Key Insights

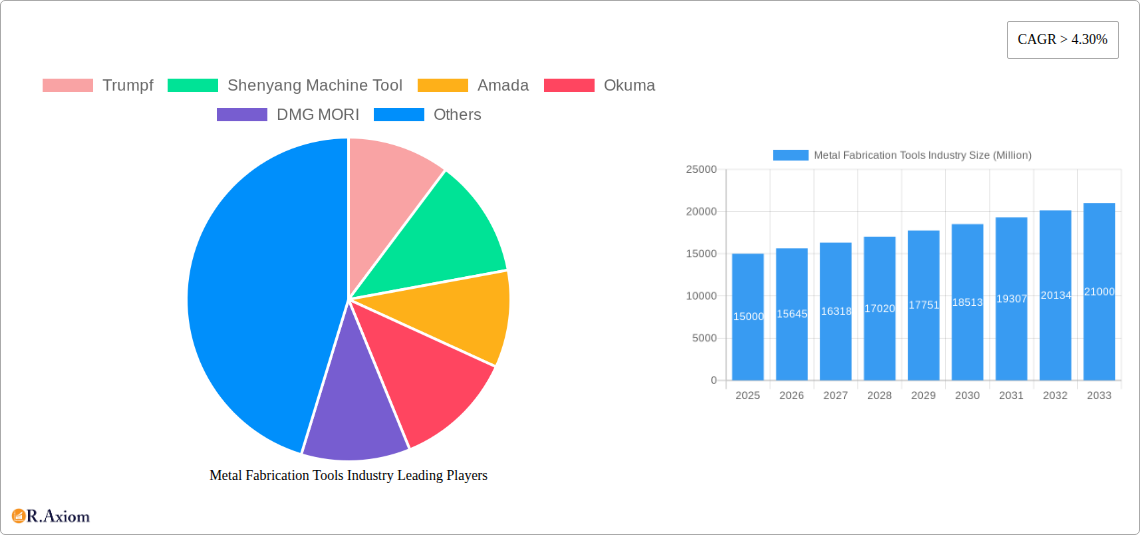

The global metal fabrication tools market is experiencing robust growth, driven by increasing demand across diverse sectors like automotive, aerospace, construction, and electronics. The market's Compound Annual Growth Rate (CAGR) exceeding 4.30% from 2019 to 2024 indicates a sustained upward trajectory. This expansion is fueled by several key factors. Automation in manufacturing processes is a major driver, with companies seeking to enhance efficiency and precision through advanced metal fabrication technologies. The rising adoption of additive manufacturing (3D printing) and laser cutting techniques further contributes to market growth. Moreover, growing infrastructure development globally and the increasing demand for durable and lightweight materials in various industries are also propelling market expansion. Leading players such as Trumpf, Amada, and DMG MORI are investing heavily in research and development to innovate and improve their product offerings, enhancing market competitiveness. While supply chain disruptions and fluctuating raw material prices pose some challenges, the overall market outlook remains positive.

Metal Fabrication Tools Industry Market Size (In Billion)

Despite potential restraints, the long-term prospects for the metal fabrication tools market appear promising. The continuous development of advanced materials and the adoption of Industry 4.0 principles are expected to further stimulate demand. Specific segments within the market, such as laser cutting systems and robotic welding equipment, are anticipated to witness faster growth rates compared to traditional methods. Regional variations exist, with developed economies showing sustained demand and emerging markets offering significant growth potential as their manufacturing sectors expand. The forecast period of 2025-2033 suggests continued market expansion, with the market size likely exceeding current estimates significantly due to the aforementioned growth drivers. Strategic partnerships, mergers, and acquisitions among key players will likely further shape the competitive landscape.

Metal Fabrication Tools Industry Company Market Share

Metal Fabrication Tools Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Metal Fabrication Tools industry, covering market size, segmentation, key players, industry trends, and future growth prospects from 2019 to 2033. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends through 2033. The study includes detailed analysis of market concentration, innovation, dominant segments, and key challenges and opportunities for stakeholders in this dynamic sector. The total market value is estimated to reach xx Million by 2033.

Metal Fabrication Tools Industry Market Concentration & Innovation

The Metal Fabrication Tools industry exhibits a moderately concentrated market structure, with several large multinational players holding significant market share. Key players such as Trumpf, Shenyang Machine Tool, Amada, Okuma, DMG MORI, FANUC Corp, Colfax, Atlas Copco, and BTD Manufacturing (list not exhaustive) compete fiercely, driving innovation and technological advancements. The combined market share of the top five players is estimated at xx%, with Trumpf holding an estimated xx% market share in 2025.

Innovation is a key driver, fueled by the need for higher precision, automation, and efficiency in manufacturing processes. Regulatory frameworks, such as those concerning safety and environmental standards, influence technological advancements and product development. The industry sees ongoing M&A activity, as illustrated by recent acquisitions such as Ryerson Holding Corporation's purchase of Apogee Steel Fabrication. These mergers and acquisitions often involve significant financial transactions, with deal values exceeding xx Million in several instances. The increasing adoption of additive manufacturing technologies, such as 3D printing, also presents both opportunities and challenges for existing players. Product substitutes, such as alternative machining techniques, pose a competitive threat, requiring constant innovation to maintain market share. End-user trends, particularly towards greater customization and shorter lead times, impact the demand for specialized fabrication tools and services.

- Market Share (2025 Estimate): Trumpf: xx%, Amada: xx%, DMG MORI: xx%, Others: xx%

- M&A Deal Values (2022): Ryerson Holding/Apogee Steel: xx Million; Other significant deals: xx Million

Metal Fabrication Tools Industry Industry Trends & Insights

The Metal Fabrication Tools industry is experiencing robust growth, driven by several key factors. The global manufacturing sector's expansion, particularly in developing economies, is a major catalyst. Technological disruptions, including advancements in automation, robotics, and digitalization, are transforming manufacturing processes and increasing demand for sophisticated tools. Consumer preferences for customized products and shorter production cycles further fuel the need for flexible and efficient metal fabrication tools.

Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants, particularly in niche segments. The industry shows a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of advanced technologies, such as laser cutting and robotic welding, is steadily increasing, leading to higher productivity and improved product quality. This continuous technological evolution necessitates significant investment in R&D by industry players. Growing demand for lightweight materials in various industries, such as aerospace and automotive, is driving innovation in specialized metal fabrication tools. The rising adoption of Industry 4.0 principles, focusing on data-driven decision-making and connected manufacturing, significantly influences market growth.

Dominant Markets & Segments in Metal Fabrication Tools Industry

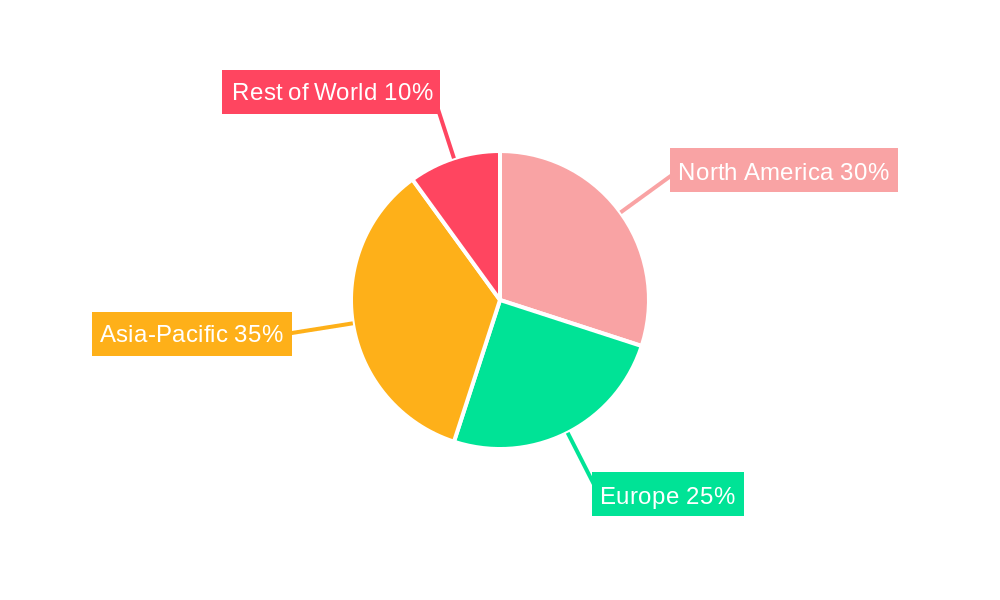

The Asia-Pacific region dominates the Metal Fabrication Tools market, driven by robust economic growth, significant industrialization, and expanding manufacturing sectors in countries like China, India, and Japan. North America and Europe also hold considerable market share, characterized by advanced manufacturing capabilities and significant technological innovation.

Key Drivers of Dominance in Asia-Pacific:

- Rapid industrialization and economic growth.

- Government initiatives promoting manufacturing and technological advancements.

- Large and growing manufacturing base.

- Significant investment in infrastructure development.

Key Drivers of Dominance in North America:

- High adoption of advanced technologies.

- Presence of major OEMs and technology providers.

- Well-established manufacturing infrastructure.

- Strong focus on innovation and R&D.

Key Drivers of Dominance in Europe:

- Presence of well-established industrial clusters.

- High levels of automation and digitalization in manufacturing.

- Focus on sustainable manufacturing practices.

- Significant government support for technological innovation.

The automotive, aerospace, and construction sectors are the major end-use segments, collectively representing a substantial portion of the market. Other segments, including electronics, medical devices, and energy, also contribute significantly to industry growth.

Metal Fabrication Tools Industry Product Developments

Recent product innovations focus on enhancing precision, speed, and automation capabilities. Laser cutting systems, robotic welding machines, and automated material handling systems are experiencing significant technological advancements. These innovations offer improved productivity, higher product quality, and reduced manufacturing costs, leading to a strong market fit and competitive advantages for manufacturers. The integration of smart sensors and data analytics further enhances efficiency and enables predictive maintenance. The ongoing trend towards modular and customizable tools caters to the growing demand for flexible manufacturing solutions.

Report Scope & Segmentation Analysis

This report segments the Metal Fabrication Tools market based on several key parameters, including product type (laser cutting systems, bending machines, punching machines, welding equipment, etc.), application (automotive, aerospace, construction, electronics, etc.), and geography (North America, Europe, Asia-Pacific, etc.). Each segment exhibits distinct growth trajectories and competitive dynamics, providing comprehensive market insights. Market size projections, CAGR estimations, and competitive landscape assessments are provided for each segment, offering detailed market intelligence.

- By Product Type: Each product type segment (e.g., laser cutting machines) shows varying growth rates based on technological advancements and adoption rates. The market size of laser cutting systems is estimated at xx Million in 2025, projected to reach xx Million by 2033.

- By Application: Automotive and aerospace applications are projected to show the highest growth due to increasing demand for lightweight and high-strength materials. The automotive application segment is estimated at xx Million in 2025, expected to reach xx Million by 2033.

- By Geography: The report analyzes the market dynamics and growth prospects of each major region. Asia-Pacific is projected to hold the largest market share, driven by its robust economic growth and manufacturing expansion.

Key Drivers of Metal Fabrication Tools Industry Growth

Several factors fuel the Metal Fabrication Tools industry's growth. Technological advancements, such as automation, robotics, and advanced materials, significantly improve manufacturing efficiency and product quality. Economic growth and industrial expansion, particularly in developing economies, create substantial demand for metal fabrication tools. Government regulations concerning safety, environmental standards, and energy efficiency drive technological innovation and product development. For example, the increasing adoption of Industry 4.0 principles necessitates investment in smart factory technologies, boosting demand for advanced metal fabrication tools.

Challenges in the Metal Fabrication Tools Industry Sector

The Metal Fabrication Tools industry faces several challenges. Fluctuations in raw material prices and supply chain disruptions can significantly impact profitability and production. Intense competition, particularly from low-cost manufacturers, necessitates cost optimization and continuous innovation. Stringent environmental regulations and safety standards require substantial investments in compliance measures, potentially impacting profitability. Furthermore, skilled labor shortages in some regions pose challenges in meeting the increasing demand for specialized expertise. The combined impact of these factors can reduce market growth by an estimated xx% annually.

Emerging Opportunities in Metal Fabrication Tools Industry

Several emerging trends offer significant opportunities for growth. The increasing adoption of additive manufacturing (3D printing) in metal fabrication creates new market segments and potential applications. The growing demand for lightweight and high-strength materials in various industries opens up opportunities for specialized tools and technologies. The rising adoption of Industry 4.0 principles and the Internet of Things (IoT) enhances operational efficiency, creates opportunities for data-driven decision-making, and boosts demand for connected metal fabrication tools. Finally, expansion into developing economies presents significant untapped market potential.

Leading Players in the Metal Fabrication Tools Industry Market

- Trumpf

- Shenyang Machine Tool

- Amada

- Okuma

- DMG MORI

- FANUC Corp

- Colfax

- Atlas Copco

- BTD Manufacturing (List Not Exhaustive)

Key Developments in Metal Fabrication Tools Industry Industry

November 2022: Momentum Manufacturing Group (MMG) acquired Evans Industries and Little Enterprises, expanding its manufacturing capacity and expertise in precision metal machining for semiconductor production. This acquisition showcases the industry's expansion into high-growth sectors and highlights the increasing demand for precision metal fabrication tools.

March 2022: Ryerson Holding Corporation acquired Apogee Steel Fabrication Incorporated, strengthening its value-added services and expanding its capacity in sheet metal fabrication. This acquisition underlines the consolidation trend within the industry and the ongoing competition to capture market share.

Strategic Outlook for Metal Fabrication Tools Industry Market

The Metal Fabrication Tools industry is poised for continued growth, driven by technological advancements, industrial expansion, and increasing demand for high-precision and customized products. The integration of Industry 4.0 technologies and the rise of additive manufacturing will shape the future of the industry, creating new opportunities for innovation and market expansion. Companies that invest in R&D, embrace automation, and adapt to changing consumer preferences will be best positioned to succeed in this dynamic market. The market's growth potential is substantial, with significant opportunities in emerging economies and specialized applications.

Metal Fabrication Tools Industry Segmentation

-

1. Service Type

-

1.1. Machining and Cutting

- 1.1.1. Machining Centres

- 1.1.2. Lathe Machines

- 1.1.3. Drilling, Grinding, Horning, and Lapping Machines

- 1.1.4. Laser, Ion Beam, and Ultrasonic Machines

- 1.1.5. Gear Cutting Machines

- 1.1.6. Sawing and Cutting-off Machines

- 1.1.7. Other Handling and Cutting Equipment

-

1.2. Welding

- 1.2.1. ARC Welding

- 1.2.2. Oxy-fuel Welding

- 1.2.3. Laser Beam Welding

- 1.2.4. Other Types of Welding

-

1.3. Forming

- 1.3.1. Forging Machines and Hammers

- 1.3.2. Bending, Folding, and Straightening Machines

- 1.3.3. Shearing, Punching, and Notching Machines

- 1.3.4. Wire Forming Machines

- 1.3.5. Other Presses and Metal Forming Machines

- 1.4. Other Service Types

-

1.1. Machining and Cutting

-

2. End-user Industries

- 2.1. Automotive

- 2.2. Construction

- 2.3. Aerospace

- 2.4. Electrical and Electronics

- 2.5. Other End-user Industries

Metal Fabrication Tools Industry Segmentation By Geography

- 1. North America

- 2. Latin America

- 3. Asia Pacific

- 4. Europe

- 5. Middle East and Africa

Metal Fabrication Tools Industry Regional Market Share

Geographic Coverage of Metal Fabrication Tools Industry

Metal Fabrication Tools Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Focus on the Implementation of Industry 4.0

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Metal Fabrication Tools Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Machining and Cutting

- 5.1.1.1. Machining Centres

- 5.1.1.2. Lathe Machines

- 5.1.1.3. Drilling, Grinding, Horning, and Lapping Machines

- 5.1.1.4. Laser, Ion Beam, and Ultrasonic Machines

- 5.1.1.5. Gear Cutting Machines

- 5.1.1.6. Sawing and Cutting-off Machines

- 5.1.1.7. Other Handling and Cutting Equipment

- 5.1.2. Welding

- 5.1.2.1. ARC Welding

- 5.1.2.2. Oxy-fuel Welding

- 5.1.2.3. Laser Beam Welding

- 5.1.2.4. Other Types of Welding

- 5.1.3. Forming

- 5.1.3.1. Forging Machines and Hammers

- 5.1.3.2. Bending, Folding, and Straightening Machines

- 5.1.3.3. Shearing, Punching, and Notching Machines

- 5.1.3.4. Wire Forming Machines

- 5.1.3.5. Other Presses and Metal Forming Machines

- 5.1.4. Other Service Types

- 5.1.1. Machining and Cutting

- 5.2. Market Analysis, Insights and Forecast - by End-user Industries

- 5.2.1. Automotive

- 5.2.2. Construction

- 5.2.3. Aerospace

- 5.2.4. Electrical and Electronics

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Latin America

- 5.3.3. Asia Pacific

- 5.3.4. Europe

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Metal Fabrication Tools Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Machining and Cutting

- 6.1.1.1. Machining Centres

- 6.1.1.2. Lathe Machines

- 6.1.1.3. Drilling, Grinding, Horning, and Lapping Machines

- 6.1.1.4. Laser, Ion Beam, and Ultrasonic Machines

- 6.1.1.5. Gear Cutting Machines

- 6.1.1.6. Sawing and Cutting-off Machines

- 6.1.1.7. Other Handling and Cutting Equipment

- 6.1.2. Welding

- 6.1.2.1. ARC Welding

- 6.1.2.2. Oxy-fuel Welding

- 6.1.2.3. Laser Beam Welding

- 6.1.2.4. Other Types of Welding

- 6.1.3. Forming

- 6.1.3.1. Forging Machines and Hammers

- 6.1.3.2. Bending, Folding, and Straightening Machines

- 6.1.3.3. Shearing, Punching, and Notching Machines

- 6.1.3.4. Wire Forming Machines

- 6.1.3.5. Other Presses and Metal Forming Machines

- 6.1.4. Other Service Types

- 6.1.1. Machining and Cutting

- 6.2. Market Analysis, Insights and Forecast - by End-user Industries

- 6.2.1. Automotive

- 6.2.2. Construction

- 6.2.3. Aerospace

- 6.2.4. Electrical and Electronics

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Latin America Metal Fabrication Tools Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Machining and Cutting

- 7.1.1.1. Machining Centres

- 7.1.1.2. Lathe Machines

- 7.1.1.3. Drilling, Grinding, Horning, and Lapping Machines

- 7.1.1.4. Laser, Ion Beam, and Ultrasonic Machines

- 7.1.1.5. Gear Cutting Machines

- 7.1.1.6. Sawing and Cutting-off Machines

- 7.1.1.7. Other Handling and Cutting Equipment

- 7.1.2. Welding

- 7.1.2.1. ARC Welding

- 7.1.2.2. Oxy-fuel Welding

- 7.1.2.3. Laser Beam Welding

- 7.1.2.4. Other Types of Welding

- 7.1.3. Forming

- 7.1.3.1. Forging Machines and Hammers

- 7.1.3.2. Bending, Folding, and Straightening Machines

- 7.1.3.3. Shearing, Punching, and Notching Machines

- 7.1.3.4. Wire Forming Machines

- 7.1.3.5. Other Presses and Metal Forming Machines

- 7.1.4. Other Service Types

- 7.1.1. Machining and Cutting

- 7.2. Market Analysis, Insights and Forecast - by End-user Industries

- 7.2.1. Automotive

- 7.2.2. Construction

- 7.2.3. Aerospace

- 7.2.4. Electrical and Electronics

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Metal Fabrication Tools Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Machining and Cutting

- 8.1.1.1. Machining Centres

- 8.1.1.2. Lathe Machines

- 8.1.1.3. Drilling, Grinding, Horning, and Lapping Machines

- 8.1.1.4. Laser, Ion Beam, and Ultrasonic Machines

- 8.1.1.5. Gear Cutting Machines

- 8.1.1.6. Sawing and Cutting-off Machines

- 8.1.1.7. Other Handling and Cutting Equipment

- 8.1.2. Welding

- 8.1.2.1. ARC Welding

- 8.1.2.2. Oxy-fuel Welding

- 8.1.2.3. Laser Beam Welding

- 8.1.2.4. Other Types of Welding

- 8.1.3. Forming

- 8.1.3.1. Forging Machines and Hammers

- 8.1.3.2. Bending, Folding, and Straightening Machines

- 8.1.3.3. Shearing, Punching, and Notching Machines

- 8.1.3.4. Wire Forming Machines

- 8.1.3.5. Other Presses and Metal Forming Machines

- 8.1.4. Other Service Types

- 8.1.1. Machining and Cutting

- 8.2. Market Analysis, Insights and Forecast - by End-user Industries

- 8.2.1. Automotive

- 8.2.2. Construction

- 8.2.3. Aerospace

- 8.2.4. Electrical and Electronics

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Europe Metal Fabrication Tools Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Machining and Cutting

- 9.1.1.1. Machining Centres

- 9.1.1.2. Lathe Machines

- 9.1.1.3. Drilling, Grinding, Horning, and Lapping Machines

- 9.1.1.4. Laser, Ion Beam, and Ultrasonic Machines

- 9.1.1.5. Gear Cutting Machines

- 9.1.1.6. Sawing and Cutting-off Machines

- 9.1.1.7. Other Handling and Cutting Equipment

- 9.1.2. Welding

- 9.1.2.1. ARC Welding

- 9.1.2.2. Oxy-fuel Welding

- 9.1.2.3. Laser Beam Welding

- 9.1.2.4. Other Types of Welding

- 9.1.3. Forming

- 9.1.3.1. Forging Machines and Hammers

- 9.1.3.2. Bending, Folding, and Straightening Machines

- 9.1.3.3. Shearing, Punching, and Notching Machines

- 9.1.3.4. Wire Forming Machines

- 9.1.3.5. Other Presses and Metal Forming Machines

- 9.1.4. Other Service Types

- 9.1.1. Machining and Cutting

- 9.2. Market Analysis, Insights and Forecast - by End-user Industries

- 9.2.1. Automotive

- 9.2.2. Construction

- 9.2.3. Aerospace

- 9.2.4. Electrical and Electronics

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Metal Fabrication Tools Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Machining and Cutting

- 10.1.1.1. Machining Centres

- 10.1.1.2. Lathe Machines

- 10.1.1.3. Drilling, Grinding, Horning, and Lapping Machines

- 10.1.1.4. Laser, Ion Beam, and Ultrasonic Machines

- 10.1.1.5. Gear Cutting Machines

- 10.1.1.6. Sawing and Cutting-off Machines

- 10.1.1.7. Other Handling and Cutting Equipment

- 10.1.2. Welding

- 10.1.2.1. ARC Welding

- 10.1.2.2. Oxy-fuel Welding

- 10.1.2.3. Laser Beam Welding

- 10.1.2.4. Other Types of Welding

- 10.1.3. Forming

- 10.1.3.1. Forging Machines and Hammers

- 10.1.3.2. Bending, Folding, and Straightening Machines

- 10.1.3.3. Shearing, Punching, and Notching Machines

- 10.1.3.4. Wire Forming Machines

- 10.1.3.5. Other Presses and Metal Forming Machines

- 10.1.4. Other Service Types

- 10.1.1. Machining and Cutting

- 10.2. Market Analysis, Insights and Forecast - by End-user Industries

- 10.2.1. Automotive

- 10.2.2. Construction

- 10.2.3. Aerospace

- 10.2.4. Electrical and Electronics

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Trumpf

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shenyang Machine Tool

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amada

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Okuma

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DMG MORI

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FANUC Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Colfax

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Atlas Copco

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BTD Manufacturing**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Trumpf

List of Figures

- Figure 1: Global Metal Fabrication Tools Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Metal Fabrication Tools Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Metal Fabrication Tools Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Metal Fabrication Tools Industry Revenue (Million), by End-user Industries 2025 & 2033

- Figure 5: North America Metal Fabrication Tools Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 6: North America Metal Fabrication Tools Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Metal Fabrication Tools Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Latin America Metal Fabrication Tools Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 9: Latin America Metal Fabrication Tools Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: Latin America Metal Fabrication Tools Industry Revenue (Million), by End-user Industries 2025 & 2033

- Figure 11: Latin America Metal Fabrication Tools Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 12: Latin America Metal Fabrication Tools Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Latin America Metal Fabrication Tools Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Metal Fabrication Tools Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Asia Pacific Metal Fabrication Tools Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Asia Pacific Metal Fabrication Tools Industry Revenue (Million), by End-user Industries 2025 & 2033

- Figure 17: Asia Pacific Metal Fabrication Tools Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 18: Asia Pacific Metal Fabrication Tools Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Metal Fabrication Tools Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Europe Metal Fabrication Tools Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Europe Metal Fabrication Tools Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Europe Metal Fabrication Tools Industry Revenue (Million), by End-user Industries 2025 & 2033

- Figure 23: Europe Metal Fabrication Tools Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 24: Europe Metal Fabrication Tools Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Metal Fabrication Tools Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Metal Fabrication Tools Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 27: Middle East and Africa Metal Fabrication Tools Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Middle East and Africa Metal Fabrication Tools Industry Revenue (Million), by End-user Industries 2025 & 2033

- Figure 29: Middle East and Africa Metal Fabrication Tools Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 30: Middle East and Africa Metal Fabrication Tools Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Metal Fabrication Tools Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Metal Fabrication Tools Industry Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 3: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: Global Metal Fabrication Tools Industry Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 6: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Global Metal Fabrication Tools Industry Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 9: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: Global Metal Fabrication Tools Industry Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 12: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Global Metal Fabrication Tools Industry Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 15: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 17: Global Metal Fabrication Tools Industry Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 18: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Metal Fabrication Tools Industry?

The projected CAGR is approximately > 4.30%.

2. Which companies are prominent players in the Metal Fabrication Tools Industry?

Key companies in the market include Trumpf, Shenyang Machine Tool, Amada, Okuma, DMG MORI, FANUC Corp, Colfax, Atlas Copco, BTD Manufacturing**List Not Exhaustive.

3. What are the main segments of the Metal Fabrication Tools Industry?

The market segments include Service Type, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Focus on the Implementation of Industry 4.0.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Momentum Manufacturing Group (MMG), a metal producer, recently acquired two companies that enable the production of semiconductors in order to enter the semiconductor sector. Evans Industries in Topsfield, Massachusetts, and Little Enterprises in Ipswich, Massachusetts, have joined MMG, giving the Georgetown, Massachusetts-based company 86,000 square feet of additional manufacturing space and almost 160 highly qualified team members. Both businesses provide wafer fabrication equipment support components and offer precision metal machining. The purchases will improve MMG's current manufacturing business, which consists of 10 facilities spread throughout New England.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Metal Fabrication Tools Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Metal Fabrication Tools Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Metal Fabrication Tools Industry?

To stay informed about further developments, trends, and reports in the Metal Fabrication Tools Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence