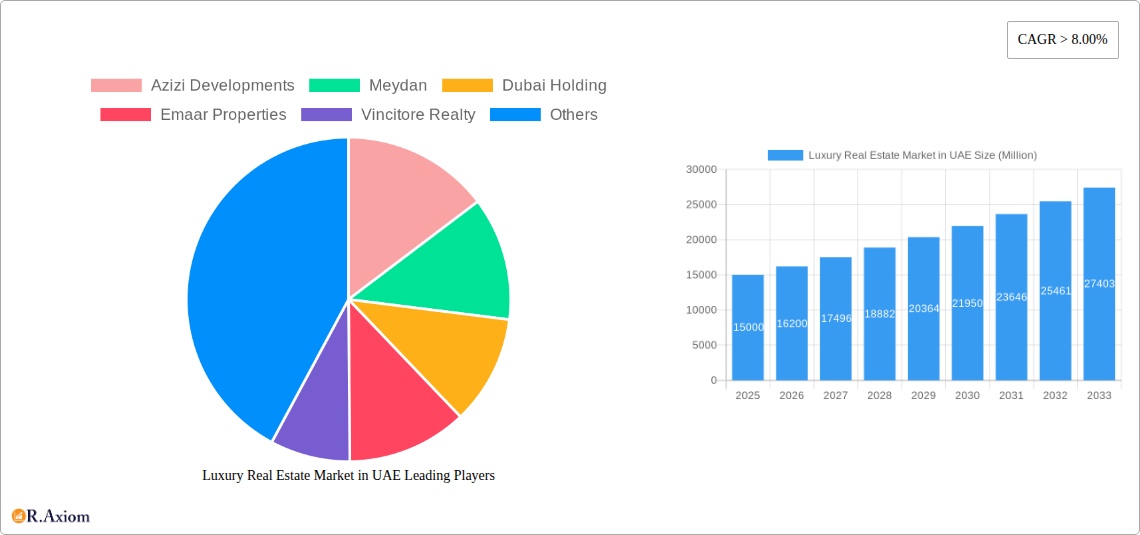

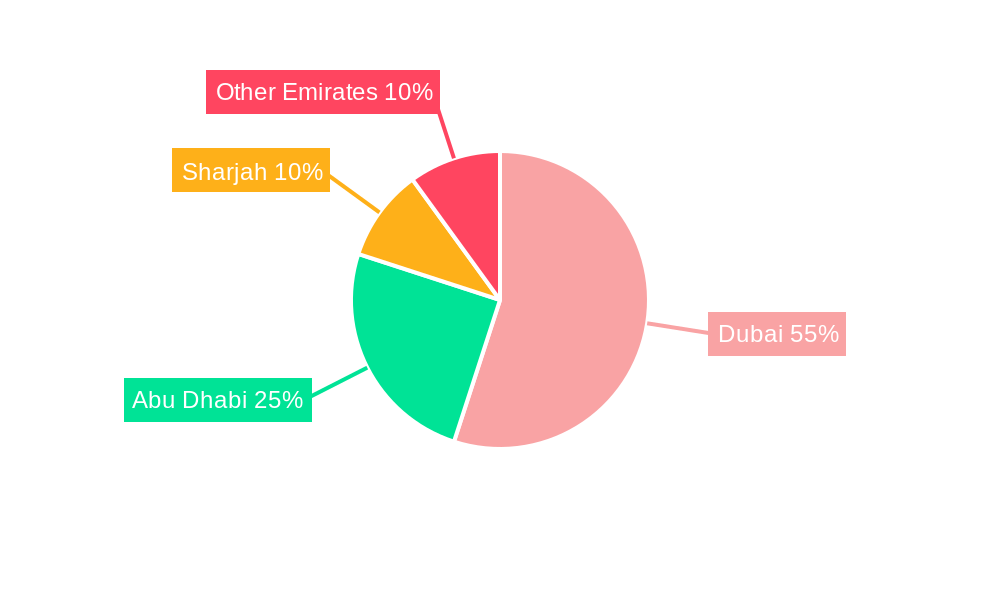

However, the market faces certain challenges. These include potential fluctuations in global economic conditions affecting investment flows, competition among developers, and regulatory changes impacting property transactions. While Dubai remains the dominant city in terms of luxury property sales, other emirates like Abu Dhabi and Sharjah are also witnessing increased demand, particularly for villas and landed houses which offer more privacy and space. The segmentation within the luxury market is also noteworthy. While apartments and condominiums remain popular, the demand for villas and landed houses reflects a shift towards larger, more exclusive properties. Major players like Emaar Properties, Aldar Properties, and DAMAC Properties continue to dominate the landscape, but newer entrants are also emerging, increasing the market's dynamism. This overall positive outlook suggests a strong potential for continued investment and growth within the UAE's luxury real estate sector throughout the forecast period.

Luxury Real Estate Market in UAE: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the luxury real estate market in the UAE, covering the period from 2019 to 2033. It offers valuable insights for investors, developers, and industry stakeholders seeking to understand the market dynamics, growth opportunities, and competitive landscape of this lucrative sector. The report utilizes a robust methodology incorporating historical data (2019-2024), base year (2025), and forecast data (2025-2033) to deliver reliable and actionable intelligence. Key segments analyzed include apartments and condominiums, villas and landed houses, across major cities like Dubai, Abu Dhabi, Sharjah, Al Ain, and other cities. Leading players such as Emaar Properties, DAMAC Properties, Aldar Properties, and Nakheel Properties are thoroughly examined.

Luxury Real Estate Market in UAE Market Concentration & Innovation

The UAE's luxury real estate market is characterized by a moderate level of concentration, with a few large players holding significant market share. Emaar Properties, DAMAC Properties, and Aldar Properties, among others, dominate the landscape, though the presence of numerous smaller developers contributes to a dynamic competitive environment. The market share of these top players is estimated at approximately xx% in 2025, with Emaar holding the largest share. Innovation is driven by factors such as the adoption of smart home technologies, sustainable building practices, and the creation of unique architectural designs to cater to high-net-worth individuals' preferences. Regulatory frameworks, particularly building codes and zoning regulations, play a significant role in shaping the market. While direct substitutes are limited, the market faces competition from alternative investment options, such as high-end art, private jets, and yachts. End-user trends indicate a strong preference for properties with high-end amenities, prime locations, and exceptional views. M&A activity remains relatively robust, with several significant deals recorded in recent years. Examples include Dubai Holding’s acquisition of The Westin Paris - Vendome (February 2023), valued at xx Million. Deal values vary significantly, ranging from tens of Millions to hundreds of Millions depending on the size and location of the asset.

- Market Concentration: High (xx%), dominated by a few major players.

- Innovation Drivers: Smart home technologies, sustainable design, unique architecture.

- Regulatory Impact: Significant influence on development and construction.

- M&A Activity: Moderate to high, with deal values ranging from tens to hundreds of Millions.

Luxury Real Estate Market in UAE Industry Trends & Insights

The UAE’s luxury real estate market is experiencing robust growth, driven by a confluence of factors including a strong economy, increasing high-net-worth individuals, and government initiatives promoting tourism and investment. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, significantly impacted by ongoing infrastructure development and the Expo 2020 legacy. Technological disruptions, such as the use of Building Information Modeling (BIM) and virtual reality for property visualization, are enhancing the customer experience. Consumer preferences are shifting towards sustainable and technologically advanced properties. Competitive dynamics are shaped by the ongoing entry of new developers and the expansion of existing players. Market penetration of smart home technologies is growing steadily, with an estimated xx% of new luxury developments incorporating such features by 2033.

Dominant Markets & Segments in Luxury Real Estate Market in UAE

The Dubai market holds the dominant position in the UAE's luxury real estate sector.

Dubai: Key drivers for Dubai's dominance include its well-established infrastructure, strong economic performance, strategic location, vibrant lifestyle, and government initiatives to attract international investment. Its diverse luxury property offerings cater to a wide range of preferences. The city's iconic skyline and world-class amenities further enhance its appeal to ultra-high-net-worth individuals.

Abu Dhabi: Abu Dhabi’s luxury market is characterized by a more exclusive and discreet appeal, focusing on high-end villas and waterfront properties. While experiencing considerable growth, it remains smaller in terms of overall volume compared to Dubai.

Other Cities: Sharjah, Al Ain, and other cities contribute to the market, though their share remains comparatively smaller, primarily due to less developed infrastructure and a comparatively smaller HNW population.

By Type: Villas and landed houses command premium prices and significant demand driven by a desire for exclusivity and larger living spaces. However, the demand for luxury apartments and condominiums in prime locations remains strong, driven by convenience and accessibility.

Luxury Real Estate Market in UAE Product Developments

Recent product innovations include the integration of smart home technology, sustainable building materials, and personalized design options. Developers are increasingly focusing on creating unique architectural designs and incorporating state-of-the-art amenities to attract discerning buyers. The market sees a growing demand for eco-friendly and energy-efficient properties, aligning with global sustainability trends. These developments provide a competitive advantage by appealing to environmentally conscious buyers and investors.

Report Scope & Segmentation Analysis

This report segments the UAE luxury real estate market by property type (Apartments & Condominiums, Villas & Landed Houses) and by city (Dubai, Abu Dhabi, Sharjah, Al Ain, Other Cities). Each segment is analyzed considering growth projections, market size estimations, and competitive dynamics. The apartment and condominium segment is projected to exhibit a CAGR of xx% between 2025 and 2033, while the villa and landed house segment is expected to grow at xx% over the same period. Market sizes are detailed in the full report. Competitive dynamics vary across segments and cities, reflecting different supply-demand balances and the presence of niche players.

Key Drivers of Luxury Real Estate Market in UAE Growth

Several factors fuel the growth of the UAE’s luxury real estate market. These include robust economic growth attracting significant foreign investment, government initiatives to promote real estate development, a rise in high-net-worth individuals seeking prestigious properties, and the development of world-class infrastructure. Technological advancements like smart home integration and sustainable building practices further enhance property appeal, driving up demand.

Challenges in the Luxury Real Estate Market in UAE Sector

Challenges include stringent regulatory frameworks that can impact development timelines and costs, potential fluctuations in the global economy impacting buyer confidence, and intensifying competition among developers. Supply chain disruptions can lead to material cost increases and construction delays, potentially affecting project profitability. The availability of skilled labor remains a factor impacting construction costs and timelines.

Emerging Opportunities in Luxury Real Estate Market in UAE

Emerging opportunities exist in sustainable development, smart home integration, and the development of unique, high-end lifestyle communities. Growing demand for luxury serviced apartments presents opportunities for operators. The increasing interest in health and wellness presents a chance for properties with advanced wellness amenities to capture market share.

Leading Players in the Luxury Real Estate Market in UAE Market

- Azizi Developments

- Meydan

- Dubai Holding

- Emaar Properties

- Vincitore Realty

- Nakheel Properties

- Sobha Realty

- Aldar Properties

- DAMAC Properties

- Meraas

Key Developments in Luxury Real Estate Market in UAE Industry

March 2023: Emaar The Economic City’s (Emaar EC) deal with Al Bilad Tourism Fund highlights the increasing interest in large-scale luxury resort developments, showcasing opportunities in tourism-linked real estate investment. The USD 717 Million investment signifies significant confidence in the sector's future growth.

February 2023: Dubai Holding’s acquisition of The Westin Paris - Vendome demonstrates the expansion of UAE-based investment firms into the global luxury real estate market, underlining the growing internationalization of the sector.

Strategic Outlook for Luxury Real Estate Market in UAE Market

The future of the UAE's luxury real estate market looks promising, driven by continued economic growth, infrastructure development, and the ongoing appeal of the country as a global investment hub. The focus on sustainable development and smart technologies will continue to shape the market, offering opportunities for innovative developers and investors. Continued government support for the real estate sector, alongside strategic partnerships and investments, will contribute to sustained growth in the years to come.

Luxury Real Estate Market in UAE Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. Cities

- 2.1. Dubai

- 2.2. Abu Dhabi

- 2.3. Sharjah

- 2.4. Al Ain

- 2.5. Other Cities

Luxury Real Estate Market in UAE Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Luxury Real Estate Market in UAE REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Spending on the Commercial Construction

- 3.3. Market Restrains

- 3.3.1. Materials and Labor Shortages

- 3.4. Market Trends

- 3.4.1. Post-Expo landscape looks bright for Dubai luxury home market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Real Estate Market in UAE Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Cities

- 5.2.1. Dubai

- 5.2.2. Abu Dhabi

- 5.2.3. Sharjah

- 5.2.4. Al Ain

- 5.2.5. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Luxury Real Estate Market in UAE Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Villas and Landed Houses

- 6.2. Market Analysis, Insights and Forecast - by Cities

- 6.2.1. Dubai

- 6.2.2. Abu Dhabi

- 6.2.3. Sharjah

- 6.2.4. Al Ain

- 6.2.5. Other Cities

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Luxury Real Estate Market in UAE Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Villas and Landed Houses

- 7.2. Market Analysis, Insights and Forecast - by Cities

- 7.2.1. Dubai

- 7.2.2. Abu Dhabi

- 7.2.3. Sharjah

- 7.2.4. Al Ain

- 7.2.5. Other Cities

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Luxury Real Estate Market in UAE Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Villas and Landed Houses

- 8.2. Market Analysis, Insights and Forecast - by Cities

- 8.2.1. Dubai

- 8.2.2. Abu Dhabi

- 8.2.3. Sharjah

- 8.2.4. Al Ain

- 8.2.5. Other Cities

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Luxury Real Estate Market in UAE Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Villas and Landed Houses

- 9.2. Market Analysis, Insights and Forecast - by Cities

- 9.2.1. Dubai

- 9.2.2. Abu Dhabi

- 9.2.3. Sharjah

- 9.2.4. Al Ain

- 9.2.5. Other Cities

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Luxury Real Estate Market in UAE Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Apartments and Condominiums

- 10.1.2. Villas and Landed Houses

- 10.2. Market Analysis, Insights and Forecast - by Cities

- 10.2.1. Dubai

- 10.2.2. Abu Dhabi

- 10.2.3. Sharjah

- 10.2.4. Al Ain

- 10.2.5. Other Cities

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Azizi Developments

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Meydan

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dubai Holding

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Emaar Properties

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vincitore Realty

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nakheel Properties

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sobha Realty

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aldar Properties

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DAMAC Properties**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Meraas

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Azizi Developments

List of Figures

- Figure 1: Global Luxury Real Estate Market in UAE Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: UAE Luxury Real Estate Market in UAE Revenue (Million), by Country 2024 & 2032

- Figure 3: UAE Luxury Real Estate Market in UAE Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Luxury Real Estate Market in UAE Revenue (Million), by Type 2024 & 2032

- Figure 5: North America Luxury Real Estate Market in UAE Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Luxury Real Estate Market in UAE Revenue (Million), by Cities 2024 & 2032

- Figure 7: North America Luxury Real Estate Market in UAE Revenue Share (%), by Cities 2024 & 2032

- Figure 8: North America Luxury Real Estate Market in UAE Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Luxury Real Estate Market in UAE Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Luxury Real Estate Market in UAE Revenue (Million), by Type 2024 & 2032

- Figure 11: South America Luxury Real Estate Market in UAE Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Luxury Real Estate Market in UAE Revenue (Million), by Cities 2024 & 2032

- Figure 13: South America Luxury Real Estate Market in UAE Revenue Share (%), by Cities 2024 & 2032

- Figure 14: South America Luxury Real Estate Market in UAE Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Luxury Real Estate Market in UAE Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Luxury Real Estate Market in UAE Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe Luxury Real Estate Market in UAE Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Luxury Real Estate Market in UAE Revenue (Million), by Cities 2024 & 2032

- Figure 19: Europe Luxury Real Estate Market in UAE Revenue Share (%), by Cities 2024 & 2032

- Figure 20: Europe Luxury Real Estate Market in UAE Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Luxury Real Estate Market in UAE Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Luxury Real Estate Market in UAE Revenue (Million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Luxury Real Estate Market in UAE Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Luxury Real Estate Market in UAE Revenue (Million), by Cities 2024 & 2032

- Figure 25: Middle East & Africa Luxury Real Estate Market in UAE Revenue Share (%), by Cities 2024 & 2032

- Figure 26: Middle East & Africa Luxury Real Estate Market in UAE Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Luxury Real Estate Market in UAE Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Luxury Real Estate Market in UAE Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific Luxury Real Estate Market in UAE Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Luxury Real Estate Market in UAE Revenue (Million), by Cities 2024 & 2032

- Figure 31: Asia Pacific Luxury Real Estate Market in UAE Revenue Share (%), by Cities 2024 & 2032

- Figure 32: Asia Pacific Luxury Real Estate Market in UAE Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Luxury Real Estate Market in UAE Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Cities 2019 & 2032

- Table 4: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Cities 2019 & 2032

- Table 8: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Cities 2019 & 2032

- Table 14: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Cities 2019 & 2032

- Table 20: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Cities 2019 & 2032

- Table 32: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Cities 2019 & 2032

- Table 41: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Real Estate Market in UAE?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Luxury Real Estate Market in UAE?

Key companies in the market include Azizi Developments, Meydan, Dubai Holding, Emaar Properties, Vincitore Realty, Nakheel Properties, Sobha Realty, Aldar Properties, DAMAC Properties**List Not Exhaustive, Meraas.

3. What are the main segments of the Luxury Real Estate Market in UAE?

The market segments include Type, Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Spending on the Commercial Construction.

6. What are the notable trends driving market growth?

Post-Expo landscape looks bright for Dubai luxury home market.

7. Are there any restraints impacting market growth?

Materials and Labor Shortages.

8. Can you provide examples of recent developments in the market?

March 2023: Emaar The Economic City (Emaar EC) agreed to sell a prime beachfront land plot in Murooj Golf Community District, King Abdullah Economic City (KAEC), as an in-kind contribution to Al Bilad Tourism Fund. It is a Capital Market Authority (CMA)-regulated Shariah-compliant closed-end private real estate investment fund. In return for the land sale, Emaar EC will acquire units in the fund worth SAR 269.2 million (USD 717 million), representing 41.15% of the fund's equity. The fund strategy is to develop and operate the resort under the Rixos Premium brand (an all-inclusive luxury resort and waterpark comprising around 550 properties with lifestyle, retail, and food and beverage offerings). This is to create value and exit at the planned maturity of 12 years, said the company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Real Estate Market in UAE," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Real Estate Market in UAE report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Real Estate Market in UAE?

To stay informed about further developments, trends, and reports in the Luxury Real Estate Market in UAE, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence